Jim Rossman is Managing Director and Head of Corporate Preparedness at Lazard. This post is based on a Lazard publication by Mr. Rossman. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); The Myth that Insulating Boards Serves Long-Term Value by Lucian Bebchuk (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Review of Shareholder Activism in 1H 2017

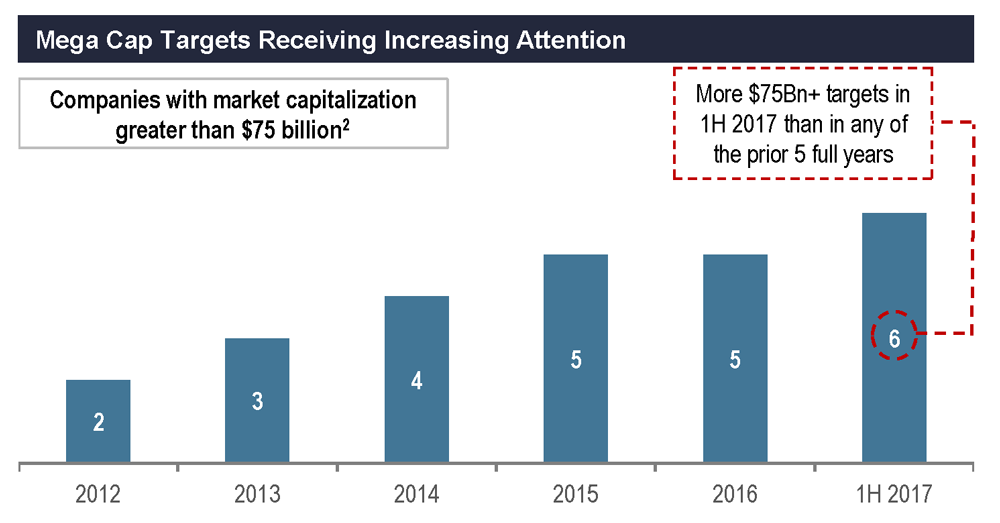

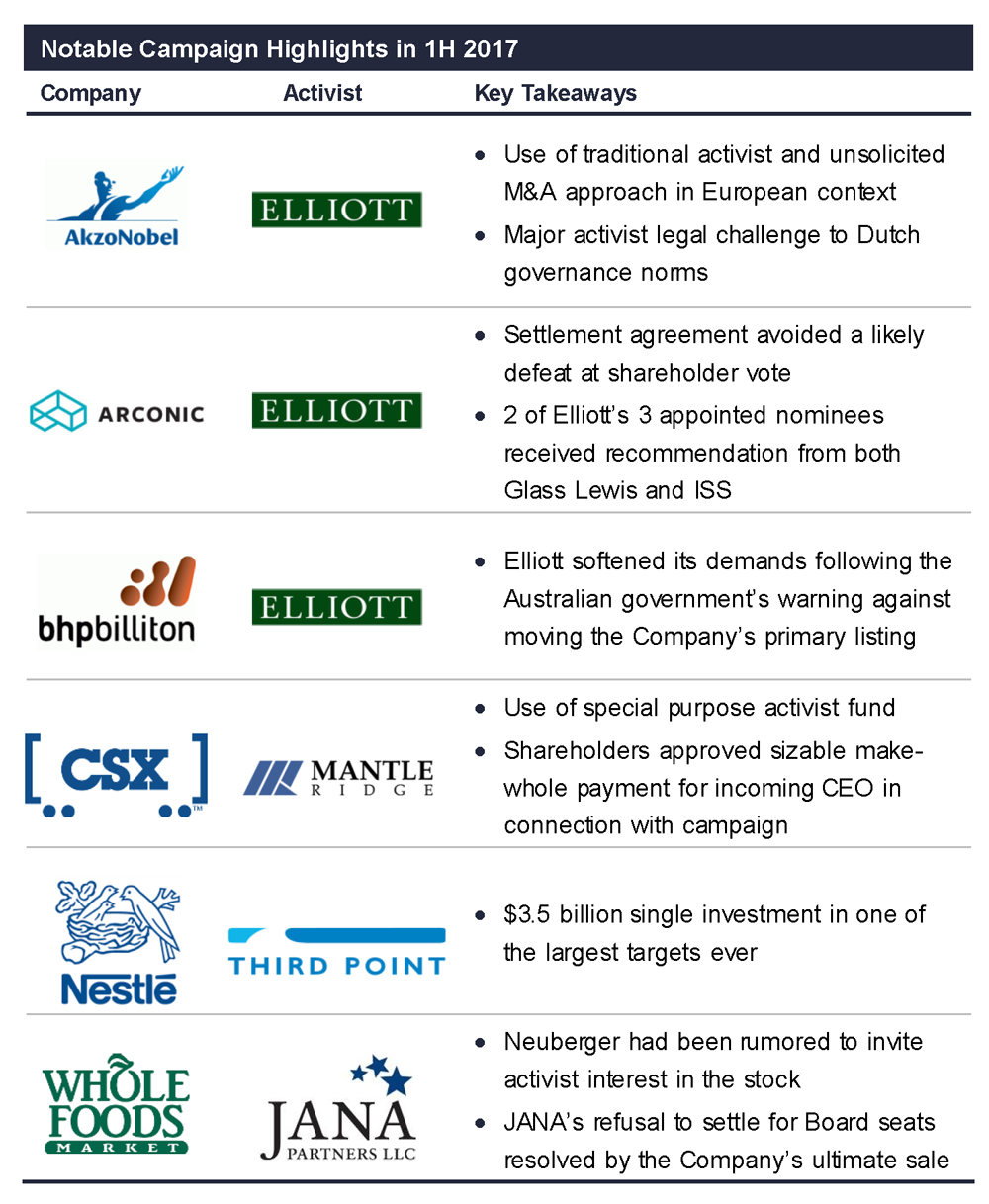

1. The most prominent activists have ramped up their activity, raising capital and launching campaigns against blue chip targets

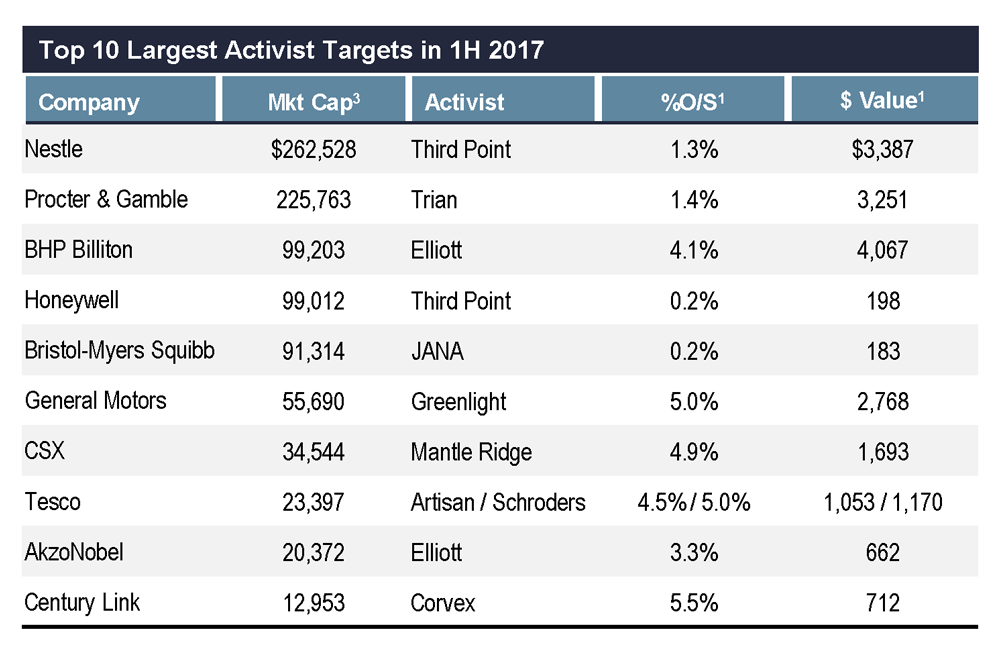

- Unique approaches such as Mantle Ridge’s single-investment targeting of CSX, Greenlight’s dual-class proposal at GM and Elliott’s partnership with BlueScape at NRG indicate a willingness to pursue ambitious and creative strategies

2. Activists are increasingly looking beyond the United States and investing significant resources globally

- Elliott’s campaigns at AkzoNobel and BHP Billiton, and Third Point’s recently-announced activity at Nestlé, highlight a trend toward pursuit of large targets overseas

3. Index owners are proactively engaging in contested situations, delivering on their promises to become more assertive

- Company engagement with Vanguard and BlackRock reportedly swung the Taubman Centers proxy contest in management’s favor

- Increased assertiveness follows the January 2017 launch of governance-focused Investor Stewardship Group, which counts many prominent institutions as signatories

4. Activists were successful in securing management change, with numerous high-profile CEO exits following relentless activist scrutiny and proxy campaigns

- Among those affected were AIG, Arconic, CSX, GE, Pandora, and Perrigo

5. Continued flows out of actively-managed strategies and into index funds have provided activists with outsized influence in an environment of increasing shareholder concentration

- According to Morningstar, passive fund inflows reached over $250 billion in 1Q 2017, building off a trend from 2016 when active funds saw $285 billion in outflows and $428 billion flowed into passive funds

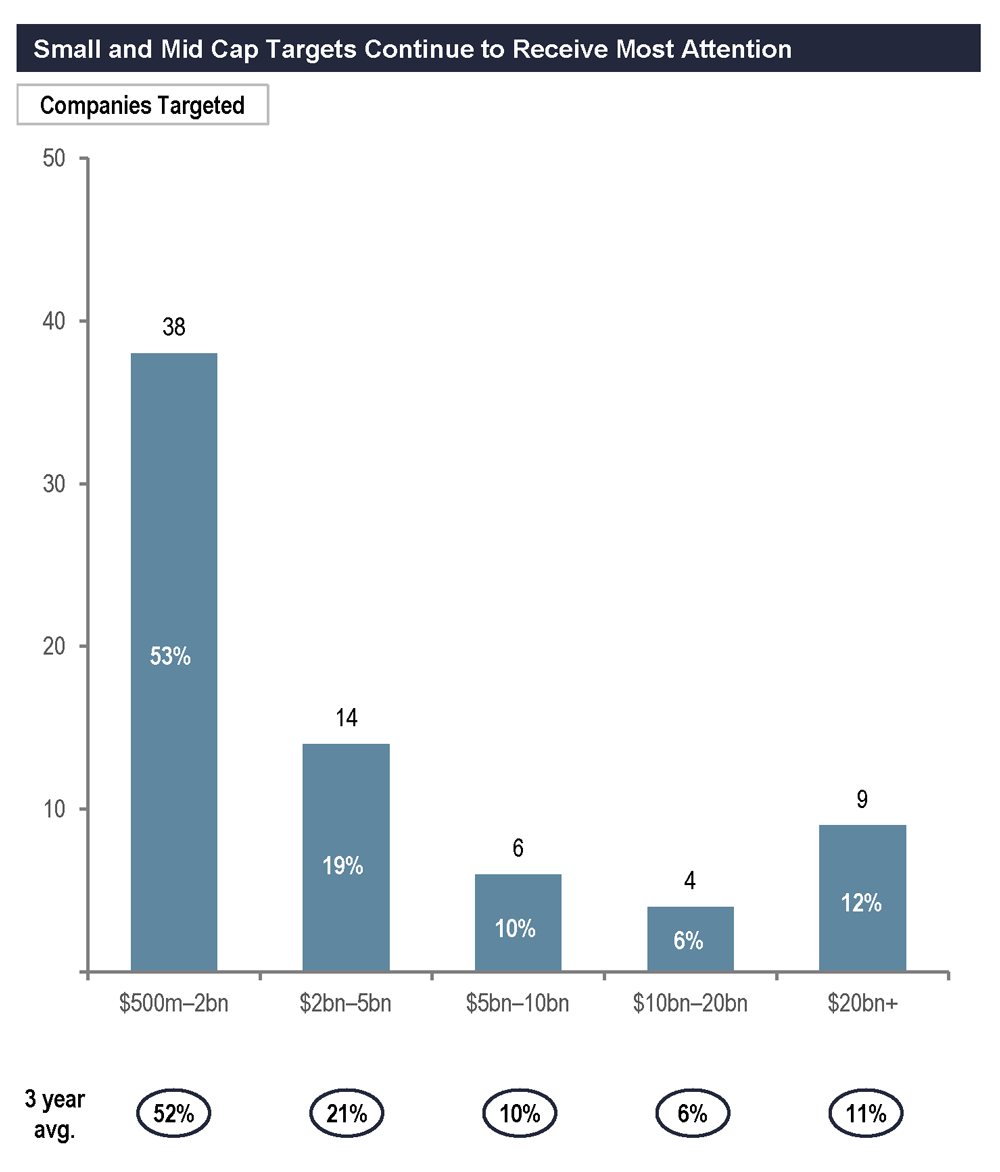

Companies Targeted by Activists

Source: Activist Insight, FactSet and public filings.

Note: All data is for activist campaigns conducted by U.S. activists targeting global companies or non-U.S. activists targeting U.S. companies with market capitalizations greater than $500 million at time of campaign announcement.

1Companies spun off as part of campaign process counted separately.

2Calculated as of campaign announcement date.

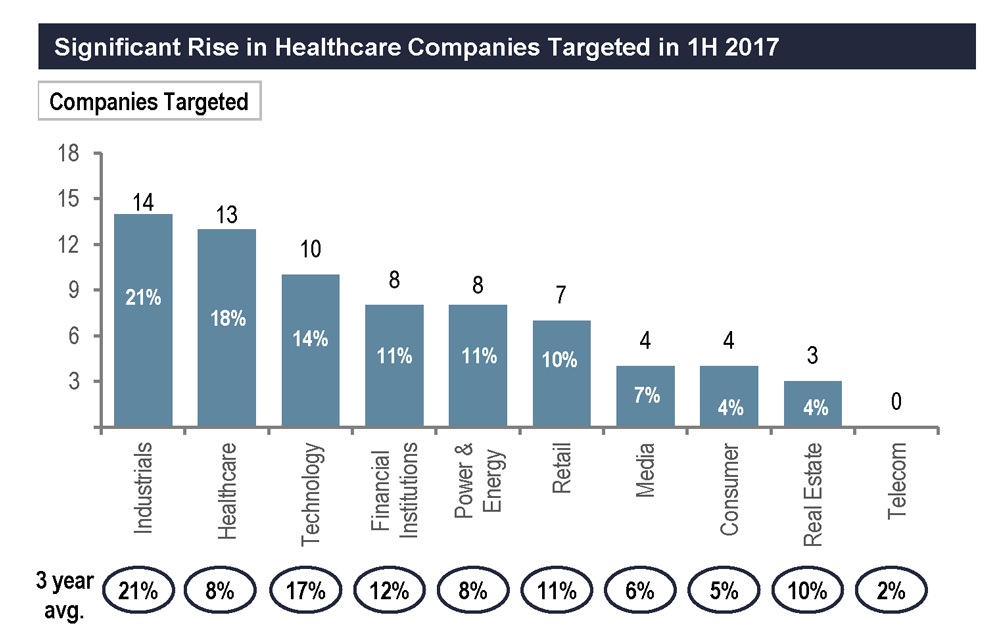

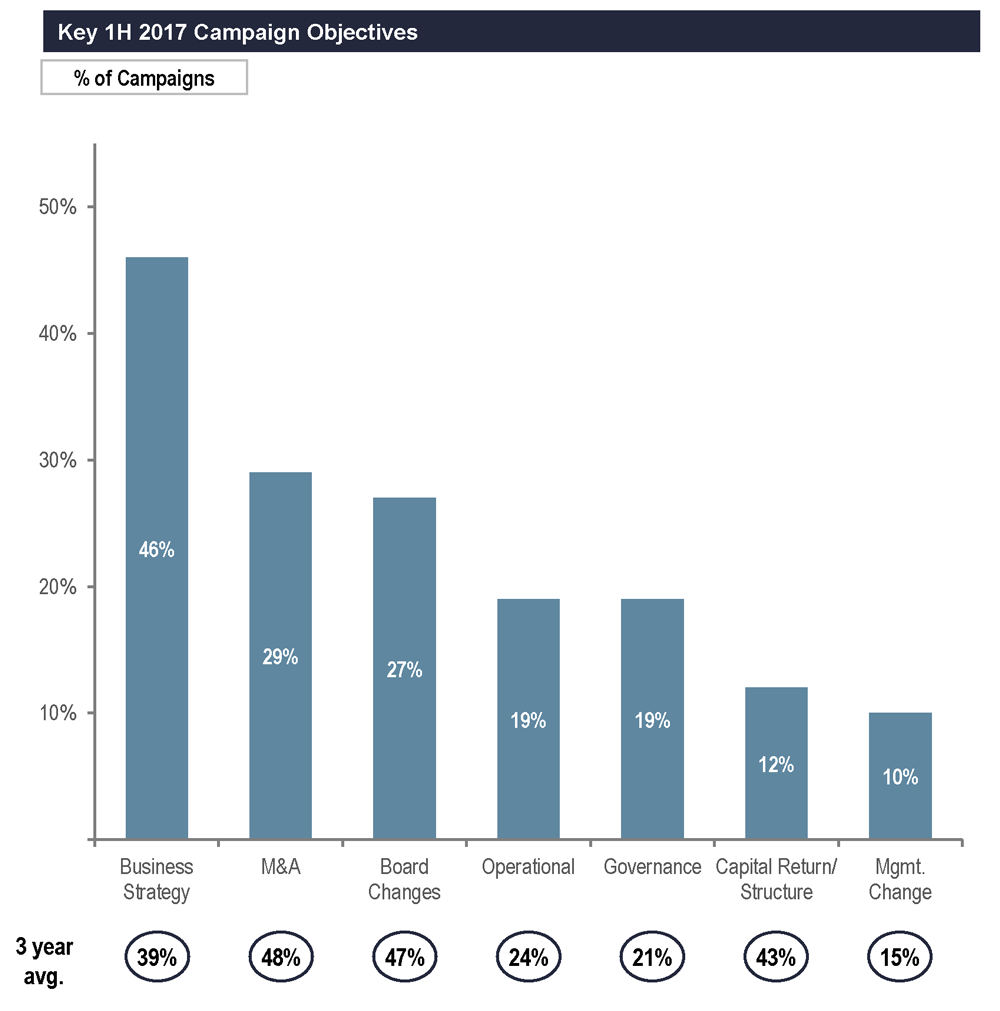

Additional Observations on 1H 2017 Campaigns

Source: Activist Insight, FactSet and public filings.

Note: Further detail available in Appendix of the complete publication, available here. All data is for activist campaigns conducted by U.S. activists targeting global companies or non-U.S. activists targeting U.S. companies with market capitalizations greater than $500 million at time of campaign announcement. Three year averages represent period from 2014 to 2016.

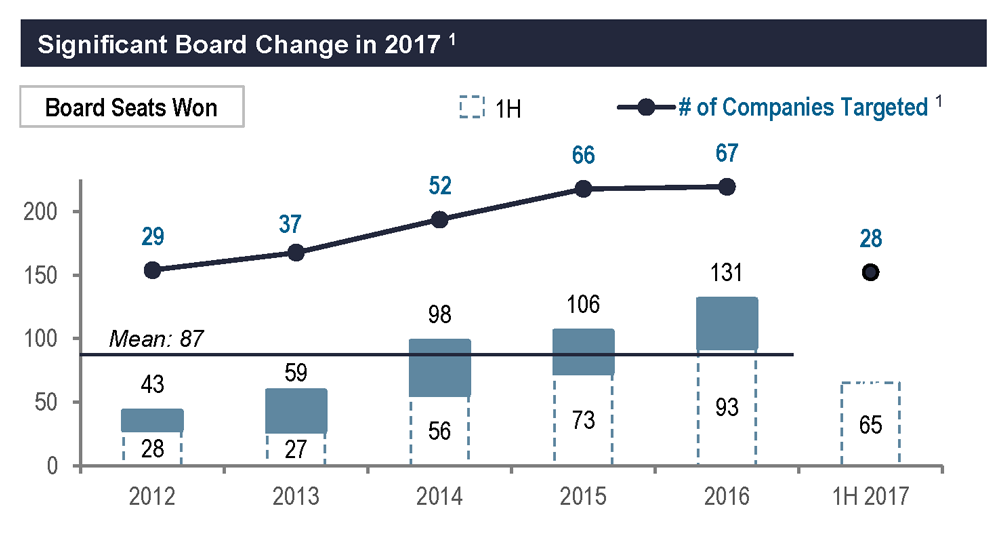

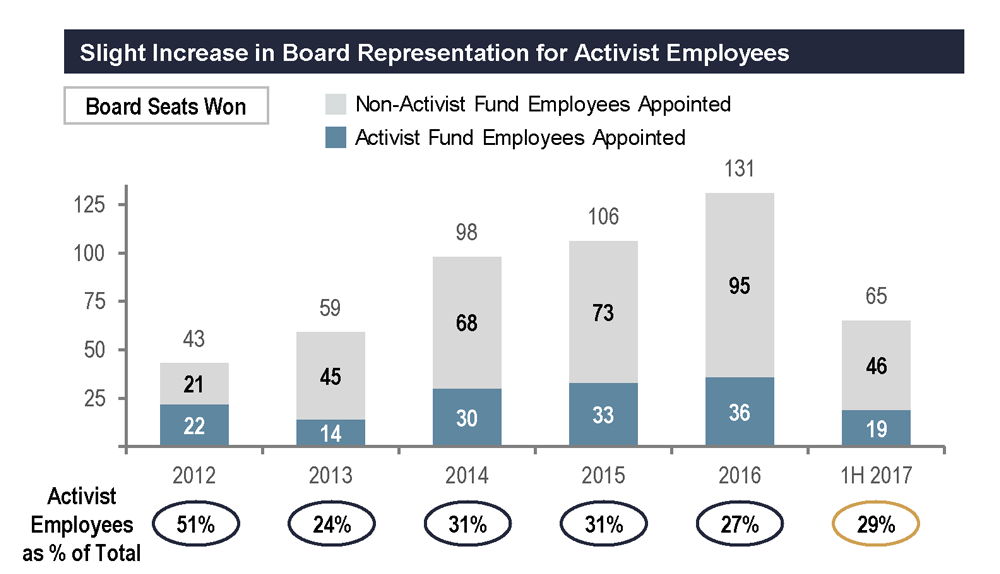

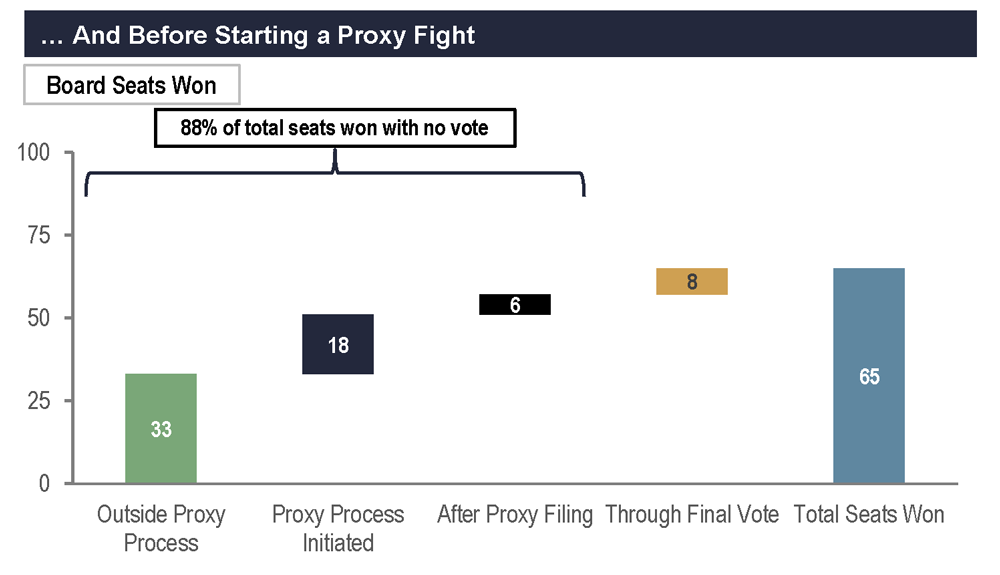

Board Seats Won by Activists

Source: Activist Insight, FactSet and public filings.

Note: All data is for activist campaigns conducted by U.S. activists targeting global companies or non-U.S. activists targeting U.S. companies with market capitalizations greater than $500 million at time of campaign announcement.

1Represents Board seats won by activists in respective year, regardless of the year in which the campaign was initiated.

Prominent Activists and Market-Defining Campaigns

Source: Activist Insight, FactSet and public filings.

Note: All data is for activist campaigns conducted by U.S. activists targeting global companies or non-U.S. activists targeting U.S. companies with market capitalizations greater than $500 million at time of campaign announcement.

1Calculated as of campaign announcement date.

* * *

The complete publication, including Appendix, is available here.

Print

Print