Jack “Rusty” O’Kelley III is a Managing Director at Russell Reynolds Associates. This post is based on a Russell Reynolds publication by Mr. O’Kelley. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); The Myth that Insulating Boards Serves Long-Term Value by Lucian Bebchuk (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Clients who are anticipating or early in the process of an activist situation, and a potential proxy contest, often ask us two questions:

- How do you know if an activist is going to seek to expand the board or target specific directors for replacement (and potentially escalate the situation to a proxy contest)?

- If an activist chooses a board member replacement strategy, how can you predict which directors an activist may target?

Based on our experience working with corporate boards defending against activists (as well as our broader board search and effectiveness expertise), we have gathered insights regarding how activists analyze and target boards of directors. In response to client requests, we have developed this guide to help our clients proactively think through defensive measures regarding board composition and governance issues.

Activists generally will utilize against individual directors all current and historical negative press, statistics, and data that is publicly available, whether or not it is accurate, comprehensive, or fair. Boards should be ready for this tactic and be ready to take back control of the narrative about the board.

Russell Reynolds only works on behalf of corporations and their existing board and management teams. We urge our clients to take a proactive, “clear-eyed” activist view of their board to understand how an activist may attack their board. We have prepared this overview based on our experience and on the insights of several activist defense lawyers, investment bankers, and proxy advisors with whom we have worked. Additionally, we have talked with activist investors who were willing to share their approaches.

Expansion vs. Replacement

Anticipating an activist’s approach to targeting board seats

Activists target a board to influence decision- making and increase value creation. While activists may take different approaches and specific tactics vary by activist and situation, key indicators can help identify their potential path.

Two of the most common activist approaches to maximizing influence on a board are either pressuring the company’s board to expand the number of board members or targeting specific incumbent directors to be replaced. Both may be done by way of a proxy contest or by using the threat of such a contest to pressure the target board into a settlement that places activist-backed directors on the board. There is no strict methodology for predicting which tactic an activist will pursue, and activists’ decisions are frequently determined by how companies react to the activists’ ideas.

We have identified some key indicators that determine if activists are likely to look to expand a board or target specific board members.

Expansion

Activists often seek to expand a board in less contentious activist situations

We have observed that the earlier a company is in the process of engaging with an activist, the more likely it is that the activist will encourage the board to expand its size by adding activist-backed directors. The longer and more public the process, the more likely it is that the activist will target specific incumbent directors and consider conducting a proxy fight.

Board expansion usually occurs in several situations based on several factors, which include:

- The board has accepted the activist’s investment thesis and acknowledges the validity of its recommendations

- The activist wants to monitor a situation or progress

- There is specific insight or expertise the activist and board feel is missing based on business strategy

- The board has classified terms (to get around limitations of a replacement strategy with staggered terms)

The first procedural step is for the board to look at its size in relation to its bylaws and peer benchmarks. As a general rule, relatively large boards make expansion less desirable. If the board is already at the maximum membership allowed by its bylaws, expansion is less attractive as the board may not want to change the bylaws to increase the number of directors. Board expansion will dilute the magnitude of activist influence (compared to replacement), and may face less resistance from the target board in a settlement.

For example, if an activist seeks to add 2 directors to a 10-member board, a board agreeing to expand the membership will net the activist 16% representation (2 of 12), as opposed to the 20% representation by replacing 2 sitting directors (2 of 10).

Board Expansion May Not Be the End of Activist Opposition

An activist and the board may agree to expand the board, but the activist may subsequently use their influence from their new board seats to later call for certain incumbent directors to step down in the following board election. Often, activists will look to break up groups of power on a board. They prefer to have at least two directors on a board to increase the number of voices and leadership for change. It is easier to dismiss one voice rather than two voices on an issue. Should the activist-backed directors seek to replace other directors likely targets could include:

- Directors with the poorest history of value creation

- The longest-tenured directors who approved the strategy to which the activist objected

- The chairman or the director(s) who led the campaign against the activist

- Activists usually do not target the CEO unless they create a “CEO referendum” evidenced by strong, public complaints about value creation (e.g., Arconic). Once an activist joins the board, the average CEO tenure is 15 months

Replacement

Activists often seek to replace board members in more contentious and drawn-out situations

Activists will spend the time and effort needed to win these contests to drive adoption of their perspective around major strategic/value creation issues when the financial returns will reward it. The director replacement strategy has the benefit (for the activist) of increasing the magnitude of the activist’s influence on a board (compared to expanding the board).

Under U.S. securities law, activists may and usually identify, by name, the incumbent directors that they are targeting for replacement when submitting a proxy filing. Replacing directors sends the clearest message of an activist’s desire to drive change in strategic direction to enhance value creation.

Activists usually go down this path the greater the disagreement between a company and an activist on strategies for value creation, and the less willing management is to implement the activist’s ideas. We see a greater chance that an activist will seek to replace directors to demonstrate the need for dramatic change when:

- There are visible public disagreements about strategic or operational issues and value creation

- Increasingly public and “tougher” language

- Situations where the board is too large and cannot be expanded

Activists often are looking for directors who can provide specific insight or expertise about an industry and can act as change agents.

Identifying Incumbent Directors Activists May Target

Anticipating an activist’s approach to targeting board seats

Activists have become very sophisticated in how they determine which directors to target in connection with a proxy contest. Activists will try to create the narrative around the full board and/or each director to advance the story that suits their goals. Activists will use time frames and benchmarks around total shareholder return and share price appreciation that paints management and board members in the worst possible light. While boards and directors may claim this is unfair or misleading (not taking into account the full facts or context), activists have the advantage of being on the offensive and using “facts” in a manner that benefits them. Activists look at a series of “filters” for each director. The record of value creation and relevance of each director’s skill set are critical. Unfortunately, a director with a great track record of value creation and with highly relevant skills can be targeted if there are publicly available stories that raise questions about that director’s judgment or integrity.

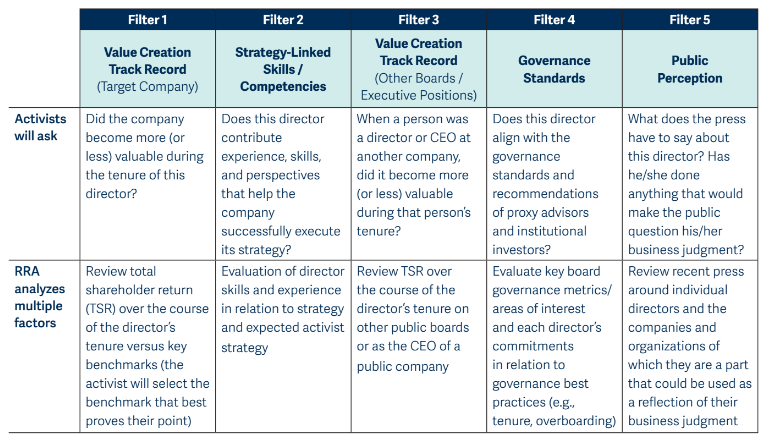

Russell Reynolds recommends that boards conduct a proactive board and director activism defense review. To help prepare and defend against an activist targeting a board and individual directors, RRA uses five filters to analyze each incumbent director and identify those most likely to be targeted by an activist investor.

Our proactive board composition and performance audit review includes:

Summary

Scrutiny of public company boards from activists, institutional investors, and the media shows no signs of abating. publicly and, what was once privately available information, continues to increase. New databases from ISS, Glass Lewis, Bloomberg, S&P and other information service providers increase the ability of activists and others to analyze multiple aspects of a board and individual directors’ performance, background, and governance standards. Boards need to prepare and be “clear-eyed” and objective in foreseeing the risks they may face should an activist or institutional investor initiate a review of the board.

Print

Print