The following post is based on a publication from CamberView Partners, authored by Abe M. Friedman, Erica K. Lukoski, Bob McCormick, and Eric Sumberg.

On Friday, September 8, New York City Comptroller Scott M. Stringer sent a letter to 151 companies seeking engagement around a range of disclosures regarding the race and gender of company directors, the creation of a standardized director skills matrix and details of those companies’ director evaluation and succession plans. The letter, sent on behalf of the New York City Pension Funds (NYC Funds), is also intended to put pressure on companies to engage on the topic of pursuing diverse independent board candidates. The request was packaged as part of the launch of the second phase of the NYC Funds’ Boardroom Accountability Project, which in its first phase focused on achieving widespread adoption of proxy access.

The NYC Funds have a track record of coordinating among investors to run shareholder proposal campaigns and other initiatives that have received widespread support. In our view, NYC Funds are among the most likely investors to attempt to use the proxy access right. Accordingly, issuers should think carefully about how they manage their response to this outreach.

Proxy Access Campaign

In 2014, Comptroller Stringer filed 75 shareholder resolutions requesting the right for “proxy access,” the ability for shareholders to nominate directors using the company’s ballot. The Comptroller’s office approach was intended to help set a market-standard around the terms of proxy access bylaws. The NYC Funds filed resolutions at companies that fit within three categories that were likely to gain the support of traditional institutional investors: carbon-intensive energy companies significantly impacted by climate change, companies at which executive compensation was misaligned with company performance and companies with limited or no board diversity (in addition to filing at some of its largest holdings).

At the start of the campaign in 2014, just six U.S.-based companies had enacted proxy access bylaws. Today, more than 440 companies have a bylaw in place, including 60% of the S&P 500 and 80% of the S&P 100. The NYC Funds’ proxy access proposals routinely receive majority support and a significant number of issuers now preemptively adopt a proxy access bylaw to avoid a vote on the shareholder proposal.

Boardroom Accountability Project Campaign—Version 2.0

The next phase of Comptroller Stringer’s Boardroom Accountability Project seeks to “ratchet up the pressure on some of the biggest companies in the world to make their boards more diverse, independent, and climate-competent, so that they are in a position to deliver better long-term returns for investors.” The 151 U.S. companies that received the letter include those that enacted proxy access after receiving a shareholder resolution from the NYC Funds and companies at which an NYC Funds- sponsored proxy access proposal received majority support in 2017. The letter requests that companies disclose the demographic background, skills and experience of directors in a standardized “matrix” format and enter into a dialogue regarding their board refreshment process.

The Comptroller’s letter also outlined four sample engagement topics that representatives from the NYC Funds would like to discuss with a member of each recipient’s Nomination/Governance committee, including:

- The matrix currently used by the board to help them and investors understand the range of skills and experiences the board considers most critical and how current directors and potential board candidates best serve the Company’s long-term business strategy, executive succession planning process and risk oversight responsibilities.

- Understanding how the company evaluates individual directors on an ongoing basis, to assess whether and how directors continue to contribute to the above board responsibilities and to changing responsibilities over time. This would also include discussing what processes are in place for companies to discuss board transitions in cases where a particular director no longer is able to contribute in this way.

- How to establish a process whereby director search firms that a company may retain, would regularly reach out to significant shareowners for suggestions for the names of both potential board candidates and other organizations that specialize in sourcing potential diverse board candidates.

- How to establish a normalized and structured process, pursuant to which the NYC Funds and other significant shareowners may provide to Nominating/Governance Committees the names of potential board candidates, on an ongoing basis.

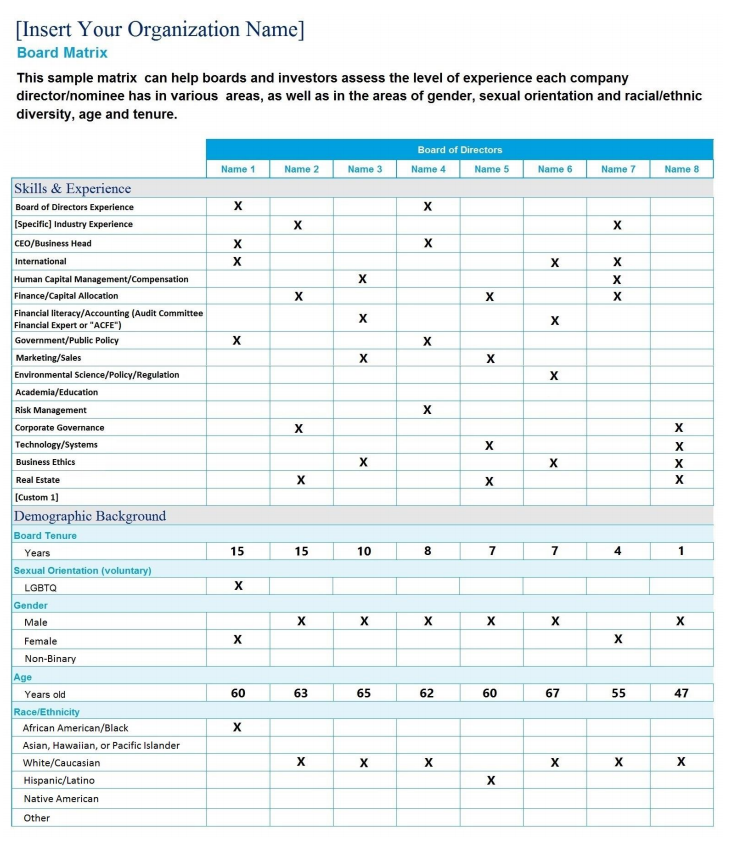

Of these four topics, the Comptroller’s letter focuses most of its attention on the board skills matrix. According to the letter, disclosure of a matrix allows investors to assess how well-suited individual director nominees are for the company, identify any gaps in skills, experience or other characteristics, and to more fully exercise shareholder voting rights. The NYC Funds also published a sample matrix, displayed below, that outlines the skills and experience of individual directors as well as their tenure, sexual orientation, gender, age and race/ethnicity.

Takeaways for Issuers

Certain themes in this phase of the Boardroom Accountability Project, such as boardroom diversity and climate risk, are likely to resonate with the investor community. However, much of the NYC Funds’ request is forward-leaning and some investors may consider it overly prescriptive or not necessary for all companies. It is not clear that investors would broadly support shareholder proposals on these topics unless they were fairly high-level and focused on the overall objective of boardroom diversity. However, this phase of the campaign may be a precursor to identifying companies at which the NYC Funds may seek to run a proxy access campaign in the future.

Companies that received the letter and have risk on topics where a shareholder proposal might receive broad-based support should consider engaging with their investors to assess what, if anything, investors would like to see them do around the issues outlined in the NYC Funds letter. Given the deliberate approach being taken toward engagement by the NYC Funds, all issuers may want to begin evaluating their practices against industry standards and conducting analyses of their board diversity and composition, as well as their board’s processes for evaluation and regular refreshment. In addition, issuers should review and consider whether enhancements to their governance-oriented engagement on these topics is appropriate.

Print

Print