Brian Broughman is Professor of Law at Indiana University; Audra Boone is the C.R. Williams Professor in Financial Services at the Neeley School of Business at Texas Christian University; and Antonio Macias is Assistant Professor of Finance at Baylor University. This post is based on a recent paper authored by Professor Broughman, Professor Boone, and Professor Macias, and is part of the Delaware law series; links to other posts in the series are available here.

As the volume of merger appraisal litigation has exploded over the last decade, so too has the debate over the desirability of appraisal and how this remedy should be structured. Much of this debate is based on untested assertions about appraisal’s ex-ante effect on the structure and pricing of takeovers. Proponents of appraisal argue that it creates a credible reserve price that benefits target shareholders through higher upfront acquisition premiums. Critics, in contrast claim that a strong appraisal regime only benefits speculators engaged in appraisal arbitrage, which would ultimately “reduce deal flow, and lead to lower prices being paid to selling shareholders.” [1] In a new empirical study, we test these competing explanations to better understand the ex ante impact of appraisal on merger negotiations.

Delaware is ground zero for this debate. Academics on both sides filed amicus briefs in DFC Global predicting radically different ex ante consequences associated with a strong appraisal remedy. While the Delaware Supreme Court refused to create a strong presumption, language in DFC Global v. Muirfield (Aug 2017) encourages the Chancery court to grant considerable weight to the negotiated merger price, except in unusual circumstances. Currently, commentators are closely watching Dell, which is scheduled to be argued before the Delaware Supreme Court later this month and tackles similar issues.

We exploit the fact that recent developments in appraisal have been limited to Delaware, and do not apply to target firms incorporated elsewhere. This structure provides a treatment group (acquisitions involving Delaware targets) and a control group (non-Delaware targets). We study multiple events—Delaware statutes and judicial decisions—that either increase (or decrease) the strength of the appraisal remedy in the treatment group but leave the control group unaffected. Thus, our analysis isolates the effect of changes in the appraisal remedy on ex ante terms of acquisition.

Contrary to the critics of appraisal, we find no evidence that bidders lower their up-front price so they can afford to pay off dissenting shareholders post-sale. Furthermore, threat of appraisal does not appear to impact method of payment, likelihood of closing, or limit the amount of takeover activity. Instead, we find that shareholders of Delaware targets receive marginally higher acquisition premiums following events that strengthen the appraisal remedy in Delaware. In general, our results are consistent with appraisal providing ex-ante protection in settings where public investors are most at risk.

Our study is based on deal terms from over 2,000 acquisitions of publicly-held US targets from 2004 to 2017. For the remainder of this post we highlight four key findings.

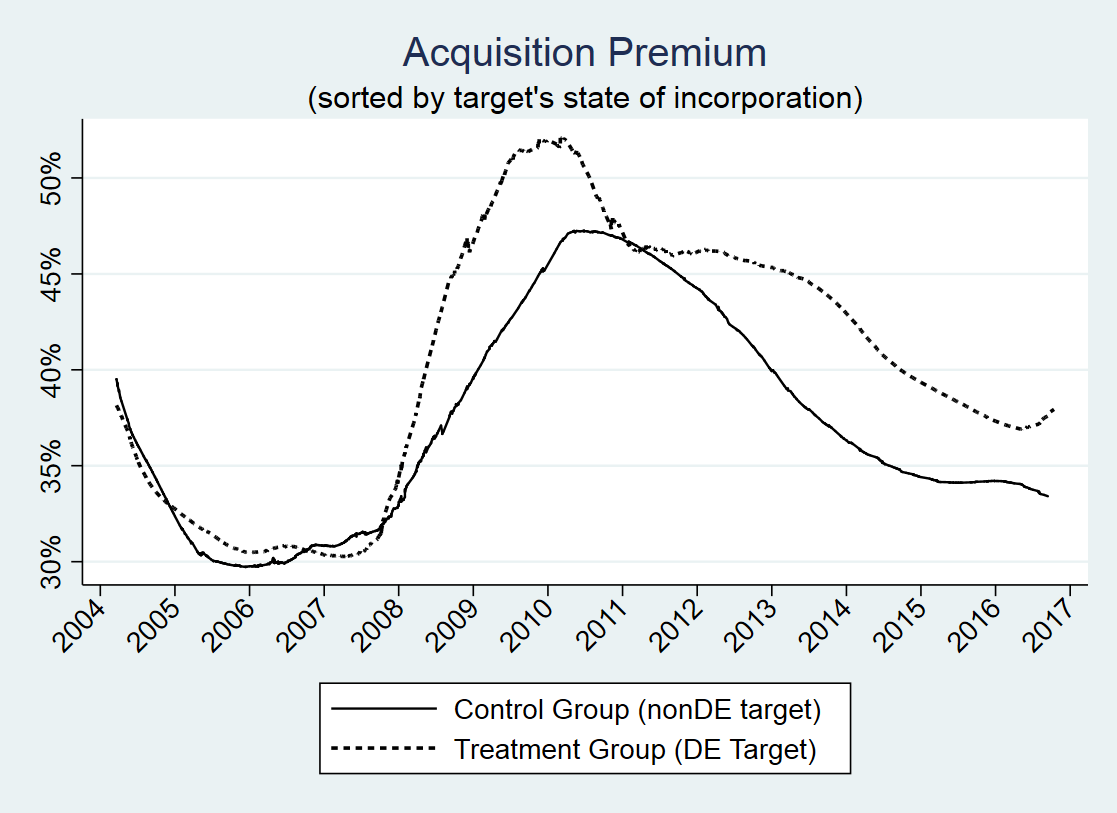

First, we analyze target returns and merger premiums. We find that shareholders of targets incorporated in Delaware receive marginally higher acquisition premiums, and somewhat higher announcement returns, following events that strengthen the appraisal remedy. This effect is illustrated in the graph below, which shows higher premiums for Delaware targets, relative to the control group, as the threat of appraisal increased over the past decade. [2]

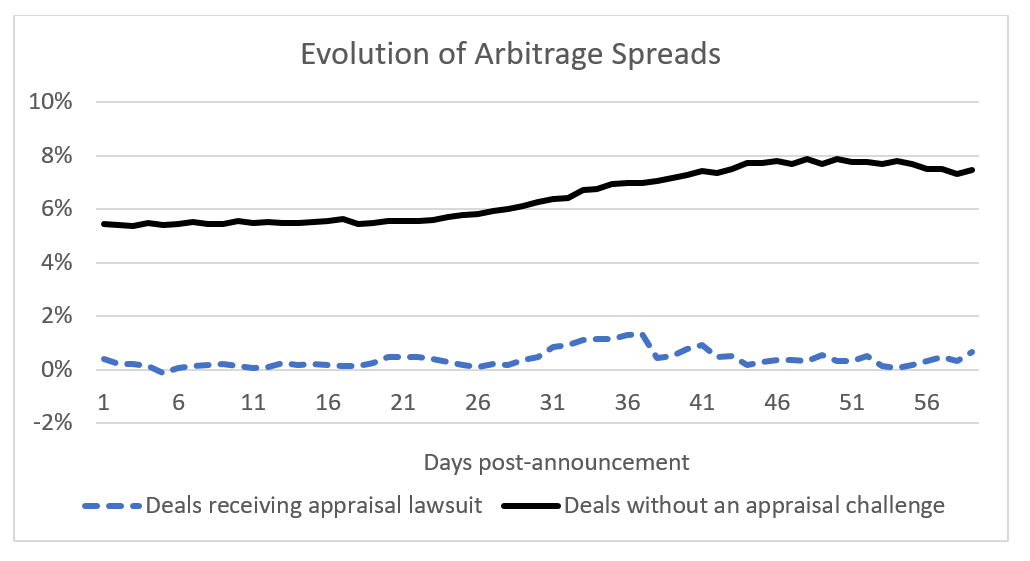

Second, we consider arbitrage spreads. In deals that do not receive an appraisal lawsuit, the average arbitrage spread is approximately 6%, meaning the stock trades for 6% less than the negotiated merger price. By contrast, the average spread is effectively zero in deals that receive an appraisal challenge. Thus, on average, arbitrageurs must pay the full merger price—with no guarantee the deal will close—to purchase their position, whereas non-dissenting investors receive approximately 6% more if they decide to sell prior to closing (insuring against the risk of deal failure) in a deal that received an appraisal challenge. This pattern is illustrated in the graph below, which shows the average arbitrage spreads for the 60 days after public announcement of the acquisitions in our sample.

Third, we find that events increasing the strength of the appraisal remedy have no deterrent effect on the likelihood that a firm becomes a target in a given year. Furthermore, threat of appraisal does not appear to impact method of payment (cash vs stock) or the likelihood that an announced deal will close.

Fourth, we find no evidence that bidders seek contractual protections against appraisal. Indeed, as threat of appraisal increases we find a significant decline in the use of appraisal out clauses—a closing condition triggered by the number of shares that seek appraisal—within the treatment group. This pattern is counterintuitive: the primary contractual protection against appraisal is used less frequently as threat of appraisal increases. [3] This finding suggests that bidders are less concerned about the court setting valuation above their reservation price, than targets are about the increased uncertainty created by the inclusion of an appraisal out clause. The fact that bidders seldom insist on an appraisal out is a strong (implicit) endorsement of the appraisal valuations reached by the Delaware Chancery court in recent years.

Our analyses suggest that ex-ante price discrimination, if any, is not widespread, and is overshadowed by bidders trying to avoid an appraisal challenge. In other words, our evidence implies that appraisal remedies afford important protection for minority shareholders during our sample period.

The complete paper is available for download here.

Endnotes

1See a post on the Forum by Trevor Norwitz at https://corpgov.law.harvard.edu/2015/03/09/delaware-poised-to-embrace-appraisal-arbitrage/(go back)

2We use three different proxy variables to measure the strength of the appraisal regime in Delaware, and our main results regarding acquisition premiums holds for each proxy.(go back)

3By contrast see Subramanian, G., 2017. “Using the Deal Price for Determining ‘Fair Value’ in Appraisal Proceedings,” (discussed on the Forum here). Forthcoming in The Corporate Contract in Changing Times: Is the Law Keeping Up?, University of Chicago Press (noting that from May 2016 to early 2017 there has been an uptick in the use of appraisal out clauses in Delaware deals). Whether the recent uptick identified by Subramanian reflects a meaningful change is too early to say. The broader trend over the past 13 years, however, is contrary to Subramanian’s analysis. Indeed, even in 2016 appraisal outs were used more outside Delaware than within.(go back)

Print

Print