Andrew M. Freedman, Steve Wolosky, and Ron S. Berenblat are partners at Olshan Frome Wolosky LLP. This post is based on an Olshan publication by Mr. Freedman, Mr. Wolosky, Mr. Berenblat, and Kenneth Mantel. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); and Dancing with the Activists by Lucian Bebchuk, Alon Brav, Wei Jiang and Thomas Keusch (discussed on the Forum here).

As shareholder activists fine-tune their communications strategies for the upcoming proxy season, we expect that many will view social media as an increasingly important means of getting their message out to shareholders. Although a number of prominent investors have used certain forms of social media for years (e.g., Carl Icahn’s use of Twitter), we have only recently seen investors begin to engage with multiple social media platforms as part of a comprehensive digital and social media strategy for their campaigns. Noted examples include Elliott Management’s successful campaign at Arconic and Pershing Square’s ongoing election contest at Automatic Data Processing.

This post lays out the important legal issues and other information that investors should consider when evaluating whether and how to use social media in their upcoming campaigns.

Why Utilize Social Media?

Given social media’s massive popularity as a news source, [1] the better question than “why utilize social media?” may well be “how can you not?” Still, a number of other developments have made social media platforms more appealing and important to shareholder activists.

First, with the help of advisors experienced with digital and social media communications, shareholder activists can use social media to target shareholders in an impactful, efficient and cost-effective manner. Potential advantages of utilizing social media in proxy campaigns include the following:

- paid social media advertisements (often in conjunction with search engine marketing) can target an audience based on interest in the company, geography and other attributes, and ensure that messages will be prioritized and not immediately buried beneath other posts;

- brief topical digital communications can quickly and directly address developments in the campaign and maintain contact with the target audience;

- links included in digital communications can drive traffic to campaign websites that provide dynamic and impactful content, including graphics and videos, helping to maximize engagement with the target audience and tell a more compelling story; and

- data analytics can measure interest in particular content and help shareholder activists refine their communications to optimize results.

Second, companies increasingly are using social media platforms on a regular basis as part of integrated digital and social media marketing strategies and investor relations efforts. As a result, many companies are well-positioned to leverage an established digital and social media presence, as well as knowledge of their target audience, to help solicit votes in proxy campaigns. This requires shareholder activists to make up ground to build a social media presence and compete for the attention of a large audience of social media users.

Third, the publication of SEC guidance with respect to electronic communications and the SEC’s track record of engaging with investors in a reasonable and constructive manner regarding applicable issues, based on our recent experiences, have given shareholder activists and their counsel comfort to move forward without fear of unexpected consequences from social media use in the heat of a proxy campaign. However, constant dialogue and coordination between shareholder activists and their legal counsel is necessary to ensure continuous compliance with SEC rules.

A few examples of recent social media communications by activist shareholders are included below for reference.

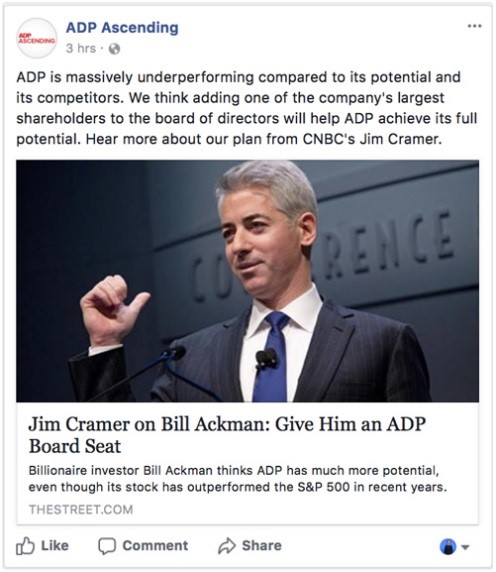

Facebook Post

Twitter Post

Facebook Advertisement

SEC Rules

The SEC has a number of rules governing communications that may constitute the solicitation of a proxy, which we refer to as soliciting materials. The SEC broadly defines “solicitation” to include the furnishing of any communication to shareholders under circumstances reasonably calculated to result in the procurement, withholding or revocation of a proxy, subject to certain exceptions. [2] The term “communication” is interpreted broadly, and is considered to cover electronic communications made over social media platforms, so social media posts and advertisements generally are subject to the same rules as traditional written communications (e.g., press releases, letters and newspaper advertisements).

The key solicitation rules applicable to shareholder activists utilizing social media include the following:

- soliciting materials must be filed with the SEC on the date of first use;

- soliciting materials disseminated before a definitive proxy statement is furnished to stockholders must include an appropriate legal legend; and

- soliciting materials are subject to anti-fraud rules.

Same-Day Filing of Soliciting Materials

All soliciting materials must be filed with the SEC no later than the date they are first sent or given to shareholders. [3] This includes the text of any social media posts or advertisements, as well as transcripts of any audio or video content included in those communications.

The SEC’s daily filing deadline is 5:30 pm Eastern. Due to the time involved in preparing and formatting an SEC filing once the soliciting material is finalized, which process often takes longer for graphic-intensive communications and audio or video content required to be transcribed, shareholder activists and their legal counsel must coordinate closely to ensure that soliciting materials are timely filed. In our experience, shareholder activists can best avoid issues by creating, circulating and regularly updating a calendar of expected communications, and when attempting to respond to events in “real time”, generally avoiding communications shortly before the deadline.

Rule 14a-12 Legal Legends

The general SEC rule is that no solicitation is permitted to be made unless the person solicited is or has been furnished with a proxy statement containing the information required under SEC rules. [4] However, under Exchange Act Rule 14a-12(a), the SEC permits solicitations made before a proxy statement is furnished to stockholders if any such written communication includes the following information, which we refer to as the Rule 14a-12 legend: (i) certain information regarding the participants in the solicitation, or a prominent legend advising shareholders where they can obtain that information, and (ii) a prominent legend advising shareholders to read the proxy statement when it is available and that they can obtain the proxy statement, and any other relevant documents, for free at the SEC’s website, and describing which documents are available for free from the participants. [5]

Depending on the shareholder activist’s fund structure and the number of participants in the solicitation, the Rule 14a-12 legend can become lengthy. That tends not to be a problem for traditional written and digital communications, in which the Rule 14a-12 legend generally can be included at the end of the document in a manner that does not detract from its visual impact. For social media communications, however, a social media platform’s applicable space and character constraints (e.g., Twitter’s 140-character limitation) may make the legend obtrusive or impossible to include in full.

The SEC addressed this issue in a compliance and disclosure interpretation first published in 2014. [6] In that interpretation, the SEC acknowledged that limitations on the number of characters or amount of text that may be included in a communication on certain social media platforms make the inclusion of the Rule 14a-12 legend impossible. In those instances, and those instances only, the SEC stated that the Staff would not object to the use of a hyperlink to the legend that prominently conveys that important or required information is provided through the hyperlink (often done by styling the hyperlink as “Important Information” or “SEC Legend”). Posts on social media platforms that do not have such limitations must include the full legend.

In our experience, the Rule 14a-12 legend typically does not impact social media communications as most often shareholder activists do not take their campaign to social media platforms prior to filing a definitive proxy statement. This is a strategically-driven approach that may evolve as the use of social media in activist situations becomes more commonplace. Nevertheless, shareholder activists have relied on the SEC’s interpretation to utilize social media prior to filing a definitive proxy statement.

A question we have seen arise with respect to the SEC’s interpretation is how it applies to character and spatial limitations for social media advertisements and search engine marketing that make the inclusion of a legend impossible. For a printed newspaper or magazine, where sufficient space always can be purchased, the SEC has been clear that the legend is required in advertisement text no matter the cost. However, for advertisements on social media platforms and search engine marketing that would be otherwise effectively off-limits prior to the filing of a definitive proxy statement due to the inability to include the full legend, a reasonable argument can be made that the SEC should permit the advertisement with a hyperlink to the legend.

Anti-Fraud Rules

When utilizing social media during a proxy campaign, shareholder activists always should be mindful of the prohibition on making a solicitation containing any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact, or which omits to state any material fact necessary in order to make the statements therein not false or misleading.[7] The SEC has highlighted the following as examples of what may be deemed misleading: (i) predictions as to specific future market values; (ii) material which directly or indirectly impugns character, integrity or personal reputation, or directly or indirectly makes charges concerning improper, illegal or immoral conduct or associations, without factual foundation; and (iii) claims made prior to a meeting regarding the results of a solicitation.[8]

Compliance with the anti-fraud rules extends not only to communications via social media developed by the shareholder activist, but also to any third party information re-transmitted, endorsed or linked to in the shareholder activist’s communications, as the SEC may attribute offending third party statements to the shareholder activist. [9] Therefore, shareholder activists generally should refrain from hyperlinking to third party websites and exercise caution when endorsing third party content.

Endnotes

1See News Use Across Social Media Platforms 2017, Pew Research Center, September 7, 2017, http://www.journalism.org/2017/09/07/news-use-across-social-media-platforms-2017/(go back)

2Exchange Act Rule 14a-1(go back)

3Exchange Act Rule 14a-6(go back)

4Exchange Act Rule 14a-3(a)(go back)

5Exchange Act Rule 14a-12(a)(1)(go back)

6Compliance and Disclosure Interpretations, Securities Act Rules, Question 164.02, https://www.sec.gov/divisions/corpfin/guidance/securitiesactrules-interps.htm(go back)

7Exchange Act Rule 14a-9(go back)

8Note to Exchange Act Rule 14a-9(go back)

9Securities Act Release No. 33-8591 (July 19, 2005), “[W]hether information prepared and distributed by third parties that are not offering participants is attributable to an issuer or other offering participant depends upon whether the issuer or other offering participant has involved itself in the preparation of the information or explicitly or implicitly endorsed or approved the information.”(go back)

Print

Print