Wolfgang Keller is Professor of Economics at the University of Colorado-Boulder and Director of the McGuire Center for International Economics; William Olney is Associate Professor of Economics at Williams College. This post is based on their recent paper. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here) and The Growth of Executive Pay by Lucian Bebchuk and Yaniv Grinstein.

Inequality

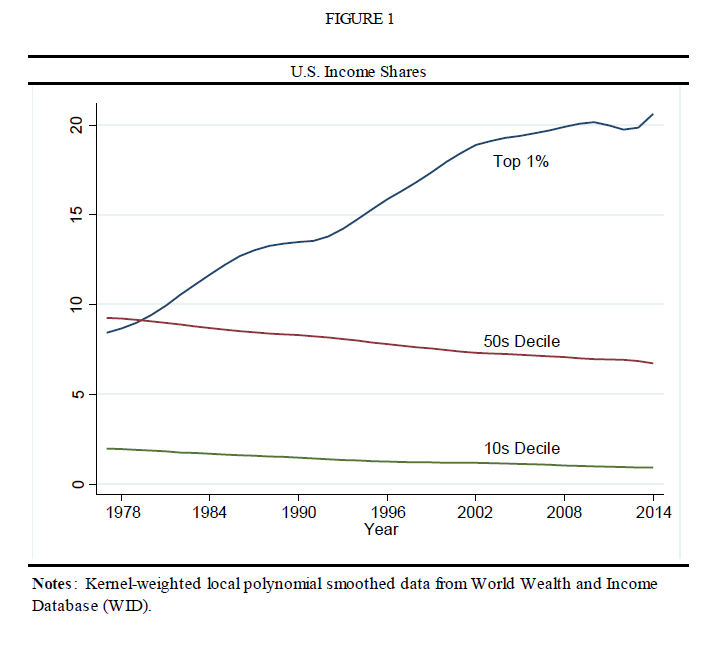

Growing inequality has been one of the most salient features of the U.S. economy over the last forty years. As depicted in Figure 1, nearly all of this growth in inequality is driven by the rapid increase in top incomes (Piketty and Saez 2003; WID). The share of income accruing to the top one percent of earners has risen from less than 10% in the 1970s to over 20% today. Despite important policy implications, the causes of this growth in top incomes remains an open question.

Explanations

A variety of explanations for the rapid growth in top incomes and executive compensation (the largest share of top incomes) have been proposed, including growing firm size (Gabaix and Landier 2008), new technology (Garicano and Rossi-Hansberg 2006), the market for superstars (Rosen 1981), poor governance (Bertrand and Mullainathan 2001), and changes in top tax rates (Piketty, Saez, and Stantcheva 2014). Despite the common perception that globalization has played a role in the growth in executive compensation, [1] there is relatively little work studying this channel and our recent paper fills this gap (Keller and Olney 2017). Our findings complement recent research showing that rising import competition has adversely affected the low end of the income distribution (Autor, Dorn, and Hanson 2013, Pierce and Schott 2016). Given that the vast majority of income inequality is driven by growth in top incomes, focusing on exports and executive compensation seems especially relevant and important.

Globalization’s Impact

Broadly, there are two channels through which globalization could affect executive compensation. First, market returns to executive talent may be rising with globalization. Talented executives may expand the firm globally, globalization may lead to high ability executives matching with the best firms, or the nature of the job could change in response to globalization. Fundamentally, the importance of top superstar executives increase in the global economy and their compensation rises accordingly.

Second, globalization could affect executive compensation for reasons unrelated to market returns to talent. The firm may be in an industry that happens to be expanding globally for reasons outside of the executive’s control, but the executive is nonetheless reaping the rewards of this fortunate turn of events. Alternatively, perhaps the complexity of operating in a globalized world economy allows executives to personally benefit through rent- capture activities, especially in poor-governance environments.

Evidence

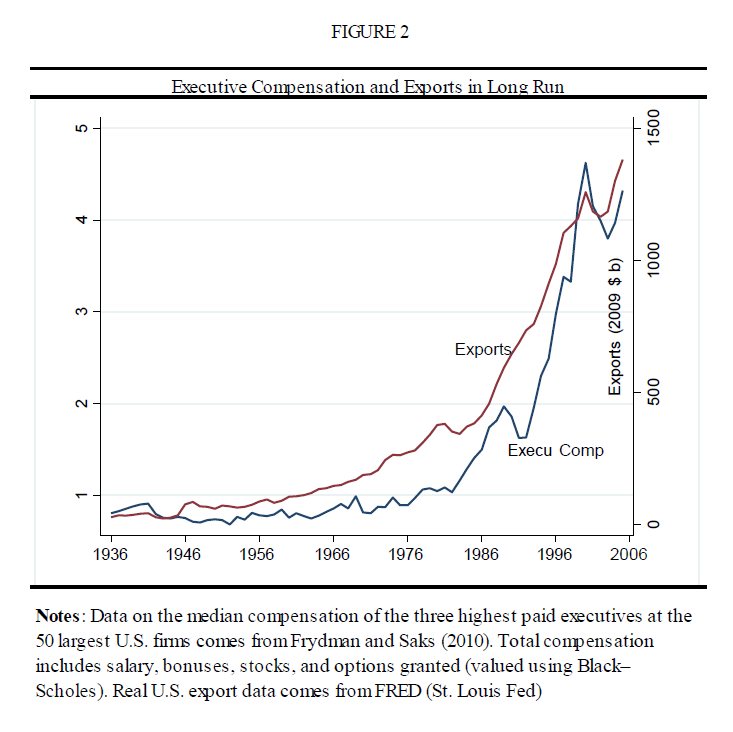

A preliminary check of the data offers support for the idea that globalization has contributed to growth in top incomes. In Figure 2 we see that exports and executive compensation have followed a similar trajectory over the last 70 years, suggesting that globalization is a promising long-run explanation for the growth in top incomes.

Our analysis uses a large dataset with detailed compensation information for U.S. executives over the years 1993-2013. The results confirm that firm size, technology, and poor governance all influence top incomes. Importantly we find that exports are just as important in determining executive compensation as these other, more established explanations.

We then examine whether this observed relationship between globalization and executive compensation reflects market or non-market returns. To isolate the latter channel, we identify (using an instrumental variable approach) growth in exports that has nothing to do with the executive’s talent or actions. We find that a 10% export shock leads to a 2% increase in executive compensation (left column of Figure 3). The fact that exogenous export shocks significantly increase executive compensation suggests that globalization does indeed affect top incomes in part through non-market channels. Additional results indicate that these exogenous export shocks do not increase the returns to talent as predicted by a matching or nature-of-the-job hypothesis.

We have three approaches to assess the extent to which this result is driven by rent-capture activities. First, we investigate whether executive bonuses, which are relatively discretionary and thus conducive to rent-capture, are more sensitive to export shocks. Second, we ask whether the impact of exogenous export shocks on executive bonuses is stronger at poor-governance firms where rent-capture is common. Finally, we examine whether executives with more managerial power (i.e. CEOs) are the ones that disproportionately benefit from exports shocks at poor-governance firms.

As illustrated in Figure 3, we find evidence in support of all three of these predictions. Export shocks disproportionately affect the bonuses of powerful executives at poor-governance firms, all of which suggests that rent-capture is playing an important role in the relationship between globalization and executive compensation.

Conclusions

Overall, these findings indicate that globalization has played a more central role in the rapid growth of executive compensation and U.S. inequality than previously thought. Furthermore, non-market returns and in particular rent-capture is contributing to this observed relationship. However, these findings should not be interpreted as a rationale for protectionist policies, since globalization has also generated large increases in the standard of living. The key question for policy makers is to devise ways to address the distributional implications of globalization, such as those identified in this paper, without compromising aggregate welfare gains.

The complete paper is available for download here.

References

Autor, David H., David Dorn, and Gordon H. Hanson. 2013. “The China Syndrome: Local Labor Market Effects of Import Competition in the United States.” American Economic Review, 103(6): 2121-68.

Bertrand, Marianne and Sendhil Mullainathan. 2001. “Are CEOs Rewarded for Luck? The Ones without Principals Are.” The Quarterly Journal of Economics, 116(3): 901-932.

Gabaix, Xavier, and Augustin Landier. 2008. “Why has CEO Pay Increased so Much?” The Quarterly Journal of Economics, 123(1): 49-100.

Garicano, Luis and Esteban Rossi-Hansberg. 2006. “Organization and Inequality in a Knowledge Economy.” The Quarterly Journal of Economics, 121(4): 1383-1435.

Keller, Wolfgang and William W. Olney. 2017. “Globalization and Executive Compensation,” NBER Working Paper # 23384.

Pierce, Justin R. and Peter K. Schott. 2016. “The Surprisingly Swift Decline of US Manufacturing Employment.” American Economic Review, 106(7): 1632-62.

Piketty, Thomas, and Emmanuel Saez. 2003. “Income Inequality in the United States, 1913-1998.” The Quarterly Journal of Economics, 118(1): 1-41.

Piketty, Thomas, Emmanuel Saez, and Stefanie Stantcheva. 2014. “Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities.” American Economic Journal: Economic Policy, 6(1): 230-271.

Rosen, Sherwin. 1981. “The Economics of Superstars.” The American Economic Review, 71(5): 845-858.

The World Top Incomes Database (WID). F Alvaredo, T Atkinson, T Piketty, E Saez, and G Zucman. Online at http://wid.world

Endnotes

1“American policy has allowed the winners to keep most of the spoils of trade and has given the losers crumbs. This has exacerbated income inequality by raising the profits of big corporations and the salaries of executives and other white collar professionals while leaving blue-collar and lower-skilled workers poorer[.]” New York Times Editorial, April 2, 2016(go back)

Print

Print