Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an ISS publication by Mr. Mishra. Related research from the Program on Corporate Governance includes The Elusive Quest for Global Governance Standards by Lucian Bebchuk and Assaf Hamdani.

2017 was an eventful year in corporate governance. With significant shifts in investor preferences, voting outcomes, societal norms, and the regulatory environment, 2018 promises to be just as eventful. In anticipation of the New Year, we asked our research experts around the globe to gaze into the crystal ball and give us their predictions in relation to corporate governance developments for their regions.

Cultural Evolution

A common theme among our analysts’ predictions is that 2018 promises to be a year of corporate cultural evolution, with growing focus on gender issues and corporate behaviors and attitudes. In North America, conditions are right for women joining boards in unprecedented numbers, reversing the trend of the U.S. slowly falling behind global norms. Given many recent high-profile cases and allegations of sexual harassment hitting the news, corporate culture is likely to become even more of a focal point for both boards and investors globally, ensuring that risks are being managed much more proactively than ever before.

Culture is also likely to feature prominently in discussions about risk oversight across many topics in light of a wide variety of scandals across the globe: aggressive sales strategies and poor data protection in the U.S., corruption scandals in Latin America, collusion among car manufacturers in Germany, negligent quality controls at Japanese firms, and poor lending practices and misconduct at Australian banks. Not surprisingly, several corporate governance codes now begin to place significant emphasis on culture.

The challenge for investors will be how to evaluate corporate culture and detect potential risks given the available disclosure.

Codes of Change

On the disclosure front, some changes are already underway as many countries revise their governance codes and improve recommended best practices and disclosure requirements. Canada, the United Kingdom, the Netherlands, Denmark, Brazil, Taiwan, India, Malaysia and the Philippines are among the many countries strengthening their regulatory frameworks to improve disclosure and independence standards. At the same time, many investors are asking for more information on key issues such as the director qualification and nomination process, climate change risk, management incentive structures and corporate strategy.

Seismic Political Shifts

Political developments may either slow down or accelerate the rate of change in many countries. Calls for tightening the reins on executive pay commonly appear during election campaigns. However, efforts towards the restriction of shareholders may also emerge in the form of protectionism or more management-friendly legislation. In the U.S., a mix of deregulation and regulation efforts are underway. For instance, stricter rules on the filing of shareholder proposals—paradoxically, an increased regulation of investor activities—may result in fewer filings and lead to alternative courses of action. In Europe, political instability may delay regulatory developments. Brexit, challenges with the formation of government coalitions and separatism (in the case of Catalonia) immediately come to mind. The greatest wave of political change may even occur in Latin America, where Brazil and Mexico both have elections in 2018 and there is intense focus on curbing corruption.

Here’s what our expert research teams think may happen in 2018 across the globe:

Americas

United States

Board and Governance

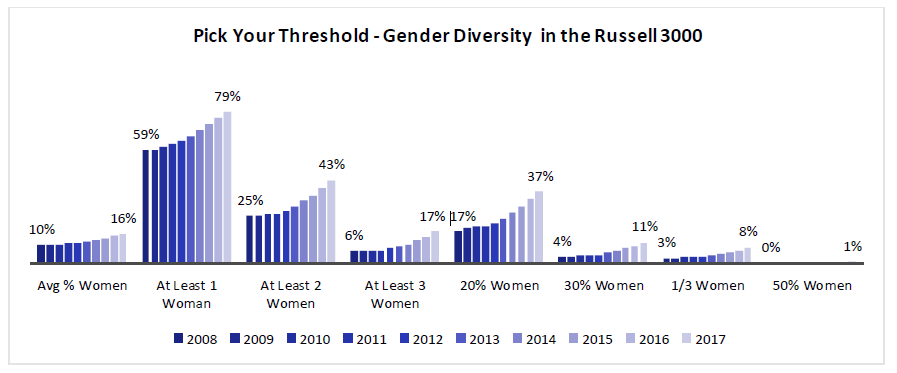

Gender Diversity on Boards: Engagement and the threat of shareholder action is likely to drive an unprecedented wave of companies recruiting more women to join as directors during the run-up to the 2018 proxy season. Look for more investors to adopt board diversity policies.

Risk Oversight: Sexual harassment may join cyber threats at the top of the list of shareholder-director engagement topics in 2018. Look for shareholders to come down hard on directors who fail to address problematic corporate cultures.

Shareholder Rights: Efforts to roll back voting rights and to erect barriers to shareholders’ exercise of their ownership rights may drive larger negative votes against directors who take such actions without shareholder approval. The proxy access momentum will also continue, albeit with fewer proposals on ballot.

Compensation

Pay for Performance: Investors will continue to focus on incentive program weaknesses. Look for some shareholders to rebel against large quantum of pay, pay program complexity, high levels of discretion, metrics that don’t tie clearly to business outcomes, and low performance hurdles.

Clawbacks: Expected anger over Equifax compensation package payouts [1] could spur calls for tougher clawback provisions and support for rigorous shareholder proposals as Dodd-Frank mandated rules languish at the SEC.

Pay Disparity: As pay ratio disclosures come into effect, most investors will be in wait-and-see mode. Look for some eye-popping ratios to capture headlines and drive debate about pay inequality at some high-profile meetings.

162(m) Changes: The tax reform bill will eliminate the exemption for performance-based compensation as it relates to the $1 million limit for tax deductions. This means that it will cost companies more to pay the same compensation they pay now. In addition, the bill changes the definition of “covered employee” to include the CFO and provides that, once an employee is covered by the rule, they remain a covered employee in subsequent years they receive compensation from the company rega rdless of their role.

Environmental and Social Issues

Climate Change Risk: Another bumper crop of shareholder proposals will likely see a bump in voting support as more institutions climb on the risk bandwagon in the wake of a public policy vacuum.

Human Capital Management: Concerns over harassment will focus more attention on corporate culture, behaviors, gender pay gaps and other human capital management issues.

Curbing Shareholder Proposals: Expect SEC staff to permit more exclusions of E&S-related shareholder proposals heading into 2018 season. Some expect the SEC to raise the bar for both proposal submission and resubmission.

Politics Unusual: The administration’s policy decisions will shape the agenda for shareholder campaigns in terms of topics and ways of engagement. Requests on political contributions and lobbying will continue to appear in high numbers. Potential restrictions on filing proposals, such as higher ownership thresholds, may lead to the emergence of new, larger filers or coalition formations.

ESG Interconnectedness: Governance, environmental and social issues will become ever-more interconnected as investors link board composition, accountability, executive compensation, climate risk, and company culture with each other as part of ESG integration or in the engagement process.

Activism and M&A

Contested Mergers: Expect more deal activism, including opposition to mergers from shareholders of acquirers questioning the strategic rationale and/or economic benefits of proposed transactions (e.g. Icahn vs. Sandridge).

Many Paths to Activism: Activist funds will continue to experiment with diverse tactics that set the level of aggressiveness in proxy contests, ranging from direct attacks on CEOs (e.g. Elliott vs. Arconic) to “minimally invasive” approaches (e.g. Trian’s campaign at P&G, where Nelson Peltz promised to re-nominate the director he unseated).

New Type of Activism? Brand-name activists—those involved in contests that went to a vote this year—will remain very active in 2018, but we could also see growing involvement from investors with a heightened focus on ESG issues in the form of no vote campaigns or proxy access. Alternatively, we may see the incorporation of ESG factors in the platforms of traditional activist campaigns.

Contested Votes: It is still too early to make an adequate prediction on the volume of contested meetings that make it to a shareholder vote in 2018; this will depend on many variables: tax reform, the overall health of the market, as well as companies’ overall approach to settlement negotiations.

Canada

Gender Diversity: More investors are likely to vote against boards with no diversity policies or no female directors. The general perception is that the market is moving slowly on the issue. As such, regulatory follow-up is likely, perhaps in the form of enhanced guidance or comply-or-explain requirements (see also Bill C-25 below).

Board Renewal: Board renewal continues to be a major focus, with issues like overboarding, director attendance, director qualifications and independence under increased scrutiny and review by investors, particularly in the context of enhancing diversity on boards.

Bill C-25: The proposed legislation requires annual elections and majority voting, and prohibits bundled director elections. The Bill introduces new disclosure requirements on diversity of the board and senior management. Diversity is defined broadly and may include gender, age, ethnicity or other factors. Companies affected would be specific to those that operate under the CBCA—which represents over half of Canada’s largest public companies.

TSX Disclosure Updates: No later than April 1, 2018, TSX-Listed issuers will need to disclose multiple governance-related documents and policies on their websites, including, but not limited to, the following: articles and bylaws, majority vote policies and advance notice requirements. In addition, beginning October 31, 2017, compensation disclosure improved to include burn rate figures as well as vesting and term requirements for all stock-based awards.

Proxy Access: All six of the largest Canadian banks have now adopted proxy access. Given the success of proxy access proposals in 2017, expect more such requests or voluntary adoptions of in 2018.

Environmental and Social Issues: Look for increased focus on disclosure around the financial impacts of climate-related risks and opportunities. In addition, we may see the first 2-degree scenario shareholder proposals at Canadian companies given the popularity and support of such proposals in the U.S. in 2017.

Compensation: One-time awards continue to raise significant concerns. Investors want to see more disclosure and better rationales for these types of awards, along with performance-based conditions and longer-term vesting provisions.

Antitakeover Measures: The TSX will place more scrutiny on private placements or other potential antitakeover measures, as companies are increasingly savvy with respect to tactics used in proxy contents and contested arrangements. Example: OSC’s decision re: tactical private placements (i.e. Eco Oro Minerals decision).

Latin America

General Elections: The political environment will likely continue to bring volatility to the markets of some of the largest countries in region, as Brazil, Mexico, and Colombia will hold general elections in 2018. Chile will be wrapping up its presidential election in December 2017.

Anti-Corruption Legislation: As massive corruption scandals continue to unfold in the region, Latin American countries are strengthening their anti-corruption laws. Argentina, Brazil and Mexico recently adopted new laws to fight bribery and sleaze. Look for improved compliance mechanisms at companies as a result of the new laws and greater awareness of corruption problems.

Remote Voting Cards: All Brazilian publicly traded companies will be required to offer the remote voting card system for their upcoming annual meetings and special meetings taking place on the same day or with election items. The Brazilian Securities Regulator is expected to recommend improvements to the remote voting card system including greater flexibility for the inclusion of minority shareholders nominees and the possibility to refile an updated card at least 15 days prior to the meeting date.

Corporate Governance Compliance: Brazilian companies will be required to adopt and disclose the corporate governance “comply or explain” form developed by the country’s regulator. Companies will have seven months after the end of their fiscal year to file their forms. In addition, 2018 marks the deadline for Brazilian state-controlled companies to comply with the 2016 law which established specific governance criteria with the aim of limiting political influence at such firms. Finally, Argentina is exploring the adoption of a listing segment with higher corporate governance standards, similar to the Novo Mercado segment in Brazil.

Europe

United Kingdom

New Governance Code: The Financial Reporting Council’s (FRC) proposed update to the UK Corporate Governance Code includes a number of significant changes, including the removal of the concept of the “Higgsian Chair” which precluded an annual assessment of the chair’s independence beyond their first appointment (i.e. was the chair “independent on appointment”?). Under the revised proposals—which are currently out for consultation—the chair’s independence would be assessed annually, in line with the approach for other non-executive directors. In addition, certain exceptions for smaller companies—i.e. companies outside the FTSE 350—have been removed, resulting in more consistent (and tougher) rules for all companies with a premium listing on the LSE, regardless of size.

Workforce Involvement: The draft version of the new code also incorporates new rules on the representation of workforce interests on boards, recommending that companies adopt any one of the following: a) the appointment of a director from the workforce, b) a formal workforce advisory panel, c) or a designated non-executive director to represent the workforce.

Emphasis on Culture: The Code places significant emphasis on company culture as part of the company’s governance declaring that the board must define the purpose, strategy and values of the company in collaboration with the wider workforce. The emphasis on culture is largely influenced by the FRC’s Culture Report from earlier this year.

Pay Ratios: The Government is expected to publish a law which will make the disclosure of pay ratios of CEOs versus an average UK-based employee mandatory. Look for early adopters to report pay ratios voluntarily before the law comes into effect.

Minding the Gap: Mandatory Gender Pay Gap reporting is also already into effect in that the data needs to be collected from April 2017 and disclosed from April 2018. Additional disclosures on non-financial metrics are expected, including the promotion of diversity of gender, ethnic and social backgrounds, as well as cognitive and personal strengths.

Shine a Light on Pay: On remuneration, there remains a sharp focus on disclosure. Investors expect annual bonus targets to be disclosed retrospectively, with an increasing focus on the discussion around any non-financial targets. Companies are also expected to demonstrate how pay outcomes are aligned with performance through the provision of adequate supporting rationales.

The Alt-Pay Wrangle: A few companies are pushing ahead with so-called “alternative” remuneration structures that deviate from the conventional model of variable pay, which typically has included an annual bonus and a forward looking long-term equity incentive. Perhaps the most divisive of these alternate structures is the inclusion of time-based restricted stock awards which are not subject to performance conditions.

Updated Prospectus Rules: A key change in the UK’s Prospectus Rules may allow companies to circumvent the Pre-emption Group Guidelines on the issuance of new shares without pre-emption rights, which in 2015 were increased by the Group to 10% of the issued share capital (subject to certain restrictions). The new Prospectus Rules may portend the return of cashbox placings, as the threshold at which a prospectus must be produced has been increased from 10% to 20% of the issued share capital.

France

More Binding Say-on-Pay: Shareholders will vote on a binding vote to approve the previous year’s compensation for the first time in 2018 in addition to the binding vote on remuneration policy (since 2017). A failed vote will result in the non-payment of variable remuneration earned during the past fiscal year.

Approval of Severance Packages: A good number of chairmen and CEOs will see their mandate of director renewed next year, which implies a vote on their severance package and additional pension scheme (in the framework of the related party transactions).

Engagement: Engagement between shareholders and the board will remain a key topic of interest (as discussed for the first time in the report of the High Committee of Corporate Governance).

Tax Reform en Route: Potential amendment of tax environment could prompt companies to propose new proposals to implement new long term incentive plans.

Germany

Focus on Pay: Given the backdrop of low support levels on say-on-pay in 2017 (66% on average at blue chip companies), expect shareholders to pay close attention to the disclosure of concrete performance targets, peer groups, and payout levels in order to make sure that pay and performance are aligned. Should companies not improve in this respect, approval rates might drop even further. Say-on-pay is voluntary and advisory in Germany.

Car Trouble: The German car industry with its flagships Volkswagen, Daimler, and BMW could face turbulent shareholder meetings next year amid allegations of collusion between government and industry related to costs, emissions controls and suppliers. The three carmakers (as well as VW’s Porsche and Audi brands) have been accused of colluding on dozens of technology-related matters.

Revised Code: The German Corporate Governance Code Commission announced that t he Code will be “fundamentally revised” in order to become more relevant and understandable. The Commission agreed to discuss the Code’s structure and recommendations and it also plans to compare the Code with international investors’ guidelines. The Commission has identified two main topics: board independence and executive remuneration. Consultations with investors, board members and other interested parties next year will take place prior to the submission of an official draft.

Austria

Gender Quota: As of Jan. 1, 2018, listed companies with more than 1,000 employees have to make sure that at least 30 percent of each gender is represented on supervisory boards. Since most Austrian companies have five-year board terms, the requirement does not apply until the next scheduled board elections take place. This quota is similar to the German legislation that came into effect two years earlier. Currently, only a minority of Austrian companies have female representation of 30 percent or more. Austria will be the newest addition to roughly 15 European markets with hard law female quotas.

Switzerland

Activist Battleground: Investors will see multiple high-profile activism campaigns and contentious situations at large cap companies, including Clariant, Nestle, Credit Suisse, and Sika (the latter concerns a dispute with the founding family). In the cases of Clariant and Nestle, the campaigns are driven by U.S.-based funds Corvex and Third Point, respectively. As company size is no longer a barrier, expect cross-border activism to continue especially at large-cap companies across many European and Asian markets.

Netherlands

New Code Focuses on Culture: Next year will be the first reporting season on the new Dutch corporate governance code. The new code places more emphasis on long-term value creation and introduces culture as an integral and explicit part of corporate governance. The Code Commission believes corporate culture is a driving force for the effectiveness of the corporate governance of a company.

National Interests: The newly formed Dutch government has expressed interest in taking measures to protect Dutch companies from foreign takeovers, following international bids for Unilever, PostNL, and AkzoNobel. The potential measures include identifying “vital sectors” in relation to national safety and risk, introducing a 250-day wait period for companies to contemplate foreign bids and lowering the ownership disclosure requirement threshold from 3% to 1% of share capital.

Belgium

Loyalty Shares: The Belgian legislator is reviewing Belgian Company Law with the main aim being simplification and removing gold-plating. Many governance related changes are foreseen but the most eye-catching change is the introduction of loyalty voting shares (after a holding period of 2 years). It will be an opt-in provision and must pass a shareholder vote (75-percent majority requirement). The law is due to be put up to a parliamentary vote in 2018 and will be in effect in 2020.

Denmark

New Governance Code: The new Danish corporate governance code will come into effect. The amendments to the Code focus primarily on management evaluation, board and committee composition and the content of the remuneration policy. The new code also implements certain parts of the 2017 European Shareholder Rights Directive ahead of its legal implementation into Danish law, including a new recommendation that compensation policies be subject to approval at least every four years. The code also includes new recommendations on board independence, including that an out-going CEO should not take on the positions of board chairman or vice chairman.

Stewardship Code: Furthermore, 2018 will see the first reports from Danish investors on compliance with the new Danish stewardship code, which covers seven recommendations aimed at promoting Danish companies’ long-term value creation and increasing transparency as to how individual Danish institutional investors choose to exercise stewardship activities. The Code closely follows the recommendations of the UK equivalent. As of Nov. 30, 2017, thirty-one Danish institutional investors disclosed that they will consider the Code.

Italy

Voter Turnout: Look for increased participation by institutional shareholders at general meetings. Foreign institutional investors represented 33% of voted shares at 2017 general meetings of Italian blue chips (up from 10% in 2016). This trend is expected to be accompanied by higher levels of opposition on say-on-pay votes.

Spain

Farewell to Catalonia? The uncertainty surrounding Catalonia’s independence has significant implications for business. Many companies have already moved or are considering moving their headquarters away from Catalonia to Madrid or elsewhere in Spain (a responsibility of the board, under Spanish law).

Asia Pacific

Japan

Reform Discussions Continue: With the revision of the Stewardship Code in 2017, which put emphasis on the role of asset owners, Japanese public pension funds began to play a more active role. Companies’ excessive retaining earnings has become a political issue and may become a major topic of corporate governance reform. Quality controls and culture will be a key area of focus in light of the eruption of a series of scandals related to falsifying controls data at large firms such as Kobe Steel, Mitsubishi Materials, Nissan, and Subaru. Expect to see gradual improvements in board independence, but not by double-digit increases, as seen in the past several years.

New Corporate Law: The Ministry of Justice will likely to release draft for the Corporate Law reform in early 2018. The reform will likely include mandating earlier and electronic disclosure of proxy materials, improved compensation disclosure, and allowing companies to indemnify (or compensate) directors in case of shareholder directive lawsuit.

China

Government Control: The central government will continue its grip on enterprises through measures like the inception of Communist Party committees, allegedly also in non-SOEs and foreign enterprises.

Hong Kong and Singapore

Dual Class: Look for the development and potential implementation of new regulatory frameworks and/or listing segments that would allow the primary listings of companies with unequal voting rights structures.

Taiwan

Getting the Act Together: The anticipated reform of the Company Act is expected to bring positive changes that will improve shareholder rights and transparency, including the provision for a nomination system for all directors. Furthermore, the government will continue its top-down approach to improve corporate governance of listed companies, placing emphasis on conflicts at family-controlled entities.

South Korea

Audit Committee Elections: Expect a lot of debate around the election of internal auditors and audit committee members. A shadow voting measure that allows companies to pass resolutions without majority shareholders present will lapse at the end of this year. In the meantime, large shareholders cannot exercise more than three percent of voting power when it comes to audit-related elections. As such, many proposals may not receive sufficient quorum.

Becoming Good Stewards: The South Korean Stewardship Code was originally published in December 2016, but not many investors adopted it until now. NPS, the world’s third largest asset owner, announced that it will gradually adopt the code by mid-2018, and asset managers who manage NPS funds are expected to follow NPS’ move.

India

Kotak Committee Reform: Look for changes to corporate governance norms for listed companies based on the report of the Kotak Committee formed by the SEBI. The suggested changes relate to board diversity, board and committee independence, related-party transactions, and director remuneration, among other factors.

Malaysia

Raising the Bar: A new Code on Corporate Governance of recommended practices was introduced in April 2017, and is expected to have an impact on the 2018 proxy season. The most notable change is the recommendation to have at least 50 percent independent directors, along with stricter independence criteria for committees.

Philippines

More Independent: A new Code of Corporate Governance of required practices was introduced in November 2016, and will be fully implemented in the 2018 proxy season. Boards are now required to have at least 3 independent directors or one-third of the board, whichever is higher. Stricter independent requirements are also introduced for board committees.

Australia

Bank Review: The Prime Minister announced a Royal Commission into the banking sector, and in particular the conduct and practices of the Big 4 banks, in light of the history of scandals in the past decade concerning lending practices, interest rate fixing and problematic practices around financial advice. Analysts speculate that the Big 4 banks could spend up to $100 million in legal fees alone. Expect new rules and regulations as a result of the inquiry.

Social Mindfulness: Boards are likely to be more mindful of underlying social factors of business activities including consumer protection and pay inequality. Expect more emphasis on transparency and governance in an effort to demonstrate appropriate exercise of companies’ social license to trade.

Endnotes

1Equifax’s departing CEO Richard Smith is estimated to receive approximately $18 million in retirement benefits in addition to total compensation of approximately $15 million earned in 2016. The New York City Comptroller submitted a shareholder proposal requesting the company a mend its clawback policy to cover misconduct that causes significant financial and reputational harm.(go back)

Print

Print