Paula Loop is Leader of the Governance Insights Center at PricewaterhouseCoopers LLP; George M. Anderson is Leader of Board Effectiveness Services at Spencer Stuart; and Paul DeNicola is Managing Director of the Governance Insights Center at PwC. This post is based on a PwC and Spencer Stuart publication by Ms. Loop, Mr. Anderson, Mr. DeNicola, and Barbara Berlin.

Board composition and performance continue to be under scrutiny by various stakeholders. Institutional investors are paying close attention to the individuals representing their interests in the boardroom, and how the board addresses its own succession. Hedge fund activists are also watching and certainly have not been shy about seeking change. And directors themselves are increasingly vocal about the performance of their peers. In fact, 46% of directors believe someone on their board should be replaced; 20% believe two or more directors should.

46% of directors believe someone on their board should be replaced.

20% believe two or more directors on their board should be replaced. [1]

They say their top reasons are because directors overstep the boundaries of their oversight role, are reluctant to challenge management, have a style of interacting that negatively affects board dynamics and advanced age has led to diminished performance. So, how do boards use their annual assessment process to measure effectiveness, drive refreshment and raise performance? They shift to a continuous improvement mindset.

Most directors have completed board and committee assessments for years as required by stock exchange listing standards. Fewer boards conduct individual self-assessments; only about a third of S&P 500 boards evaluate the full board, committees, and individual directors as part of their annual assessment process. [2] While some boards are quite good at conducting these assessments, others could stand to get more out of the exercise. The biggest roadblocks? Viewing it as a compliance exercise, using an approach that doesn’t really allow for honest feedback and failing to follow-up on the results.

Boards and individual directors would benefit from re-envisioning their assessment approach. This involves re-defining the process as one that is ongoing and provides real value and continuous improvement. Here are five key actions to ramp up the board’s next annual assessment:

Lead like a lion. Board leadership is critical to making changes happen. Without a strong leader, it doesn’t matter how meaningful your assessment process is.

Change the endgame. Making the assessment process an ongoing exercise with the goal of continuous improvement can deliver better results. But early buy-in from all directors on the process is critical.

Address the elephant in the room. Boards that have frank discussions about what is holding their performance back can excel. This involves having a way to provide honest individual director feedback, which can be done in different formats. A periodic independent perspective can help.

Take action to get real results. Effective boards are disciplined about identifying and holding themselves accountable for action items coming out of the assessment. They also integrate assessment results into their director succession plan.

Give investors greater insights. Many boards are taking a closer look at their disclosures around board assessments—seeking to provide stakeholders with a greater understanding of the process. Shareholder engagement in this area has risen, and boards are taking steps to be more transparent.

Lead like a lion

Board leadership is critical to making any changes happen. The board leader sets the tone for the culture of the board, and in many cases leads and drives the assessment process. In fact, 87% of directors indicate that a strong focus from the board chair or lead director is an effective method to drive board refreshment. [3] Without a strong leader, it doesn’t matter how meaningful your assessment process is.

A close look at board culture and whether directors really can be candid when providing feedback is also needed. This involves understanding the way that directors make decisions, handle disagreements and share information. If the board is to continue to grow and improve, the culture has to be open to the idea of giving—and receiving—regular feedback. And, board leadership is key to ensuring this environment exists.

Change the endgame

Let’s face it, the word “assessment” can have a negative connotation. It can put people on edge, even in a boardroom of high-performers. Because of the collegial nature of many boards, it can sometimes be hard to deliver less than glowing feedback about a fellow director—which can turn the process into “something to get finished” rather than a way to enhance board performance.

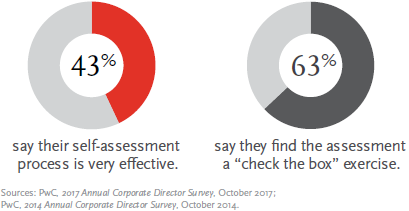

According to PwC’s Annual Corporate Director Survey, only 43% of directors say their self-assessment process is very effective. [4] They also view assessments as a compliance requirement: 63% of directors say they find the assessment a “check the box” exercise. [5] So what can boards do?

Take a fresh look at the approach: Boards can improve the value of their assessment process by focusing on continuous improvement and board excellence. Effective assessments should look at ways to enhance board dynamics, composition, oversight and practices. They should reinforce what is working well and highlight those obstacles that are limiting strong performance. And, the assessment is best viewed as an ongoing process rather than just a once a year event.

Some boards have embraced a continuous improvement mindset by adding more frequent opportunities to discuss effectiveness as part of their agendas. Others have instituted a formal process for providing director feedback or coaching throughout the year. Boards can also take a fresh look at their assessment approach and evolve the format or ask different questions to drive a better outcome. They may even find it valuable to dive deeper on a few particular areas where they believe there is potential improvement.

Get early buy-in: Before the assessment process begins, directors should discuss the approach and decide on any changes they wish to make. This involves engaging directors early and giving them a chance to provide input and voice their concerns so these items can be addressed appropriately. The discussion should cover the assessment’s scope and objectives, how it will be conducted and reported back, and the need to openly share and receive feedback. The goal is to get agreement on what the assessment process should accomplish and obtain commitment and support for it.

Directors’ views of self-assessments

Six key questions to consider asking in self-assessments

Boards that are committed to self-improvement use assessments to ask:

- How effectively do we engage with management on the company’s strategy?

- How healthy is the relationship between our CEO and board?

- What is our board succession plan?

- What is our mechanism for providing individual director feedback?

- What is our board culture and how well does it align with our strategy?

- What processes are in place for engaging with shareholders?

Source: Spencer Stuart “Performance in the Spotlight: Assessment and Board Effectiveness,” March 2016, https://www.spencerstuart.com/research-and-insight/performance-in-the-spotlight

Address the elephant in the room

What holds boards back from top performance? Board culture and interpersonal dynamics tend to be the most common sources of dysfunction in the boardroom. Dysfunction can take various forms, whether it is a lack of trust between the board and CEO, disruptive or disengaged directors, factions in the boardroom or poor decision-making processes. These issues, though sometimes apparent to those in the boardroom, can be the most difficult to address.

To improve board performance, directors need to identify and address what isn’t working, and the assessment process can be a key way to do so. But directors need to be frank in these discussions. This isn’t always easy: 70% of directors say they find it at least somewhat difficult to be frank during the assessment process. [6] Add to this the fact that many boards do not have a way for directors to share feedback with their fellow directors. So what can boards do to address the elephant in the room?

Institute mechanisms for honest director feedback: Boards can address whether the assessment process really allows for issues and concerns to surface and be dealt with, particularly the ones related to individual director performance. The process should permit the board, its committees, and individual directors to think critically, have meaningful discussions and identify potential areas for improvement, as well as demonstrate a willingness to address any weaknesses. A high-performing board culture allows directors to feel comfortable being open and candid with their concerns.

Feedback on individual directors is increasingly viewed as a critical component of the assessment process. Directors can use the output to improve their performance. The format of individual director feedback can vary. The goal shouldn’t be to grade directors, but to provide constructive input that can improve performance. Approached in this way, directors often welcome the opportunity to receive feedback.

“Boards should be open to the results of the assessment and be prepared to deal with the findings. This involves having candid discussions about performance issues that are raised and prioritizing what should be addressed.”

— George Anderson, Leader of North American Board Effectiveness Services, Spencer Stuart

Some boards use a formal individual director assessment or a peer assessment process. Others may implement a mentoring program for directors. Another way to provide individual director feedback can be to have each director meet periodically with the chairman/lead director or nominating/governance committee chair.

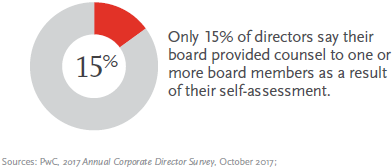

Board leadership plays a critical role in ensuring directors receive important feedback. Board leaders frequently get feedback on individual directors or observe behavior in meetings that can be improved. However, awareness of these behaviors does not always translate into action. For example, only 15% of directors say their board provided counsel to one or more board members as a result of their self-assessment. [7] High-performing board chairs and lead directors will embrace this role.

Consider periodically getting an independent perspective: Companies may choose to periodically engage an independent facilitator to assess board performance. Twenty-one percent of boards engaged a third party in 2016. [8] And, this number is likely to increase because of growing stakeholder pressure on board performance.

An independent view can be very helpful in providing the board with perspectives on how it compares to its peers or “measures up” to the evolving standards of corporate governance. The third party can also conduct interviews individually and share the collective feedback with the director without providing attribution to help them understand what is working well and where there are concerns or areas for improvement. Ultimately, the independent of the financial cost, some boards hire third-party facilitators every third year or as needed in response to changing board dynamics or emerging challenges.

Take action to get real results

Committing the time to review the results of the assessment process and having an open discussion about the findings are critical. But boards often fall short as they spend too little time—or even no time—discussing and acting upon assessment findings. This is a missed opportunity.

Agree on action items and develop a plan for change: Directors should work together during the assessment process to identify and agree on areas in which the board would like to improve. Areas for improvement might be to add a director with particular experience, increase the board’s diversity, schedule a board retreat that focuses on strategy, create more opportunities to communicate with the CEO or hold more frequent executive sessions. At the individual level, a director may be advised to attend an educational program to enhance knowledge in a particular area, engage more often in discussions or change behavior in the boardroom.

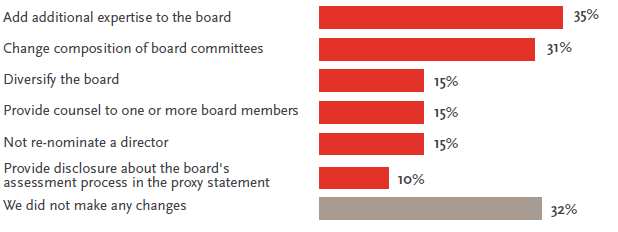

Board action on assessments

Source: PwC, 2017 Annual Corporate Directors Survey, October 2017, In response to the results of your last board/committee assessment process, did your board/committee decide to do any of the following?

Effecting real change requires a plan for addressing issues raised in the assessment. Such a plan starts with identifying a leader—often the chairman, lead director or nominating/governance committee chair—to drive the changes. The leader should develop an action plan to discuss needed changes with the appropriate parties, as well as identify potential strategies, options, and key milestone dates. It is then important for the leader to monitor implementation of the action plan for additional follow-up and results, keeping the full board updated on progress.

Integrate assessment results into board succession planning: As part of the action plan coming out of the assessment process, the board should discuss whether changes are needed to the board succession plan. The assessment process is a natural platform for reviewing the skills and expertise needed on the board in the context of the company’s long-term strategy. Does the board need access to deeper technological skills? Does it need more diversity of perspective? These discussions should filter into director succession planning, which is often led by the nominating/governance committee.

Today, director succession planning is often performed as a separate, distinct exercise, done on an as-needed basis when facing an impending vacancy on the board. In fact, typical drivers of renewal cited by directors are director retirements (91%), the desire to add new skills (79%) and the goal to increase diversity on the board (62%). [9] But when findings from the assessment process are integrated into succession planning, the board is more likely to address issues in its composition and make the changes needed to get the right people in the boardroom. If new or different skills and expertise are needed, boards can consider them when seeking new directors. High-performing boards evaluate composition holistically and address it over a longer period of time, perhaps even with a five-year succession plan. Some boards act sooner by expanding their size to accommodate a new director with the needed skills and expertise.

Give investors greater insights

Shareholders are seeking more information about how boards address their own performance, including whether they are using assessments as a catalyst for refreshing the board. Today, disclosures are fairly limited in this area. Beyond reporting that boards conduct an annual assessment, most S&P 500 boards disclose few details about their assessment process.

A handful offer more detailed disclosures, including descriptions of the areas that the board assessment cover, the process and the actions the board has agreed to take following the assessment.

Benchmark disclosure on assessments and consider voluntarily expanding it: Boards are generally doing more than they disclose. And, with the increasing spotlight on board performance, the time may be right to reassess these voluntary disclosures and provide more insight. The Council of Institutional Investors (CII) suggests that “[s]uch disclosure is an indication that a board is willing to think critically about its own performance on a regular basis and tackle any weaknesses.” [10]

CII highlights two best practice models for disclosure. One focuses on the mechanics of the assessment process, illustrating the process the board uses to identify and address gaps in its skills and performance. The other focuses on the most recent assessment, recapping the key takeaways and plans for improvement.

CII notes that depending on the board’s process, disclosure may include:

- A description of the steps in the board evaluation, including who is reviewed and how reviews are conducted

- A discussion of continuous improvement initiatives and the activities that directors participated in during the past year

- Whether the board engaged an external adviser to conduct the board evaluation and the role

- that the adviser played (for example, interviewing board members)

- The objectives for the evaluation and how the board will use the findings

- Follow-up discussions that occurred. For example, some boards report having a mid-year check-in to evaluate the progress made in addressing areas of focus identified in the annual evaluation

Boards can ask management to benchmark the company’s disclosure about the board assessment process with that of peer companies. They can also ask them to draft a sample enhanced disclosure that includes additional information on the board’s assessment practices and considers insights drawn from management’s review of other companies’ disclosures and shareholders’ perspectives. This information can help the board to critically evaluate whether it should voluntarily enhance its proxy disclosures.

Be prepared for potential engagement with shareholders on self-assessments: Direct communications between board members and investors has grown considerably over the last several years. Just under half of directors now say their board has such engagement. [11] Shareholders are more often meeting with nominating/ governance chairs and asking about board assessments as part of their engagement program. They want to understand how boards are assessing their own performance and the skills and expertise needed to oversee the company’s long-term strategy. They also want to understand the board’s position on director turnover, succession planning and diversity. Some high-performing boards even conduct “opposition research” to understand and identify what a tough critic would say about their board’s composition to be prepared for any potential engagement.

Conclusion

Board performance is being scrutinized by shareholders, the media, the public and others. In today’s environment, boards will want to refresh their assessment process to ensure it encourages a continuous improvement mindset and allows for candid and honest feedback. When done well, the assessment often results in changes that allow the board to deliver greater value to the company and its shareholders. And boards will want to tell their investors that they critically evaluate their own performance, addressing obstacles and striving for improvement.

Endnotes

1PwC, 2017 Annual Corporate Director Survey, October 2017. (go back)

2Spencer Stuart, 2016 Spencer Stuart Board Index, October 2016.(go back)

3PwC, 2017 Annual Corporate Director Survey, October 2017.(go back)

4PwC, 2014 Annual Corporate Director Survey, October 2014.(go back)

5PwC, 2014 Annual Corporate Director Survey, October 2014.(go back)

6PwC, 2014 Annual Corporate Director Survey, October 2014.(go back)

7PwC, 2017 Annual Corporate Director Survey, October 2017.(go back)

8PwC, 2016 Annual Corporate Director Survey, October 2016.(go back)

9Spencer Stuart, 2016 Spencer Stuart Board Index, October 2016.(go back)

10Council of Institutional Investors, Best disclosure, Board evaluation, September 2014. cii.org(go back)

11PwC, 2016 Annual Corporate Director Survey, October 2016.(go back)

Print

Print