Steve W. Klemash is EY Americas Leader at the EY Center for Board Matters. This post is based on an EY publication by Mr. Klemash.

As boards and executives work to identify strategic opportunities and address shifting risk and business environments, institutional investors too are seeking to strengthen and protect their holdings for the long-term. With this in mind, investors are increasingly engaging with companies.

At the same time, the historically diverse priorities of the wide range of institutional investors appear to be aligning on key topics—board composition and environmental and social matters, in particular. Importantly, the shift in investor views is affecting their policies, and engagement and voting practices.

In this sixth year of the EY Center for Board Matters’ annual investor outreach, we interviewed more than 60 institutional investors representing US$32 trillion in assets under management, including asset managers, public pension funds, labor pension funds, and faith-based and socially responsible investors (SRIs), as well as investor associations and advisors.

Based on the outreach conversations, investors tell us their top five priorities for companies in 2018 are:

- Board composition, with a particular focus on enhanced diversity

- Board-level expertise that is more aligned with business goals

- Increased attention to climate risk and the environment

- Enhanced attention to talent and human capital management

- Compensation that is more aligned with performance and strategy

Investors’ top 5 priorities in 2018

1. Board composition, with a particular focus on enhanced diversity

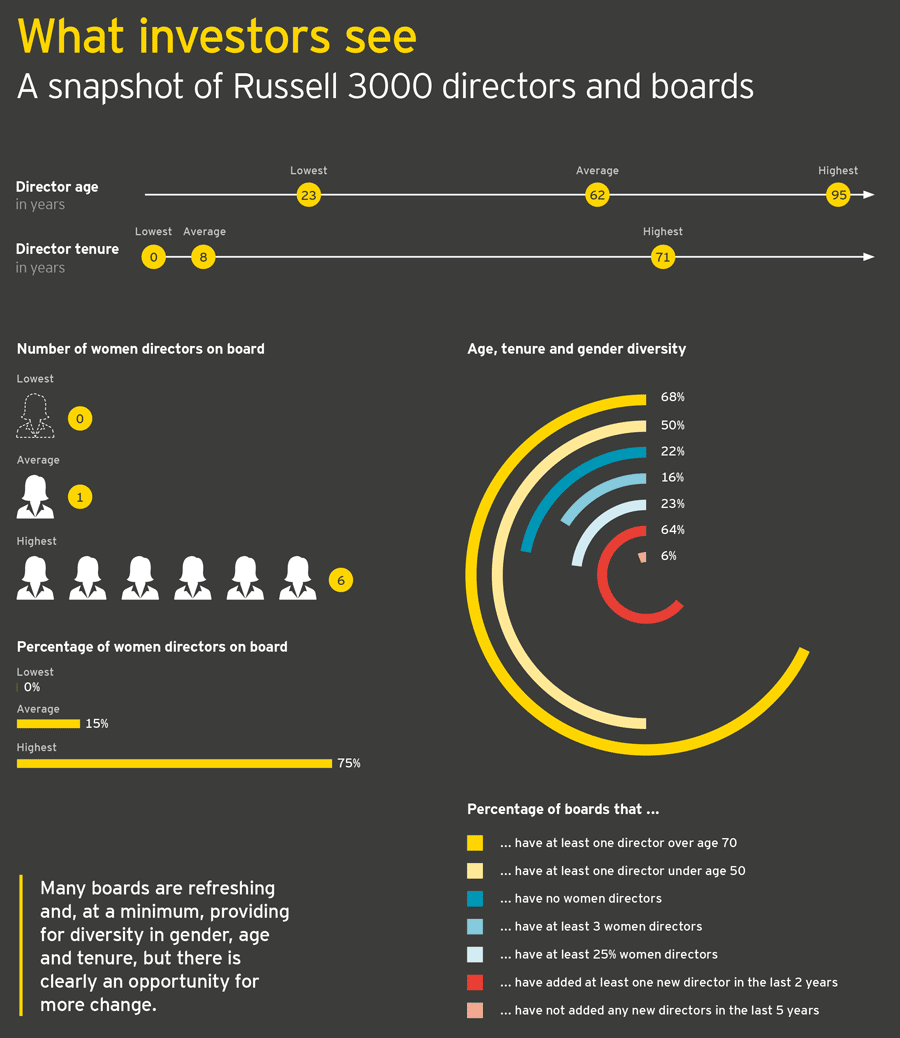

Eighty-two percent of investors said composition should be a board priority, including having fresh and different perspectives in the boardroom. Most investors highlighting this priority were asset managers (52%), SRIs (18%) and public funds (16%).

The focus on board composition includes a specific focus on diversity as investors continue to call for enhanced diversity in director characteristics and experience. This may include gender, race and ethnicity, age, nationality and geography, socio-economic backgrounds or other forms of diversity, but gender was most commonly cited, partly due to the lack of consistent disclosure on any other characteristic. Around half said that they consider board diversity in director election voting practices. Around one-quarter said they do so on an event-driven basis, such as proxy contests and shareholder proposals on board diversity.

About one-fifth separately shared that they were considering changes to their own diversity policies to clarify or expand diversity definitions or to hold companies to a stricter standard.

The close attention to director characteristics and backgrounds is driven by interest in effective board composition, given the wide range of studies demonstrating the benefits of diversity, including how diverse perspectives enhance issue identification and problem-solving ability and impede “group think.” Around one-quarter observed that they would like to see at the board level a “current” perspective, ability to think differently or willingness to challenge the status quo. For some, long tenure (which they define as over 10 to 12 years) was a particular concern given their view that this compromises independence.

Other board composition considerations highlighted include board assessment, refreshment and succession planning processes are another commonly highlighted priority as investors seek assurance that existing processes position the board and therefore the company for long-term success. Approximately one-quarter called for more disclosure around board composition, such as showing how board member selection aligns with the company’s strategic goals or providing a meaningful skills matrix.

A subset noted they do their own analysis, including creating their own skills matrix to understand board composition, as needed.

- Note investor concerns and frustration with the perceived slow pace of change in board diversity.

- Consider whether board composition reflects a diverse mix of personal characteristics and experiences in addition to skills and expertise.

- Identify ways to enhance disclosures around board diversity and refreshment efforts as a way to communicate considerations about board effectiveness.

2. Board-level expertise that is more aligned with business goals

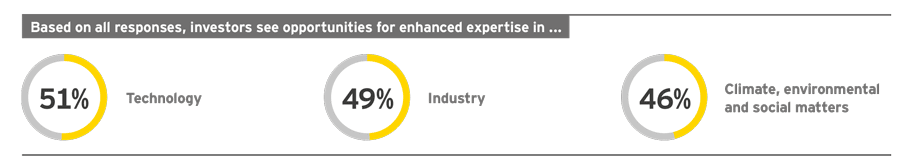

We asked investors for issue areas where they perceive opportunities for enhanced board expertise, whether in the form of adding more experts to a board or in terms of improving board access to management and third-party expertise. In response, over 90% pointed to at least one of five areas—technology, industry, climate competency, risk oversight and strategy. Most investors in this group were asset managers (49%), SRIs (18%) and public funds (14%).

The highlighted areas of expertise speak to investor attention to the long-term sustainability of businesses. Around half highlighted technology-related expertise, such as cybersecurity, artificial intelligence, digitalization and e-commerce. Cybersecurity was the most commonly cited concern by far, and this was frequently raised in connection with consumer data privacy. Investors also commonly (around half) perceived an opportunity for boards to strengthen industry expertise, with a few suggesting that this may be achieved by adding a non-independent director to provide that expertise. This includes investors who perceived a need for enhanced international expertise at the boards of US multinationals, for example. Investors also indicated strong interest in climate competency, risk oversight and strategy.

Investors acknowledged that there may be overlap across the expertise areas; for example, technology and climate can be considered to have elements that fall under risk oversight and strategy. Also, many investors highlighted both risk oversight and strategy, with more investors highlighting risk oversight alone. The differing levels of attention might suggest that the investors we spoke with view risk oversight a more pressing area—at least for now.

One-fifth of investors referenced corporate controversies and their own engagement experiences in sharing that they perceived opportunities for enhanced communication between management and the board, including more frequent reporting by management. This suggests possible opportunities to enhance existing processes to support the work of the board.

- Investors recognize that company needs vary and that boards cannot be expected to master technical areas, but there is an expectation that directors need to be informed and experienced enough to oversee key company-specific priorities.

- Note that investors look at board expertise as they assess board composition.

- Consider how board access to expertise aligns with

company strategy and whether this is communicated in

proxy statement disclosures. As one example, we have

observed voluntary proxy statement disclosures around

the qualifications of financial experts and the work of the

audit committee.

3. Increased attention to climate risk and the environment

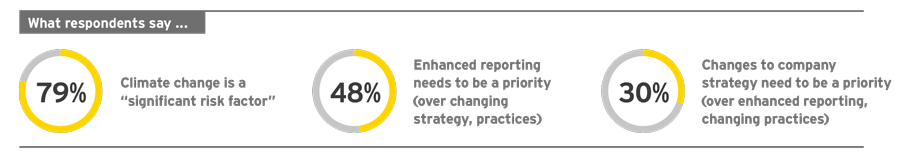

Sixty-four percent of investors told us that a priority is for companies to address climate risks and environmental sustainability matters. This may include improving disclosures, strengthening board oversight, and/or addressing company-specific risks and opportunities. Of these investors many said that climate and environmental matters need to be a priority for both the board and management. Most investors highlighting this priority were asset managers (44%), SRIs (26%) and public funds (15%).

The percentage of investors that told us that climate change specifically is a priority has more than tripled since 2016. The heightened level of attention reflects growing concern about climate risk, reactions to changes in US environmental policy, and interest by the investors’ own stakeholders. Investors expressed interest in a range of topics, such as resource use, greenhouse gas emissions reduction, the company’s carbon footprint or preparation for a low-carbon economy. Possible topics of engagement also may include a company’s policies, statements and activities on environmental matters, including regarding political spending and lobbying.

When asked whether they agree with the statement that climate change is a “significant risk factor,” 79% said yes. Investors were then asked to rank their preference for enhanced company reporting, changing company strategy or changes in business practices. Most said that enhanced reporting needs to come first as it lays the groundwork for transparency and accountability. Others said that changes to company strategy need to be a bigger priority as reporting can follow.

There is no consensus on a specific reporting framework. Indeed, investors acknowledged challenges in reporting and said that company reporting on climate risk needs to be appropriate to company circumstances and situation, even if it is just to say that climate is not material to the business.

- Consider how investors may assess the company’s communications and actions around the climate and environmental sustainability matters.

- Discuss with management the company’s opportunities regarding sustainability-related disclosures and investor engagement, particularly if the company’s key investors include supporters of or signatories to programs, such as the Task Force on Climate-related Financial Disclosures, the Sustainability Accounting Standards Board, Climate Action 100, or the United Nations Principles for Responsible Investment.

- Boards, particularly in the energy and utility sectors, may wish to consider disclosing their climate competency and creating a structure for board oversight of sustainability matters.

4. Enhanced attention to talent and human capital management

Fifty-two percent of investors called for companies to prioritize management attention to and enhanced board oversight of talent and human capital management, including diversity and inclusiveness matters. Most investors highlighting this priority were asset managers (48%), SRIs (16%) and public funds (15%).

Investors focused on human capital management speak to a wide range of topics related to how the company works on attracting, retaining, training and engaging the workforce—from senior executives to the broad base of employees. For example, investors called out the importance of companies addressing the changing definition of work for millennials and workers facing technology-driven displacement, whether full-time, part-time, contingent or gig workers. Some also expressed interest in worker training and broader company efforts to address projected skills shortages.

Investors also referred to company culture and how this relates to a company’s ability to hire and retain the best talent—and fundamentally, to remain competitive over the long run. Some noted that companies that are strongly identified with a culture of improving the environment or benefiting communities have an advantage in attracting top talent, demonstrating that people want to work in companies that have good corporate citizenship.

Human capital management also connects to culture through diversity and inclusiveness. Several indicated attention to diversity among senior executives because they represent the future pipeline to the boardroom and because of the view that corporate leaders need to represent the company’s priorities regarding its people. Some observed that companies with diversity within the ranks but not at the top, raise questions about the company’s long-term sustainability. Investors also noted the importance of workplace protections from discrimination and harassment. Some observe that a lack of diversity at the top makes it harder for companies to effectively manage talent and human capital. Investors calling attention to pay disparity also bring attention to a company’s internal strategies. Given the general view that diversity and inclusiveness add value to business, evidence of pay gaps suggests a need for attention to corporate policies.

- Concurrent with growing investor interest, we have observed that more boards are adopting a broader view of understanding a company’s talent strategy and taking a fresh look at their oversight roles. There may be an opportunity for companies to communicate how human capital drives the business and how workforce transformation efforts align with company strategy.

5. Compensation that is more aligned with performance and strategy

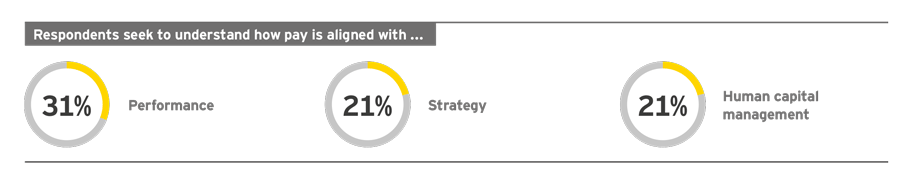

Thirty-six percent of investors are prioritizing executive compensation as a focus area this year, and additional investors are considering new ways to research and better understand how companies might strengthen alignment of pay and performance. Most investors highlighting pay as a priority this year were asset managers (45%), SRIs (23%), public funds (14%) and labor funds (14%).

Thirty-six percent of investors are prioritizing executive compensation as a focus area this year, and additional investors are considering new ways to research and better understand how companies might strengthen alignment of pay and performance. Most investors highlighting pay as a priority this year were asset managers (45%), SRIs (23%), public funds (14%) and labor funds (14%).

Although overall support for Say-on-Pay proposals continues to be very high for about 90% of all public companies, the investors who told us they are focusing on executive compensation say their own views differ significantly. They told us they remain concerned about the rigor of performance incentive structures and the size of pay, with some investors noting that they vote against a significant proportion of Say-on-Pay proposals. There also was interest in the company-specific context for pay strategy. For example, for some companies, particularly in the energy and utilities sectors, investors may ask how environmental and social considerations are reflected in pay practices.

Investors indicated that they would like to better understand how a company’s long-term strategic priorities as well as its culture of integrity and accountability are aligned with its approach to pay. These investors noted that misaligned compensation incentives can affect a company’s risk culture and the ethical behavior and compliance culture of its people. Some investors shared that accounting for the impact of litigation costs in pay calculation considerations could be one method to enhance pay for performance alignment.

Some investors focused on possible gender, race or ethnicity related pay disparities between various groups of employees—with an eye to following new pay gap disclosures in the United Kingdom. This year, while much attention this proxy season is expected to focus on CEO pay ratio disclosures in the US market, only a few investors raised the topic in our outreach conversations. Those who did, raised this topic in the context of human capital management, focusing on how companies may be managing internal communications about the CEO pay ratio across different employee groups. Although overall support for Say-on-Pay proposals continues to be very high for about 90% of all public companies, the investors who told us they are focusing on executive compensation say their own views differ significantly. They told us they remain concerned about the rigor of performance incentive structures and the size of pay, with some investors noting that they vote against a significant proportion of Say-on-Pay proposals. There also was interest in the company-specific context for pay strategy. For example, for some companies, particularly in the energy and utilities sectors, investors may ask how environmental and social considerations are reflected in pay practices.

Investors indicated that they would like to better understand how a company’s long-term strategic priorities as well as its culture of integrity and accountability are aligned with its approach to pay. These investors noted that misaligned compensation incentives can affect a company’s risk culture and the ethical behavior and compliance culture of its people. Some investors shared that accounting for the impact of litigation costs in pay calculation considerations could be one method to enhance pay for performance alignment.

Some investors focused on possible gender, race or ethnicity related pay disparities between various groups of employees—with an eye to following new pay gap disclosures in the United Kingdom. This year, while much attention this proxy season is expected to focus on CEO pay ratio disclosures in the US market, only a few investors raised the topic in our outreach conversations. Those who did, raised this topic in the context of human capital management, focusing on how companies may be managing internal communications about the CEO pay ratio across different employee groups.

- Consider how stakeholders may view a company’s executive compensation practices in view of the company’s long-term strategy and industry. Given attention to CEO pay ratio disclosures and pay issues more broadly, there may be an opportunity for boards and management to make pay-related communications more specific to the company’s specific situation and to tie them to the company’s values and culture.

- As investors seek to protect the value of their investments for the long-term, boards and management have an opportunity to show, through enhanced disclosure and engagement, how their companies are poised for sustained success. Consider engaging with the largest investors as well as smaller investors, who rely on tools, such as shareholder proposal submissions and letter-writing to provide input to the board and management.

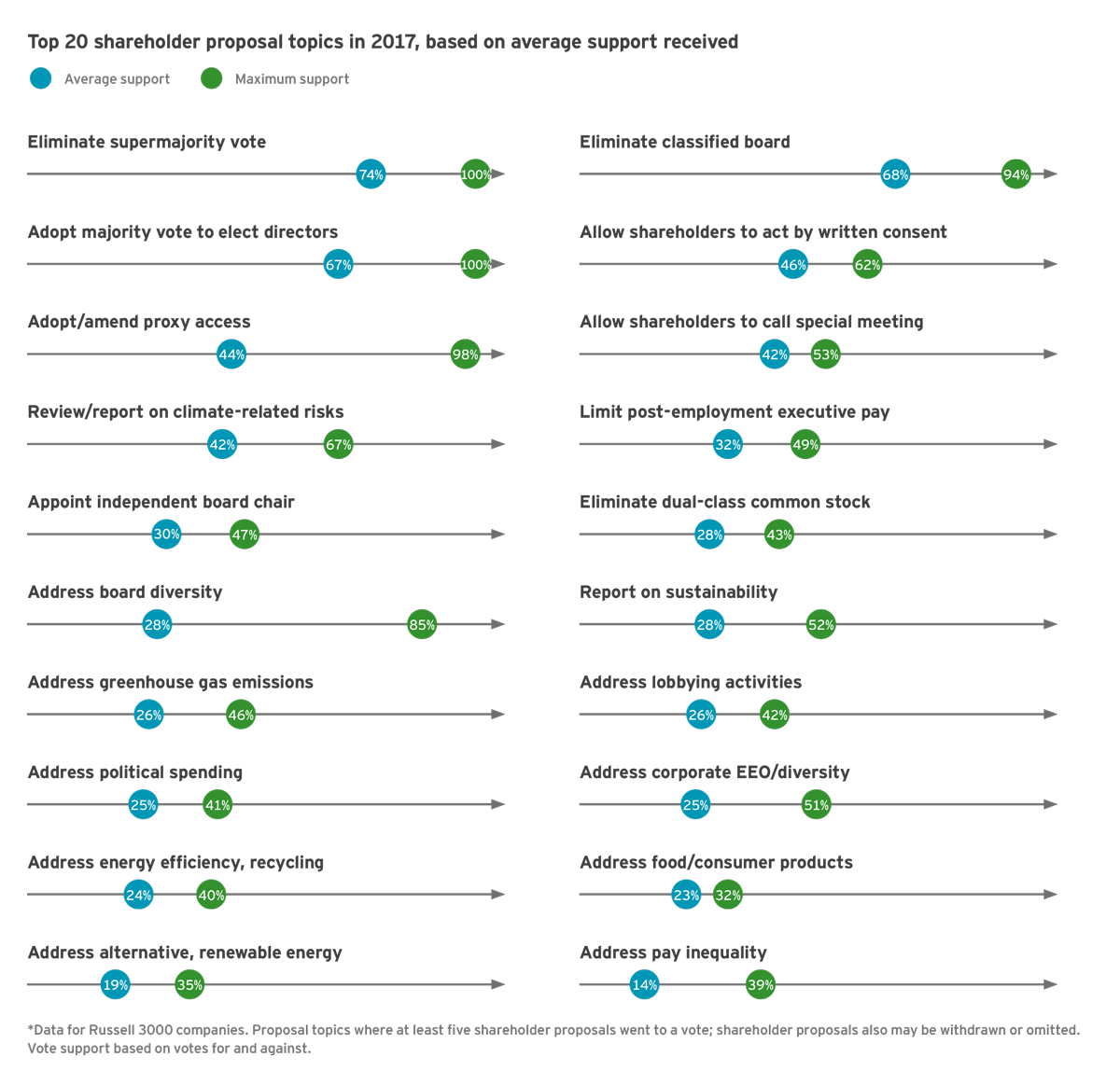

Investor priorities as seen through the shareholder proposal lens

For a broader perspective of investor priorities, a review of the top shareholder proposal topics of 2017, based on average support, shows that around half focus on environment and social topics. While the average support for many of these proposal topics appear low, this understates impact. Environmental and social proposals typically see withdrawal rates of around one-third, primarily due to company-investor successes in reaching agreement. Depending on the company situation and specific proposal being voted, some proposals may receive strong support of votes cast by a company’s broader base of investors.

Conclusion

Institutional investors are increasingly asking companies about how they are navigating changing business environments, technological disruption and environmental challenges to achieve long-term, sustained growth. By addressing these same topics in their interactions with and disclosures to investors, boards and executives have an opportunity to highlight to investors how the company is positioned to navigate business transformations over the short- and long-term. This opportunity, in turn, enables companies to attract the kind of investors that support the approach taken by the board and management. Like strong board composition, enhanced disclosure and investor engagement efforts can serve as competitive advantages.

- Are there opportunities to strengthen disclosures around the board’s composition and director qualifications and how these support company strategy?

- Do the board and its committees have appropriate access to deep, timely expertise and open communication channels with management as needed for effective oversight?

- Do the board and management understand how key investors generally view the company’s disclosures and strategic initiatives regarding environmental and social matters?

- How does the board define and articulate its oversight responsibilities with regard to talent? And does the board believe that the company has an adequate plan for talent management considering recent employee and employment-related developments and the company’s competitive position?

- To what extent have the board and management offered to dialogue with the governance specialists at their key investor organizations, whether active or passive, and including the largest and smallest, vocal shareholder proponents?

Print

Print