Linda-Eling Lee is Global Head of ESG Research at MSCI, and Matt Moscardi is Head of Financial Sector Research for MSCI ESG Research. This post is based on an MSCI publication by Ms. Lee and Mr. Moscardi.

For years, a growing number of institutional investors have pressured companies to disclose more of their ESG practices. Companies are responding, but voluntary disclosure has its limits in providing a full picture of companies’ ESG risks. In 2018, we anticipate that the disclosure movement reaches a tipping point, as investors seek broader data sources that can balance the corporate narrative and yield better signals for understanding the ESG risk landscape actually faced by portfolio companies.

Companies historically have been caught between investor demands for transparency and a desire to control their corporate narrative. On one side, investors have supported numerous efforts to encourage company disclosure. [1] They have enlisted regulators to compel disclosure on select topics or metrics and influenced exchanges to require more disclosure on sustainability as part of their listing requirements. [2] On the other side, some companies may carefully manage disclosures through a painstaking editing and brand-polishing process [3] while protecting proprietary information.

As one of the world’s largest consumers of voluntary sustainability disclosures, [4] MSCI ESG Research observes this pressure firsthand. What we see suggests corporate resistance is increasingly futile as investors globally are pressing hard for greater transparency around ESG and sustainability issues. [5] In response, companies are boosting the volume of voluntary disclosures and sustainability reports.

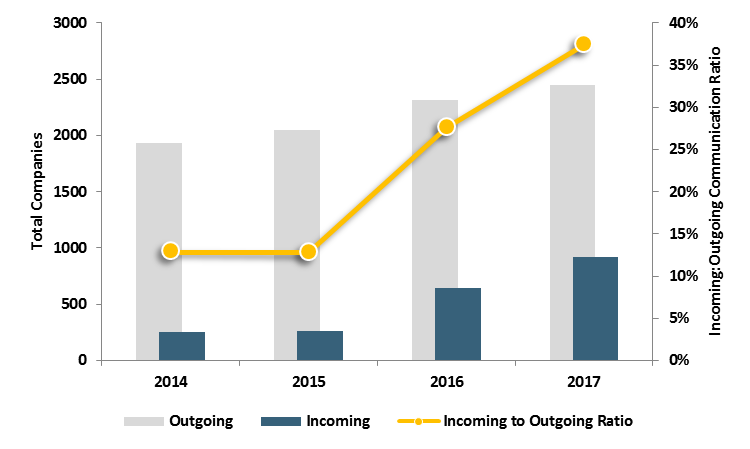

These public voluntary disclosures are a part of our ESG ratings research process. MSCI ESG Research shares with each company the data that we have collected from publicly disclosed documents. [6] Companies are invited to provide comments and feedback on the data in the reports. We have observed a dramatic increase in the volume of “inbound” communications from issuers asking about their ESG assessments, while the volume of our “outbound” communications (invitations to review their data) has stayed relatively level. Between January 1, 2014 and November 30, 2017, the ratio of incoming company queries to outgoing company communications nearly tripled for MSCI ACWI Index constituents, a statistic we take as a sign that companies are paying increased attention to how they are assessed.

Volume of Communications With Issuers by Year, Outgoing vs. Incoming

Source: MSCI ACWI Index constituents as of November 30, 2017. MSCI ESG Research, 2017

Investors should be encouraged by companies’ increased willingness to invest in providing more transparency around ESG issues. At the same time, it is important to note that company disclosure provides only a partial understanding of a company’s underlying risks. Take the Wells Fargo customer account scandal as an example. At the beginning of 2016, Wells Fargo’s cross-selling prowess, for which the company has reported metrics such as percentage of customers with multiple Wells Fargo accounts, [7] was the envy of other banks. [8] By the end of the year, other members of the banking industry were questioning the practice and scrutinizing their own cross-selling policies. [9]

In fact, even relying on audited, regulator-mandated financial data can provide an imperfect picture. In 2016 alone, 22% of all U.S.-listed companies issued “non-material” restatements on their regulatory filings and 7%, or 669 companies, issued a material restatement; both statistics were actually six-year lows. [10] Whether disclosure is voluntary or mandatory, it may not provide a full picture of a company’s practices or reveal obvious lapses in internal controls.

The fact that companies tend to put their best foot forward may not be lost on investors. A 2017 PwC survey of U.S. investors found that 62% felt they don’t “have enough trust in the information companies report” to be confident in investment analysis and decisions. [11]

What this suggests is that an objective signal of a company’s ESG risks cannot primarily be driven by an issuer’s own corporate narrative, particularly when much of that narrative is purely voluntary and not subject to regulatory (or even auditor) oversight. We find that additional information sources are crucial to balance self-disclosed information. In the era of big data, the opportunity exists to extract more data from a wider variety of publicly available sources that can provide a more accurate and complete picture of companies’ ESG risks and performance.

To illustrate how important these additional data sources are to ESG assessments, relative to the contribution of voluntary company ESG disclosure, we decompose the contribution to our ESG ratings by sources of information. We separated sources of information into:

- Voluntary company ESG disclosure, which includes data from sustainability reports and corporate websites covering all MSCI ACWI Index constituents where available

- Mandatory company disclosure, such as financial filings and proxy statements, covering over 28,000 companies globally

- Enforcements and media sources, such as databases on government fines, violations and investigations, as well as 1,600+ local and global media outlets

- Datasets on specialized topics from government, academic, NGO and commercial sources such as those provided by the World Bank; Eurostat; International Labor Organization; Water Resources Institute; the Lamont-Doherty Earth Observatory; UK Reporting of Injuries, Diseases and Dangerous Occurrences Regulations (RIDDOR); International Chemical Secretariat (ChemSec); US Bureau of Labor Statistics; and others, covering more than 100 specialized datasets.

Different sources of information contribute to different scoring components of the ESG Rating. For example, mandatory disclosure is the predominant information source underlying the sub-model for assessing corporate governance practices. [12] We examined a sample of our coverage universe, the 2,434 constituents of the MSCI ACWI Index, as of November 30, 2017.

What we found helps illustrate both the value and potential limits of voluntary disclosure in our ESG signal. Fully 35% of any given company ESG rating, on average, is composed of scores that rely on what a company has disclosed through voluntary sources, while the other 65% is composed of scores using data from specialized data sources, enforcement and media sources, and mandatory disclosure. [13] For companies that are “strong disclosers,” [14] 39.5% of their ESG Ratings came from scores that rely on voluntary ESG disclosure. This compares to 27.4% for the “weak disclosers.” Because voluntary ESG disclosure does not drive the majority of the ESG Rating, “strong disclosers” are not automatically highly rated, and “weak disclosers” are not automatically lowly rated. In fact, 5% of “strong disclosers” got a rating of B or lower (considered “ESG Laggards,” as ratings range from AAA to CCC), and conversely, almost 60% of “weak disclosers” got a rating of average or above. The implication here is pretty simple: more voluntary disclosure may contribute more to the ESG rating, but may only result in improved ratings up to a point.

Voluntary Company Disclosure is a Significant, But Not Predominant,

Contributor to ESG Ratings

2,434 constituents of the MSCI ACWI Index as of November 30, 2017. Source: MSCI ESG Research.

While investors will, and should, continue to demand greater corporate transparency, they also need objective signals that don’t overly rely on what companies say they do. As campaigns for improvements in disclosure ramp up this year, we may find that we hit a turning point in how investors view such disclosures. The availability of big data will likely increase and play a crucial role in balancing the corporate narrative to produce a more powerful ESG signal.

Endnotes

1https://www.blackrock.com/corporate/en-us/literature/whitepaper/viewpoint-exploring-esg-a-practitioners-perspective-june-2016.pdf shortlists the major disclosure frameworks on pages 4-5, including CDP, GRI, SASB, IIRC, and the FSB.(go back)

2See for example: http://www.sseinitiative.org; https://www.world-exchanges.org/home/docs/studies-reports/SE&SD-Report17.pdf; http://iri.hks.harvard.edu/files/iri/files/corporate_social_responsibility_disclosure_3-27-15.pdf(go back)

3https://www.theguardian.com/sustainable-business/2016/aug/20/greenwashing-environmentalism-lies-companies(go back)

4https://www.msci.com/documents/1296102/1636401/MSCI_ESG_Research_Factsheet.pdf/411954d3-68af-44d6-b222-d89708c5120d(go back)

5https://corpgov.law.harvard.edu/2017/04/25/the-importance-of-nonfinancial-performance-to-investors(go back)

6MSCI ESG Research does not conduct surveys of companies, nor will it use or accept non-public information from companies or other sources. Any company disclosed information that is used in MS CIESG Research’s ratings research process must be publicly disclosed. See https://www.msci.com/for-corporate-issuers. MSCI ESG Research invites all corporate issuers at least once per year to engage in a standardized data review process through which issuers may review the ESG data that we have collected on their company to produce various MSCI ESG Research reports, including the MSCI ESG Ratings report.(go back)

7https://www08.wellsfargomedia.com/assets/pdf/about/investor-relations/presentations/2014/consumer-lending-presentation.pdf(go back)

8https://www.forbes.com/sites/halahtouryalai/2012/01/25/the-art-of-the-cross-sell/#72023b1a55a3(go back)

9https://www.apnews.com/7007a4cd928240679a0c7cd359d1607b(go back)

10https://blogs.wsj.com/cfo/2017/06/07/financial-restatements-hit-six-year-low;

http://www.auditanalytics.com/blog/2016-financial-restatements-review(go back)

11https://www.pwc.com/gx/en/corporate-reporting/assets/cr-survey-us-final.pdf(go back)

12Other important sub-models that drive the overall ESG Rating include the risk exposure model which relies predominantly on specialized data sources, and the risk management model which relies predominantly on voluntary corporate ESG disclosure.(go back)

13A company’s ESG Rating is driven by major its management practices and performance vis-à-vis the level of industry-specific ESG risks the company faces (risk exposure) and, its corporate governance practices. To assess the first input to the signal i.e. whether the company has requisite management, the model relies heavily on voluntary ESG disclosures. Higher level of relevant company’s voluntary disclosures on its practices and performance informs the model better, relying less on other three sources. The second input to the model i.e. risk exposure is informed by our modeled non-company datasets while the last input to the model, corporate governance practices is researched based on the mandatory company disclosures. To understand the how much our model signals are driven by availability of these sources.(go back)

14The MSCI ESG Rating model does not “score” companies on the volume of disclosure they make, nor do we make this data public as it is used for largely internal purposes. Solely for this analysis, we have categorized companies based on a qualitative assessment of companies’ disclosure practices, as follows: Strong disclosers: Company reports on extensive list of KPIs found in CSR report and/or integrated with other disclosures and/or on its website; Industry standard disclosers: Company provides general statements, few datapoints/KPIs covered in CSR report, integrated with other disclosures, and/or on its website; Weak disclosers: Company provides only non-ESG specific information on career websites, investors relations page, financial or regulatory disclosure.(go back)

Print

Print