This post is based on the SEC Draft Strategic Plan for Fiscal Years 2018-2022, released for public comments on June 19, 2018.

Our Mission

To protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

Our Vision

To promote capital markets that inspire public confidence and provide a diverse array of financial opportunities to retail and institutional investors, entrepreneurs, public companies, and other market participants.

Our Values

Integrity: We inspire public confidence and trust by adhering to the highest ethical standards.

Excellence: We are committed to excellence in pursuit of our mission on behalf of the American public.

Accountability: We embrace our responsibilities and hold ourselves accountable to the American public.

Teamwork: We recognize that success depends on a skilled, diverse, coordinated team committed to the highest standards of trust, hard work, cooperation, and communication.

Fairness: We treat investors, market participants, and others fairly and in accordance with the law.

Effectiveness: We strive for innovative, flexible, and pragmatic regulatory approaches that achieve our goals and recognize the ever-changing nature of our capital markets.

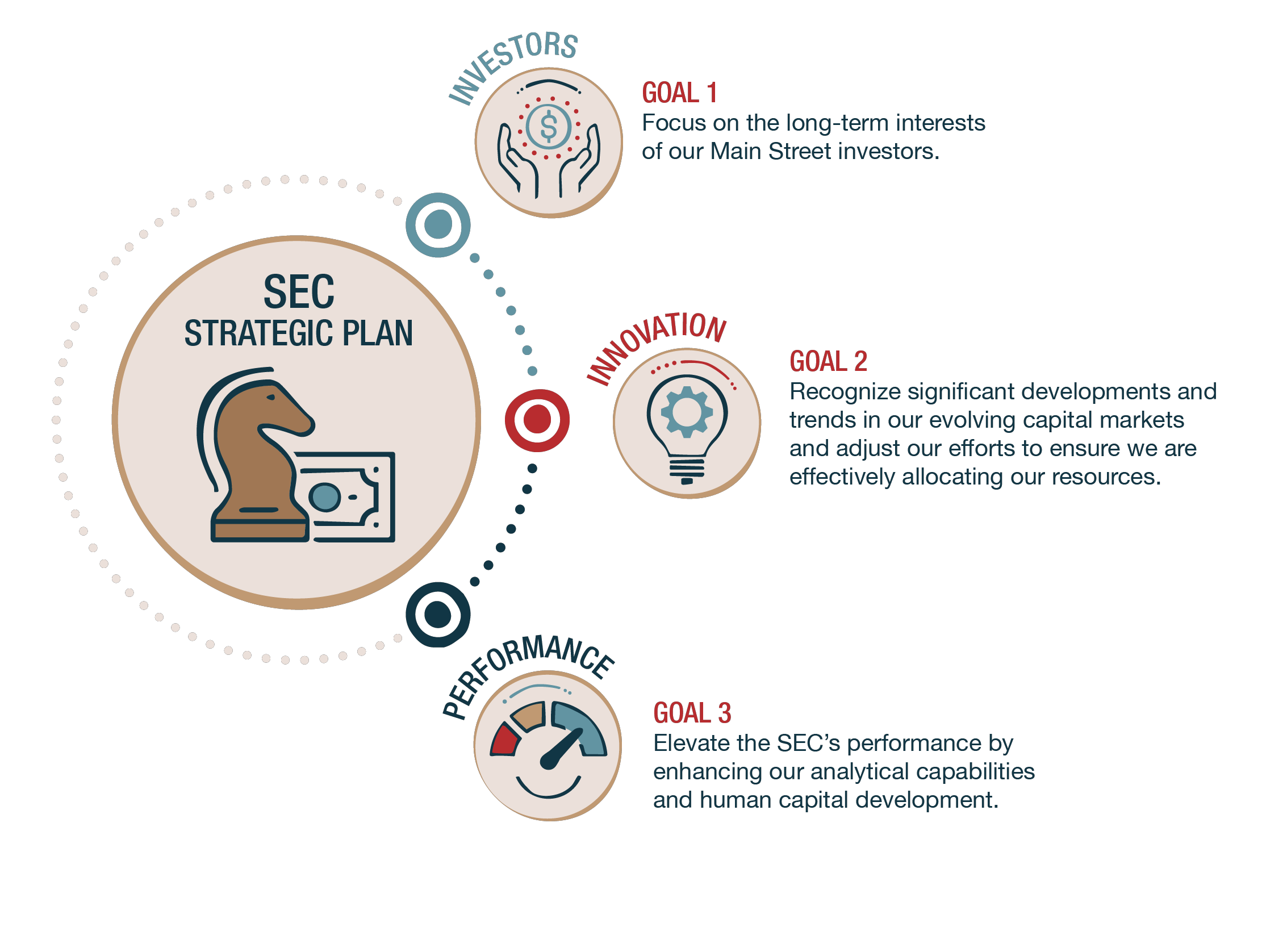

Our Goals: Focusing on Investors, Innovation, and Performance

The SEC’s long-standing tripartite mission—to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation—remains our touchstone. The core principles we have applied over the past 84 years to carry out this mission are timeless: requiring sellers of securities to make material disclosures to facilitate informed decision-making; placing heightened responsibilities on key market participants; and using our examination and enforcement resources to bolster those requirements and protect investors.

Over the past decade, the SEC has undertaken significant efforts to respond to the lessons learned from the global financial crisis. These efforts, combined with those of our regulatory colleagues, have made our capital markets stronger and more resilient. This is an important achievement, but we should not be satisfied. Our securities markets and the technologies

that support those markets and our internal operations are also evolving and innovating at a fast pace. These changes present numerous benefits, as well as challenges. Future success requires the SEC to be efficient and nimble in the allocation of our resources.

Goal 1. Focus on the long-term interests of our Main Street investors.

Investors have long looked to the securities markets to grow their hard-earned savings to fund important life events, including buying a new home, paying for college, and funding retirement. These needs are ever-changing.

Today, significant numbers of Americans are nearing retirement age and living longer in retirement. This has put increased importance on the investment products that retirees rely on for stable income. The continuing evolution away from company-managed retirement plans to 401(k) plans also means that today’s workers must shoulder more responsibility for saving and investing for retirement compared to prior generations.

Other areas also have experienced substantial evolution. When Main Street investors seek professional advice, their choices all too often are not as clear as they should be. The distinction between investment professionals who sell securities and those who provide investment advice has become less clear. This lack of clarity makes it challenging for investors to understand what standards of conduct govern the investment professionals who assist them. Contemporaneously, the number of companies raising capital through the public securities markets has declined, and those that are joining our public disclosure and offering regime are doing so later in their lifecycle. This dynamic has reduced the number of opportunities our Main Street investors have to invest in companies, including those in the emerging and growth sectors of our economy.

Market developments such as these make the SEC’s vigilance more important than ever. They also require us to reassess the tools, methods, and approaches used in the past and adapt them to ensure their continued effectiveness. Most importantly, as our markets change, we should deploy our resources in the way that most benefits the long-term interests of our Main Street investors.

The SEC has identified five initiatives in pursuit of this strategic goal and our efforts to mitigate and respond to the identified challenges.

1.1 Enhance our understanding of the channels retail and institutional investors use to access our capital markets to more effectively tailor our policy initiatives.

We should gain deeper insight into how different types of investors participate in our capital markets. Armed with this information, we can better deploy the agency’s resources to address new or emerging risks to investors, which could facilitate additional investment opportunities that address investor needs and goals.

1.2 Enhance our outreach, education, and consultation efforts, including in ways that are reflective of the diversity of investors and businesses.

Our regulatory programs should reflect the reality that not all investors, businesses, and securities markets are the same. Through this initiative, the SEC will expand outreach to retail investors and small businesses to better enable the agency to hear their various perspectives, and to ensure we provide investors and businesses timely and relevant guidance.

1.3 Pursue enforcement and examination initiatives focused on identifying and addressing misconduct that impacts retail investors.

Today’s interconnected world market offers new opportunities for securities manipulation, fraud, and abuse, while also giving new life to age-old scams like Ponzi schemes. Through this initiative, the SEC plans to expand our efforts in various areas, including, for example, securities custody and penny stock trading. Recently, increased focus in these areas has detected and, we believe, deterred fraud that impacts our retail investors.

1.4 Modernize design, delivery, and content of disclosure so investors, including in particular retail investors, can access readable, useful, and timely information to make informed investment decisions.

With more Americans directly responsible for their own investment choices, access to timely, material, and quality business and accounting disclosure to inform investment decisions has increased in importance. The SEC will continue to reexamine business and accounting disclosure requirements and modernize EDGAR, the information technology system that filers use to make critical public disclosures for the benefit of current or prospective investors. These initiatives should make it easier for investors to find key information, while also making the system more efficient and secure for filers.

1.5 Identify ways to increase the number and range of long-term, cost-effective investment options available to retail investors, including by expanding the number of companies that are SEC-registered and exchange-listed.

Through this initiative, the SEC will focus attention on facilitating vibrant public securities markets, which offer a growing array of investment choices so that retail investors have access to investment opportunities appropriate to their personal financial goals.

Goal 2. Recognize significant developments and trends in our evolving capital markets and adjust our efforts to ensure we are effectively allocating our resources.

Data security and the rapid transmission of data are vital to the functioning of the U.S. and global securities markets. Technology has fundamentally altered consumer interactions with securities market participants. On a continuous basis, investors make critical, long-term decisions that are routed through the complex IT systems underpinning the securities markets. Main Street investors rely less on traditional personalized advisory services; they are increasingly seeking advice and pursuing trades that are informed by data analytics and executed via algorithms on electronic platforms. And, with market participants constantly searching for new technology to improve the efficiency and security of transactions, this type of change should be expected to continue.

The benefits and costs of these changes are significant in scope and magnitude and, in some cases, are not easily identified or measured. Transaction costs have come down, and efficiency and fairness have increased in many of our markets. However, increased use of, and reliance on, technology has introduced new risks and, in some cases, amplified better known market risks. For example, cybersecurity threats to the complex system that helps the markets function are constant and growing in scale and sophistication.

Similarly, our markets are interconnected and interdependent. They function on a 24-hour cycle and across geographic barriers. Information from one market impacts others, and capital flows across our markets, both geographically and in asset type, in amounts that would have been unimaginable only a few decades ago. Those looking to raise capital can explore an array of choices beyond our public capital markets, as private markets and foreign markets have become highly competitive and efficient. These developments also create regulatory and oversight challenges as the operations of large investment firms extend well beyond our borders, and new entrants to our markets—such as some of the recent sponsors of initial coin offerings, or ICOs—may seek to avoid or evade our securities laws. The need for coordination with fellow financial regulators, including foreign regulators, will continue to rise. Global risks are U.S. risks, and wrongdoing that affects the U.S. markets increasingly occurs outside our country.

The SEC has identified four initiatives in pursuit of this strategic goal.

2.1 Expand market knowledge and oversight capabilities to identify, understand, analyze, and respond effectively to market developments and risks.

As technological advancements and commercial developments have changed how our securities markets operate and spurred the development of new products, the SEC’s ability to remain an effective regulator requires that we continually monitor the market environment—and adapt. We should expand our focus, expertise, and, as necessary, our scope of operations in vital areas such as market monitoring analysis, market operations, including clearing and settlement, and electronic trading across our equity, fixed-income, and other markets.

2.2 Identify, and take steps to address, existing SEC rules and approaches that are outdated.

Effective rulemaking does not end with rule adoption. In today’s global and rapidly changing markets, it is important for the SEC to continually analyze and seek feedback from investors and others about where rules are, or are not, functioning as intended. Through this initiative, the SEC will improve and bring greater involvement in, and acceptance of, our rulemaking efforts.

2.3 Examine strategies to address cyber and other system and infrastructure risks faced by our capital markets and our market participants.

Data collection, storage, analysis, availability, and protection are fundamental to our capital markets, the individuals and entities that participate in those markets, and the SEC. The scope and severity of risks that cyber threats present have increased dramatically, and vigilance is required to protect against intrusions and disruptions. Consistent with our legal authority, the SEC will focus on ensuring that the market participants we regulate are actively and effectively engaged in managing cybersecurity risks and that these participants and the public companies we oversee are appropriately informing investors and other market participants of these risks and incidents.

2.4 Promote agency preparedness and emergency response capabilities.

The SEC will review and update, as necessary, our preparedness and capabilities for responding to a market emergency or incident that impacts agency operations. The SEC will provide regular training and testing to promote a clear understanding of roles and responsibilities at the SEC, and will review and test our plans periodically to evaluate our preparedness as risks evolve.

Goal 3. Elevate the SEC’s performance by enhancing our analytical capabilities and human capital development.

Because of the breadth of our mission, the SEC’s success depends on using resources wisely and adapting our operational focus to meet constantly changing and evolving risks. The experience, knowledge, creativity, leadership, and teamwork of the SEC’s staff and its leaders are the foundation of the agency. The SEC will strengthen our human capital management program to facilitate our ability to attract and retain talent, especially in high-demand, high-skill areas. Within our workforce, we will seek to develop future leaders, foster high-levels of employee engagement, and provide continuous learning and development.

The SEC also must innovate to stretch our resources further for the benefit of our mission. Most notably, the SEC must find ways to use data and technology to uncover risks to the markets and investors, as well as to conduct activities more efficiently. With the increased use of data comes risk and the practical risk mitigation imperative to collect only what we need to advance our mission, and institute proper procedures for protection of that data.

The SEC has identified five initiatives in pursuit of this strategic goal.

3.1 Focus on the SEC’s workforce to increase our capabilities, leverage our shared commitment to investors, and promote diversity, inclusion, and equality of opportunity among the agency’s staff.

The SEC’s success is dependent on an effective, highly-skilled workforce. We will focus on recruiting, retaining, and training staff with the right mix of skills and expertise. We will also promote diversity, awareness, inclusion, and mutual respect within our workforce so that every staff member has an equal opportunity to contribute and succeed.

3.2 Expand the use of risk and data analytics to inform how we set regulatory priorities and focus staff resources, including developing a data management program that treats data as an SEC-wide resource with appropriate data protections, enabling rigorous analysis at reduced cost.

In today’s fast-paced, data-driven markets, it is imperative the SEC be able to leverage data analytics to allocate our resources most effectively in furtherance of our mission. At the same time, it is also imperative that the SEC have data management practices that appropriately reflect the sensitivity of that data. Under this initiative, the agency will advance our risk analytics and data management programs. Working collaboratively across the SEC’s divisions and offices, we will invest in needed data streams, deploy new technological tools, where appropriate, and improve our enterprise data management practices and infrastructure.

3.3 Enhance our analytics of market and industry data to prevent, detect, and prosecute improper behavior.

Data analytics are essential to rooting out wrongdoing in our markets. The SEC will continue to invest in the data and tools needed for our enforcement and examination programs to uncover and prosecute violations of the federal securities laws.

3.4 Enhance the agency’s internal control and risk management capabilities, including developing a robust and resilient program for dealing with threats to the security, integrity, and availability of the SEC’s systems and sensitive data.

The SEC will strengthen our cybersecurity program and promote the resiliency and security of our network, systems, and sensitive data. The SEC will expand and strengthen our internal enterprise risk capabilities, including through the establishment of a new Chief Risk Officer position to lead and coordinate the agency’s various risk management efforts.

3.5 Promote collaboration within and across SEC offices to ensure we are communicating effectively across the agency, including through evaluation of key internal processes that require significant collaboration.

Effective and efficient partnership of staff across the agency is critical to our ability to carry out our mission. Under this initiative, the SEC will explore new ways to promote effective collaboration and information sharing across the agency, and will review the collaborations connected to the SEC’s major functional areas, such as examination of registered entities for compliance with our rules, investigating potential violations of our rules, and writing and proposing new rules.

How This Plan Was Developed

In developing the Strategic Plan, the SEC took into account the information gleaned from meetings with the many external parties with which the agency interacts on a regular basis, including members of Congress and congressional committees, investors, businesses, financial market participants, academics, and other experts and stakeholders. This includes formal outreach efforts through the SEC’s Investor Advisory Committee, Advisory Committee on Small and Emerging Companies, and Fixed Income Market Structure Advisory Committee; Commission-sponsored roundtables focused on specific issues; the agency’s Annual Government-Business Forum on Small Business Capital Formation; the SEC’s annual conference with the North American Securities Administrators Association; and solicitations of public comments on Commission rule proposals and strategic plans. Further, by publishing this draft Strategic Plan for public review and comment, we hope to gain the benefit of additional outside perspectives.

The SEC values independent, high-quality assessments of our performance against our goals and desired strategic objectives. Such assessments help measure our progress so we can take action, as needed, to refine our programs or allocate resources accordingly. Various audits, studies, and evaluations of SEC programs and securities industry-related issues have been completed since the release of the agency’s previous Strategic Plan, and these have served as important resources in the development of this Strategic Plan. In particular, the SEC considered the findings from recent independent audits of the agency’s performance conducted by the Government Accountability Office and the SEC’s Office of Inspector General. [1] The SEC also considered the results of internal assessments and evaluations of the agency’s performance, including those reported in the agency’s Annual Performance Report. [2]

In the coming years, the SEC will continue to draw on evaluations from a variety of sources to improve our programs.

While the initiatives outlined in this Strategic Plan are intended to address our top priorities over the next four years, it must be mentioned that there are, of course, risks to, and limitations on, our ability to achieve our strategic goals. Some of these risks and limitations are operational in nature, such as those pertaining to key technology systems or oversight of outside vendors who support SEC programs, and other risks that result from external sources, such as new forms of fraud, evolution of financial products, or changes to funding levels and the availability of qualified personnel. Accordingly, the SEC continues to build our enterprise risk management program, supported by representatives from SEC divisions and offices, to strengthen our ability to proactively identify, assess, and mitigate risks to attaining our mission. We also are committed to developing and strengthening our human capital.

We firmly believe that the SEC’s continued commitment to enterprise risk management and human capital management will strengthen our ability to achieve the ambitious goals set forth in this Plan.

Endnotes

1For more information, see GAO.gov and SEC.gov/oig(go back)

2The SEC’s most recent Annual Performance Report is available at SEC.gov/reports(go back)

Print

Print