Edward A. Hauder is Lead Consultant and Senior Advisor at Exequity, LLP. This post is based on an Exequity memorandum by Mr. Hauder.

If your company’s say-on-pay (SOP) vote received less than 80% support, you will need to respond appropriately in next year’s proxy or face even lower support and, possibly, vote recommendations against directors. And if the SOP vote received less than 50% support, your response will be even more critically evaluated. The two major proxy advisory firms, Institutional Shareholder Services Inc. (ISS) and Glass Lewis & Co. (GL), expect companies to respond to a “low” SOP vote (i.e., below 70% for ISS and below 80% for GL) in a particular manner, or they could find the company was unresponsive to the shareholder vote and recommend against not only the SOP on next year’s proxy, but also directors—those on the compensation committee that approved the pay at issue and/or the full board. The disclosures the proxy advisory firms want to see are very particular, and need to follow a specific format and address several items.

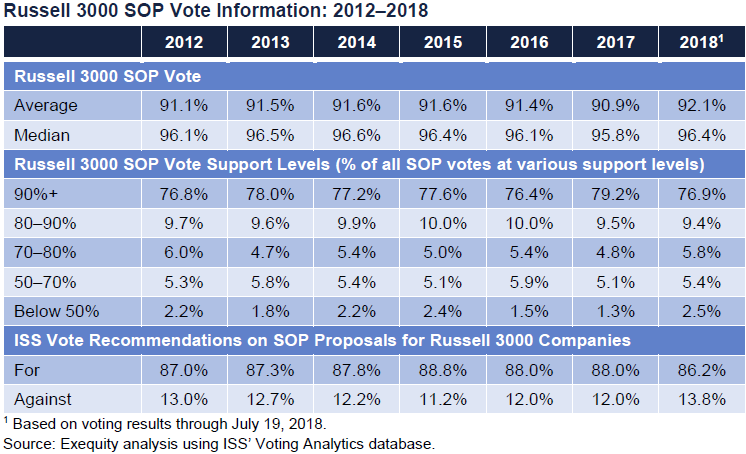

Even companies whose SOP vote was higher than the 70% or 80% levels that ISS and GL, respectively, consider a significant threshold, but below average/median SOP vote levels (see SOP vote information for the Russell 3000 chart below) may feel the need to be more responsive in their next proxy. Over the past several years, median SOP support among the S&P 500 has run about 96% and the average SOP vote level has run around 92%. So far in 2018, only about 7.5% of Russell 3000 companies had SOP vote support under 70%.

Overview of Response Plan

In a nutshell, here are the steps most companies take when looking to bounce back from a low SOP vote:

- Assess the SOP vote itself and try to determine which shareholders did not support the SOP proposal.

- Assess the ISS and GL proxy reports to see which items caused ISS or GL to recommend against your company’s SOP vote.

- Convene a team to help guide shareholder engagement efforts and identify shareholders, and applicable contacts, for outreach.

- Prepare for shareholder meetings/calls to discuss the SOP vote and points raised by proxy advisory firms, as well as the company’s perspective.

- Determine what changes (if any) could be made to address issues raised by ISS and/or GL.

- Have a core team engage with shareholders and listen to what drove shareholders to not support the SOP vote and, even among shareholders that supported the SOP vote, any critical comments they raise about the company’s pay programs.

- Discuss the findings of the shareholder engagement effort with the broader team, discuss possible courses of action, and come up with recommendations.

- Discuss shareholder engagement efforts with the compensation committee/board of directors, issues raised, and possible courses of action.

- Decide what action(s) (if any) to take to address issues raised by shareholders and/or ISS and GL.

- Prepare a mock-up of next year’s proxy disclosure detailing engagement efforts and discussing action(s) taken as a result and the rationale.

- Review mock-up disclosure and see what comments the team or committee/board have.

- Enact any changes that were approved and prepare for next year’s proxy.

- Monitor and test how proxy advisory firms and shareholders may react to the next proxy statement.

- Prepare next year’s proxy, being sure to include information detailing shareholder engagement efforts and the changes made by the company as a result (even if it was keeping things as they were), along with a compelling rationale for such actions.

What the Proxy Advisors Want to See

Proxy advisory firms will evaluate your company’s response to a low SOP vote when reviewing next year’s proxy before issuing their vote recommendations. Therefore, it is important for companies to know the influence both ISS and GL have on their shareholders, as it could impact their response to a low SOP vote.

ISS

According to ISS policy and FAQs, in the year following an SOP vote receiving less than 70% of votes cast (for and against), ISS will assess the compensation committee’s responsiveness to shareholder opposition, considering the following:

- The disclosure details on the breadth of shareholder engagement, including information on the frequency and timing of engagements, the number of institutional investors, the company participants, and whether independent directors participated;

- The disclosure of specific feedback received from investors on concerns that led them to vote against the proposal;

- Specific and meaningful actions taken to address the issues that contributed to the low level of support;

- Other recent compensation actions taken by the company and/or the persistence of problematic issues;

- Whether the issues raised are recurring or isolated;

- The company’s ownership structure; and

- Whether the proposal’s support level was less than 50%, which would warrant the highest degree of responsiveness.

ISS wants a company’s proxy to clearly disclose:

- The number of shareholders with whom the company engaged and the percent of outstanding shares they hold;

- Who from the company spoke with the shareholders;

- What the company heard were the issues from shareholders that led them to oppose the SOP vote;

- What the company did as a result to address these issues and, if not, why not; and

- Whether the issues will reoccur and what, if any, steps the company took to ensure the issue(s) will not reoccur.

Glass Lewis

GL has a higher threshold for SOP support, 80%, before it begins to look for the company to address the reasons why and the efforts it took to engage with its shareholders in the next proxy. GL views 20% or greater shareholder opposition to an SOP vote as significant. If that level of opposition exists, then GL believes the board should demonstrate some level of engagement and responsiveness to the shareholder concern behind the low vote. Therefore, it may prove easier for a company to be in the “low SOP vote doghouse” with GL than with ISS.

GL believes that companies should provide some level of response to a significant SOP against vote, including engaging with large shareholders to identify their concerns. GL has indicated that in instances where there is no evidence that the board actively engaged shareholders on these issues after a significant SOP against vote and responds accordingly, GL may recommend against compensation committee members for failing to adequately respond to shareholder opposition. In doing so, GL indicated that it will carefully consider the level of shareholder protest and the severity and history of compensation problems at the company.

Develop a Game Plan

Once the results are in and your company’s vote received less than the threshold low support level ISS or GL has established, you need to figure out why the company’s shareholders voted against the SOP vote. The best way to figure out why is to engage your key shareholders (those holding a significant portion of the company’s outstanding shares, typically the largest 15 to 25 shareholders) on the matter.

Before you do, assemble your engagement team—HR, General Counsel, Corporate Secretary, outside legal counsel, the company’s compensation consultant, and proxy solicitor. Have everyone review the proxy statement, the ISS and GL proxy reports, and the vote results. Then set up a call/meeting to go through the issues that were raised by the proxy advisory firms and what, if any, response to those the company has already made or might be willing to undertake.

Go through those issues and see if there is anything unique to your company that the proxy advisory firms missed that investors would understand and which explains why those issues exist. For example, sometimes the proxy advisory firms criticize a company’s choice of performance metrics or the targets that were selected (especially when set lower than prior-year actual results). Perhaps the metrics are ones the company and investors realize are appropriate. Similarly, if the performance targets were established lower than prior-year actuals, there may have been a good reason for doing so which investors already understand—make sure the proxy clearly explains the rationale for setting the targets lower than the prior-year actual results. Finally, consider what changes would be viewed positively by the proxy advisory firms and how those would interact with the company’s compensation philosophy. Remember, no one knows more about your business than you do.

Be sure any proposed changes to the compensation program will aid the company in achieving its strategic goals. Understand what your investors want and what types of compensation designs they are comfortable with and which ones may need some explanation and justification. Decide who from the company will engage directly with shareholders (common participants include the CEO, the compensation committee chair, the head of HR or executive compensation, and the head of investor relations; however, this may vary depending on the importance of the shareholder relationship) and whether any outside advisors will be involved in the direct engagement of shareholders.

Engage with Shareholders

Once you have done this, set up meetings or calls with your key shareholders. Note who attends the meetings from the company and note the topics and issues that are raised by each shareholder. When concluding your meeting, make sure to let them know that you and the compensation committee will be taking what they and other shareholders tell you under advisement and will then decide on an appropriate course of action. Be sure to ask if they would be open to a follow-up discussion once your next proxy is filed. Recognize that all shareholders you talk to are not created equally and they may have very different issues or concerns—try to identify common themes.

Timing of engagement with shareholders is also important. Try to conduct the engagement efforts in the “off season,” before shareholders are inundated with requests for meetings or calls. Trying to engage during the actual proxy season will likely be unproductive. Recognize that some shareholders will decline to engage, and make note of this for your subsequent disclosure.

Discuss Findings of Shareholder Engagements

After the shareholder meetings are completed, write up a summary of which shareholders agreed to meet with your company, which shareholders did not, the shares held by each such shareholder and percent of common shares outstanding represented by both groups, the issues raised by the shareholders, and their thoughts, if any, about any alternatives presented.

Take Action

Once you have spoken with your top shareholders and prepared a summary of the issues they indicated in your conversations with them, reconvene your group to discuss the findings. Determine what common issues were raised by shareholders as well as what alternatives exist with respect to each action. Discuss the pros and cons of each alternative and how these might ultimately impact shareholder support for the SOP vote next year as well as for directors, and whether they would support the company’s strategic goals and objectives. Decide on a course of action that addresses the concerns raised by shareholders. Sometimes you may find that your prior disclosures failed to adequately give a compelling rationale for why your compensation program was/is structured the way it was/is. In such a case, it may be possible to address shareholder concerns by providing better disclosure about the underlying rationale for the design of your compensation programs in subsequent proxies.

If any elements or the design of your compensation programs need to be revised in response to shareholder concerns, figure out which alternative will address shareholder concerns while still fitting within the company’s compensation philosophy and approach to utilizing compensation to help drive the achievement of strategic goals and objectives.

Be sure you have recorded the rationale for any changes made to your compensation program as a result of shareholder feedback. Also, to the extent you are not making changes to parts of your compensation program that ISS or GL did not like, be sure to reevaluate your rationale for those designs and consider whether the rationale provided in the last proxy was sufficient.

Draft Disclosures for Next Year’s Proxy Statement

Once you have decided on the changes, if any, your company will make to its compensation programs, it is good practice to write this in a draft disclosure for the next proxy. The disclosure should clearly lay out the shareholder meetings conducted, the number of shareholders, their ownership level in the company, who from the company participated, and the issues that were taken away from the shareholder meetings. The disclosure should also clearly articulate what actions were taken in response to these concerns/issues, i.e., what changes were made to the compensation programs or to the disclosure concerning such programs.

Revise other parts of your compensation disclosures for the next proxy as well. If you need to make changes to the performance metrics, vehicles, or design that are not going to be made until the following year (which is likely in most cases), consider whether the next proxy should have a supplemental disclosure concerning compensation in that subsequent year, which would not ordinarily be covered in the next proxy. Including such a section can help lay out the changes the company has committed to make in response to the discussions with shareholders and help shareholders and proxy advisors to see how the changes were made in practice.

Once your next proxy statement is filed, consider reengaging with shareholders. You want an opportunity to meet with them before the next annual meeting to discuss the steps your company took to address shareholder concerns raised with last year’s SOP vote and how the pay program going forward is responsive to shareholders concerns. Also, asking if they have any questions about the pay program and its pay-for-performance relationship should help ensure shareholders voice any concerns prior to vote time.

Conclusion

While each vote recommendation and outcome will have a unique set of facts and circumstances, this post has provided a high-level overview of a response process to a low SOP vote.

Print

Print