Nick Dawson is Managing Director & Co-Founder of Proxy Insight. This post is based on a Proxy Insight letter sent in advance of the SEC’s Proxy Process Roundtable.

Proxy Insight appreciates the opportunity to provide comments on issues related to the Securities and Exchange Commission’s staff Roundtable on “Proxy Process” to be held on November 15, 2018. Proxy Insight’s views are those of an independent data provider tracking the voting records and policies of over 1,700 global investors.

Based on our extensive engagement with market participants and thorough analysis of the data, we believe that much of the criticism of Proxy Voting Advisors (PVAs) is unwarranted. Most importantly, our data demonstrates that investors are clearly making voting decisions themselves rather than simply delegating to PVA house positions.

It should be stressed that Proxy Insight is not, has never been and does not intend to become a PVA, so can provide a completely objective viewpoint. Indeed, a number of our clients have suggested that we are uniquely placed to contribute to this debate without any real or perceived bias.

Principal Conclusion

PVAs generally provide an essential service to asset managers and owners looking to cast their votes in the most effective way possible. The key issue missed by many commentators is that this service is typically focused around the implementation of each investor’s own voting policy rather than the house view of a specific PVA. The number of investors delegating their entire policy and voting to a PVA is actually very low—from a sample of 1,413 investors, 75% have their own dedicated proxy voting policy representing a significant 92% of the assets under management.

As the quotes provided by investors show at the end of this report, PVAs are therefore typically only used as a cost-effective way of monitoring and screening issuer communications against a custom policy. For example, one Governance Head described proxy advisers as “an input into our voting decisions and not the decision makers,” while Allianz’s Eugenia Unanyants-Jackson said, “we follow our own policy and views and do not rely on ISS (our provider) in our voting decisions.”

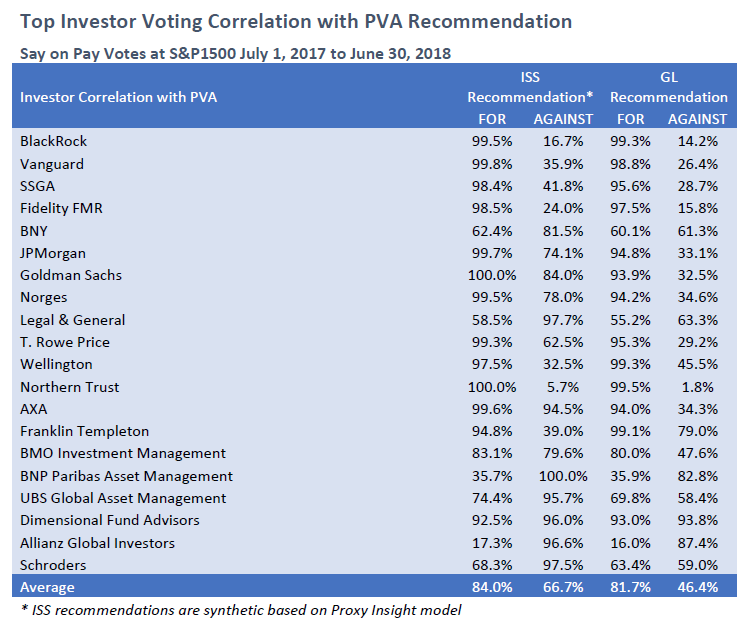

Given that the majority of resolutions put to a shareholder vote are not contentious, it would seem sensible for investors to use such screening to enable more focused attention of specific areas or issuers. When PVAs flag problem resolutions with an “AGAINST” recommendation, most investors typically then form their own opinions with input from their governance teams, proxy voting committees and portfolio managers. For ISS* “FOR” recommendations the average correlation across the top 20 investors is 84%; this number falls, however, to 66.7% for ISS* “AGAINST” recommendations.

Our analysis of investor voting correlation with house recommendations from the two largest PVAs, ISS* and Glass Lewis(see table on the following page), shows a clear divergence in actual voting behavior. As would be expected given the different voting policies employed by each investor, some choose to oppose less than the PVAs while some oppose more.

The fact that BlackRock, SSGA, Vanguard, FMR and others all correlate very highly with both PVAs on “FOR” recommendations is not really surprising. After all, as a number of investors have told us, good governance is good governance. Or, as Paul Clark of UBS put it, “many large managers… incorporate best practice guidelines into our policies, as do proxy advisors, and I would not expect proxy advisors to have significantly different view on what constitutes good governance.”

The fact that Allianz, BNP, L&G and Schroders have very low correlation on “FOR” recommendations simply reflects their much more aggressive positions on compensation, as detailed in their voting policies. Michael Herskovich of BNP Paribas said: “It is not a surprise that we always voted against when ISS recommended against as you can see we have so often opposed even when ISS was recommending FOR.”

The “AGAINST” PVA house recommendations display the most startling disconnect from actual voting. The correlation of BlackRock, SSGA, Vanguard, FMR etc. all drop significantly for PVA house “AGAINST” recommendations, with BlackRock only following suit 16% of the time. Indeed, of the top 20 investors, only Dimensional had a high correlation with both PVAs on both “FOR” and “AGAINST” recommendations.

Our Methodology

Proxy Voting Policies

As part of our normal course of business, Proxy Insight uses investor disclosure and direct contact to ascertain whether and how each investor uses a PVA.

From a sample of 1,435 Asset Owners or Asset Managers who disclose a Proxy Voting Policy:

- 74.7% have their own policy

- 12.8% delegate to and use the ISS voting policy o 6.5% delegate to and use the Glass Lewis policy

- 4.0% delegate to and use another PVA’s policy o 2.0% delegate to the policy of their sub adviser

PVA Correlation with Top 20 Investors

Proxy Insight analyzed the voting of the Top 20 asset managers on advisory executive compensation resolutions put forward at S&P 1500 companies during the period July 1, 2017 through to June 30,2018. We then compared each vote to the corresponding vote recommendations of the standard house policies of the main PVAs—ISS and Glass Lewis. Glass Lewis supplied these recommendations directly, whereas the ISS recommendations are synthetically created using our proprietary model. These synthetic recommendations were supplied to ISS for their reference. The summary data has also been provided to each investor detailed, and comments are included at the end of this document.

Investor Comments

“As a large global investor, LGIM believes our votes are vital in order to influence change at the companies in which we invest. Voting decisions are based on global voting policies developed by the experienced Corporate Governance team. We continue to strengthen these policies and minimise abstentions to ensure we use the power of our voting that is available to us.

At LGIM, we support the idea that companies which demonstrate good long-term performance should be able to reward their executive management team. However, we believe that such incentives should be aligned with long term performance and returns to shareholders. The Proxy Insight data shows that the LGIM policy is stronger on Say on Pay in the US than most proxy voting advisors, as we are voting against management on this issue significantly more often. Our strong global voting policy is part of our overall strategy to influence companies to be more in line with their long-term shareholders.”

Clare Payn

Head of Corporate Governance North America

Legal & General Investment Management

“We have clearly a tougher vision compared to ISS and do not use Glass Lewis recommendations.

It is not a surprise that we always voted against when ISS recommended against as you can see we have so often opposed even when ISS was recommending FOR.”

Michael Herskovich

Head of Corporate Governance

BNP Paribas Asset Management

“We always follow our voting policy which is not derived from or influenced by ISS’s (we use ISS’s platform to vote). Obviously, investors and research providers can independently arrive at the same conclusions/vote approach around areas of poor governance practice.

As you say, PVAs perform a valuable role facilitating the voting efforts of key investors and enabling shareholder democracy.”

Kalina Lazarova

Vice President, Responsible Investment

BMO Global Asset Management

“We would agree that proxy advisors have a valuable role to play in both the execution of votes by investors, and by providing supporting background data and information to investors to enable them to make an informed voting decision.

However, as demonstrated by your results, large investors typically have internal policies and guidelines which inform their decisions and the input received from advisors forms only part of the process. Very few large managers routinely follow the recommendation of an external proxy service. For us, voting decisions have long been an integral part of our investment decision process. When deciding how to vote we look at our policy framework and link this to the knowledge we have of a company through our investment research and engagement, before making a judgement based upon the whole picture. This avoids a tick-the-box approach to voting and your research indicates that the market generally follows the same approach.

Having said that, I would expect to see a significant degree of correlation between investors and proxy advisors, as also demonstrated by your analysis, for 2 reasons. Firstly, the policies of advisors have developed over time following discussions with clients using their services, so ISS and Glass Lewis policies will largely reflect the views of their clients, as well as their own opinions. Also, many large managers, including ourselves, incorporate best practice guidelines into our policies, as do proxy advisors, and I would not expect proxy advisors to have significantly different view on what constitutes good governance.”

Paul Clark

Head of Stewardship

UBS Asset Management

“Our views on PVA is that they are an input into our voting decisions and not the decision makers. We have established custom voting policies for all markets including the US which we ask our Proxy Adviser to use as the basis for reaching voting decision. This means that our policy and not that of the proxy adviser is the determiner of our votes.

However, it is not surprising that there will be some correlation. Voting policies are based on best practice principles in relevant markets, in addition to our in-house views, and proxy advisers also pay attention to these same best practice principles. Ultimately, we have always felt that asset managers are responsible for votes cast at shareholder meetings on behalf of their clients. It is not a responsibility that we assign to proxy advisers.”

Top 20 Head of Corporate Governance, Responsible Investment who preferred not to be named

“We follow our own policy and views and do not rely on ISS (our provider) in our voting decisions.”

Eugenia Unanyants-Jackson

Global Head of ESG Research

Allianz Global Investors

Print

Print