Patrick McCabe is an Assistant Director at the Board of Governors of the Federal Reserve System. This post is based on a recent paper authored by Mr. McCabe; Kenechukwu Anadu, Senior Risk Manager at the Federal Reserve Bank of Boston; and Mathias Kruttli, Emilio Osambela, and Chae Hee Shin, Senior Economists at the Board of Governors of the Federal Reserve System. The views expressed in this post are those of the authors and do not necessarily represent the views of the Federal Reserve Bank of Boston or the Board of Governors of the Federal Reserve System. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst (discussed on the Forum here), and Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy, by Lucian Bebchuk and Scott Hirst (discussed on the Forum here).

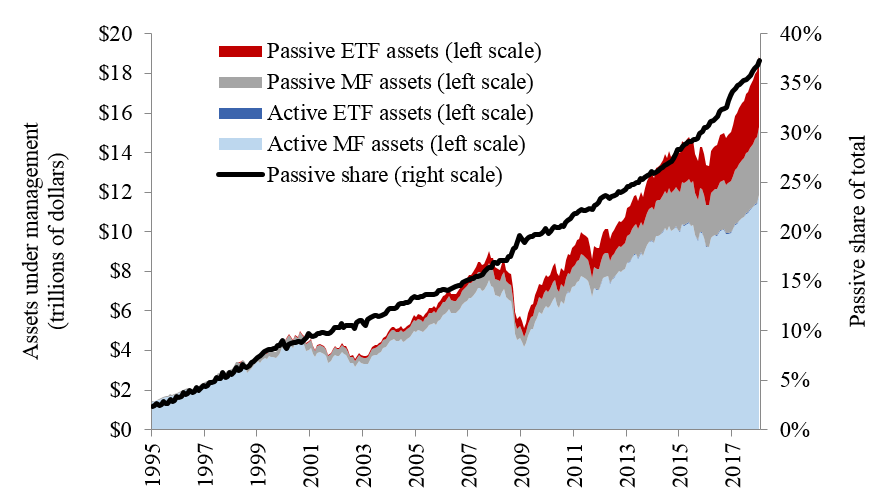

A massive shift is underway in the $80 trillion global asset-management industry. Investors have moved trillions of dollars in the past couple of decades from active investment strategies, which involve selecting assets to try to outperform a benchmark, to “passive” or “indexing” strategies that aim to replicate a benchmark. In the U.S., assets in passive mutual funds (MFs) and exchange-traded funds (ETFs) have increased from $220 billion twenty years ago to $7 trillion today (figure 1). Similar shifts appear to be occurring in other asset-management sectors and around the world, and passively managed funds hold a rising share of total financial assets. The shift to passive investing has sparked research and debate on a wide range of possible repercussions, including effects on asset prices and volatility, market liquidity, price discovery, industry concentration, competition, and corporate governance. Our contribution is a comprehensive examination of the potential repercussions of the active-to-passive shift for financial stability.

Figure 1: Total assets in active and passive MFs and ETFs and passive share of total.

Source: Morningstar, Inc.

In our working paper, we examine four channels by which the active-to-passive shift may affect financial stability: (1) effects on liquidity transformation and redemption risk for investment funds; (2) growth of passive products with strategies that amplify asset-price volatility; (3) increased asset-management industry concentration; and (4) effects of indexing on the prices, volatility, and comovement of financial assets.

We find that the active-to-passive shift is affecting the composition of financial stability risks, as the shift is reducing some risks and increasing others. Table 1 summarizes our results.

Table 1. Mechanisms by which the active-to-passive shift may affect financial stability (FS) risks

| Risk type | Description | Impact on FS risks |

|---|---|---|

| 1. Liquidity transformation and redemption risk | Funds redeem daily in cash regardless of portfolio liquidity, and investors redeem when returns are poor, so funds may be forced into fire sales in periods of stress. | Reduces |

| 2. Investing strategies that amplify volatility | Leveraged and inverse exchange-traded products require high-frequency trades that exacerbate price swings. | Increases |

| 3. Asset-management industry concentration | A more concentrated industry is more vulnerable to idiosyncratic shocks. | Increases |

| 4. Changes in asset valuations, volatility, and comovement | Greater comovement of returns and liquidity may broaden the impact of shocks. | Unclear |

1. Liquidity transformation and redemption risk. Economists and policymakers have argued that liquidity transformation by investment funds—for example, offering daily redemptions in cash regardless of the liquidity of the assets they hold—may pose risks to financial stability. Our working paper lists examples of this work. The bottom line is that liquidity transformation may create first-mover advantages for redeeming investors who get out before a fund’s most liquid assets are depleted, and rapid redemptions could cause fire sales of assets by the funds. Because investors often sell shares of funds that perform poorly, declines in asset prices during periods of financial stress may spark further redemptions.

The shift to passive investing is likely reducing risks from liquidity transformation, especially in the very large MF and ETF sectors, where daily redemptions are a statutory requirement. Moving assets from MFs to the largely passive ETF sector generally diminishes liquidity transformation because most ETF redemptions are in-kind exchanges of the ETF’s shares for “baskets” of the securities that make up the fund. By offering securities to redeeming investors, rather than cash, ETFs avoid depleting their liquidity.

In addition, we offer new evidence that performance-related redemption risks are smaller for passive MFs than for active funds. For example, during the 2013 Taper Tantrum, passive corporate bond funds experienced inflows while active funds had outflows, and we show in a regression analysis that the positive relationship between flows and past performance is weaker for passive funds. Thus, a shift to passive funds may be dampening the risks of destabilizing redemptions during periods of financial stress.

2. Growth of passive investing strategies that amplify volatility. Some passive investment strategies may amplify price volatility because they require trading in the same direction as recent market moves. In particular, recent research has shown that leveraged and inverse ETFs (LETFs)— which seek returns that are, respectively, positive and negative multiples of an underlying index return—both must buy assets (or exposures via derivatives) on days when prices rise and sell when the market is down. LETFs and exchange-traded notes with similar strategies probably contributed to an unprecedented spike in stock-price volatility, as measured by the VIX, on February 5, 2018. While these products are a small share of passive funds’ aggregate assets under management, further growth would expand their potential to amplify volatility.

3. Increased asset-management industry concentration. The shift to passive management has contributed to increased concentration in the asset-management industry because passive asset managers tend to be more concentrated than active ones. Greater concentration, evident in the emergence of some very large passive-oriented asset-management firms, probably reflects a couple of factors. First, whereas active managers’ abilities to select assets to outperform benchmarks may be diminishing in scale, selection ability is less relevant for passive funds and less of a brake on their growth. Second, passive funds offer little differentiation of portfolios and manager talent, so large funds can take advantage of economies of scale to charge low fees and attract disproportionate shares of investors’ cash. Greater concentration increases the risk that a significant idiosyncratic event—such as a cyber-security breach—at a very large firm could spark massive redemptions from its funds and lead to destabilizing fire sales.

4. Changes in asset valuations, volatility, and comovement. Increased passive investing may be affecting the valuations, returns, and liquidity of financial assets that are included in indexes. “Index-inclusion effects,” particularly greater comovement of returns and liquidity, could broaden the impact of shocks to asset markets.

Some researchers have found, for example, that when firms are added to the S&P 500, the systematic risk, or betas, of their stocks tend to increase. This “excess comovement” may be driven in part by passive managers buying (or selling) stocks of all index members simultaneously to maintain exposure to the index. However, the evidence is mixed on whether return comovement has increased with the prevalence of passive, indexed investing.

Indexed investing also may increase the comovement of liquidity among assets and the odds that assets become illiquid simultaneously. Researchers have found evidence of rising systematic liquidity for U.S. stocks and linked it to the increase in indexed investing.

The outlook. The active-to-passive shift currently shows no signs of abating, so the effects on financial stability that we have described may become more important over time. That said, we caution against simple extrapolation of the effects we have observed so far. For example, the financial stability benefits arising from a growing ETF sector would be diminished if future growth is dominated by funds that redeem in cash. And if index-inclusion effects, such as price distortions, do become more significant over time, they may slow the shift to passive investing by increasing the profitability of active investing strategies that exploit these distortions.

The complete paper is available here.

Print

Print