Stephen Choi is Murray and Kathleen Bring Professor of Law at the New York University School of Law; Sara E. Gilley is Vice President at Cornerstone Research; and David Marcus is Senior Vice President at Cornerstone Research. This post is based on joint report published by Cornerstone and the NYU Pollack Center for Law & Business and authored by Professor Choi, Ms. Gilley, Mr. Marcus, Heather B. Lazur, and Lindsay V. Schick.

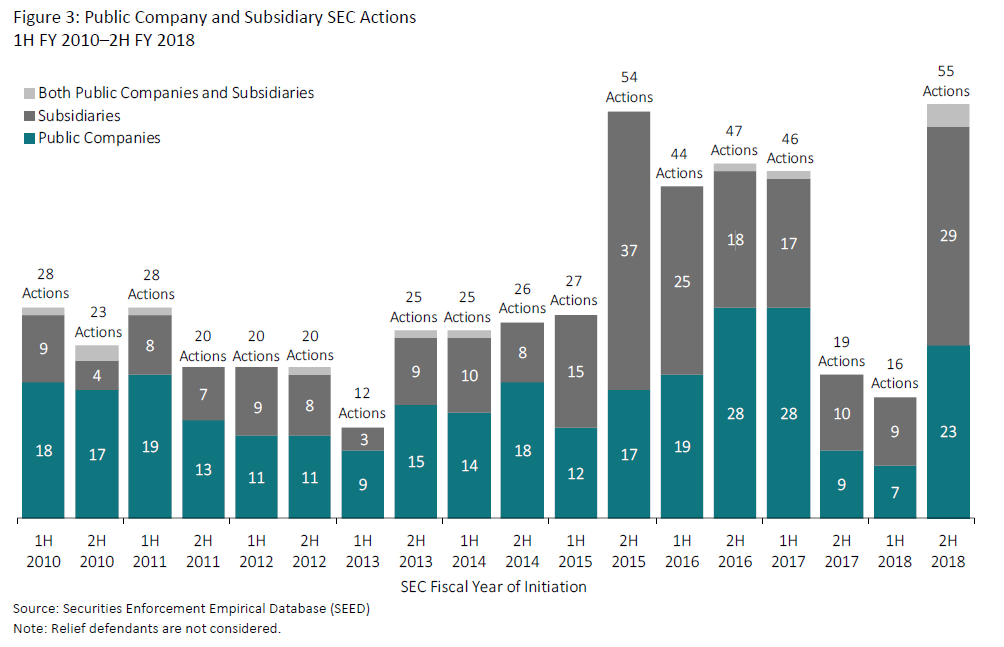

After a decline in new enforcement actions that began in the second half of FY 2017 and continued into the first half of FY 2018, SEC activity rebounded in 2H FY 2018. The SEC filed a record-setting 55 new actions against public companies and subsidiaries in 2H FY 2018, resulting in a total of 71 new actions for the fiscal year.

Findings on public company and subsidiary defendants are based on data from the Securities Enforcement Empirical Database (SEED), a collaboration between the NYU Pollack Center for Law & Business and Cornerstone Research. SEED data cover FY 2010 through the present. [1]

SEC enforcement actions against public companies and subsidiaries more than tripled in the second half of the fiscal year. While it is common to see an uptick towards the end of the year, this year’s increase was particularly pronounced, with 23 actions in the last month of FY 2018.

—Stephen Choi, Murray and Kathleen Bring Professor of Law, Director of the Pollack Center for Law & Business, New York University

Filings

- The SEC initiated a total of 490 independent enforcement actions in FY 2018, the third-highest number on record.

- Of this total, 71 comprised new actions against public companies and subsidiaries—up 9 percent from FY 2017.

Individuals

- The last quarter of FY 2018 saw the highest number of public company and subsidiary actions that also named individuals as defendants in any single quarter tracked by SEED.

Enforcement Venue

- The proportion of actions filed as administrative proceedings continued to be substantially higher for public company and subsidiary actions (85 percent) compared to actions without public companies or subsidiaries (45 percent).

Allegations

- Almost half (45 percent) of public company and subsidiary actions involved Broker Dealer or Investment Advisor/Investment Company allegations.

Industry

- Public company and subsidiary actions targeted the Finance, Insurance, and Real Estate industry most frequently (51 percent of actions).

Settlements

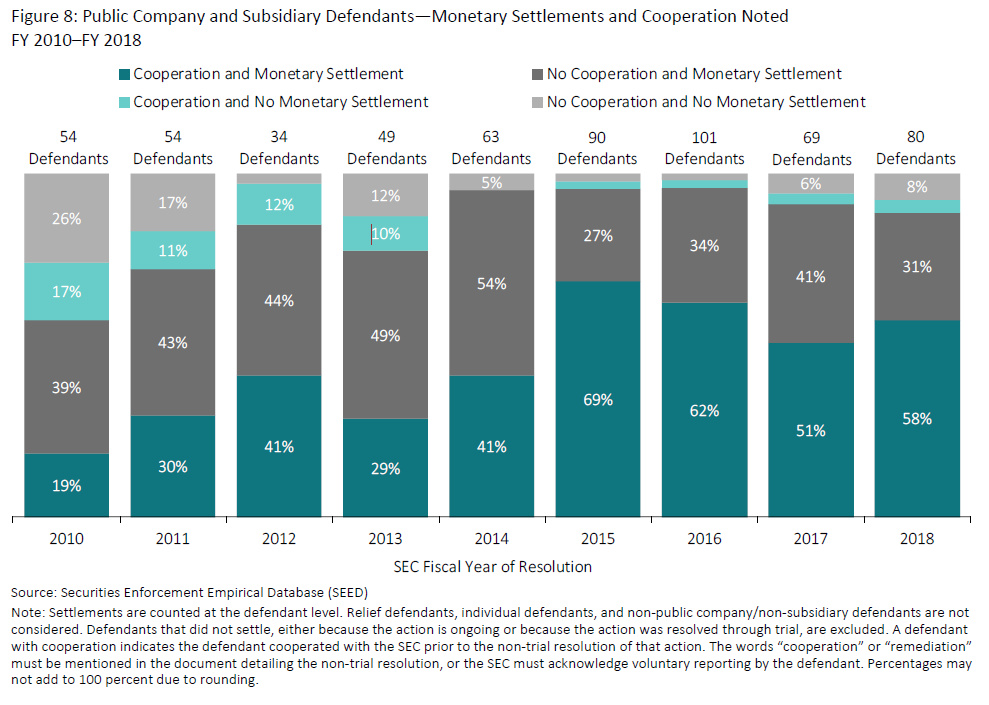

- More than half (61 percent) of public company and subsidiary defendants cooperated with the SEC.

- The SEC imposed monetary penalties on 89 percent of public company and subsidiary defendants that reached settlements in FY 2018.

Key Trends

The key trends reported below summarize how FY 2018 compares to historical trends since FY 2010. They also compare FY 2018 to the recent period of unusually high enforcement activity during FY 2015–FY 2016. [2]

- Despite a slow first half of FY 2018, the 71 actions against public companies and subsidiaries initiated during the full fiscal year was higher than the FY 2010–FY 2017 average and FY 2017 total, though lower than the average during the peak years of FY 2015–FY 2016.

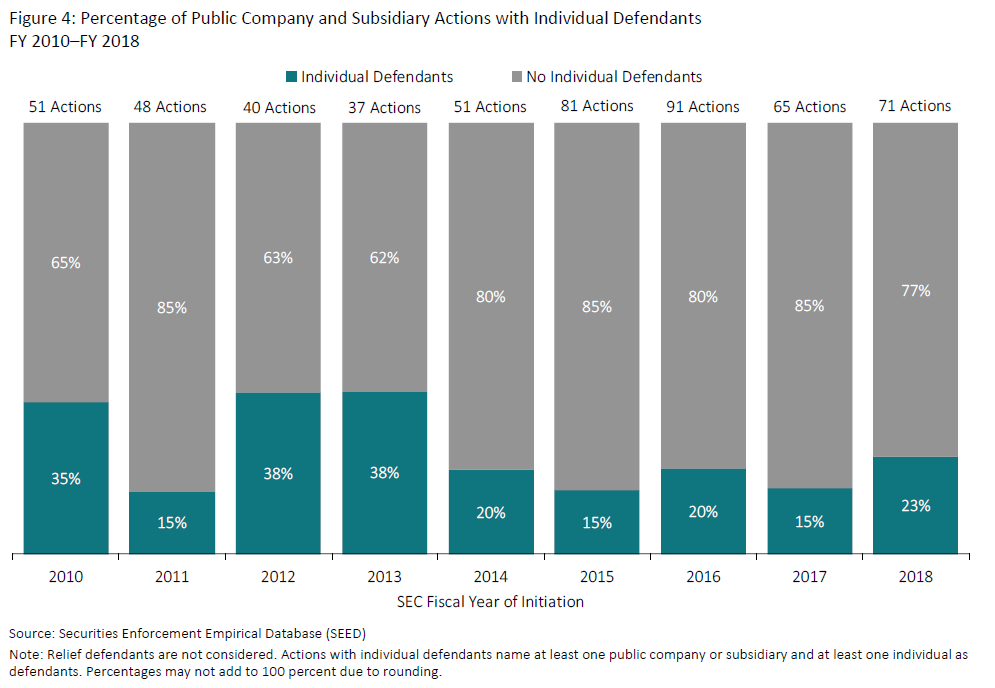

- The 23 percent of public company and subsidiary actions with individuals named as defendants was consistent with the FY 2010–FY 2017 average and higher than the FY 2015–FY 2016 average.

- In FY 2018, 85 percent of public company and subsidiary actions were brought as administrative proceedings, higher than the FY 2010–FY 2017 average, but lower than the FY 2015–FY 2016 average.

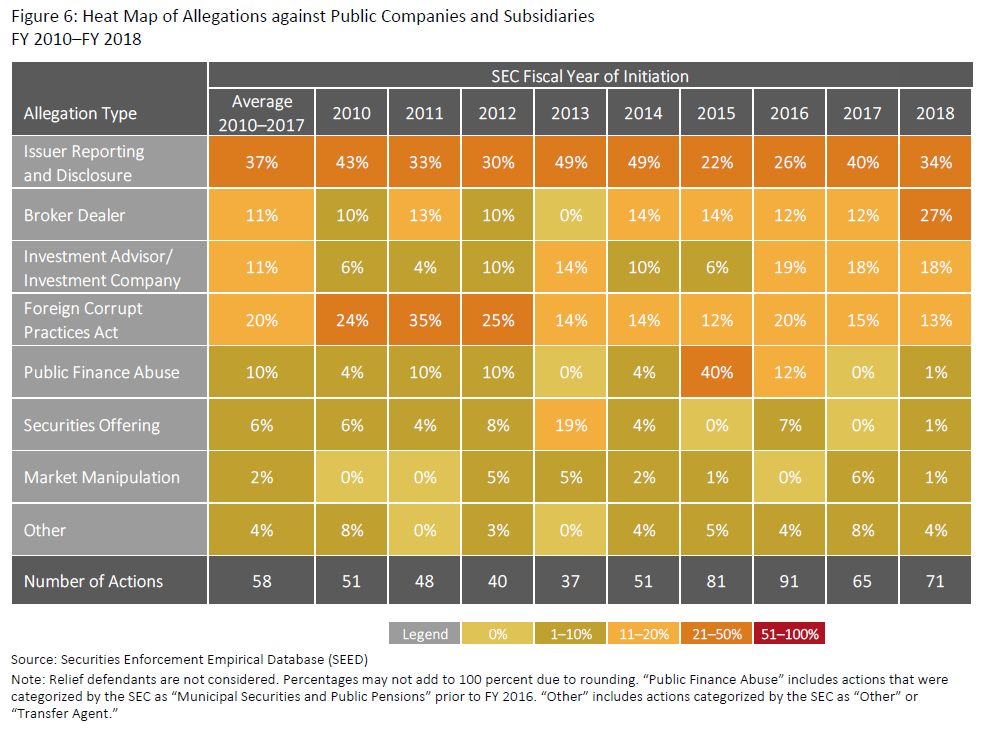

- The number and percentage of actions with Foreign Corrupt Practices Act (FCPA) allegations in FY 2018 were lower than both the FY 2010–FY 2017 and FY 2015–FY 2016 averages.

- The percentages of actions involving Broker Dealer and Investment Advisor/Investment Company allegations in FY 2018 were higher than historical averages (both FY 2010–FY 2017 and FY 2015–FY 2016).

- Over half of settlements with public company and subsidiary defendants noted cooperation in FY 2018, higher than the FY 2010–FY 2017 average but lower than the increased rates of cooperation noted in FY 2015–FY 2016.

- Monetary settlements in public company and subsidiary actions totaled $2.4 billion in FY 2018, more than the total in any fiscal year since at least FY 2010 (the first fiscal year in SEED). This total was driven by a $1.8 billion settlement in a single action against a public company; however, the amount paid in the action will be offset by related settlement payments not made to the SEC.

After a year of fewer cases against public companies, enforcement activity dramatically increased in 2H FY 2018. Despite the lower level of activity in the first half, the record number of cases filed in the second half of the fiscal year brought overall enforcement activity broadly in line with recent trends.

—David Marcus, Senior Vice President, Cornerstone Research

Number of Filings

All Independent SEC Actions

The SEC reports the annual number of enforcement actions filed as independent (stand-alone) actions, follow-on administrative proceedings, and delinquent filing actions. [3] The defendants in these actions include public companies, subsidiaries of public companies, individuals, and other (non-public) entities. SEED covers independent actions that are filed against public companies or subsidiaries of public companies. Collectively these defendants are referred to as public companies and subsidiaries.

- The SEC initiated a total of 490 independent actions in FY 2018. This was the third-highest total since FY 2013, the earliest period for which the SEC has reported the number of independent actions. [4]

- Following a slow 1H FY 2018, the SEC filed 331 independent actions in 2H FY 2018, the highest number since at least 1H FY 2015.

- The total number of new independent actions increased substantially in 4Q FY 2018. Fourth-quarter actions accounted for 44 percent of the FY 2018 total.

- Public company and subsidiary actions accounted for 14 percent of all independent actions in FY 2018, consistent with the previous five fiscal years.

- Public company and subsidiary actions had an even more pronounced uptick in activity for the fourth quarter, with 63 percent filed in 4Q FY 2018.

Public Company and Subsidiary SEC Actions

The remainder of this report focuses on actions against public companies and subsidiaries based on data from SEED unless noted otherwise.

- The SEC filed 71 new enforcement actions against public companies and subsidiaries in FY 2018, a 9 percent increase over FY 2017.

- The number of new actions rebounded dramatically in the second half of FY 2018 to 55 actions, compared to the previous two half-year periods that each had fewer than 20 actions.

- The second half of FY 2018 had the most actions in any half-year covered by SEED, and more than triple the number filed in 1H FY 2018.

- A record 45 actions were filed in the last quarter of FY 2018, including 16 in the last two weeks of September. Thirteen of these 16 actions involved monetary settlements.

- Public company and subsidiary actions were split almost equally between the two defendant types in FY 2018.

Filings Involving Individuals

SEED tracks information on individuals named as defendants in actions against public companies and their subsidiaries— referred to in this report as “individual defendants.” (See Research Sample)

- Individuals were named as defendants in 23 percent of public company and subsidiary actions in FY 2018— consistent with the historical average of 24 percent over the prior eight fiscal years.

- In 4Q FY 2018, 11 public company and subsidiary actions also named an individual defendant. This was the highest number in a single quarter tracked by SEED.

- The majority (53 percent) of the individuals named as defendants in FY 2018 were CEOs or CFOs.

- More than half (54 percent) of actions involving Issuer Reporting and Disclosure allegations—the most common allegation type in FY 2018—also named an individual defendant in FY 2018.

Enforcement Venue

- In January 2018, the U.S. Supreme Court agreed to review Lucia v. SEC, which challenged whether the SEC had unconstitutionally appointed its administrative law judges (ALJs). [5]

- In 1H FY 2018, before the Lucia ruling, administrative proceedings declined to 81 percent of all public company and subsidiary actions. This was the lowest percentage since 1H FY 2014.

- At the end of June 2018, the Supreme Court ruled in Lucia that the SEC’s ALJs are “officers of the United States” subject to the Appointments Clause and, thus, had not been properly appointed by the SEC. [6] Following the ruling, the SEC confirmed the appointments of its ALJs and offered to rehear administrative proceedings. [7]

- In 2H FY 2018, the SEC continued to bring the majority (85 percent) of public company and subsidiary actions as administrative proceedings. Thus, in FY 2018, 15 percent of these actions were civil actions—the highest level since FY 2014.

- For comparison, civil actions accounted for the majority (55 percent) of independent actions in FY 2018 that did not name a public company or subsidiary as a defendant, according to SEC data. [8]

- At the end of November 2018, Lucia filed a new lawsuit alleging the SEC’s ALJs are still unconstitutional. [9]

Allegations

- Issuer Reporting and Disclosure continued to be the most common allegation type. In FY 2018, it accounted for 34 percent of actions.

- Broker Dealer and Investment Advisor/Investment Company allegations combined for nearly half of FY 2018 actions. This is consistent with the SEC’s focus on retail investors and the launch of its Retail Strategy Task Force at the end of FY 2017. [10]

- The 19 Broker Dealer actions filed in FY 2018 represented the largest number and percentage of Broker Dealer allegations faced by public companies and subsidiaries in the fiscal years covered by SEED.

- FCPA allegations accounted for only 13 percent of actions in FY 2018, down from the historical average of 20 percent.

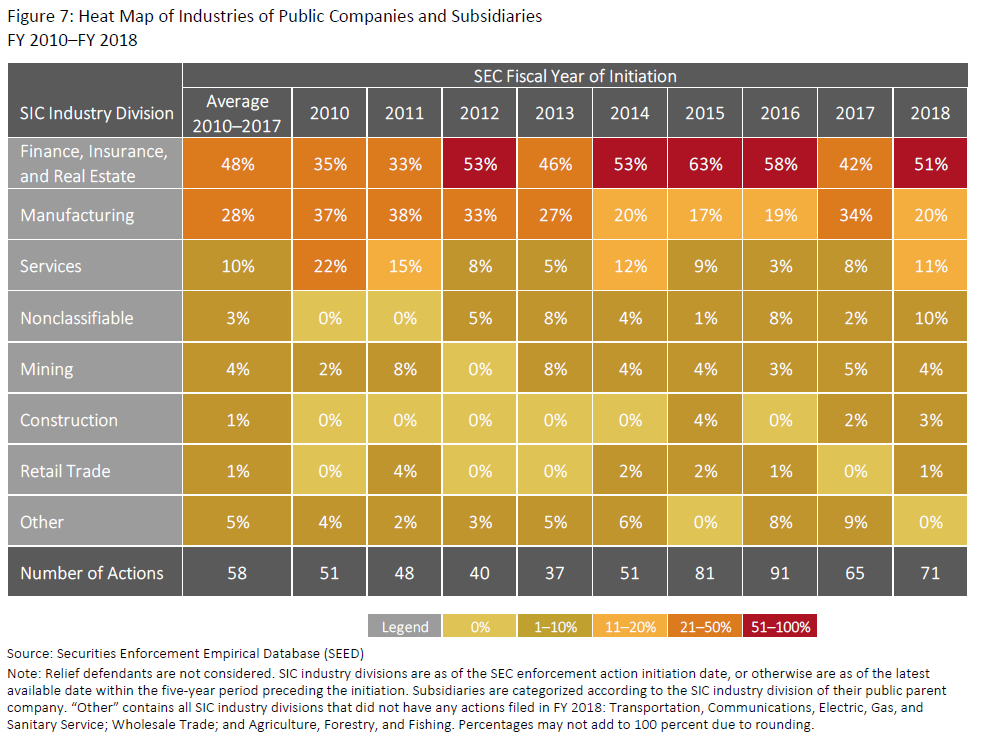

Industry

SEED classifies public companies and parent companies of subsidiaries by Standard Industrial Classification (SIC) code.

- In FY 2018, approximately half of actions targeted the Finance, Insurance, and Real Estate industry, consistent with the historical average of 48 percent.

- Public company and subsidiary actions against Commercial Banks (included in the Finance, Insurance, and Real Estate industry) accounted for more than 25 percent of actions in FY 2018.

- All but one of the 36 actions against Finance, Insurance, and Real Estate defendants in FY 2018 were administrative proceedings. The majority (83 percent) of actions in this industry involved Broker Dealer or Investment Advisor/Investment Company allegations.

- Manufacturing defendants comprised 20 percent of public company and subsidiary actions in FY 2018. More than half (57 percent) of these actions targeted Drugs Manufacturers or Communications Equipment Manufacturers, and all but one involved either Issuer Reporting and Disclosure or FCPA allegations.

Settlements

The SEC considers four factors when negotiating a settlement with a cooperating defendant: “self-policing, selfreporting, remediation, and cooperation.” [11] SEED measures the latter three factors as an indication of whether a public company or subsidiary defendant cooperated with the SEC based on whether the SEC acknowledges voluntary reporting or explicitly mentions “remediation” or “cooperation” by the defendant in the settlement announcement (collectively referred to in this report as “cooperation” or “cooperated”).

- For the fourth consecutive fiscal year, more than half (61 percent) of FY 2018 settlements with public company and subsidiary defendants noted cooperation with the SEC.

- In FY 2018, a record percentage of defendants cooperated when resolving FCPA (100 percent of nine defendants) and Investment Advisor/Investment Company allegations (81 percent of 16 defendants).

- The SEC imposed monetary settlements on 89 percent of public company and subsidiary defendants in FY 2018.

- Out of the 49 settlements that noted cooperation, 94 percent had monetary settlements imposed.

SEED includes data for monetary settlements imposed by the SEC on all types of defendants in public company and subsidiary actions: public companies, subsidiaries, individuals, and other entities. [12]

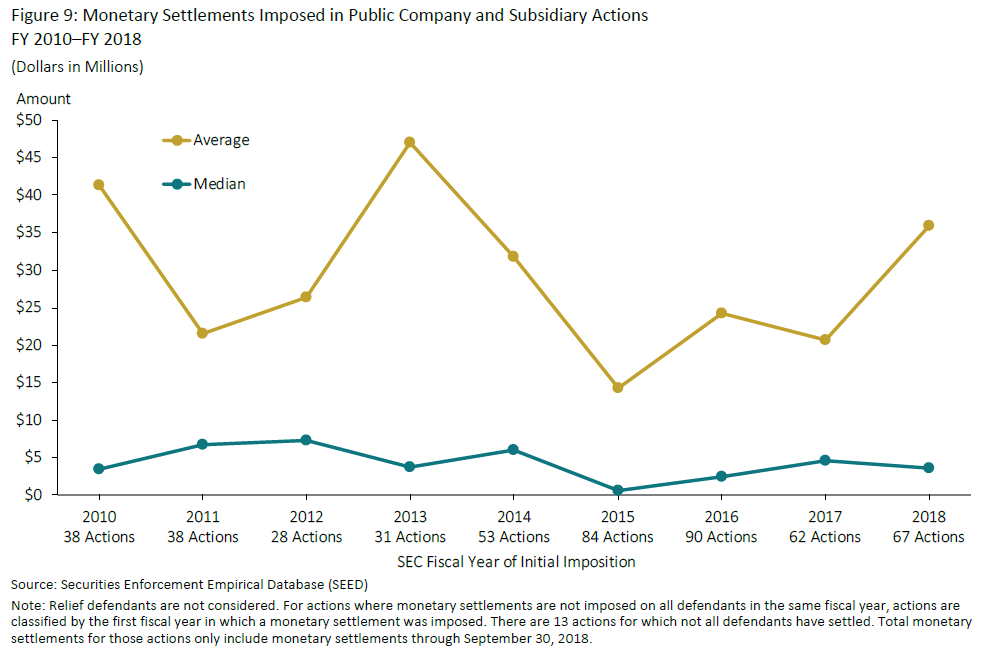

- Monetary settlements in public company and subsidiary actions totaled over $2.4 billion in FY 2018—more than the total in any fiscal year since at least FY 2010, and an 87 percent increase from FY 2017.

- The largest monetary settlement in any public company and subsidiary action since FY 2010 was $1.8 billion in FY 2018, accounting for 74 percent of the fiscal year total.

- This monetary settlement, which related to FCPA allegations, was more than three times the size of the next largest settlement of $551 million (FY 2010). However, the SEC will receive substantially less than $1.8 billion because that amount will be offset by a class action settlement and settlements the company will pay to other agencies.

- The average monetary settlement increased from $21 million in FY 2017 to $36 million in FY 2018. The median settlement for FY 2018 ($3.6 million) was only 10 percent of the average, generally consistent with historical trends.

Research Sample

- The Securities Enforcement Empirical Database (SEED) is a collaboration between the NYU Pollack Center for Law & Business and Cornerstone Research. The analysis in this report is based on data identified by NYU and Cornerstone Research as of November 30, 2018 (http://seed.law.nyu.edu).

- SEED identifies 535 SEC enforcement actions initiated against 471 public companies and subsidiaries between October 1, 2009, and September 30, 2018.

- SEED identifies 256 individuals that are named defendants in the 535 actions initiated against public companies and subsidiaries between October 1, 2009, and September 30, 2018.

- The sample used for the majority of this report is referred to as “actions initiated against public companies and subsidiaries” and includes only those enforcement actions with public companies or their subsidiaries listed explicitly as defendants. The sample does not include cases where the allegations relate exclusively to delinquent filings.

- Public companies are defined as those that traded on a major U.S. exchange as identified by the Center for Research in Security Prices (CRSP) at the time the enforcement action was initiated, or otherwise within the five-year period preceding the initiation. Thus, public companies that traded over-the-counter or only on major non-U.S. exchanges are excluded, as are companies that did not become publicly traded until after the enforcement action was initiated.

- Subsidiaries are defined as those entities that had a publicly traded parent company at the time the enforcement action was initiated, or otherwise within the five-year period preceding the initiation. The public parent companies of subsidiaries were identified as those cited in the enforcement action document initiating proceedings when available, or those identified through SEC filings if no parent company was mentioned in the initial enforcement action document.

- Individuals are defined as individuals who are named as defendants in actions against public companies or their subsidiaries.

Endnotes

1SEC fiscal years begin on October 1 of the prior year and end on September 30. SEC fiscal year 2010 through fiscal year 2018 spans October 1, 2009, to September 30, 2018.(go back)

2The SEC notes that “cases brought in connection with certain initiatives—such as the Commission’s Municipalities Continuing Disclosure Cooperation (MCDC) Initiative, which ran from FY 2015 to FY 2016—can skew the results for a particular year.” See “Division of Enforcement Annual Report 2018,” U.S. Securities and Exchange Commission, p. 9, footnote omitted, https://www.sec.gov/files/enforcement-annual-report-2018.pdf.(go back)

3See, e.g., “Division of Enforcement Annual Report 2018,” U.S. Securities and Exchange Commission, November 2, 2018, p. 9, https://www.sec.gov/files/enforcement-annual-report-2018.pdf.(go back)

4“Division of Enforcement Annual Report 2018,” U.S. Securities and Exchange Commission, November 2, 2018, p. 9, https://www.sec.gov/files/enforcement-annual-report-2018.pdf; “SEC Announces Enforcement Results for FY 2015,” U.S. Securities and Exchange Commission, Press Release 2015-245, October 22, 2015, https://www.sec.gov/news/pressrelease/2015-245.html.(go back)

5See, e.g., Dunstan Prial, “Supreme Court Agrees to Review SEC’s In-House Judges,” Law360, January 12, 2018, https://www.law360.com/articles/998166.(go back)

66 Lucia v. SEC, 585 U.S. ___ (2018).(go back)

7See, e.g., Rachel Graf, “SEC’s Post-Lucia Case Rehearings Largely for Show,” Law360, August 31, 2018, https://www.law360.com/articles/1078432/sec-s-post-lucia-case-rehearings-largely-for-show.(go back)

8“Division of Enforcement Annual Report 2018,” U.S. Securities and Exchange Commission, November 2, 2018, https://www.sec.gov/files/enforcement-annual-report-2018.pdf.(go back)

9See, e.g., Rachel Graf, “Lucia Says SEC’s In-House Judges Remain Unconstitutional,” Law360, November 29, 2018, https://www.law360.com/articles/1106380/lucia-says-sec-s-in-house-judges-remain-unconstitutional.(go back)

10“SEC Announces Enforcement Initiatives to Combat Cyber-Based Threats and Protect Retail Investors,” U.S. Securities and Exchange Commission, Press Release 2017-176, September 25, 2017, https://www.sec.gov/news/press-release/2017-176.(go back)

11Andrew Ceresney, Director, Division of Enforcement, U.S. Securities and Exchange Commission, “The SEC’s Cooperation Program: Reflections on Five Years of Experience” (speech, University of Texas School of Law’s Government Enforcement Institute, Dallas, TX, May 13, 2015), https://www.sec.gov/news/speech/sec-cooperation-program.html.(go back)

12Total monetary settlements include disgorgement, prejudgment interest, civil penalties, and other monetary penalties imposed by the SEC in public company and subsidiary actions. For actions where monetary settlements are not imposed on all defendants in the same fiscal year, actions are classified by the first fiscal year in which a monetary settlement was imposed. There are 13 actions for which not all defendants have settled. Total monetary settlements for those actions only include monetary settlements through September 30, 2018.(go back)

Print

Print