Amit Batish is Content Manager at Equilar Inc. This post is based on an Equilar memorandum by Mr. Batish, with data analysis contributed by Courtney Yu, Lyla Qureshi, and Hailey Robbers.

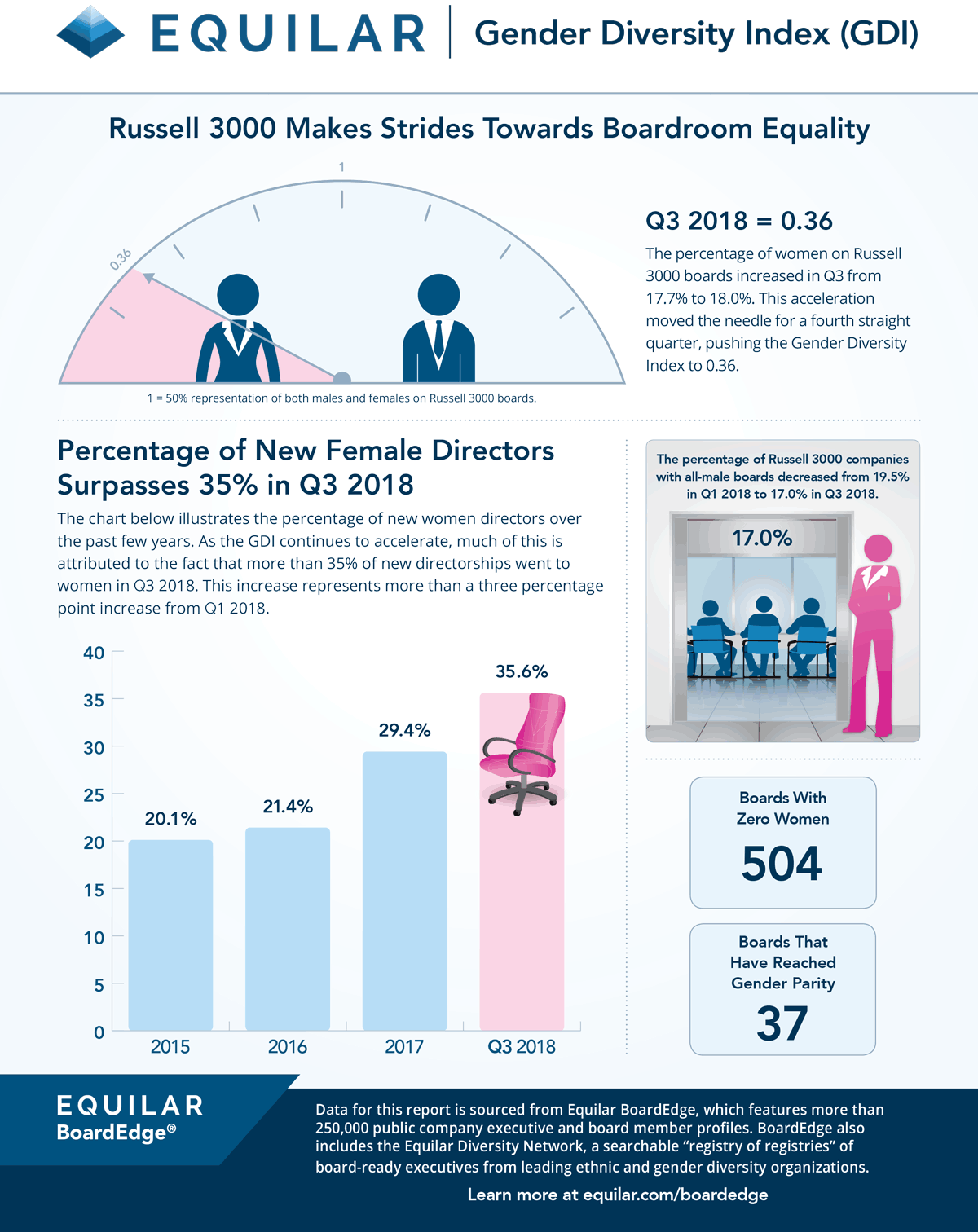

For the fourth consecutive quarter—an entire year—the Equilar Gender Diversity Index (GDI) increased. The percentage of women on Russell 3000 boards increased from 17.7% to 18.0% in Q3 2018. This acceleration moved the needle, pushing the GDI to 0.36, where 1.0 represents parity among men and women on corporate boards.

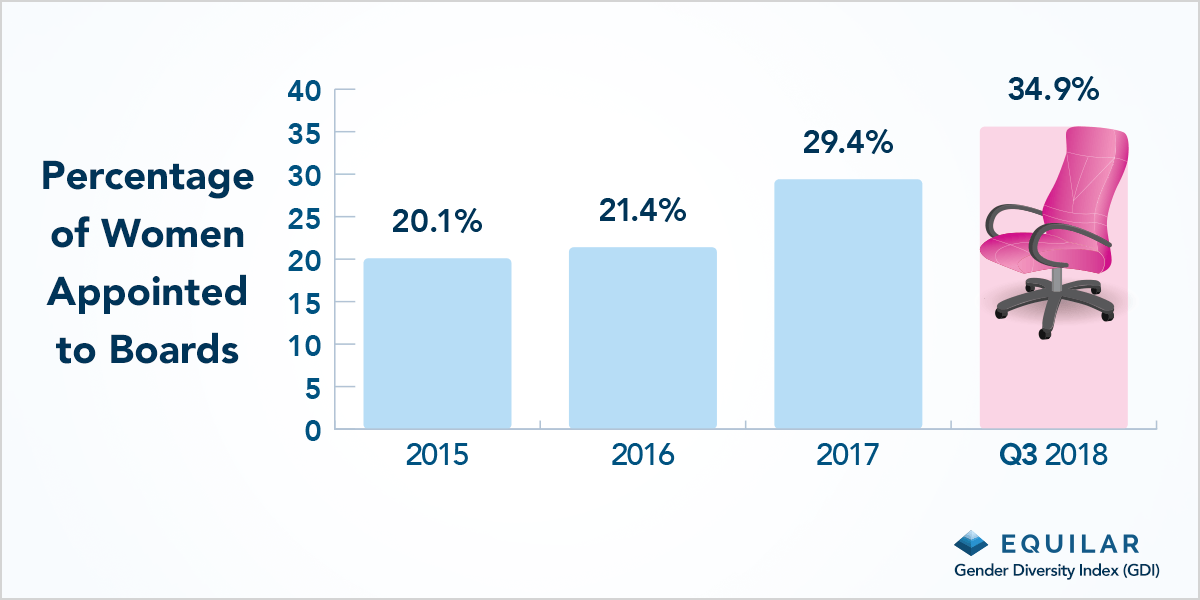

Over the last year, the percentage of new directorships that went to women continued to rise each quarter. Q3 2018 was no different—35.9% of new board seats were filled by women. This has certainly been a lead driving factor in the consistent increase in the GDI.

“In Q3 of 2018, over 30% of newly-elected directors were women, which we believe indicates that companies are changing their approach to diversity,” said Brigid Rosati, Director of Business Development at Georgeson. “It seems that companies are beginning to understand better the benefits that a more diverse board can bring, but are also in some cases responding to signs of increased interest from investors, including in the way they vote in director elections.”

Many corporate leaders are also making a concerted effort to implement various initiatives across their organizations to drive awareness on the topic. Last year, PwC U.S. Chairman Tim Ryan launched CEO Action for Diversity & Inclusion, a CEO-driven business commitment to advance diversity and inclusion within the workplace. Currently, 550 CEOs have signed the pledge.

“Companies more generally are realizing the value of diversity and inclusion initiatives,” said Blair Jones, Managing Director at Semler Brossy Consulting Group. “More diverse teams make better decisions.”

Investors and Proxy Advisors Take Action

Over the past year, the investor community has placed a heightened emphasis around gender diversity. In February of 2018, BlackRock—the world’s largest money manager—publicly stated that companies in which it invests should have at least two female board members. Michelle Edkins, Global Head of Investment Stewardship at BlackRock, wrote a letter to Russell 1000 that have fewer than two women on the board to ask them to disclose their approach to boardroom and employee diversity, The Wall Street Journal reported.

“We believe that a lack of diversity on the board undermines its ability to make effective strategic decisions,” wrote Edkins in the letters reviewed by the Journal. “That, in turn, inhibits the company’s capacity for long-term growth.”

Furthermore, the two major proxy advisory firms—Glass Lewis and ISS—have both updated their proxy advisory guidelines to reflect a greater focus around board diversity. Glass Lewis will now generally recommend a vote against the nominating committee chair of a board that has zero female board members, while ISS plans to enforce the same policy in 2020.

“Given these developments, companies that lack board gender diversity should consider refreshing their board to add at least one female director in the near term,” said Rosati. “Beyond this, we believe that continued media coverage and scrutiny means that we will see continued pressure from investors towards companies with zero women on their boards.”

California Legislation Leads the Charge for Progress

The State of California recently passed a piece of legislation—SB 826—that will require public companies headquartered in California to have a minimum of one female on its board of directors by December 31, 2019. That minimum will be raised to at least two female board members for companies with five directors or at least three female board members for companies with six or more directors by December 31, 2021. Violators of this legislation will be subject to financial consequences.

California is the first state in the nation to pass a mandate of this kind, and, most likely, not the last. The past year has shown exceptional signs of progress, and with California leading the way with an official quota, gender diversity will only continue to become a point of focus at boardrooms across corporate America.

“The law is a reflection of a common concern–impatience with the slow pace of change in the boardroom,” said Susan Angele, Senior Advisor of Board Governance at KPMG’s Board Leadership Center. “Boards today need a broad range of perspectives around the table, and the spotlight on gender diversity will continue to increase—not only in California but with institutional investors and other stakeholders.”

The Future State of Board Assessment

The Q3 2018 GDI is indeed a promising sign that boards are taking adequate measures to address the lack of gender diversity in the composition of their boards. The combination of pressure from investors and proxy advisors, as well as legislative quotas, is sure to lead to a continued trend in this direction.

However, there is still an overwhelming number of Russell 3000 companies that have zero women on their boards. According to the GDI analysis, 504 Russell 300 boards lack a female director—an exceptionally high figure.

As we approach 2019, there is no doubt that boards that fall into this bucket will face some level of scrutiny from investors. Companies that want to address this issue—and address it thoroughly—must prioritize practices that promote diversity and the value it brings to a boardroom.

“If you want the most talented board, you cannot limit the talent pool,” H. Rodgin Cohen, Senior Chairman at Sullivan & Cromwell, said in a recent interview for Equilar C-Suite magazine. “If you want the best board, you need to have a meaningful number of women or else you’re just not getting the best people that you could have.”

About Equilar Gender Diversity Index

The Equilar GDI reflects changes on Russell 3000 boards on a quarterly basis as cited in 8-K filings to the SEC. Most indices that track information about board diversity do so annually or even less frequently, and typically with a smaller sample size, sometimes looking back more than a full year by the time the information is published. While this data is reliable and accurate, the Equilar GDI aims to capture the influence of the increasing calls for diversity from investors and other stakeholders in real time.

The Equilar GDI is powered by Equilar BoardEdge, a database of more than 250,000 public company board members and executives. BoardEdge includes exclusive features that show how board members and companies are connected to each other, as well as the Equilar Diversity Network (EDN), a “registry of registries” of board-ready executives from leading ethnic and gender diversity partnerships, organizations, and publications.

Print

Print