Jim Rossman is Head of Shareholder Advisory at Lazard. This post is based on a Lazard memorandum by Mr. Rossman. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

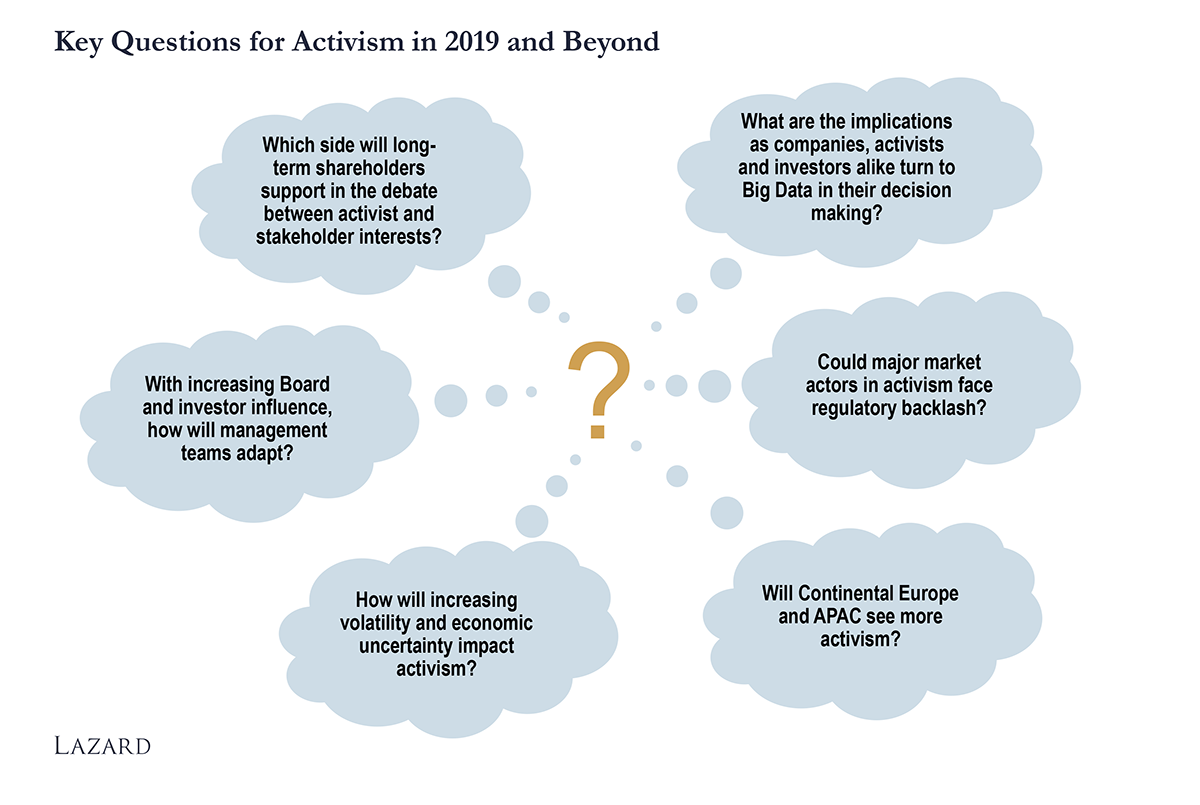

1. A New High-Water Mark for Global Activist Activity

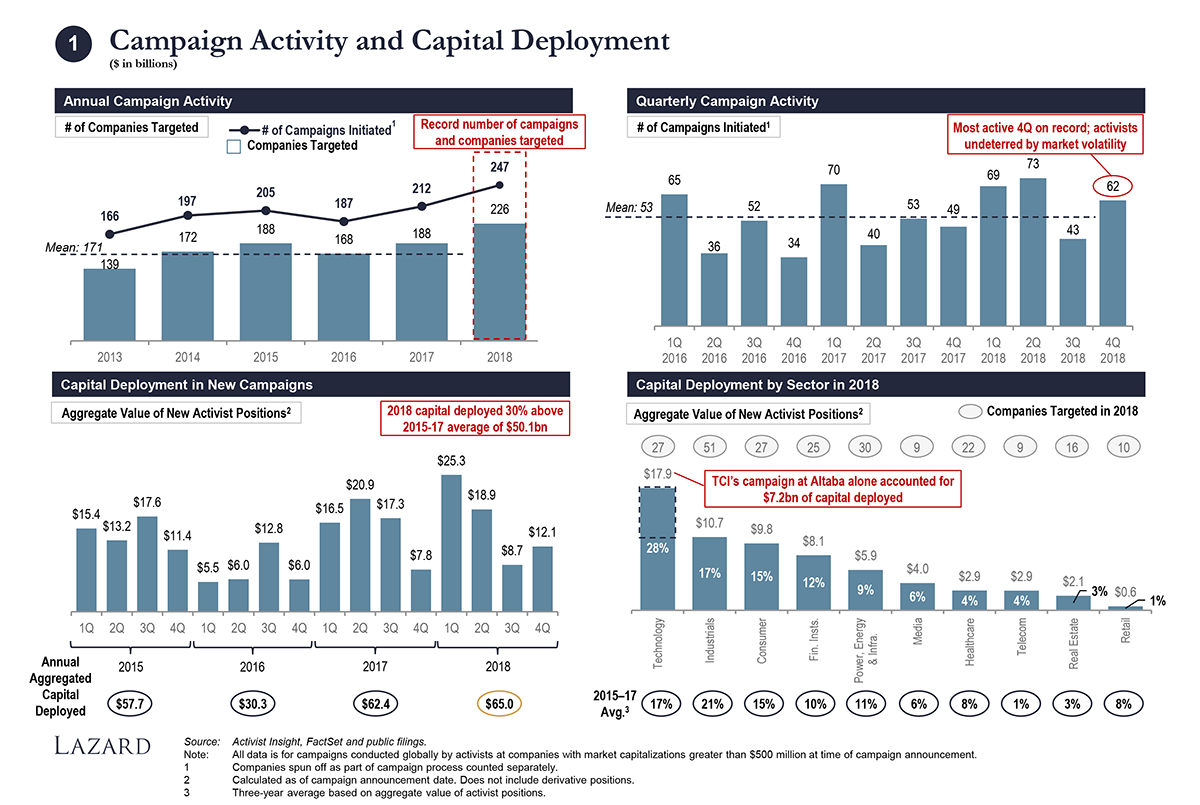

- A record 226 companies were targeted in 2018, as compared to 188 companies in 2017

- $65.0bn of capital deployed in 2018, up from $62.4bn in 2017

- In spite of significant market volatility, Q4 2018 was the most active Q4 on record both by campaign volume and capital deployed

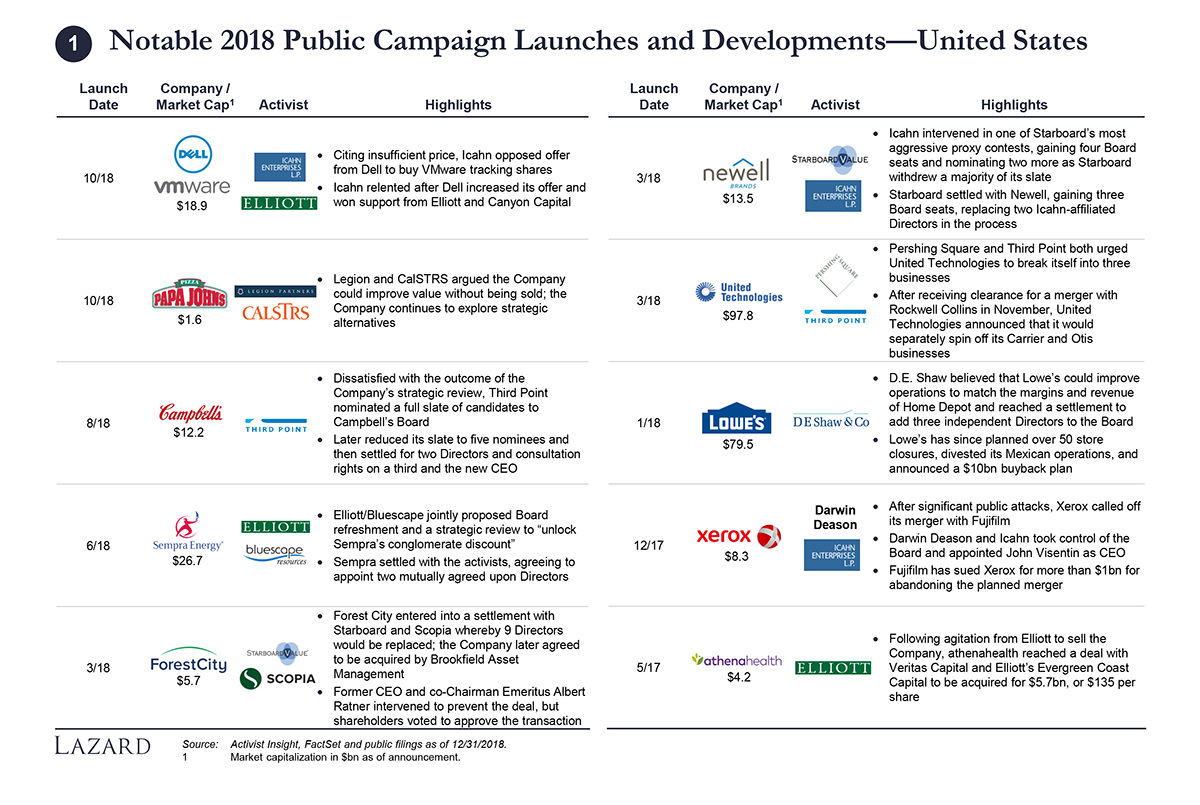

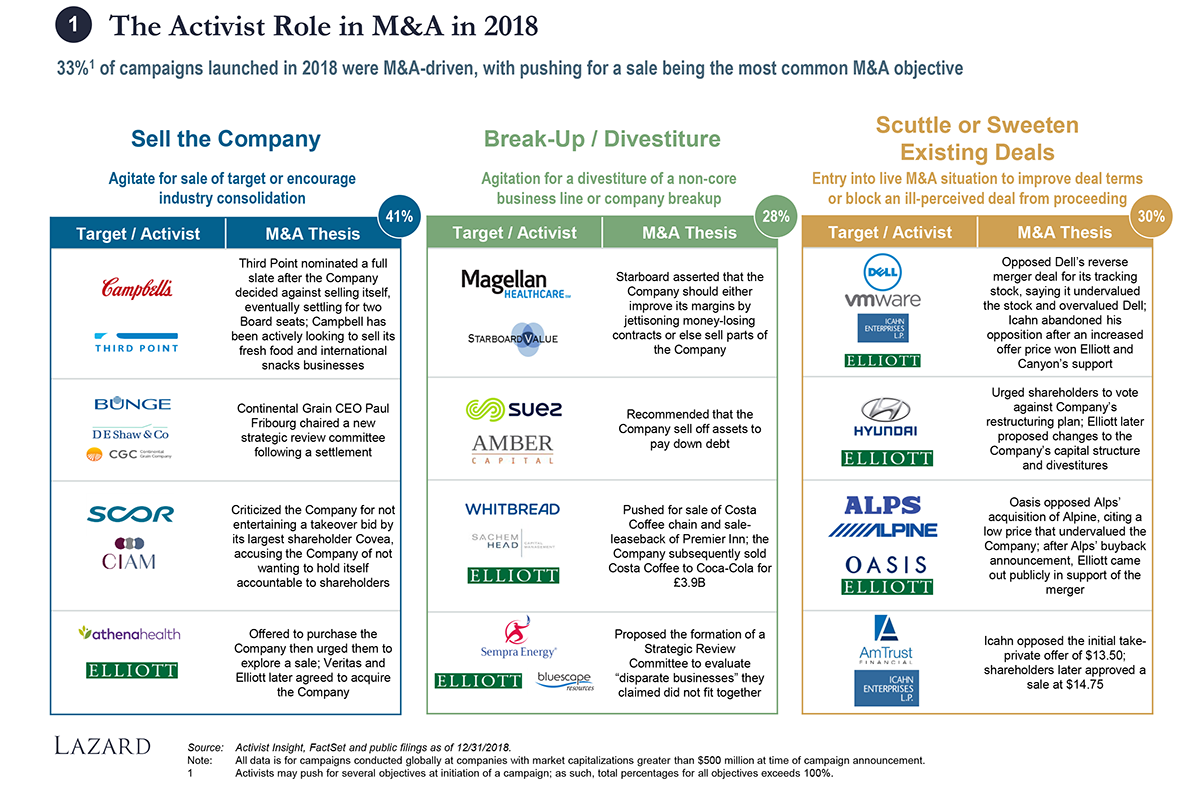

- Against the backdrop of a robust M&A market, 33% of 2018 activist campaigns were M&A related

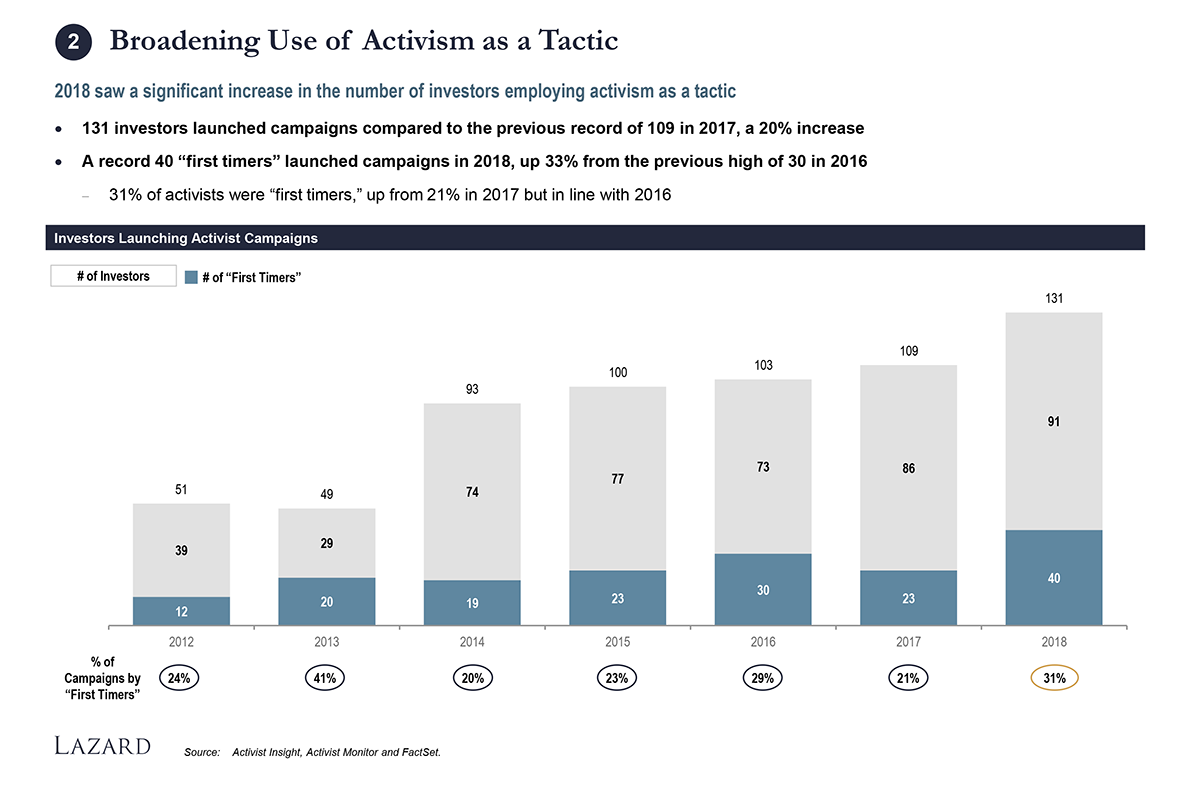

2. Broadening Use of Activism as a Tactic

- A record 131 investors engaged in activism in 2018, reflecting the continued expansion of activism as a tactic

- 40 “first timers” launched activist campaigns in 2018, as compared to 23 “first timers” in 2017

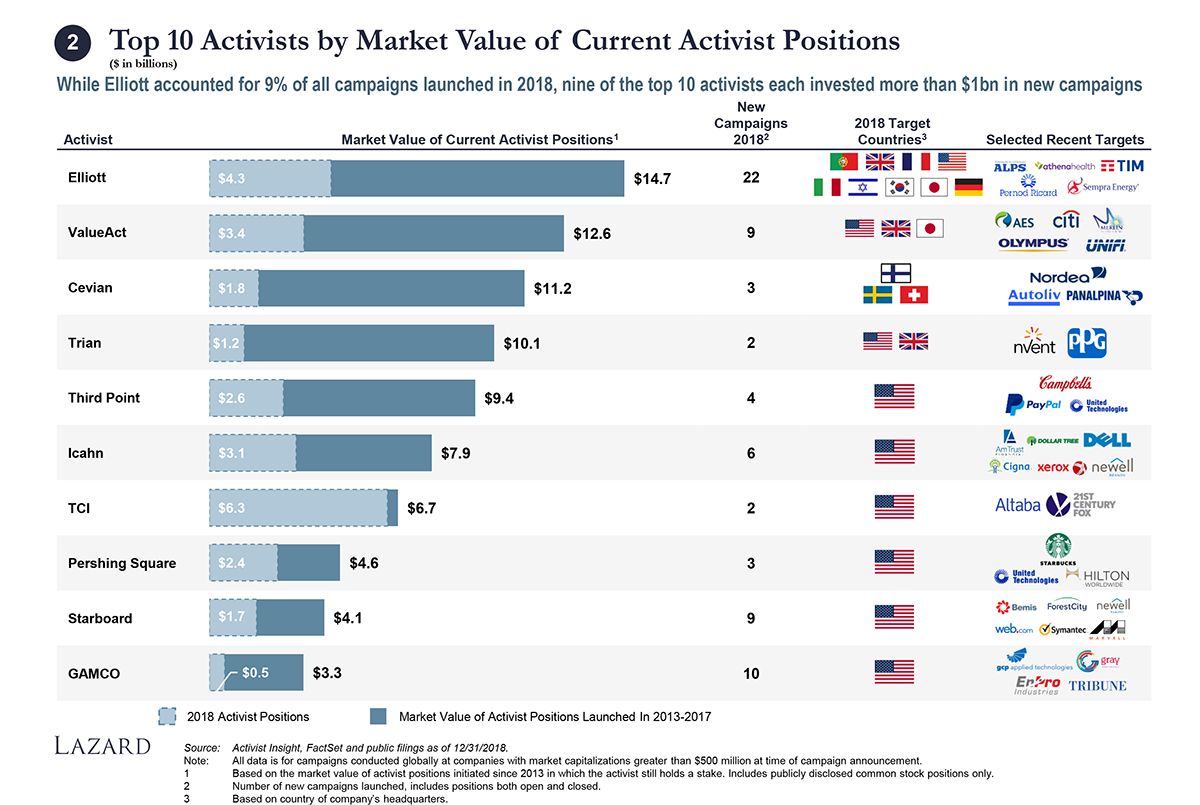

- Nine of the top 10 activists (by current activist positions [1]) invested more than $1bn in 2018 (60 new campaigns in aggregate)

- Elliott continued to be the most prolific activist, with 22 new campaigns launched in 2018

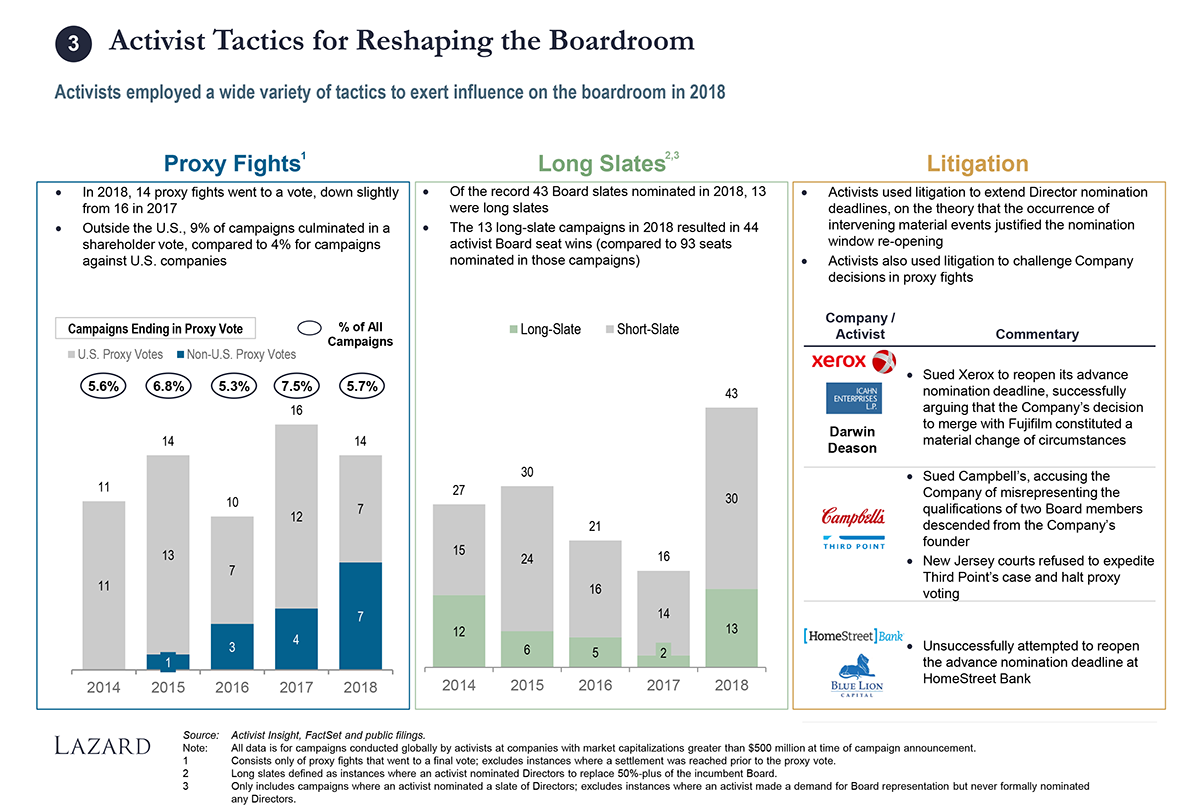

3. Activism Is Reshaping Boardrooms

- 161 Board seats won in 2018, [2] up 56% from 2017 and 11% higher than the previous record of 145 seats in 2016

- Starboard led the way in 2018, winning 29 seats exclusively through negotiated settlements

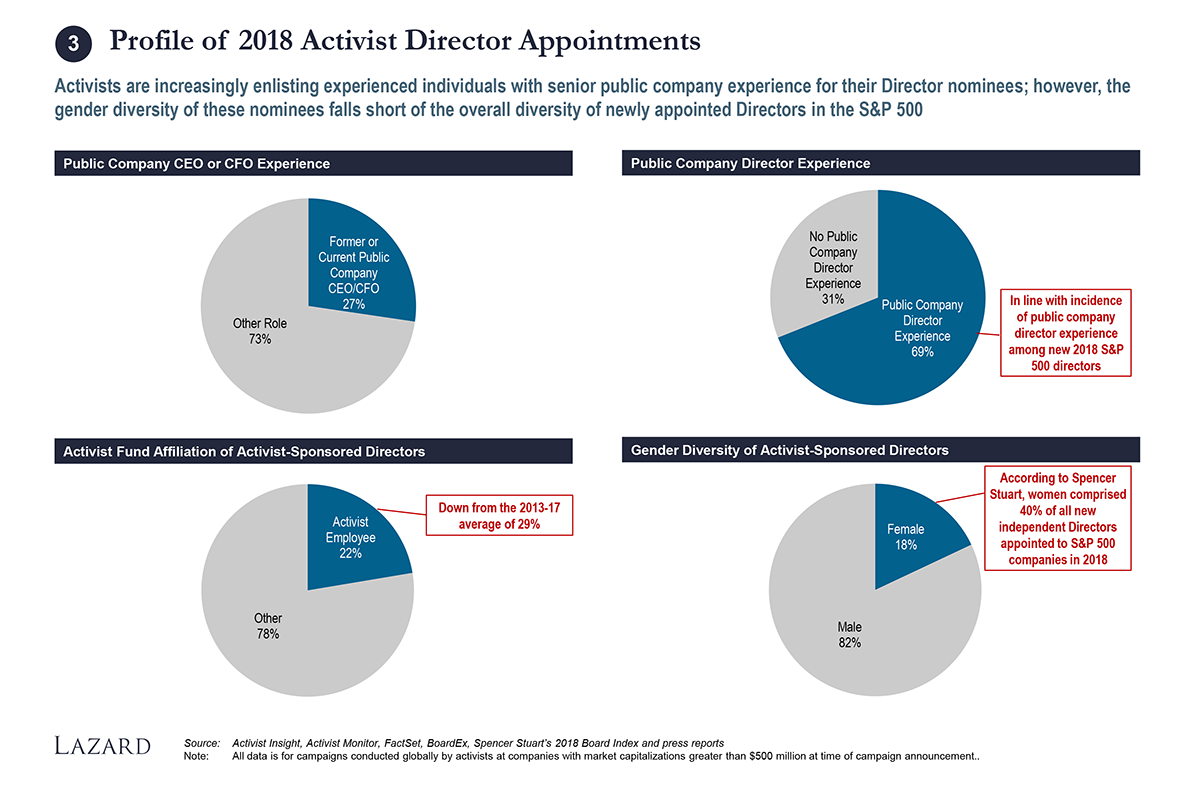

- Activists continue to name accomplished candidates, with 27% of activist appointees having public company CEO/CFO experience

- However, only 18% of activist appointees in 2018 were female, as compared to 40% of new S&P 500 directors in 2018 [3]

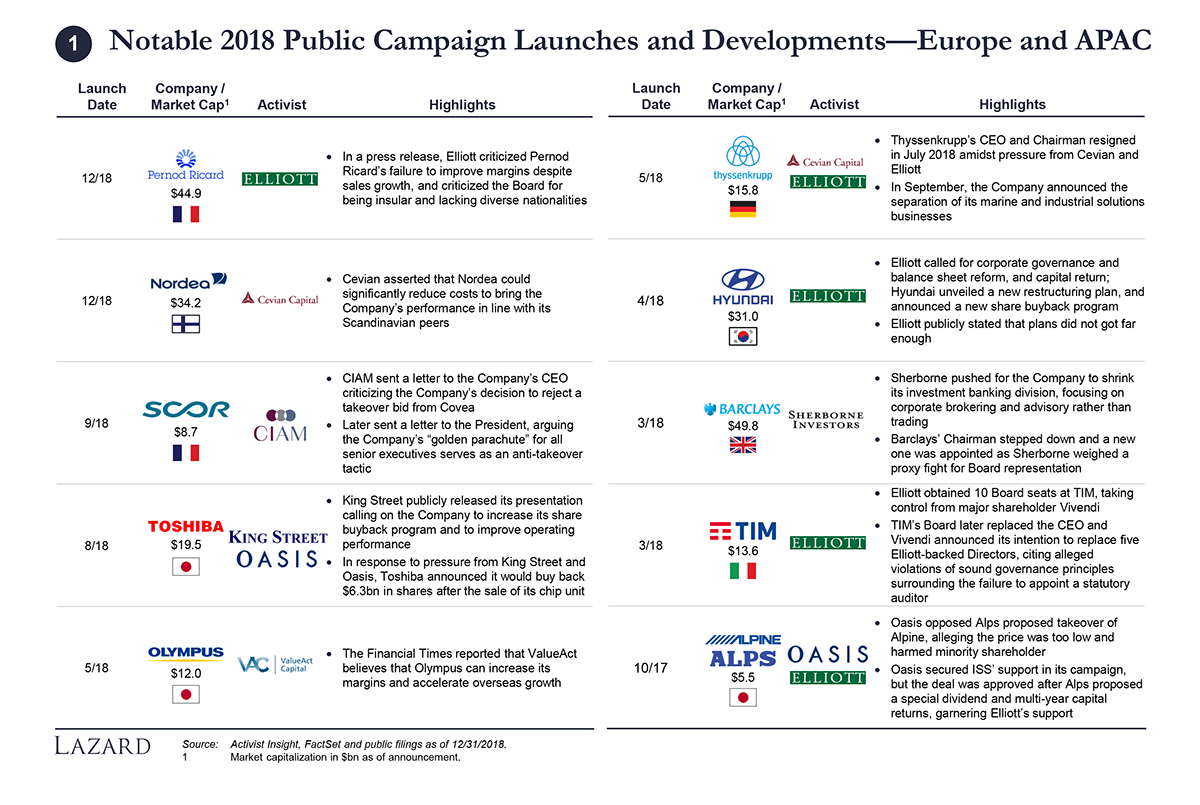

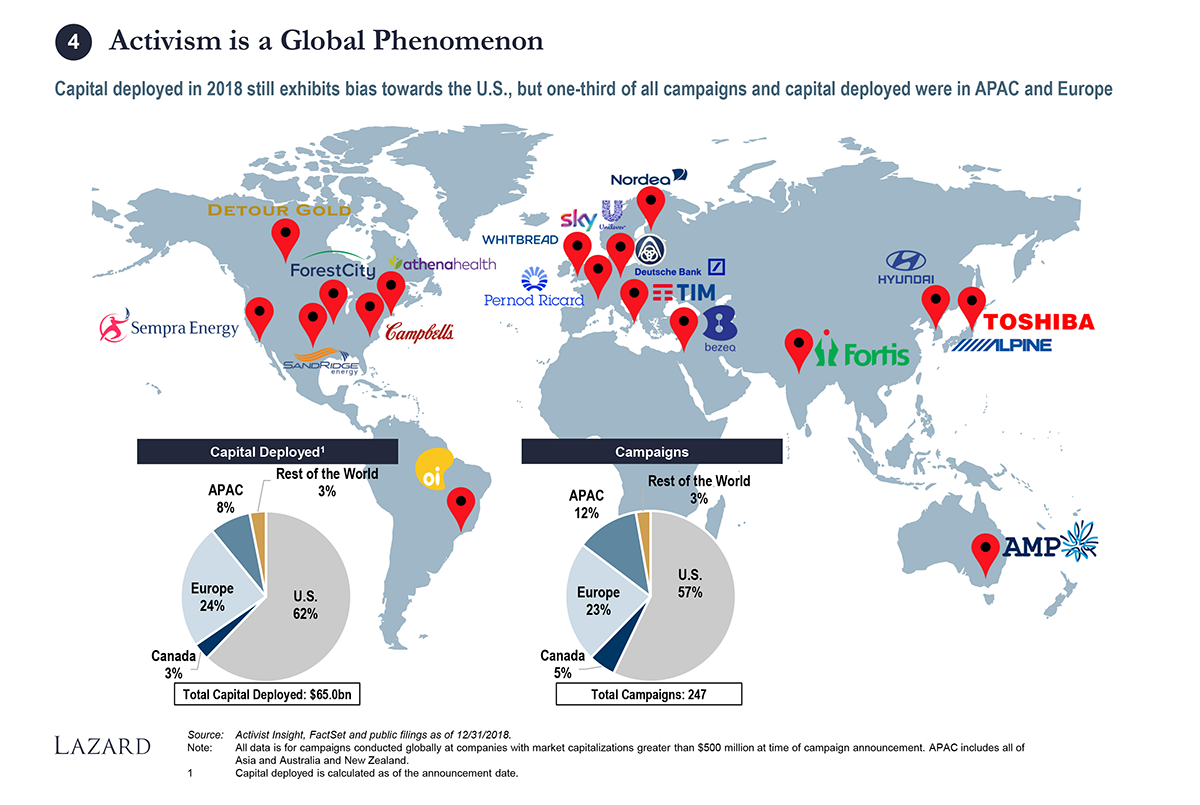

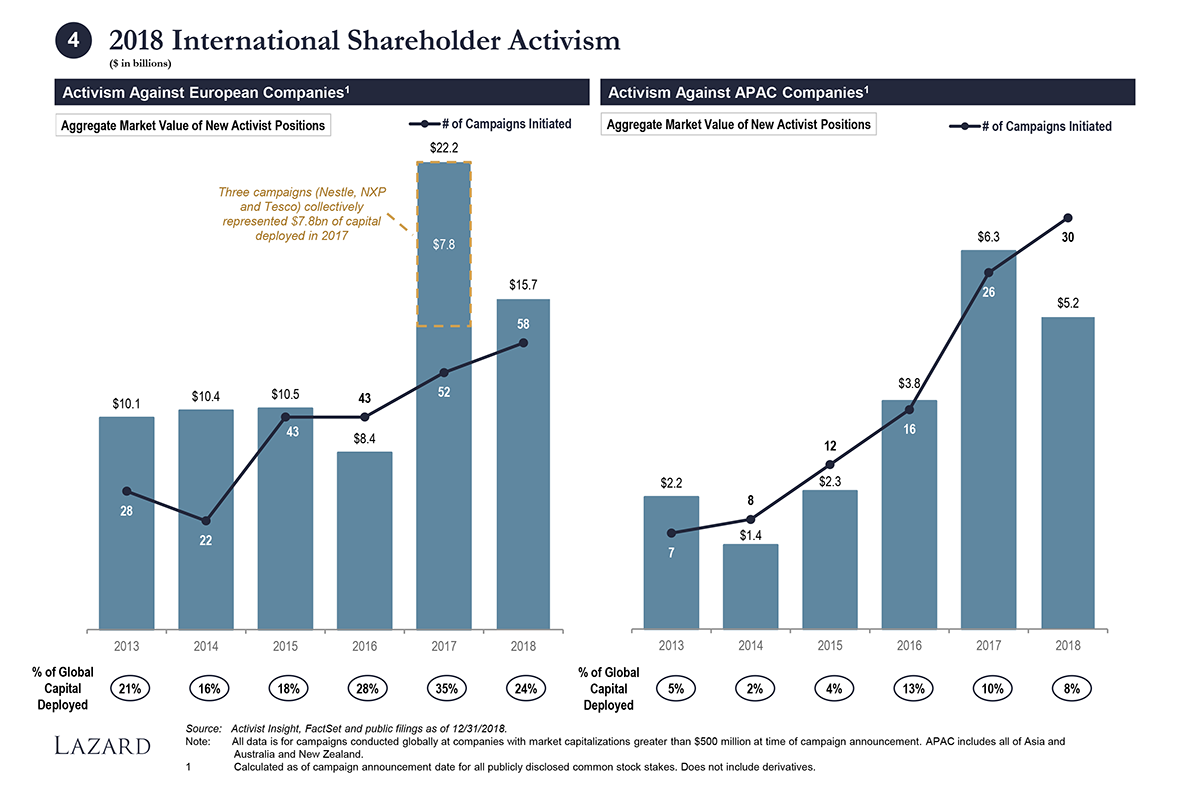

4. Activism Has Global Reach

- Activist campaigns in Europe and APAC accounted for 23% and 12% of companies targeted, respectively

- 58 European campaigns and 30 APAC campaigns in 2018 were each record highs

- National champions, iconic family owned companies and regulated industries featured prominently among targeted companies

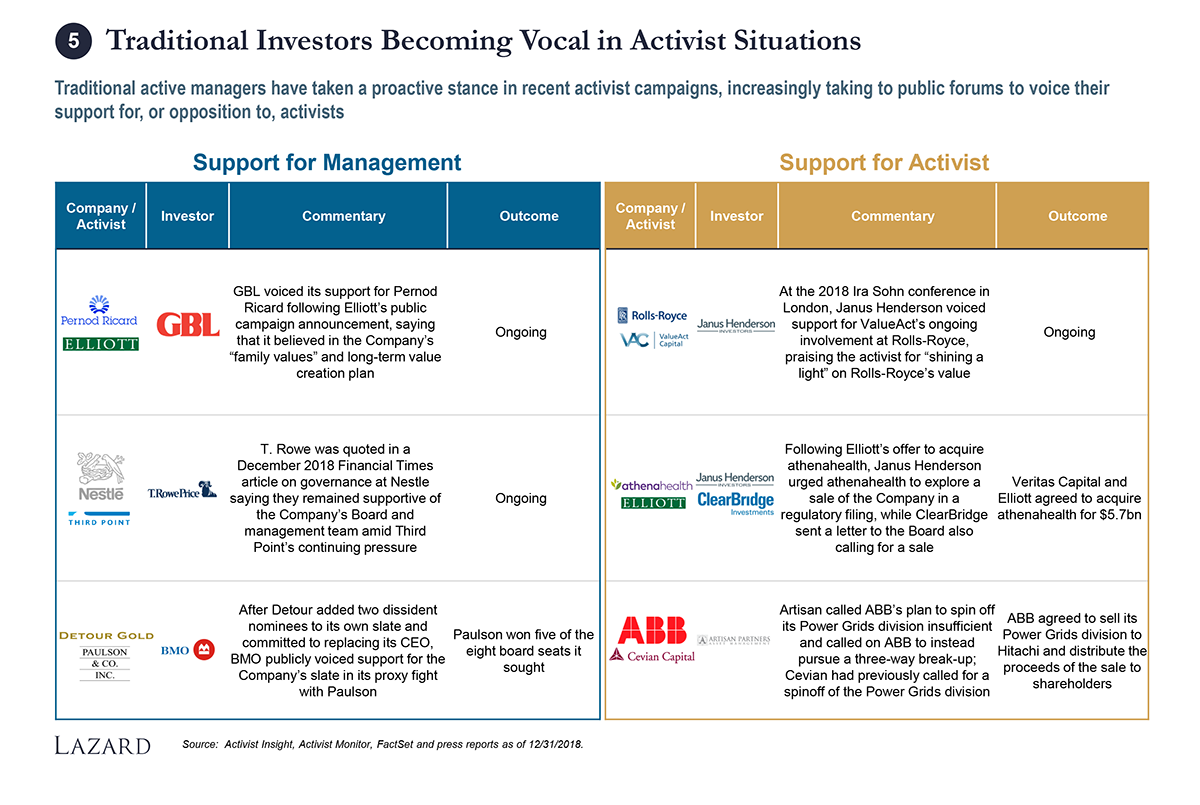

5. Traditional Active Managers Are the “New Vocalists”

- Traditional active managers are increasingly comfortable sharing their views on major activist campaigns in private interactions with

management and more public forums - Traditional managers like T. Rowe Price, Janus Henderson and GBL publicly voiced their opinions on major activist campaigns

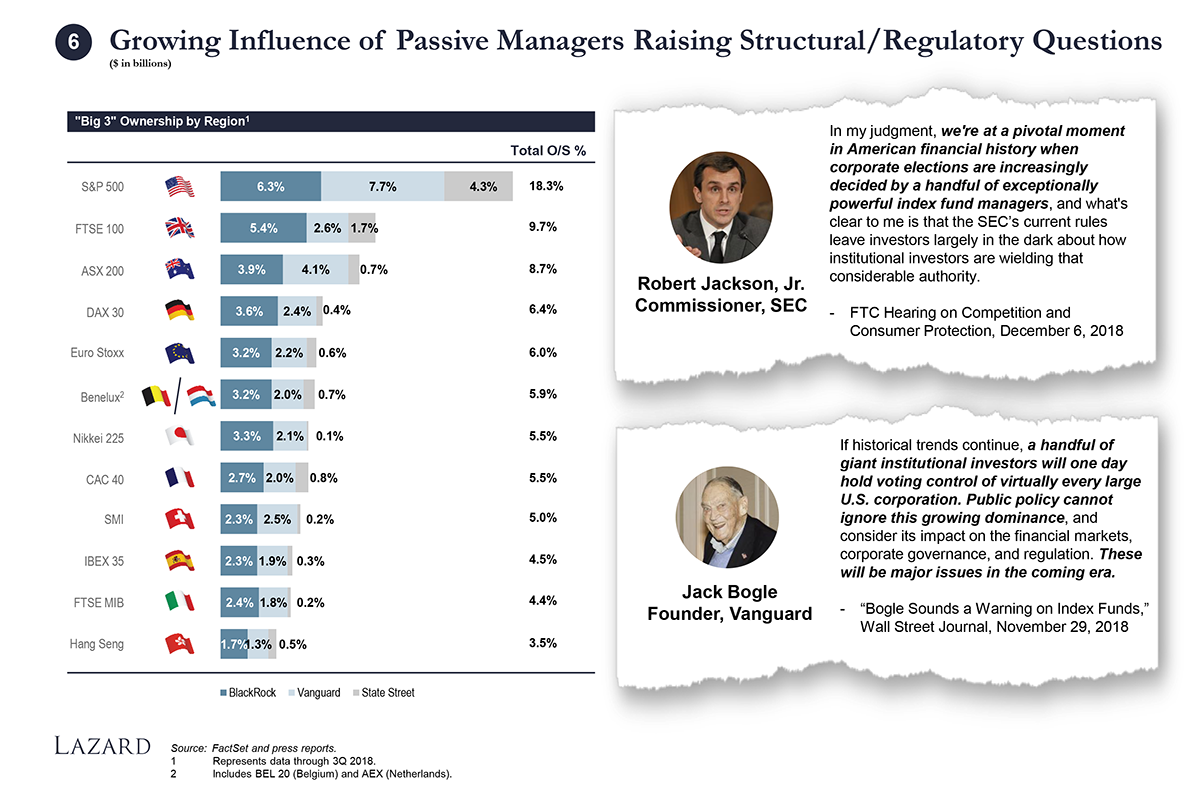

6. Shareholder Dynamics Are Attracting Scrutiny

- BlackRock’s Larry Fink set the tone for the year, calling on companies to identify and follow through on their social purpose

- Stakeholder duties, employee Board representation and capital allocation / share buybacks became political issues

- Voting power of index funds remains a highly debated topic, and regulators have begun to explore the influence of proxy advisory firms and the proxy voting process itself

The complete publication, including Appendix, is available here.

Endnotes

1Based on the market value of activist positions initiated since 2013 in which the activist still holds a stake.(go back)

2Represents Board seats won by activists in respective year, regardless of the year in which the campaign was initiated.(go back)

3Board data from Spencer Stuart’s 2018 Board Index.(go back)

Print

Print