James Woolery and Rob Leclerc are partners and Richard Fields is counsel at King & Spalding LLP. This post is based on a King & Spalding memorandum by Mr. Woolery, Mr. Leclerc, Mr. Fields, Timothy Fesenmyer, Elizabeth Morgan, and Kevin Manz. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

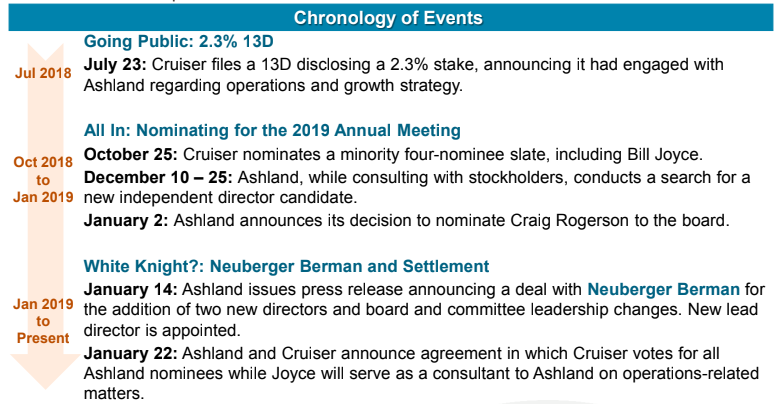

Following a contentious two-year campaign, Ashland recently settled its proxy contest with Cruiser after reaching an agreement with Neuberger Berman, an active manager and 2.8% holder. Ashland agreed to refresh committee leadership, appoint a new lead independent director, and add two new directors with Neuberger’s input.

This was a highly unusual development, as active managers do not often publicly intercede to end a proxy contest.

However, this new vocalism should not come as a complete surprise—as active managers have been under significant pressure in recent years due to the growth of index funds, they have found new ways to exert influence, and this latest development is the logical extension of those efforts.

Neuberger sided with Ashland in this case. In future proxy contests, given the dynamics and transformation of the shareholder landscape, expect active managers to side with whichever party helps advance their agenda most.

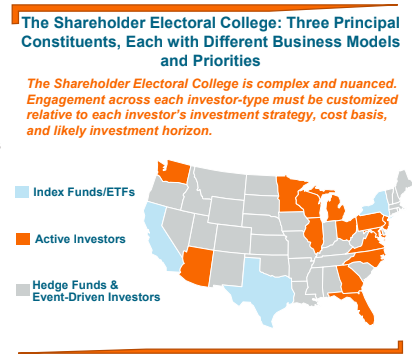

Whether active managers choose to align with activists or companies will depend on how the company engages with its shareholders—highlighting the need for companies to thoughtfully navigate the Shareholder Electoral College.

Key Takeaways

- Expect more active managers to embrace the role of the “swing voter” and be willing to publicly intervene in proxy contests

- Anticipate passive managers—who are often more interested in policies than particular people—taking a page from the Neuberger playbook to advance their interests in enhanced board refreshment in contested situations

- If companies do not effectively engage with top shareholders and build alignment, then the activists will

Another Lesson: Company Leaders On Competing Slates

Another highly unusual aspect of the contest was the presence of contemporaneous company leaders on opposite sides of the proxy card. After Cruiser nominated four directors—including Hexion Director Bill Joyce—Ashland announced that it was adding Craig Rogerson, current Hexion CEO and Chairman, to its board. The net result was that two Hexion directors were running on competing slates during the proxy contest. As activists have become increasingly successful at recruiting highly qualified individuals to their slates, this development provides a useful reminder to companies to evaluate their policies on outside board service in order to avoid these potentially uncomfortable consequences.

Print

Print