Heidi Welsh is Executive Director at the Sustainable Investments Institute (Si2) and Michael Passoff is the founder and CEO of Proxy Impact. This post is based on a joint report from Proxy Impact, Si2, and As You Sow, authored by Ms. Welsh, Mr. Passoff, and Andrew Behar. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

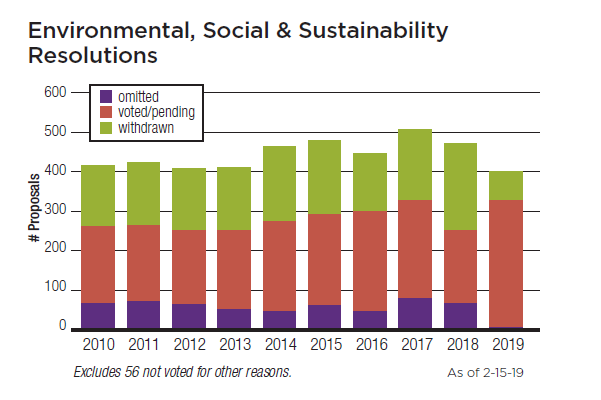

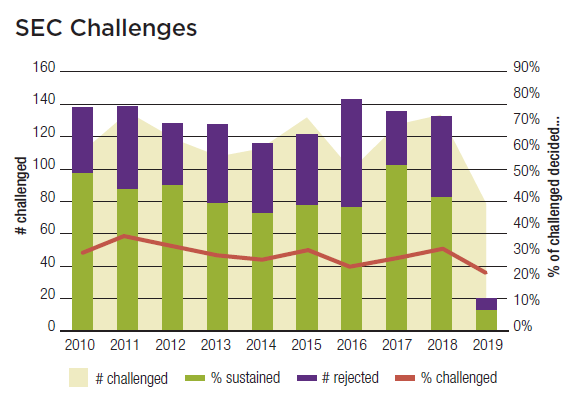

Proponents have filed at least 386 shareholder resolutions on environmental, social and sustainability issues for the 2019 proxy season, Environmental, Social & Sustainability Resolutions with 303 still pending as of February 15. Securities and Exchange Commission (SEC) staff have allowed the omission of only six proposals so far in the face of company challenges, far fewer than the 27 omitted at this point last year because the SEC was included in the recent six-week government shutdown. Companies have lodged objections to at least 54 more proposals that have yet to be decided.

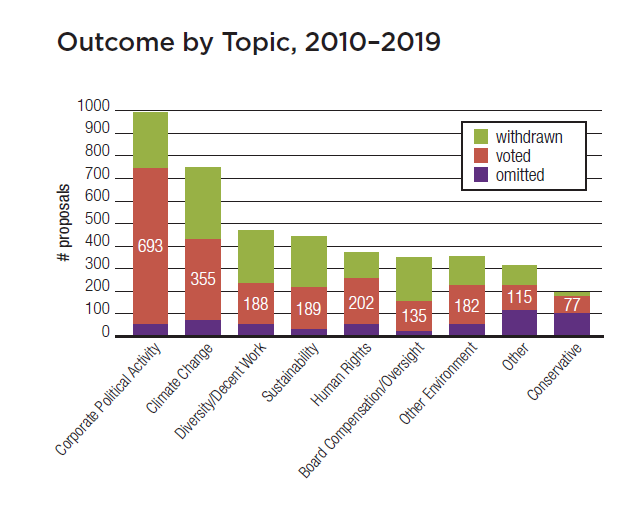

Proponents have already withdrawn more proposals than they had last year—71, up from 62 in mid-February 2018. Usually these are a sign that proponents and companies have reached an agreement.

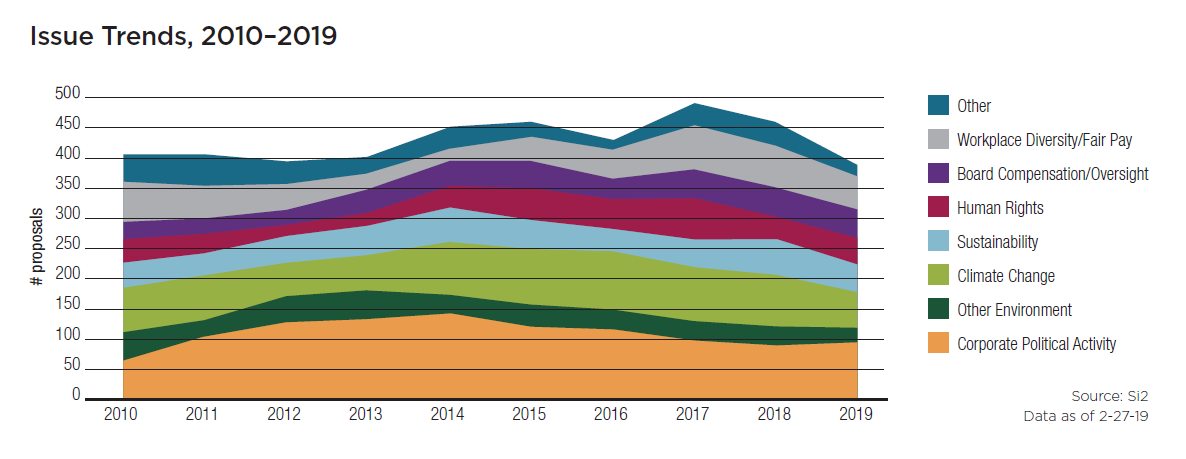

Last year, the overall tally of resolutions reached 460 by year’s end, down from 494 in 2017. The proportion voted on dropped by 10 percentage points, to 177 resolutions, the lowest level of the decade and well below a high of 243 in 2016. Proponents withdrew 210 resolutions in 2018, nearly half of all they filed. Companies omitted a total of 65 proposals after SEC challenges in 2018, down from 77 in 2017.

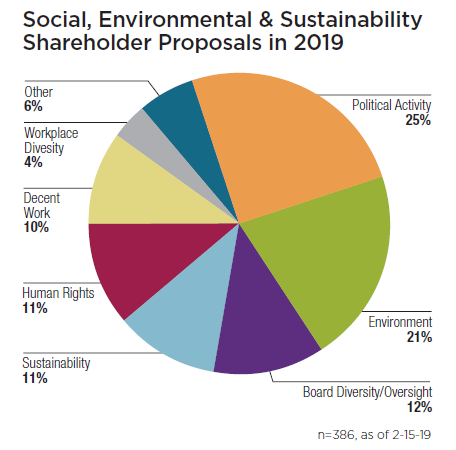

Corporate political activity and environmental proposals (mostly on climate change) account for just under half of the resolutions this year. The categories of board diversity and oversight, sustainability, human rights and decent work each contribute about 10 to 12 percent. Diversity in the workplace makes up another 4 percent of proposals. The remainder are about health issues, media concerns, ethical finance and animal testing.

Key Recent Developments

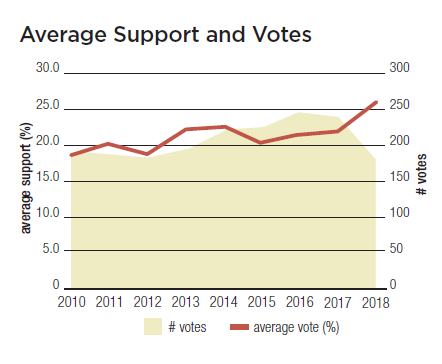

Mutual funds voting: Several of the huge mutual funds that have influential stakes in nearly every corner of proxy voting on environmental, social and sustainability issues. This started in 2017 with votes supporting climate change and last year expanded to include proposals about the opioid epidemic and gun control. This pushed average support to more than 25 percent. Votes in 2019 are likely to be high, as well.

Possible changes to the proxy voting process: Growing votes, combined with Republican control of the White House and both houses of Congress until last fall’s election, seem to have sparked a backlash. Some trade organizations and business groups express the belief that many shareholder proposals create a bothersome distraction for boards and companies; they are continuing to press for changes to tighten up the SEC’s Shareholder Proposal Rule arguing that the proxy process is badly in need of an update. (The last rulemaking was in 1998, just as the Internet was taking hold and many agree some technical changes would improve the process, but there are significant differences of opinion about whether and how the filing and resubmission of proposals should be changed.)

Any change in the process likely would have to come from rulemaking by the SEC. One indicator of change is the shifting interpretation by SEC staff of what may be included in proposals, explained in interpretive bulletins released by the commission in late 2017 and 2018. Another was an SEC roundtable in mid-November where investors and companies exchanged fire over whether the process is broken. (The commission is continuing to invite comments, which can be viewed on the SEC website.) Meanwhile, on Capitol Hill, a bill that could impose some restrictions on proxy advisory firms that make voting recommendations on resolutions passed the House in 2017 and proceeded to the Senate, which held a hearing last December that largely replayed the viewpoints set out at the SEC roundtable.

New Proposals and Questions for 2019

Climate change: This issue is still a major feature of the proxy season, but there are fewer climate-related proposals in

2019, although some escalated the issue by including Paris-compliant transition language. It remains unclear if proposals seeking greenhouse gas emission goals will be struck down by the SEC following a surprise decision in 2018; several reformulated goals proposals will provide test cases. The New York City pension funds decided not to wait for the commission to weigh in and sued TransDigm in December to force the inclusion of a GHG goals proposal; the company ultimately settled, but similar cases may occur—pushing questions to the courts.

Environmental management: Plastic “nurdles” (also known as pellets) are being targeted as pollution that should be controlled at four petrochemical companies in a new campaign.

Corporate influence spending: Proponents of more corporate oversight and disclosure of election spending have revved up their longstanding campaign and filed a record 57 resolutions this year, double what was filed last year, although lobbying proposal numbers are down.

Decent work: Last year’s surge in gender pay equity proposals is continuing and a new resolution asks companies not to require mandatory arbitration and non-disclosure agreements, which proponents say is particularly harmful for victims of sexual misconduct but also can allow other malfeasance to fester.

Diversity at work: Half as many resolutions as in 2018 have been filed so far seeking data on gender, race and ethnicity of employees, but a new proposal is specifically targeting diversity in management.

Health: The Investors for Opioid Accountability coalition, in its second year, got an early win with a 60.5 percent vote at Walgreens Boots Alliance in January for a resolution seeking risk management disclosures. Its campaign at opioid makers, distributors and treatment makers continues, after two majority votes last year.

Human rights: New proposals ask about immigrant rights and detention, and online child sexual exploitation. New proposals at travel companies Booking and TripAdvisor ask how they avoid complicity in conflict zones.

Media: Alphabet, Facebook and Twitter continue to face questions about how they manage content and address risks posed by those who use their platforms to secretly influence elections and disseminate hate speech. Amazon.com is being asked about facial recognition software used by U.S. Immigration and Customs Enforcement (ICE) in a new proposal.

Board diversity and oversight: Alongside continued requests to diversify board nominees is a notable request to include sexual orientation and gender identity in the definition of desired diversity for directors. New proposals also raise pointed questions about a wide range of hot button issues—racism, immigrant detention, drug pricing and the social impact of Amazon.com’s business—with many SEC challenges.

Sustainability disclosure and management: Proponents are testing out a new idea—asking for reporting using the metrics defined as material by the Sustainability Accounting Standards Board (SASB). Resolutions about tying executive pay to a wide range of issues continue.

SEC Challenges

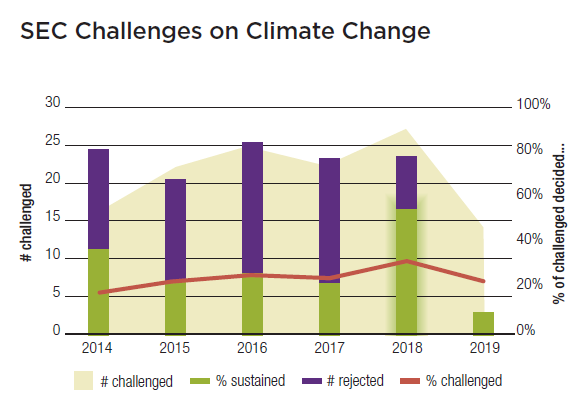

The ultimate impact of the SEC’s new clarifications of the Shareholder Proposal Rule in 2017 and 2018 remains to be seen. Overall, the new approaches did not substantially affect the outcome of challenges in 2018; this was not true for climate-related proposals, however, which were disproportionately affected.

All are hampered by the lasting impacts from the six-week government shutdown that has left the SEC far behind in responding to 2019 company challenges. Incomplete figures based on data gathered by Si2 from proponents suggest that three-quarters of the challenges have yet to be decided, significantly lagging where things stood at this point in years past.

Overview and New Issues in 2019

This section provides a look at the main issues raised in each of the topics covered in this report, giving special attention to new issues and continuing points of contention about the Security and Exchange Commission’s shift in interpretation of its Shareholder Proposal Rule, set out in two Staff Legal Bulletins issued in the last two years.

Environment

The topic of climate change makes up the vast majority of resolutions filed on environmental issues and undergirds many other corners of shareholder activity this proxy season.

Climate change: The number of proposals specifically concerned with climate change has dropped to 60, down from 83 last year, although as in the past climate change also is raised in other proposals about sustainability disclosure and in a few on lobbying. Proponents seek information about how companies are managing greenhouse gas (GHG) emissions and carbon asset risks, and want to know how companies plan to adapt their business models to be Paris-compliant and address our changing climate.

GHG emissions—Last year, the SEC upended years of precedent when it told EOG Resources on February 26, 2018 that a resolution asking it to adopt GHG goals concerned ordinary business, by seeking to “micromanage” the company. The exclusion allowed for proposals judged to raise mundane ordinary business issues not suitable for shareholder involvement is the ground for omission cited most frequently of the 13 listed in the shareholder proposal rule. The EOG letter followed the Nov. 1, 2017, SEC Staff Legal Bulletin 14I asking for board analysis of whether the underlying issue raised to a resolution is significant enough to transcend the mundane. That was followed by a second Staff Bulletin, 14J, Oct. 23, 2018, clarifying the first and discussing more fully the issue of micromanagement.

The EOG letter came too late to affect similar resolutions last year, since companies with similar proposals already had lodged their objections, but companies took note and the EOG letter features in many challenges this year, which are still to be decided. Proponents have reformulated some of their GHG goals requests this year, but 11 companies have received the basic, longstanding request to set quantitative, time-bound reduction goals; all invoke consideration of the Paris Climate Agreement. Five more ask energy companies about how they plan to lighten their carbon footprints, also keeping Paris in mind. Four more want reports on GHG targets.

A new resolution at three banks asks them to limit their financing on “extreme fossil fuel projects” in the Arctic, Canada’s oil sands and for coal; two challenges are outstanding.

In all, 19 GHG emissions proposals are pending and four have been withdrawn so far.

Methane-related resolutions have largely dried up as companies have reported more about their oil and gas operations that use hydraulic fracturing, although not all critics are assuaged. There have been two withdrawals and the only vote on the issue may be that which already has taken place at Atmos Energy, 34.8 percent on February 6. In an ironic twist after last year, EOG Resources this year sat down with proponents and has agreed to set qualitative and quantitative methane reduction targets.

Carbon asset risk—Proponents filed and then withdrew a swath of proposals last year seeking reports about how energy, utility and other firms plan to adapt to the low-carbon economy needed to meet the Paris treaty goals. The release of the Financial Stability Board’s recommendations for climate scenario reporting, backed by financial interests with more than $81 trillion in assets appears to have persuaded many companies to report, as did the 2017 majority votes at ExxonMobil and Occidental Petroleum. But because most assessments of current corporate reporting on climate change adaptation find it falls short of what is needed to avoid large scale disruption, proponents are persisting with resolutions seeking reports about transitions compliant with the Paris agreement. In all, 11 carbon asset risk resolutions are now pending and proponents have withdrawn eight. One has been omitted on technical grounds.

Eight filings ask how companies will help to limit temperature increases to “no more than” or “well below” 2 degrees Celsius. Four more ask for specific annual reporting on metrics gauging risks. A new variant is before Amazon.com, citing problems it has experienced from extreme weather. Another new resolution about the effects extreme storm-induced flooding may have on petrochemical facilities is at DowDupont and ExxonMobil, while another puts Duke Energy on the spot about public health risks from flooded ash waste ponds, which occurred in September 2018 during Hurricane Florence, the wettest tropical cyclone ever to hit the Carolinas.

Renewable and efficient energy—Nine proposals ask for reports on energy efficiency and renewable energy goals, at food firms, industrialists and retailers. Proponents still want to see more renewable energy use, but may be stymied by the SEC’s view, expressed last year, that renewable energy goals at three companies were a matter of ordinary business. Agreements have produced four withdrawals so far, at Archer Daniels Midland, Dollar General, Goodyear Tire & Rubber and Verizon Communications. Five more are pending.

Deforestation—Concerns about how food production contributes to deforestation, chipping away at carbon sinks, have prompted some companies to pledge they will source only from sustainably grown commodities. Aramark has agreed to report using quantitative metrics about its supply chain, prompting Green Century Capital Management to withdraw its proposal, but a resolution seeking a similar report is pending at three more food firms, including one about cocoa at Mondele–z International, owner of Cadbury.

Sustainable energy access—While deforestation raises environmental and human rights concerns, another new proposal also addresses sustainable development, asking ExxonMobil what it is doing to alleviate “energy poverty” by offering sustainable energy solutions.

Environmental management: Nine of the 13 proposals about environmental management issues beyond climate change concern waste. Five proposals face SEC challenges that have yet to be decided and one has been omitted on technical grounds. Twelve are now pending and one has been omitted.

“Nurdles”—As You Sow has a new proposal aiming to curb plastic pollution from pre-production plastics pellets known as “nurdles” generated by Chevron, DowDupont, ExxonMobil and Phillips 66. Three challenges are outstanding, arguing it is an ordinary business issue or cannot be addressed given joint venture production arrangements.

Four more proposals seek reports from food and restaurant companies on packaging and recycling, including at a new target, seasoning and spice company McCormick, which is swapping out glass and metal containers for plastic to meet carbon reduction goals but at the same time raising concern about what will become of the plastic replacements.

Water—Only two water risk proposals are on tap for 2019. One is at Energen, where a methane proposal about its oil and gas operations earned a near majority back in 2011. This time, proponents want to know how the company is handling water risks given its usage with hydraulic fracturing in arid areas. The other regards polluted effluent at Pilgrim’s Pride chicken processing plants.

Nuclear power—The only proposal now pending about nuclear power asks PNM Resources about a leasing arrangement tied up in litigation before the New Mexico Supreme Court, which proponents say might leave investors on the hook for decommissioning the Palo Verde nuclear plant, a longtime target of critics.

Industrial agriculture:

Farming practices—After two years of strong votes (43.1 percent last year) and a purchasing community showing increasing preference for antibiotic-free meat, As You Sow has withdrawn a proposal at chicken producer Sanderson Farms. Last year the company was still disputing that antibiotics in animal feed have a negative impact on human health, but it now has agreed to a report on a possible phaseout. A similar agreement was reached at Costco. But Domino’s Pizza is invoking the SEC’s new stance on “micromanagement,” which allows for exclusion of proposals that impose specific timeframes or require intricately detailed studies. Domino’s is seeking the commission’s blessing to omit a proposal that wants goals for using more antibiotic-free pork and beef.

Animal products—Harrington Investments wants to rid Kohl’s and TJX of fur with a policy about a cruelty free supply chain, while People for the Ethical Treatment of Animals (PETA) goes further, asking Bed Bath & Beyond to use synthetic stuffing instead of down, which it says is inhumanely produced.

Social Issues

Animal testing: Three drug companies have challenged a new proposal from PETA that asks them to stop using the “Forced Swim Test” with animals for the development of antidepressants. The companies argue it concerns ordinary business, is not significant to their operations and (in one case) that the test is not used. It’s not clear any will go to votes.

Corporate political activity: Proponents are continuing their longstanding campaigns asking companies about contributions to elections and about lobbying disclosure. They have revved up the campaign to persuade companies to put in place formal oversight and more substantial disclosure about how much they spend to support political candidates, but they have fewer proposals this year about oversight and spending on lobbying lawmakers and regulators after elections. The overall tally on the two issues had been dropping but this year has risen to 93, up from 80 in 2018. The enduring sticking point remains the requested and resisted disclosure of spending by trade groups and other non-profit groups.

Elections and lobbying—Sixteen of the 57 proposals filed using the model of the Center for Corporate Political Accountability (CPA) on election spending are resubmissions; all but two are now pending. A total of 33 ask for similar oversight and disclosure about federal, state and local lobbying; one earned 11.1 percent support at Tyson Foods in January and proponents have withdrawn five others after agreements; 25 are pending (two more also ask about elections as well as lobbying).

Additional issues—Three more resolutions raise related issues. One suggests, among other things, that shareholders should be allowed an advisory vote on election-related and PAC spending, at Intel. Another is a resubmission to Citigroup and JPMorgan Chase of an AFL-CIO proposal that seeks to limit “revolving door” rewards for employees who leave to work for the government; these proposals, around since 2015, earned 35 percent last year at Citi and 29.3 percent at JPMorgan.

Last year, a free market activist group, the National Center for Public Policy Research (NCPPR), submitted proposals that used precisely the same resolved clause as the disclosure advocates on lobbying, but approached the issue from the opposite standpoint of encouraging lobbying. The NCPPR proposals pre-empted mainstream proposals filed later. This year, the NCPPR copy-cat proposal has surfaced again, but is likely to exclude only one mainstream proposal, at Pfizer. (NCPPR filed second at Honeywell.)

Critical SEC questions—Last year at this time, it was unclear whether companies would be able to use the SEC’s new interpretation of the Shareholder Proposal Rule laid out in Staff Legal Bulletin 14I to redefine what constitutes “significantly related” regarding political activity proposals. In addition to clarifying the staff view of the ordinary business exclusion, the bulletin was intended to clarify the section of the rule that allows companies to omit resolutions judged “not significantly related” to their business. Four companies unsuccessfully argued their political expenditures were insignificant, with some also saying that investors are just not interested in the disclosure sought by proponents. The SEC demurred, which relieved proponents, but in doing so it noted previous levels of support of 20 percent or more—potentially signaling an interest in increasing the resubmission thresholds, which for more than 50 years have required that first year proposals earn at least 3 percent to qualify for resubmission, 6 percent the second year and 10 percent in each year thereafter. While the SEC has made no formal rulemaking proposal for reforms yet, some movement in that direction has occurred.

This year, Pfizer is trying to apply the SEC’s “micromanagement” interpretation voiced at EOG Resources last year. Pfizer says the lobbying resolution is too detailed and therefore constitutes ordinary business.

Decent work: Growing economic inequality in the United States, which is more acute for women and racial and ethnic minorities, along with the #MeToo movement’s demand for equal treatment—and, implicitly, equal pay—have driven a surge of resolutions about pay equity and working conditions since 2014. Thirty-one of the 38 proposals about decent work are now pending and five have been withdrawn.

Pay equity—Ten of the 29 proposals on pay equity are resubmissions and proponents have withdrawn four so far, mostly at tech and financial sector firms. New this year is a modified request to provide data on the global median gender pay gap (six companies), while others ask about the risks posed by such a gap. Most focus on women, but some also raise differential pay rates for people of color. Some companies have agreed to take substantive action. Pfizer, for instance, is hiring an outside firm to look at its global workforce regarding gender, and at race domestically—and plans to report by next year. As a result, Proxy Impact withdrew its proposal; three other firms, including Citigroup, also have agreed on more disclosure and proponents have withdrawn.

“Inequitable employment practices”—The New York City pension funds and the federation of labor unions Change to Win have filed a new proposal at seven companies, asking for an end to mandatory arbitration and non-disclosure agreements; six are now pending, with a challenge from Yum Brands that contends the proposal concerns ordinary business and is insignificant. The concern is that these arrangements contribute to a hostile work environment and may hide serious problems such as sexual misconduct and other malfeasance. An additional proposal to McDonald’s asks for a report on mandatory arbitration, noting that all 50 state attorneys general support an end to its in cases of sexual harassment.

Diversity in the workplace: Half as many proposals address workplace diversity data this year—just 16, down from 34 in 2018. They ask for current workforce breakdowns and/or what companies are doing to provide for more equal representation by women and minorities. Four of five EEO proposals filed by Trillium Asset Management are pending. Home Depot faces a disclosure proposal that is pending for a record 18th time; last year it earned 48.3 percent.

New SASB metrics—One of two test resolutions is pending at Fastenal. As You Sow is asking for diversity data on metrics determined by the Sustainability Accounting Standards Board (SASB) to be material to the company’s sector.

Executive diversity—Trillium Asset Management has a new proposition pending at five companies asking for reports on efforts to diversify upper management.

LGBTQ protections—Walden Asset Management wants the health care management services firm CorVel to assess the impact of its policy that does not have explicit protections for LGBTQ employees in place. It argues in a new proposal that affected employees face a patchwork of state laws about equal rights and mixed signals from the federal government. This is the only issue on LGBTQ workers’ rights offered this year; 30 were proposed as recently as 2012. However, several of the board diversity proposals ask about LGBTQ representation.

Ethical finance: Trillium has a new resolution asking about overdraft fees and their differential impact on poor and minority communities at Bank of America and JPMorgan Chase, and is asking for more transparency about the proceeds from the federal tax reform legislation at Gilead Sciences. A further banking ethics proposal from Harrington Investments also seeks a report on company practices at Wells Fargo.

Health: The Investors for Opioid Accountability (IOA) campaign, led by Mercy Investments and the UAW Retirees’ Medical Benefit Trust, is now in its second year and boasts support from 53 members with $3.4 trillion in assets. It continues to seek corporate governance reforms and disclosure at opioid-connected firms. In January, investors gave 60.5 percent support to a proposal at Walgreens Boots Alliance about more effective monitoring and management of risks related to its role as a distributor, following a similar vote at Rite Aid last fall. Another proposal at Insys Therapeutics is pending and one at AmerisourceBergen has been withdrawn.

Other health proposals include a pending repeat at Altria that seeks a report on nicotine levels and efforts to reduce them in its tobacco products. Further, The UAW Trust has withdrawn a new resolution at Johnson & Johnson about allegations that it tried to delay generic drug competitors, after the company provided more disclosure. (Additional proposals on drug pricing seek links to pay, covered under Governance below.) Another new proposal is still pending on the health effects of sugary products at Coca-Cola; it faces an SEC challenge.

Human rights: After a dip in 2018, investors have doubled down on human rights this year, with new resolutions on immigrant rights and detention, child sexual exploitation, hate speech and privacy. Forty-four proposals have been filed, nine have been withdrawn and 33 are pending; two have gone to votes.

Risk and impact assessments—Proponents this year are citing new reports that compare and score firms on their adherence to international standards to identify human rights risks and avoid or manage them effectively—such as Know the Chain on forced labor and the Corporate Human Rights Benchmark that rates the 100 largest global agriculture, extractives and apparel companies. Proponents have targeted firms with particularly low scores.

A new resolution from Azzad Asset Management asks Alphabet about Google’s development of a censored search engine in China. Azzad also has a first-ever proposal at consultant Booz Allen Hamilton, saying it needs a human rights policy given its record of advising the Saudi Arabian government, which has been implicated in the alleged murder of journalist Jamal Khashoggi. Withdrawals following agreements have occurred at Dunkin’ Brands and Southwest Airlines.

Conflict zones—Four of the five resolutions filed on conflict zone operations are pending. These include a new proposal to travel companies Booking Holding and TripAdvisor, both of which carry listings in zones rife with civil strife and human rights violations, such as the Democratic Republic of Congo, Iraq, Myanmar and the Palestinian Occupied Territories. It asks how the companies make decisions to stay in fraught areas and how they monitor their presence there to avoid being complicit in abuses.

Immigration and the penal system—The intense public debate over immigration and border security has spilled over into proxy season. After agreements, the Service Employees International Union (SEIU) withdrew a new resolution at Bank of America and Wells Fargo, which both lend to private prison companies involved in the detention of immigrants under President Trump’s policies. A resolution from inmate rights advocate Alex Friedman is proposing that private prison firms CoreCivic and GEO Group not participate in the detention of migrant children or their parents, but the proposal faces a challenge from each company and its fate remains uncertain. The Jesuit Conference has a second proposal at GEO about inmate and detainee rights, which cites problems at a California facility last fall.

Taking another new approach, the Sisters of St. Dominic of Caldwell, N.J., want Northrop Grumman to report on how its human rights policy is being implemented, given the company’s contract to develop a biometric identification system for the Department of Homeland Security. The company has lodged a challenge contending the proposal is ordinary business.

Prison labor—Northstar Asset Management persuaded Costco Wholesale to adopt a policy on domestic prison labor sourced goods last year, but now wants the company to provide a report on suppliers’ compliance; this resolution received 28.7 percent in January, a big jump from last year’s 4.8 percent. Northstar withdrew after cordial discussions at IBM but has two other pending proposals on prison laborers, and the Nathan Cummings Foundation wants to see guidelines and more transparency about this issue from Walmart.

Human trafficking—Christian Brothers Investment Services (CBIS), Proxy Impact and faith-based investors have a new proposal about online child sexual exploitation at tech and telecom firms. CBIS withdrew at Apple but the group’s proposal seeking an assessment of company risk management is pending at Sprint and Verizon Communications.

Right to water—Chevron faces a new resolution seeking information on how it addresses the human right to water in its operations, from the Sisters of St. Francis of Philadelphia.

Hate speech and related products—A new resolution from the Nathan Cummings Foundation asks Amazon.com about how it addresses the spread of hate speech and restricts related products.

Media: The “big three” social media firms—Alphabet, Facebook and Twitter—face resubmitted proposals asking for reports on how they manage problematic content. The resolutions have been updated with current references to election meddling, hate speech and other abusive content, which the resolution characterizes as presenting significant business risks to all three firms.

A new privacy proposal from the Sisters of St. Joseph of Brentwood asks Amazon.com to prohibit the sale of its Rekognition facial recognition software to governments if it cannot determine that civil and human rights will be protected. The proposal notes that Amazon provides cloud computing services to the Immigration and Customs Enforcement Agency, and says it therefore could be become connected to immigrant surveillance and racial profiling controversies.

Sustainable Governance

Board diversity: At least 28 proposals ask companies to report on or adopt policies to encourage greater diversity on boards of directors, nearly all at new recipients; 24 are pending. All but a few ask for reports on how boards are trying to diversify their mix of nominees. Notable are four proposals from As You Sow on behalf of Amalgamated Bank that include sexual orientation and gender identity in the definition of diversity, at Caesars Entertainment, Eastman Kodak, New Media Investment Group and Skechers U.S.A. All mention gender, race and ethnicity.

The New York City pension funds are continuing a campaign begun last year to persuade companies to disclose the race, gender and ethnicity of board directors and nominees, as well as other strategically relevant attributes, in a matrix presented in the proxy statement. This proposal survived an SEC challenge last year from ExxonMobil. This year, eight companies have received the proposal and it has been withdrawn following agreements so far at Minerals Technologies and Noble Energy. (A version from political conservatives that asks about reporting on “ideological diversity” is noted below.)

Board composition and oversight: Thirteen resolutions ask for specific types of board oversight, up from seven last year; three more request particular types of board member expertise. This covers ground familiar from past proxy seasons and companies do not appear to like the resolutions; there are SEC challenges lodged against all but three, with seven still to be decided. Eight are now pending and four have been withdrawn.

The most striking characteristic of these proposals is that each raises a hot button issue of intense public debate, which the proponents think company boards are not handling well. This ranges from processing transactions for white supremacists (pending at Mastercard) to funding contractors that help carry out “zero tolerance” U.S. immigration policies (withdrawn at SunTrust Banks). The issue is drug pricing at AbbVie (withdrawn after a pledge for more proxy statement disclosure). At McDonald’s, it’s “food integrity” (challenged). At Amazon . com, it says a “social risk oversight committee” should assess the societal consequences of company’s business model and offer guidance on strategic decisions; with Amazon’s February 15 decision to cancel its plan to locate a new headquarters in New York City, this carries particular piquancy.

The AFL-CIO also suggests that Amazon.com would benefit by amending its corporate governance guidelines to add human capital management to the set of skills it considers important for directors, pointing to BlackRock’s focus on the subject as an engagement priority and the new Human Capital Management Coalition, which submitted a petition to the SEC in July 2017 asking for more corporate disclosure on such issues; the coalition is backed by investors with $2.8 trillion.

Sustainability oversight and disclosure: Last year, as reporting requests surged to 58, more of the sustainability disclosure and management proposals were withdrawn than went to votes. This year, 33 of 44 proposals filed are now pending and nine have been withdrawn. All ask for financially material or “the most important” sustainability data, while six specify climate change metrics should be included (three of these are still pending, at Charter Communications, Mid-American Apartment Communities and Middleby, where last year it earned 57.2 percent). All but five of the targets are new.

Sustainability Accounting Standards Board (SASB) variants—New this year are five resolutions that ask companies to report using SASB-defined metrics for particular industries. One was withdrawn at PACCAR after it released such a report and the other four are pending, although Advance Auto has a pending SEC challenge.

Tailored ideas—New and tailored sustainability reporting resolutions have been less likely to appear in proxy statements and that is again true for three this year. One at Amazon.com that, like the board oversight proposal noted above, asks about the company’s societal impact—but it faces an “ordinary business” challenge similar to one that succeeded before. Most notable otherwise was a Walgreens Boots Alliance proposal tying questions about tobacco sales to the company’s commitment to the UN Sustainable Development Goals, but the SEC agreed the company’s reporting made it moot.

ESG pay links—The big increase last year in proposals seeking reports on how executive compensation is linked to sustainability metrics continues, unabated. This year, proponents have filed 20 pay links proposals, about the same as the

22 in 2018. Nine address risks connected to drug price increases (four of these are resubmissions) and another the opioid crisis; three address senior executive diversity and two are about cybersecurity; further issues, with one proposal each, are banking ethics, greenhouse gas emissions goals and human rights.

Conservatives

Less information is available at this point in the proxy season than in years past about resolutions proffered by politically conservative groups, given the government shutdown in December and January that temporarily halted the SEC’s evaluation of corporate challenges. The proponents do not publicly share information, so posting about challenges to these proposals on the SEC website are a key source of information on them.

Lobbying: As noted above, what has emerged so far are two proposals that use the same resolved clause as the main lobbying disclosure campaign, but praise corporate influence spending as an example of a well- functioning free market. This proposal, from the National Center for Public Policy Research (NCPPR), may go to a vote at Pfizer. Eli Lilly has challenged it at the SEC, which has yet to respond to the contention the proposal concerns ordinary business; the SEC rejected similar challenges last year.

Board diversity: Conservatives are also copying existing diversity resolutions, but with the opposite intent—so far at Apple and Starbucks. The proposal says “ideological diversity” is missing and would benefit company boards, which it says reflect a hegemonic corporate culture that “eschews conservative people, thoughts, and values.” The SEC rejected Apple’s contention the proposal was too vague, moot and related to ordinary business and the proposal went to an early vote on March 1, receiving 1.7 percent support, not enough for resubmission.

Update on Shareholder Proposal Rule Reform

The SEC, shareholder rights advocates and companies have been jockeying for position about possible changes to the Shareholder Proposal Rule over the last two years, as noted above. New interpretations about proposals have come out in two new legal bulletins from the commission—issued in 2017 and 2018, a formal roundtable has aired opposing views about the need for reform in November, and a Senate hearing considered possible new requirements for proxy advisory firms in December.

SEC Staff Legal Bulletins: Proponents are grappling with the fallout from recent interpretive guidance issued by the SEC’s Division of Corporation Finance, the referee which determines if proposals challenged by companies meet the requirements of the Shareholder Proposal Rule (see Appendix for a listing of substantive and technical grounds for omission). SEC Staff Legal Bulletin 14I in November 2017 articulated the staff’s current view about what constitutes “ordinary business” and what is “significantly related” to a company, two of the rule’s provisions. The bulletin also called for more deliberation by boards of directors on these issues to help shape SEC assessments of what should be in included. In October 2018, Staff Legal Bulletin 14J clarified the earlier guidance.

As discussed above, the decision last year at EOG Resources reversed longstanding precedent when it said a greenhouse goals proposal would “micromanage” the company, an ordinary business matter, and allowed the proposal’s omission. The fate of additional similar proposals about setting greenhouse gas emissions goals this year remains uncertain. In 2018, the overall proportion of omitted proposals did not jump much despite proponents’ concerns, but its impact was clearly felt on climate change proposals, where omissions rose significantly. In their SEC challenges about 2019 resolutions, companies are arguing that many other issues also seek to micromanage and therefore address ordinary business and can be excluded, citing both bulletins and the EOG letter. No decision has yet emerged.

The question of boards’ analysis of a resolution’s significance came up in the political activity proposal challenges last year, and in a few others, but did not seem to affect SEC decisions. It was addressed further in the 2018 bulletin, however, and 2019 challenges are providing more information than last year about the nature of board deliberations, which could affect decisions this year.

Sanford Lewis, an attorney working for many of the proponents discussed in this report, penned a legal analysis of the 2017 bulletin in July 2018. He argued it threatens “market-wide” impacts on issues “that could affect corporate risk management and financial and ESG performance.” Gibson Dunn, a law firm companies often hire to lodge their challenges, concluded in July that while initial attempts to use the 2017 bulletin to exclude proposals were “generally unsuccessful,” they may be going forward.

SEC roundtable: SEC chair Jay Clayton said last July, “Shareholder engagement is a hallmark of our public capital markets, and the proxy process is a fundamental component of that engagement.” But he said the commission should review the process because more companies are reporting shareholder engagement, on more issues, and the commission needs to determine if current rules are effective. As a result, the commission hosted a roundtable on November 15 to consider proxy voting mechanics and technology, shareholder proposals and “effective shareholder engagement and the role played by proxy advisory firms. (The commission is continuing to invite comments, which can be seen on its website.)

Legislative developments: As noted in the executive summary, some business groups, including the National Association of Manufacturers (NAM), are working to make it more difficult for shareholder resolutions to be filed and reconsidered, and to restrict the activities of proxy advisory firms. But so far they have been unable to pass a law that would affect the process. The House did pass H.R. 4015 in December 2017, regarding proxy advisors; the Senate Banking Committee held a hearing on Dec. 6, 2018, which saw some comments similar to those from the November roundtable. It did not proceed further.

NAM is supporting these efforts with a new entity called the Main Street Investors Coalition (MSIC), asserting shareholder proponents are playing politics to the detriment of good financial returns. The proponents counter they are raising key issues that threaten long-term corporate financial health, alongside harms to the environment and society. Mainstream investment firms and corporate governance experts continue to excoriate Main Street Investors, in acidic terms such as the August blog post from the mutual fund behemoth Morningstar entitled “Attacks on ESG from the Swamp.”

While battle lines in Washington are clear, the outcome is uncertain—largely because longtime proponents of shareholder resolutions now count as allies major players on Wall Street who routinely use environmental and social metrics to make decisions about investments. Investors signed up to the UN Principles for Responsible Investment manage $70 trillion.

The complete publication is available here.

Print

Print