Glenn Booraem is Principal and an Investment Stewardship Officer at Vanguard. This post is based on Vanguard’s Investor Stewardship Commentary. Related research from the Program on Corporate Governance includes Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy by Lucian Bebchuk and Scott Hirst (discussed on the forum here).

- As the industry’s only mutually owned investment company, Vanguard takes seriously its responsibility to represent the interests of the more than 20 million people who invest in Vanguard funds. As more investors have flocked to Vanguard and especially to the index funds pioneered by its founder, the late John C. Bogle, we have grown only more steadfast in our sense of responsibility for our clients and our safeguarding of their interests.

- In this commentary, we look at the history of corporate governance, the vast improvements in it over the past few decades, and opportunities for further improving governance and investment stewardship.

- We also seek to reframe the conversation about sustainable investing. When a Vanguard fund—particularly an index fund—invests in a company, we expect that the fund may hold shares of that company conceivably forever. The way a board governs a company—including its oversight of material environmental and social risks—should be aligned to create sustainable value long into the future.

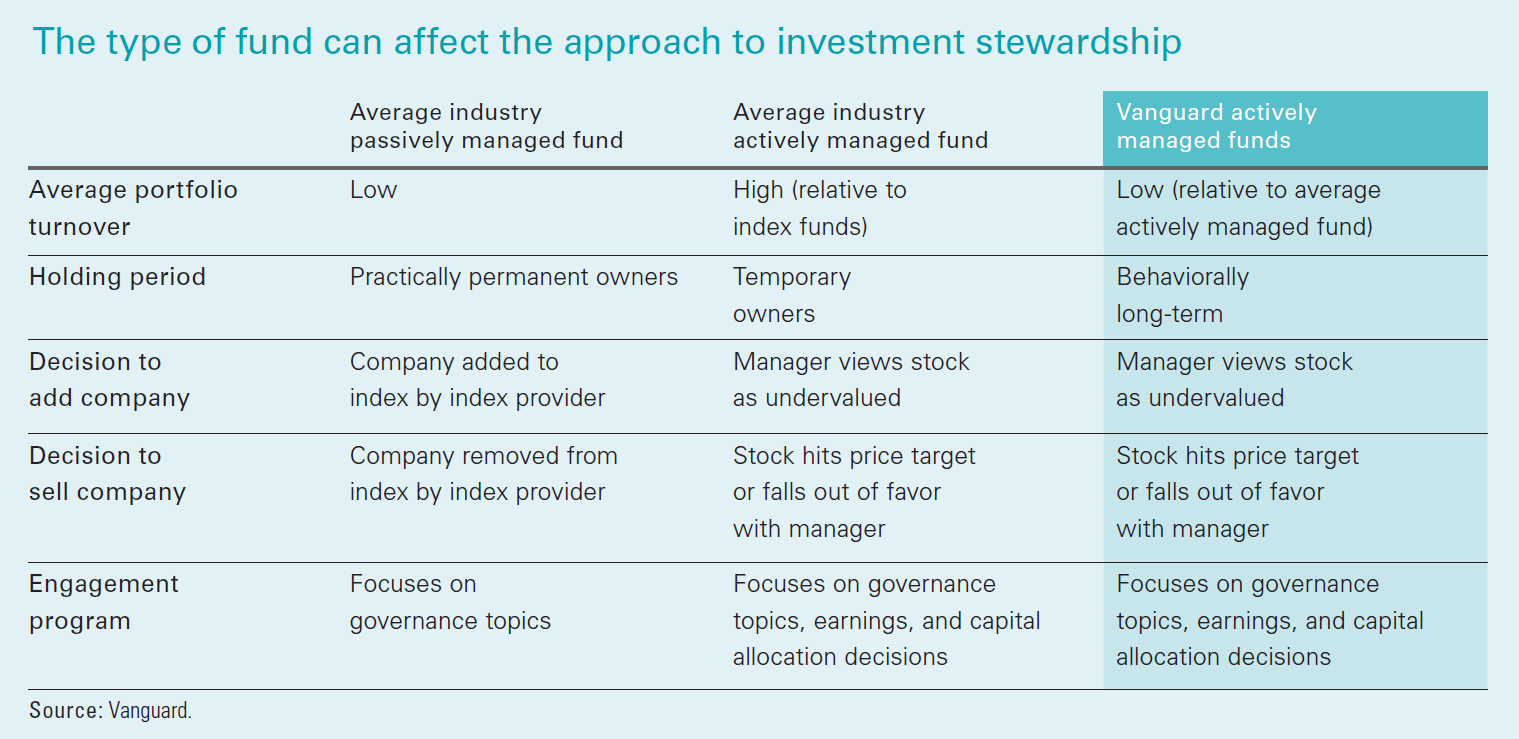

- Finally, we differentiate Vanguard’s role as a provider of both index and actively managed funds by exploring the different approaches that index and active managers may take to investment stewardship.

Over the past several decades, investors have increasingly turned to index funds as a way to invest for a secure financial future. Investors have recognized the benefits of buying and holding the entire market through these low-cost, highly diversified, tax-efficient funds.

The increasing reliance on index funds has spurred greater interest in how stewards of index fund assets—such as Vanguard—fulfill their obligations to the funds and their shareholders.

Academics, regulators and other policymakers, and investors have increasingly debated two issues related to this obligation:

- Corporate governance—the balance of rights and responsibilities between corporate boards and companies’ shareholders.

- Investment stewardship—the ways that asset managers/asset owners care for the assets entrusted to them by investors/beneficiaries.

We believe that good governance and effective stewardship can add value over the long term for all shareholders. This is evident as we review the history of governance, including high-profile failings and the significant improvements that have been enacted in their wake.

Vanguard’s Investment Stewardship program represents the interests of the more than 20 million people around the globe who invest in Vanguard funds. Vanguard offers investors both index funds and actively managed funds, including active funds managed by 25 third-party investment advisors, such as Wellington Management Company LLP, headquartered in Boston, Mass., and Baillie Gifford Overseas Ltd., a U.K.-based asset manager. The roles of index fund managers and active fund managers differ, and on the next page we detail our plans to further integrate the investment management and stewardship capabilities of the external advisors of Vanguard’s active funds.

Finally, this commentary delves into future opportunities for improving governance and stewardship, including the convergence of global standards and practices, the alignment of global reporting frameworks, and a greater appreciation of the views of long-term shareholders

Where we’ve been

Good governance is good for investors . . .

A large and growing body of knowledge points to the positive relationship between good governance and good outcomes for shareholders. Some studies look at the return profiles of companies with strong governance versus those with weak governance; some look at the relationships between stock market valuations and overall assessments of governance quality. Others review more nuanced topics such as the passage of shareholder proposals calling for better governance structures, or the impact of antitakeover measures on shareholder value (see References, below). And although no one simple metric translates directly into basis points of company outperformance, the body of evidence, in the aggregate, tilts very much in the positive direction.

. . . and governance has improved

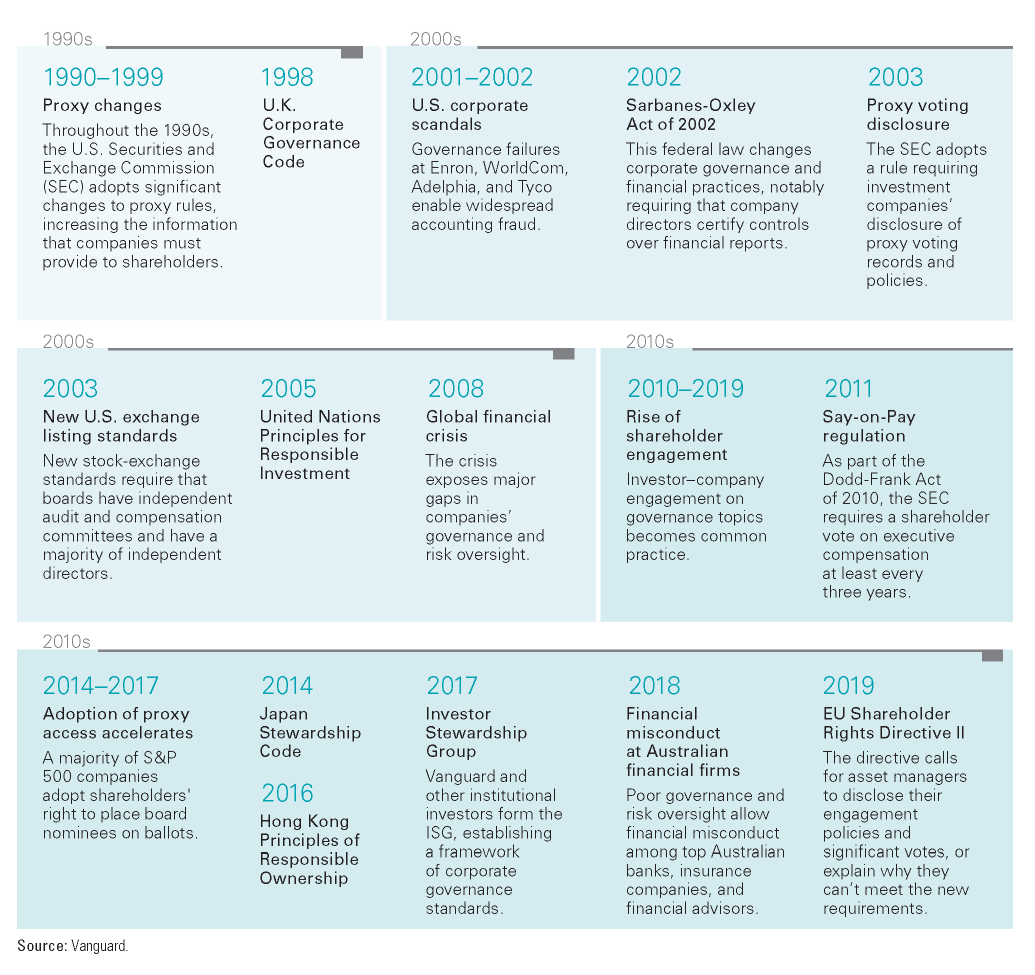

Corporate governance has evolved and improved over the past several decades. Many of the changes—whether driven by corporations, regulators, or investors—aimed to prevent painful history from repeating itself.

For example, in the 1980s, activist investors—known then as corporate raiders—waged a number of hostile takeovers at companies where they saw bad governance, bad management, inefficiency, and bloat. The activists took large ownership stakes, made changes to pump up a company’s value in the short term, then sold their stakes for a quick profit. Corporate boards took notice and said, essentially, “If we don’t want to be the target of the next hostile bid, we need to improve management and we need to improve governance.” And soon, governance practices improved.

In the United States, the Enron, WorldCom, and Tyco corporate scandals of the early 2000s and the failures of risk oversight during the global financial crisis wiped out billions of dollars in value for investors. These events led to tighter listing standards at major stock exchanges and to legislation, such as the Sarbanes-Oxley Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act, that strengthened governance regulation.

Same goals, different approaches

Vanguard plans to tighten the integration between portfolio management and proxy voting for our externally managed active funds. Here’s what you need to know.

Although index funds still represent the majority of Vanguard’s total assets under management, we have for many years worked with high-performing external investment managers to underpin our active product range. As of February 2019, Vanguard’s 25 external fund managers oversaw more than $471 billion in equity assets across portions of 27 Vanguard funds.

Historically, proxy voting on behalf of all of Vanguard’s index and active funds has been administered centrally by Vanguard’s Investment Stewardship team. In the first half of 2019, the boards of trustees of Vanguard’s externally managed funds instructed Vanguard to give full proxy voting privileges to the funds’ external managers, creating a greater alignment of investment management and investment stewardship on a fund-by-fund basis. The transitions are expected to be completed by the end of 2019.

Crucially, nothing has changed about Vanguard’s philosophy on proxy voting. Our Investment Stewardship program remains grounded in our four principles of good governance: board composition, oversight of strategy and risk, executive compensation, and governance structures.

We believe this move clarifies the roles and responsibilities of Vanguard’s Investment Stewardship team and those of our external subadvisors. As we have increasingly collaborated with the carefully chosen external active managers overseeing Vanguard’s active funds and as the governance ecosystem has evolved, it has become clear that integrating proxy voting and engagement activities with the manager’s investment strategy is a value-add for our fund investors.

The approaches may differ on questions of detail and emphasis, but our actively and passively managed funds share a similar goal: to invest in companies that generate consistent, long-term value for their shareholders.

Across Europe, Asia, and Australia, failures of governance that enabled financial scandals, environmental calamities, and the erosion of shareholder rights have inspired the adoption of more rigorous codes, standards, and regulations. This action has been significantly driven by Vanguard and other asset managers and asset owners advocating over time on behalf of their shareholders and beneficiaries.

At the same time, individual investors have been gaining more of a collective voice on governance matters through the mutual funds in which they’re investing for retirement, education, and other long-term goals. Vanguard has worked closely with like-minded asset managers to reshape the governance ecosystem to serve in the best interest of long-term investors; we are among the founding signatories to major initiatives such as the Investor Stewardship Group’s Framework for U.S. Stewardship and Governance and the Commonsense Corporate Governance Principles. We were also a driving force behind the Coalition for Inclusive Capitalism’s EPIC initiative, which focused on identifying metrics that help companies articulate long-term value to investors and other stakeholders.

A decade of progress

The decade following the global financial crisis brought a sea change in governance practices across most developed markets. At the heart of the change has been better communication between investors and boards of directors. More asset managers have been forthcoming with their expectations of portfolio companies—moving beyond merely publishing their proxy voting guidelines, as required of mutual funds since 2003. At the same time, companies and boards have better used disclosure to explain their approach to governance. The past decade also gave rise to the now-widespread practice of shareholder engagement, with independent board members and/or leadership teams meeting with investors to discuss governance matters.

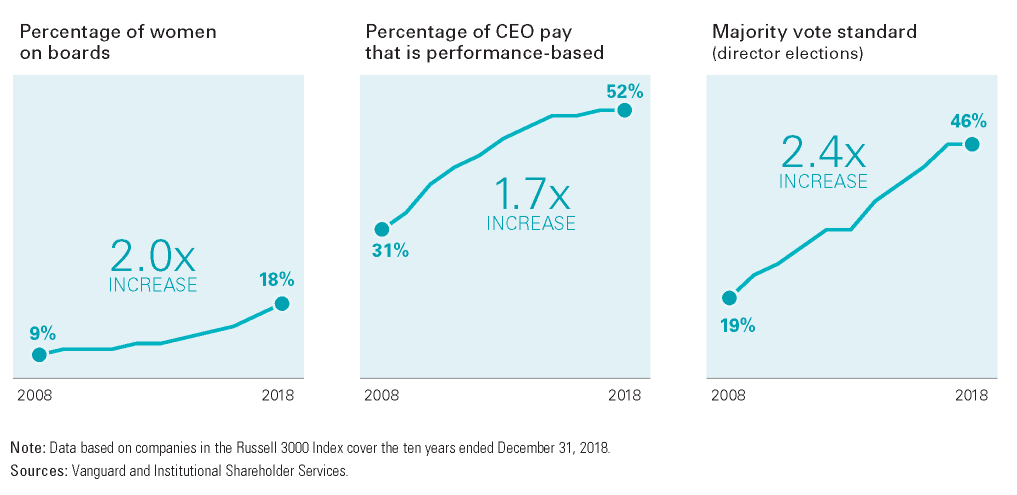

Better communication of expectations has yielded better governance. We’ve seen improvements to shareholder protections, such as more companies holding annual elections of directors using majority voting standards, and expanded adoption of proxy access and other shareholder-rights measures. The approach to executive compensation/remuneration has also evolved in many markets to align more with the interests of long-term shareholders, with wider adoption of performance-linked pay plans.

Vanguard has been among the firms driving this marketwide evolution. We have continually expanded our investment stewardship efforts, from a small group focused on guideline-driven voting nearly 20 years ago to a dedicated team of more than 30 multidisciplinary analysts today.

Vanguard continues to influence the governance ecosystem in ways that we believe benefit our fund shareholders over the long term. This influence has ranged from periodic open letters to corporate boards from Vanguard’s CEO to an ever-expanding body of topical thought leadership and reporting on our investment stewardship efforts. Members of our senior leadership and Investment Stewardship team have been recognized every year since 2010 by the National Association of Corporate Directors as leading influencers shaping boardroom practices and performance.

Vanguard leaders also serve in advisory roles in many leading organizations shaping the global governance dialogue. For example, we are a founding member of the Investment Stewardship Group, an investor-led effort to develop baseline expectations of corporate governance for U.S. companies. The ISG and its members—60 U.S. and international institutional investors representing $31 trillion in U.S. invested assets—are encouraging companies to begin disclosing how their governance principles align with ISG’s framework, and we’ve already seen evidence of the framework’s early adoption.

As a result of this advocacy, we’ve also seen the role of corporate boards evolve. Higher expectations are placed on board members today. Decades ago, a board served largely to “review and approve.” Now, directors play a more integral role in the oversight of strategy and risk. Boards are generally becoming more thoughtful about their composition and disclosing how the diverse range of skills, characteristics, and expertise in the boardroom evolves in alignment with a company’s strategy. We have been encouraged by this trend.

Corporate governance over the past three decades

The timeline below reflects on key points in corporate governance history that profoundly shaped regulatory change and gave shareholders a powerful voice in influencing governance matters at the companies they invest in.

At the turn of the century, massive financial scandals at a number of large corporations exposed critical gaps in risk oversight and accountability within boards of directors. The widespread governance failures drew attention to a greater need for legislation to protect shareholders, hold executives and directors accountable for their companies’ actions, and increase transparency.

These events reinforced the need for stronger governance practices and continue to influence the evolution of corporate governance.

Why we care

Several years ago, before shareholder engagement was a common practice, our Investment Stewardship team reviewed the executive compensation plan of a large technology company. The plan raised some red flags for us. It wasn’t shareholder-friendly, it was too large relative to its peers’ compensation plans, and it lacked the kinds of long-term incentives that are good for Vanguard fund investors. We reached out to the company, expressed our concerns, and asked to meet with the board. We got no response. A few weeks later, the Vanguard funds cast an advisory vote against the CEO’s pay package. The company called to ask us why. We again expressed our concerns. The company replied: “Vanguard runs index funds. We didn’t think that you cared.”

That comment and others like it serve as an important reminder for Vanguard. Most of the feedback that publicly traded companies receive is short-term in nature, such as quarterly earnings calls, analyst upgrades or downgrades, daily news developments, and intraday stock price fluctuations. Index funds are not part of that cacophony, so there is a risk that the long-term interests of index fund investors are ignored or misunderstood.

So why does Vanguard care about governance?

Vanguard is the ultimate long-term investor. Vanguard cares deeply about governance—maybe more than most. Our active funds are behaviorally long-term, and our index funds are structurally long-term, practically permanent owners of the companies in which they invest. An index fund typically owns all the stocks listed in its benchmark for as long as a company is included in the benchmark. Index fund managers don’t sell out of a stock because they don’t like it, nor do they buy more of a stock because they do like it. Because we do not control the composition of the benchmarks, Vanguard funds’ vote and voice are the most important levers we have to protect our clients’ investments and help build long-term value.

We take a stand for all investors. Vanguard’s investment stewardship efforts are an important part of our mission, which is to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success. Ultimately, we want governance practices to improve in investable markets around the world. We believe that a rising tide of good corporate governance will lift all boats.

Measurable improvements

The figures below show selected governance improvements over the last decade on issues including the growing number of women on company boards and executive compensation that is tied to long-term performance. But even with this progress, there is still work to be done.

We focus on the whole pie, not just the pieces. Vanguard funds invest in more than 13,000 companies in roughly 70 countries, and much of that reach is covered in a series of broad-based stock market index funds. Managers of index funds don’t pick winners or losers; we own shares in them all. The funds are designed to give everyday savers and investors access to diversified investments in thousands of companies at a very low cost. We believe that investors benefit from highly competitive markets in which individual firms must compete to win and stay relevant. This belief is reflected in our principles on executive compensation, which call for firms to incentivize long-term outperformance versus peers.

Unique ownership structure, unique perspective. Vanguard is the world’s only mutually owned mutual fund company. Rather than being publicly traded or owned by a small group of individuals, Vanguard is owned by its U.S. funds, which in turn are owned by their investors. This unique structure aligns our interests with those of our investors and drives the culture, philosophy, and policies throughout the Vanguard organization worldwide. It is also worth noting that Vanguard invests money on behalf of fund shareholders. It’s their money. Vanguard does not profit from the performance of any Vanguard fund or its holdings, and excess revenues generated are returned to shareholders through lower fund expenses or reinvestment in Vanguard funds and services.

Our shareholders expect it. In addition to professional investment management, what people expect when they invest in a mutual fund is professional investment stewardship. On one level, it provides service and convenience to our fund shareholders: Voting hundreds or thousands of company proxies each year could be an overwhelming task for any individual. More important, shareholders depend on Vanguard to establish and maintain governance principles and consistent voting guidelines that will protect their investments and promote long-term value. They count on Vanguard to know the issues, do the research, maintain vigilance, and be an effective steward.

We view it as our duty and responsibility. Vanguard does all of this—from proxy voting through engagement—because we believe it’s aligned with our duty to shareholders. We adhere to the regulations for each of the markets in which we operate. We act in the best interest of Vanguard fund investors. Doing the right thing is part of our DNA.

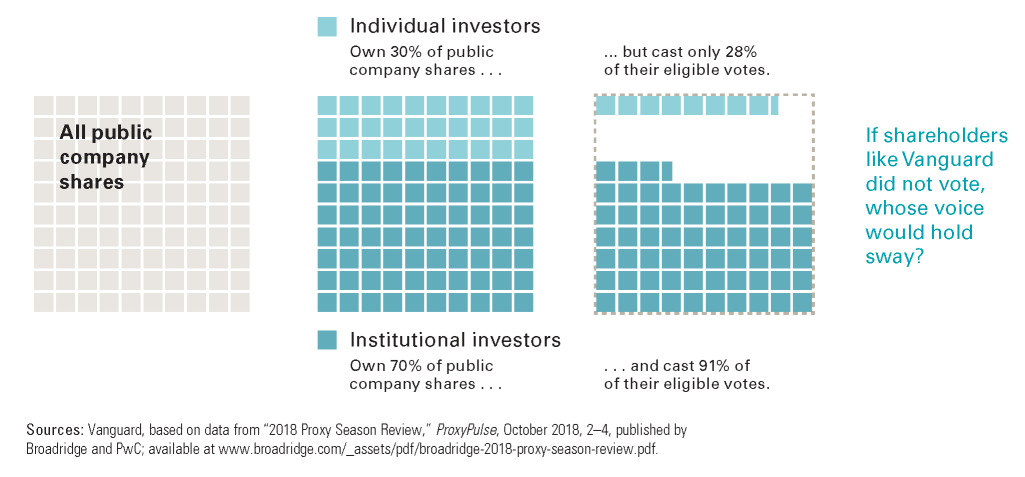

What if Vanguard didn’t vote?

In 2018, institutional investors (including mutual funds) collectively held 70% of public company shares in the United States and voted 91% of the shares they held. Individual investors who directly held stocks accounted for the remaining 30% of share ownership, yet they voted only 28% of the shares they held. Some interest groups have suggested that mutual funds muffle the voice of individual investors. The truth is, mutual funds are the voice of individual investors. If Vanguard didn’t speak on behalf of its more than 20 million investors, whose voice would hold sway? That of activists? Company management? Proxy advisors?

Four principles of good governance

Vanguard’s investment stewardship activities are grounded in four principles of good governance:

Board composition

We believe good governance begins with a great board of directors. Our primary interest is to ensure that the individuals who represent the interests of all shareholders are independent, committed, capable, and appropriately experienced.

We also believe that diverse groups make better, more informed decisions and that, in turn, can lead to better results. That’s why we want to see highly effective boards whose directors bring diverse perspectives to the table. We seek to understand, through disclosure, a board’s mix of experience, professional expertise, tenure, and personal characteristics such as gender, race, age, and national origin and how that aligns with the company’s strategy.

Boards must also continuously evaluate themselves and evolve to align with the long-term needs of the business.

Oversight of strategy and risk

Boards are responsible for effective oversight of a company’s long-term strategy and any relevant and material risks.

In candid conversations, we try to assess how deeply the board understands strategy. We believe there should be a constant exchange of information between the board and management across a company. After all, we expect directors to bring a wealth of experience to the boardroom, and they can provide valuable counsel to company leaders who are executing on strategy.

Investors benefit when the market has better visibility into significant risks to the long-term sustainability of a company’s business. Evaluation and disclosure of significant risks to a business arising from a variety of potential factors—competitive forces, regulation, government action, consumer demand and preferences, environmental considerations, and so on—result in a more accurate valuation of the company.

Accurate valuation over time is critical to ensuring that fund investors are appropriately compensated for the investment risks they assume in markets. Because index funds are price-takers, we need markets to be efficient and have all the material information necessary to appropriately price the stocks we’re buying and selling every day.

Executive compensation

We believe that performance-linked compensation (or remuneration) policies and practices are fundamental drivers of sustainable, long-term value. We look for pay plans that incentivize outperformance versus industry peers over the long term. When shareholders do well, so should executives. When companies underperform, however, executives’ pay should move in the same direction.

Governance structures

We believe companies need to have in place governance structures (for example, shareholder-rights and accountability measures) to ensure that boards and management serve in the best interest of the shareholders they represent. We view this as a safety valve to protect shareholder rights.

What we do, how we do it

Vanguard’s Investment Stewardship program has three main components:

We advocate publicly for the highest standards of corporate governance worldwide. We engage in dialogue with boards and company leaders to understand their governance practices and to share our governance perspectives and expectations. And we vote in accordance with these governance principles to represent the long-term interests of Vanguard fund investors.

How we advocate

We do: Take a principles-based approach, work with governance-focused organizations to promote advancements in governance standards, report results to clients in a plain-talk fashion, and represent the voice of long-term investors to regulators and other policymakers.

We don’t: Chase trendy fads or name and shame companies in the media.

Vanguard funds invest in more than 13,000 companies worldwide, and we aim to communicate our perspectives on governance matters as widely as possible to portfolio companies, clients, policymakers, industry groups, and academics. We have a responsibility to be a voice for better governance practices, and we do this by supporting governance-focused organizations, speaking at dozens of conferences each year, advocating for—and in some cases crafting—governance codes and standards, and sharing our perspectives through the media and our own published materials.

How we engage

We do: Focus on issues that are relevant to long-term value, seek to engage with independent directors, seek an understanding of long-term strategy, and ask companies to publicly disclose material risks to long-term value.

We don’t: Offer opinions on company strategy, seek to influence it, or focus on short-term financial results.

Engagement benefits both shareholders and companies. It is the foundation of our Investment Stewardship program and is a year-round process that goes beyond our proxy voting at a company’s annual meeting. Because our index funds are practically permanent owners of portfolio companies, we aim in our engagements to build a strong understanding of how companies govern their long-term strategy, but we do not seek to influence company strategy. We participate in the full range of engagement with directors and executives—from understanding high-level strategy to asking targeted questions on specific voting matters. This process unfolds over many exchanges and enables us to understand a company’s corporate governance practices and long-term strategy and to monitor progress of those governance practices over time. Most of our engagements fall into one of three categories:

- Event-driven discussions may focus on a contentious ballot item or a company crisis. In these instances (such as a proxy contest, corporate action, shareholder proposal, or data breach), we want to hear all relevant perspectives before we vote.

- Topic-driven engagements discuss matters within the board’s purview that materially affect a company’s long-term value. These engagements are usually conducted with companies with which we would like to discuss one of our four principles in more depth or that have a record of underperformance and gaps in corporate governance.

- Strategic engagements are high-level discussions in which we can discuss a company’s long-term strategy and industry dynamics. We seek to understand how the company’s governance choices and practices, such as board composition, align with that strategy. This enables us to understand decisions in the context of the company’s long-term goals.

What we want to know

Stakeholders are often curious about what takes place during an engagement with a portfolio company. Below is a list of typical questions we discuss with company leaders and board members. We also post these questions on our website, as they represent the kind of governance information we hope to learn about all of our portfolio companies, whether through public disclosure or individual company discussions.

Board composition:

- Based on your company’s strategy, what skills and experience are most critical for board members, now and in the future?

- How does the board plan for evolution and future director selection (that is, for strategic board evolution)?

- How do your company’s disclosure and shareholder communications articulate board committee structure and oversight?

- How does the board define and consider diversity in the director selection process?

- How does the board assess director, committee, and board effectiveness over time?

- How does your company ensure effective independent oversight through the composition of the board and selection of board and committee leaders?

Oversight of strategy and risk:

- What is the company’s long-term strategy, and how might your value proposition evolve over time?

- What role does the board play in setting your company strategy?

- How do the board and management team track and measure performance of the strategy?

- What are the primary long-term risks to your company? What processes/systems are in place to mitigate risk?

- How is the board involved in the oversight of company risks?

- How are risks identified and elevated within the company? How is the board involved in that process?

- How do the board and management determine the company’s approach to risk disclosure?

Executive compensation/remuneration:

- Describe your company’s compensation philosophy and how the measures you’ve chosen align with long-term company strategy and shareholder value.

- How does the compensation committee set goals for those measures? How does it determine that the goals are set at rigorous performance levels?

- How does the compensation committee seek to align executive pay with the company’s performance relative to peers and the market?

- What is the process for selecting your company’s peer group, and what factors in the selection process are most important?

Governance structures:

- How does your company ensure that shareholders have a voice and a vote on governance matters?

- How do the company’s shareholders have basic foundational rights (such as annual election of directors and majority vote standard)?

Engagement matters: A case study

Vanguard is but one steward among many stewards and institutional investors who engage with portfolio companies.

Our engagement and boards’ responsiveness to engagement have made a real difference for everyday investors. These benefits run the gamut from trimming tens of millions of dollars from an excessive CEO pay package at a single company to ensuring that billions of dollars of executive compensation/remuneration are more tightly aligned with company and shareholder return.

A recent case study supports the idea that continued engagement, while hard to measure, can result in outcomes that enhance and protect long-term value for shareholders:

Vanguard engaged with a U.S. consumer discretionary company more than a half-dozen times over two years to discuss a range of topics, including executive compensation. After the company announced plans to acquire a competitor, a sizable compensation package that extended the CEO’s tenure was presented to shareholders. The board, which considered the CEO crucial to the company’s continued growth, supported the decision. The plan was inconsistent with the governance principle that executive compensation should incentivize performance and be proportionate to expectations; accordingly, it was potentially detrimental to shareholder value. Its structure granted outsized rewards for easily achievable performance goals. The significant investment in a single person also raised questions about the strength of the company’s succession plans. Shareholders expressed disapproval by voting against the plan at the company’s annual meeting.

Throughout the following year, company leaders and board members sought shareholder feedback on revisions to the compensation plan. Just before the next annual meeting, the company announced a drastic reduction in its CEO’s pay package, which would preserve tens of millions of dollars for shareholders. The new plan was approved by shareholder vote at the meeting.

How we vote

We do: Vote on a fund-by-fund basis in the best interest of each individual Vanguard fund, vote consistent with our published voting guidelines and our own research and analysis, and support shareholder proposals on topics relevant to long-term value creation.

We don’t: Nominate directors or seek board seats, submit shareholder proposals, or vote in lockstep with proxy advisor recommendations.

Our Investment Stewardship team consists of an experienced group of analysts that evaluates proposals in the proxies of the Vanguard funds’ portfolio companies and casts votes on behalf of each fund in accordance with the voting guidelines the fund has adopted. Each fund’s guidelines are designed to promote long-term shareholder value by supporting good corporate governance practices.

The guidelines frame the analysis of each proxy proposal, providing a basis for decision-making. The trustees of the fund boards periodically review and approve each fund’s proxy voting guidelines so that they incorporate current governance standards and address relevant risks to long-term shareholder value. In evaluating votes, the Investment Stewardship team may consider information from many stakeholders, including the company’s management and board, shareholder groups, and various research and data resources. Each fund’s voting decision on each proposal will be based on its guidelines and an analysis of the proposal’s impact on the fund’s long-term value.

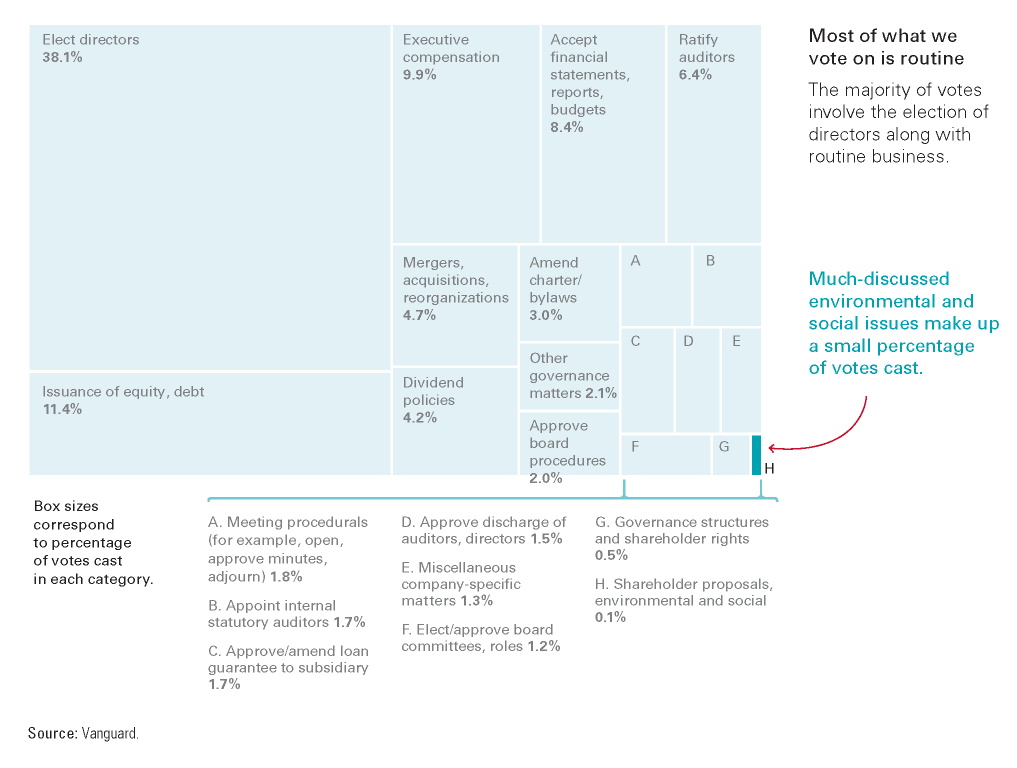

The Investment Stewardship team does not vote in lockstep with recommendations from proxy advisors (such as Institutional Shareholder Services [ISS] or Glass Lewis) for voting on behalf of the Vanguard funds. Data from proxy advisors serve as one of many inputs into our research process. Even when a fund’s vote happens to be consistent with a proxy advisor’s recommendation, that decision is made independently. In the 2018 proxy voting year, for example, Vanguard funds voted differently from ISS on 7% of ISS’s “for” recommendations and 9% of its “against” recommendations. Those differences may seem small to some observers, but they must be viewed in the greater context of the full range of proposals that investors are asked to vote on, from electing directors to approving meeting minutes (see the figure below). Many items that are put to a vote are already part of investors’ baseline expectations, so overlap in voting outcomes can be expected.

The nuts and bolts of proxy voting

During the proxy year ended June 30, 2018, Vanguard funds cast proxy votes on 168,786 individual ballot items. Although environmental and social proposals get a lot of attention, director elections, capitalization matters, and executive compensation issues accounted for the majority of our voting activity.

How Vanguard defines sustainable investing

Ask investors, regulators, industry experts, or asset managers to define sustainable investing, and you are likely to get a range of answers about directing investments to companies that align with certain views on environmental or social issues. Although Vanguard is intentional about developing products that take these factors into consideration, we view sustainable investing in a way that extends beyond a company’s views on particular issues.

Our definition of sustainable investing starts with the premise that index funds can hold a company’s stock in perpetuity—or as long as it’s listed in an index. With such a long-term horizon, our funds must focus on how companies are set up for success—tomorrow, next year, and long into the future. “Long-term investing” and “sustainable investing” are synonymous.

At Vanguard, ESG starts with G

In investing, ESG commonly refers to environmental, social, and governance considerations. Each of these important areas must be overseen by a company’s board, and that’s why we view them through a governance lens.

We consistently engage with portfolio companies about climate risk, especially companies in carbon-intensive industries. We believe that climate risk can potentially have a long-term impact on companies in many sectors. But our discussions on these issues are anchored to a broader conversation about governance, in particular how a company’s strategy and the related risks are governed by its board. Our index funds, by design, generally hold all the companies in their benchmark; these include winners and losers, leaders and laggards. This ownership across the spectrum gives us the opportunity to influence investor outcomes by directly engaging about material environmental and social risks with directors and executives at the companies in which our funds invest.

Our fund shareholders have entrusted their assets to Vanguard to create and protect sustainable, long-term value as they save for their important financial goals. Ensuring that the 13,000 global companies in which our funds invest on their behalf have a similar long-term mindset is central to our stewardship program. By advocating for policies and practices that support sustainable value creation over the long term, we believe we are giving our clients—and all investors—their best chance for investment success.

Looking ahead

In the first part of this commentary, we discussed several improvements in corporate governance in recent history. We’ll conclude with a look at the future. Below, we note three areas in which governance can advance and the role that Vanguard intends to play as it acts on behalf of its funds.

Opportunities to improve governance

Greater global consistency in governance standards. Despite advancements we’ve seen around the world, local governance norms can differ widely. For example, if you ask what constitutes an independent board, the answer you get in countries across Europe will differ from the answer you get in the U.S., which in turn will differ from the answer you get in Asia. As global markets become more integrated and interconnected, so will investor expectations about governance. And Vanguard will be right there, advocating for that progress.

Alignment of global reporting frameworks. Many efforts are under way to improve the disclosure of relevant, material risks on sustainability topics. In fact, the industry is crowded with options. Several of these efforts reflect thoughtful research, analysis, and considerations for both issuers and investors. These frameworks are also being discussed by policymakers and regulators in different markets. Vanguard believes that reporting on material matters is an important part of corporate governance that boards should oversee and own. Our Investment Stewardship team looks for disclosure that is consistent and comparable over time. We have found the frameworks from the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures to be best in class, and we hope to see the market coalesce around a disclosure framework that is effective for all parties.

Greater appreciation for long-term investors. The concept of “long-termism” is being embraced by more and more public companies with a growing appreciation for their index fund investors. They know that Vanguard funds are—in every sense of the word—invested in their long-term success, since the funds are practically permanent owners. Vanguard encourages and hopes to see an evolving dialogue between public companies and their so-called permanent capital—a dialogue that occurs outside the quarterly cadence of active investors and that focuses on how companies are aligned with the best interests of long-term investors.

A pledge from Vanguard

We are not a public company, but we must continuously earn and maintain the public trust. We do that by taking a stand for all investors, by treating them fairly, and by giving them the best chance for investment success.

As steward for the assets of more than 20 million people worldwide, we have an obligation to report on the investment management and investment stewardship activities of Vanguard funds. We understand that people want to know how their funds are advocating, engaging, and voting on their behalf. As our Investment Stewardship program further evolves, we pledge to continue providing transparency about our stewardship activities to keep clients, portfolio companies, regulators, and other policymakers informed.

References

The following studies found a positive or neutral correlation between corporate governance and financial performance:

Bebchuk, Lucian A., Alma Cohen, and Allen Ferrell, 2009. What Matters in Corporate Governance? Review of Financial Studies 22(2): 783–827.

Bebchuk, Lucian A., Alma Cohen, and Charles C.Y. Wang, 2014. Learning and the Disappearing Association Between Governance and Returns. Journal of Financial Economics 108(2): 323–348.

Cuñat, Vicente, Mireia Gine, and Maria Guadalupe, 2012. The Vote Is Cast: The Effect of Corporate Governance on Shareholder Value. Journal of Finance 67(5): 1943–1977.

Diavatopoulos, Dean, and Andy Fodor, 2016. Does Corporate Governance Matter for Equity Returns? Journal of Accounting and Finance 16(5): 39–59.

Gompers, Paul A., Joy L. Ishii, and Andrew Metrick, 2003. Corporate Governance and Equity Prices. Quarterly Journal of Economics 118(1): 107–155.

Plazzi, Alberto, and Walter Torous, 2016. Does Corporate Governance Matter? Evidence from the AGR Governance Rating. Swiss Financial Institute Research Paper No. 16-54.

The following studies found a positive or neutral correlation between corporate governance and firm market value:

Amihud, Yakov, Markus Schmid, and Steven Davidoff Solomon, 2017. Settling the Staggered Board Debate. University of Pennsylvania Law Review 166: 1475–1510.

Appel, Ian, Todd A. Gormley, and Donald B. Keim, 2016. Passive Investors, Not Passive Owners. Journal of Financial Economics 121(1): 111–141.

Brown, Lawrence D., and Marcus L. Caylor, 2006. Corporate Governance and Firm Valuation. Journal of Accounting and Public Policy 25(4): 409–434.

The following studies looked at the impact of certain governance structures practices and policies on company value:

Bistrova, Julia, and Natalja Lace, 2011. Evaluation of Corporate Governance Influence on Stock Performance of CEE [Central and Eastern European] Companies.

Gormley, Todd A., and David A. Matsa. Playing It Safe? Managerial Preferences, Risk, and Agency Conflicts, 2016. Journal of Financial Economics 22(3): 431–455.

Hoepner, Andreas G.F., Ioannis Oikonomou, Zacharias Sautner, Laura T. Starks, and Xiaoyan Zhou, 2018. ESG Shareholder Engagement and Downside Risk. American Finance Association paper.

McConnell, John J., and Qianru Qi, 2018. Just Talk? CEO Succession Plan Disclosure, Corporate Governance and Firm Value.

Print

Print