Sacha Sadan is Director of Corporate Governance at Legal & General Investment Management Ltd. This post is based on his LGIM memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst (discussed on the Forum here); Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here); and Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy by Lucian Bebchuk and Scott Hirst (discussed on the forum here).

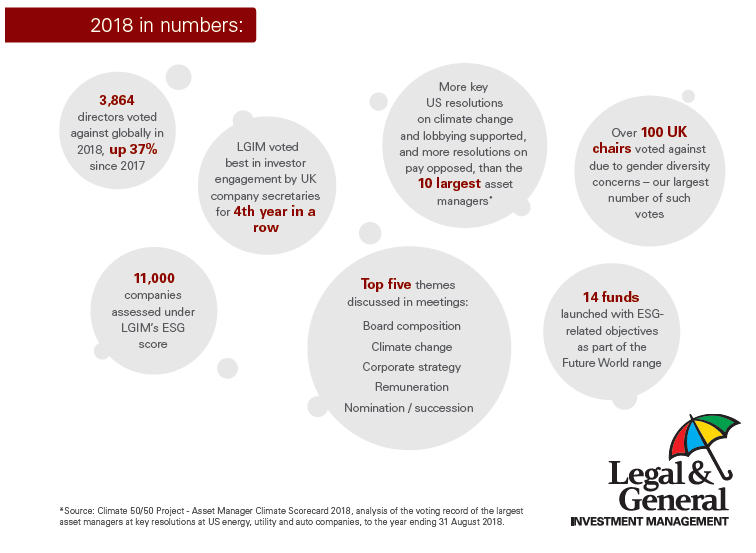

Active ownership means working to bring about real, positive change to create sustainable value for our clients. Our annual Corporate Governance report details how we achieved this in 2018.

“There is now even more interest from clients, regulators and governments in corporate stewardship.”

—Sacha Sadan, Director of Corporate Governance

Sustainability

- LGIM developed more investment solutions to support the low-carbon economy

- We reported the climate leaders and laggards under our Climate Impact Pledge for the first time

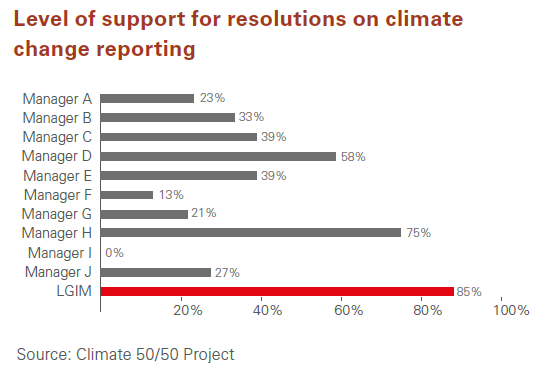

- In the US, we supported more shareholder resolutions on climate change in key votes than any of the world’s 10 largest asset managers

2018 in review

Climate change carries significant financial risks, so protecting the planet and protecting our clients’ investments go hand-in-hand. And a spate of incidents, from wildfires in the US to drought in the UK, reminded the world last year that the threat is growing.

A report from the UN painted a far darker picture of the consequences of climate change than previously thought, warning that the world economy needs to be transformed at a speed and scale with “no documented historic precedent” to avoid the damage. The window of opportunity is shrinking, with only a dozen years remaining for global warming to be kept at a maximum of 1.5°C.

But 2018 also saw increased efforts from policy makers, consumers and companies to address the challenge.

The UN and EU made progress on implementing the Paris Accord to limit the rise in temperatures. There was a global clampdown on single-use plastic around the world. Meanwhile, clean technology made further progress, with new power capacity overwhelmingly coming from renewable sources.

At the same time, electric vehicles appear set to become cheaper to own and drive than their gas-guzzling counterparts, while governments such as Germany have announced plans to phase out the use of coal.

Managing climate risks

We believe an essential part of our fiduciary duty involves the management of climate risks. To do so, we work with companies, clients and regulators because climate change is a systemic issue that requires a system-wide response.

This involves using the weight of our assets to substantiate our position. Looking at key shareholder proposals in the US, for example, a report found that last year LGIM supported more shareholder resolutions on climate change than any of the world’s 10 largest asset managers.

Climate leaders and laggards

Under the Pledge, LGIM committed to ‘name and fame’ companies. In June 2018, we released our first annual ranking, to a positive response from clients and broad media coverage.

We highlighted companies taking positive steps, such as:

- The board of Toyota endorsing the 2°C target of the Paris Agreement. The company also plans to make all its cars available as either electric or hybrid models by 2025

- Wells Fargo, the US bank, pledging to invest $200 billion in climate action and sustainability by 2030

- Australia’s Commonwealth Bank committing to phase out its lending to coal plants

- Oil and gas major Total planning to adopt a 2°C scenario at the centre of its strategy, an important step in alignment with the Paris Agreement

A number of companies, however, either did not respond to our requests for engagement or only showed superficial signs of improvement—if any at all.

Therefore, we voted against several company chairs, and no longer hold the following companies within our Future World range of funds: China Construction Bank, Dominion Energy, Japan Post Holdings, Loblaw Companies, Occidental Petroleum, Rosneft Oil, Subaru and Sysco Corp.

Our action prompted each of these eight companies to get in touch and ask what they need to do in order to be reinstated in the funds. We believe this highlights the power of our approach to engagement.

Throughout the year, we saw positive outcomes as a result of our broader engagement with companies and collaboration with other investors.

Diversity

Promoting diversity of thought to foster long term success

- LGIM voted against the largest number of UK chairs to date on the issue of gender diversity

- We launched a fund aimed at promoting gender diversity, run according to a proprietary company scoring process

Diversity of thought is crucial for the long-term success of the businesses in which we invest on behalf of our clients. We believe that creating gender-balanced teams, in particular, is a strategic and economic imperative.

There was much to celebrate regarding diversity in 2018, the centenary of women being first granted the right to vote in the UK. On average, women made up more than 30% of FTSE 100 boards for the first time, and gender pay gap reporting became mandatory in the UK.

Regulators at the FRC focused on the reporting of diversity by UK companies. And the Hampton-Alexander Review reported progress towards women making up a significant proportion of senior leadership teams (alongside weak excuses by companies for their failure to act).

We echo the comments made by the review, in its third annual report, that achieving real change requires committed leadership at the top and sustained effort to shift mindsets and correct hidden biases. Over the course of the year, LGIM pushed to make this happen.

Votes and scores

In 2018 we placed our largest number of votes against UK chairs on the issue of gender diversity to date—over 100 in total.

“Many investors now see gender diversity as a core and critical business issue for boards and their leadership teams to address and are actively monitoring their holdings. However, few investors have been as consistent or as active as LGIM in holding business leaders to account on diversity and helping to drive progress. They have led the way for many years and their approach continues to set a fine example to industry peers.”

—Denise P Wilson OBE, Chief Executive, Hampton-Alexander Review

Diversity on boards is not a UK market phenomenon alone. Since 2017, we have been voting against all-male boards of S&P 500 companies; last year, we included Russell 3000 constituents and also began to vote on the issue globally.

In addition, from 2020, we will start to vote against the largest 100 companies in the S&P 500 and S&P/TSX—two major indices in US and Canada—where there are less than 25% women on the board.

We believe our actions are having an impact. The number of all-male, FTSE 250 boards dropped to an all-time low of five at the end of 2018 (at the time of writing this has slipped further yet to only two).

The percentage of women on Russell 3000 boards has increased for four straight quarters; however, 504 boards still remain with no female directors, according to Equilar.

Last year we also released our diversity scores, which we use to rank around 350 of the largest UK companies according to their levels of gender diversity. The LGIM Gender Diversity Score takes into account the percentage of women on a company’s board, in the executive team, in senior management and in the overall workforce.

In order to be fully transparent, and help in our engagements with companies on the issue of

diversity, we published the scores on our website.

We also used the scores to launch the first gender-oriented fund to focus exclusively on UK listed

companies.

The L&G Future World Gender in Leadership UK Index Fund is aimed at raising gender diversity standards in companies across the UK equity market, by allocating more to companies that have achieved higher levels of gender diversity. The fund aims to empower investors to make a difference to the companies in which they invest and to wider society.

Targets, not quotas

Much still remains to be done. In the UK, data suggest that companies may find it easier to appoint women as non-executive directors from outside their organisations, than to promote women internally to the executive level.

Due to the imposition of quotas, several European markets have made good progress promoting gender diversity at the board level; for example, France, Germany and Sweden. But gender diversity at the executive level in these countries is still extremely low.

This suggests that board-level quotas may lead to tokenism, without an effective commitment to the pipeline of women executives, which is one of the reasons why LGIM has not supported quotas for the UK. Rather, we push for companies to adopt aspirational targets, to ensure progress is maintained.

Another emerging trend is that the board tenures of women tend to be shorter than those of men, whether in a non-executive or executive role. We still lack a definitive answer to why this is the case. Nonetheless, companies should certainly consider the skills of their board chairs more closely, in order to ensure they are able to manage more diverse boards effectively.

Board effectiveness

Engaging on board composition to strengthen corporate governance

- LGIM conducted engagement campaigns in Europe on the separation of chair and CEO roles, and the appointment of a Lead Independent Director (LID)

- The majority of our votes against directors in Japan and the Asia Pacific region were on board independence; we also increased our votes against UK directors on this issue

We continued to engage last year on board composition, discussing the topic at 104 of our meetings with companies globally. We also took a stronger stance on the issue through voting and in our work with regulators.

In Europe, we launched two engagement campaigns aimed at strengthening the boards of 43 of the region’s largest companies. We will always aim for constructive dialogue, but the absence of action may result in us sanctioning companies through our votes.

1. Separation of chair-CEO powers

LGIM believes that the two positions of board chair and CEO should be separated, as the perceived advantages of concentrating power in the hands of a single individual do not outweigh the risks posed by such a structure.

Separate chair and CEO positions provide a balance of authority and responsibility that is in both the company’s and investors’ best interests, in our view.

We have expressed our concerns to companies that combine the roles of board chair and CEO for many years. While markets vary, we note France and Spain have high numbers of combined chair and CEO roles.

We are currently engaging with 14 of the largest companies in France and three of the largest in Spain, to encourage their boards to split the two roles when putting in place a new succession plan.

Case study: Renault

The arrest in November 2018 of Renault’s joint chair and CEO, Carlos Ghosn, provided an illustration of some of the risks associated with combining the two functions.

LGIM has been engaging with the French carmaker for many years on the issue, formally asking the company to split the roles by letter in May 2017 and again in September 2018. In addition, we met with Renault twice last year, pressing the company on the subject and calling for succession planning to be conducted well in advance of Ghosn stepping down.

In November 2018, Ghosn was arrested in Japan and indicted for financial misconduct, including allegedly understating his pay at Nissan. Following his arrest, Nissan and Mitsubishi removed Mr Ghosn as board chair. In January 2019, Mr Ghosn resigned from his position at Renault; the board of company subsequently decided to split the roles of chair and CEO.

The issue is not limited to Europe…

The separation of functions is a global issue. We have, for instance, been engaging for many years on the topic with North American companies and also using our voting powers:

- We voted against the management of 16 North American companies with a combined chair and CEO and no Lead Independent Director

- We opposed the election or re-election of 30 directors of North American boards who decided to combine the functions of chair and CEO

- We supported 41 shareholder resolutions to put in place an independent board chair

Encouragingly, companies increasingly recognise the benefits of separating the two functions: in 2008 just 39% of US boards split the roles, versus 51% in 2017.

2. Appointing a Lead Independent Director We believe LIDs are indispensable to well-run boards, as they play a key role in supporting the chair, against whom they also represent a counterweight. But their presence on boards is not established in all markets.

In France, while it is common practice to see a LID on the board, this almost always happens where there is also a combined chair and CEO.

We are currently discussing the benefits of appointing a LID with eight of France’s 40 largest companies. In our response to a 2018 consultation, we asked the bodies responsible for drafting the French Governance Code to consider raising the profile of the LID.

In Germany, it is common to see the presence of a deputy chair who is an employee representative—and, as such, not independent. We are engaging with 18 of Germany’s 30 largest companies, to explain to them why we believe the roles of the deputy chair and the LID are different and designed to be complementary.

A summary of our position was also published in the Harvard Law School Forum on Corporate Governance and Financial Regulation.

As part of a consultation in December, LGIM formally requested that the German Corporate Governance Code recommend the appointment of a LID to company boards.

Executive pay

Pressing companies to reduce income inequality

- We strengthened policies on pay, especially on pension provisions

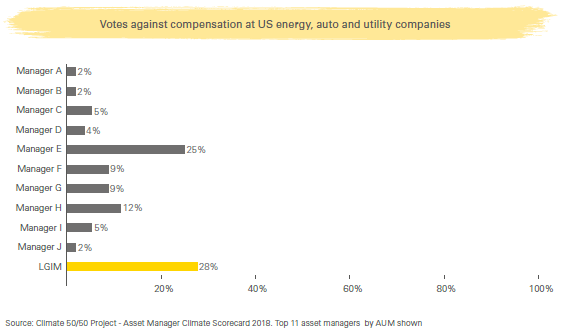

- At key votes in the US, LGIM’s level of opposition to management on executive pay was higher than that of any of the world’s 10 largest asset managers

Income inequality remains a significant challenge globally, with the pay gap between executives and average workers continuing to widen.

Investors, however, also persisted in trying to address this challenge, voting down remuneration reports at companies like Playtech, the gambling firm; Centamin, the gold miner; and Inmarsat, the satellite telecoms group.

The Investment Association is tasked with maintaining a public register of all UK companies that fail to garner more than 80% support for their resolutions at general meetings. The association added 63 companies to the register on executive remuneration-related resolutions last year, versus 56 companies added in 2017.

Pay alignment

We continue to want executive pay to be aligned with a company’s performance and its workforce. Yet executive pay has continued to diverge from company performance and pay for its workforce. It is common for an increase in profit targets to be met with a proposal for increased rewards; but where companies look to reduce profit targets it is less frequent this is accompanied with lower share awards. This is because the lower targets are perceived as equally stretching, given the current circumstances the company faces.

We would like to encourage more companies to introduce restricted shares, which are shares that must be held for five years before they become fully transferable. In addition, we would require executives to maintain a significant proportion of their shareholdings for two years after leaving the company. This is to incentivise strategic decision-making that helps ensure sustainable company performance over a longer period.

Annual cash bonus awards have continued to grow because short term targets are easier to set and evidence shows that they are easier to deliver against it. Last year, we called for a curb in gradual increases in bonuses driven by short-term operational objectives. Instead, we ask remuneration committees to focus on aligning pay with long-term performance. We have made this point by exercising our rights by voting against many proposals to increase short-term bonuses.

LGIM believes share ownership throughout an organisation allows the workforce to feel more aligned with the performance of the business; some studies show that this can drive productivity, too.

Companies should ensure that share ownership is not restricted to executive levels but is cascaded down the organisation.

Last year, an independent report by the Climate 50/50 Project looked at how the largest 11 asset managers voted on executive pay at resolutions at US energy, auto and utility companies in 2018. The report states that LGIM showed the highest level of opposition to companies’ pay practices.

Pension practices and minimum wages

We have continued to push for pension provisions to be harmonised across companies.

In 2018, the new UK Corporate Governance Code called for changes to pension practices at companies. For our part, we committed to vote against any new company pay policy introduced from 2020 that does not seek to curb the inequality in pension provisions between executives and the general workforce.

While we have limited this initiative to new executives and role changes, as changing the contracts of serving executives is dependent on the willingness of individuals, we have asked board chairs to address the pension provisions of existing directors and have seen some results.

Through active engagement we have been asking companies to ensure they are paying the living wage, whereby all employees are paid no less than the absolute minimum required to live. This is one way, we believe, that companies can demonstrate a culture in which the workforce is valued. Last year we worked with Persimmon to encourage the UK homebuilder to become a living wage employer; we believe it is now paying a living wage and is actively pursuing accreditation.

Shareholder rights

Fighting to protect our clients’ rights

- LGIM engaged with index providers and the Hong Kong Stock Exchange to oppose the issuance of new shares without voting rights

- We worked to protect shareholders’ ability to resist excessive dilution

The provision of shareholder rights is a basic entitlement for investors—and yet these rights remain under constant pressure. Over 2018, LGIM actively engaged across multiple fronts in order to protect them.

One share, one vote

Voting is a powerful tool. It forms the central mechanism by which shareholders exercise ownership rights; without it, their ability to hold management to account on issues from poor performance, to executive pay, to climate change is compromised.

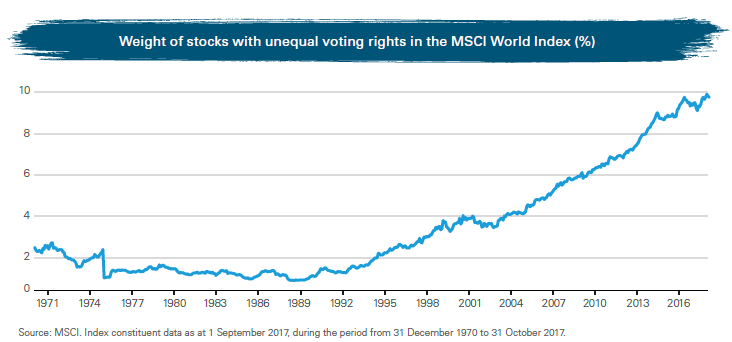

The ‘one share, one vote’ standard rests on the principle that a shareholder’s control of a company should be proportional to the amount of capital committed. Over the past 20 years, the number of companies issuing stock with reduced voting rights has increased from the long-term average. This is largely due to the popularity of multi-class capital structures among new technology companies.

Corporate management teams often argue that such structures allow companies to innovate and invest for the long term, free from outside investor pressure to maximise short-term profits. But we and many other equity investors—do not believe that this perceived benefit justifies breaking the link between control and commitment of capital over the long

As a result, we have collaborated with other investors to engage with index providers on this issue, participating in consultations with FTSE, Standard & Poor’s and MSCI on their voting rights rules. FTSE and S&P subsequently have not included new companies with no voting rights in any of their major indices.

We were, however, disappointed to see a U-turn from MSCI following last year’s consultation, meaning its default indices would not take voting rights into account. After this decision, we publicly voiced our opposition to this stance.

In 2018, LGIM also contributed to a consultation by the Hong Kong Stock Exchange on whether some companies should be allowed to be listed with weighted voting rights, which do not adhere to the principle of one share, one vote.

While the exchange’s ultimate decision was not aligned with our views, we continue to push globally, alongside other investors, for this fundamental right to be upheld.

Pre-emption

LGIM supports the right of companies to issue shares to raise capital. However, they should only do so in order to maintain business operations—and not expose minority shareholders to excessive dilution of their holdings.

The existence of ‘pre-emption’ rights is crucial to protecting shareholders from excessive dilution, as they entitle existing shareholders to be offered any new shares, pro-rata to their existing holdings, ahead of the securities being offered to other investors.

ESG integration

Integrating ESG considerations into investment processes

- We have developed data-driven ESG tools for our index and active funds and for our engagements

- LGIM launched 14 funds with ESG-related objectives as part of the Future World range

- We created a list of companies that fail to meet the minimum standards of globally accepted business practices, in which the Future World funds will refrain from investing

Unmanaged ESG factors pose risks, which can potentially have a material impact on the performance of our clients’ investments. As a result, the Corporate Governance team has continued to work with colleagues across LGIM to integrate ESG considerations into investment processes.

ESG integration in index funds

Active ownership remains at the cornerstone of how we approach ESG across index strategies. We remain committed to engaging and voting on holdings across our entire book, on behalf of our clients, as detailed throughout this report.

However, for the past four years we have been working to take ESG a step further within our index strategies, in order to further enhance our approach to active ownership.

In 2018, the Corporate Governance and Index teams developed the LGIM ESG Score. Driven by a rules-based and transparent methodology, we assess and score companies against ESG metrics to inform decisions about allocating capital to—and engaging with—companies.

We have also utilised the score to design equity and fixed income indices with ‘tilts’ towards higher-scoring companies, and away from lower-scoring companies, which we use for our Future World index range.

In order to incentivise companies to raise their standards, we publish the scores of the companies we analyse on our website, letting them know exactly where they are doing well and where they need to improve. We believe this can also help the overall market to improve over the long term.

ESG integration in active funds

Our approach within index funds complements that applied by our Active Equity and Global Fixed Income teams, to whose tools for assessing ESG risks we devoted a significant amount of time to enhancing this year.

The result is our Active ESG View, which seeks to identify the ESG risks and opportunities within a company. It takes the inputs that form the LGIM ESG Score as a starting point, then incorporates additional quantitative and qualitative inputs.

The view forms an essential component of LGIM’s overall active research process, and involves teams leveraging their sector expertise, knowledge of company dynamics and access to corporate management. This leads to each company under review being given a status that ranges from very strong to very weak.

The degree to which the ESG View drives security selection within a given fund will depend on the specific strategy.

For our core active products, the Active ESG View is integrated in how we fundamentally assess a company, alongside all other components of investment analysis. It remains at the portfolio manager’s discretion as to whether a company with a weak ESG integration status offers the necessary level of return to be held, for the level of risk it poses.

For the active funds within the Future World range where we go further in addressing ESG issues—the portfolio managers would only invest in a company with a weak status if they expected to see improvements as a result of successful engagement.

ESG in product development—Future World launches

In 2018, LGIM introduced 14 Future World funds across a variety of asset classes and strategies, for clients who wish to express a conviction on ESG themes.

The funds incorporate key ESG metrics, which are closely aligned to the engagement and voting activities we carry out on behalf of our clients.

By developing the range, we aim to bring investments that incorporate ESG principles into the mainstream.

LGIM’s Future World Protection List

For the Future World range, we developed a list of companies that have failed to meet the minimum standards of globally accepted business practices. The funds will not hold any securities issued by these companies, which make up the Future World Protection List, or will significantly reduce their exposure to them.

The list includes companies that meet any of the following criteria:

- Involvement in the manufacture and production of controversial weapons

- Perennial violators of the United Nations Global Compact, an initiative to encourage businesses worldwide to adopt sustainable and socially responsible policies

- Pure coal miners—companies solely involved in the extraction of coal

In 2019, LGIM will also vote against the election of the chair of the boards of these companies across our entire equity holdings. Where the chair of the board is not up for a vote at the AGM, we will vote against the second most senior board representative.

Our push in ESG integration in 2018 builds on our past work. And while greater activity in this regard meant the Corporate Governance team could not hold quite as many meetings with companies last year, we are thrilled to see growing external recognition for our efforts.

“Some important actions have already been taken. For example, on the asset-owner side, HSBC has constructed a climate-tilted fund with Legal and General Investment Management as the default option for their defined contribution pension scheme”

—HRH The Prince of Wales, discussing finance leaders’ response to climate change in July 2018

* * *

The complete publication, including footnotes, is available here.

Print

Print