Paul Hammes is Global Divestment Leader, Rich Mills is Americas Divestment Leader, and Carsten Kniephoff is Europe, Middle East, India and Africa Divestment (EMEIA) Leader at Ernst & Young LLP. This post is based on an EY memorandum by Mr. Hammes, Mr. Mills, Mr. Kniephoff, and Paul Murphy.

In their quest for greater value, C-suites across the globe face a myriad of forces affecting divestment plans—from shifting customer expectations, to technology-driven sector convergence, to ongoing shareholder pressure. Companies are streamlining operating models so that they can pivot more quickly in pursuit of new growth opportunities and stay competitive. In particular, they are using divestments to fund new investments in technology, products, markets and geographies.

This is keeping the appetite for divestments near record levels, with 81% of companies saying the desire to streamline the operating model will impact their divestment plans over the next 12 months. They continue to divest businesses no longer core to the portfolio or best left in the hands of another owner. As companies reshape their portfolios, they are building greater trust with stakeholders and mitigating pressure from activists.

But once companies decide to divest, the complex separation process requires far more preparation than sellers often expect. This year’s Global Corporate Divestment Study aims to help companies understand the critical steps to increase divestment success—from weighing the merits of different deal structures to pre-empting regulatory hurdles and addressing interdependencies across their businesses—and improve the valuation of the remaining organization.

To further drive value, sellers need to prepare for a widening pool of buyers—from private equity to cross-sector—by leveraging analytics, aligning leadership around deal perimeters and building stand-alone operating models so these buyers have confidence that the business has been properly prepared for separation.

All of these critical divestment steps can help companies accelerate their pace of transformation, reposition the remaining business for future growth and, ultimately, drive total shareholder value.

Why are so many companies divesting?

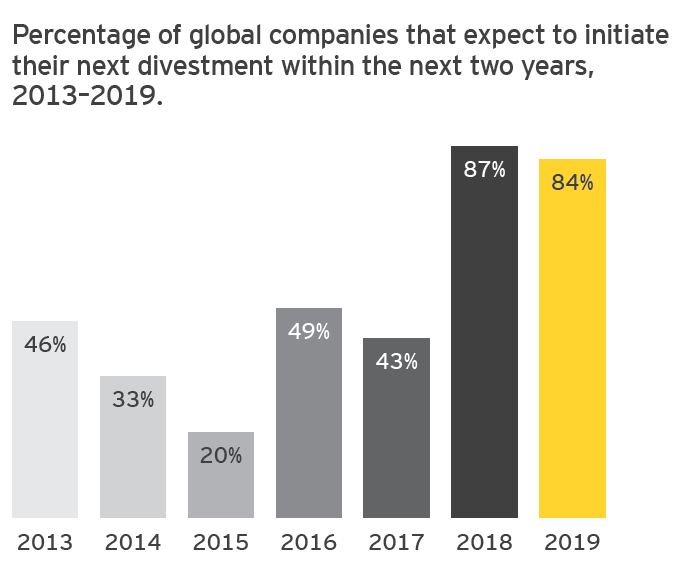

The intent to divest remains at record levels—84% of companies plan to divest within the next two years, consistent with last year’s record of 87%. Despite uncertainty from tariffs, a trade war, desynchronized growth and geopolitical concerns, the market offers sellers a resilient yet competitive environment.

Streamlining operating models for better agility and sharper focus

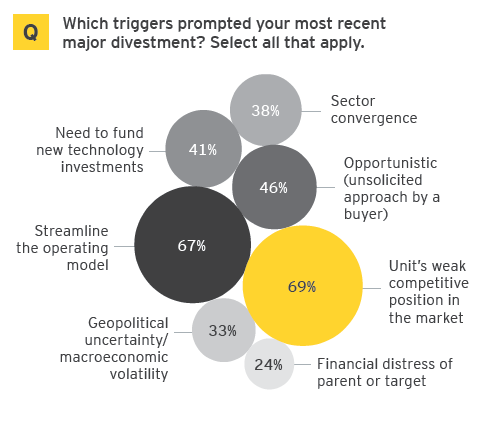

Faced with evolving sector landscapes, businesses are continuously evaluating their growth strategies and competition. They are more rigorous in portfolio management—two-thirds (66%) of companies say they review their portfolios at least every six months, according to the latest EY Capital Confidence Barometer survey—and they continue to actively dispose of underinvested assets best left in the hands of another owner. This disciplined approach to portfolio management is working. More companies are divesting for strategic reasons as opposed to because of a failure in the business: companies that cite a unit’s weak competitive advantage as a driver in their latest divestment fell significantly to 69% from 85%.

The result is a streamlined operating model that gives companies the ability to quickly execute on their capital agendas. Eighty-one percent of companies say streamlining the operating model will factor into their divestment plans over the next 12 months, while two-thirds (67%) say this was a factor behind their most recent divestments.

The importance of portfolio reviews is further evidenced in the deconglomeration trend of the last several years, sparked in part by shareholder activism. Many companies have become increasingly complex by operating in several disparate, yet intertwined, businesses. This complexity, while often resulting in some cost savings, has come at a price. In addition to hampering agility, this conglomerate model often negatively affects market valuation. Various academic studies indicate large conglomerates often operate at a 5%–15% discount

relative to the sum of their parts.

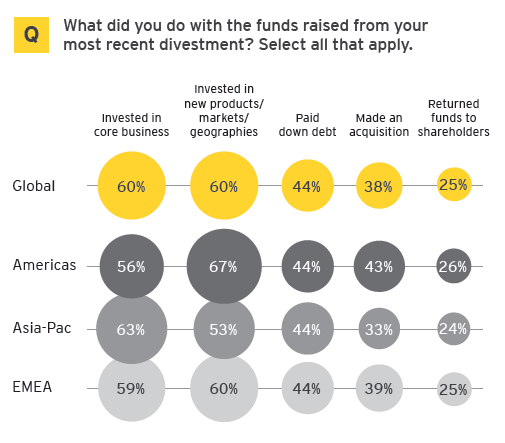

Companies that divest may redeploy proceeds in growth areas to improve shareholder value. Sixty percent of companies reinvested proceeds from their last divestment in new products, markets and geographies. Honeywell completed two spin-offs in 2018 representing US$7.5 billion in revenue. When the divestitures were announced, CEO Darius Adamczyk commented that he was “excited” about M&A in its four businesses, and the company has made acquisitions since.

Technology accelerates the pace of transformation

Companies must continually reformulate their capital agendas and go-forward strategies relative to their competition, particularly in light of technology-driven changes in consumer habits and supply chain. Seventy percent expect more large-scale transformational divestments within the next 12 months, up from 50% in 2018. At the same time, companies are making acquisitions that allow them to add new capabilities, such as IBM’s purchase of open source software and technology distributor Red Hat.

Sector convergence prompts divestment

Further, 70% say sector convergence is more likely to drive their own divestment decisions, as they focus on innovation in the face of new competition from companies outside of their traditional sectors. With technology often being the catalyst of this convergence, many companies have redefined their business strategies around a narrower set of priorities and are determining the capital investments required to support technology for future growth.

Recent examples of these technology and cross-sector transformations include Philips shedding its lighting business to reposition for new technological growth in health care and GE refashioning its business through divestitures to focus on growing its footprint in renewable energy as well as its technology-driven power and aviation businesses.

Technology-driven divestments increase

Separately, 80% of companies expect the number of technology-driven divestments to rise in the next 12 months, compared with 66% in 2018. These plans may also support the capital requirements to fund new technology investments. Further, companies that say changes in the technology landscape are directly influencing their divestment plans are more than seven times as likely as their counterparts to secure a higher price for the business sold. This may be because these companies have their eyes on the market and their portfolios, and are more prepared to address the impact technology has on their operating model.

Geopolitical shifts: a constant variable in the divestment equation

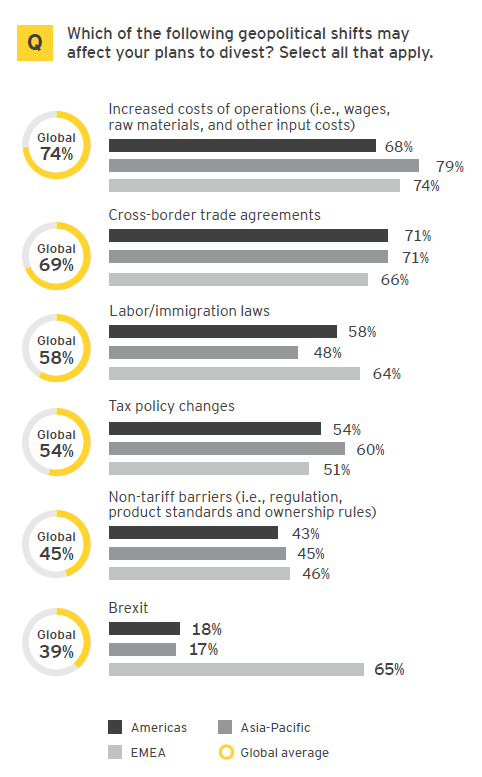

Despite uncertainty within the global markets, whether driven by tariffs or trading costs, companies must continue to diligently review their portfolios. The current US administration has raised the stakes over global trade, while Brexit in the UK, the rise of populist governments in Europe and the ongoing debate over immigration add to complexity when making strategic portfolio decisions.

Companies appear to have grown more accustomed to this uncertainty over the past year: 51% of companies, compared with 62% in 2018, say that macroeconomic and geopolitical triggers will play into divestment decisions next year. Still, these factors must be weighed in the financial forecasts of companies operating in affected markets.

Almost three-quarters (74%) of companies expect these geopolitical shifts to push operating costs higher, while 69% wonder whether they can depend on existing cross-border trade agreements to remain in force. They will have to factor these rising costs into their divestment strategy and timing. Whether these factors can otherwise be addressed through vendor negotiations, price increases or cost reductions may factor into whether a company decides to divest a unit that is affected by tariffs, trade disputes or geopolitical uncertainty. One company recently entered into an earn-out agreement relative to tariffs. Knowing it is still too early to predict the full ongoing impact of tariffs, but considering its commitment to selling the business, the company took the risk of whether the earn-out will potentially pay off relative to the strategies implemented prior to the closing of the sale.

Active portfolio management tempers opportunistic divestments

Through more active portfolio management, companies have sharpened their focus on agility and improved their ability to respond to new opportunities both inside and outside of their sector. They have become better at identifying assets ripe for divestment and are starting to prepare their assets to maximize the potential for success when receiving an unsolicited bid. To capture full value, opportunistic divestors need a solid understanding of their earnings power, net assets and working capital, both historically and projected. It is no longer enough to focus on pro forma historical performance. Sellers have to understand and credibly portray—using analytics and sophisticated tools—the drivers of forecasted performance for potential buyers.

Opportunistic divestments by the numbers

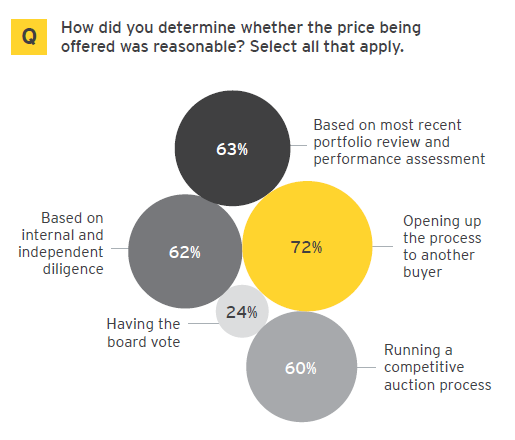

65% of those reporting an opportunistic divestment say they had already started considering a sale and therefore completed some level of preparation when the unsolicited bid was made. They were also four times more likely than their counterparts to meet or exceed their expectations for both price and timing in the divestment, demonstrating that preparation for a possible divestment as a result of portfolio reviews pays off when the asset is divested.

72% of companies opened their opportunistic divestment process up to at least one other buyer to create competitive tension and validate the price offered. Companies can maximize value by taking the appropriate steps in the best interest of shareholders.

46% of sellers describe their last divestment as opportunistic, down from 71% in 2018. While every business may be for sale in whole or in part, active portfolio management may mean that companies have fewer assets remaining that they are willing to part with, even if a buyer appears.

34% of companies say they are not confident they would be able to accurately value their businesses were they to receive an unsolicited bid today, underscoring the need to regularly conduct portfolio reviews with an eye toward the value of a business to different types of potential buyers.

When opportunistic divestments present themselves, success is by no means guaranteed. Unplanned divestments are four times less likely than planned divestments to achieve expectations on price and improve the valuation of the remaining company.

With a more active approach to portfolio management, companies can begin to prepare a compelling value story for an increasingly diversified pool of buyers. This is an essential step in closing the widening price gap between buyers and sellers.

How can you maximize value from the next wave of buyers?

In a volatile marketplace driven by high valuation expectations, sector convergence and an abundance of capital—both private equity and corporate—who will be your next buyer? How will you anticipate the needs of different buyers and maintain competitive tension? What tools do you need in your negotiation playbook?

Expect wider price gaps

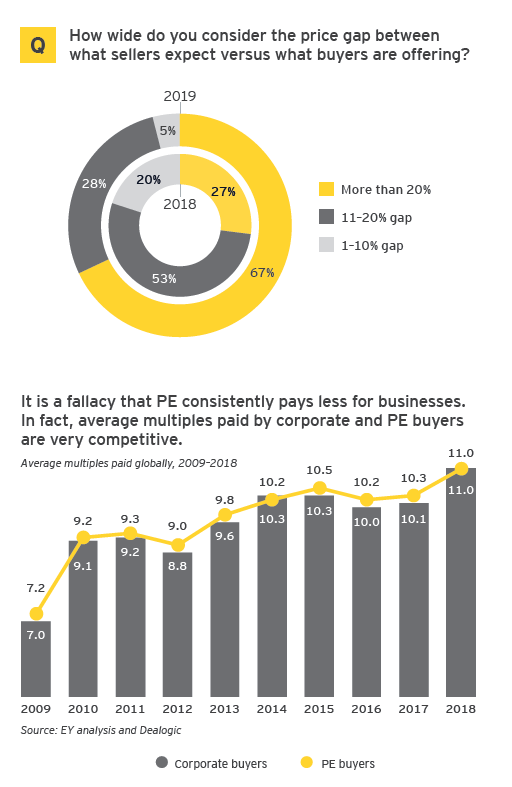

The price gap between what buyers and sellers expect has risen sharply over the past year. Sellers of quality businesses often value assets through a combination of improvements and projected earnings power, while buyers are inclined to calibrate against historical earnings to discount for short-term or unquantified risks while balancing their desire to stay in the deal process.

Two-thirds (67%) of sellers say the price gap between what they expect to receive for an asset and what buyers are willing to pay is greater than 20%. In 2018, only a quarter noted such a significant gap. Now, more than ever, it is critical for sellers of quality businesses to build a credible value story with supporting data and start the related preparation early to achieve their desired valuation.

High purchase prices and the fluency with which PE can close a deal are highly positive factors that increase the value of the deal. They are efficient deal makers with the ability to align the loose ends of a deal and keep a diligent check on execution.

—Director of Mergers & Acquisitions at a technology business in the UK

Leverage the power of private equity

Appealing to private equity buyers sometimes requires significant time and effort, but these bidders can also bring sharper focus on value, increased competition and potentially higher multiples to the sales process.

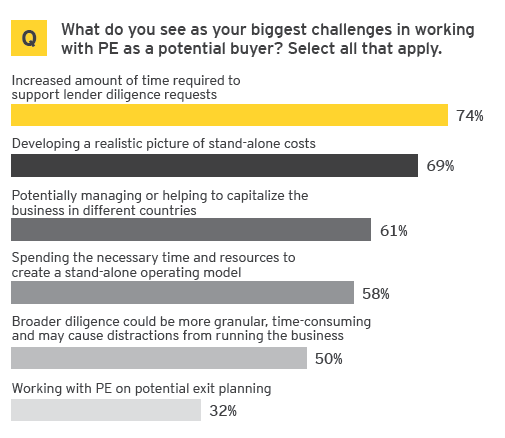

Unlike corporate buyers, PE may not necessarily have a portfolio company in which to integrate the business being sold. In the absence of synergies, sellers may find PE diligence demands to be more granular, and therefore time-consuming. Seventy-four percent of sellers say the increased amount of time for PE diligence requests was a challenge. But fulfilling these exacting requirements during negotiations can support a faster closing once the deal is signed. Forty-nine percent of sellers say that PE’s involvement in the divestment led to a reduced time to close. Reasons for a faster closing may be that PE firms require fewer regulatory disclosures; they may already have expertise relative to a particular business based on ownership experience with an existing portfolio company; or their clarity relative to the exit strategy and related time sensitivity speeds up the process. There are other benefits, too: 38% say working with a PE buyer led to an increase in purchase price.

Sellers should take the following steps to maximize PE participation in a competitive process:

- Build a compelling picture of the asset as a stand-alone business: one quarter of PE firms say a well-thought-out stand-alone case and related cost model are key to keeping them in the sales process. Sellers may need greater flexibility in financial reporting systems as a first step in developing an accurate picture.

- Keep an eye on operational performance: missed forecasts concern potential buyers, particularly if the business misses forecasted performance outlined in marketing materials. More than a third (39%) of private equity bidders cite this as the most likely reason they would drop their price or walk away.

- Help PE “see” the exit strategy: the nature and timing of an exit is of ultimate focus to PE. Sellers should articulate their perspective around potential monetization strategies early in the process.

- Be prepared to generate granular data: half of PE firms say access to granular data was a key factor in their decision about whether to stay in an auction process. The seller may need to have historical and projected information down to transactional and SKU-level detail, often monthly, and for as many as 10 years.

- Tell a consistent story about financial forecasts, growth opportunities, capital requirements, the management team and the overall business going forward. These are focus areas to PE as they drive the financial and operational business models as well as the exit strategy.

Keeping PE engaged in the process can be vital to a successful deal. For example, a fifth of businesses say their last divestment ultimately lost value because they failed to maintain competitive tension throughout the deal process. Not articulating a clear value story, lack of adequate preparation for diligence requests and not fully understanding the buyer pool’s requirements (e.g., operational, regulatory, financing) can contribute to the loss of bidders in the sales process.

Case study: Stress test through a buyer’s lens

One global consumer company preparing to divest used analytics to test revenue forecasts relative to customer churn and product pricing. While the company was confident in its revenue projections among top-tier customers, analytics revealed how price increases had impacted the bottom tier of customers, driving 40% of gross profit. This lower-tier customer base was turning over on average

every three years and therefore needed to be continually replaced—clearly a risk to potential buyers. In uncovering this issue early, the company was able to illustrate its success in managing such turnover given the overall market potential.

Use analytics in the sales process

When faced with widening interest from more diverse buyer pools—from PE to cross-sector corporates—sellers may benefit by leveraging analytics in the negotiation process. Advanced analytics can produce greater insight for buyers on the historical and future performance of a business while allowing sellers to tailor and strengthen their value story for different buyers. Only 39% of sellers say they used analytics during buyer negotiations, but 52% say it’s a step they should have taken. In doing so, sellers and buyers alike can avoid surprises leading to loss of value or cause the deal to fail.

Further, companies that use analytics in negotiations are three times more likely to achieve a higher sales price and increase valuation in the remaining business, as well as to close the deal faster, than those that do not. Additionally, use of analytics during negotiations can reduce the workload of the management team by anticipating buyer’s questions before they arise. This success can be attributed to providing buyers with the appropriate level of granular data that both satisfies their diligence requests and supports the value story. Also, use of analytics minimizes surprises and avoids additional time spent on negotiations relative to matters the company should have been aware of at the start of diligence.

Tools to support the negotiation playbook

Divestment tools can help sellers save time and make more informed decisions during the negotiation process by streamlining access to data across business functions. These specialized deal tools can be loaded with commingled financial and operational information. Then, using specified parameters, sellers can isolate transactions and information specific to the business being divested. This becomes the basis not only for generating financial statements and financial analytics to support diligence, but mapping fixed assets, intangibles, SKUs, inventory, vendors, customers and employees to support operational separation. Companies then have better insights on the deal perimeter impact to working capital, legal entities, operations, supply chain, HR and tax. Even more importantly, sellers will have a better, faster understanding of how the slightest change in perimeter may impact the target financial forecasts across the business.

For example, a multinational automation company was forced to divest parts of a business during an acquisition process. Without having time to complete full diligence on the assets, a small yet strategic and high-value part of the business had been included in the deal perimeter. The seller realized this late in the process and wanted it removed. However, the bidders knew their market, saw the importance of this business and wanted it left in the perimeter. In the end, it was removed and the deal value dropped, with time and money lost, as well as delays to the sales process.

Build value through stand-alone operating models

In carve-outs, buyers may recognize greater value by presenting a stand-alone operating model. In fact, sellers that present a business as a stand-alone are twice as likely to achieve a higher price and complete their deal faster than those electing not to do so. Buyers have confidence in the operating model and know that the business has been properly prepared for sale, with a comprehensive separation plan. Further, significant time is saved post-signing by not having to take these steps, long ago completed. This is critical to PE—51% of PE buyers say it’s required for them to stay in a purchase process for corporate assets—as they often do not have the infrastructure or personnel to support a stand-alone business unless there is a match with an existing portfolio company.

The benefits also extend to sellers by:

- Enabling them to easily understand the impact of potential deal perimeter changes in “real time”—to make the business more attractive to a buyer

- Assisting with TSAs, one-time costs and stranded cost remediation, which impacts the deal model for both the buyer and seller

- Serving as key input into and aligning with the standalone cost model that drives deal economics

- Building the foundation for the seller’s separation planning and the buyer’s integration planning, both of which will be greatly accelerated

- Allowing for proper planning relative to capitalization and regulatory requirements, which avoids delayed or deferred closings

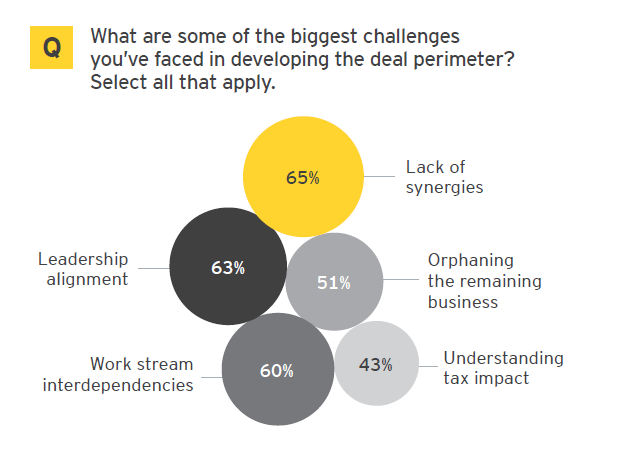

Align on deal perimeter

Companies often ask us, “The deal perimeter simply reflects the business — why are we spending so much time on this?” The business to be divested is often defined differently by executives and functions within the organization. Too often, deal models are prepared utilizing historically generated system data that contains improperly allocated costs, excludes certain costs and does not reflect the business to be ultimately transferred. Accordingly, alignment on the deal perimeter across all functional areas, with a clear line of site to the deal model for each buyer, is critical.

Leadership alignment around the deal perimeter — across RemainCo and DivestCo — is essential, but this is a challenge for 63% of companies. One common deal perimeter issue for sellers is deciding on the disposition of commingled manufacturing and production facilities. For example, one life sciences company was looking to carve out a business that shared manufacturing facilities with other businesses in the portfolio. The seller’s supply chain leaders pushed to remove the divested business from all commingled locations around the globe to pursue new growth opportunities. Buyers immediately recognized this as costly and highly disruptive to the business, thereby eroding value and requiring lengthy negotiations to reach a compromise. Sellers can improve alignment in deal perimeters by involving leadership early in the portfolio management process with the right data to inform decision-making.

A US-based service provider sold a series of comparable businesses across the globe. A performance analysis of these initial carve-outs uncovered two steps the company failed to take in the sales process to help support a higher deal price. In their next divestment, they addressed the analysis by delivering buyers a detailed separation plan and providing a vendor due diligence report. As a result, they increased the EBITDA multiple by 17%.

Leading practices in the negotiation process

- Articulate and support the value story: ensure product pipeline and business strategy supports revenue growth projections. Develop a target operating model that identifies potential cost and revenue synergies available from combining the asset to be divested with the businesses of potential buyers as well as other value creation opportunities, such as changes to the country go-to-market strategy.

- Involve leadership teams: bring the management of the business into the process at an early stage to increase divestment success. Seek their views on potential buyers, upsides that can be incorporated into the forecast and value story, risks likely to be discovered during diligence and how to deal with them, the likely go-forward operating model and how to anticipate buyer concerns. Consider “boot camps” that include executives and experienced deal professionals from outside the organization that have “been there and done that” to prepare management for successful meetings with buyers.

- Communicate the tax upsides: evaluate how different divestment structures impact the business value from the buyer perspective and factor this into negotiations. Clearly identify and specify tax assets already available or triggered upon the divestment to allow the buyer to evaluate impact on the financial model and cash taxes.

- Demonstrate deal flexibility: understand how different deal structures and perimeters may appeal to different buyers and consider dual tracking if necessary.

- Share analytics and necessary diligence materials: make sufficient diligence materials available to prospective buyers who may otherwise identify opportunities to pay less.

- Develop a negotiation matrix: evaluate each key point in the negotiation process, its impact on the remaining organization and stakeholder value, and also determine “how far you are willing to go.”

The complete publication is available for download here.

Print

Print