Rakhi Kumar is Senior Managing Director and Head of ESG Investments and Asset Stewardship at State Street Global Advisors. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here).

Key Takeaways

- The COP21 Paris Climate Accord signals the turning point of a global effort to address climate change. As nations begin to pursue their emission reduction strategies, directors should evaluate the climate-related risks facing their companies.

- State Street Global Advisors believes that boards should regard climate change as they would any other significant risk to the business and ensure that a company’s assets and its long-term business strategy are resilient to the impacts of climate change.

- State Street Global Advisors has developed a framework to help directors evaluate potential climate-related risks that may impact companies within a sector.

- The three primary climate-related risks we have identified are physical risk, regulatory risk and economic risk.

- Climate change will continue to be a priority for our asset stewardship and company engagement program in 2016 as we seek to promote effective environmental and sustainability practices and better company performance on behalf of our clients and other stakeholders.

- Our guidance for directors is based on over 160 climate-related engagements we have had with companies over the past three years.

Background

The success of the COP21 climate negotiations has brought a sense of urgency to the global transition towards a low carbon economy. This new global direction agreed upon by heads of 195 countries, encompassing 95% of global emissions in Paris, presents challenges and opportunities to boards and companies across all sectors. The challenges come in the way of possible changes to strategy to meet specified goals; allocating capital in technology and/or infrastructure; and managing reputation based on corporate practices that demonstrate a company’s climate consciousness. The opportunities are presented through proactively identifying new business lines; mitigating future regulatory risk; and leveraging sustainability practices as a differentiator to enhance brand/firm reputation.

In this post State Street Global Advisors contextualizes the implication of COP21 on a sector and provides a framework for directors to oversee risks pertaining to climate change. In addition, through a set of guidance questions, we clarify investor expectations of board members on their responsibilities with regards to climate change related matters at their companies.

The COP21 Paris Climate Accord at a Glance

Goal Limit global average temperature increase to no more than 2 degrees Celsius with ambition for 1.5 degrees

Implementation Mechanism Individual countries were requested to design an Intended Nationally Determined Contributions plan or INDC, which simply put, includes a national greenhouse gas (“GHG”) emission reduction goal and a strategy to achieve this goal. INDCs give countries the flexibility to design a plan that balances their sources of emissions with economic and national priorities.

Four strategies that will commonly be pursued by different nation states include:

- Making coal plants more efficient or switching from coal-fire to natural gas plants

- Shifting energy generation to a renewable source such as wind or solar

- Enhancing energy efficiency, especially in commercial, industrial and transportation. For example, through more stringent fuel economy standards for light and heavy duty vehicles

- Forest conservation or reducing deforestation

State Street Global Advisors Framework For Overseeing Climate Change Risk

Climate change has been a priority engagement issue since 2014. Over the course of the past three years, we have held over 160 climate-related engagements with companies on topics such as disclosure, practices, risk management and the impact of climate change on the company’s long-term strategy.

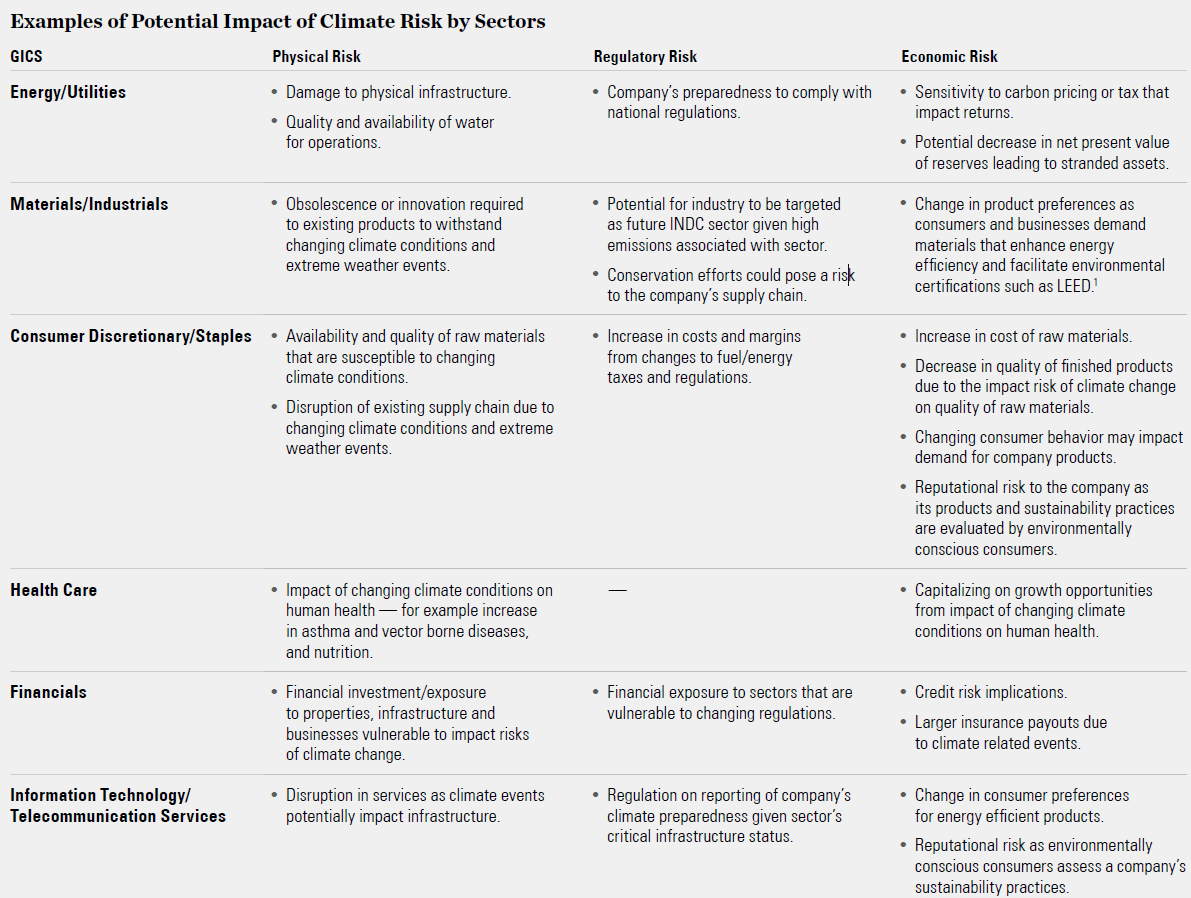

Based on our discussions, the firm has developed a framework to capture and evaluate different types of risks associated with climate change facing companies within specific sectors. These risks, which can impact a company’s assets and its long-term strategy, include:

Physical Risk Captures the tangible risks of climate change that could manifest itself through a rise in sea levels, droughts, flooding, extreme temperatures, and increased frequency of extreme weather events. These climate phenomena could damage infrastructure, cause supply chain disruption, result in raw materials scarcity, or harm human health.

Regulatory Risk Captures the changes in regulatory landscape that can impact existing business operations or could increase the cost of operations.

Economic Risk Captures the risks of changing consumer habits and a growth in climate consciousness as individuals recognize their role in aiding climate change, and reputational risk stemming from a company’s sustainability practices relative to stakeholder expectations. It also includes investment allocation decisions in companies and sectors that are better suited for a low carbon economy.

The impact of these risks goes beyond the traditional high emitting sectors of energy, utilities and transportation, and creates opportunities and challenges to any company in any sector. Below, State Street Global Advisors has provided a table that identifies how each of these risks can affect a company within a specific sector.

Guidance for Directors on Evaluating Climate Risk and Preparedness of a Company

- Analyze sector and company exposure to the different climate risks, inquire if the company has adequately mitigated potential risks, and assess the potential impact on the company’s long-term strategy under different scenarios on a periodic basis.

- Review capital allocation and direct investment into technology and programs that may mitigate risks and/or give the company a competitive advantage amongst its peers.

- Keep abreast with regulation to understand impacts of potential policy changes on long-term strategy.

- Be conversant with the company’s strategy to deal with the evolving climate change-related risks. Be prepared to discuss company’s climate change strategy with investors.

- Companies in high-risk sectors should assess board composition and director expertise in relation to climate competence of the board; establish mechanisms such as access to climate experts to help educate directors on evolving climate-related risks.

- Review shareholder proposals that the company receives and evaluate the spirit of proposals in the context of the business risk.

Endnotes

1Leadership in Energy and Environmental Design (LEED) is a certification program established by the US Green Building Council for optimizing a building’s sustainability related efficiencies.(go back)

Print

Print