Barbara Novick is Vice Chairman at BlackRock, Inc. This post is based on a Policy Spotlight issued by Blackrock.

In 1990, Professor Harry Markowitz was awarded the Nobel Prize in Economics for his groundbreaking work on the importance of portfolio diversification to achieving better risk-adjusted returns, which serves as the basis of modern portfolio theory. [1] The value of diversified investing is now being challenged by a small group of academics who claim that ownership of diversified portfolios may create anti-competitive effects.

According to their theory, when investors own more than one company in a concentrated industry (‘common ownership’ or ‘horizontal shareholding’), these companies are less likely to compete. Investment funds and pension plans—including those using active or index strategies—are equally implicated by this theory, as these investors own broadly diversified investment portfolios, which often entail owning more than one company per sector. The plausibility of the theory (as discussed below) and the methods and data used to measure this purported effect have been vigorously criticized by academics and practitioners. For example, the foundational paper in this area, sometimes called the ‘airlines paper’ is based on incorrect data (see Policy Spotlight, Common Ownership Data is Incorrect). [2] Nonetheless, this theory has received media attention and some focus in competition circles.

Although the papers underlying this theory are controversial, and the theory itself has been challenged by other academics, some anti-trust scholars have accepted the theory and claim that diversified portfolios are creating societal harm. Based on this view, they have proposed drastic policy measures such as: (i) limiting ownership to one company per sector or (ii) eliminating proxy voting rights of mutual funds, pension funds, and other institutional investors. [3]

Common Ownership Theory is Misapplied to Broadly Diversified Portfolios

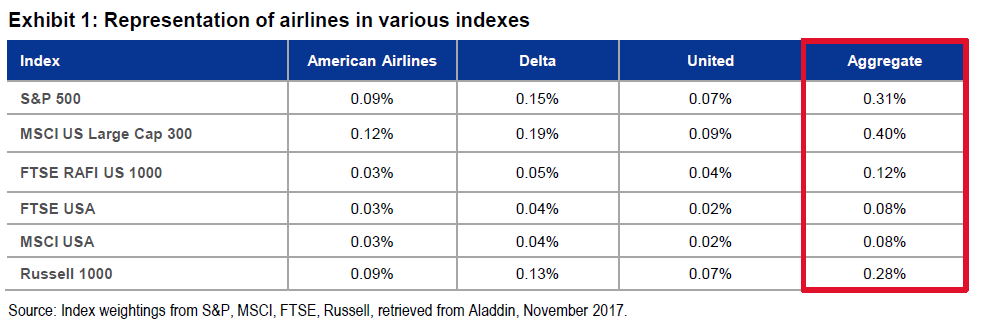

The ‘common ownership’ theory relies on the assumption that all ‘common owners’ benefit from lessened competition, as it is derived from theories of oligopolies and ‘cross ownership’ (e.g., where a company buys a stake in its competitor). While lessened competition might benefit certain concentrated investors, broadly diversified investors, like index funds, own the whole market and do not benefit from lessened competition. This is because broadly diversified investors are subject to inter– industry effects—meaning that what happens in one sector affects the performance of the fund’s holdings in other sectors. For example, airline carriers represent less than 1% of all major indexes (Exhibit 1), so the benefit of higher ticket prices for the 1% of an index fund’s portfolio comprised of airline stocks is likely offset by the negative impact of increased travel expenses (both directly and indirectly on companies whose businesses are sensitive to travel costs) on the other 99% of the portfolio.

Common Ownership Theory Lacks a Plausible Causal Mechanism

The proponents acknowledge that there is no evidence to suggest that ‘common owners’ are actively discouraging competition. Instead, they argue that since common owners do not encourage competition, their mere presence causes anti – competitive behavior by company management. A range of investors—from active and index fund managers, to pension funds, and even individual investors—make investments in more than one company in concentrated sectors. As discussed in the Policy Spotlight, Shareholders are Dispersed and Diverse, public companies have a diverse range of shareholders that engage with companies in different ways based on their investment strategies and objectives. Aside from activist investors, most other types of investors do not tend to get involved in influencing business strategy of their portfolio companies and focus instead on encouraging good governance. Thus, it seems implausible that the mere presence of hundreds, if not thousands, of investors who are shareholders in public companies is grounds for the far-reaching policy measures that have been suggested. For example, policy measures that call for these investors to own only one company per concentrated sector would likely lead to billions of dollars of divestment from public companies, in addition to a host of other challenges.

Another irony of this debate is that one of the proposed policy measures to mitigate ‘common ownership’ involves curtailing voting rights of diversified institutional investors. If adopted, this policy measure would ensure that diversified investors’ could never encourage competition, which is clearly circular if the concern being addressed is that diversified investors are not encouraging competition enough. Further, this policy measure would ultimately empower concentrated investors with shorter- term interests in the performance of a company at the expense of long-term savers.

Common Ownership Theory Contradicts CEO Incentives

Theories about the incentives of company executives due to common owners fail to consider the metrics by which the performance of executives is measured and the composition of pay packages, which is primarily in company stock. For example, according to their 2018 annual proxy filing, American Airlines’ CEO has had 100% of his direct compensation paid in the form of equity since 2015. Further, airline executives’ performance is measured by metrics such as pre-tax income, margin improvement, and stock price—all measures driven by own-company performance. Exhibit 2 provides actual language from the proxy statements of American Airlines and United Continental Holdings. With compensation tied to company stock performance, CEOs are heavily incentivized to compete. According to the common ownership theory, these CEOs are willing to sacrifice their own personal financial interests to satisfy a theoretical benefit to minority shareholders. This seems implausible.

Exhibit 2: Examples of Compensation Metrics in Company Filings

American Airlines Group

Our CEO and other executive officers have demonstrated their commitment to fair pay and pay for performance by initiating the following exceptional actions with respect to their compensation.

- Since 2015, at Mr. Parker’s request, we provide 100% of his direct compensation in the form of equity incentives in lieu of base salary and annual cash incentive compensation. That has helped to advance our commitment to paying for performance and aligning Mr. Parker’s interests with that of our stockholders. More than half of these equity incentives will be earned not earlier than the third anniversary of the grant date based on our relative pre-tax income margin and total stockholder return (TSR) performance.

- At his request, Mr. Parker’s target direct compensation has been historically set at below the average for his peers at Delta and United.

- Also at his request, in 2016, our Compensation Committee agreed to eliminate Mr. Parker’s employment agreement so that he is no longer contractually entitled to receive a set level of compensation and benefits and is no longer protected by the change in control and severance provisions of that employment agreement.

United Continental Holdings, Inc.

Our 2017 incentive awards are directly tied to Company performance metrics that we believe are appropriate measures of our success and that will lead to value for our stockholders:

- annual pre-tax income;

- long-term pre-tax margin performance improvement (measured on a relative basis versus our industry peers);

- stock price performance;

- operational performance, as measured by key indicators of customer satisfaction (on-time departures, flight completion factor, and mishandled baggage ratio); and

- specified strategic initiatives designed to enhance management focus on key corporate

We eliminated ROIC performance, which had historically been included as a performance measure under our prior long-term incentive program design, from our 2017 long-term incentive design in order to accommodate greater focus on our pre-tax margin results. The 2017 long-term incentive structure is equally divided between the pre-tax margin Performance-Based RSU awards and time-vested RSU awards, which provides stability and retentive features to the design.

Sources: United States Securities and Exchange Commission Schedule 14A filings for American Airlines Group Inc. and United Continental Holdings, Inc. Based on 2018 filings.

Bottom line:

There are numerous flaws with the common ownership theory, making it extremely premature to consider policy measures. Sweeping policy measures that would undermine the value proposition of diversified investing, eliminate voting rights for long-term diversified investors, and lead to billions of dollars of divestment from public companies would be very harmful to markets and the global economy, especially in light of the lack of evidence that diversified portfolios cause anti-competitive effects.

Endnotes

1Markowitz jointly received the 1990 Alfred Nobel Memorial Prize in Economic Sciences along with Professors Merton Miller and William Sharp for contributions in the theory of financial See the official press release announcing their award at https://www.nobelprize.org/prizes/economic-sciences/1990/press-release/.(go back)

2The ‘airlines paper’ refers to José Azar, Martin C. Schmalz, and Isabel Tecu, The Journal of Finance, “Anticompetitive Effects of Common Ownership” (updated May 2018), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2427345.(go back)

3See Eric A. Posner, Fiona M. Scott Morton and E. Glen Weyl, Antitrust Law Journal, Forthcoming, ‘A Proposal to Limit the Anti-Competitive Power of Institutional Investors’ (March 22, 2017), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2872754.(go back)

4ProxyPulse (A Broadridge & PWC Initiative), ‘2018 Proxy Season Review’, October 2018. Available at https://www.broadridge.com/_assets/pdf/broadridge-2018-proxy- season-review.pdf.

(go back)

Print

Print