Anne Sheehan is Chair of the SEC’s Investor Advisory Committee (IAC) and John C. Coates is a Committee member and the John F. Cogan, Jr. Professor of Law and Economics at Harvard Law School. This post is based on a recent IAC recommendation.

This recommendation relates to the U.S. proxy system. The proxy system is complex and multifaceted and will require an iterative, multi-step approach to improve it over a long period of time. We do not believe private actors will improve the system without SEC intervention. We have focused on areas that are clearly in need of immediate attention, that can attract a consensus from a wide array of stakeholders, and that we also believe are actionable by the Commission in a relatively short period of time. After setting out goals, noting reasons that private actors may lack incentives to improve the system on their own, reviewing evidence about problems with the current system, and noting the possibility of comprehensive, long-term, technology-based reform, we make four specific recommendations:

- The SEC should require end-to-end vote confirmations to end-users of the proxy system, potentially commencing with a pilot involving the largest companies;

- The SEC should require all involved in the system to cooperate in reconciling vote-related information, on a regular schedule, including outside specific votes, to provide a basis for continuously uncovering and remediating flaws in the basic “plumbing” of the system;

- The SEC should conduct studies on (a) investor views on anonymity and (b) share lending, and

- The SEC should adopt its proposed “universal proxy” rule, with the modest changes that would be needed to address objections that have been raised to that

Annex A sets out an overview of the proxy system.

1. Proxy system goals and challenges for private reform

U.S. public companies routinely ask (and are required by law to ask) their shareholders to vote, under state corporate law. Over 600 billion shares are voted every year at more than 13,000 shareholder meetings, including more than 3,000 at SEC-registered operating companies. Shareholders typically vote via agents known as proxies, subject to oversight and regulation by the Securities and Exchange Commission (SEC). As described in the overview in Annex A, shares are commonly owned in “stacks” or chains of contracts through intermediaries or agents such as custodians, broker-dealers, banks, and transfer agents, many of which are regulated by the SEC. Many participants outsource some or all aspects of voting to third parties. The overall system of voting, proxies, intermediation, and third-party services will be referred to in this recommendation as the “proxy system.”

a. Goals of the proxy system

The primary goal of the proxy system should be to provide accurate, timely and cost-effective vote counts. [1] The system should do so in a way that is transparent to shareholders, with equal access by issuers and shareholders alike, and should reduce fraud and increased informed voting. Accuracy, timeliness and important aspects of transparency are formally already required by law, if not fully achieved in practice.

When achieved, vote counts with these attributes increase legitimacy and confidence in the capital markets, reduce conflicts and disputes, and increase investor engagement, reducing the costs of capital formation.

b. Value of a good proxy system and challenges for private reform of the proxy system

The vast majority of elections or other issues [2] on which shareholders vote do not result in a close vote. As a result, for many votes, inaccuracies can exist without having a direct and significant effect on the outcome under corporate law. [3] As a result, individual companies lack strong incentives to fix the system on their own. For any one company, the expected benefits of investments in improved voting technology or services may not exceed their costs.

However, some votes are close. When votes are close, the system should be capable of generating rapid, accurate, and precise counts. Precise counts allow outcomes to be determined correctly when votes matter the most. For a given company faced with a close vote in majority slate board elections, by definition, board control is up for grabs. Board control includes control over management, strategy, finance, operations, value, and even viability. In a close vote, a company—and its board, management, and all of its shareholders—have a significant and shared interest in an accurate and timely voting system. (Of course, accurate vote counts are also important even when the votes are not close, both for obvious reasons of legitimacy and because they can provide important information about shareholder views.)

At the point of a close vote, moreover, it is too late for the company and its shareholders to make the large and long-term investments an accurate and timely system requires. Since some close votes do occur every year, companies and investors have a significant collective interest in a reliable system. The difference between individual company interests before it is known which companies will face a close vote, on the one hand, and the collective interests that they all share as different companies face close votes over time, is a challenge typical of collective action mechanisms generally and provides a reason for public regulation of the voting system.

Beyond the direct impact of inaccurate or delayed votes, the contingency planning, opportunity costs, and transaction costs of managerial distraction to respond to the risk or actual occurrences of inaccurate or slow vote counts are material. As discussed in Part 2, hand counts, recounts, litigation, negative publicity, delay, and acrimony all routinely accompany close votes under the current system. Worse, publicity associated with inaccurate or slow vote counts undermines the legitimacy of other votes, of corporate governance as a whole, and of U.S. equity markets generally. Lack of confidence in voting makes it harder to raise capital, reduces liquidity, and impedes the ability of the capital markets to function.

Complicating private incentives is the fact that the proxy system exhibits economies of scale and significant fixed costs, creating barriers to entry, reinforced by SEC rules mandating cost reimbursement by companies to intermediaries. As discussed in Part 2, these conditions conduce to natural monopoly. As discussed in Annex A, Broadridge has a market share of more than 90%. This reduces competitive pressure to enhance cost-effective services.

2. Consensus on problems with current system

A consensus appears to exist that the current proxy system generates routine and at times significant problems. As noted in its 2010 Concept Release, SEC “staff often receives complaints from individual investors about the administration of the proxy system,” including “technical problems with electronic voting platforms offered by proxy service providers and failures by [companies] to respond to shareholder complaints about proxy-related matters.” [4] The Release went on to recount problems associated with over-voting, under-voting, and lack of information about vote outcomes (i.e., whether intermediaries correctly submitted the right number of vote instruction forms (VIFs) and whether those VIFs were followed) and the impact of share lending on voting entitlements.

The SEC’s November 2018 roundtable on “proxy plumbing” produced a similar consensus, largely echoing the same themes: lack of accuracy and lack of transparency. [5] The same themes were raised at the IAC’s panel on the proxy system in September 2018. [6] At neither event did anyone speak in defense of the current proxy system, although some noted that modest improvements had been made over the past ten years, and we commend participants for the efforts they have made since the SEC’s 2010 release. However, while not everyone agreed on what response is best, all agreed that the status quo could be significantly improved. To better understand how the system might be improved, we describe here some of the problems in some detail.

a. An example of the problems with the current system

A specific example of problems with the current “Byzantine” proxy system is laid out in Delaware Vice Chancellor Laster’s decision about the 2016 votes of mutual funds advised by T. Rowe Price in the buyout of Dell Inc. [7]

As typical for mutual funds, neither the funds nor T. Rowe were holders of record and instead the funds held shares through a custodial bank, State Street, which is a member of the Depository Trust Company (DTC), the holder of record. As customary, DTC transferred voting authority to State Street via an omnibus proxy, which then needed to obtain voting instructions from T. Rowe. As is common, State Street outsourced the task of collecting and implementing voting instructions to Broadridge, the leading proxy servicer, via a power of attorney. As is also common, T. Rowe itself retained ISS, the leading proxy advisor, to notify it of various upcoming votes, provide voting recommendations, and to convey T. Rowe’s voting instructions to Broadridge.

T. Rowe provided ISS with default voting rules (e.g., to vote in favor of management-supported mergers) in order to reduce costs. T. Rowe could override those rules with different specific instructions through a computer system it used to communicate with ISS, and through it, with Broadridge and State Street. T. Rowe initially provided deal-specific instructions to vote against the Dell buyout. However, the Dell meeting was postponed and the deal modified in response to objections by investors. This triggered the need for a new set of voting instructions to be communicated from Rowe through ISS to Broadridge and State Street.

For the new (i.e., postponed) meeting, the T. Rowe voting instructions were pre-populated with default instructions to vote for the deal, rather than deal-specific instructions. Neither T. Rowe nor ISS staff realized this, and so the default instructions were not overridden. Because it is not required of either the company or any of the agents involved—neither Dell, nor State Street, nor DTC, nor ISS—T. Rowe was not given any confirmation of how its shares were being voted, until long after the vote occurred (and only then because it sought evidence on its vote in order to participate in the appraisal lawsuit). As a result, T. Rowe’s intended “no” vote did not occur, and its shares were voted in favor of the buyout. The bottom-line results included a $194 million loss for which T. Rowe reimbursed its fund clients, a high-profile event casting doubt on the reliability of all involved, and a higher-than-intended “yes” vote for a merger that was the subject of controversy.

b. Other examples of problems with the current system

Additional examples of vote count inaccuracies in the current proxy system are not difficult to find:

- Barron’s recounts an example of a 2005 election at Taser Int’l where 82 million votes were cast even though the company had only 61 million outstanding. [8] The company attracted short seller interest at the time, and brokers failed accurately to reconcile instructions from short sellers and shareholders whose securities they

- Yahoo was forced to recount votes in its contested 2008 director election, concluding that “Broadridge … had made significant errors in reporting votes at [Yahoo’s] annual shareholder meeting,” and Broadridge confirmed that “there was a truncation error in the final printout sent to the ” [9]

- In a prominent example about which the IAC heard testimony from the direct participants, the 2017 proxy fight between Trian and Procter & Gamble, many proxies were invalidated because of systemic issues such as breaks in the chain of custody, improperly filled proxy cards, or proxies separated from ballots. [10] One mistake had persisted for ten years previous to the proxy fight, without the investor ever realizing. The result was under-voting, in which numerous vote instructions were effectively nullified. Because of how close the vote was in the contest, the errors imposed significant delay and uncertainty on who was in control of one of the world’s largest companies.

c. Challenges arising from share lending

Additional problems commonly arise from share lending, such as to short sellers. Short sellers who borrow the shares sell them in the market, and the buyer becomes the new beneficial owner of the shares. Some institutional investors have a policy of calling back shares on loan in order to retain voting power, while others do not, even in close votes where the decision to not recall shares can affect the outcome of the vote. If shares are on loan on a record date, those acting for the lender and for the borrower both need to reflect the effect of the loan in determining their voting entitlements and submitting VIFs. Because shares are held in fungible bulk, [11] if the broker lends a small part of the company’s shares it holds on behalf of its many clients, it may have to make an arbitrary decision regarding which account the borrowed shares come from or, alternatively, to cut back all client votes pro rata. Often, customers are not informed about the need to cut-back votes due to share lending. In addition, not uncommonly, share lending results in over-voting, as where a broker does not reduce the number of votes to reflect share lending, two beneficial owners submit votes, and no other party in the voting process notices that the same shares have been voted twice.

d. Direct out-of-pocket costs of the current system

Nor is the current system problematic simply because companies are not paying much for it. A problem-plagued, delayed, and often inaccurate vote count is not cheap. Indeed, even a count that does not encounter significant “plumbing” problems or inaccuracies is not cheap. For example, the 2002 contested vote on the merger of Hewlett Packard and Compaq required the companies to pay a reported $1 million vote-counting fee to the vote tabulator. [12] Because intermediaries are legally guaranteed reimbursement for costs in distributing proxy materials, and because aspects of the proxy system appear to reflect a natural monopoly, it is not clear that market pressures on the price of proxy services are currently as strong as it would ordinarily be in a competitive setting. (These direct out-of-pocket costs are in addition to more general costs, such as confusion about who controls a company and loss of system legitimacy, sketched in Part 1 above.)

e. Opacity of the current system

A final problem with the current proxy system is that it is opaque—to both investors and companies. Investors cannot determine if their shares were voted as intended, and in contested votes, many votes are in fact disqualified due to mismatches or other recordkeeping errors. Broadridge has created a method for institutional investors to use an online end-to-end voting system, which allows for confirmations of votes. Uptake on the system has been slow, however, and it is currently not used by individuals.

Companies cannot directly communicate with the bulk of their investors, because they must work through intermediaries. While customers can elect to be NOBOs, [13] existing rules and practices are such that many shareholders do not do so, perhaps out of a mistaken belief that this preserves their anonymity. Retail (individual) participation in the proxy system has been declining, and companies cannot easily or cheaply use electronic means to reach out to individuals in the current system.

Companies cannot even tie costs of a vote back to the size of the shareholder base. The total of shares owned by total shareholder count for a given vote—which forms the basis for the bills a company must pay—is often inconsistent with total shares outstanding. Companies that attempt to reconcile bills “often give up in frustration.” [14] The result is a lack of cost discipline even for companies that overcome the collective action disincentives sketched in Part 1.

f. Summary of problems with the current system

In sum, systematic and sometimes high-profile flaws in the current proxy system undermine confidence in the system generally. No one is satisfied with the current system. Shareholders cannot determine if their votes were cast as they intended; issuers cannot rapidly determine the outcome of close votes; and the legitimacy of corporate elections, which depend on accurate, reliable, and transparent vote counts, has been called into doubt. Research has clearly established that investor confidence affects the cost of capital, [15] so (while difficult to quantify precisely) the current proxy system almost certainly increases the difficulty of capital formation.

3. Technologies, incentives and the possibility of comprehensive reform

Many observers of the proxy system see a potential path toward comprehensive reform in the form of improved technologies. Distributed ledger technology (commonly called “blockchain”), for example, in principle offers a way to create a unified platform outside a given institution and make it available on a secure, “non-censorable” basis to all participants in the proxy system. [16]A blockchain system could be “permissioned,” meaning that it would not be open to anyone, but could be continuously updated by any person who had obtained requisite access. Other countries—such as Spain, South Africa and Estonia—have moved to simple and apparently effective systems for tracking ownership and voting of shares. [17]

It should be noted, however, that the basic technologies necessary for tracking shares and votes—essentially a spreadsheet plus electronic communication—have been available for decades. A simple central book-entry ledger could (technologically) have been implemented long ago, as it has been in Spain. Blockchain or other more complex technologies are not necessary components of a simpler, more effective system. Sometimes it is thought that such a system would destroy the ability of investors to preserve their privacy, as the simplest such centralized system would list all beneficial owners in a form available to companies and to others conducting proxy solicitations. However, privacy could be maintained through nominee accounts, without imposing the same many-layered ownership and voting stacks in the current U.S. system.

Rather than technological impediments, it is incentives and private interests (as affected by existing regulation), coupled with the externalities of networks, which have prevented moving the U.S. proxy system onto a single, reformed technological platform. Indeed, companies are currently permitted by both state and federal law to voluntarily opt into a single standard model for tracking their share ownership and/or the voting of shares, including the use of blockchain in either task. At least one company has reportedly used blockchain for voting at an annual meeting. [18] Yet most companies have not done so, despite the technology having long been available, presumably because the company-specific costs and challenges associated with departing from customary ownership practices in the context of a public offering are not viewed as worth their benefits, particularly as ownership and control of most newly public companies remain concentrated for some time after the public offering, making accurate voting results less important at that stage of a company’s lifecycle.

Technology-based solutions could be mandated by the SEC, although some would argue that would require Congressional authorization. Ordinarily, a government mandated system might generate the risk that it would freeze into place a system that would not remain optimal over time. In the case of ownership and voting, however, the proven capacity of current technologies to function at low cost in other countries, and—as complex as the system currently is—the straightforward capabilities that such a system would require, together suggest that that risk would not be as great as it ordinarily would be. Moreover, the current system exhibits attributes of a natural monopoly, [19] built in part on the service-cost reimbursement rules put into place by the SEC. In some ways, the current system combines the worst attributes of a government-sponsored near-monopoly (inertia, poor incentives, lack of competitive market pricing) with the worst attributes of a disaggregated non-centralized market (confusion, duplication, complexity, errors). It is not clear that a government-sponsored centralized system (whether or not using blockchain) would do any worse for investors and companies.

Recognizing that wholesale reform and government-sponsored technological solutions may not be feasible, the SEC nevertheless could continue to review its own rules and practices (as well as those of the stock exchanges) to ensure that they are not impeding technological improvements or creating unnecessary barriers to competitive entry. Those rules include those requiring companies to reimburse DTC and intermediaries for their costs in carrying out their roles in the proxy system, [20] which may reduce the incentive of the companies entitled to reimbursements to invest in or find ways to invest in improving the system or to cut costs. [21] “Maximum” rates in legally mandated schedules—such as those imposed by the NYSE for reimbursement of costs in delivering proxy materials—in practice have often turned into effective minimums, creating a stable stream of payments that intermediaries may be reluctant to displace, even when doing so would benefit investors and companies alike. [22] In the longer term, perhaps a technology platform will be developed that will be sufficiently attractive and cost-effective that companies will begin to opt into using it.

4. Specific recommendations: confirmations, reconciliations, studies, universal proxy

Unless and until a more comprehensive reform of the proxy system is developed, there a number of short-term improvements that we would recommend to the SEC. Four specific recommendations include (a) end-to-end confirmation, (b) enforcement of a duty to cooperate in more routine, off-cycle reconciliations, (c) studies of investor beliefs and preferences regarding anonymity and of share lending, and (d) a relaxation of current regulations that inhibit or bar private market use of universal

a. End-to-end vote confirmations

As discussed above, investors currently are unable to determine whether their voting instructions for shares they own are carried out and counted in company votes. Partly this is because neither companies nor intermediaries have any obligation to provide that information, and partly because it is not in the interests of others involved in the proxy system to do so. Without that information, investors are often unaware of the problems with the proxy system overall. Even if they are generally aware, they are not specifically aware that intermediaries on whom they rely have acted in ways that result in their voting instructions not being carried out.

To remedy this situation, the SEC should require confirmations be sent to end-users, i.e., individuals or institutions with final voting authority over a given share. The confirmations should indicate that proxies and/or voting instructions have been received and implemented as directed, or if not, the reason that those instructions or proxies have not been implemented as directed. Information of this kind would increase confidence in the proxy system and provide incentives for those involved to eliminate routine problems that prevent proxies or voting instructions from being implemented as shareholders direct. Inquiries from investors when instructions are not implemented will organically generate root-causes analyses of the reasons for that failure. Those analyses will provide the foundation for a continuous cycle of system improvements over time.

End-to-end confirmations could take any reasonable form, including electronic delivery for shareholders who do not opt for written confirmations, and/or could combined with other types of shareholder communications to reduce the marginal costs of the confirmations. [23] Confirmations could take place through the system developed already and in place by Broadridge, for those investors who invest through intermediaries. For investors holding directly with a company, it would be relatively simple for transfer agents to provide that information.

In the first instance, costs and responsibility for confirmations should fall on companies. [54] However, in recognition of the fact that they do not have the ability to directly communicate with end investors (due to NOBO rules), those costs should shift to intermediaries who are unable or unwilling to provide investor identification to companies. This would place costs on those best able to minimize them, and modestly reduce incentives to maintain layers of ownership. Intermediaries would have an affirmative reason to persuade “objecting” clients to become NOBOs, permitting companies to communicate directly with the investors. Intermediaries would more saliently need to explain to clients the fact that share lending, when it occurs, results in transfer of voting power to borrowers and accordingly results in loss of voting power by lenders.

In estimating aggregate marginal costs of end-to-end confirmations, it should be recognized that companies and intermediaries already have to have ways of actually paying end-users cash in the form of dividends and in merger and acquisition transactions, as well as to provide routine SEC-mandated annual and quarterly reports, and to facilitate proxy solicitations. And, as noted, Broadridge already has in place an electronic system for providing confirmations to those using Broadridge’s ProxyEdge services, including the vast majority of shares held through intermediaries. End-to-end confirmations are thus technologically feasible under the current proxy system. The content of the confirmations itself would be minimal. If concerns about the increase in marginal costs remain serious despite these considerations, the SEC could conduct a pilot with the largest companies before extending confirmations to other companies.

We note that substantial support for confirmations has been expressed by the most important participants in the proxy process. These include members of an “end-to-end vote confirmation working group” that included transfer agents (e.g., American Stock Transfer and Trust Company, Computershare), custodians (e.g., Bank of New York Mellon, Northern Trust), proxy servicers (e.g., Broadridge), fund advisors (e.g., Capital Management and Research Co.), brokers (Securities Industry and Financial Markets Association (SIFMA)), and companies (e.g., Society for Corporate Governance). Given this broad consensus, we believe the SEC should move expeditiously to make end-to-end confirmation a reality.

b. Duty to cooperate in regular reconciliations

As discussed above, errors and mismatches in vote-relevant information are routine in the current system. Existing system participants have obligations under various laws to maintain accurate books and records, which would encompass ownership and vote-relevant information necessary to make the current system work. For example, transfer agents are required by SEC rule to cooperate with each other to resolve record ownership differences. [24]

However, the strength and content of these obligations vary, and they are often un- or under-enforced. Efforts to reconcile records across organizations are often undertaken only in the heat of a proxy contest where allocation of voting entitlements could affect outcomes, raising the stakes for close examination of every proxy, VIF, and ownership chain. Yet such settings are time-pressured and not the best settings for careful consideration of records and potential mismatches or errors, and their root causes.

To improve the resiliency of the proxy system, the SEC should require every participant in the proxy system to cooperate with the others to reconcile ownership and voting information on a regular basis, both during and outside the context of specific votes. This requirement would track the existing requirement applied to transfer agents, but would be extended to custodians, banks, brokers, proxy servicers and proxy advisors.

The SEC’s enforcement or inspection staffs would then enforce this obligation. While off-cycle reconciliations of this kind will not be a panacea, and new errors and mismatches may arise during actual votes, a regular and routine sequence of reconciliations will contribute to overall system improvements. Costs associated with these reconciliations would fall over time, as the process becomes routinized.

c. Studies of investor views on anonymity and of share lending

Both at the SEC Roundtable and the IAC panel discussion, witnesses provided varying information about both investor views on anonymity and on share lending. The proxy system’s current complexity, and some of its problems, stem from the way in which investor identity is kept from companies, and from share lending and its effect on vote entitlements. We believe the SEC should explore these topics in more depth. (We recommend the SEC and its staff cooperate with academics and other researchers in studying such issues as well.) Specifically, we recommend that the SEC staff carry out two studies, prioritized in the following order.

First, the staff should study the reasons for and the extent to which customers of intermediaries actually want to remain anonymous (i.e., to not be “NOBOs” [25]) to the companies in which they own stock. The study should begin by obtaining actual customer or client contracts from representative samples of both institutional and individual investors, including for both types those holding directly through a transfer agent and those holding through an intermediary in the “Street” system. A review of those contracts could determine the extent to which the nominal default rule—by which broker customers are treated as NOBOs unless they object—has been “flipped” in broker contracts. The study would then consist of a survey of investors (in the same or similar samples) to determine (a) whether such “flips” were done without actual (as opposed to constructive) customer knowledge and (b) the extent to which investors actually want to remain anonymous, and why, including whether reasons identified by investors are consistent with law and practice (i.e., is the expectation of anonymity matched in reality). One goal of the study is to whether investor “choice” to be anonymous is due to confusion or incentives of intermediaries. Another is to learn whether investors understand the effects of their contracts on the ability of issuers to communicate directly with investors. This study could then inform further monitoring or rulemaking for OBOs/NOBOs, voting, and shareholder communications generally.

Second, the staff should study the extent to which share lending in fact contributes to errors, over-votes or under-votes, and whether the effect of share lending on voting entitlements is effectively disclosed to investors. Again, this may involve obtaining contracts authorizing share lending, reviewing their contents, and surveying a variety of investors about their understanding of those contracts and how they affect voting entitlements. This study should also examine specific examples of how companies with significant amounts of shares on loan have the associated votes processed and counted, and how those involved verify that the shares lent are not voted twice or not at all due to the share loan arrangements. The study should also survey investors to determine whether shares on loan are consistently recalled for votes, and the costs and benefits of an obligation for fiduciaries to do so as a matter of policy. The study could inform further monitoring or rulemaking for obligations of intermediaries regarding voting in the context of share lending.

d. Universal proxy or ballots

A last recommendation relates to current rule impediments to use of a so-called “universal proxy” or “universal ballots.” [55] The IAC in 2013 recommended the SEC move forward on in this concept, [26] and numerous investor groups have endorsed the concept as well. [27] Other countries—for example, Switzerland—have now used universal ballots for years with no significant problems.

As reflected in the SEC’s 2016 proposal, universal ballots would only be used when there is an election that is contested in some way between an issuer and a dissident, so that (currently) there are two streams of competing proxy ballots, and would not be used for investment companies, which have distinct governance structures and shareholder voting practices. When used, universal ballots would reduce the confusion, costs and burden on investor-voters associated with the current system, which typically involves delivery of multiple (often duplicative) proxies throughout a contest. The current system also requires careful attention by the tabulator and others involved to make sure that the “last” submitted proxy with respect to a given share is identified and counted as the valid vote. The current two-stream system imposes significant costs on issuers (and thus investors) and dissidents. The problems with the current system are not entirely due to dual streams of proxies in contests, but they are magnified and more challenging as a result of the dual streams. A universal ballot could help “clear the pipes” in a system that is significantly clogged in the best of situations. Some opposition was voiced when the SEC made a specific proposal for universal proxies in 2016, particularly from companies and trade groups representing companies, who were concerned that a universal proxy might increase proxy contests by favoring dissidents over incumbents. [28] However, it was apparent at the IAC’s panel discussion of the proxy system in September 2018 that opposition by companies has diminished significantly, in part because of evidence that a universal proxy would not in fact favor dissidents over incumbents. [29] Opposition now is confined to specific elements of the SEC’s 2016 proposal, or the need for clarifications, [30] which we believe can be addressed in a revised rule.

For example, a rule needs to address what percentage of shareholders dissidents should be required to solicit to be able to use universal proxy. The SEC’s 2016 proposal was for this requirement to be 50%; this could be raised (e.g., to 67%) to address concerns that dissidents would not try to leave out many investors.

Sometimes objections to universal proxies are framed as arguments that dissidents should be on a “level playing field” with companies. But in evaluating such arguments, it should be recognized that those soliciting on behalf of an incumbent board of directors can routinely expect to be reimbursed by the company for their costs under state law, whereas dissidents are only reimbursed if they win or otherwise reach a settlement with the company.[31]

Another objection is that some incumbents might refuse to serve if elected to split slate, which could result from a universal ballot. But there is a simple way to address this concern, by requiring disclosure of that fact if known to those issuing the universal proxy. It should be noted, too, that there is always a risk that a director may choose not to continue on a board in response to changes in board or manager composition or for any reason, so shareholders are always exposed to this kind of governance risk.

Annex A. Overview of U.S. Proxy System

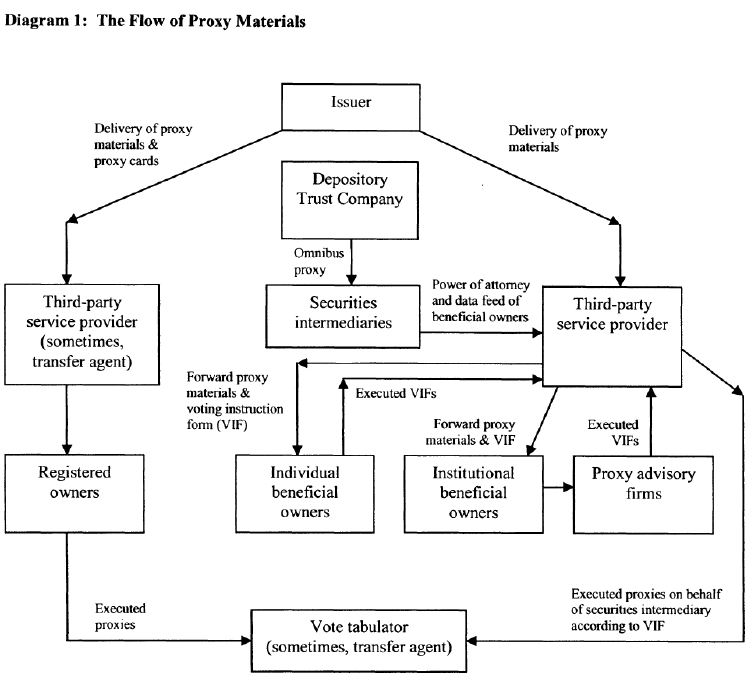

The following description unpacks the simplified version of the actual proxy system depicted in Diagram 1, from the SEC’s 2010 Concept Release on the U.S. Proxy System. [32]

Public companies by definition have dispersed, numerous, ever-changing owners (shareholders). Even if the proxy system simply had to elicit votes from shareholders of a company, it would still face challenges.

Owners entitled to vote on a given question at a given day in time (a “record date”) would need to be determined, and the votes would need to be counted. Traditionally, companies have relied on third parties called “inspectors” or “tabulators” to carry out the basic task of determining voting entitlements, and counting votes. [33]

Most companies continue to hold votes at physical in-person annual or special shareholder meetings. [34] Yet most shareholders are unwilling or unable to attend meetings. Shareholders give agents—“proxies”—power to vote for them at the meeting. They manifest proxy appointments with “proxy cards”. Stock exchanges require companies to solicit proxies, [35] and SEC rules require proxy solicitations to be preceded or accompanied by proxy statements and other proxy materials. To obtain proxies, and to comply with quorum requirements that effectively impose minimum “get out the vote” efforts, companies employ proxy solicitors who advise companies, communicate with shareholders, and liaise with other third parties involved in the system (such as Broadridge and proxy advisory firms, whose roles are summarized below).

Most votes are about board elections, and as noted above, most board elections are not contested. For most votes, one and only one person seeks to be a proxy for shareholders—the issuer itself, acting under authority of its board through its officers and agents. For most votes on board elections, one proxy solicitor seeks proxies for the issuer, a few shareholders show up at the meeting in person and vote by “ballot,” and the issuer votes as proxy for most shareholders. Outcomes are known in advance (proxies are provided over time, in advance of the meeting) and are usually not controversial. In such cases, substantial inaccuracies may (and based on other cases, are likely to) exist in such votes, without being detected. [36]

But sometimes a proxy contest emerges, with more than one person seeking proxies to elect directors. [37] Issuers must also provide ways for shareholders to direct proxies on issue votes (such as mergers and shareholder resolutions), which can be contested and close even if no person other than the issuer solicits proxies. Finally, many public companies have adopted “majority voting” bylaws that require directors to obtain a majority of votes cast to be validly elected, which can make accurate vote counts important even without a proxy contest.

Nearly all routine proxies are revocable, and are revoked by the grant of a later proxy—effectively the proxy granted last in time governs. The result often results in disputes over the validity and sequence of proxies granted over the same shares. Proxies can be provided by mail, by phone, or electronically. [38] To insure that the last-in-time proxy is identified for each holder, proxies provided through each channel must all be reviewed and compared before the final set of votes can be certified.

More complexity in the proxy system arises from ownership intermediation (“securities intermediaries” in Diagram 1). Historically, companies directly issued shares in the form of “certificates” to investors, and hired “transfer agents” [39] to keep lists of “record shareholders” entitled to vote (and to dividends and other shareholder rights) as a matter of state law. [40] Some transfer agents outsource voting-related functions to sub-agents. [41] Even today, many companies have many shares held directly by individuals and institutions. For those shareholders, proxy materials are provided by issuers through service providers (sometimes transfer agents), and proxies are provided to tabulators (sometimes through transfer agents or sub-agents).

However, once a company sells shares in a public offering, shares trade on secondary markets such as stock exchanges. Brokers facilitate trade, holding shares on behalf of their customer-clients, and dealers hold shares directly. Trading between broker-dealers dominates trading for most public companies. Banks also hold shares in trust for others, and act as custodians for others, safekeeping shares for individuals, broker-dealers, other banks, and other institutions. As a result, at any given moment, the “beneficial owners” with ultimate authority to vote a given share of stock are usually not the same as the record shareholder listed on the masterfile of an issuer or its transfer agent. [42]

Beneficial-owners can in principle elect to be identified to companies—they choose to be “non-objecting beneficial owners” or “NOBOs”—and in fact SEC Rule 14a-13 establish a “default” that customers will be deemed to be NOBOs unless they “opt out” of identification. However, intermediaries have an interest in keeping their customer identities private, and commonly provide in standard contracts that a customer will be deemed to object to identification unless a customer specifically chooses otherwise. [43] Some individuals may also be under the impression that electing to be NOBO will reduce the amount of communications they receive during a vote, or will protect their anonymity generally as an investor, and some intermediaries do not adequately train their staff on these questions. [44] Effectively, contract practices have overridden the SEC default on customer identification. As a result, companies can only communicate with their investors through intermediaries, and cannot use (for example) direct telephonic or electronic communications to reach a large percentage (roughly 25%) of their retail investors, and most of their institutional investors. [45] (It should be noted that the NOBO system is not required to preserve investor anonymity from companies—that could be accomplished with a nominee system, in which an institution agreed to hold on behalf of an anonymous investor, but the nominee would be fully disclosed and could be directly communicated to by companies and others soliciting proxies.)

To reduce the costs of paper trades, broker-dealers and banks formed a collectively owned entity called Cede & Co. (also known as the Depositary Trust Company or DTC, later organized as the Depositary Trust and Clearing Corporation, or DTCC) to hold shares on their behalf. When members of DTC trade among themselves, DTC did not need to move physical share certificates to complete the transfer. Instead, it “immobilized” share certificates and made “book entries” in its own records to reflect ownership. Because most broker-dealers including those based on Wall Street are members of DTC, shares owned through DTC are called “Street” shares. Currently, the vast majority of all shares of public companies are Street shares.

DTC reduced the complexity and costs of recording transfers of stock ownership, but added complexity to the proxy system. That is because, for voting purposes, under state law, DTC is the record owner formally entitled to vote, for shares held by the vast majority of broker-dealers and banks today. [46] As a result, DTC must obtain or facilitate the provision of voting instructions for “omnibus” proxies that it formally appoints on behalf of its members. Those members, in turn, must provide and then obtain voting instruction forms or VIFs [47] for shares they hold on behalf of customer-clients, in part because stock exchange rules limit the ability of broker-dealers to vote shares for customers without instructions. [48] Before doing so, they transmit proxy materials, [49] which they must obtain from the issuer, and which issuers are require to facilitate under SEC Rule 14a-13. [50] Delivery of proxy materials and VIFs is now typically done through a separate service provider, as described more below.

For most shares, then ownership determines a voting “stack” with at least three layers:

- One or more actual beneficial owners, who may be an individual or institution,

- A broker-dealer or bank, who holds on behalf of beneficial owners, and

- DTC.

For most shares, the stack is more complex, and has grown more so over time. Broker-dealers outsource their custodial roles to banks. Custodians outsource some or all of their roles to specialized sub-custodians. The person with ultimate power to vote a given share under state law may be an individual who is a trustee of a trust at a bank, or a pension or mutual fund. Trusts and funds may own stock through a broker-dealer and held at a custodian or sub-custodian. For many shares, the “stack” can consist of up to five or more layers.

In addition, a given DTC member may separately own shares held not by it at DTC but by third parties, such as custodians, whose shares may be separately included in their own DTC participant accounts. A DTC member may also separately own shares that are directly registered with the issuer. So for any given intermediary, multiple channels of communication and ownership must be tracked and used for a given vote. Opportunities for confusion and record-keeping errors have increased over time.

Proxies and VIFs and related share ownership information need to be reconciled up and down a stack for each vote, to insure the proper number of shares are voted for and by the correct person with voting power over the shares, and that the aggregate votes are tallied correctly. As part of this process, DTC is required to provide upon request by a company a “securities position listing” that identifies its participants (i.e., brokers and banks) having a position in the company’s stock and the number of shares held by each participant. [51]

The DTC listing can then be used to allocate among DTC participants the votes for the shares they hold on their behalf, which are then reflected in an “omnibus proxy” delivered by DTC to others involved in the process. DTC participants reconcile the numbers on the DTC listing with their own records, and then they engage in a similar process to determine and allocate voting entitlements and provide and then receive back VIFs among their customers. Their customers may be themselves intermediaries who hold on behalf of others, requiring yet another allocation and communication.

At each step up and down a stack, mismatches or other errors can occur in the information about who owns shares, and how many shares, and how the shares should be voted. Some institutions believe that they own shares through DTC that they actually own in certificated form, outside DTC. Other institutions believe they own shares that they have in fact lent out or sold. Other institutions have incorrectly reflected ownership data for their customers. Mismatches can be due to recordkeeping errors as simple as the inclusion of a comma in a legal name, or the failure to update a legal name change. When mismatches or other errors in share-related information occurs, otherwise valid proxies may be disqualified by tabulators or others on the stack, or they may not be noticed, permitting erroneous votes to be counted. In addition, multiple VIFs may be submitted with respect to the same shares, either because a person with power to vote changed their mind, or through error, or because more than one person believed they were entitled to vote the same shares.

For Street shares, two more types of service providers emerged to play major roles in the proxy system: proxy advisors and proxy servicers. Proxy advisors such as ISS and Glass-Lewis, which primarily provide advice on how institutions should vote their shares, also play a direct role in the proxy system by obtaining and processing VIFs on behalf of institutional clients, such as pension funds.

Broadridge functions as the leading “proxy servicer” by distributing proxy materials and VIFs up and down a stack. For most intermediaries, this is done based on an electronic feed listing beneficial owners and shares owned, provided to and from Broadridge, and Broadridge takes on the communication obligations of the broker or bank, described above. Broadridge reports processing proxies for more than 80% of all U.S. equities in 2018 and more than 90% of stocks held by DTC members. Broadridge maintains an electronic proxy delivery and voting system (ProxyEdge) for institutional investors and financial advisors. Although Broadridge is not directly regulated as a proxy servicer, its role in the proxy system is subject to SEC oversight because it acts as an agent for brokers, which are supervised by the SEC.

Final elements of the proxy system arise from the business models of broker-dealers and banks, who hold shares for customers. Broker-dealers and banks commonly have the contract right to lend shares to third parties, including to facilitate short sales. For voting purposes, if a share loan is outstanding on a record date, it is the borrower that has voting power. Broker-dealers do not always inform their customers about the fact of specific share loans, or their effect on vote entitlements. As with DTC, broker-dealers commonly hold shares in fungible bulk, without specific attribution of shares at a given moment in time to specific clients. [52] “The anonymity, complexity, and uncertainty created by the indirect holding system is aggravated by share lending and the related practice of short selling.” [53] In addition, share trades fail. As a result of share lending, inaccurate records, and trade fails, on a given record date, more than one person may believe themselves to have ownership and voting power over the same share, resulting in attempted over-votes, and some shareholders may not be aware that they have vote entitlements, resulting in under-votes. When discovered over-votes can also result in under-votes, if inspectors or tabulators disqualify all votes associated with the mismatched votes and vote entitlements.

Endnotes

1These same goals are reflected in the Commission’s Concept Release on the U.S. Proxy System, Rel. 34-62495; IA-3052; IC-29340; File No. S7-14-10 (2010), available at https://www.sec.gov/rules/concept/2010/34-62495.pdf. (go back)

2Shareholders vote to elect directors, to approve mergers and other unusual transactions, and on shareholder resolutions. Most resolutions are non-binding, where vote accuracy is arguably less important than in binding votes. But votes on non-binding resolutions are important forms of information about shareholder preferences and beliefs that have effects on board and manager decision-making, and the fact that even a formally non-binding resolution is approved by a majority of investors currently forms the basis of governance responses by boards and investors. (go back)

3Vote counts convey information as well as determine corporate law outcomes, and so there is a continued value in accurate and timely counts even when it is clear that an outcome will not be directly affected by how accurate the count is, over some plausible range.(go back)

4SEC Concept Release, note 1 above, at note 9.(go back)

5E.g., SEC, Roundtable on the Proxy Process (Nov. 15, 2018) at 20 (Commissioner Roisman noting “If the process were perfect, we wouldn’t be here today.”), 22 (Corporate Finance Director Hinman stating “Many say the confirmation of whether investors’ shares are accurately voted in accordance with their wishes continues to be more difficult than it need be.”), 32 (SEC Chief of Office of M&A Ted Yu noting “Recently the Securities Transfer Association estimated that out of approximately 183 meetings that its members tabulated this past year, about 130 or so had suspected overvoting.”), 33-35 (Katie Sevcik, CEO of EQ, testifying that overvotes occur, including for one meeting alone at least ten broker overvotes, each in the millions of shares, and that some individuals involved initially downplay their significance and seek to ignore them), 37 (SEC Corporate Finance staff person stating “our view at this point is that it is time for a fundamental rethink”), 43 (Bob Schiffelite, CEO of Broadridge, testifying that “we’re all in violent agreement that we should have vote confirmations,” which are not currently required), 44-46 (Paul Conn, CEO of Computershare, testifying “in terms of vote confirmation, we as a major transfer agent in this country, and the largest in the world, are in violent agreement” that there should be a new requirement and noting that “if there are shares in a customer account that are used to cover a short position in a brokerage position … that person today doesn’t even know that their shares are not really sitting behind what’s in their account.”).(go back)

6IAC Meeting (Sep. 13, 2018), agenda at https://www.sec.gov/spotlight/investor-advisory-committee-2012/iac091318-agenda.htm. At that meeting, the IAC heard from representatives of institutional investors (Ken Bertsch of the Council of Institutional Investors, testifying that “The current system of proxy voting is fraught with inefficiencies and a too-large margin for error.”); proxy solicitors (Arthur Crozier of Innisfree M&A testifying that “A significant problem at Procter & Gamble and other proxy fights is the invalidation of otherwise valid votes due to breaks in the custodial chain of voting authority.”), companies (Deborah P. Majoras, general counsel of Procter & Gamble, testifying “For those shareholders who vote by proxy card, the card has multiple opportunities to be disqualified, particularly when names or titles are slightly mismatched or shares are held in trust accounts. We have many examples of errors made and proxies disqualified. For beneficial owners, it is even uncertain whether their votes will actually be executed, because those votes must be filtered through brokers or other custodians, and there is much room for error.”), and a stock exchange (John Zecca, Senior Vice President of Nasdaq, testifying “we face the same frustrations as our listed company clients with the inefficiencies and needless expenses of the current proxy system.”).(go back)

7In re Appraisal of Dell Inc. (Case No. 9322) (May 22, 2016). The specific issue was whether T. Rowe had successfully voted against the buyout, giving it appraisal rights.(go back)

8“Three Proxy Votes That Went Bad,” By Vito J. Racanelli, Barron’s, July 6, 2018, https://www.barrons.com/articles/three-proxy-votes-that-went-bad-1530924007.(go back)

9“New Yahoo election tally reveals big protest vote,” Eric Auchard, Reuters, August 5, 2008, https://www.reuters.com/article/uk-yahoo-idUKN0134256120080806.(go back)

10“Three Proxy Votes That Went Bad,” By Vito J. Racanelli, Barron’s, July 6, 2018, https://www.barrons.com/articles/three-proxy-votes-that-went-bad-1530924007.(go back)

11On “fungible bulk,” see note 41 in Annex A.(go back)

12“With Fewer Nasty Battles, One Firm Profits Less,” Lynnley Browning, The New York Times, 9/29/2010, https://deabook.nytimes.com/2010/09/29/with-fewer-nasty-battles-one-firm-profits-less/. In that contested vote, the result was ultimately not close, but the process took significant time, due in part to shareholders having submitted multiple undated proxies and to litigation unrelated to the vote itself.(go back)

13See Annex A, page 10, for a discussion of NOBOs.(go back)

14See testimony of John Zecca before the IAC, available at https://www.sec.gov/spotlight/investor-advisory-committee-2012/iac091318-john-zecca-nasdaq-opening-statement.pdf. To be clear, proxy solicitation costs are more related to numbers of shareholder accounts and to types of shareholders than to numbers of shares outstanding; nonetheless, shares outstanding should in principle equal shares voting plus shares not voting.(go back)

15See, e.g., Giannetti, M., and T. Y. Wang. 2016. Corporate scandals and household stock market participation. Journal of Finance 71(6): 2591-2636; Guiso, L., P. Sapienza, and L. Zingales. 2008. Trusting the stock market. Journal of Finance 63 (6): 2557–2600; Jain, P., and Z. Rezaee. 2006. The Sarbanes-Oxley Act of 2002 and capital-market behavior: Early evidence. Contemporary Accounting Research 23: 629–654. Bonaccorsi di Patti. 2009. Weak Institutions and Credit Availability. Banca d’Italia Occasional Papers No. 52.(go back)

16On blockchain generally, see materials submitted at the IAC meeting on Oct. 12, 2017.(go back)

17On Spain, see Marcel Kahan and Ed Rock, The Hanging Chads of Corporate Voting, 96 Geo. L.J. 1277 (2008); on South Africa and Estonia, see testimony of John Zecca, SVP of Nasdaq, at the SEC Roundtable on the Proxy Process (Nov. 15, 2018), at 99-100, available at https://www.sec.gov/files/proxy-round-table-transcript-111518.pdf.(go back)

18See statement of Bill Hinman at the SEC Roundtable on the Proxy Process (Nov. 15, 2018), at 23, available at https://www.sec.gov/files/proxy-round-table-transcript-111518.pdf.(go back)

19These attributes generally include high fixed costs and economies of scale. See Paul Joskow, Regulation of Natural Monopoly, in Handbook of Law and Economics.(go back)

20See notes 42-45 in Annex A.(go back)

21Joskow, supra note 19, at 1304 (“cost of service recovery mechanism does not provide any incentives for the management to exert effort”).(go back)

22For this reason, ordinarily, maximum price schedules agreed by competitors directly, or through a trade association, would be illegal under antitrust law. This may seem counterintuitive, since it would seem at first that a maximum price would protect consumers. However, “[t]here are several reasons why maximum price fixing is deemed per se illegal. First, an agreement to a maximum price could really be a target price for a minimum, in which case it likely raises prices. Second, even if a maximum price really does reduce prices, subcompetitive prices are bad for consumers because they lead to subcompetitive levels of output or quality. In other words, consumers would be willing to pay more for the competitive level of output and quality. Thus, pricing above or below competitive levels leads to deadweight loss and harm to consumer welfare. Third, maximum price-fixing that really lowered prices would reduce entry into the … market ….” Einer Elhauge, U.S. Antitrust Law & Economics 83-84 (3d ed. 2018).(go back)

23To be clear, the confirmations would not be a public disclosure—such as in an 8-K—but directly to an investor.(go back)

24See note 38 below.(go back)

25See Annex A for an explanation of this and other specialized jargon used in this recommendation.(go back)

26See IAC Recommendation, available at https://www.sec.gov/spotlight/investor-advisory-committee-2012/universal-proxy-recommendation-072613.pdf.(go back)

27E.g., https://www.cii.org/cii_universal_proxy; see also testimony at the SEC Roundtable on the Proxy Process (Nov. 15, 2018).(go back)

28SEC Release No. 34-79164; IC-32339; File No. S7-24-16, available at https://www.sec.gov/rules/proposed/2016/34-79164.pdf; see comments on that proposal here: https://www.sec.gov/comments/s7-24-16/s72416.htm.(go back)

29Scott Hirst, Universal Proxies, 35 Yale J. on Reg. (2018), available at: digitalcommons.law.yale.edu/yjreg/vol35/iss2/3. On the willingness of companies to view universal proxies more favorably, see, e.g., Mackenzie Partners, The Universal Proxy Gains Traction, http://www.mackenziepartners.com/UniversalProxyWhitePaper.pdf.(go back)

30Any(go back)

31Lucian Arye Bebchuk & Marcel Kahan, A Framework for Analyzing Legal Policy Towards Proxy Contests, 78 Cal. L. Rev. 1073 (1990).(go back)

32SEC, Concept Release on the U.S. Proxy System, Rel. 34-62495; IA-3052; IC-29340; File No. S7-14-10 (2010), available at https://www.sec.gov/rules/concept/2010/34-62495.pdf.(go back)

33Tabulators or inspectors are required by state corporate law. See, e.g., Del. Gen. Corp. L. section 231. Many tabulators are also transfer agents, discussed below.(go back)

34Shareholders can also act by “written consent” under some state corporate laws and company charters, but all Delaware companies must have annual shareholder meetings. Meetings can be held “virtually” (i.e., electronically), but few companies do so.(go back)

35NYSE Listed Company Manual 402.04. This is justified by the NYSE as a convenience for shareholders. Id.(go back)

36As an example, an error in vote entitlements for an institutional shareholder of Procter & Gamble went undetected by the shareholder for ten years before it was discovered during the course of the Trian proxy fight in 2017. See SEC Roundtable on the Proxy Process (Nov. 15, 2018), at 65 (testimony of Brian L. Schorr, Chief Legal Officer and Partner, Trian Fund Management, L.P.). For evidence of other known errors, see testimony at SEC, Roundtable on the Proxy Process (Nov. 15, 2018), available at https://www.sec.gov/files/proxy-round-table-transcript-111518.pdf.(go back)

37Roughly 50 to 60 companies face contests each year, involving more than 100 board seats. See Lazard’s Quarterly Review of Shareholder Activism, available at https://www.lazard.com/perspective/.(go back)

38The same is true of VIFs, discussed below.(go back)

39Transfer agents are governed by SEC Rules 17Ad-6, 17Ad-7, 17Ad-9, 17Ad-10, and 17Ad-11. Those rules require agents to maintain records for the issuer, including official records of ownership (the “masterfile”) and securities issued and outstanding (the “control book” or “registrar”). The SEC issued a Concept Release on Transfer Agent Regulations in 2015, see https://www.sec.gov/rules/concept/2015/34-76743.pdf, but has not updated its transfer agent rules since 1977.(go back)

40Companies are still generally required to do this under state corporate law. See Del. Gen. Corp. L. § 219(a). But because of the movement of shares to “Street” ownership, discussed below, this requirement is more formal than practical.(go back)

41Current SEC rules governing transfer agents do not specifically address voting or proxies, although their requirements could come into play insofar as inaccurate ownership records might affect determination of voting entitlements. For example, transfer agents are required to (a) pay “diligent and continuous attention” to resolve “record differences,” i.e., discrepancies between stockholder files and control books, or in certificate detail between master files and transferred certificates, (b) report to issuers and agencies any record differences unresolved after 30 days, and (c) cooperate with other transfer agents. See rules cited in note 37 above.(go back)

42 Still more intermediation occurs through investment companies, such as mutual funds and hedge funds. Those funds pool cash from dispersed individuals and institutions and invest on their behalf. As a matter of law, such funds retain voting rights for the shares they purchase on behalf of their own investors, and so do not directly complicate the proxy system. The economics of fund investing are such, however, that mutual funds and hedge funds do contribute the proxy system’s complexity indirectly, by outsourcing voting-related functions to third parties, such as proxy advisors.(go back)

43See testimony of Alexander Lebow, Co-Founder and Chief Legal Officer, A Say Inc., at the SEC Roundtable on the Proxy Process (Nov. 15, 2018), at 86, available at https://www.sec.gov/files/proxy-round-table-transcript-111518.pdf; testimony of Katie Sevcik, Executive Vice President and Chief Operating Officer, EQ, id., at 89 (“ten years ago—there was an effort by intermediaries, brokers and banks and issuers, and looking at the contacts. So I know there were comments made that in some cases, the default was to OBO”).(go back)

44Being an “objecting” beneficial owner or “OBO” will not in fact protect the anonymity of an investor if a court or enforcement authority seeks their identity for (for example) tax enforcement or insider trading investigations. On training of intermediary staff, see testimony of Bruce H. Goldfarb, Founder, President and Chief Executive Officer, Okapi Partners at the SEC Roundtable on the Proxy Process (Nov. 15, 2018), at 76, available at https://www.sec.gov/files/proxy-round-table-transcript-111518.pdf.(go back)

45See Katten Law, Frequently Asked Questions Regarding the SEC’s NOBO-OBO Rules and Companies’ Ability to Communicate with Retail Shareholders, available at https://www.kattenlaw.com/nobo.(go back)

46DTC holds deposited securities in “fungible bulk.” No specifically identifiable shares are directly owned by DTC-member banks and brokers. Rather, each member owns a pro rata interest in the aggregate number of shares of a particular issuer held at DTC, and each customer of a DTC member bank or broker—such as a mutual fund or individual—owns a pro rata interest in the shares in which the DTC member has an interest. The fact that shares are held in fungible bulk is a major source of operational risk in voting.(go back)

47 In principle, proxies can allow the power to vote to move up or down a stack, so customers of intermediaries could obtain a proxy from the intermediary over the shares they own and attend the shareholder meeting in person, but this rarely occurs.(go back)

48See NYSE Rule 452.(go back)

49This is required by NYSE Rule 451 and by SEC Rule 14b-1 and 14b-2. Those rules permit issuers to directly transmit proxy materials to beneficial owners who do not object to having their identities provided to issuers, subject to obtaining a commitment from the issuer to reimburse the intermediaries for their “reasonable expenses” in complying with the rule.(go back)

50SEC Rule 14a-13 requires issuers to notify record holders in advance of a vote, a “search card,” which inquires whether the record holders hold on behalf of others, and the number of sets of proxy materials and VIFs needed to allow record holders to pass those along to their customers. (DTC and other clearing organizations are explicitly addressed in the rule, which requires issuers to effectively communicate with both DTC and its members in complying with the rule.) Issuers are then required to submit the required amount of proxy materials to intermediary record holders, and, importantly, to pay each intermediary “its reasonable expenses for completing the sending of such material to beneficial owners.” Stock exchange rules formally specifying maximum rates that member firms may charge listed issuers as reasonable reimbursement. E.g., NYSE Rule 465 Supplemental Material.(go back)

51See SEC Rule 17Ad-8(b). SEC Rule 17Ad-8 permits DTC to charge issuers a fee equal to the “reasonable costs” of providing the list. An issuer or its agent, such as a transfer agent or proxy servicer or solicitor, can pay extra fees to subscribe to a DTC service and obtain the securities position listing once or on a weekly, monthly, or more frequent basis.(go back)

52Unless an intermediary specifically agrees otherwise (such as in setting up a special deposit account), customers of intermediaries have only a general pro rata claim on the securities held in “bulk” by the intermediary. Securities intermediaries are obligated under state contract law to provide customers with all of the economic and governance rights that comprise the financial asset, and the same law provides that customers can look only to that intermediary for performance of the obligations. See generally UCC 8-501 et seq. (1994).(go back)

53David C. Donald, Heart of Darkness: The Problem at the Core of the U.S. Proxy System and its Solution, 6 Va.L. & Bus. Rev. 41 (2011), at 77.(go back)

54As discussed in the text, there are reasons to believe that the investment needed to permit and execute confirmations should not be significant, but the extent of the investment is not yet clear. The Committee recommends that the SEC and its staff should conduct the cost-benefit analysis it ordinarily conducts for rulemakings, treat investment companies as a distinct type of company for purposes of this analysis, and implement the recommendation if its benefits outweigh its costs. A minority of members of the Committee, while agreeing with goals of the confirmation recommendation, have more serious concerns about potential costs, particularly at meetings where no proposal or election is contested and the results are the election are not close. To that end, a subset of these members suggests that the SEC consider whether costs could be limited, and substantially all of the benefits of the proposal obtained, if mandatory end-to-end confirmations were to apply only in limited cases, such as contested elections, and that the SEC should conduct a pilot before mandating the rule more generally. Other members believe that only a requirement of confirmation for all votes is likely to improve the overall proxy system, and emphasize the need for cost-benefit analysis.(go back)

55Consistent with the 2013 IAC recommendation, which predated the SEC’s 2016 proposal, a minority of Committee members support making a universal proxy voluntary rather than mandatory. Companies or dissidents would each be able to choose whether to solicit using a universal proxy card or a more traditional proxy card, but neither would be required to use a universal proxy card if it did not want to solicit votes that way. To implement this, SEC rules would be amended to remove obstacles to the use of universal proxy cards, but the use of that proxy card in practice would depend on private ordering. These members also believe that, because universal proxy cards may increase the need for solicitations, the SEC should only adopt rule changes to implement universal proxy cards after the SEC has conducted the OBO/NOBO study recommended above and either eliminated or significantly reduced current impediments to companies being able to identify and directly communicate with their investors.(go back)

Print

Print