Steve W. Klemash is Americas Leader, Jamie Smith is Investor Outreach and Corporate Governance Specialist, and Jennifer Lee is Audit and Risk Specialist, all at the EY Americas Center for Board Matters. This post is based on their EY memorandum.

As US public companies and their audit committees maintain an almost decade-long trend of increased voluntary disclosures to shareholders about audits, it’s clear that rigorous oversight of public company audits by independent audit committees helps protect investors, and disclosing information about that oversight process contributes to investor confidence.

Many investors, regulators and other stakeholders share the view that increased transparency regarding the audit committee’s oversight process builds investor confidence. [1]

EY’s Center for Board Matters (CBM) measured this trend in its eighth annual assessment of voluntary disclosures by Fortune 100 companies relating to the important audit oversight role carried out by audit committees.

To help raise awareness of the audit, and audit committees’ important role in the audit process, the CBM seeks to shed light on the types of information about the audit available to investors—beyond disclosures required by laws or regulations—and how the availability of information is increasing.

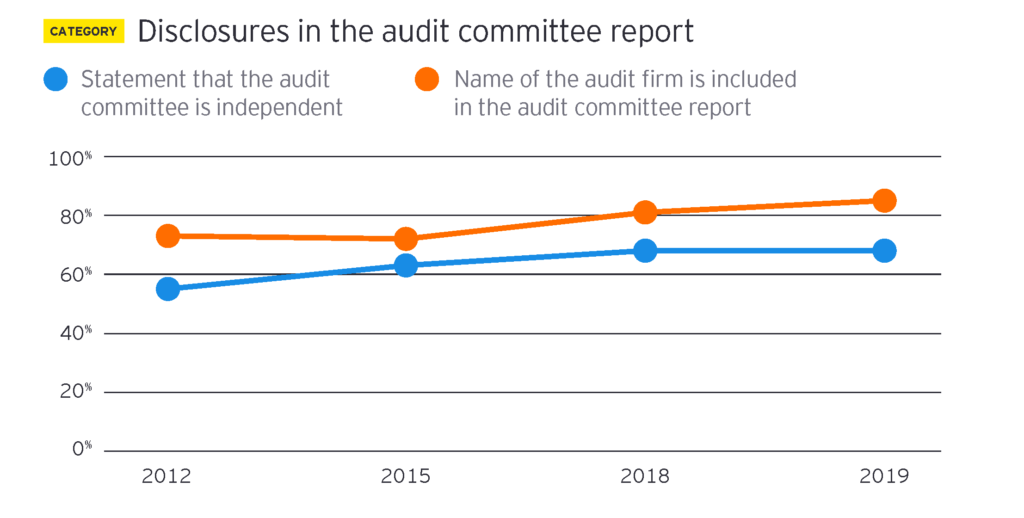

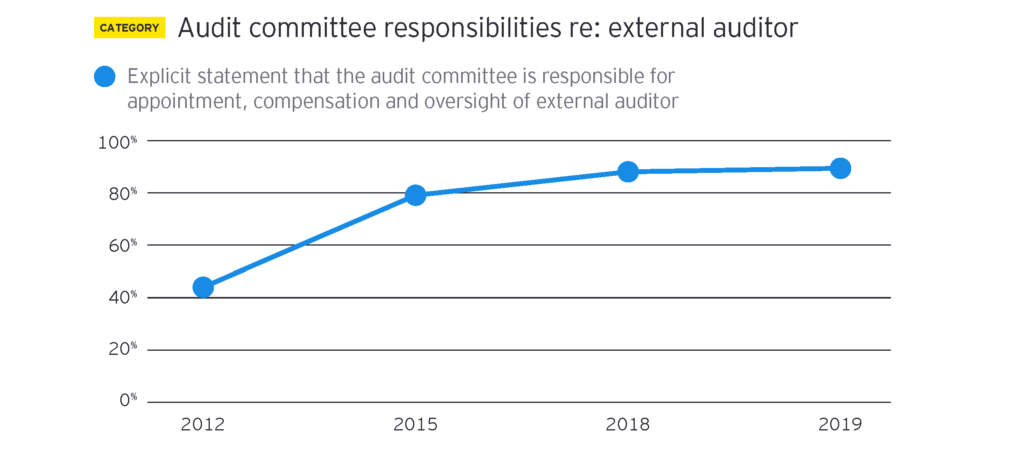

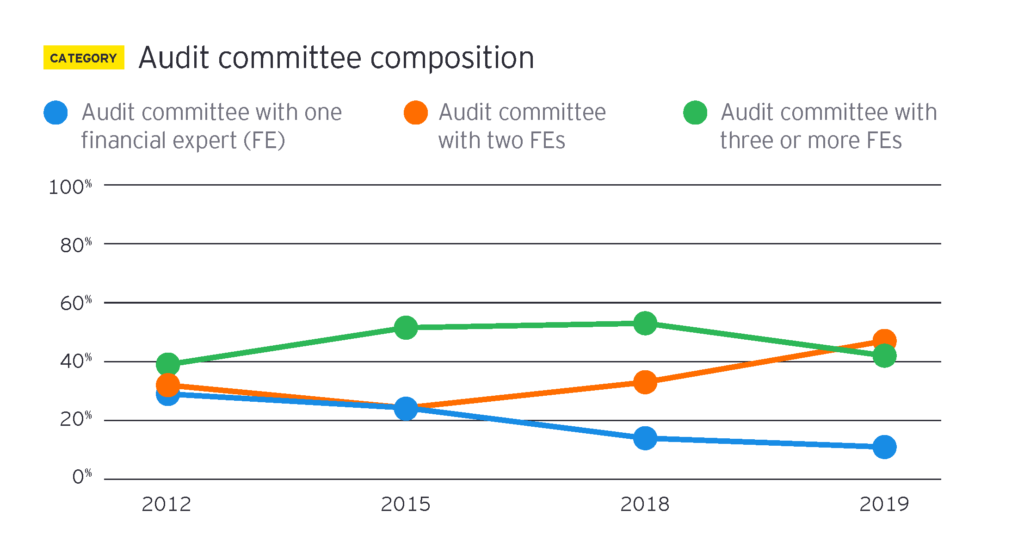

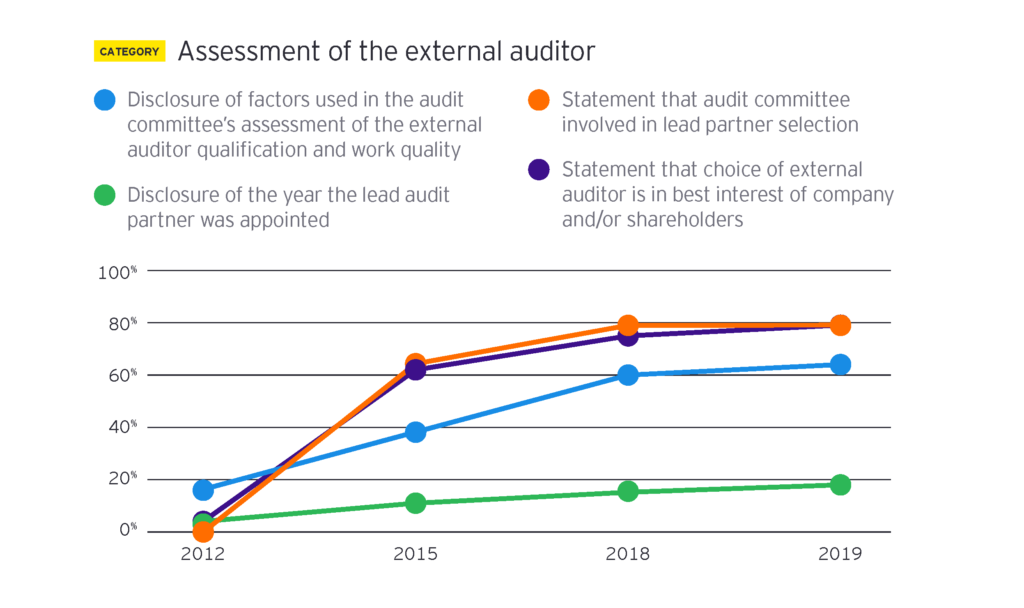

To carry out this assessment, CBM has reviewed the proxy statements of Fortune 100 companies to compare audit-related disclosures from 2012–19, providing a clear view of trends.

What we see in 2019

While the year-over-year change in the percentage of companies providing these voluntary disclosures is incremental, there has been a dramatic increase in disclosures in most categories since EY began examining them in 2012. For example:

- This year, nearly 80% of companies disclosed that the audit committee is involved in selecting the lead audit partner. None of these companies made that disclosure in 2012.

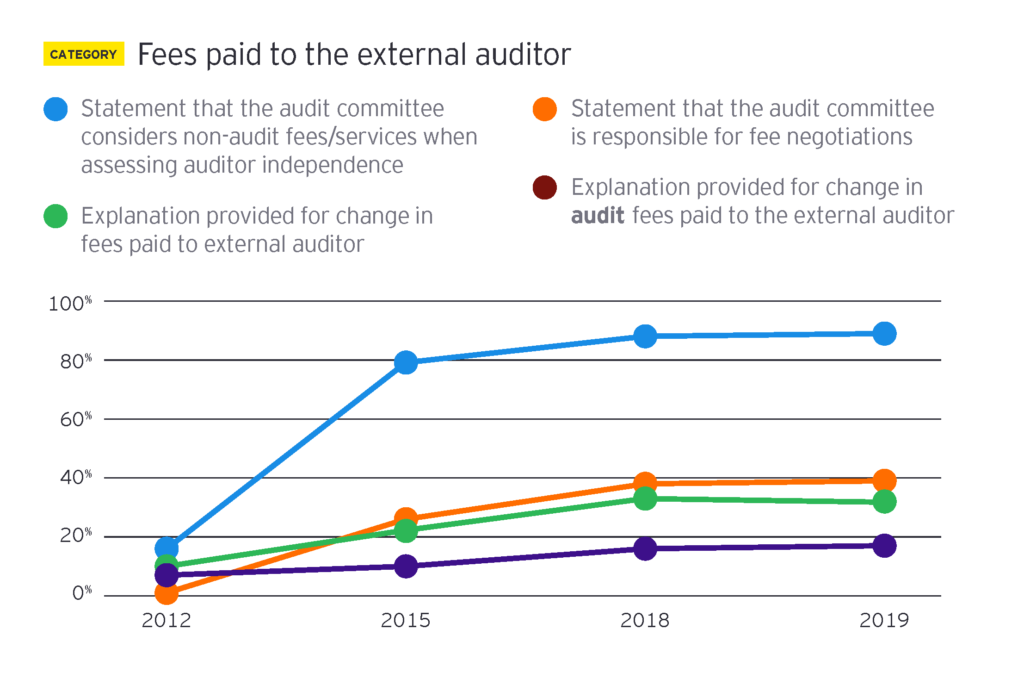

- Nearly 90% of companies disclosed that the audit committee considers non-audit fees and services when assessing auditor independence vs. just 16% in 2012.

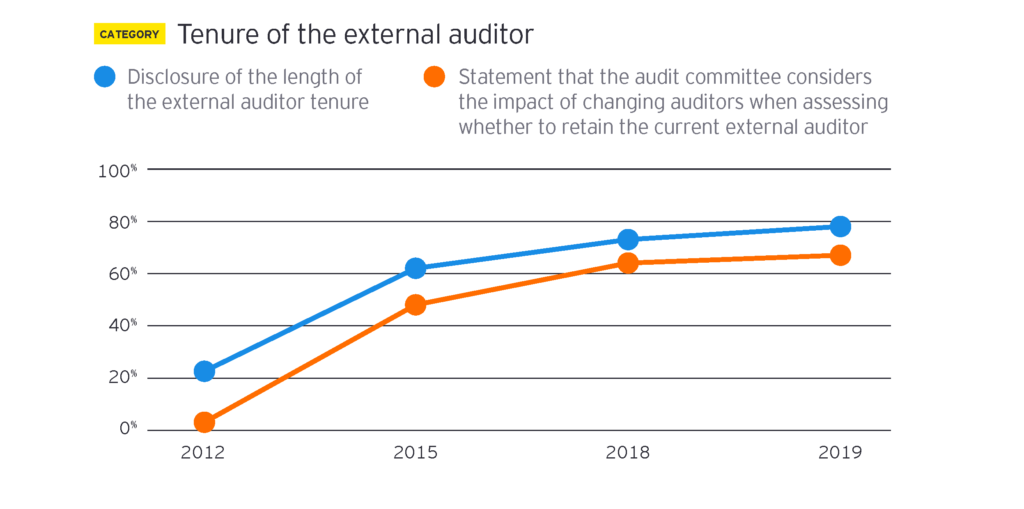

- Two-thirds of companies stated that they consider the impact of changing auditors when assessing whether to retain the current external auditor, and 78% disclose the tenure of the current auditor. That’s up from just 3% and 23%, respectively, in 2012.

- Sixty-four percent of companies disclose factors used in the audit committee’s assessment of the external auditor qualifications and work quality, which is four times the 16% that did so in 2012.

Looking ahead—more audit-related disclosures on the way

The higher volume of voluntary disclosures by public companies relating to their audits is occurring at the same time auditors are making new disclosures required by the US Public Company Accounting Oversight Board (PCAOB), which oversees public company auditors. These developments together provide a more complete view into the audit for investors than ever before. They include:

- Starting this year, auditors of large public companies must begin to disclose critical audit matters (CAMs) in their reports about 2019 audits, providing a new audit-related information source to investors. CAMs are matters communicated or required to be communicated to the audit committee that relate to material accounts or disclosures and involve especially challenging, subjective or complex auditor judgment. [2] Some have suggested that CAM disclosures may lead to additional corporate disclosures.

- New auditor disclosure requirements implemented over the past several years include the length of auditor tenure; [3] lead audit partner’s name; [4] and identification of the names and locations of other accounting firms that participate in an audit, as well as the extent of their participation. [5]

Disclosure observations and sample language from 2019 Fortune 100 proxy statements

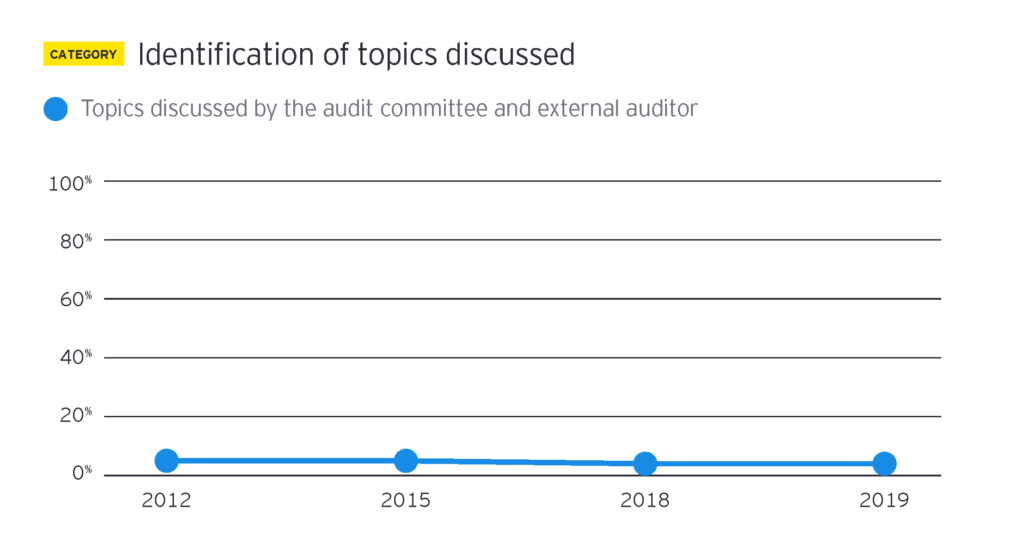

Topics discussed by the audit committee and external auditor

Reviewed companies indicated that the audit committee raised certain topics with their external auditors other than those required by regulations.

The Audit Committee reviewed with the Independent Auditors significant risks and exposures identified by management, the overall adequacy and effectiveness of the Company’s legal, regulatory and ethical compliance programs, including the Company’s Codes of Business Conduct, and the Company’s quality and food safety programs, workplace and distribution safety programs and information technology security programs.

Explanation provided for change in fees paid to external auditor

Most companies provide an explanation for the types of services included within each fee category. Reviewed companies explained the circumstances for the change.

Audit fees increased in 2018 due to additional audit procedures associated with the new lease accounting standard, goodwill impairments, debt offering, and the Company Transaction.

Disclosure of factors used in the audit committee’s assessment of the external auditor qualifications and work quality

Reviewed companies provided examples of criteria used in auditor assessments.

The Audit Committee considered a variety of factors, including: independence; candor and insight provided to Audit Committee; proactivity; ability to meet deadlines and respond quickly; feasibility, benefits of audit firm/lead partner rotation; content, timeliness and practicality of Audit Firm’s communications with management; adequacy of information provided on accounting issues, auditing issues and regulatory developments affecting financial institutions; timeliness and accuracy of all services presented to Audit Committee for pre-approval and review; management feedback; lead partner performance; and comprehensiveness of evaluations of internal control structure.

Statement that the audit committee considers the impact of changing auditors when assessing whether to retain the current external auditor

Reviewed companies indicated that the audit committee considered alternatives to retaining the external auditor.

The Audit Committee considered the relative costs, benefits, challenges, overall advisability, and potential impact of selecting a different independent public accounting firm.

Questions for the audit committee to consider

- Does the company’s proxy statement effectively communicate how the audit committee is overseeing and engaging with the independent auditor? Does it address areas of investor interest, such as the independence and performance of the auditor and the audit committee’s key areas of focus?

- How has the role of the audit committee evolved in recent years (e.g., oversight of enterprise risk management, cybersecurity risk), and to what extent are these changes being communicated to stakeholders?

- What impact will new auditor reporting requirements have on audit committee disclosures?

- What additional voluntary disclosures might be useful to shareholders related to the audit committee’s time spent on certain activities, such as cybersecurity, business continuity, mergers and acquisitions, and financial statement reporting developments?

- How do director qualifications and board composition-related disclosures highlight the expertise, experiences and backgrounds of audit committee members?

Endnotes

1See, e.g., speech, “Remarks before the 2019 Baruch College Financial Reporting Conference: Aiming toward the future,” Wesley Bricker, former Chief Accountant of the US Securities and Exchange Commission, 2 May 2019, SEC website, https://www.sec.gov/news/speech/speech-bricker-050219, accessed August 2019.(go back)

2PCAOB standard, Auditing Standards on the Auditor’s Report and the Auditor’s Responsibilities Regarding Other Information and Related Amendments, 1 June 2017, PCAOB website, https://pcaobus.org/Rulemaking/Pages/Docket034.aspx, accessed August 2019.(go back)

3PCAOB standard, Auditing Standards on the Auditor’s Report and the Auditor’s Responsibilities Regarding Other Information and Related Amendments, 1 June 2017, PCAOB website, https://pcaobus.org/Rulemaking/Pages/Docket034.aspx, accessed August 2019.(go back)

4PCAOB standard, Improving the Transparency of Audits: Rules to Require Disclosure of Certain Audit Participants on a New Form and Related Amendments to Auditing Standards, 15 December 2015, PCAOB website, https://pcaobus.org/Rulemaking/Docket029/Release-2015-008.pdf, accessed August 2019.(go back)

5Ibid.(go back)

Print

Print