Ravi Sinha is vice president and Per Axelson is a senior manager at Cornerstone Research. This post is based on their Cornerstone Research memorandum and is part of the Delaware law series; links to other posts in the series are available here.

Introduction

This post examines litigation challenging M&A deals valued over $100 million announced from 2009 through 2018, filed on behalf of shareholders of publicly traded target companies.

These lawsuits usually take the form of class actions filed in either federal or state court. Plaintiffs typically allege that the target’s board of directors violated its fiduciary duties by conducting a flawed sales process that failed to maximize shareholder value.

Common allegations include:

- failure to conduct a sufficiently competitive sale

- existence of restrictive deal protections that discouraged additional bids

- conflicts of interest, such as executive retention post-merger or change-of-control payments to executives

- failure to disclose information about the sales process and the financial advisor’s valuation

The volume of such litigation has raised concerns in recent years. Often resolutions have involved settlements where defendants paid attorneys’ fees to plaintiffs’ counsel and in return, plaintiffs dropped their claims. The typical consideration for shareholders was a “supplemental disclosure” of information not included in the original proxy statement of the proposed merger. Such disclosure-only settlements, it was often argued, imposed a costly friction but added little or no value to shareholders.

Although litigation patterns appear to have stabilized, Trulia’s impact is still evident.

In January 2016, the judicial scrutiny culminated in the Delaware Court of Chancery’s decision in In re Trulia Inc. Stockholder Litigation (Trulia) to reject disclosure-only settlements where, in its view, the supplemental disclosures are not plainly material.

As noted in previous reports, Trulia contributed to a stark change in the M&A litigation landscape. This current report focuses on 2018 trends and establishes that Trulia’s impact is still evident, although litigation patterns appear to have stabilized, and in certain regards reversed somewhat since 2017.

Executive Summary

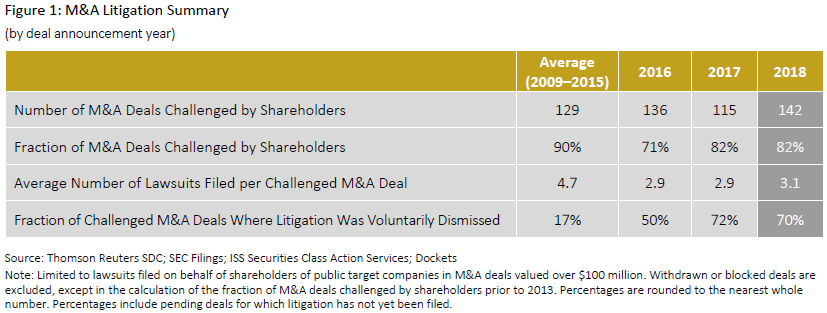

The impact of the Delaware Court of Chancery’s Trulia decision against disclosure-only settlements appears to have stabilized. In the years before Trulia, shareholders litigated around 90 percent of M&A deals valued over $100 million. In 2016—the year of the Chancery Court’s decision—that rate declined to just 71 percent. In 2017 and 2018, however, the litigation rate rebounded to 82 percent.

Trulia further appears to have contributed to a decline in the number of lawsuits per challenged M&A deal, and to a significant increase in voluntary dismissal rates. The 2018 data suggest that these metrics have stabilized around their 2017 levels.

Filing activity in both state and federal courts increased in 2018. Most of the increase in federal court litigation reflected activity in the Second and Third Circuits. The number of M&A deals challenged in state venues more than doubled from the 10-year low in 2017.

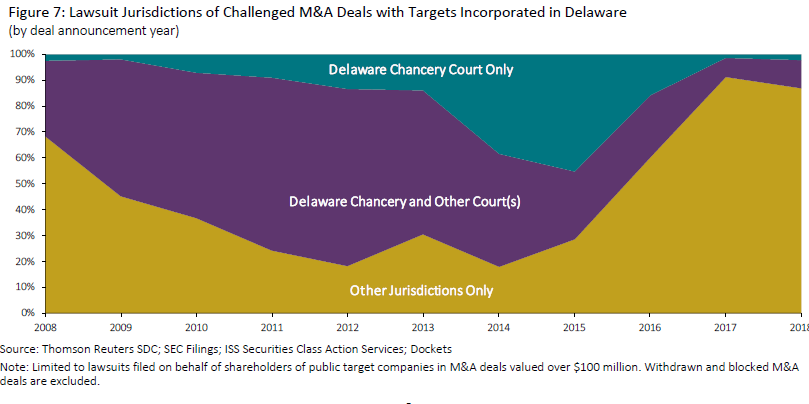

Between 2009 and 2015, only a minority of litigated deals were challenged in federal court, with almost all litigated in state venues. Trulia contributed to the stark shift from state to federal courts. In 2018, however, the shift reverted slightly.

Filings

- Reflecting an increase in M&A activity, a total of 142 proposed deals valued over $100 million had associated lawsuits in 2018, compared to 115 in 2017.

- On average, 90 percent of M&A deals were litigated between 2009 and 2015. This fraction began to decline in 2015, and in 2016, the year of the Trulia decision, fell to a 10-year low of 71 percent. Litigation activity has rebounded and stabilized in 2017 and 2018.

- At 82 percent, however, litigation activity is still below its pre-2015 levels.

Overall litigation activity has rebounded since Trulia but is still below its pre-2015 levels.

Lawsuits per Litigated Deal

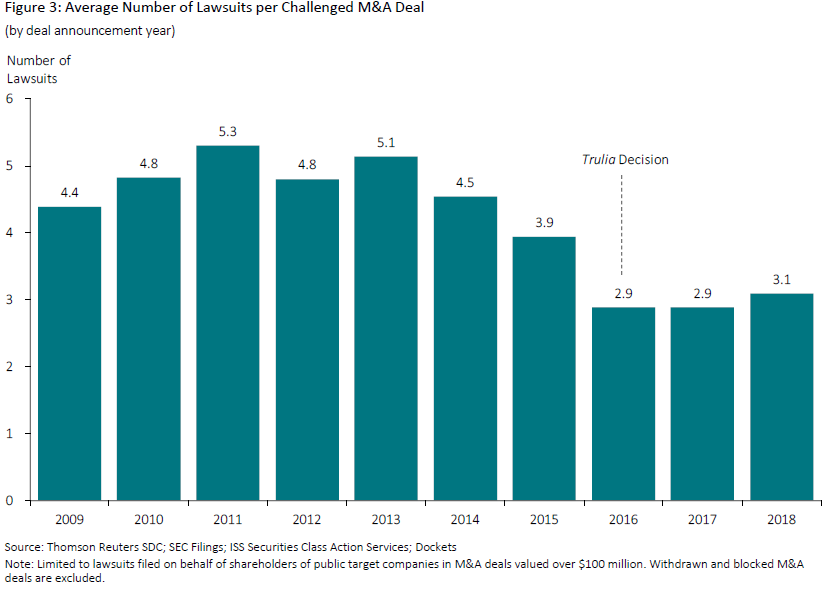

- In 2016, in the immediate aftermath of Trulia, the average number of lawsuits per M&A deal declined substantially.

- The lower propensity to challenge M&A deals still prevails. The number of lawsuits per challenged M&A deal has remained around three since Trulia, compared to the 2009–2015 average of 4.7 lawsuits per deal.

The average number of lawsuits per challenged M&A deal has not increased significantly since its 2016 decline.

Most Active Courts

- In 2018, 91 percent of litigated M&A deals were challenged in federal venues, down slightly from 96 percent in 2017. The pre-Trulia average from 2009 through 2015 was 26 percent.

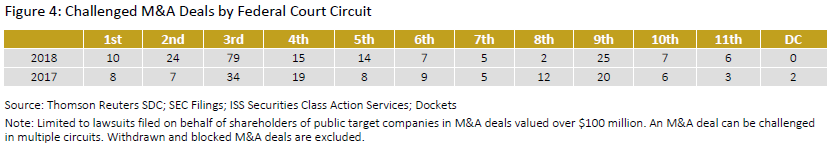

- Because of increased M&A activity, the number of M&A deals litigated in federal court in 2018 rose by 19 percent compared to 2017. This increase was mostly due to a pronounced increase in activity in the Second and Third Circuits,

- The Third Circuit, which includes Delaware, was by far the most active federal court in 2018 with more than twice the number of challenged M&A deals compared to 2017.

- In 2018, 34 percent of litigated M&A deals were challenged in state courts, a rebound from 18 percent in 2017. The pre-Trulia average from 2009 through 2015 was 97 percent.

- The number of M&A deals litigated in state courts more than doubled—from 21 in 2017 to 49 in 2018. The most notable trend at the state court level was a sharp increase in activity in the Maryland state courts where 12 M&A deals were litigated in 2018, compared to none in 2017.

- The number of M&A deals litigated in the Delaware Court of Chancery was 13 in 2018, an increase from seven in 2017 but significantly lower than in 2016 (37).

In 2018, the shift from state to federal courts that began with Trulia reversed slightly.

Litigation Jurisdictions

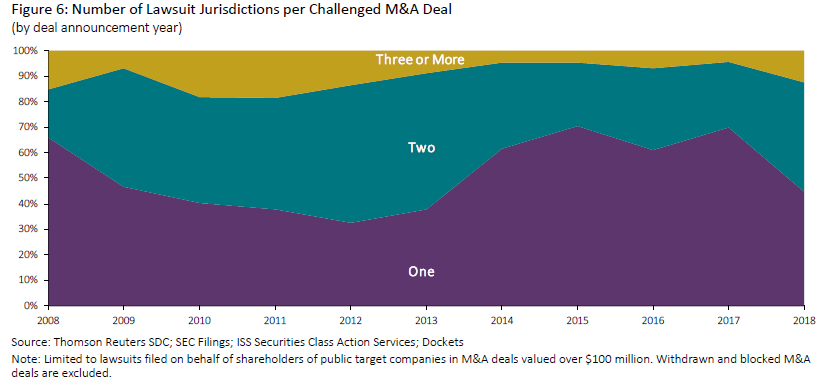

- In 2018, only 45 percent of challenged M&A deals were litigated in one jurisdiction only, a five-year low.

- 43 percent of M&A deals were challenged in two jurisdictions, compared to 26 percent in 2017.

- 12 percent of deals were challenged in three or more jurisdictions, triple the 4 percent figure in 2017.

- For Delaware-incorporated targets, plaintiffs filed in Delaware for only 13 percent of challenged M&A deals.

For the first time since 2013, less than half of challenged deals faced litigation in only one jurisdiction.

Litigation Resolution

- Between 2009 and 2014, more than 65 percent of M&A litigation was resolved before the deal closed.

- The rate of resolution prior to deal closing has declined steadily from 68 percent in 2012 to a 10-year low of 33 percent in 2018.

- Historically, of litigation that was resolved prior to closing, a large percentage of cases settled. The remainder was either voluntarily dismissed (withdrawn) or dismissed by courts.

- Settlement rates are considerably lower for lawsuits that were resolved post-closing.

- Voluntary dismissals in 2018 were at approximately the same high level as in 2017. This likely reflects the removal of the disclosure-only settlement option in Delaware post-Trulia. That removal appears to have contributed to a shift whereby M&A lawsuits are commonly resolved through voluntary dismissals combined with mootness fees paid to plaintiffs’ attorneys.

As in 2016 and 2017, the majority of M&A litigation was voluntarily dismissed in 2018.

Research Sample

The research sample in this report uses Thomson Reuters SDC to identify mergers above $100 million and where the target company is publicly traded. Withdrawn or blocked M&A deals are excluded.

Institutional Shareholder Services through Securities Class Action Services (ISS Securities Class Action Services) is used to identify the lead case in each jurisdiction against the target company involved in the merger. Data on other challenges to the target company are collected using SEC filings and PACER docket information. Only litigation filed before merger closing is considered.

The sample contains 1,928 deals announced from November 19, 2006, through December 31, 2018. The analyses in this report are as of July 1, 2019.

Print

Print