David F. Larcker is James Irvin Miller Professor of Accounting at Stanford Graduate School of Business and Brian Tayan is a Researcher with the Corporate Governance Research Initiative at Stanford Graduate School of Business. This post is based on their recent paper. Related research from the Program on Corporate Governance includes What Matters in Corporate Governance? by Lucian Bebchuk, Alma Cohen, and Allen Ferrell and The Elusive Quest for Global Governance Standards by Lucian Bebchuk and Assaf Hamdani.

We recently published a paper on SSRN (“Loosey-Goosey Governance: Four Misunderstood Terms in Corporate Governance”) that examines four central concepts that are widely discussed—even foundational to the problem—but loosely defined and poorly understood.

A reliable corporate governance system is considered to be an important requirement for the long-term success of a company. Unfortunately, after decades of research, we still do not have a clear understanding of the factors that make a governance system effective. Our understanding of governance suffers from two problems. The first problem is the tendency to overgeneralize across companies—to advocate common solutions without regard to size, industry, or geography and without understanding how situational differences influence correct choices. The second problem is the tendency to refer to central concepts or terminology without first defining them. That is, concepts are loosely referred to without a clear understanding of the premises, evidence or implications of what is being discussed. We call this “loosey goosey governance.”

1: Good Governance

The most commonly misunderstood term in corporate governance is the most central: good governance. Survey data shows that investors are willing to pay a premium for companies with “good governance.” Institutional investors advocate for “principles of good governance” and believe “good governance adds value.” One pension fund “not only sees good corporate governance practices as a way to add value but also to mitigate risk.” Another believes “good corporate governance—that is, accountable corporate governance—means the difference between wallowing for long periods in the depths of the performance cycle, and responding quickly to correct the corporate course.”

Good governance is a set of processes or organizational features that, on average, improve decision making and reduce the likelihood of poor outcomes arising from strategic, operating, or financial choices, or from ethical or behavioral lapses within an organization. Unfortunately, this is not how the term is generally used. Instead, many observers use the term good governance to mean the degree to which a company has adopted certain structural features that increase board independence and shareholder rights, under the assumption that these are synonymous with good governance. The problem is that these standards are not shown to actually improve governance quality. Consider three examples:

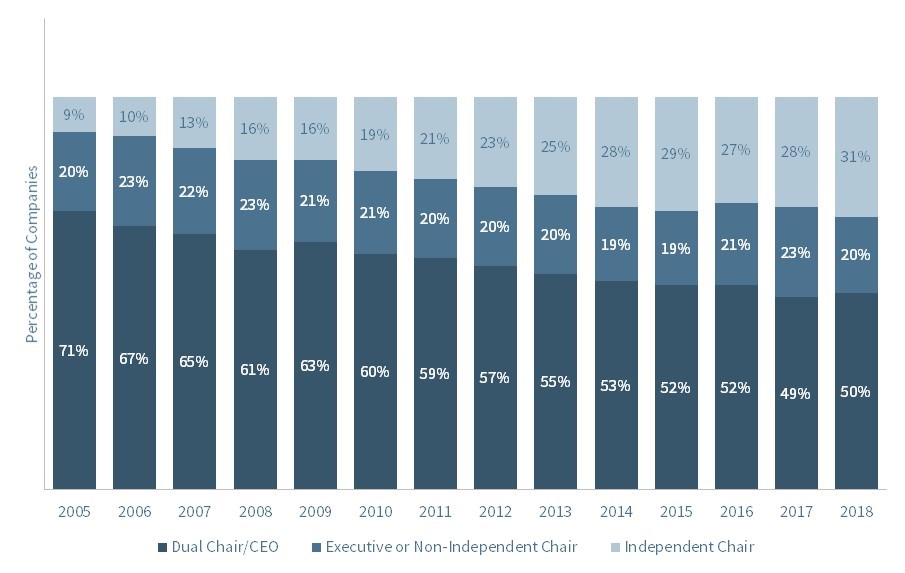

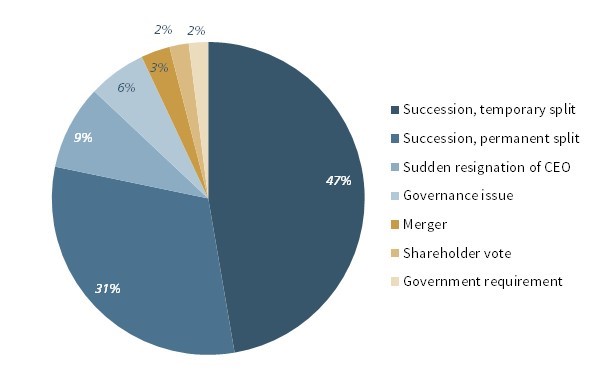

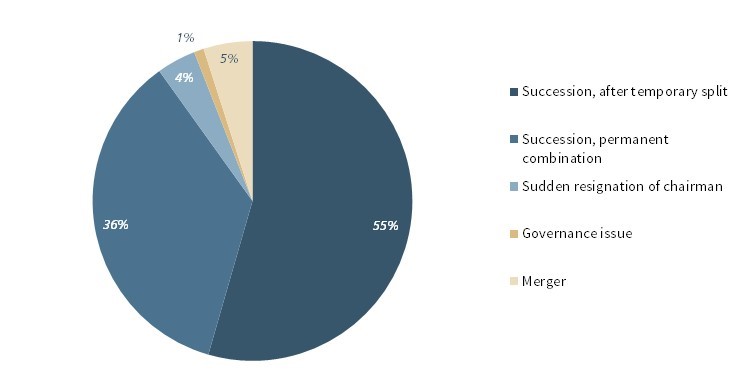

Independent Chairman. Because the board of directors is tasked with overseeing the company and its management, many experts recommend that the roles of board chair and CEO be separated. The UK Corporate Governance Code states that “a chief executive should not become chair of the same company.” Journalists criticize companies that combine the roles, and shareholders agitate in favor of separation. According to Sullivan & Cromwell, shareholder proposals to require an independent chairman were the most common governance-related issue put forth by investors in the 2019 proxy season.

The problem with this is that research shows no consistent benefit from requiring an independent chair. Dalton, Daily, Ellstrand, and Johnson (1998) perform a meta-analysis across 31 studies and find no correlation between chair status and performance. Baliga, Moyer, and Rao (1996) examine the impact of a change in independence status (decisions to either separate or combine the roles) and also find no impact on performance. Dey, Engel, and Liu (2011) find that forced separation leads to worse performance. Krause, Semadeni, and Cannella (2013) review 48 studies and find that independence status has no impact on performance, managerial entrenchment, organizational risk taking, or executive pay practices. That is, the independence status of the chairman has no relation to governance quality (see Exhibit 1).

Exhibit 1: Independent Chairman

Separations

Combinations

Source: David F. Larcker and Brian Tayan, “Independent Chairman: Research Spotlight,” Stanford Quick Guide Series (November 2015).

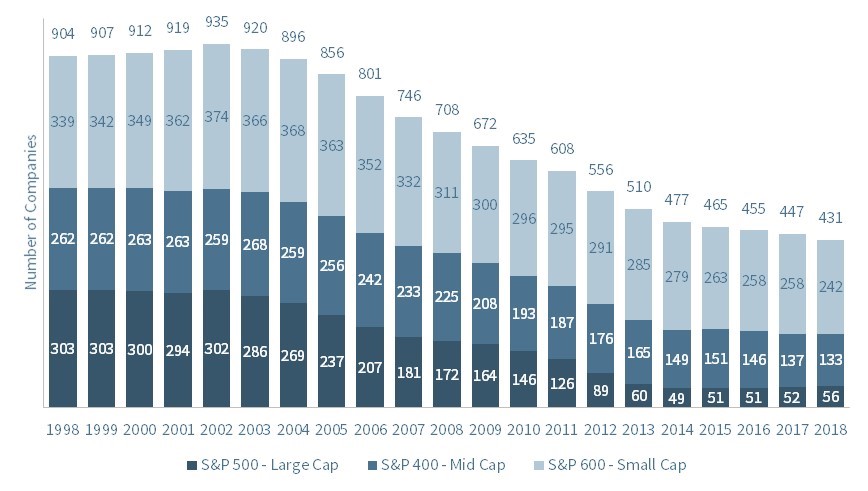

Staggered Boards. Many institutional investors are similarly critical of companies that have classified (or staggered) boards: a structure in which directors are elected to three-year terms with only one third of directors standing for reelection each year. A staggered board is considered a poor governance choice because it prevents an activist investor from taking majority control of a board in a single election and instead requires two years for a proxy contest to be successful. For this reason, proxy advisory firms oppose classified boards. Institutional Shareholder Services (ISS) proxy voting guidelines recommend “against proposals to classify (stagger) the board” and “for proposals to repeal classified boards.” Similarly, Glass Lewis “favors the repeal of staggered boards…. Staggered boards are less accountable to shareholders than boards that are elected annually.”

However, research shows quite plainly that the impact of a staggered board is not uniformly positive or negative. There is an extensive body of work that finds that staggered boards harm shareholders by decreasing merger activity, entrenching management, and lowering firm value. There is an equally extensive body of work that finds that staggered boards protect valuable business relations, thwart unsolicited offers, and boost firm value (see Exhibit 2). A staggered-board structure itself is not indicative of governance quality. It can be a feature of good governance or a feature of bad governance, depending on the company and the people who control it.

Exhibit 2: Staggered Boards

Source: David F. Larcker and Brian Tayan, “Staggered Boards: Research Spotlight,” Stanford Quick Guide Series (September 2015).

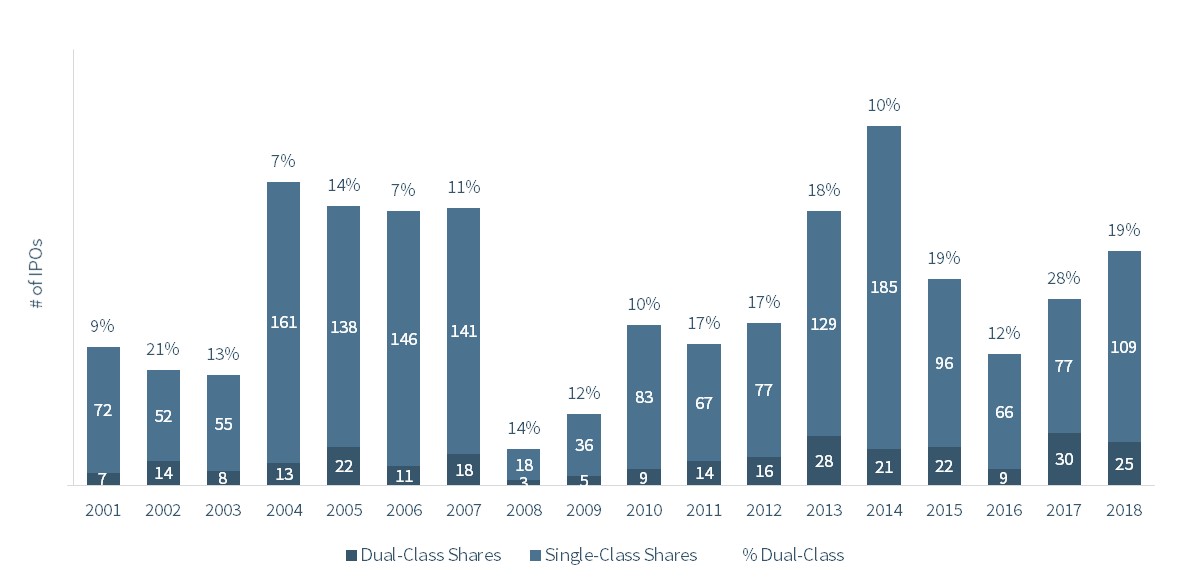

Dual-Class Shares. A dual- (or multiple-) class share structure is also considered a poor governance choice because it grants a small group of shareholders voting rights well in excess of their economic interest. Such a structure is seen as inconsistent with democratic fairness and the principle that corporate decisions should be made on a “one share, one vote” basis. ISS recommends against proposals to create a second class of common stock. Stock market index providers such as S&P Dow Jones and FTSE Russell have begun to pressure companies to eliminate dual-class structures by restricting or preventing newly public companies with more than one class of stock from being included in their indices. Some regulators have proposed that dual-class share structures be phased out a specified number of years following IPO (mandatory sunset provision).

While the research evidence on dual-class share structures tends to be negative, it is not universally so. A dual-class share structure can provide potential benefits, such as insulating management and the board from external pressure and allowing a company to invest in the long-term without the threat of an opportunistic takeover. Cremers, Lauterbach, and Pajuste (2018) find that companies with dual-class shares have similar long-term performance to companies with a single class of stock. Anderson, Ottolenghi, and Reeb (2017) find that the governance quality of dual-class share companies depends on factors other than their share structure, such as the composition of the controlling shareholder group (see Exhibit 3). That is, requiring a single class of stock might be consistent with good governance, and it might not.

Exhibit 3: Dual-Class Shares

Share structure at IPO

Source: David F. Larcker and Brian Tayan, “Dual-Class Shares: Research Spotlight,” Stanford Quick Guide Series (March 2019).

These are just three examples of commonly accepted best practices in corporate governance. Nevertheless, the research literature shows fairly conclusively that structural features such as these do not universally lead to good governance and, moreover, no list of best practices along these dimensions likely exists (see Exhibit 4). Instead, it appears that a reliable governance system depends on organizational features that are unrelated to the structure of the board and shareholder rights and yet improve decision making and reduce the likelihood of misbehavior. Without providing an exhaustive list, these include leadership quality (the skill, knowledge, judgment, and character of both the board and management team), culture (the modes of behavior prevalent in the organization that guide individual choices), and incentives (the financial and nonfinancial rewards that reinforce behavior and shape decision making). While these are inherently more difficult to measure than structural features, research and observation suggest they are likely more significant determinants of good governance. More research attention should be paid to collecting large samples of companies with bad (or good) outcomes and examining the organizational features in place to find common attributes that determine governance quality.

Exhibit 4: Research on Board Attributes

| Board Attribute | Explanation | Research Findings |

|---|---|---|

| Independent chair | Chairman of the board meets NYSE standards for independence | No evidence this matters |

| Lead independent director | Board has designated an independent director as the lead person to represent the independent directors in conversation with management, shareholders, and other stakeholders | Modest evidence this improves performance |

| Number of outside directors | Number of directors who come from outside the company (non-executive) | Mixed evidence that this can improve performance and reduce agency costs. Depends primarily on how difficult it is for outsiders to acquire expert knowledge of the company and its operations |

| Number of independent directors | Number of directors who meet NYSE standards for independence | No evidence that this matters beyond a simple majority |

| Independence of committees | Board committees are entirely made up of directors who meet NYSE standards for independence | Positive impact on earnings quality for audit committee only. No evidence for other committees. |

| Bankers on board | Directors with experience in commercial or investment banking | Negative impact on performance |

| Financial experts on board | Directors with experience either as public accountant, auditor, principal financial officer, comptroller, or principle accounting officer | Positive impact for accounting professionals only. No impact for other financial experts. |

| Politically connected directors | Directors with previous experience with the federal government or regulatory agency | No evidence that this matters |

| Employees | Employee or labor union representatives serve on the board | Mixed evidence on performance |

| “Busy” boards | “Busy” director is one who serves on multiple outside boards (typically three or more). Busy board is one that has a majority of busy directors. | Negative impact on performance and monitoring |

| Interlocked boards | Executive from Company A sits on the board of Company B, while executive from Company B sits on the board of Company A | Positive impact on performance, negative impact on monitoring |

| Board size | Total number of directors on the board | Positive impact on performance to have smaller board if company is “simple,” larger board if company is “complex” |

| Diversity | Board has directors that are diverse in background, ethnicity, or gender | Mixed evidence on performance and monitoring |

| Classified (staggered) boards | Board structure in which directors are elected to multiple-year terms, with only a subset standing for reelection each year | Mixed evidence on performance and monitoring |

| Director compensation | Mix of cash and stock with which directors are compensated | Mixed evidence on performance and monitoring |

Source: David F. Larcker and Brian Tayan, “Real Look at Corporate Governance,” Chapter 2, NYSE: Corporate Governance Guide, (2014), available at: https://www.nyse.com/publicdocs/nyse/listing/NYSE_Corporate_Governance_Guide.pdf.

2: Board Oversight

A second poorly understood concept in governance is that of board oversight. The board has a dual mandate to advise and monitor the corporation and management. Some degree of tension exists in this mandate, because an advisory role inherently conveys a notion of collaboration and partnership while monitoring conveys a notion of independence and accountability. Regulatory requirements have steadily added to the monitoring responsibilities of the board. Still, survey data demonstrates that companies predominantly value outside directors for their advisory role, more than their monitoring role. According to one study, 55 percent of companies report that industry expertise was the most important skill they sought when recruiting their first outside director; managerial, commercial, or operational experience ranked second with 31 percent. Only a small fraction cite governance and oversight experience as the most important skill.

Within this dual mandate, the oversight responsibilities of a board are extensive. They include vetting the corporate strategy, ensuring that a reliable risk management program is in place, developing an executive compensation program, measuring corporate and CEO performance, developing a viable CEO succession plan, ensuring the integrity of financial statements, and ensuring compliance with relevant laws and regulations, among other obligations. Many of these duties require the input and participation of management, and to satisfy them the board relies primarily (and in many cases solely) on information provided by management. Nevertheless, the role the board plays is separate and distinct from that of management. The board vets strategy, while management is responsible for proposing and implementing it. The board ensures the integrity of financial reporting, but it does not prepare the statements. The board is not an extension of management.

As a result, when a company fails, it is not always evident whether the failure is due to the performance of the board or management—or chance. (For example, does a company that experiences a cyber-breach have poor board oversight of cybersecurity risk? Does a company that does not experience a breach have effective oversight?) It is possible for a company with rigorous oversight mechanisms to experience bad outcomes, and a company with poor oversight mechanisms to perform well. The board’s performance cannot be assessed solely on outcomes.

However, research shows that intangible factors contribute to board quality, and on average, these contribute to performance. Among these are expertise, independence, and board culture.

First, boards with greater expertise appear to provide better oversight. Dass, Kini, Nanda, Onal, and Wang (2014) find that companies with directors that have related-industry experience trade at higher valuations and have better operating performance. Larcker, So, and Wang (2013) find that companies with well-connected boards have greater future operating performance, in part through sharing of information and practices. Duchin, Matsusaka, and Ozbas (2010) find that the effectiveness of outside directors is related to the difficulty for outsiders to acquire expertise about the company. If the cost of acquiring information is low, a company’s performance increases when outside directors are added. If the cost of acquiring information is high, performance deteriorates.

Second, board oversight can improve through the recruitment of directors with independent judgment. This does not mean that the independence standards required by the New York Stock Exchange necessarily produce independent directors. The research literature is highly mixed on this point. The independence standards of the New York Stock Exchange primarily emphasize commercial independence—individuals who do not have significant business or compensation-related ties to the organization. Such individuals might be financially independent but they can be beholden to the company or its management in other ways. For example, Hwang and Kim (2009) find that directors who are socially independent (in terms of their work experience, education, and life background) of management provide better oversight, in terms of setting compensation and willingness to terminate underperforming CEOs. In their words, “Social ties affect how directors monitor and discipline the CEO.” Similarly, Coles, Daniel, and Naveen (2014) find that directors appointed during the current CEO’s tenure are less independent than those appointed prior to the current CEO’s tenure. The assumption is that directors appointed by the current CEO have allegiance to the CEO for helping to attain their directorship and therefore are co-opted. The authors find that companies whose boards have a high percentage of co-opted directors have higher CEO pay levels, lower pay-for-performance, and lower sensitivity of CEO turnover to performance. They conclude that “not all independent directors are effective monitors” and that “independent directors that are coopted behave as though they are not independent.” Similarly, Fogel, Ma, and Morck (2014) examine whether powerful directors act independently. They define powerful directors as those with large professional networks and therefore having numerous alternative board and employment opportunities. They find powerful directors are associated with more valuable merger-and-acquisition decisions, stricter oversight of CEO performance, and less earnings management.

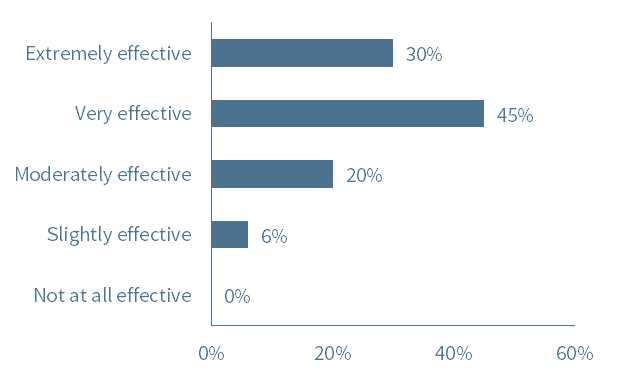

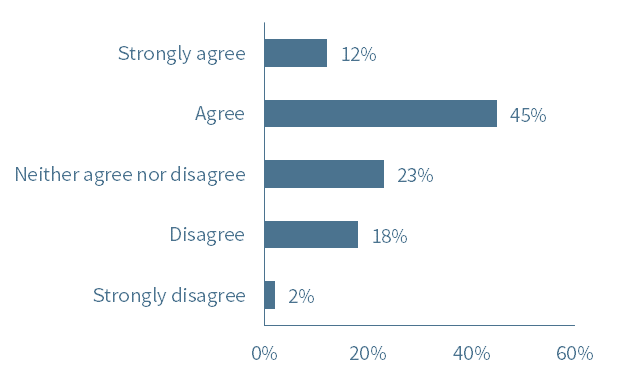

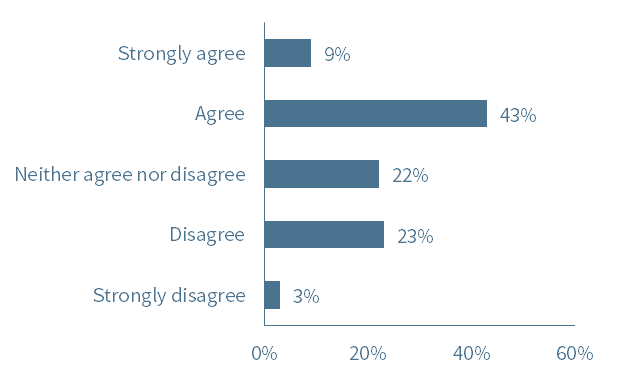

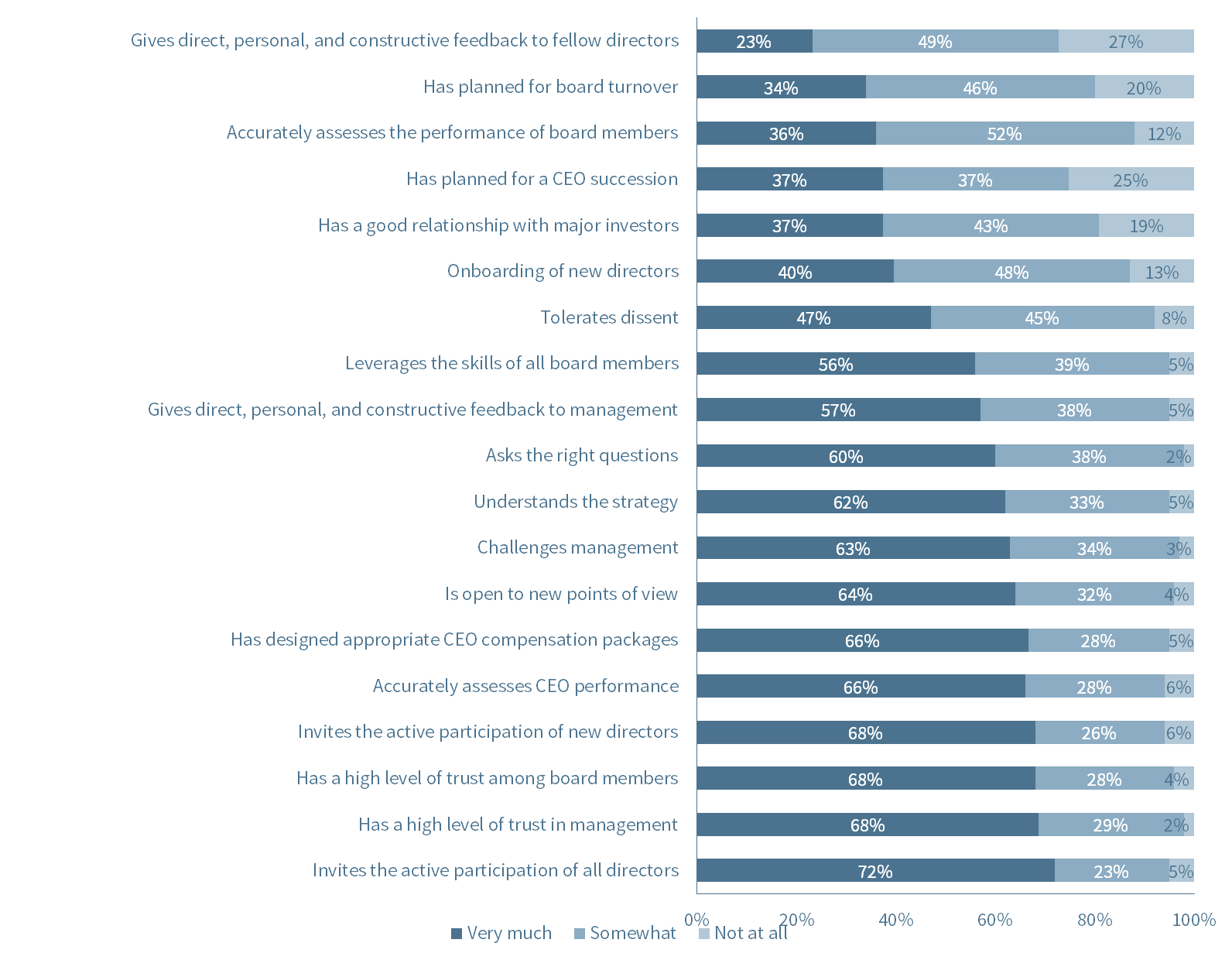

Finally, cultural practices positively contribute to board oversight, including high engagement, honest and open discussion, and continuous board refreshment to ensure a proper mix of skills. Unfortunately, survey evidence suggests that many companies lack these qualities. One survey finds that only half (57 percent) of public company directors agree that their board is effective in bringing new talent to refresh the board’s capabilities before they become outdated. Only two-thirds (64 percent) strongly agree that their board is open to new points of view, only half (56 percent) strongly believe that their boards leverage the skills of all board members, and less than half (46 percent) believe their board tolerates dissent. A third of board members say they do not have high levels of trust in either their fellow directors or management (see Exhibit 5).

Exhibit 5: Board Oversight

Overall, how would you rate the effectiveness of your board?

To what extent do you agree with the following statement: “Our board is very effective in bringing in new talent to refresh the board’s capabilities, before they become outdated”?

To what extent do you agree with the following statement: “Our board is very effective in dealing with directors who are underperforming or exhibit poor behavior”?

How would you rate your boards along the following dimensions? (sorted least to most favorable)

Source: The Miles Group and the Rock Center for Corporate Governance at Stanford University, “2016 Board of Directors Evaluation and Effectiveness,” (2016).

An objective evaluation of board quality requires understanding the composition and skills of individual directors and the board as a whole, the quality of information that a board has access to, and cultural factors that influence how boards process this information to reach decisions. These are inherently difficult for outside observers to assess.

3: Pay for Performance

A third concept that is not well understood is pay for performance. Dissatisfaction with CEO compensation is widespread. Shareholders, stakeholders, and members of society express concern that CEO pay levels are too high and their structure does not provide correct incentives for performance. For example, a 2016 survey finds that nearly three-quarters (74 percent) of Americans believe that the average CEO of a large corporation is overpaid relative to the average worker. Governance experts have criticized CEO pay as contributing to the 2008 financial crisis by encouraging excessive risk taking. More recently, experts criticize CEO pay for being inflated due to a rising stock market, leading to payouts substantially greater than boards intended or shareholders expected when they were first approved. At the most basic level, critics do not believe CEO pay contracts offer pay for performance.

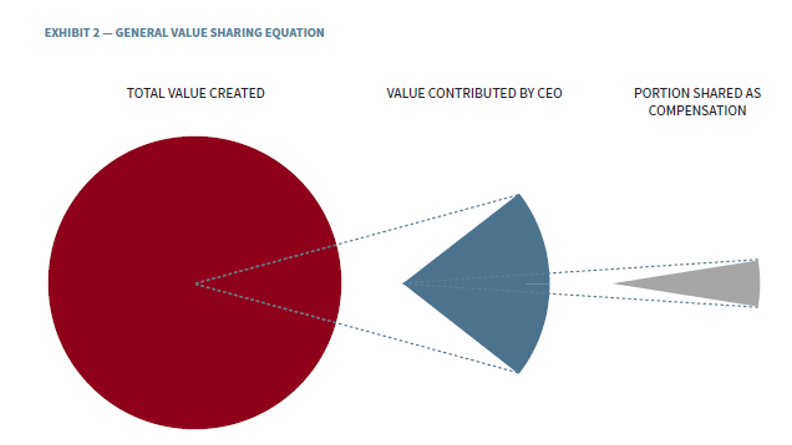

The term “pay for performance” denotes the idea that the amount paid in compensation should be commensurate with the value delivered. Several factors make it difficult to evaluate pay for performance.

First, the size of a compensation package is not clear. The Securities and Exchange Commission standardizes the manner in which companies quantify and disclose executive pay in the annual proxy. However, the total compensation figures disclosed in this document include a mix of forward- and backward-looking, as well as fixed and contingent, amounts. The complexity of these contracts makes it difficult to understand the amount of pay offered and the conditions under which it will be received. The amount offered might differ materially from the amount earned when incentives vest. The amount earned, in turn, might differ further from the amount realized when incentives are ultimately sold for cash. Add to this the perceived injustice associated with individual practices—such as severance agreements, golden parachute provisions, and supplemental pensions—and it becomes more evident why outside observers express frustration over the size and structure of CEO pay.

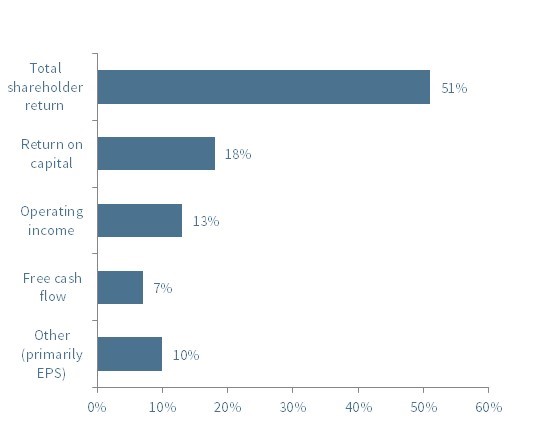

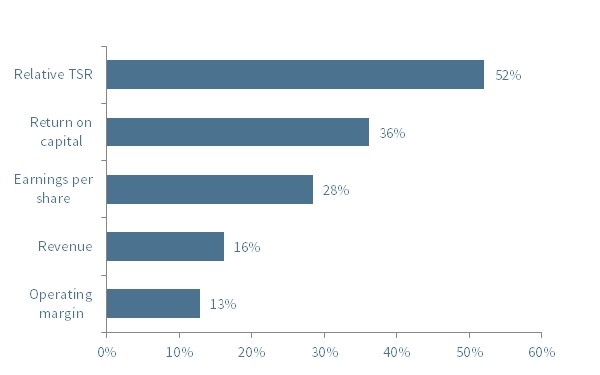

Second, a determination of pay for performance requires knowing how much value was created during a specified time period and how much of that value should be attributed to the efforts of the CEO. One method of calculating value creation is to look at the cumulative change in stock price. Relying on changes in stock price to measure performance has the benefit of being easily quantifiable and closely aligned to shareholder interests. However, it also has the potential to be overly influenced by positive or negative swings in the market that are outside the CEO’s control. To adjust for this, performance relative to peers might be calculated. An alternative method of calculating value creation is to look at the cumulative increase in operating metrics—particularly, sales, earnings, and other key performance indicators with a proven correlation to profitability such as customer satisfaction, employee satisfaction, new product innovation, and product defect and employee safety rates. These measures are more directly under the CEO’s control. However, they still might be positively or negatively influenced by economic conditions. Furthermore, operating improvements might not be reflected in a corresponding change in stock price. For these reasons, most executive compensation plans include a mix of stock price and operating performance metrics (see Exhibit 6). The number and complexity of these metrics make it difficult to determine how much value was actually created.

Exhibit 6: Pay for Performance

In your best estimate, what percentage of a company’s overall performance is directly attributable to the efforts of the…

In your opinion, if you were to select only one metric, which of the following*g is the best measure of company performance?

Metrics used in Long-Term Incentive Programs (LTIP)

Sources: Nicholas Donatiello, David F. Larcker, and Brian Tayan, “CEO Pay, Performance, and Value Sharing,” Stanford Closer Look Series (March 3, 2016); Heidrick & Struggles and the Rock Center for Corporate Governance at Stanford University, “CEOs and Directors on Pay: 2016 Survey on CEO Compensation,” (2016); and Equilar, Executive Long-Term Incentive Plans (2018).

The final step is determining pay for performance is agreeing how much of the total value created is attributable to the efforts of the CEO and should be awarded as compensation. If the CEO is personally responsible for the vast majority of the value created at the company, then it would not be unreasonable for the board to offer a large portion of this value as compensation. Survey data shows—rightly or wrongly—that the boards of most companies do believe their CEO and senior management teams are responsible for most of the value created at their companies. A 2015 survey finds that, on average, board members of Fortune 500 companies estimate that the senior management team is directly responsible for almost three-quarters (73 percent) of the company’s overall performance, and that the CEO is directly responsible for 40 percent of performance. Critics of CEO pay would no doubt disagree with these estimates, and these estimates are clearly subjective. Nevertheless, they reflect the viewpoints of the individuals responsible for structuring CEO pay.

The controversy over CEO pay will likely not be resolved until the components of pay and performance are understood and agreed upon, which is unlikely to occur any time soon.

4: Sustainability

A fourth term not well understood is sustainability. Critics contend that companies today are too short-term oriented and are not making sufficient investment in important stakeholder groups (such as employees, customers, suppliers, or the general public) because they are overly focused on short-term profit maximization. As a result, their business models are presumed to be unsustainable: At some point in the future, this lack of investment will either lead to a deterioration in performance or contribute to a societal ill that the company is forced to redress through government action. (An important assumption underlying these claims is that shareholders do not notice the damage being done to the company today and will bid the stock price up based on current earnings without accurately pricing in the long-term risk created by foregone investment.)

The solution is to create more sustainable companies. BlackRock CEO Larry Fink encourages companies to “drive sustainable, long-term growth” by incorporating economic, social, and environmental factors into their business planning. Corporate lawyer Martin Lipton urges companies to reject a “short-term myopic approach” and embrace “sustainable improvements … [that] systematically increase rather than undermine long-term economic prosperity and social welfare.” Recently, over 180 members of the Business Roundtable agreed to revise the association’s statement on the purpose of a corporation to promote “shared prosperity and sustainability for both business and society.” A cottage industry of consultants, advisors, ratings firms, and data providers has developed to support efforts such as these under the banner of ESG (environmental, social, and governance).

However, it is not clear that companies today are unsustainable nor is it clear that senior executives are mostly short-term focused or overlook stakeholder interests as they develop their strategy and investment plans. A 2019 survey of the CEOs and CFOs of S&P 1500 companies finds that 78 percent use an investment horizon of 3 or more years to manage their business; less than 2 percent have an investment horizon of less than a year. The vast majority (89 percent) believe non-shareholder stakeholder interests are important to business planning. Only a small minority (23 percent) rate shareholder interests as significantly more important than stakeholder interests, and almost all (96 percent) are satisfied with the job their company does to meet stakeholder needs. Furthermore, senior executives expend considerable effort to communicate their commitment to sustainability to the outside world. Half (48 percent) of the executives of all earnings conference calls in the last quarter use the term “sustainable” or “sustainability” to describe their projects or initiatives. It is simply not the case that most U.S. companies ignore sustainability concerns.

The positive assessment is not limited to CEO perception surveys. External ratings providers also rate companies—particularly large companies—extremely favorably in terms of successfully incorporating ESG criteria into their organizations. An analysis of 11 prominent rankings of companies based on environmental, climate-related, human rights, gender, diversity, and social responsibility factors shows that 68 percent of the Fortune 100 companies are recognized on at least one ESG list. The combined market value of these companies is $9.4 trillion, which comprises 84 percent of the market value of the entire Fortune 100. Cisco Systems appears on the most lists—8, Microsoft on 7, and Bank of America, HP, Procter & Gamble, and Prudential Financial each appear on 6 lists. Even companies that are widely criticized by advocacy groups for their business practices are rated highly by third-party observers for ESG factors. For example, Chevron appears on the Dow Jones sustainability index and the Forbes list of best corporate citizens. WalMart is on Bloomberg’s gender equality index. Comcast is on Diversity Inc’s top 50 corporations for diversity. General Electric is named to Ethisphere Institute’s list of most ethical companies. (Perhaps unexpected, Berkshire Hathaway is not named to this list nor does it appear on any of the 11 lists reviewed. See Exhibit 7.)

If third-party providers are reliable, corporate America is sustainable.

Why This Matters

- The debate on corporate governance today suffers from two shortcomings: a tendency to overgeneralize and a tendency to use central concepts without clear and accepted definitions. Would the caliber of discussion improve, and consensus on solutions be realized, if the debate on corporate governance were less loosey-goosey?

- The quality of a company’s corporate governance system is widely considered to be a critical factor in its future success. However, many of the structural features commonly associated with good governance (such as board structure, share structure, etc.) are not shown to have a consistent relation with performance, and many of the organizational features that might lead to superior performance (such as leadership quality, board oversight, culture, and incentives) are not well studied or understood. After decades of research, why can we still not answer the question, “What makes good governance?”

- The board of directors plays a central role in governance quality. Nevertheless, a gap exists between what outsiders think a board does and what they actually do. Furthermore, outside observers, including shareholders, have very limited insight into the factors that would help them understand the quality of oversight that their board provides. How can our understanding of board quality improve without betraying the confidential information that a board discusses?

- CEO compensation is a highly controversial issue, primarily because most members of the public do not believe that CEOs deserve the level of compensation they receive. The root cause of this appears to be that despite extensive disclosure in the company proxy, most stakeholders—including shareholders—have considerable difficulty determining the relation between pay and performance. Why is it so difficult to answer the basic question, “How much should the CEO be paid?”

- Large corporations are routinely criticized for being too short-term oriented and not taking into account the interests of important stakeholders, such as employees, customers, suppliers, and the general public. At the same time, most senior executives claim to manage their companies with a long-term horizon and to pay considerable attention to the needs of their most important stakeholders. Are companies really short-term myopic? Is there large-scale evidence for this claim? Can a company really maximize shareholder value without optimizing stakeholder needs?

The complete paper is available here.

Print

Print

One Comment

Who funded this research?