Craig Lewis is the Madison S. Wigginton Professor of Finance and Professor of Law at Vanderbilt University. This post is based on his recent testimony before the United States House of Representatives’ Committee on Financial Services.

Thank you for inviting me to appear today [Oct. 17, 2019] to discuss corporate priorities as they relate to share repurchase program, workers, communities, and investment. I am the Madison S. Wigginton Professor of Finance at Vanderbilt University’s Owen Graduate School of Management and a Professor of Law at the Vanderbilt School of Law. I have been on the faculty since 1987. From 2011 to 2014, I served as the Director of the Division of Economic and Risk Analysis and Chief Economist at the SEC.

1. General

The House Financial Services Committee is considering a number of regulatory initiatives designed to reduce or even eliminate the ability of corporations to repurchase shares. I discuss the economic substance of share repurchase programs and argue that share repurchases, or “stock buybacks,” represent a highly efficient way to distribute cash to shareholders, and when compared to ordinary dividends, represent nothing more than an alternative mechanism for public corporations to distribute cash to shareholders.

As to my background, I helped develop the SEC’s current approach that is used to evaluate the economic effects of rulemakings, and it is through that lens that I have made my comments. To paraphrase the SEC’s current guidance, a key requirement of any proposed rulemaking is the identification of the need for regulatory action and how the proposed rule will meet that need. An integral part of an economic analysis is to begin by identifying the “baseline.” I will focus my remarks on the current baseline as a means to identify the main economic effects of stock buyback programs.

There are four House Bills under consideration: the Reward Work Act, the Stock Buyback Reform and Worker Dividend Act of 2019, the Stock Buyback Disclosure Improvement Act of 2019, and a fourth Stock Buyback Disclosure Bill. All of these rules reflect an implicit perspective that share repurchase programs represent a market failure that cannot be resolved through private action. Opponents of share buyback programs typically argue that they: 1) artificially inflate share price, 2) crowd out investment, 3) result from managerial short-termism, and 4) disproportionately benefit the wealthy and corporate insiders. I argue that these conjectures are either not supported by empirical analysis or are based on misconceptions about the how share repurchase programs actually operate.

I begin by characterizing the economic substance of share repurchase programs. Although similar to ordinary dividends, share repurchases differ in several important ways. The most compelling examples include: 1) their ability to signal undervalued share price, 2) their role as a mechanism for distributing excess cash, 3) individual income tax advantages, and 4) reallocation effects.

- Signaling undervalued share price. In general, the announcement of share repurchase programs is associated with share price increases of approximately 2%. The positive wealth effects are typically attributed to management trying (and succeeding) to signal that their firms are undervalued.4 Stock buyback programs are viewed as credible signals to investors because managers typically hold non-trivial ownership stakes and would not personally benefit from overpayment. By having the firm repurchase shares at what they believe to be “fair” prices, management is effectively “putting its money where its mouths is.”

- Distributing excess cash reserves. Investors have a tendency to view share repurchases as discretionary payments and ordinary dividends as non-discretionary obligations. In other words, when a firm announces a share repurchase program, investors do not interpret it as a long-term commitment. By contrast, once a firm begins paying ordinary dividends, investors expect them to continue to pay them, and will punish firms that cut dividends. For example, Dielman and Oppenheimer (1984) find that firms cutting dividends by more than 25% or omitting dividends entirely respectively experience abnormal returns of—7.7% and -8.1% on the announcement date. Given the downside risk associated with a dividend cut, firms respond by treating ordinary dividends as though they are just as important as new investment.

- The other relevant consideration is that regardless of whether a firm elects to distribute past earnings as dividends, share repurchases, or if it chooses to let them to accumulate as cash on the balance sheet, earnings represent the return to the capital that shareholders put at risk. In a well-functioning capital market, the price that investors pay for future earnings reflects a fair rate of return for the risk they bear.

- Individual income tax advantages. Share repurchase programs confer significant tax advantages to shareholders relative to ordinary dividends. Ordinary dividends and long-term capital gains from the sale of shares (the difference between the sale price and the shareholder’s tax basis) both qualify for a lower federal tax rate. When a shareholder receives an ordinary dividend, tax is due immediately and without regard to whether the shareholder has cash to pay the tax. By contrast, any additional value resulting from a share repurchase program is taxable only to those shareholders that elect to sell their shares, who then pay capital gains taxes.

- Reallocation effects. Another point that is often overlooked in the share repurchase debate is that the cash paid to shareholders does not disappear. Investors selling shares either spend the cash received on goods and services or reinvest it elsewhere. The reallocation of capital into consumption and other investments potentially redirects it to activities that have higher value than incremental investments available to firms. In the long-run, this stimulates growth and creates better jobs than would be possible if firms were to make suboptimal investments simply because the cash was available.

These explanations contrast sharply with critics who view stock buybacks as financial gimmicks, primarily aimed at “artificially” inflating share price. Consider Senator Elizabeth Warren’s comment that, “stock buybacks create a sugar high for the corporations. It boosts prices in the short run, but the real way to boost value of a corporation is to invest in the future, and they are not doing that.” Senator Warren’s quote is instructive because it highlights many of the misconceptions shared by critics of share repurchases.

- Artificial price inflation. Investors do, in fact, respond favorably to share repurchase announcements. This has led critics to conjecture that firms can engage in a type of price manipulation wherein they simply announce their intention to initiate share repurchase programs in the hope that prices will rise. This argument fails because it does not consider managerial incentives. When managers hold equity positions in the firms they manage, it would not be in their self-interest to overpay via share repurchase because to do so would subsidize departing shareholders at their expense.

- If stock buy-backs are solely designed to artificially inflate valuations, stock prices would be expected to revert to pre-announcement levels once it became clear that higher prices could not be justified on the basis of the available information. The empirical evidence is inconsistent with this conjecture and finds instead that announcement date price increases are permanent.

- Inadequate future investment. It is not possible to observe investment opportunities that a firm considered but did not take, yet we can determine whether share repurchases crowd out investment or merely reflect the distribution of excess cash. Contrary to the view that firms cut back on capital investment to repurchase shares, I find that, on average, firms have been able to invest in new projects, pay dividends, and repurchase shares without constraint. In situations where such firms need additional funds, they are able to access capital markets to obtain the necessary funding. By contrast, firms that do not repurchase shares would be unable to fund new investment from earnings and needed to access capital markets to obtain the necessary funding.

- Managerial Short-Termism. There is a widely held belief that pressure by activist shareholders creates managerial incentives to meet short-term goals at the expense of long-term value maximization. Proponents argue that managers frequently respond by repurchasing shares in an attempt to placate disgruntled investors. An analysis by Lazonick (2014) suggests that share repurchases and dividends absorb 91% of net income. Using an appropriately adjusted definition of net income, I report numbers that are much lower. I find that firms only pay 47.10% of adjusted net income as dividends and share repurchases. Moreover, firms are able to retain 36.26% of adjusted net income net of new external financing after investing in productive opportunities, paying ordinary dividends, and repurchasing shares. My estimates are low enough that payments to shareholders would not be expected to significantly impair a firm’s ability to focus on long-term decisions.

- Repurchase Plans Disproportionately Benefit the Wealthy. It has been estimated that approximately one half of US families have direct or indirect investment in the stock market and that the proportion of families with equity exposure are an increasing function of age. Seniors, in particular, rely on equity markets to provide them with the ability to meet threshold spending levels in retirement. For example, a recent study by Brady (2017) examines individual W-2 tax return data and finds that participation and contribution rates for employer-sponsored retirement plans increase with age as individuals become more concerned about retirement. Brady (2017) reports that 68% of individuals aged 55 to 64 are active participants in a retirement plan or have a spouse who is an active participant, and this age group contributes an average of 7.7% of their wages to retirement plans.

- Repurchase Plans Disproportionately Benefit Corporate Insiders. The argument that share repurchases disproportionately benefit corporate managers would only be true if share repurchases were being used to manipulate prices so that they could trade at artificially high levels. Given the discussion presented above, there is no evidence that this is the case. If, instead, share repurchase programs are used to signal “fair” value, investors and corporate insiders are simply realizing benefits that already should have accrued to them.

- Regardless of whether executives sell or retain their shares, their wealth is effectively unchanged. If they sell shares in the open market, the receive cash at post-announcement prices. If they hold onto their shares, there investment would have appreciated by the same amount. Not only would executives be indifferent between selling and retaining shares based on price alone, these are the same choices available to every shareholder.

2. Do Share Repurchase Programs Constrain Investment?

The short answer is no.

Much of the current debate surrounding share buybacks stems from provisions in the Tax Cuts & Jobs Act of 2017 (TCJA) to tax unrepatriated foreign earnings. To the extent that the repatriation tax frees previously inaccessible cash, one would expect these firms to redeploy excess cash.

Reacting to the propensity for firms to repurchase shares with this cash, Dr. Kevin Hassett, the White House’s Chairman of the Council of Economic Advisors, offered the following at a February 2018 press conference:

“Well, the thing that you have to remember is that we’re starting out with trillions of dollars that were parked overseas. And that trillions of dollars — those monies are coming home right now and that’s a one-time adjustment. And a lot of firms are taking that money and they’re paying bonuses, but they’re also doing things like increasing dividends and doing share buybacks, which sometimes happens when firms find money.”

The idea that some firms announce share buybacks when they “find” money is hardly surprising. As Dr. Hassett suggests, there are many valid ways to redeploy “found” money. Firms that previously faced financial constrains may optimally increase investment spending. Alternatively, firms that were able to fully invest may not need the cash. For these firms, the decision to return cash to shareholders could be a better choice than retaining it for unspecified corporate purposes.

Excess cash balances are largely the result of the accumulation of retained earnings. Since the TCJA eliminated incentives to retain cash overseas, the uptick in stock buybacks is largely attributable to decisions by firms to make choices about how best to handle cash balances they may no longer need. Policy solutions that are designed to increase the cost of repurchasing shares impose a permanent cost on what is likely to be a transitory phenomenon.

One factor motivating the decision to repurchase shares could be a decision by corporate boards to actively limit managerial discretion over the unspent cash balances. Finance theory suggests that as managerial discretion increases, it becomes easier for managers to take actions that benefit themselves to the detriment of shareholders. One only needs to look at the recent failure of the WeWork initial public offering to understand the importance of limiting managerial discretion. Former CEO, Adam Neuman, was asked to step-down once it became clear that invstors were concerned about unprofitable operations and excessive perquisite spending.

One of the most effective way to reduce managerial discretion is to eliminate excess cash balances via stock buybacks. With less available cash, managers are forced to be more selective about investment choices. When cash balances are insufficient to fund new investment, firms must turn to external capital markets and face increased monitoring.

This raises a series of questions—What are the characteristics of firms that repurchase shares? Are they able to finance projects from cash flows? Do they access capital markets? What should firms do with cash that no longer required for investment?

Economic theory argues that new investment should only be taken if new projects are expected to earn returns that exceed the opportunity cost of capital. That is, a firm should only invest in projects that have positive net present value (NPV). Suboptimal investments—those with negative NPVs—destroy firm value. When firms do not have attractive investment opportunities, repurchasing shares is a sensible alternative to investment in negative net present value projects.

2.1 The empirical evidence of investment by firms that do and do not repurchase shares

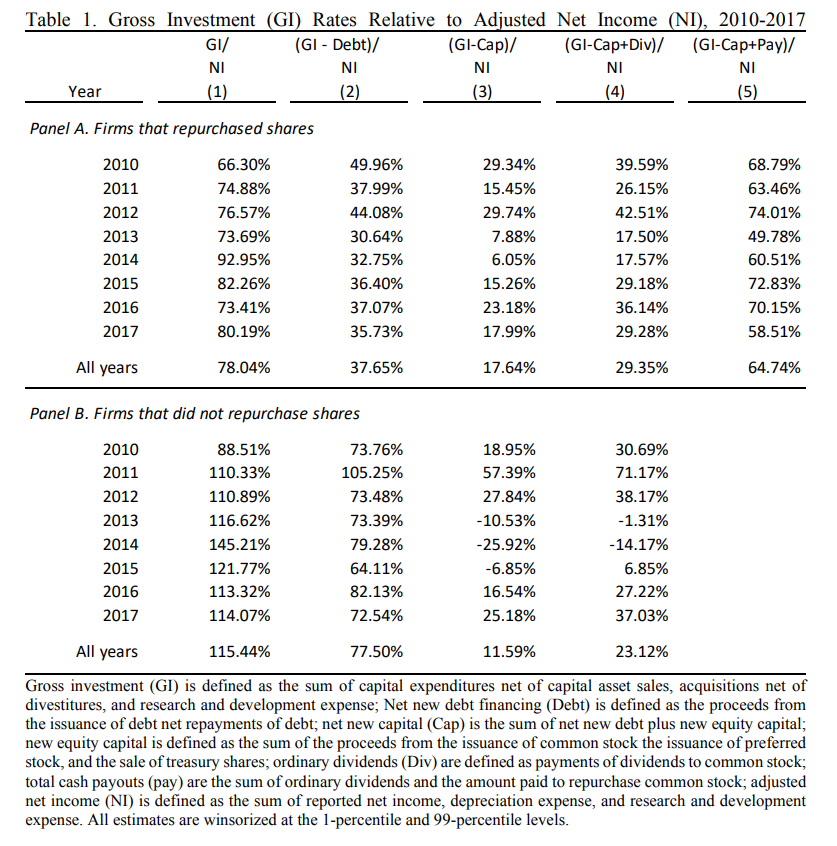

I address this question by examining the investment activity of publicly traded companies over the years 2010 through 2017. Table 1 provides an analysis of gross investment rates (GI) relative to adjusted net income (NI). Gross investment represents the amount spent on capital assets, acquisitions, and research and development expense. Adjusted net income is a measure of the cash generated by operations that could be used by shareholders for investment purposes. I add back research and development expense because it is recognized as an expense for financial reporting purposes even though it is more appropriately viewed as speculative investment in future growth. I also add back depreciation expense because it is a non-cash expense that does not require the use of any funds. Adjusted net income is the amount that could be used to spend on investment, dividends, and share repurchases.

2.1.1 Uses of cash for firms that repurchase shares

In Panel A of Table 1, Column (1) indicates that, on average, firms spend 78.04% of adjusted net income on gross investment. While this is a substantial amount, these firms also are active in debt and equity markets. For example, Column (2) shows that net debt issues are used to finance approximately 47% of gross investment (47% = (78.04-37.65)/78.04). This suggests that even though these firms could have financed gross investment from current cash flows, they chose to borrow funds. The decision to borrow may be a reflection of the relatively low interest rate environment that persisted over the sample period. Firms also financed new investment with equity (Column (3)). On average, equity issuances further reduced the impact of new gross investment relative to adjusted net income by 26% ( 26% = (37.65%-17.64%)/78.04%). The yearly numbers indicate that firms were particularly active in equity markets in 2013 and 2014.

Panel A also indicates the fraction of adjusted net income net of new capital that was used for investment and to pay dividends and repurchase shares. Column (4) reports that, on average, firms used 29.35% of adjusted net income to invest and pay ordinary dividends net of net borrowing and equity issuances. This suggests that, on average, firms were able to invest and pay ordinary dividends in a relatively unconstrained manner.

On average, firms use 64.74% of adjusted net income (net of new financing) for new investment and cash payments to shareholders. Given that “repurchase” firms retain 35.26% of adjusted net income, they show no signs of being financially constrained, even after using 35.39% of adjusted net income to repurchase shares (64.74%-29.35%).

The main takeaway is that these firms have the capacity to invest in capital assets, pay dividends, repurchase shares and still have over one-third of adjusted net income remaining for other corporate uses.

2.2.2 Uses of cash for firms that do not repurchase shares

Panel B of Table 1 shows that firms that do not repurchase shares have gross investment levels that exceed adjusted net income. Column (1) reports that, on average, these firms would not be able to invest without accessing external capital markets—the ratio of gross investment to adjusted net income is 115.44%.

“Non-repurchase” firms have a tendency to rely on debt almost as much as firms that repurchase shares. For example, Column 2 of Panel B indicates that they borrow 40.39% of adjusted net income compared to 37.94% for firms that repurchase shares.19 By contrast, “non-repurchase” firms issue significantly more equity than “repurchase” firms. Column 3 of Panel B finds that new equity issues are 65.91% (77.50%-11.59%) of adjusted net income for “non-repurchase” compared to 20.01% (37.65%-17.64%) for “repurchase” firms. Not surprisingly, firms that issue substantial amounts of new equity are unlikely to repurchase shares at the same time.

3. Key Economic Features of Bills Under Consideration

3.1 Bills that are designed to eliminate or constrain stock repurchase programs

The “Reward Work Act” and the “Stock Buyback Reform and Worker Dividend Act of 2019” are designed to reduce the ability of corporations to repurchase shares. The Reward Work Act calls for the outright prohibition of share repurchase programs. The second bill would require firms that repurchase shares to pay workers an amount proportional to 1-millionth of the amount spent to repurchase shares.

Both bills are based on the premise that if share repurchase programs are curtailed or become more expensive, firms will elect to increase investment in tangible and intangible assets (R&D) and pay workers more. This could happen if firms were to preference distributions to shareholders over investment in positive net present value projects. Given that, on average, firms are able to invest in profitable opportunities, pay dividends, and repurchase shares using a combination of adjusted income and access to capital markets, it is not clear why increasing the incentives to retain cash would lead to more efficient investment. If regulation creates incentives for firms to reinvest rather than distribute excess cash to shareholders, it would likely lead to an overinvestment problem in which firms would make inferior investments that would be unlikely to benefit the economy in the long-run.

3.2 Bills that require enhanced disclosure of share purchase programs

The Stock Buyback Disclosure Improvement Act of 2019 and a second unnamed Stock Buyback Disclosure Bill are designed to increase transparency around share repurchase programs. The first bill is largely a response to Commissioner Jackson’s views regarding executive participation is share repurchase programs. For reasons I note above (see footnote 10 in the complete publication), I believe that the underlying research that informs these concerns fails to document a significant market failure.

The second bill seeks to increase mandatory disclosure about the nature and purpose of planned share repurchase programs. This bill includes a requirement that firms must pre-announce a repurchase program 15 days prior to its execution. Since repurchase programs are typically executed over relatively long periods of time, it is unclear what the benefit of a mandatory pre-announcement has relative to the existing 8-K disclosure requirements.

The most surprising aspect of this bill is that the SEC would be required to approve buyback programs before they can be implemented. The decision to require a disclosure-based regulator like the SEC to become involved in financial policy decisions is unprecedented. Not only does the SEC lack the expertise to make such determinations, it is unclear how this serves the Commission tri-partite mission of investor protection, the maintenance of fair, orderly and efficient markets and the facilitation capital formation.

The complete publication, including footnotes, is available here.

Print

Print