Steve W. Klemash is Americas Leader at the EY Center for Board Matters; Bridget Neill is Americas Vice Chair, Public Policy at EY; and Jamie C. Smith is Associate Director at the EY Center for Board Matters. This post is based on their EY memorandum.

The talent paradigm is shifting. A company’s intangible assets, which include human capital and culture, are now estimated to comprise on average 52% of a company’s market value. [1] At the same time, the nature of work is rapidly evolving, new generations are reshaping the workforce and businesses are redefining long-term value and corporate purpose through a stakeholder lens.

In this era of disruption, talent and culture have leapt to the forefront of thinking around enabling strategy and innovation and creating long-term value. Accordingly, human capital has rapidly emerged as a critical focus area for stakeholders. There is clear and growing market appetite to understand how companies are managing and measuring human capital, demonstrated by:

- Comments received by the U.S. Securities and Exchange Commission (SEC) on human capital matters, as articulated in the August 2019 proposed rule amendments to revise current business disclosure requirements

- Influential investors like BlackRock and State Street Global Advisors making human capital and company culture engagement priorities

- Market-driven frameworks such as the Global Reporting Initiative, the Embankment Project for Inclusive Capital and the Sustainability Accounting Standards Board (SASB) identifying human capital as a key value driver

Advancing disclosures to keep pace with this transformational view of human capital will be a journey. To better understand where companies are on this journey, we reviewed the proxy statements of Fortune 100 companies to see how leading companies are disclosing their governance and management of human capital.

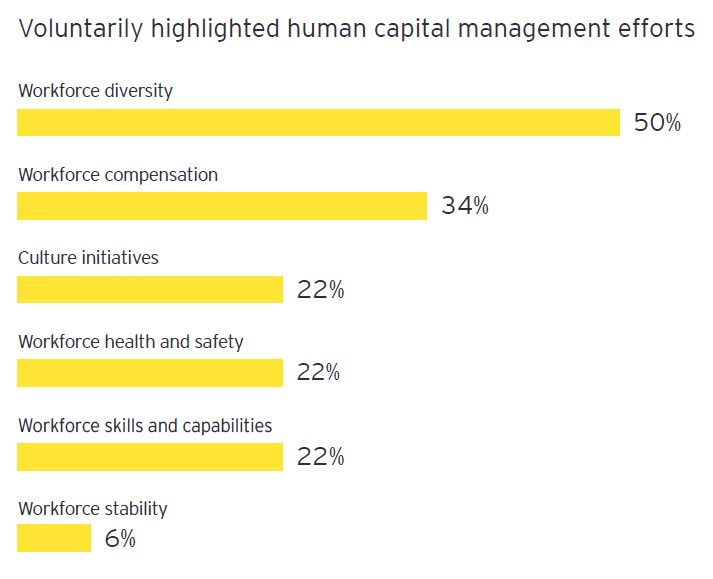

We found that Fortune 100 company proxy disclosures reflect early stage efforts to meet growing demands for better communications around the management and governance of human capital and culture. Two key observations stand out from our analysis and are explored in greater detail. One, many companies voluntarily highlight management’s general efforts around certain human capital issues (e.g., diversity and inclusion or broader workforce compensation). However, these disclosures often do not identify key performance indicators (KPIs) or quantify them. Two, many companies broadly address board oversight of human capital management or culture, and more assign related committee oversight responsibilities, but the depth and clarity of these disclosures vary and may not provide a complete picture of the board’s governance in this important area.

Of course, proxy statements are not the only vehicle for human capital or culture disclosures, as many companies disclose such information in corporate social responsibility (CSR) or sustainability reports and other public disclosures that may or may not be filed with the SEC. Proxy statements are, however, an increasingly important tool for shareholder and other stakeholder engagement and a key source of information about the board’s governance philosophy and approach.

In addition to outlining key findings from our review of Fortune 100 proxy statements, this report also highlights emerging frameworks and KPIs for measuring and reporting on human capital and culture to help guide companies as they evolve their practices and disclosures. Further, it provides an overview of related regulatory developments and increasing investor engagement on human capital and culture to reflect the continuing role of stakeholders in advancing human capital disclosures.

What we found: the current landscape for proxy disclosures on human capital and culture

As human capital and culture increasingly become priorities for boards and management, companies and others are in the early stages of identifying the best ways to address this priority, both practically and in disclosures. The workforce is changing rapidly due to technology and increased competition for talent—particularly as talent is more attracted to companies that have a clear purpose, strong culture and respected reputations. As companies navigate these changes, they can benefit and enhance their reputation with stakeholders by examining the activities that can help them attract, retain and motivate the best talent, developing KPIs around those activities and disclosing those KPIs that best indicate value creation or enhancement.

Overall, we found that current voluntary proxy disclosures on human capital and culture reflect this emerging stage of development and underscore leading companies’ efforts to proactively and voluntarily address topics of stakeholder interest.

We observe opportunity for enhancing these disclosures to provide clarity on how companies are prioritizing human capital and culture as long-term strategic assets, and how board oversight is advancing and protecting related value creation.

This is based on our analysis of human capital and culture-related disclosures in the proxy statements of 82 companies on the 2019 Fortune 100 list available as of 5 September 2019.

Disclosures relating to human capital and culture programs

While proxy statements may not be the primary vehicle for human capital or culture disclosures (which are often included in CSR or sustainability reports), they do communicate the board’s governance approach and are increasingly used as a communication tool around areas of shareholder interest, including human capital. Indeed, we found that many companies voluntarily highlighted commitments to and/or initiatives and goals with respect to human capital and culture. Only a subset of these, however, disclosed any KPIs with fewer quantifying them. The following data and observations reflect the human capital topics, and any related KPIs, most often highlighted by companies.

Workforce diversity—Half of Fortune 100 companies highlighted commitments and efforts to enhance diversity and inclusion. Key themes of these disclosures included initiatives to empower women and minorities and bring them into leadership positions, diversity statistics and recruitment goals around diverse talent, employee affinity groups, supplier diversity initiatives, collaborations with diversity organizations, and external rewards and recognition.

- Just under a third of the companies that discussed workforce diversity provided some measure of workforce diversity data (e.g., percentage of women and/or people of color across the global or US workforce, at the management level, in leadership positions or across incoming hires).

Workforce compensation—Around a third of companies highlighted key practices or developments related to compensation of the broader workforce. Most of these companies highlighted pay equity, including efforts to identify and eliminate pay gaps for women and minorities. Other key themes of these disclosures were minimum wage increases and general statements around the company’s compensation approach.

- Around 40% of the companies that discussed workforce compensation disclosed specific performance data around pay equity beyond the required CEO pay That information generally included the pay ratio for female to male employees, the pay ratio for minority to nonminority employees and in some cases a measure of the adjustments made to help close the gap. A quarter of the companies reported a specific new minimum or starting wage (usually $15 per hour but in some cases $11 per hour).

Culture initiatives—Twenty-two percent of companies mentioned some of the ways they are embedding or measuring culture beyond compliance with codes of conduct or executive pay considerations. Some of the practices highlighted include employee surveys and benchmarking reports, employee town halls, unconscious bias trainings, leadership team events, and the inclusion of culture-related messaging and feedback via onboarding processes, performance reviews and exit surveys.

- Half of the companies that discussed culture initiatives said that they use employee surveys to measure Some of the other KPIs mentioned included diversity hires, employee engagement, turnover and issues escalation resolution. With limited exceptions, the companies did not provide quantitative results for their disclosed KPIs.

Workforce health and safety—Twenty-two percent of companies discussed commitments, initiatives or benefit programs related to workforce health and safety. These disclosures included topics such as employee health and wellness resources and benefits, and, in some cases, safety metrics for the company and its suppliers.

- Less than half of the companies that discussed workforce health and safety disclosed any related Among those that did, the most common were recordable injury rates and the number of employees participating in certain health and wellness programs. However, only a handful of companies provided quantitative results for their disclosed KPIs.

Workforce skills and capabilities—Twenty-two percent of companies mentioned initiatives related to employee re-skilling, training, and leadership development programs and related resources. The level of detail provided around these programs varied.

- Half of the companies that discussed workforce skills and capabilities provided at least one related quantified KPI This information generally included the aggregate amount of money or employee hours invested in training programs, or the number of employees participating in internal training or career planning programs.

Workforce stability—A handful of companies provided observations regarding the stability of their workforce.

- Most of these companies noted employee engagement scores and certain turnover rates (e.g., turnover rate for high-performing personnel) as KPIs; few provided quantified results for their KPIs.

Disclosures relating to board oversight of human capital and culture

We found that most companies do not specify how the board and its committees allocate oversight of various dimensions of human capital or culture. Just over 40% of the Fortune 100 broadly stated that the board oversees human capital management or culture, but it was not always clear what specific topics (e.g., workforce diversity, learning and development, or recruitment and turnover) are encompassed by that oversight.

At most companies, we found human capital and culture-related oversight responsibilities assigned to various committees based on their respective areas of focus (e.g., the audit committee often oversees compliance with employee codes of conduct while the compensation committee may oversee pay equity), but it was unclear whether these responsibilities reflect the complete picture of the board’s oversight in this space.

Overall, we found that proxy disclosures would benefit from more specificity around what dimensions of human capital management and culture are overseen by the board and how the board is executing that oversight.

Many boards seek directors with human capital‑related expertise

Nearly a third of companies included human capital-related experience among the skills and areas of expertise sought at the board level. In describing this desired expertise, these companies used phrases and terms such as human capital management experience, talent or workforce management or development, or experience in building values-based ethics and compliance programs.

More companies (44%) cited human capital-related experience in at least one director biography in describing the key reasons that person is qualified to serve on the board. The backgrounds of these directors vary. Some disclosures point to a candidate’s recognized leadership in diversity and inclusion, experience in shaping culture initiatives or background in human resources.

Others cite human capital and culture experience related to executive leadership, scaling businesses, mergers and acquisitions, and service on other boards, among other factors.

Emerging frameworks and KPIs for human capital and culture disclosures

Companies seeking to enhance how they measure and report on human capital and culture may look to a variety of market-driven frameworks that support the redefinition and communication of corporate value through an expanded stakeholder lens. The following groups, for example, have created frameworks for measuring and reporting on long-term value, in each case identifying human capital as a leading driver. For example:

- The Embankment Project for Inclusive Capital (EPIC), which was formed by the Coalition for Inclusive Capitalism and Ernst & Young LLP, convened more than 30 global capital markets leaders to develop a standardized, material and comparable set of nonfinancial metrics for the measurement of company activities related to long-term value. Talent was identified as a key driver of long-term value, and EPIC proposed metrics and narrative disclosures to help guide related company reporting. [2]

- The SASB is an independent body that has published a set of detailed, industry-specific standards intended to enable companies to manage, measure and report on sustainability factors that drive value and affect financial SASB’s standards are organized into five groups, one of which is human capital.

- The Global Reporting Initiative (GRI) is an independent international organization that helps businesses and governments understand and communicate their impact on sustainability issues such as climate change, human rights, governance and social well-being. The GRI Standards cover human capital topics such as recruitment and retention, labor and management relations, health and safety, training and education, diversity and pay equity. [3]

- International Standards Organization (ISO) is an independent, nongovernmental international organization that develops voluntary, consensus-based, market-relevant international ISO 30414:2018 provides guidelines and metrics for human capital reporting, including diversity, organizational cultural, health and safety, recruitment and turnover, skills and capabilities, and more. [4]

These frameworks suggest KPIs that companies may use to better communicate human capital value. The KPIs generally correspond to those articulated by commenters on the SEC’s concept release and the Human Capital Management Coalition 2017 rulemaking petition to the SEC, which are discussed in the Regulatory developments section that follows.

Companies using these external frameworks to provide human capital and culture disclosures may help enable comparability and avoid the perception that their disclosures lack substance. Further, companies that integrate data-rich human capital disclosures (as well as substantive disclosures related to other long-term value drivers) into public reporting beyond CSR and sustainability reports may more consistently and comprehensively communicate how the company is creating long-term value.

In today’s business environment, integrating information around long-term value drivers like human capital and culture across company communications is increasingly important. A diverse and growing group of market participants view responsible corporate citizenship and increased attention to stakeholder interests—especially employees—as consistent with, and perhaps even critical to, creating long-term shareholder value. The Business Roundtable’s August 2019 statement on corporate purpose is among the most recent examples of these shifting dynamics.

Regulatory developments

In addition to market-driven reporting developments, regulatory developments may also drive changes in how human capital and culture is managed, governed and disclosed.

Human capital

For several years, the SEC has been working to make its disclosure requirements more modern, streamlined and effective. One area of focus has been on required business and financial disclosures. The business disclosures include, among many other topics, a requirement that registrants disclose the number of people they employ. This was and still is the only specific business disclosure requirement directly related to human capital.

The historical approach of disclosing only the costs of compensation and benefits often is not enough to fully understand the value and impact of human capital on the performance and future prospects of an organization. [5]

—SEC Chairman Jay Clayton

In 2016, the SEC issued a concept release to solicit comment on the information investor’s need to make informed investment and voting decisions and whether certain of its rules had become outdated or unnecessary. In response, the SEC noted [6] that it had received comments advocating for expanded human capital disclosures in the following areas:

- Worker recruitment, employment practices and hiring practices

- Employee benefits and grievance mechanisms

- “Employee engagement” or investment in employee training

- Workplace health and safety

- Strategies and goals related to human capital management and legal or regulatory proceedings related to employee management

- Whether employees are covered by collective bargaining agreements

- Employee compensation or incentive structures

In July 2017, the SEC received a rulemaking petition [7] from the Human Capital Management Coalition, a cooperative effort currently involving 28 institutional investors representing more than $4 trillion in assets, to require registrants to disclose information about their human capital management policies, practices and performance, including in categories such as:

- Workforce demographics

- Workforce stability or turnover

- Workforce composition—such as temporary, contract or migrant

- Workforce skills and capabilities

- Workforce culture and empowerment

- Workforce productivity

- Human rights commitments and their implementation

- Workforce compensation and incentives

Comment letters filed in support of the petition asserted that human capital management is important in assessing the potential value and performance of a company over the long- term and that companies with poor human capital practices might face operational, legal, and reputational risks, while companies with strong human capital management may develop a competitive advantage.

In March 2018, the SEC Investor Advisory Committee (IAC) issued a recommendation [8] to the SEC that echoed this support for expanding human capital disclosures. [9] The recommendation notes that the financial markets view human capital as a source of value for companies and that institutional and retail investors want information about how companies approach human capital management, but the current accounting treatment of and disclosure requirements relating to human capital may not reflect this. The IAC encouraged the SEC to explore the possibility of including human capital disclosures in its disclosure modernization efforts.

In August 2019, the SEC proposed rule amendments to revise current business disclosure requirements, including requiring more disclosure on human capital to the extent material. Noting the history described above and that “human capital may represent an important resource and driver of performance for certain companies” the SEC has proposed replacing the current requirement to disclose the number of employees with a principles-based requirement to provide:

A description of the registrant’s human capital resources, including in such description any human capital measures or objectives that management focuses on in managing the business (such as, depending on the nature of the registrant’s business and workforce, measures or objectives that address the attraction, development and retention of personnel).

The SEC is soliciting comment on this proposal, and has asked whether it should provide other nonexclusive examples of measures or objectives that might be material (and thus might be disclosed), including, but not limited to, the following:

- Number and type of employees, including full-time, part-time, seasonal and temporary

- Measures regarding the stability of the workforce, such as voluntary and involuntary turnover rates

- Average hours of training per employee per year

- Measures regarding worker productivity

- Information regarding human capital trends, such as competitive conditions and internal rates of hiring and promotion

- The progress that management has made with respect to any objectives it has set regarding its human capital resources

The SEC will review comments received on this and other topics within the proposing release and consider issuing final rules at a future date.

Culture

The SEC has not specifically addressed corporate culture in its recent rulemaking efforts. Yet, the SEC and its staff have always emphasized the importance of corporate culture and the board’s related role in setting the all-important tone at the top. The SEC has always viewed boards of directors as gatekeepers who need to exemplify and oversee good corporate governance, a rigorous compliance environment and strong corporate culture.

Increasing investor engagement on human capital and culture

Investor attention to and engagement on human capital and culture have increased in recent years and will likely continue to grow, increasing the pressure on companies to strengthen

their practices and disclosures in this space. Some of the world’s largest money managers have recently turned their focus to human capital. BlackRock, for example, began including human capital management (HCM) as an engagement priority in 2018. It states that a company’s approach in this area is a factor contributing to business continuity and success, particularly in today’s “talent constrained environment” and in light of evolving labor market trends. BlackRock acknowledges that human capital disclosures are evolving and says it believes “in the benefit of companies moving towards a more robust disclosure of HCM metrics.” BlackRock cites the SASB, discussed earlier, as a provider of industry-specific human capital metrics that companies may consider. [10]

In 2019, State Street Global Advisors (SSGA) announced a focus on corporate culture “as one of the many, growing intangible value drivers that affect a company’s ability to execute its long-term strategy.” SSGA observes that “this is a challenging area for boards and management teams to report on.” It offers a framework as a starting point for how boards may approach this complex issue and sets the expectation that directors be able to discuss their role in influencing and monitoring culture. The framework suggests that senior management, under the board’s oversight, undertake three exercises (a comparative analysis, implementation and reporting) to align culture with long-term strategy. [11]

Through our annual investor outreach program, the EY Center for Board Matters is hearing similar views from many investors. More than a third of the investors with whom we spoke in the fall of 2018, which included governance specialists from more than 60 institutional investors representing more than US$32 trillion in assets under management, said human capital management and corporate culture should be a top board focus, up from just 6% three years ago. Most of these investors told us that, at least for now, they are prioritizing dialogue over specific disclosure requests and generally seek to better understand how boards are engaged and exercising oversight in this space. As with companies, investors are on a learning curve in understanding how leading practice is evolving and what disclosures would be most valuable for assessing long-term value creation.

The Human Capital Management Coalition, which submitted the 2017 SEC petition for rulemaking, also continues to engage companies and other market participants with the aim of understanding and improving how human capital management, encompassing desired company culture, contributes to the creation of long-term value. The group has worked for years to elevate human capital management as a critical component in company performance. [12]

What comes next?

Company disclosures—as well as board and management practices—regarding human capital and culture are poised to evolve further. From the growing market focus on how companies are creating value for multiple stakeholders, to investors seeking increased comparable data and transparency on these topics, to the SEC proposing to make human capital management a new disclosure topic, changes are on the horizon for how companies manage, oversee, and communicate around human capital and culture.

What does this future hold? Disclosures and company practices will likely continue to be impacted by trends around technology and demographics. A preferred disclosure framework is likely to emerge, with commonality among the KPIs communicated (especially within industries). Boards will likely develop a stronger relationship with the Chief Human Resources Officer (CHRO) and continue to redefine the scope of their oversight of this space. And companies are likely to further integrate disclosures on human capital, culture and other long-term value drivers across a variety of reports beyond CSR or sustainability reports.

The benefits of such developments could be substantial and include stakeholders, particularly shareholders, being better positioned to support the company’s long-term human value proposition as short-term challenges emerge.

Questions for the board

- Does the board set the tone at the top regarding the strategic importance of human capital and culture by dedicating the appropriate level of time and attention to these topics, including at the full board and committee levels?

- Does the board have the right composition and resources to appropriately oversee culture and talent management in the wake of disruptive talent trends and transformation?

- In today’s information age, where the role of the CHRO is akin to the role of the CFO through the industrial age, is the board spending enough time meeting with the CHRO to oversee talent strategy and performance?

- Is the company communicating its culture and values across the workforce such that each individual employee fundamentally understands how her or his day-to-day responsibilities and performance drive strategy and aligns to the company’s purpose?

- Is the board regularly reviewing with the CHRO talent and culture metrics similar to its quarterly updates on financial metrics with the CFO? How is the company integrating human capital metrics and performance into earnings calls, analyst meetings and its external financial reporting to better communicate long-term value?

- How are culture and talent goals integrated into incentive compensation programs? How is the company monitoring and adjusting for any unintended consequences?

Endnotes

1Global Intangible Finance Tracker (GIFT)™ 2018, October 2018. https://brandfinance. com/knowledge-centre/market-research/global-intangible-finance-tracker-gift-20181/, accessed October 2019.(go back)

2https://www.epic-value.com/, accessed October 2019.(go back)

3Global Reporting https://www.globalreporting.org/standards/gri-standards-download-center/, accessed October 2019.(go back)

4ISO 30414:2018. https://iso.org/standard/69338.html, accessed October 2019.(go back)

5SEC Chairman Jay Clayton’s Remarks to the SEC Investor Advisory Committee, 28 March https://www.sec.gov/news/public-statement/clayton-remarks-investor-advisory-committee-032819, accessed October 2019.(go back)

6Noted in the August 2019 proposed rule amendments to revise current business disclosure requirements. https://sec.gov/rules/proposed/2019/33-10668.pdf, accessed October 2019.(go back)

7Human Capital Management Coalition SEC petition for rulemaking, 6 July https://www.sec.gov/rules/petitions/2017/petn4-711.pdf, accessed October 2019.(go back)

8Recommendation of the Investor Advisory Committee, Human Capital Management Disclosure, 28 March 2019, available at https://sec.gov/spotlight/investor-advisory-committee-2012/human-capital-disclosure-recommendation.pdf.(go back)

9The IAC was created under the Dodd-Frank Act and has a statutorily mandated advisory and consultative role on regulatory priorities of the SEC and initiatives that protect investor interests and promote investor confidence. The SEC is required to review any findings or recommendations that the IAC brings before https://www.sec.gov/spotlight/investor-advisory-committee.shtml.(go back)

10BlackRock, Investment Stewardship Engagement Priorities for 2019, January 2019, and Investment Stewardship’s approach to engagement on human capital management, January https://www.blackrock.com/corporate/literature/publication/blk-commentary-engagement-on-human-capital.pdf, accessed October 2019.(go back)

11State Street Global Advisors, Aligning Corporate Culture with Long-Term Strategy, January https://www.ssga.com/blog/2019/01/aligning-corporate-culture-with-long-term-strategy.html, accessed October 2019.(go back)

12Human Capital Management Coalition. http://uawtrust.org/hcmc, accessed October 2019.(go back)

Print

Print