Steven M. Haas and Lawton B. Way are partners at Hunton Andrews Kurth LLP. This post is based on their Hunton Andrews Kurth memorandum.

Earlier this year, The Vanguard Group announced it would vote against any named executive officer (“NEO”) who sat on more than one outside public board and against non-executive directors who sat on more than four public boards. This policy is more restrictive than Institutional Shareholder Services’ (“ISS”) voting guidelines. It is an important reminder that institutional investors continue to develop their own voting guidelines that should be monitored by the companies in which they invest.

Overboarding Policies

Overboarding continues to generate discussion within the corporate governance community. Outside board service can be helpful in grooming senior management, gaining experience or insight, and developing important business relationships. Board service, however, can be demanding, and committing to too many boards can be time-consuming and a distraction. In response to investor concerns, the number of directors at Russell 3000 companies serving on five or more boards has decreased significantly since 2008.

Currently, ISS’s policy is that a CEO should not sit on more than two outside boards plus his or her own company’s board, while other directors (including non-CEO executives) can sit on up to five boards. Glass Lewis & Co.’s policy is that inside directors (i.e., CEOs and other NEOs) should not serve on more than two boards (including their own boards), while outside directors should be limited to five boards.

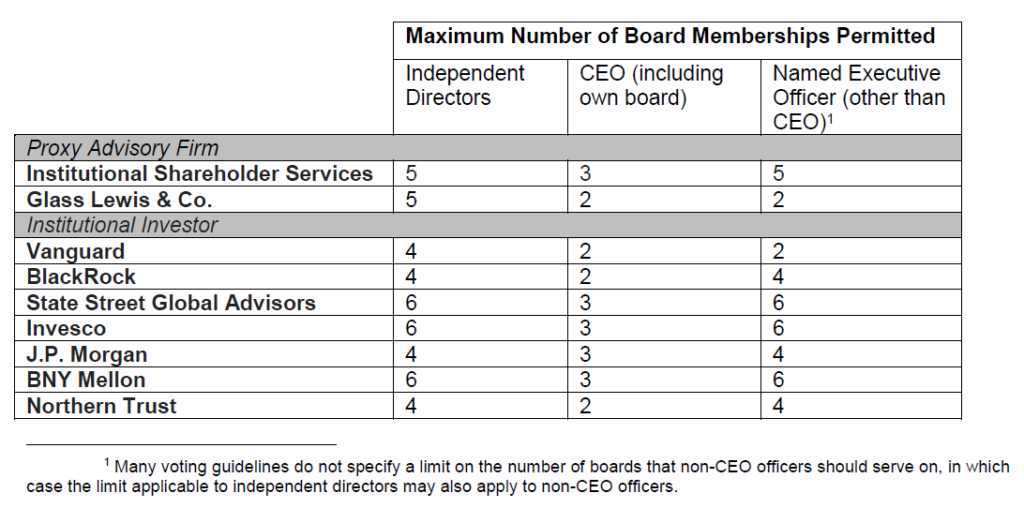

Increasingly, investors are adopting their own policies on overboarding, which sometimes deviate from ISS and Glass Lewis & Co. Proxy solicitation firm Morrow Sodali recently summarized the overboarding policies of key investors as follows:

The Council of Institutional Investors’ corporate governance policies provide as follows:

- Absent unusual, specified circumstances, directors with full-time jobs should not serve on more than two other boards (in addition to their own board).

- Currently serving CEOs should not serve as a director of more than one other company, and then only if the CEO’s own company is in the top half of its peer group.

- No other director should serve on more than five for-profit company boards.

Conclusion

It should go without saying that simply because a director exceeds the limits imposed by a proxy advisory firm or institutional investor does not mean the director is unfit or unable to serve effectively. Counting a director’s board seats is not a measure of director effectiveness. In addition, outside board service can be valuable, especially in grooming talent below the CEO level. Nevertheless, companies and boards need to consider not just their investors’ voting guidelines, but also the concerns giving rise to such guidelines.

Going forward, companies may see further development of overboarding policies, including:

- lower caps on outside board service for all directors, including independent directors;

- specific caps limiting the number of boards on which non-CEO named executive officers can serve; and

- continued customization of voting policies among institutional investors.

In addition, investors may increase their focus on outside time commitments of non-executive board chairs and audit committee chairs, especially in the wake of a corporate crisis.

Action items for management, boards, and governance committees include:

- reviewing the overboarding policies of their largest investors and of the proxy advisory firms as part of their review of board composition, board refreshment strategies, and recruiting new directors;

- reviewing their corporate governance guidelines to determine whether to adopt or update company-specific overboarding policies;

- considering other time constraints of directors and potential directors that may adversely affect board service, including the individual’s full-time job, responsibilities at not-for-profit boards, responsibilities at privately held company boards, and time-consuming committee assignments or other board leadership roles at the company or on other boards (e.g., lead independent director, board chair, audit committee membership, etc.); and

- being prepared to discuss overboarding issues when engaging with institutional investors.

Print

Print