Melissa Sawyer is a partner at Sullivan & Cromwell LLP. This post is based on a Sullivan & Cromwell publication by Ms. Sawyer, Marc Treviño, H. Rodgin Cohen, Lauren Boehmke and Nathaniel Ludewig. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

- Starboard, Ancora, Icahn and Elliott lead the way with the most publicly announced campaigns against U.S. issuers through August

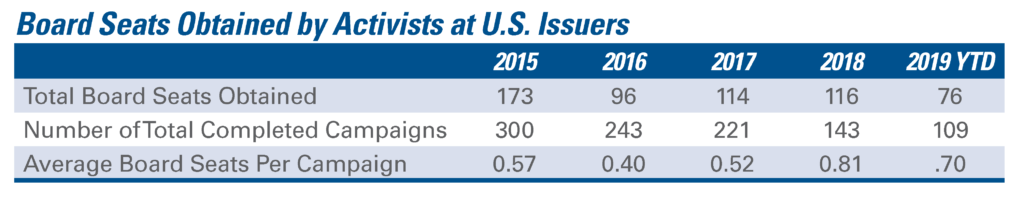

- Board seats obtained per announced campaign remain at elevated levels, as activists on average obtained 0.7 board seats per 2019 campaign (a 35% increase from 2017)

- Despite the recent focus in shareholder discourse on “purpose” and maximizing value for all stakeholders, institutional investors appear to give activists a pass on ESP topics

- Active managers are increasingly adopting activist tactics, highlighted by Neuberger Berman’s proxy contest at Verint Systems

- Activists are focused on M&A in record numbers, either by agitating for sales or divestitures or by intervening to break up previously announced transactions

- Almost 50% of issuers that added activist designees to their boards in 2017 or 2018 have since either sold themselves or engaged in a meaningful divesture

- Activists continue to hone in on issuers without a permanent CEO or with impending CEO retirements, evidenced by several prominent 2019 campaigns

Introduction

Activism activity levels thus far in 2019 have remained largely consistent with prior years. Activists launched 205 new campaigns through the end of August and won 76 board seats, as compared to 203 new campaigns and 113 board seats through the end of August last year.

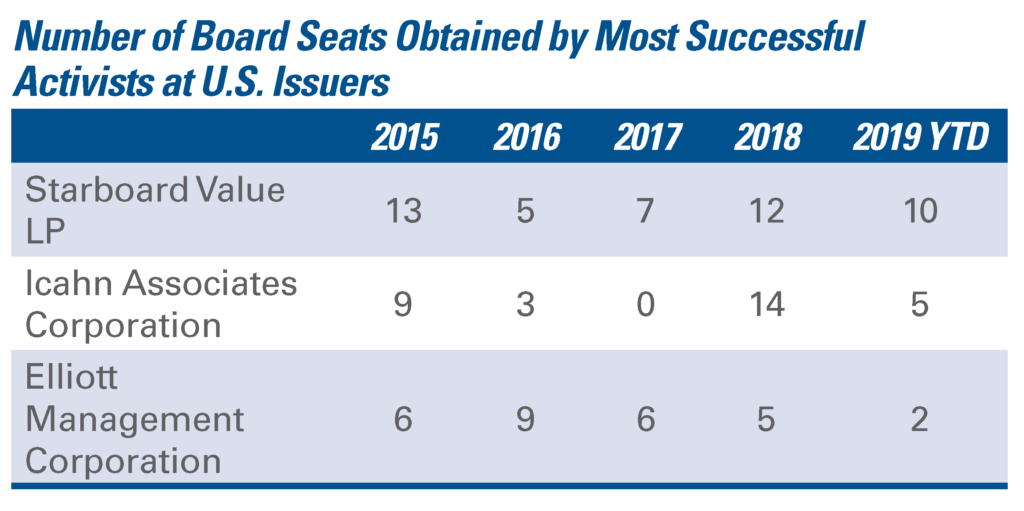

Starboard has led the pack, launching 10 new campaigns, and many of the other leaders are also well-known activists: Icahn initiated four new campaigns during the same period followed by Elliott with three. Elliott, Icahn and Third Point led all funds with $3.4 billion, $2.8 billion and $1.5 billion in capital deployed in activist campaigns in the first half of 2019, respectively.

Although the well-known activists grab the headlines in number and volume of campaigns, new activists continue to enter the space at a steady clip. First-time activists accounted for 26% of announced campaigns in the first half of 2019, roughly in line with the prior two years when first-time activists accounted for 31% and 21% of announced campaigns, respectively. We have also observed active managers entering the activism arena—some even going so far as to launch proxy contests in certain instances.

M&A has been a particular focus of activists so far this year, more than ever before, demonstrated by activists both calling for issuers to initiate a sale or divestiture process and opposing previously announced transactions. Nearly half of activism campaigns in the first half of 2019 have focused on M&A, up from prior years when M&A has consistently accounted for only roughly one-third of campaigns. It is also the case that, when an activist designee is added to a company’s board, the company will be more likely to engage in M&A going forward. This year, we conducted a proprietary review of companies that added activist designees in 2018 and 2017 and found that almost 50% of them were either sold or engaged in a meaningful divestiture following the addition. In addition, we continue to observe succession vacuums, which occur when companies lack a permanent CEO or their current CEO has an impending retirement, as a key factor correlating to an activist challenge. Further, activists are increasingly looking outside of the U.S. for potential targets—roughly 40% of capital deployed by activists in the first half of 2019 targeted European or Asian issuers.

These developments are taking place against a backdrop of an intensified debate in the corporate governance world over the “purpose” of a corporation. A number of both institutional investors and business leaders have begun to emphasize the importance of all a corporation’s stakeholders and question how directors should consider these stakeholders in their decisionmaking. This debate raises the question of whether, and how successfully, activists will seek to implement these ideas, or at least introduce the terminology into their messaging, in order to win support from key shareholders in activism contests. Moreover, the approaching 2020 U.S. Presidential election is catalyzing more vocal criticism of share buy-backs and some candidates are cautioning corporations to be more “employee-friendly.” These concerns could constrain those activists who seek a return of capital and cost-cutting measures or companies seeking to preempt or respond to these lines of attack.

Notes on the Scope and Sources of Data Used in This Publication

The information in this publication in Section 2 (Activism Campaign Data) and Section 4 of the complete publication (Settlement Agreements) is based on the database maintained by FactSet Research Systems, Inc. on SharkRepellent.net, using a dataset run on August 31, 2019 supplemented by our review of public information and other third-party sources. This dataset only includes campaigns against U.S. companies, although other sections of the memo include global data.

We have followed the SharkRepellent categorization of campaigns as “proxy fights” or “other stockholder campaigns” and have not included those categorized merely as exempt solicitations or Schedule 13D filings with no public activism. We also have excluded the mere submission of Rule 14a-8 proposals as “campaigns,” although the section “Types and Objectives of Activist Campaigns” discusses shareholder proposals brought in conjunction with the activist campaigns covered in this publication. We also have excluded from the “other stockholder campaigns” category strategic acquisition attempts that involve unsolicited offers by one business entity to acquire another, though we have included takeover attempts involving unsolicited offers by activist hedge funds. In addition, in our review of settlement agreements, where one activist launched campaigns against several affiliates we limited our discussion to one settlement agreement. Further, we have categorized activist campaigns based on the calendar year in which a campaign was launched, even if the campaign is completed (e.g., an activist gains a board seat) during the following calendar year.

Data in Section II regarding hedge fund assets under management (AUM), performance and formation is based on the Q1 2019 and year-end 2018 Hedge Fund Industry Report issued by Hedge Fund Research (HFR), unless otherwise indicated. Other data sources are identified as they arise.

Every activism situation is unique and none of the statistics and analysis presented in this publication should be construed as legal advice with respect to any particular issuer, activist or set of facts and circumstances.

Activism Campaign Data

Each year, we review the data underlying U.S. activism activity to elucidate trends. As activism matures, the data has become largely consistent and this has been the case thus far in 2019 as well. This consistency suggests that activism will continue to be an important consideration for companies going forward.

A. Activist Campaigns

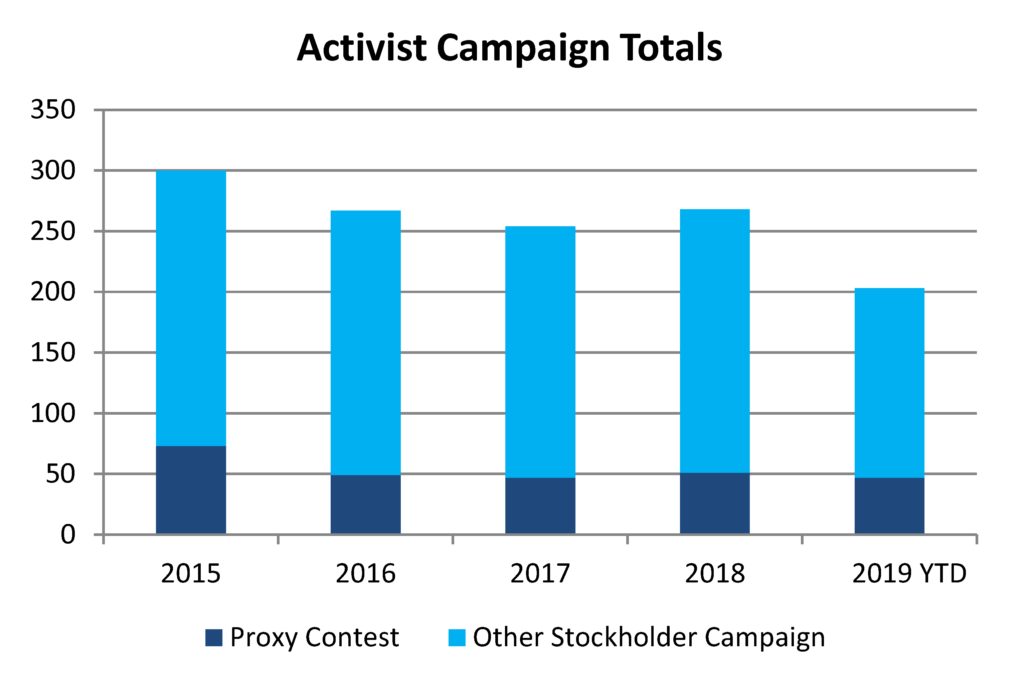

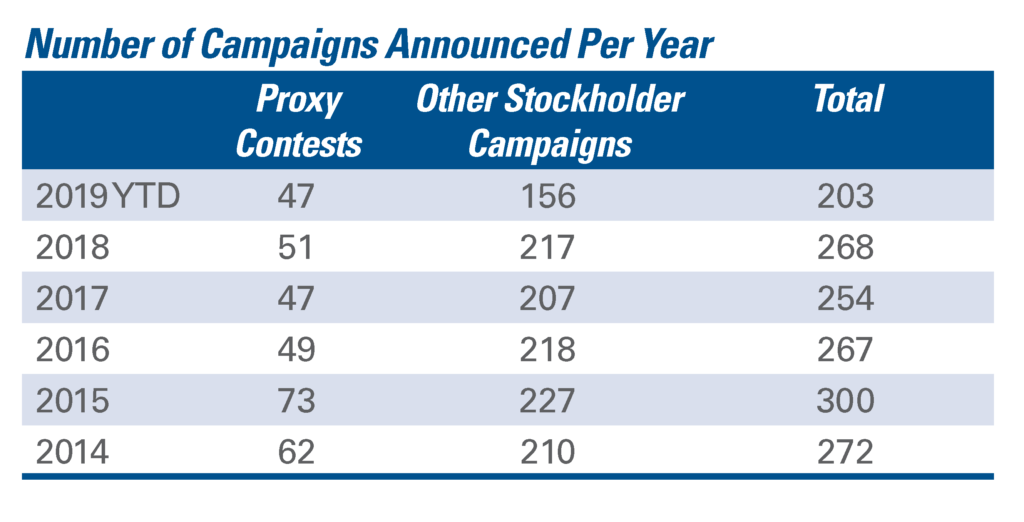

Through August, activists announced 203 campaigns against U.S. issuers, as activism activity levels remain strong. The total number of campaigns has been remarkably consistent over the past five years with an average of approximately 272 campaigns announced per year. However, the total number of public campaigns in a given year does not paint a full picture; based on anecdotal information, a significant number of activist situations also are being resolved without publicity.

Proxy contests have made up a slightly larger percentage of announced activist campaigns so far this year (23%) compared to levels during the prior three years (19%). This year’s percentage is more in line with 2014 and 2015, where full-scale proxy contests developed, on average, in slightly less than one-quarter of all activist campaigns announced in 2014 and 2015. Importantly, this statistic does not take into account campaigns that were settled prior to developing into a proxy contest but still resulted in board seats for the activists. Further, the proxy contest total may continue to grow this year as campaigns that were previously categorized as “Other Stockholder Campaigns” develop into proxy fights.

Activists have experienced higher success rates in obtaining board seats in recent years. So far this year, activists have averaged 0.7 board seats per campaign, in line with 2018 and almost double the 2016 average. As summarized in the table below, activists on average have received more than one board seat for every two campaigns announced in a particular year in each of the last three years and four of the last five years.

B. Prominent Activists

The most frequent activists in terms of announced campaigns against U.S. public companies so far in 2019 have been Starboard, Ancora Advisors and Icahn. This is the first year out of the past five years that Elliott has not appeared in the top-three of announced campaigns, although Elliott has remained active this year, falling just outside the top-three with three campaigns against U.S. issuers through August and winning two board seats. Ancora Advisors is a new addition to the top-three; the Cleveland-based fund, which founded its activist arm in 2014, was notably part of an investor group that settled with Bed Bath and Beyond in May.

In addition to the public campaigns discussed above, activists engage in “behind the scenes” campaigns that often prove successful. Further, it is important then to consider the full picture in gauging the most successful activists in a given year, including board seats obtained.

The activists that have been the most successful at obtaining board seats are generally those who are the most prolific in terms of number of campaigns. In particular, Icahn has been remarkably successful, obtaining, on average, 1.63 board seats in each announced campaign over the last five years. Many board seats are also obtained through “quiet” campaigns where an activist engages with the issuer “behind the scenes.” As noted in “Notes on the Scope and Sources of Data Used in This Publication,” this data is limited to U.S. companies, and does not reflect the success of activist funds, like Elliott, in Europe and Asia over the past five years.

C. Activist Hedge Fund Performance

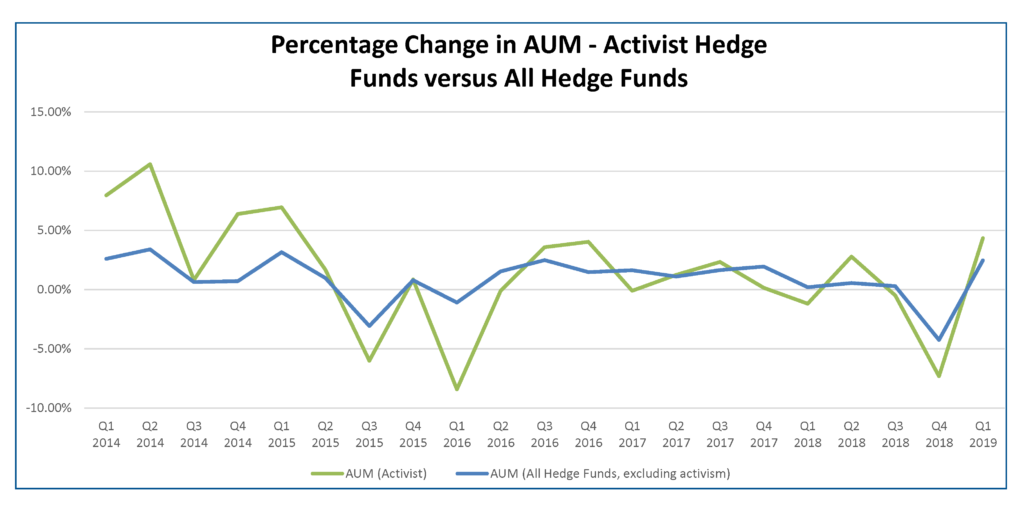

In the first quarter of 2019, activist hedge fund AUM increased by roughly 4.3%, rising at levels slightly higher than hedge funds overall (2.5%). This follows moderate decreases in 2018 driven by second half declines.

Activist hedge funds experienced positive net asset flows in the first quarter of 2019, following three consecutive quarters of negative net asset flows in 2018, which resulted in a total negative net asset flow of approximately $2.18 billion in 2018. Inflows as a percentage of AUM at activist hedge funds was higher than in the hedge fund industry in the first quarter of 2019. This comes after a three-year period where net outflows at activist hedge funds represented approximately 2% of average AUM during this period, whereas outflows at all hedge funds represented just over 1% of average AUM.

Although the data from the first quarter of 2019 is positive, the disproportionate amounts of outflows from activist hedge funds over the last three years suggest that these funds may face fundraising and fund-retention challenges when seeking to identify and capitalize on activism opportunities in the near-term.

In the first quarter of 2019, the hedge fund industry earned its highest returns since the third quarter of 2016 (3.1%) and activists slightly outperformed the hedge fund industry by posting returns of 4.9%. In contrast, in 2018, the hedge fund industry as a whole earned low returns—an average of negative 0.54% per quarter—and activists underperformed the hedge fund industry by posting average returns of negative 1.12% per quarter. In general, activist hedge funds have been more volatile than hedge funds overall, and this volatility has continued through recent years. Hedge funds significantly outperformed the S&P 500 and the Dow Jones Industrial Average in 2018, which had returns of negative 6.2% and negative 5.6%, respectively.

D. Target Companies

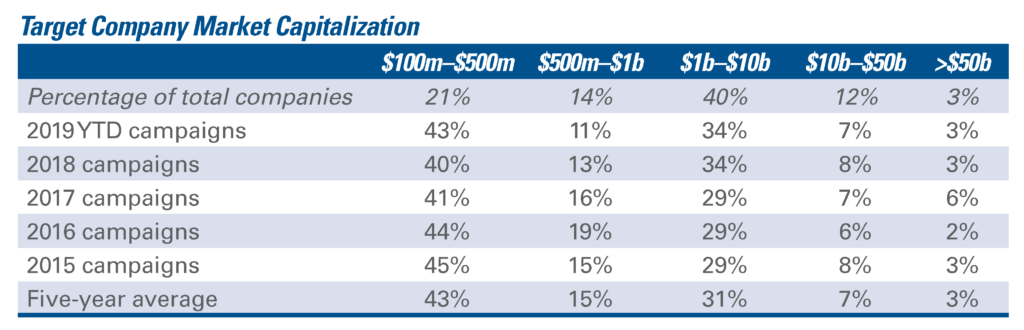

In general, the frequency of campaigns in each band of market capitalization has remained relatively steady since 2014. The following table sets forth by market capitalization the percentage of companies targeted by activist campaigns announced since the beginning of 2014, with the first row indicating the allocation of companies in the Russell 3000 Index in each range.

Smaller companies tend to be targeted more frequently, with companies whose market cap is between $100 million and $500 million representing 43% of campaigns thus far in 2019, while representing only 21% of Russell 3000 companies. In contrast, companies with market caps between $1 billion and $10 billion are less likely to be targeted than their representation as a percentage of Russell 3000 companies suggests, as these companies represent 34% of campaigns, while making up 40% of Russell 3000 companies. On average, approximately 10% of the campaigns in each year targeted companies with market caps of greater than $10 billion, with companies with market caps of greater than $50 billion making up around 3% of total campaigns aside from a one-year increase in 2017.

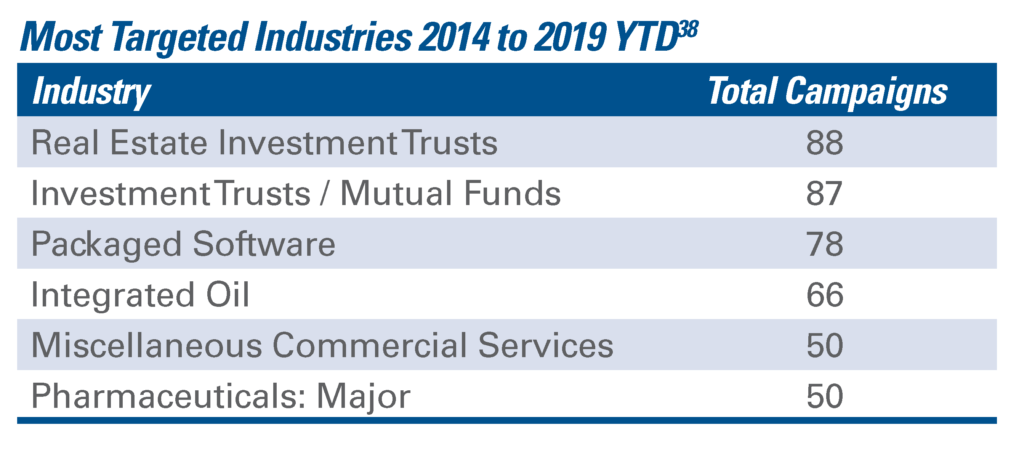

Activists have targeted a wide variety of industries since 2014. The most targeted industries, which have generally remained consistent in each year, include investment vehicles (including investment trusts and mutual funds), pharmaceutical companies, software companies and other commercial service providers.

One particular industry that has been targeted in the past two years more than in prior years is integrated oil, which includes businesses engaging in the production, exploration, refinement and distribution of oil and gas. There have been 38 campaigns announced against integrated oil companies since the start of 2018 compared to an average of just over seven per year from 2014 through 2017.

Developments Impacting Voting in Proxy Contests

There has been speculation in recent years about SEC involvement in a number of areas that could bear on voting in activism contests, including: (1) institutional investors; (2) universal proxy ballots; (3) proxy advisors; and (4) blockchain technology. This section provides an overview of recent developments with respect to each topic.

A. Institutional Investors

The influence of large index funds and other institutional investors is central to outcomes of shareholder activism contests. Despite the growth of activist investing in recent years, activists in the aggregate hold a very small percentage of public company stock. Even in companies where they launch campaigns, activists usually do not hold enough stock for those holdings to play a determinative role in voting outcomes. Thus, activists must garner support from other shareholders in order to win proxy contests. In the case of most U.S. public company targets, this requires activists to turn to institutional shareholders.

Concentration of equity ownership, particularly among the largest three index fund providers, continues to be a key component in the activism landscape. As of December 2018, one of BlackRock, Vanguard or State Street was the largest shareholder in 438 of the S&P 500 companies, roughly 88%, and collectively the three firms owned 18.7% of all shares in the S&P 500. Fidelity is the fourth-largest institutional investor and its ownership also significantly contributes to the equity concentration of the S&P 500.

Meanwhile, institutional investors have become increasingly more likely to support activist nominees. From 2013 through 2018, the 10 largest institutional investors increased their support for activist nominees by approximately 21% (from 33% to 40%). This was more pronounced among the top three institutional investors, where support rose approximately 94% during the same period (from 17% to 33%). Within this group, support rose from 6% to 41% at Vanguard and from 18% to 37% at State Street. At BlackRock, however there was a decrease in support from 29% to 22%.

B. Universal Ballots

We have discussed previously the possibility that universal proxy cards, in which management and shareholder nominees are included on a single ballot rather than two separate ballots, could make the concentration of institutional share ownership more impactful. We observed that, if a dissident shareholder could trigger the use of a universal proxy card by reaching out to a small number of large shareholders, it would be much less costly for activists to run a proxy contest. Last year, SandRidge Energy became the first U.S.-listed company to use a universal proxy card in its proxy contest with Carl Icahn. This year, we saw the first successful use of a universal proxy for a control slate in the U.S. when the Rice brothers prevailed in their proxy contest at EQT Corporation. In August, the SEC Investor Advisory Committee urged the SEC to adopt its universal proxy rule for contested elections. Proxy advisor Glass Lewis voiced its support for the universal ballot after the SEC Investor Advisory Committee’s proposal was announced, stating that it would enhance shareholder rights and simplify the mechanics of proxy voting. It still remains to be seen whether the SEC will take action on these recommendations.

C. Proxy Advisors

Proxy advisors, such as ISS and Glass Lewis, provide voting services to shareholders, including recommendations on how to vote at public company elections. Voting recommendations from proxy advisors continue to play a role in influencing institutional investors, although adherence to proxy advisor recommendations tends to be more rigid at smaller institutional investors, likely due to the large costs associated with investigating each individual voting decision. In the two-year period from 2017 to 2018, institutional investors voted in line with ISS recommendations in proxy contests 54% of the time, compared to 49% in the prior two-year period.

In 2019, the SEC issued important guidance on proxy advisors. The guidance affirms that voting recommendations from proxy advisors such as ISS and Glass Lewis constitute a “solicitation” under the SEC’s proxy rules; the interpretation reiterates the SEC’s previously stated view that a “solicitation” includes a communication by a person seeking to influence the voting of proxies by shareholders, regardless of whether that person is seeking authorization to act as a proxy. Notably, this means that proxy advisor voting recommendations will be subject to anti-fraud rules and are prohibited from containing any “false or misleading” statements and omitting any necessary material facts. In addition, the SEC offered guidelines for proxy advisors to consider disclosing when rendering voting recommendations or other advice in order to avoid a potential Rule 14a-9 violation, including explanations of the methodology used, disclosures about information sources and material conflicts of interest. SEC Chairman Jay Clayton explained that the purpose of the guidance is to ensure that proxy advisors conduct reasonable due diligence, reasonably identify and address conflicts and provide full and fair disclosure. Notably, the SEC’s interpretation does not restrict the ability of proxy advisors to rely on any applicable exemptions from the information and filing requirements of the federal proxy rules set forth in Exchange Act Rule 14a-2(b).

In October, ISS filed a lawsuit against the SEC seeking injunctive and declaratory relief with respect to the SEC’s proxy advisor guidance, contending that the guidance “has inappropriately altered the regulatory regime applicable to the voting advice provided by proxy advisory firms.” ISS’s CEO, Gary Retelny, said in a statement announcing the litigation that ISS is concerned the guidance will be interpreted in a way that could impede ISS’s ability to deliver data, research and analyses in an independent and timely manner.

It remains to be seen how ISS’s lawsuit will affect future rulemaking in this space, but proxy reform has been a continued area of focus for the SEC. The August proxy advisor guidance notes that the SEC staff is considering recommending that the SEC propose rule amendments to address proxy advisory firms’ reliance on the proxy solicitation exceptions under Exchange Act Rule 12a-2(b). For more information on the SEC’s guidance, which also addressed the proxy voting responsibilities of investment advisors, you can refer to our prior publication on this topic (available here).

D. Blockchain Technology

Another recent area of focus is the potential for blockchain technology to change proxy voting mechanics and, accordingly, activism contests. Proponents of blockchain technology argue that the technology presents an opportunity to streamline the proxy voting system. Specifically, the multi-tiered system of beneficial ownership of U.S. equity securities has historically complicated efforts to verify the legitimacy of investor participation in proxy contests—shares are typically held in “street name” and settled through book entries, making it difficult to determine the beneficial owner. Proponents argue that blockchain technology would allow share ownership to be tracked through the complete settlement cycle, thereby increasing share ownership transparency and simplifying proxy voting mechanics. In the activism context, increased share ownership transparency would allow issuers and activists alike to better target their messaging to shareholders.

Recently, corporate services companies and issuers have begun investing in and experimenting with blockchain technology in the proxy voting space. Last year, Broadridge, which has reportedly spent roughly $150 million looking into how blockchain technology can be used to innovate proxy voting and other applications, was awarded a patent applying blockchain technology to proxy voting. In March 2018, Broadridge teamed up with Santander to pilot a blockchain ballot at Santander’s annual meeting for institutional investors. This year, Santander expanded this offering to retail investors at its 2019 annual meeting.

Meanwhile, the State of Delaware has indicated that it is open to introducing blockchain technology to the corporate governance space. In July 2017, Delaware announced amendments to the Delaware General Corporation Law to include several blockchain-related provisions, including the possibility of using blockchain technology to create and administer stock ledgers. Some have called for the SEC to take action of its own to ease adoption of blockchain technology and SEC Chairman Jay Clayton has expressed interest in potential initiatives to improve the “proxy plumbing” through the use of the technology, but the SEC has not yet formally addressed this issue.

The complete publication, including footnotes, is available here.

Print

Print