Kirsty Jenkinson is Director, Sustainable Investment & Stewardship Strategies at the California State Teachers’ Retirement System (CalSTRS). This post is based on a recent CalSTRS publication by Ms. Jenkinson, Travis Antoniono, Brian Rice, Renee Evarts, and Baotran Bui. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst (discussed on the Forum here); Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here); and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Introduction

Purpose

The CalSTRS Green Initiative Task Force, the Green Team, is focused on managing sustainability-related risks, including climate risks, and taking advantage of appropriate sustainability-themed investments, including those that support the transition to a low-carbon economy, while providing robust disclosure around our efforts and initiatives to members and strategic partners.

Content and Format Update

CalSTRS continuously looks to improve disclosure around our sustainability-related investment activities that support long-term value creation. We also seek to integrate reporting frameworks that align with our efforts around important strategic issues such as climate change. This edition of the Green Initiative Task Force report reflects the desire to be responsive to those who are interested in our investment-related sustainability efforts and to provide data in the most appropriate format.

In response to the request of the California Legislature as described in SB 964 (Allen), we have included additional content that more deeply analyzes our climate risk exposure and describes how we support California’s climate goals. The discussion of California’s climate goals can be found in the Strategy section and the climate risk exposure analysis can be found in the Risk Management section of the complete publication (available here).

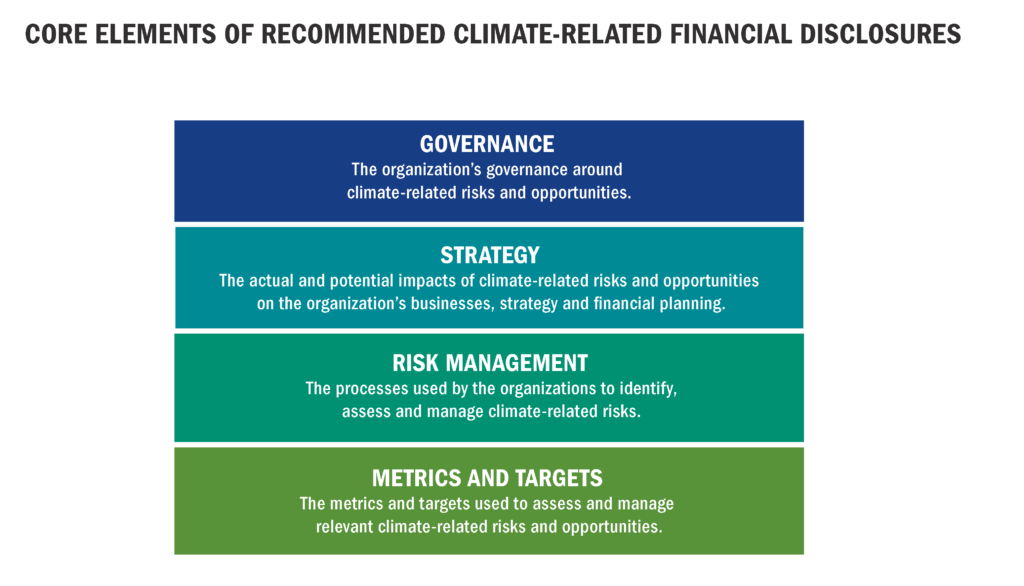

The overall structure of this report differs considerably from previous editions. This year, we align our reporting structure with the guidance of the Task Force on Climate-Related Financial Disclosures. Past editions included support for the TCFD, and since we engage companies on their integration of TCFD guidance, we have aligned our climate-related disclosure with what we believe is the most meaningful and accepted climate framework within the financial markets. To that end, each of the main sections of this report coincide with the TCFD’s core elements of recommended climate-related financial disclosures: governance, strategy, risk management, and metrics and targets.

Governance

The Teachers’ Retirement Board has sole and exclusive fiduciary responsibility to administer the investment assets in a manner that will assure the prompt delivery of benefits and related services to plan participants and their beneficiaries. The Teachers’ Retirement Board Investment Committee has

established core tenets in the form of investment beliefs that provide a broad framework for the CalSTRS Investment Policy and Management Plan and all investment policies.

Board Oversight

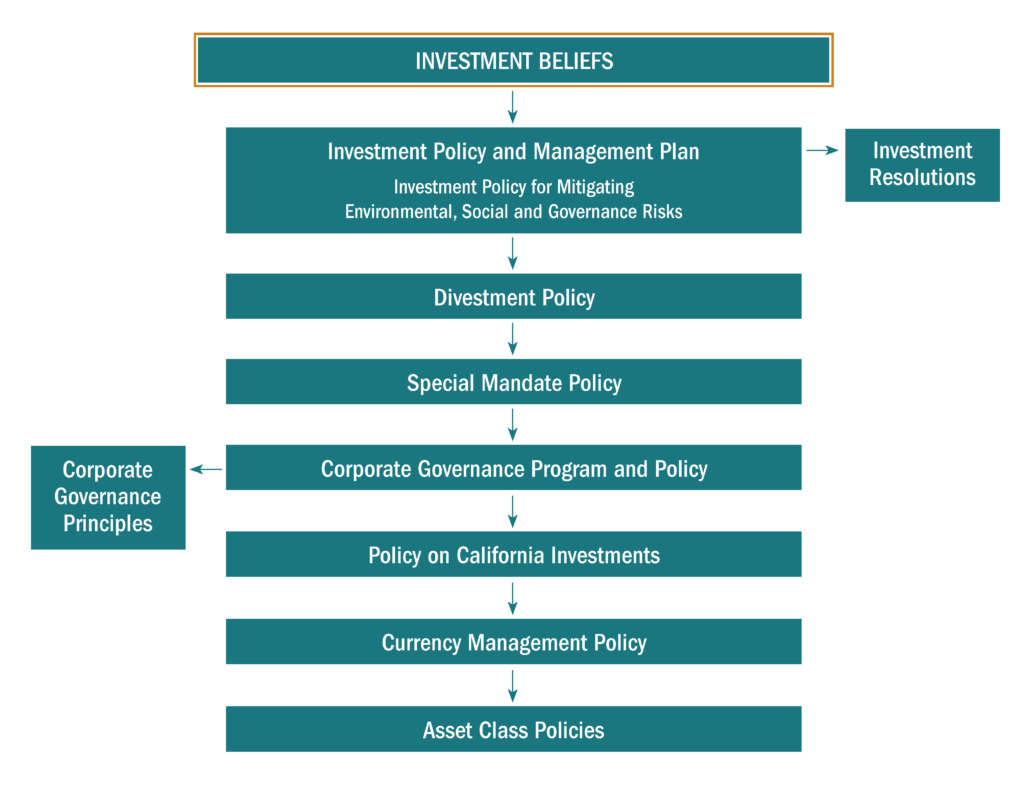

The CalSTRS Investment Portfolio is governed by:

CalSTRS investment policies are designed to mitigate strategic investment and implementation risks of investment activity. Since the CalSTRS Investment Portfolio operates in a complex global environment where environmental, social and governance risks can materially impact investment portfolio performance, the Teachers’ Retirement Board expects staff to select investments and conduct investment activities after careful consideration of risks, including ESG risks, most impactful to the fund.

CalSTRS has eight investment beliefs, including a specific belief on corporate governance and environmental, social and governance factors.

Belief 7

Responsible corporate governance, including the management of environmental, social and governance factors, can benefit long-term investors like CalSTRS.

CalSTRS ESG Risk Policy

Consistent with CalSTRS’ fiduciary responsibility to our members, the Teachers’ Retirement Board board has a responsibility to ensure the corporations and entities in which we invest strive for long-term sustainability in their operations in order to achieve the long-term rate of return the fund needs to meet our obligations to our members. To help manage these risks, the board developed its Investment Policy for Mitigating Environmental, Social and Governance Risks.

This policy was adopted in 2008 and revised in 2018, and replaces the CalSTRS Statement of Investment Responsibility, created in 1978, as the preeminent policy on ESG matters. This policy identifies 25 ESG-related risks that staff and partners are to consider when making investment decisions. The policy also provides procedures for the Investments Branch staff, the chief investment officer and the Teachers’ Retirement Board Investment Committee to follow when faced with a decision or other activity that potentially violates the policy. The procedures call for a thorough staff analysis of the potential ESG violation and its ramifications to the Investment Portfolio as well as disclosure to the board as to the findings of the investigation and analysis. The Investment Committee can then direct further actions.

Corporate Governance Principles

The Teachers’ Retirement Board is charged with maintaining a strong, stable fund in order to meet CalSTRS’ obligations to our members and beneficiaries. To fulfill that responsibility, the board oversees the Investments staff who are responsible for the day-to-day management of the portfolio. CalSTRS believes an essential part of portfolio management is attention to good governance practices. We work to establish good governance policies and practices at the companies we invest in through our corporate engagement efforts and proxy voting activities.

To guide staff in their engagement and votingefforts, the board has developed Corporate Governance Principles. These principles also provide guidance around how to consider ESG issues such as climate change when engaging companies and voting corporate proxies. Companies are believed to be in conflict with the principles when their actions could result in undesirable side effects for others, such as inadequate accounting and disclosure of carbon emissions, and failure to adequately reduce

carbon emissions.

The Corporate Governance Principles also identify ESG integration actions that we are committed to, which include participating in the development of policies and regulations, filing shareholder resolutions consistent with long-term ESG considerations, seeking standardized reporting by corporations on ESG issues, and participating in collaborative engagement initiatives with other shareholders.

Low-Carbon Transition as a Board Priority

In May 2019, as enhanced evidence of the Teachers’ Retirement Board’s commitment to managing climate risk and recognition that action around climate risk management is accelerating, the Investment Committee acted to approve new policy language that codifies their belief that global financial markets are responding to climate risk and that a transformation to a low-carbon economy is underway.

Reflecting CalSTRS’ determination that the low-carbon transition is an urgent priority, the board has recently embarked on a Low-Carbon Transition Work Plan to establish a consensus among the board and staff around how the low-carbon transition will impact the Investment Portfolio, analyze the transition readiness of the portfolio, expand stewardship activities that support an orderly transition, and continue our commitment to report and communicate actions around the low-carbon transition.

Implementation

The Teachers’ Retirement Board establishes beliefs, policies and priorities around integrating ESG considerations, such as climate change, and provides oversight of staff who are responsible for executing the board’s mission and strategies. Through the direction and leadership of the CalSTRS chief investment officer, staff works collectively and collaboratively to manage climate change and other ESG risks.

CalSTRS has established several cross-asset class teams to implement the board’s goals around ESG, including goals related to climate change, risk management and opportunity capture. We believe a team-based approach allows for the sharing of experiences and best practices, and allows for each asset class to be directly responsible for ESG integration. These teams include:

CalSTRS Chief Investment Officer

CalSTRS Chief Investment Officer, Christopher J. Ailman, is a strong advocate of integrating ESG risks, such as climate change, into CalSTRS’ investment management processes. Ailman sets the example for staff by reinforcing that assessing ESG risks and opportunities related to climate change is a priority. Ailman leads regular ESG training and education for CalSTRS staff and publicly urges other financial market participants to recognize and manage climate-related risks.

CalSTRS Green Team

The CalSTRS Green Team is a cross-asset class committee with the goal of incorporating environmental, including climate-related, considerations into investment risk management and opportunity capture. For additional information about the Green Team, see pages 12 and 37 of the complete publication.

Sustainable Investments and Stewardship Strategies

The CalSTRS Sustainable Investments and Stewardship Strategies Unit is responsible for the majority of CalSTRS’ stewardship activities, including proxy voting and engagement, around ESG and climate change. SISS oversees a portfolio that invests in sustainability-focused opportunities and serves as an ESG and climate change knowledge center for our asset classes.

CalSTRS Committee on Responsible Investment

The Committee on Responsible Investment, led by CalSTRS’ chief investment officer and composed of staff representatives from each asset class, helps the CIO evaluate exposure to ESG-related risks and take appropriate actions to ensure that external and internal managers adhere to CalSTRS’ policy surrounding the management of ESG risk exposure.

CalSTRS Asset Classes

Each CalSTRS asset class takes ownership of conducting research and carrying out due diligence as it relates to the incorporation of climate-related risks. Additionally, each asset class works with the SISS Unit for additional climate-related risk integration. Examples of how each asset class integrates climate-related risks, including physical and transition risks, into the investment management process are shown in the Strategy section of this report.

CalSTRS Green Team

The CalSTRS Green Team was formed in 2006 in response to a Teachers’ Retirement Board directive to begin integrating climate change and environmental risk considerations into CalSTRS’ investment management process.

The Green Team includes representatives from each asset class from the Investments Branch. Team members consider and incorporate sustainability-related issues into each respective asset class’s portfolio management processes and procedures. Working together, Green Team members are able to share experiences and best practices around environmental risk integration, which facilitates broader integration within the Investments Branch.

In addition to environmental risk integration collaboration, team members hear from industry experts about issues that could impact their respective asset classes at quarterly meetings. The Green Team works on:

- Integrating environmental-related risks into each asset class’s processes and procedures.

- Continuing education on environmental-related risk issues and sustainable-themed investment opportunities.

As part of the initiative of continuing education on climate-related risk issues and sustainable-themed investment opportunities, the Green Team has hosted many industry experts as guest speakers to present to Green Team members and other staff. Some of the organizations that have presented include:

- Bloomberg New Energy Finance. Bloomberg New Energy Finance head of Advanced Transport spoke about the future of mobility.

- Blackstone. Blackstone head of ESG provided education on how modern slavery affects supply chain management, including the supply chains of industries leading the electrification transition.

- California ISO. California ISO Regional Transmission Engineering lead spoke about current trends in California energy, provided insight on energy spot prices, and discussed how battery and further renewable adoption will affect the grid.

- CBRE. CBRE presented on sustainability trends impacting commercial real estate, including risks and mitigating actions.

- Agriculture Capital. Agriculture Capital staff spoke about climate-related risks and water sourcing as they relate to agriculture production with a focus on citrus, hazelnut, blueberry and table grape production.

- Blue Forest Conservation. Staff from Blue Forest Conservation discussed launching the first Forest Resilience Bond, a public-private partnership that leverages private investor capital to finance forest and watershed health in the Tahoe National Forest in 2018.

CalSTRS Committee on Responsible Investment

The CalSTRS ESG risk policy identifies ESG-related risks that could materially impact the value of the Investment Portfolio. These risks could impact a particular asset category, sector or geographic region, or the markets as a whole. Every CalSTRS portfolio manager, whether internal or external, is expected to consider these ESG risks when making investment decisions on behalf of the fund.

CalSTRS staff determined that in order to fulfill our duty to properly integrate the board’s ESG risk policy evenly across all asset classes, a team-based approach was necessary. To that end, the Investments Branch established the Committee on Responsible Investment. The CRI, composed of members from each asset class and chaired by the CIO, is tasked with supporting the CIO’s responsibility to thoroughly investigate any potential violation of the ESG risk policy and report potential risk violations to the board.

The CRI meets quarterly and discusses ongoing ESG risks and any new potential violations of policy, and makes recommendations to the CIO around future actions. CRI team members are responsible for ensuring that any relevant CRI initiatives or efforts are brought before their respective asset classes.

CalSTRS Environmental, Social and Governance Risk Management Procedures

When faced with a decision or other activity that potentially violates CalSTRS’ ESG Policy, the Investments staff, CIO and Investment Committee will undertake these actions:

- The CIO assesses the potential ESG policy violation both as an ESG risk and as an impact to the CalSTRS Investment Portfolio. The extent of staff’s responsibility to devote resources to address these issues is determined by the size of the investment and the gravity of the violation of CalSTRS’ ESG policies.

- At the CIO’s direction, Investments staff directly engages corporate management or other appropriate parties to seek information and understanding concerning the ESG policy violation and its ramifications on our portfolio.

- The CIO and Investments staff report to the Investment Committee the findings associated with an ESG policy violation engagement and recommend any further engagement or need to commit further portfolio resources. The Investment Committee can marshal further resources depending on the gravity of the situation.

Strategy

CalSTRS operates to serve our beneficiaries— more than 964,000 California public school educators and their families. Our objective is clearly laid out through our mission statement: Securing the financial future and sustaining the trust of California’s educators. Everything we do as an organization supports this mission. We must continuously reflect on and assess the risks and opportunities that might impact our portfolio today and over multiple decades in the future.

Although we are a long-term investor with significant passive public equity exposure, we are also very much active shareholders across our portfolio. Having ownership stakes in investments and companies gives us rights— to vote at company meetings, to speak up, to engage, and to advocate for changes we believe are in the best long-term interest of the CalSTRS Investment Portfolio—and we take our responsibility seriously.

Climate change is a significant systemic risk to the global economy. All investments, all industries and all companies will be affected in the transition to a low-carbon economy. There is already overwhelming evidence that the world is experiencing the impacts of climate change daily. To provide insight into our climate-related strategy, this Strategy section provides a summary of our activities relating to the transition to a low-carbon economy and includes details on our specific stewardship and investment strategies as well as activities that align with California’s climate goals.

Stewardship Activities: Proxy Voting

Voting corporate proxies is a fiduciary responsibility and an important way to manage the risks associated with public equity ownership. The Teachers’ Retirement Board has delegated the responsibility for voting CalSTRS proxies to Investments staff. Staff uses the CalSTRS Corporate Governance Principles as guidelines to assist in making proxy vote decisions. Appendix A to the principles is the Statement of Shareowner ESG Responsibility, which provides direction in determining how ESG-related proposals should be considered. The board regularly reviews, revises and approves these principles.

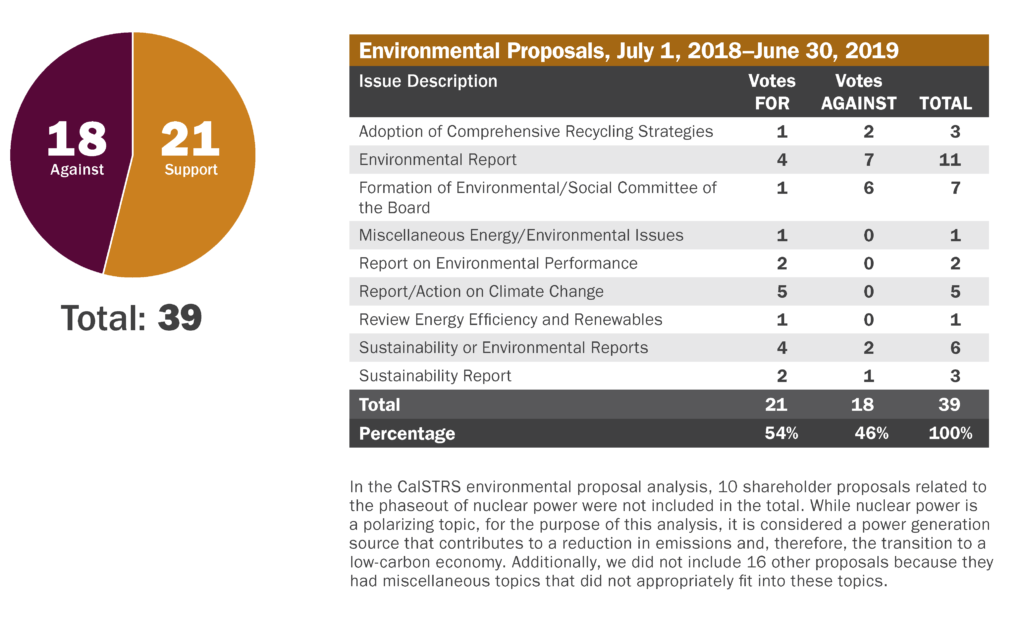

Staff considers dozens of environmental-related shareholder proposals that cover a variety of issues and ask for varying levels of action. Some environmental proposal issues are greenhouse gas emissions, energy efficiency, waste disposal and recycling. These proposals request actions such as preparing reports, establishing emissions targets and setting waste reduction goals. During the 2018–19 fiscal year, staff considered 39 environmental proposals, supporting 21 of them and voting against 18. The table below provides a breakdown of the issues considered.

CalSTRS reviewed each of these 39 proposals and assessed whether the proposal would add value to the investment if it passed and was not overly prescriptive in its request. Traditionally, we support proposals that call for improved environmental risk reporting, unless we believe the company already adequately discloses these risks. In general, we do not support environmental proposals intended to substitute for management’s operational judgments. We believe companies should manage environmental risk and decide how to design and implement risk management systems. We supported 17 of the 27 proposals that called on companies to produce an environmental, climate change or sustainability report.

Two examples of climate-related shareholder proposals that we voted in favor of were at BP and Chevron. The proposal requested that BP provide, in its future strategic reporting, a description of how its strategy aligns with the goals of the Paris Agreement, including details on new capital expenditure, metrics and targets.

The proposal requested that Chevron issue a report on how it can reduce its carbon footprint in alignment with greenhouse gas reductions necessary to achieve the Paris Agreement’s goal of maintaining global warming well below 2 degrees Celsius.

We provide transparency in how we vote at individual companies’ annual general meetings on our proxy vote disclosure website.

CalSTRS Climate-Related Shareholder Proposals

When CalSTRS Investments staff believes a company is not willing to make the necessary progress toward managing environmental risks, we will strongly consider exercising our equity ownership rights by filing a shareholder proposal with the company calling for the company to improve its environmental risk management efforts. The intent of the shareholder proposal is to bring our concerns to the company’s shareholders and generate enough support from the investor base to convince the company to commit to our recommendations. Often, the filing of a shareholder proposal will increase a company’s willingness to engage further with staff and lead to a commitment to improve risk management and disclosure.

Since 2008, we have filed 53 climate-related shareholder proposals that called on companies to improve their environmental risk-management disclosure efforts. Of these 53 shareholder proposals, 40 were ultimately withdrawn before the company’s annual meeting because staff was able to negotiate a mutually agreeable outcome. Since 2008, the 11 proposals voted on by shareholders have received, on average, 28 percent support.

Shareholder proposals that we have filed in recent years:

- Energy Efficiency Management: Shareholders request the board of directors issue an energy efficiency report describing the company’s short- and long-term strategies on energy use management. The requested report should include a company-wide review of the policies, practices and metrics related to energy management strategy. The report should be prepared at reasonable cost, omit proprietary information and be made available to shareholders.

- Water Use Management: Shareholders request that a sustainability report be issued that describes the company’s policies, performance, and improvement targets related to key environmental, social and governance risks and opportunities, including an analysis of material water-related risks. The report should be prepared at reasonable cost and omit proprietary information.

- Methane Emissions Reduction: Shareholders request a report at reasonable cost, omitting proprietary information, that reviews the company’s policies, actions and plans related to methane emissions management, including efforts to measure, monitor, mitigate, disclose, use leak detection and repair technologies (including frequency, scope and methodology), and set quantitative reduction targets for methane emissions resulting from aggregate operations under the company’s financial or operational control.

CalSTRS Led Methane Emissions Shareholder Proposals at Oil and Gas and Gas Utility Companies

Methane, the primary component of natural gas, is a climate pollutant 84 times more powerful than carbon dioxide, according to the Environmental Defense Fund. Their calculations show methane is responsible for a quarter of the warming the Earth is experiencing today. Unmanaged methane emissions could undermine the value proposition of natural gas for delivering cleaner, low-cost energy through increasing scrutiny from the public, environmental and health groups, and state and federal policymakers.

CalSTRS continues to engage oil and gas and gas utility companies on how they approach the issue of fugitive methane emissions. The focus of this ongoing engagement is to determine how companies consider the risk associated with methane emissions, to what degree they already capture fugitive methane emissions, and whether they have analyzed the business case associated with improving methane capture.

Since 2015, we have filed 10 methane emissions reduction related shareholder proposals with oil and gas and gas utility companies. More than half of these proposals were withdrawn after staff successfully negotiated a mutually agreeable outcome with the company. Some of these agreed upon outcomes were based on companies taking actions that aligned both to reducing emissions and providing a better return for investors.

Stewardship Activities: Corporate Engagement

CalSTRS is a long-term active owner. It is our responsibility to be a steward of capital, to assess companies in our portfolio and to determine ways to unlock value and mitigate risk.

As an active shareholder, we seek to use the tools we have access to in order to drive change and enhance the value of the CalSTRS Investment Portfolio over the long term. We engage hundreds of companies per year. Through these engagements, staff has direct access to corporate boards and management. Corporate engagement allows us to use our voice as a $240 billion asset owner and open a dialogue with companies. We have demonstrated that, over time, engagement can effectively drive change that has a positive impact on our fund, the companies we engage, society and the environment.

The low-carbon transition is an engagement priority for CalSTRS that incorporates engaging companies on their governance structures, business strategies and disclosures that demonstrate their resilience to changing public policies, technological advancements and physical impacts associated with concerns about climate change.

Staff regularly engages the most carbon-intensive companies individually and through collaborations with like-minded investors. The benefits of collaboration are significant and include the ability to leverage the strength of our portfolio while giving a larger voice to issues and engagements we are involved with. This section highlights examples of individual and collaborative engagements that we have led and participated in.

Task Force on Climate-Related Financial Disclosures

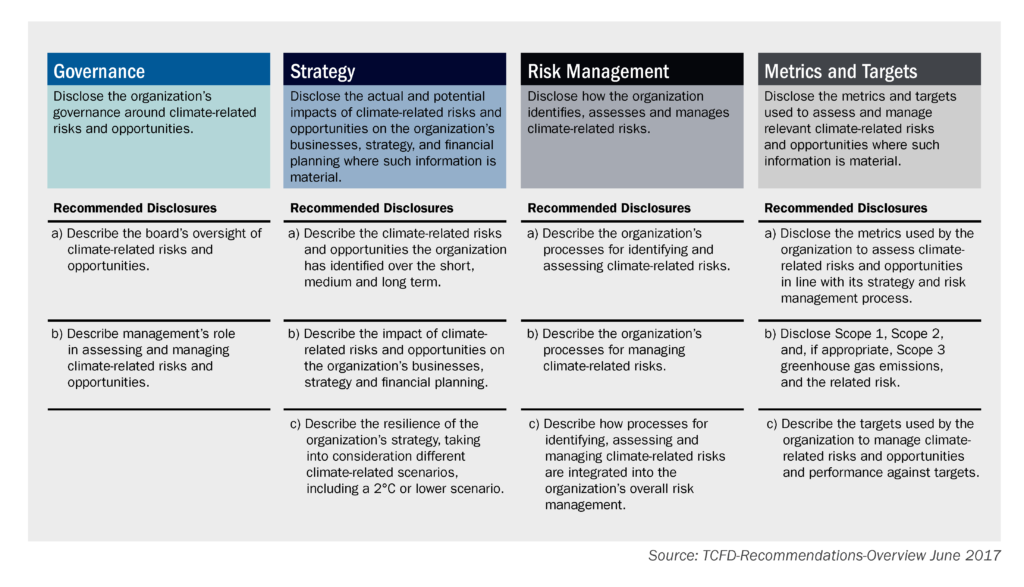

In 2015, the Financial Stability Board established the Task Force on Climate-Related Financial Disclosures to develop voluntary, consistent climate-related financial risk disclosures that companies

could use to provide information to investors, lenders, insurers and other stakeholders.

The task force considered the physical, liability and transition risks associated with climate change and what constitutes effective financial disclosures across industries in order to help companies understand what financial markets want from them regarding how they measure and manage climate change risks.

On June 29, 2017, the task force released its final report that provides the context, background and framework for climate-related financial disclosures. The following graphic summarizes the disclosures highlighted in the report.

CalSTRS formally supported the recommendations of the TCFD when they were launched and began engaging companies on TCFD guidance. Staff continues to engage companies to raise awareness about the TCFD and promote TCFD-aligned climate change risk management actions and disclosure.

Our engagements have helped drive adoption of the TCFD’s recommendations. As of September 2019, nearly 900 organizations have committed to support TCFD recommendations. Additionally, as of October 2019, nearly 200 Japanese companies have committed to support TCFD recommendations, including four Japanese companies for which CalSTRS is the lead investor as part of the Climate Action 100+ engagement.

Climate Action 100+

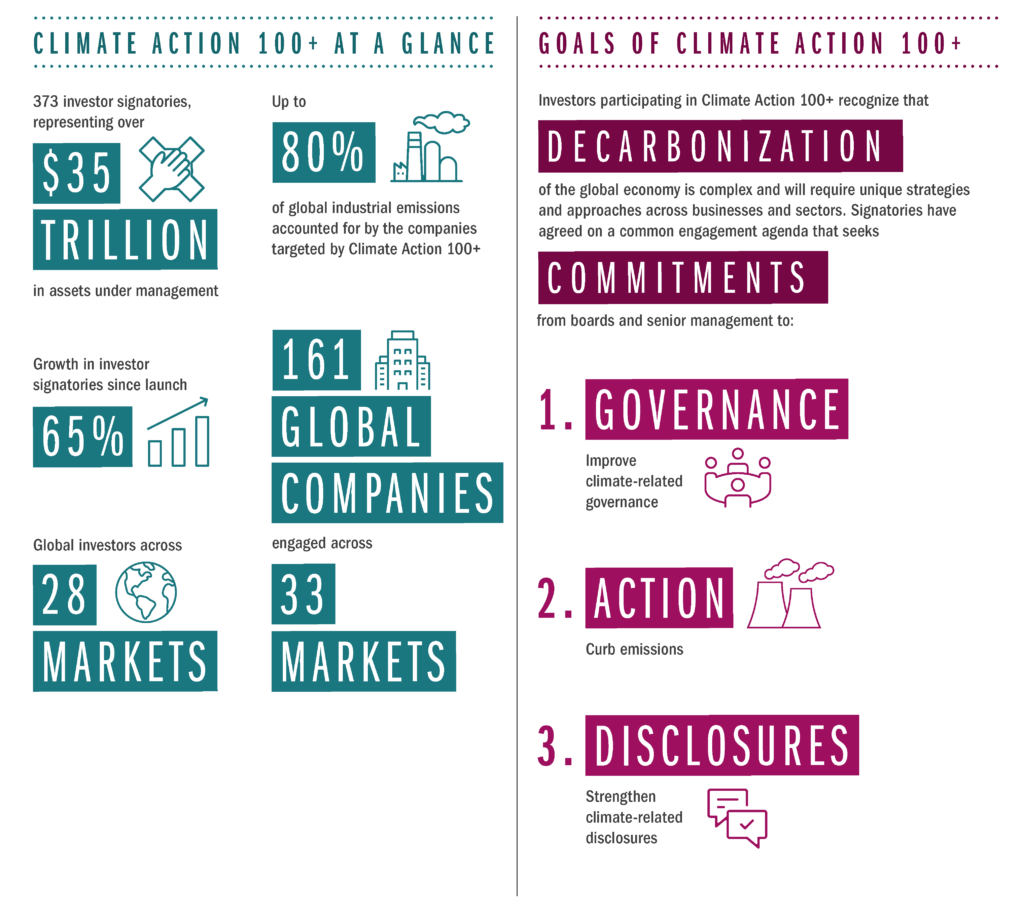

CalSTRS plays a leadership role in Climate Action 100+, a collaborative engagement effort of more than 370 global investors, representing $35 trillion in assets under management, focused on the largest global emitters of carbon dioxide. The 5-year effort centers around actions the companies are taking, or plan to take, to manage and mitigate climate change risk. Investors call on companies to improve governance on climate-related risks, curb emissions and strengthen climate-related financial disclosures.

The Collective Engagement From 370 Global Investors, Including CalSTRS, Has Led to These Industry Leading Public Commitments:

- Royal Dutch Shell, one of the world’s oil and gas supermajors, released a joint statement committing to a range of industry leading climate commitments, including emissions reduction targets that include scope 3 emissions.

- Glencore, the world’s largest exporter of thermal coal, agreed to cap coal production to current levels of about 145 million tonnes per year. Duke Energy Corporation announced an update to its carbon transition plan, with a 50% reduction in GHG emissions by 2030 and net zero emissions generation by 2050.

- Xcel Energy, a major US electric utility, has set out an intention to reach zero carbon electricity by 2050.

- Maersk, the world’s biggest shipping company, committed to net zero emissions by 2050.

- Rio Tinto has exited from mining coal, published a TCFD report, and committed to an asset by asset review to set emissions reduction targets.

- Nestlé committed to net zero emissions by 2050, including scope 3 emissions.

- PetroChina developed a climate change strategy and signalled the company’s intention to align its climate policy to the goals of the Paris Agreement.

- HeidelbergCement committed to achieve net zero emissions by 2050.

- PTT Public Company Limited (Thailand) has released a TCFD aligned report, indicating the company’s intention to align its strategy with the goals of the Paris Agreement.

- Volkswagen committed to become ‘climate neutral’ by 2050 and launch nearly 70 electric vehicle models by 2028.

- AES Corporation has conducted scenario analysis against three transition pathways, and committed to a 70% reduction in carbon intensity by 2030.

Source: climateaction100.files.wordpress.com/2019/10/progressreport2019.pdf

CalSTRS Signs Vatican Climate Action Statement

Chair of Investment Committee participates in the Pope’s dialogue on energy transition

In June 2019, CalSTRS, along with leading global investors and oil

and gas industry executives, announced a collective commitment

to accelerate action to avoid the worst consequences of climate change. After two days of dialogue hosted by the Vatican and the University of Notre Dame, the attendees issued two joint statements calling for meaningful carbon pricing and enhanced climate-related disclosure. The gathering was called The Energy Transition and Care for Our Common Home.

Pope Francis met with executives, including the Teachers’ Retirement Board’s Investment Committee Chair Harry M. Keiley, to underscore the urgent need for “a radical energy transition” that will address the challenges of climate change and protect the world’s most vulnerable populations and future generations.

“The Teachers’ Retirement Board recognizes that climate change poses existential and financial risks, and we are committed to addressing them.” —Harry M. Keiley, chair of the Teachers’ Retirement Board Investment Committee

Stewardship Activities: Public Policy Engagement

Investors play an important role in providing input for governments to create effective climate policies, and we are committed to influencing public policies that promote an orderly transition to a low-carbon economy.

CalSTRS works to identify the risks and opportunities that arise from climate change policies as well as the impact these may have on our portfolio. In certain cases, climate-related public policy can act as a catalyst to help advance the transition to a low-carbon economy. In others, policy can be developed that acts as a road block to progress and may allow companies to increase emissions or make certain renewable investments that are not as beneficial for investors and companies.

In order to enhance the influence that CalSTRS has on public policy, we collaborate and work with other investors and coalitions. Some of the most recent public policy engagement efforts that we have participated in follow.

CalSTRS calls on governments to act

Ahead of the 2019 United Nations Climate Action Summit, CalSTRS was one of 515 institutions, managing $35 trillion in assets, that delivered the Global Investor Statement to Governments on Climate Change. The statement calls on governments to phase out thermal coal power worldwide, put a meaningful price on carbon pollution, end government subsidies for fossil fuels, and update and strengthen nationally determined contributions to meet the emissions reduction goal of the Paris Agreement no later than 2020. The U.N. Secretary General mentioned the importance of hearing investor voices in his comments to the General Assembly.

CalSTRS urges companies to ensure consistent corporate and trade association lobbying

CalSTRS believes companies play an important role in providing input for governments to create effective climate policies. We, along with 200 investors representing $6.5 trillion in assets, are calling on 47 of the largest U.S. publicly traded corporations to align their climate lobbying with the goals of the Paris Agreement, warning that lobbying activities that are not consistent with meeting climate goals are an investment risk.

Specifically, investors are asking companies to:

- Ensure their own lobbying practices and those of

trade associations in which they are members align with the 2015 Investor Expectations on Corporate Climate Lobbying document. - Review the lobbying positions taken by any organization of which a company is a member.

- Engage with organizations if their lobbying positions are inconsistent with the goals of the Paris Agreement and ensure its positions are updated.

- Ask an organization that is unwilling or unable to demonstrate alignment with the Paris Agreement to consider taking steps necessary to disassociate from these positions.

Investment Activities by Asset Class

The CalSTRS Green Team, which consists of Investment staff from all CalSTRS asset classes, continues to work together to refine and enhance our understanding of environmental risk. The Green Team has identified 11 methods staff uses to incorporate environmental risk factors and climate-related considerations into investment risk management and ongoing due diligence efforts.

These methods, including a short description, are listed below. In each asset class profile in this report, we include the methods and icons that each asset class team uses to integrate environmental risk factors and climate-related considerations into the investment management process.

Each asset class profile features the total number of staff in the team, the assets under management, and the asset class’s investment focus areas. The profiles also highlight the long-term performance of the asset class and additional information related to our sustainability-focused investments.

- ESG Risk Factor Investment Management Agreement—When any manager, internal or external, makes an investment decision on behalf of CalSTRS, the manager must consider the CalSTRS ESG risk factors. The risk factors are also part of the continuous due diligence process staff undertakes with existing investments and investment managers. Staff regularly queries external fund managers about how they consider these risk factors, particularly climate risk, when making investment decisions on our behalf.

- LEED & Energy Star Certifications—LEED and Energy Star certifications are two of the most widely used frameworks to assess and benchmark a building’s energy efficiency and environmental sustainability. More efficient use of energy is a strong climate risk mitigation.

- Commodity Risk Analysis— Commodity risk analysis refers to the assessment of future market values and investment return caused by the fluctuation in the prices of commodities. These commodities may be grains, metals, gas or electricity, and may be used extensively during operations.

- Credit Rating Analysis—Many leading credit rating agencies have committed to including the use of ESG factors in a more systematic way when assessing the creditworthiness of a company participating in the debt capital markets.

- Dedicated Sustainability Investment Strategy—Even though environmental risks are incorporated throughout the CalSTRS Investments Portfolio, certain asset classes have more specifically defined sustainability investment strategies than others.

- Engineering Technical Assessment—Engineering technical assessment evaluates the design, construction, maintenance and ongoing use of the physical and naturally built environment. For a business or building, this can impact energy and water usage, building air quality, and even work productivity.

- Environmental Impact Assessment—Environmental impact assessment is a process of evaluating the likely climate-related environmental impacts of a proposed project or development. The assessment may also propose measures to avoid, mitigate or offset environmental risks.

- ESG Score Analysis—ESG scores help investors identify environmental, social and governance risks and opportunities within their portfolio. Staff conducts research on CalSTRS’ exposure to industry-specific ESG risks, especially climate risks, and a portfolio company’s ability to manage those risks relative to peers.

- Investment Advisory Boards—An advisory board is a body that provides strategic advice to the management of a corporation, organization or partnership. Staff or representatives participate as members of many investment advisory boards.

- Proxy Voting—Proxy voting is the primary means by which shareholders can influence a company’s operations, its corporate governance, and even its social and environmental responsibility activities. Voting corporate proxies is a fiduciary responsibility and an important way to manage the risks associated with public equity ownership. Over the course of any fiscal year, staff considers dozens of environmental-related shareholder proposals covering a variety of issues, including climate change.

- Public Company Engagement— Staff often engages a portfolio company that is not willing to make the necessary progress toward managing material environmental risks, such as climate risks, by developing a dialogue to better understand and motivate the company to mitigate such risks. This would also include collaboration with many other asset managers and organizations.

Sustainable Investment and Stewardship Strategies

The Sustainable Investment and Stewardship Strategies Unit was established as the Corporate Governance Program in 1978. In 2019, it was renamed to reflect the expanded scope of CalSTRS’

ESG activities.

SISS Activist Portfolio

Activist funds are concentrated portfolios in which managers acquire large individual positions and engage boards and management to undertake value-driving change. SISS activist managers actively leverage their ownership stakes to intervene and influence a company’s long-term strategy, sustainability profile, environmental impact, capital structure, capital allocation plan, executive compensation practices and corporate governance profile.

SISS Sustainability-Focused Portfolio

Sustainability-focused funds incorporate robust consideration of ESG issues throughout their investment processes. The managers recognize that ESG factors can impact company valuations and that risks and opportunities associated with ESG factors impacting strategy need to be evaluated alongside more traditional financial considerations. The sustainability-focused portfolio seeks to generate competitive returns and outperform broad market indexes while demonstrating a positive impact on the environment and society.

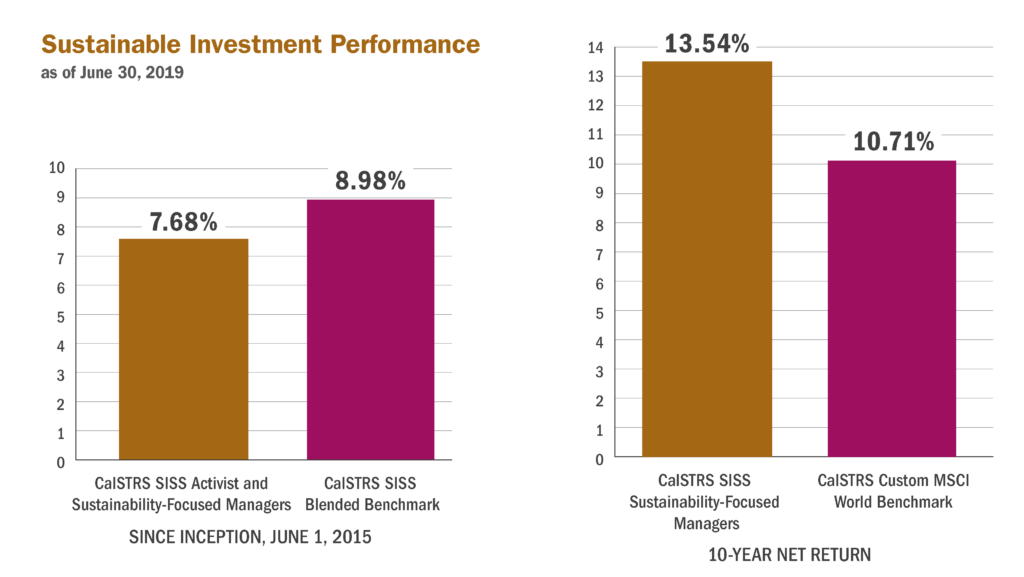

The chart below and to the left includes the aggregate performance of the SISS activist and sustainability-focused portfolios. The chart below and to the right exclusively features the performance of the SISS sustainability-focused portfolio.

CalSTRS Announces Sustainability-Focused Public Equity Managers

In June 2019, CalSTRS announced the funding of three new public equity investment managers. This was the culmination of a thorough and rigorous selection process that allowed us to identify proven industry leaders with expertise in integrating ESG analysis into investment decision making. We believe they will bring positive environmental, social and financial impacts to our portfolio.

The firms will collectively manage $750 million across sustainability-focused strategies. The three firms—Hermes Investment Management, Impax Asset Management and Schroders—are highly attuned to how sustainability-related trends, like the low-carbon transition and resource efficiency, create investment risks and opportunities. These firms offer geographic diversification and apply analytical rigor in incorporating environmental, social and governance factors into fundamental analysis, all while maintaining a long-term investment horizon.

The complete publication is available here.

Print

Print