Rakhi Kumar is Head of ESG Investments and Asset Stewardship, Nathalie Wallace is of Global Head ESG Investment Strategy, and Carlo Funk is EMEA Head ESG Investment Strategy at State Street Global Advisors. This post is based on a publication prepared by State Street Global Advisors. Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here) and Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

Introduction

In 2017, we conducted a major global survey to give deeper insight into the increasingly important Environmental, Social and Governance (ESG) market. Performing for the Future revealed a picture of ESG investment driven by performance beliefs, coupled with challenges and evolving pathways to adoption.

Fast-forward two years and ESG investing had grown by more than a third to $30+ trillion, over a quarter of the world’s professionally managed assets.

ESG may well be becoming a mainstream trend, but every institutional investor—from pension funds to endowments to sovereign wealth funds—faces a unique mix of forces pushing them towards, or pulling them away from, ESG investing.

As institutions try to respond to these competing forces—without compromising their risk–return requirements—they must chart their own course. This means finding a best-fit approach to incorporating ESG factors into their investment process and balancing cost pressures with the need to build up specialist knowledge.

Our latest research uncovers the views of more than 300 institutional investors and world-leading institutions, revealing what is driving organizations to adopt ESG, how this is influencing adoption, and the barriers that must be overcome to deliver the best outcomes.

Key Findings

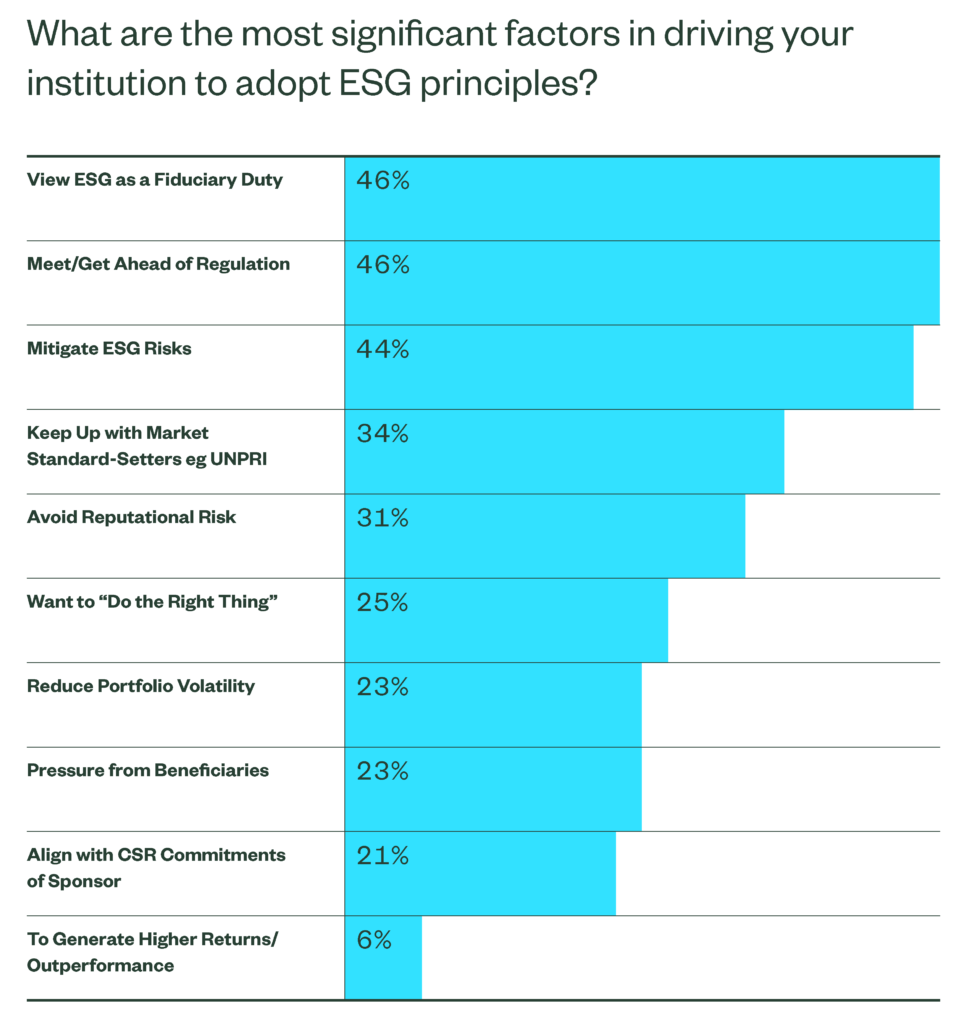

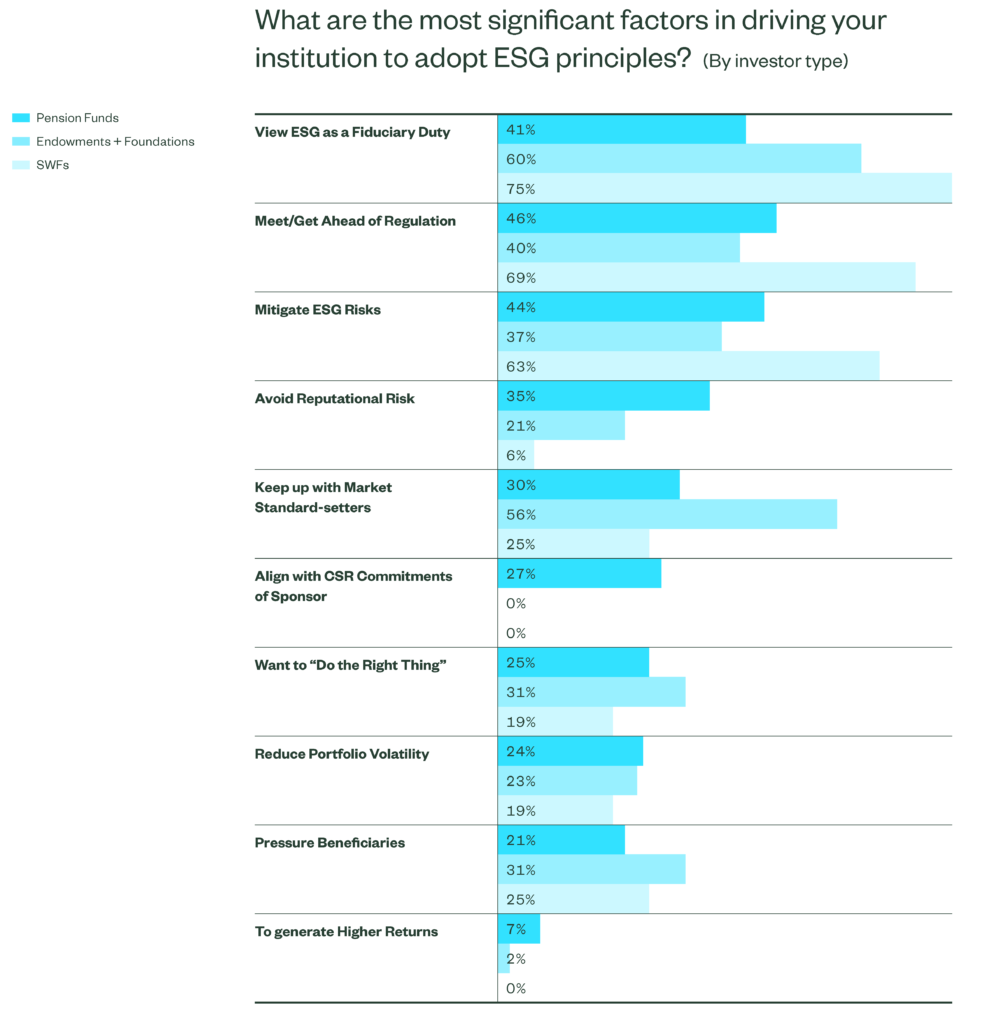

1. Fiduciary duty, regulation and mitigating ESG risk are the key push factors driving investors towards ESG

- Fiduciary Duty is Clear. Once an uncertainty for many investors, the fiduciary duty aspect of ESG is fast becoming more certain, with 46% of respondents seeing it as the key driver of adoption.

- Regulatory Landscape Driving Adoption. Also at 46%, the other leading driver for many is regulation. Though perhaps more so currently in EMEA and APAC, it is clear that regulation will increasingly shape future adoption, particularly on topics such as climate.

- Investment Risk Must be Addressed. At 44%, mitigation of ESG risk comes in very close behind, with many investors now realizing the danger that ignoring ESG entails.

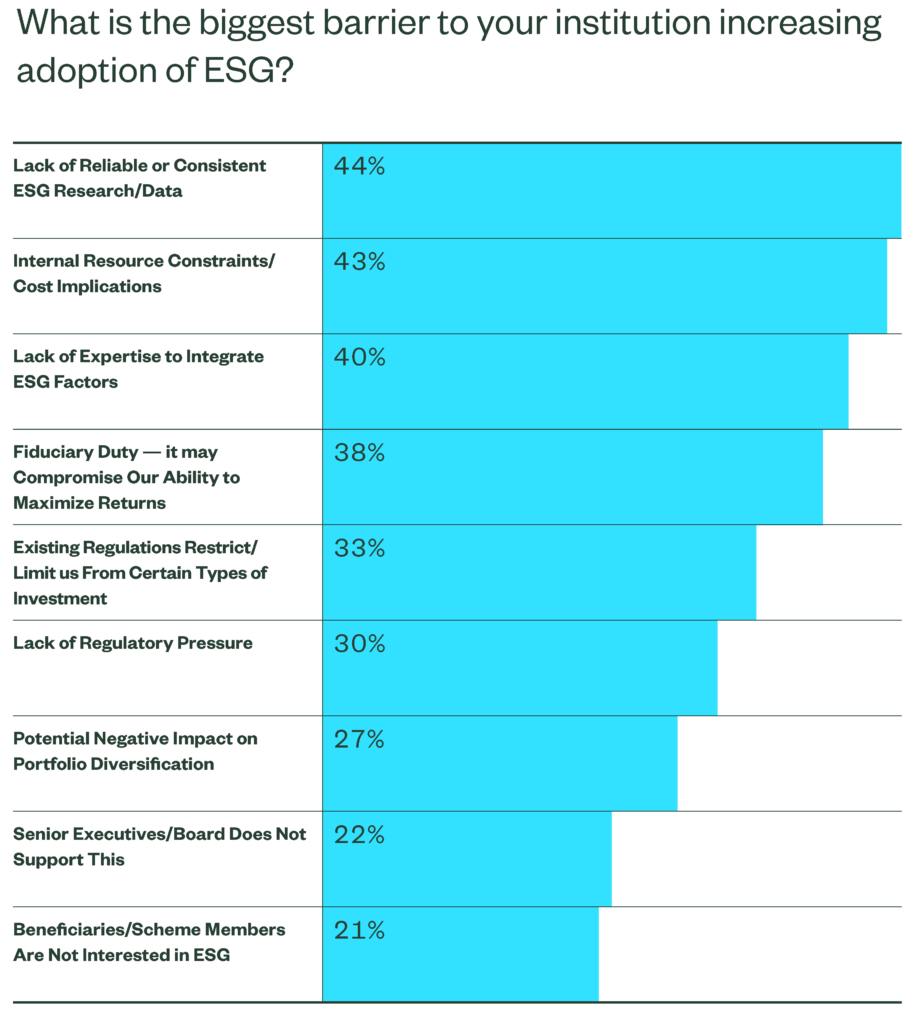

2. Data quality, internal resource constraints and the need for expertise are the key factors pulling investors away from ESG

- Data in Disarray. For nearly half of respondents, the current state of ESG data—single sourced, low correlation and confusing terminology—is a hindering factor to accurately assessing the credentials of underlying companies and their portfolio-level impact.

- Resource Constrained. Internal resource constraints loom large when it comes to ESG adoption and implementation across asset classes. Every investor surveyed has plans to employ more ESG resources.

- Expertise Needed. Allied to resource constraint, for nearly 40% of respondents a lack of expertise in integrating ESG was a key hindrance factor.

3. Effective risk measurement is critical for all, regardless of investment path taken

- Investment Approach Adopted Depends on Key Motivation or Push Factor. The relevant ESG push factor influences the investment approach taken. For example, those motivated by mitigating ESG risks are more likely to implement systematic integration or positive screening, while those driven by regulatory change and beneficiary pressure are more likely to apply exclusionary screening.

- Risk Measurement Capability Critical for Manager Choice. For 97% of institutions the ability to measure ESG risk is critical in assessing the ESG capabilities of managers.

- Ability to measure success varies between ESG Factors. Most investors report finding it far easier to measure Governance than Environmental or Social impact. Data improvements and reporting refinements are sorely needed.

What’s Driving Investors Towards ESG? The Push Factors

There’s Growing Recognition that Mitigating ESG Risk is Part of Fiduciary Duty

The view that ESG is simply part of fiduciary duty is becoming commonplace, with 46% citing this as a top push factor. Why is this? Our analysis of respondents driven by fiduciary duty suggests that mitigating ESG investment risks and shaping a sustainable economy are viewed as key responsibilities to their beneficiaries—two different drivers but with the same effect. One tangible example here is climate risk; cited clearly in qualitative feedback as a key risk that investors must address.

Regulatory Pressure is a Key Driver of ESG Adoption

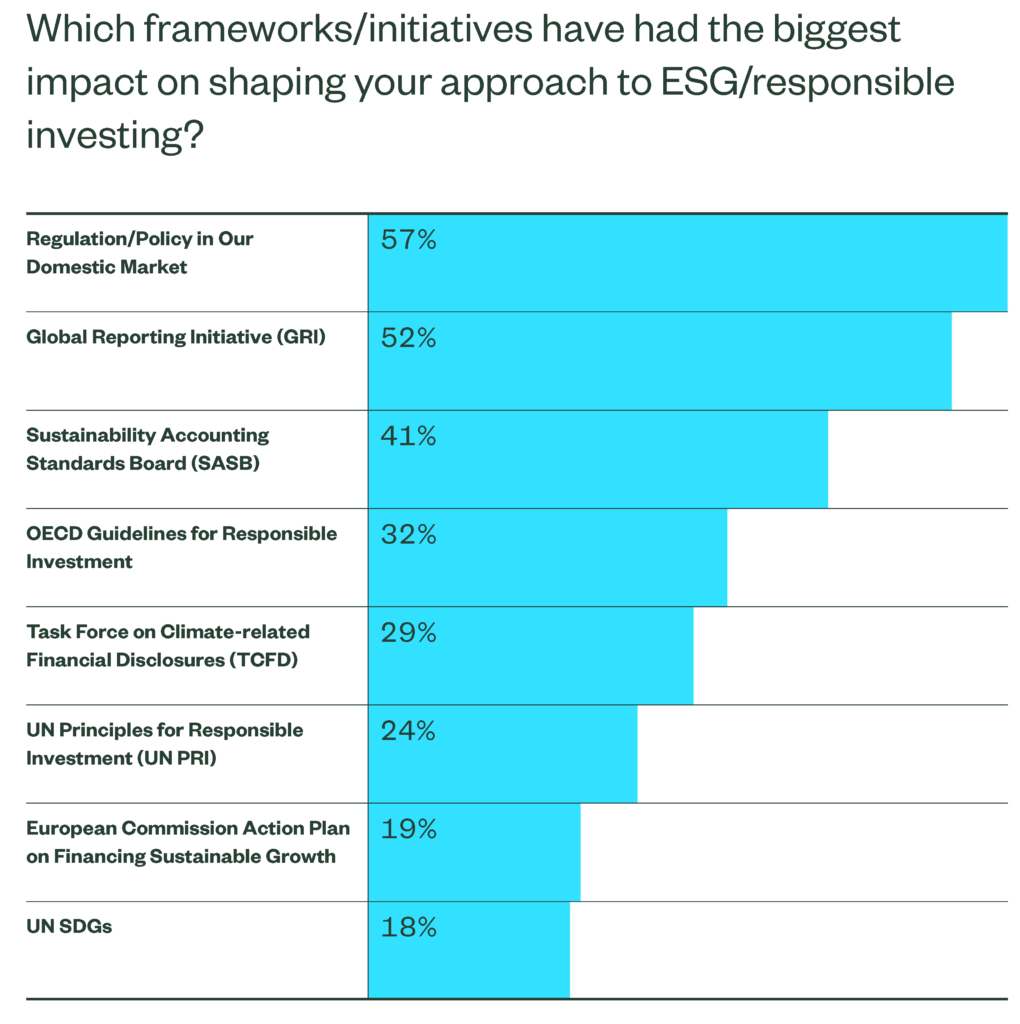

Nearly half (46%) of institutions say regulation is a top push factor driving their ESG adoption. Domestic or local regulation is a major factor shaping respondents’ approach, though institutions with more mature ESG policies in place are more heavily influenced by global initiatives such as the UN’s PRI or the SASB framework.

Risk Mitigation is Important

Mitigating ESG risk in the portfolio is a significant push factor for respondents. The expectation that ESG will drive outperformance is not and less than one in ten investors cite higher returns as a driving factor. There are measurement challenges and it’s still early in the investment cycle for many ESG strategies, so more focus may need to be directed on quantifying investment impact over the next few years.

Top Push Factors for ESG Engagement

The clear top push factors driving ESG adoption are responding to regulation, meeting fiduciary duty and mitigating ESG risks in the portfolio.

The global regulatory environment is changing fast, with increasing numbers of countries enshrining ESG requirements into their regulations. This will only continue.

The fiduciary landscape is also becoming clearer, effectively removing a previous barrier to ESG uptake. Our belief is that this is linked strongly to the importance of mitigating ESG risks as a key push factor, alongside a reduction in the notion that investors must sacrifice returns when implementing ESG investments. In fact, almost a quarter (23%) state that reducing volatility is a key driver of adoption.

Investors aren’t primarily motivated by a view that ESG will drive outperformance, perhaps since evidence is limited at this stage given the challenges of attributing performance to ESG factors. And, some ESG pay-offs will be realized long term.

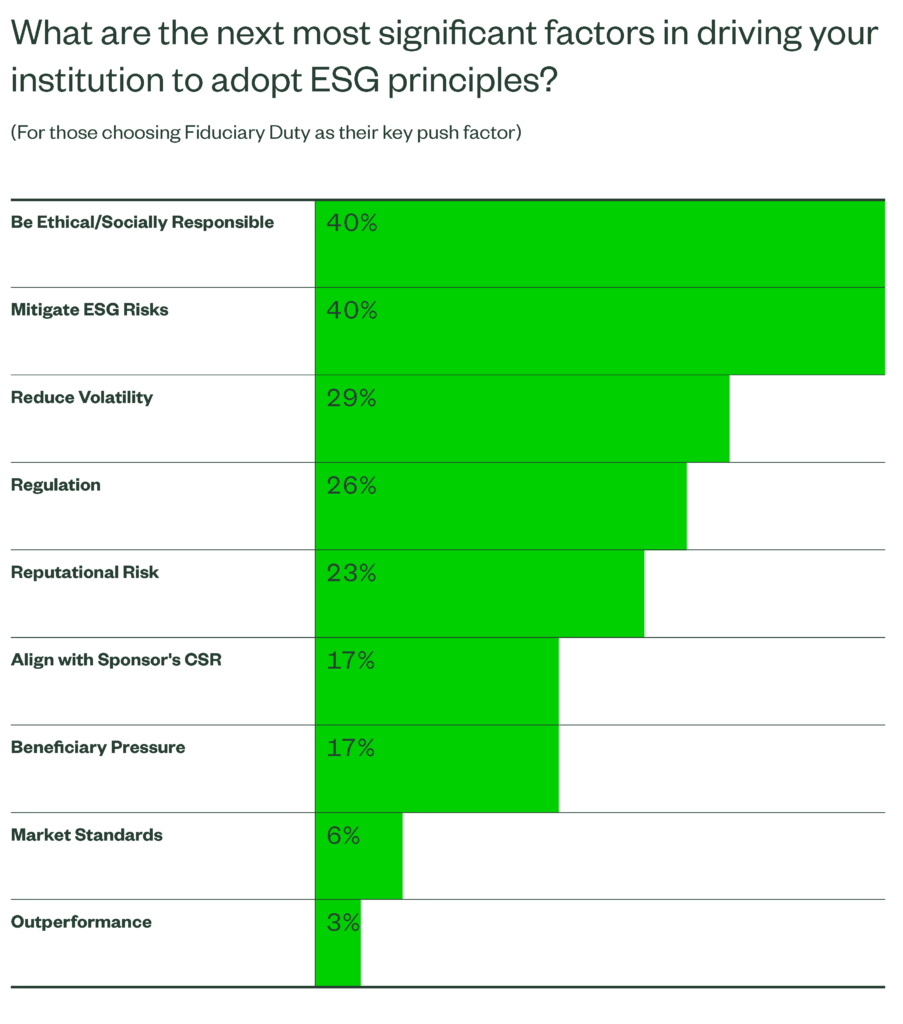

Digging Deeper: The Remaining Key Drivers for Those Primarily Driven by Fiduciary Duty

For those in the sample that are primarily driven by fiduciary duty, ESG risk mitigation and a requirement to be ethically or socially responsible are the next closest drivers. A desire to reduce volatility through ESG investment is the next driver at 29%. Investors are looking to mitigate against clear risk factors such as climate change and carbon.

As a result, some theme-based approaches are becoming increasingly popular while some important ESG principles are being left behind because it’s harder to quantify the investment risks. The question has to be asked: ‘Is this ESG investing or simply best practice investment management for long-term investors?’

The thing that has changed, though, is the factors that must be taken into account as part of that fiduciary duty. That’s the interesting part of the external forces and factors that now have come to light and are continually coming at us. The challenge is to take those factors into account, but still look at it through a lens of performance-based fiduciary duty.

—Chris Philips, Washington State Investment Board

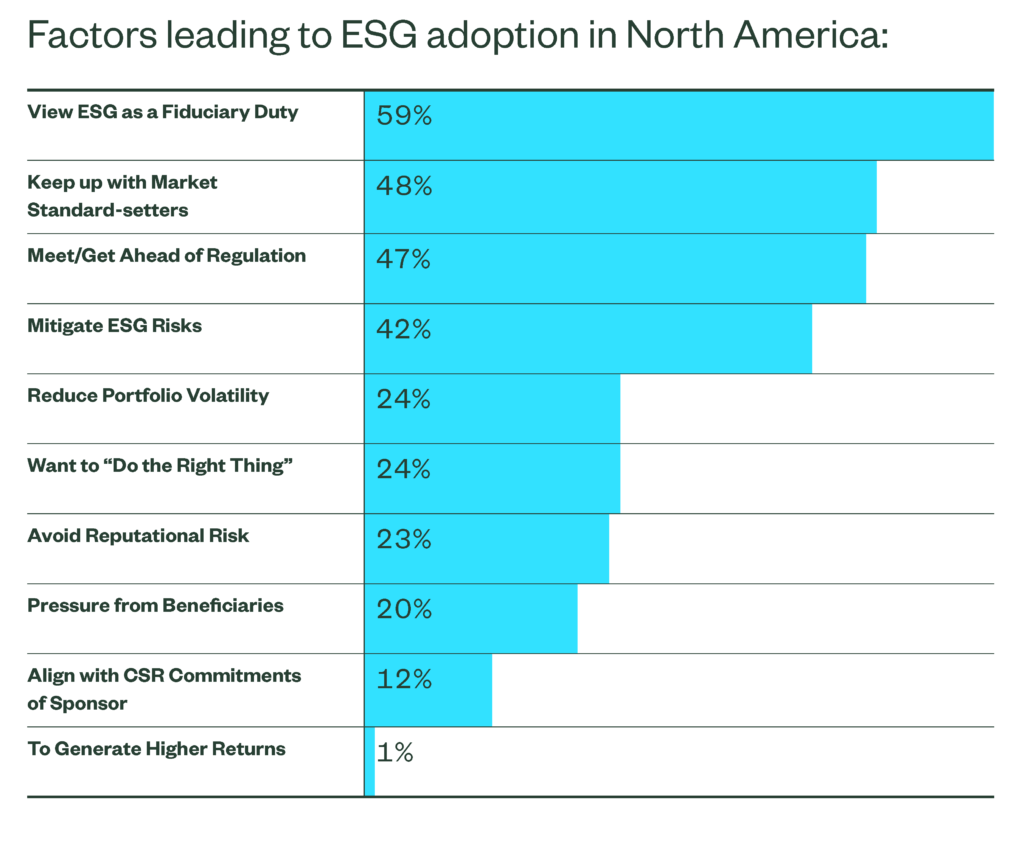

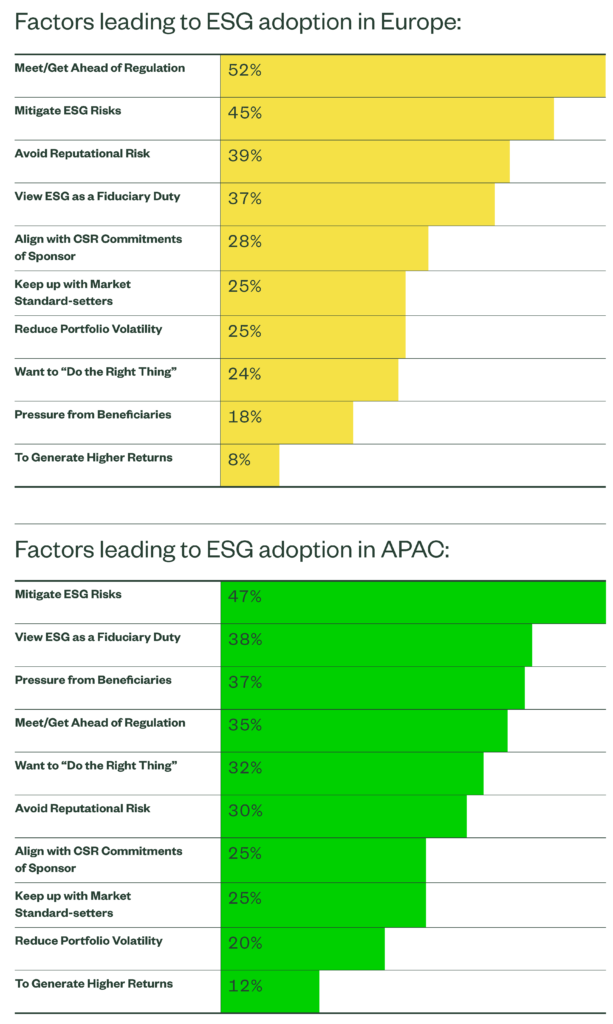

Each Region is Driven by Different Key Factors

North American investors are most likely to view ESG as a fiduciary duty, while European investors are driven by regulation, performance and reputational risk.

The prime drivers for APAC investors are performance risk and pressure from beneficiaries.

Fiduciary Duty and Regulatory Pressure are Clear Drivers for All Investor Types

Out of all the groups, pension funds are the one most concerned with reputational risk, though regulatory drivers are their top concern. Endowments and foundations feel the most under pressure from beneficiaries, but their main driver is fiduciary. For sovereign wealth funds fiduciary duty and regulatory impetus are clear push factors.

Frameworks and Initiatives Shape ESG Approach

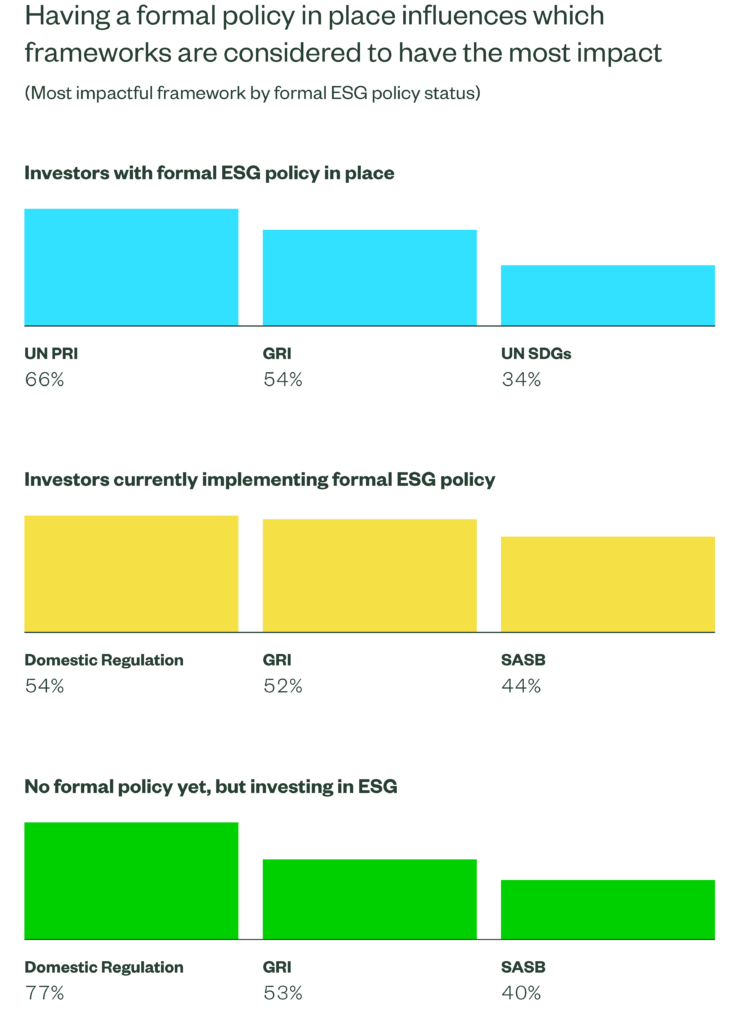

Regulation and domestic policy, followed closely by the requirements of the Global Reporting Initiative (GRI) and the increasingly influential SASB framework, are the greatest drivers in shaping investors’ ESG approaches. However, the results are nuanced depending on the degree to which investors have a formal ESG policy in place.

While GRI requirements maintain a second place throughout, those investors who have considered a formal policy are driven strongly by the UN PRI. For those with a less advanced policy positioning, domestic regulation attains a higher degree of importance. It seems that the degree of ESG knowledge and sophistication has an impact on what the main ESG adoption driver will be.

What’s Keeping Investors Away from ESG? The Pull Factors

ESG Data Remains a Concern—Particularly its Consistency and Coverage

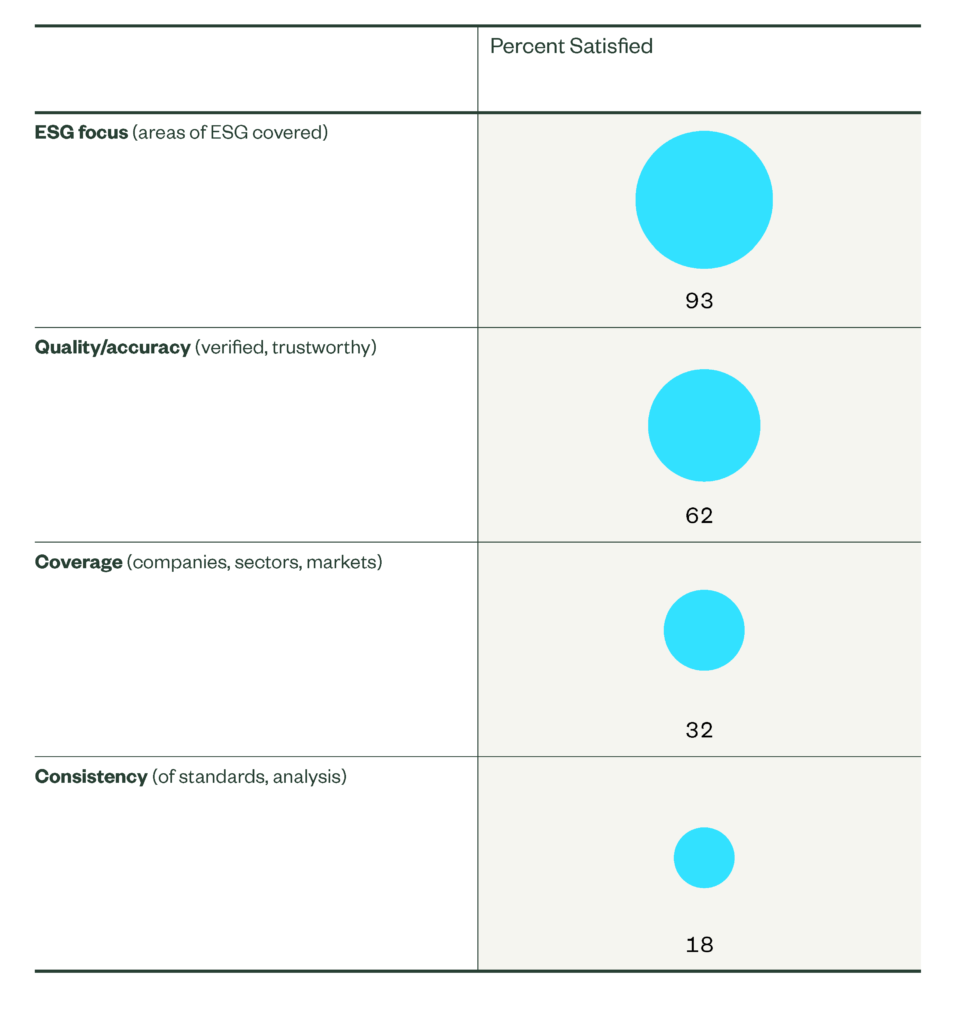

Nearly half (44%) of respondents say the state of ESG data is a top pull factor hindering their ESG adoption. Delving deeper, the most problematic aspects are the consistency of data across providers, and the lack of availability of ESG data in some areas of the market.

Resource Constraints and Cost Implications are Key Barriers

As institutions look to integrate ESG analysis into the investment process and simultaneously manage a host of new reporting requirements, pressure on resources will only increase.

Lack of Expertise is Holding Investors Back

Implementing an effective ESG strategy can be complex. Many respondents felt they lacked the expertise to do so properly. Should institutions hire specialists? Make ESG everyone’s job? Or rely on external expertise in the form of their asset managers or advisors?

Inadequate ESG Data and Resource Constraints Hinder Adoption

The availability of reliable and consistent ESG data is the top barrier to deeper ESG adoption, followed by resourcing or cost issues and a lack of available ESG talent to manage ESG adoption.

Cited by 46% as a push factor driving ESG engagement, fiduciary duty is, on the other hand, viewed as a barrier to adoption, but by less respondents (38%). What explains this dichotomy? It seems for some there’s a lingering concern that ESG adoption may hinder the ability to maximize returns. Despite this, there does seem to be a clear trajectory towards ESG increasingly being considered a key part of fiduciary duty.

ESG Data Disappoints

While most are satisfied with overall thematic coverage (eg Carbon, Greenhouse Gases), consistency and depth of specific coverage fall far short. Investors are struggling with inconsistent ESG scoring from different providers and are not satisfied with access to ESG data in many areas of the market.

Towards the Future

Our survey illuminates regional and institutional divergence on approaches to ESG investing. And yet some things are clear no matter the region or investor type:

- Investors are increasingly seeing ESG as part of their fiduciary duty, removing a previous barrier to adoption.

- Regulation is driving investors towards ESG. Though the regulatory landscape is complex and often requires expert guidance, investors will need to engage with ESG.

- ESG investment resources are sorely needed but not yet there for many institutions.

- Investors need the right data to make the right ESG decisions and yet the current state of ESG data—single sourced, low correlation, confusing terminology—is a substantial hindering factor to adoption.

- A growing awareness of the true potential impact of ESG is making the ability to measure ESG risk a key attribute of any investment manager.

Despite the mix of drivers pushing and pulling investors to or from ESG investing, it has clearly reached a tipping point where institutional investors cannot afford to ignore it—either for the risk that it may pose or, perhaps even more compellingly, the opportunities it presents.

Print

Print