Steve Kline is a director and Chris Kozlowski is a senior principal consultant at Willis Towers Watson. This post is based on their Willis Towers Watson memorandum. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The new year provides the chance to look back at where we’ve been. Our post summarizes financial performance in 2019 and how those results are expected to drive annual incentives for 2019. It’s also a time for looking ahead. So we consider how performance results are expected to rebound in 2020.

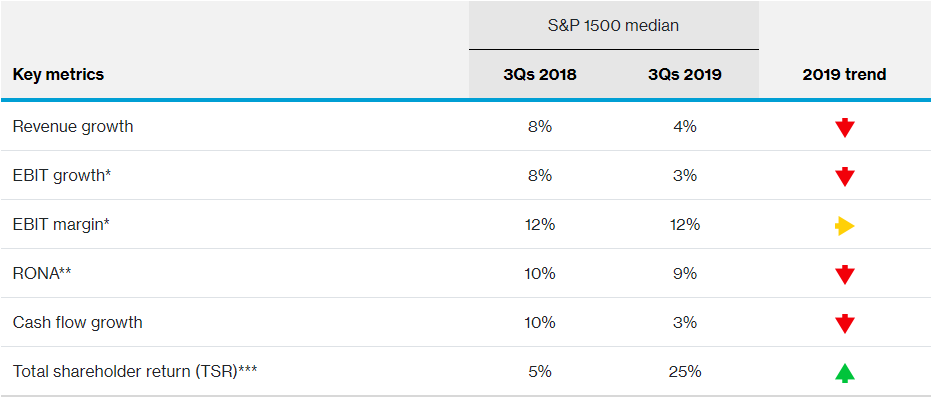

First, we consider median results for the S&P 1500 through the first three quarters of 2019. Figure 1 shows how financial performance has deteriorated from the same three-quarter period in 2018. Growth in revenue, earnings before interest and taxes (EBIT) and cash flow have been well below the trend in 2018. Returns on the balance sheet are down slightly. Interestingly, investors have remained optimistic despite volatility and persistent global risks.

Figure 1. S&P 1500 scorecard summary

Source: S&P’s Capital IQ database.

*Earnings before interest and tax

**Return on net assets

***TSR through November 30

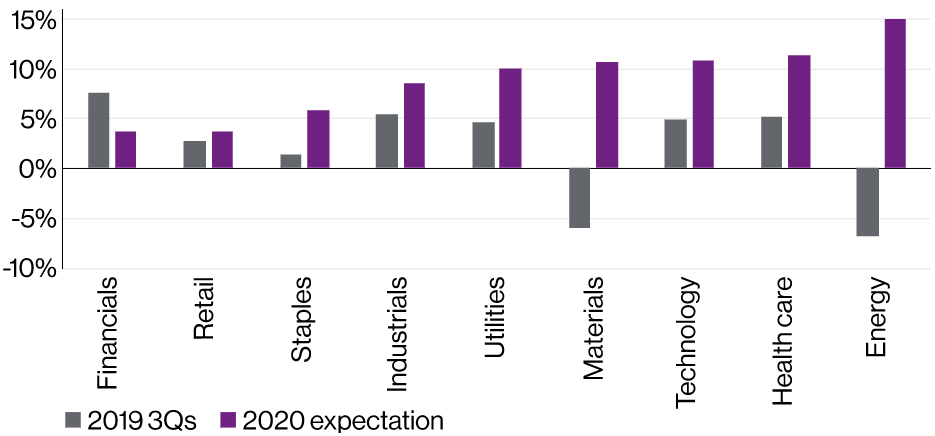

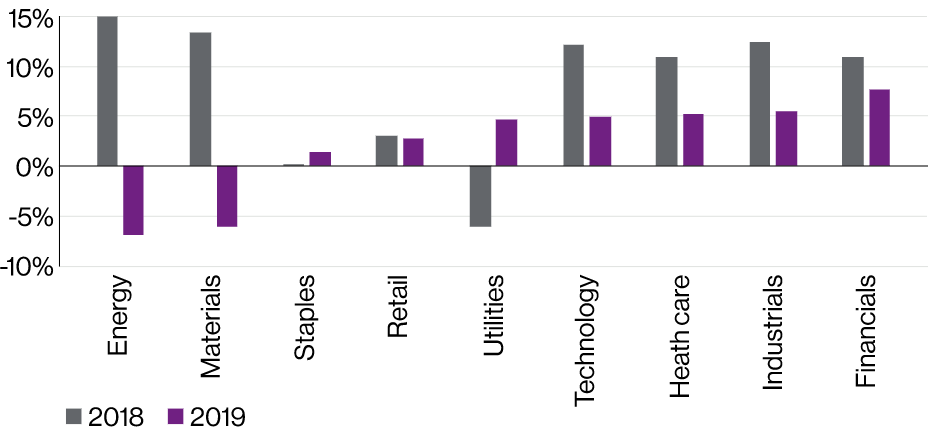

Figure 2 examines 2019 three-quarters’ financial results by sector. Looking across the sectors, the trend is clear: 2019 results are generally below the same period last year. Six of the nine sectors in our review have posted lower EBIT growth rates through three quarters of 2019 than 2018. The industrials sector, for instance, posted 12% growth in 2018 but only 5% growth so far in 2019.

Figure 2. S&P 1500 median EBIT growth by sector for three quarters

Source: S&P’s Capital IQ database. Results reflect the S&P 1500 sectors after three quarters.

Exhibit cropped at +15% to preserve scale. Energy sector 2018 growth of 31%.

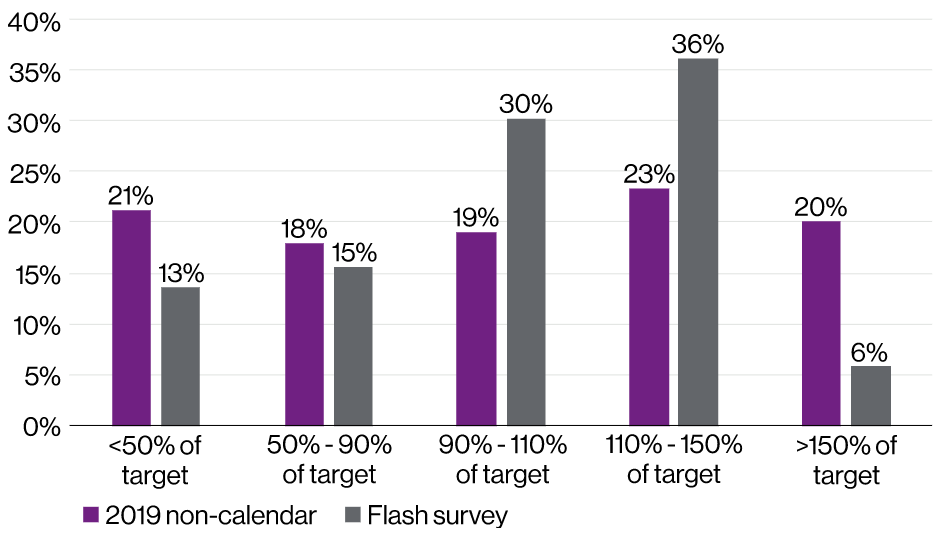

To understand the implications of this performance for bonuses, we present two perspectives (Figure 3). We report bonus results for about 100 companies with fiscal years ending after March 31 (but before year-end). We also recently conducted a flash survey about bonus expectations (representing about 100 participants). Listeners to our recent year-end webcast got a preliminary look at these flash survey results.

The median bonus for the 2019 non-calendar companies was 103% of target (compared to the 2018 median among the S&P 1500 of 113%). Results, however, were widely and evenly dispersed with about 20% in each of the five payout ranges shown.

Outcomes from the flash survey indicate a 30% likelihood of a payout in “the target range” (90% – 110% of target). The median payout from the flash survey also falls in the target range. Interestingly, a robust sample (36%) expect payouts materially above target, which is curious given the lackluster 2019 performance we’ve observed in most sectors.

Figure 3. 2019 senior executive bonus early results and expectations

Sources: 2019 proxy filings of about 100 non-calendar companies.

Flash survey results of about 100 participants.

Shifting our focus to 2020, we explore how investment analysts’ expectations for 2020 compare to 2019 results. Figure 4 shows EBIT growth expectations by sector. Analysts expect nearly all sectors to perform better in 2020. For example, analysts expect the industrials sector to grow 9% in 2020, compared to 5% in 2019.

Figure 4. 2020 EBIT growth expectations versus 2019

Source: Capital IQ. 2019 reflects results of the S&P 1500 sectors after three quarters

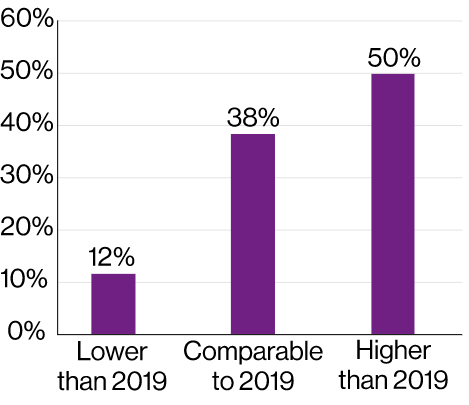

Given the context of meager financial results in 2019 but robust expectations for 2020, we wanted to understand how companies are thinking about incentive plan goals for 2020. We polled our flash survey participants about the preliminary direction of 2020 incentive plan goals. Specifically, we asked how companies are expecting to set 2020 profitability goals compared to 2019 performance goals. Figure 5 shows that 50% of respondents expect to raise the bar in 2020—consistent with analysts’ expectations. Even when target goals are robust, it’s important to set compelling threshold and max goals.

Another 38% expect to set goals at comparable levels, and 12% expect to set lower goals. When goals are modest there’s even more pressure on ensuring that threshold goals are sufficiently robust and well-explained to shareholders.

Figure 5. 2020 goal-setting expectations

Source: flash survey of about 100 participants

To recap, 2019 performance generally fell short of 2018—overall and across most economic sectors. Despite such lukewarm results, 2019 bonuses are expected to trend around target. Wall Street is expecting a stronger 2020 performance than 2019. Our survey results indicate many companies are expecting to set higher incentive plan targets in 2020, consistent with the rising tide of expectations.

Print

Print