Steve W. Klemash is Americas Leader at the EY Center for Board Matters and Kris Pederson is Corporate Governance Leader, Americas Advisory at EY. This post is based on their joint EY and Corporate Board Member memorandum.

Staying future focused can lead to sustainability

In November 2019, the EY Center for Board Matters welcomed a group of corporate directors—who collectively represent more than 80 boards and $1 trillion in market capitalization—to its Strategy and Innovation Board Summit in New York City. The objective was to share experiences and discern how boards can be more effective in their oversight of strategy and innovation amid rapidly evolving technology and market disruption.

The session started at the New York Stock Exchange, with directors experiencing the excitement of the trading floor and watching employees of a newly admitted company ring the bell, which served as a direct reminder for board directors to be mindful of their key role as stewards of the financial health of the companies they represent. The summit featured highly interactive discussions on topics such as the necessity of balancing short- and long-term performance, how boards are changing their approach to strategic planning and governance, and the importance of bringing outside perspectives to the boardroom. This post captures the key insights from the summit to help advance the strategy and innovation agenda for directors.

We encourage ourselves and board directors to seek out and hear diverse points of view. This summit helped us with that. It was inspiring to hear about leading practices and engage in discussions about how boards can govern strategy and support innovation that leads to sustainable growth.

—Stephen W. Klemash, EY Americas Center for Board Matters Leader

The board’s role in securing a future in an age of disruption

Today’s products and services—along with the processes and systems that design, build, market and deliver them—can become obsolete overnight, with replacements subject to their own displacement just as fast.

In such turbulent times, conventional strategic planning processes are no longer robust enough as companies must also strive to keep a pulse on disrupters that can threaten or provide opportunities that impact their strategy.

Leading boards are taking a closer look at what they are doing—from asking better questions to helping management see pivot points when signals emerge. They are engaging in healthy discussion about the tensions between new investments and innovation while continuing to deliver short-term results and achieving long-term sustainable growth. Board members came to the summit to wrestle with this new reality, through the lens of strategy and innovation.

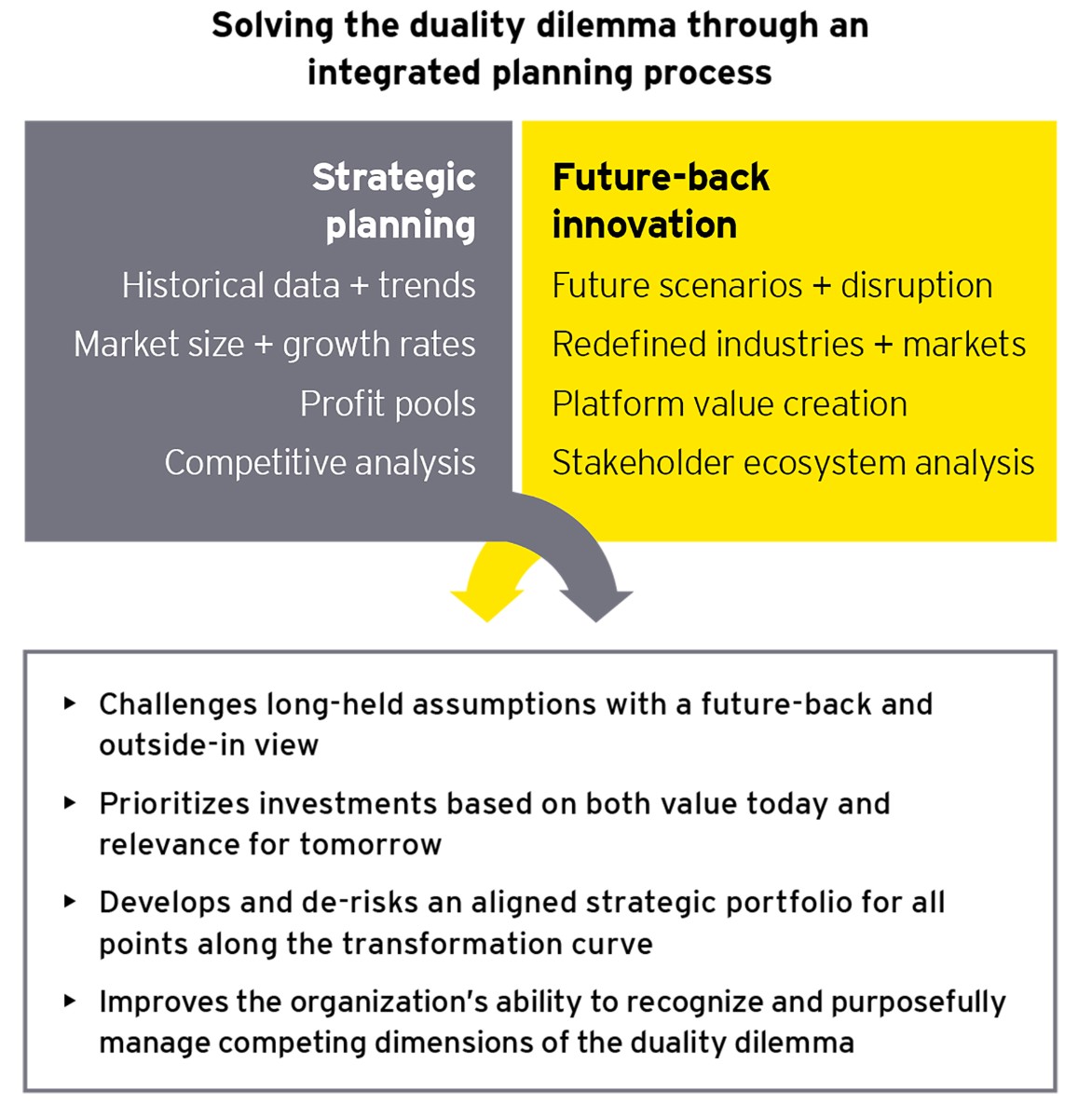

What’s needed is for boards to consider an integrated planning process from two lenses that supports today and builds for tomorrow. Jim Doucette, EY Americas Strategy Leader, put it this way, “To oversee strategy, the board must become ‘future focused’ while also considering short-term strategic business needs.”

Together with management, directors must look ahead three to five years to find trends in their industry, and in adjacent industries, that may spawn new disruptions and unleash new types of challengers. The business trends, together with projected technology advancements and other big shifts (demographic, geopolitical, legislative and climate related, to name just some), should then be played out in different scenarios to suggest what the world might look like. This dual approach helps companies consider the drivers of strategy from both perspectives, as illustrated below.

The discussions at the summit were engaging and interactive. I especially enjoyed the conversations on the drivers of long-term value, as these are critical forces in today’s corporations and boardrooms. Long-term value forms the mega strategy of a business.

—Kristen J. Pederson, EY Americas Advisory Strategy Leader

Disrupt before you are disrupted

Boards are in a unique position to help their companies redefine the future through pre-emptive innovation. It can be hard to know when to pull the trigger on changing a company’s course and to determine whether it is the strategy that should change or the CEO’s implementation or both. One director referenced former Cisco CEO John Chambers’ view that it’s not always that company leaders do the wrong things, but sometimes they do the right things for too long.

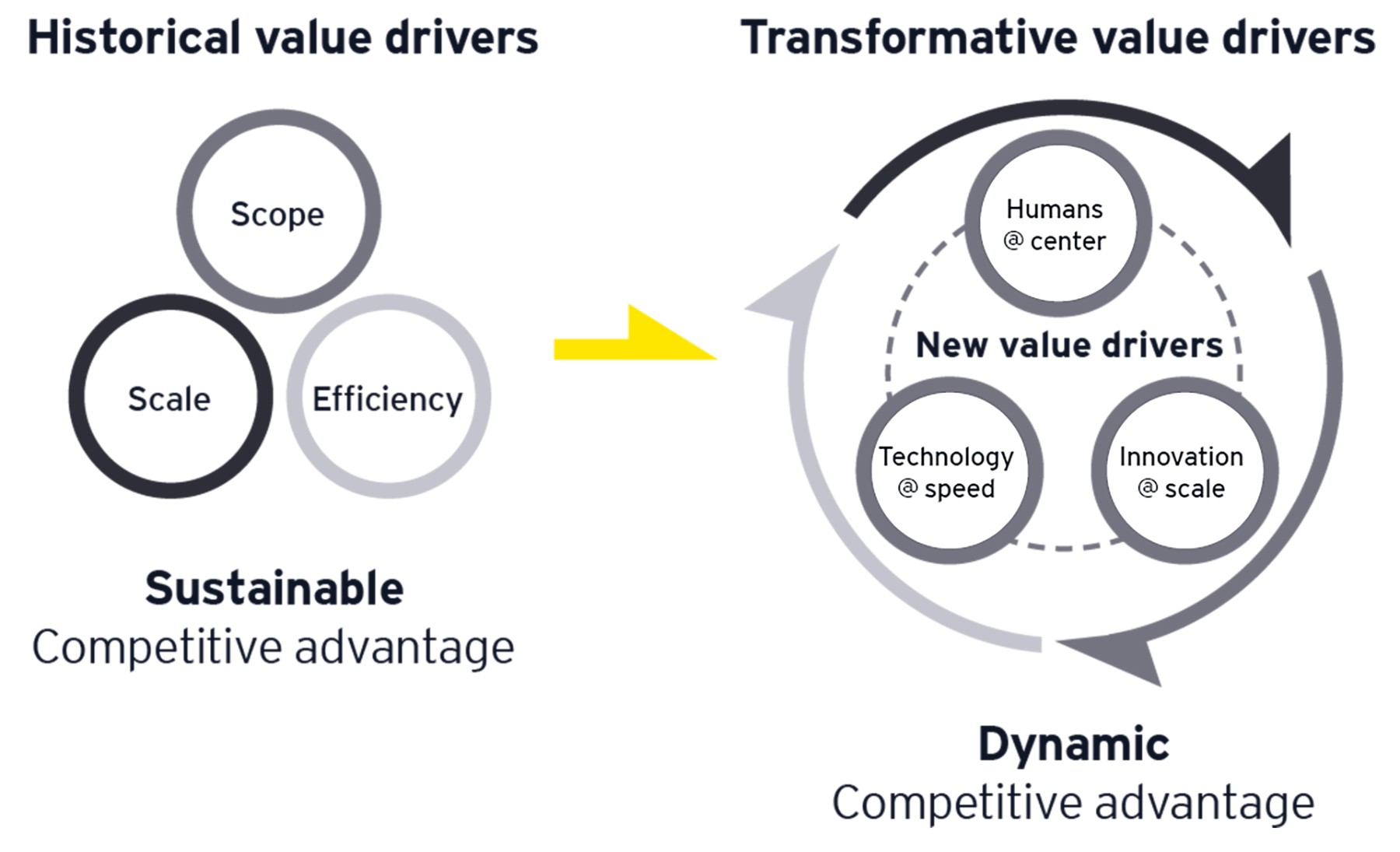

Strategy oversight is no longer a once-a-year exercise for boards. Instead, directors should have ongoing discussions with management that allow them to constantly review the company’s strategy and innovation initiatives, understanding that historical value drivers like scale, scope and efficiency have given way to digital technology’s power to upend (and sometimes displace) entire industries.

One way to jump-start the board and management dialogue on innovation is to use demographic, environmental, social and other megatrends as prompts for brainstorming potential strategic opportunities and risks. At the summit, attendees participated in a workshop based on an actual exercise conducted by the board and management team of an industrial company. Teams identified a range of possible new products, services, revenue streams and internal opportunities for change because of trends, such as the increase in extreme weather events, the aging US population, the rise of robotics and drones, and the increased focus on sustainability concerns. These “future-back” visioning sessions can be extremely useful tools, said Michael Kanazawa, of Ernst & Young LLP. “When boards create venues for these types of open discussions, it creates an opportunity to challenge long-standing assumptions in the company’s strategic plans that may be obsolete.”

Summit participants identified several other considerations for board oversight of strategy and innovation, including:

- Establish a clear and shared definition of corporate purpose as the foundation for the future strategy. Ask the question: why do we exist?

- Select leaders who have vision, not just the ability to generate short-term results. Adjust leadership succession and development criteria accordingly.

- In strategy sessions with management, ask leaders to share the strategic options that were not chosen, and why.

- Ensure that performance metrics reward innovation and recognize that some level of failure will be involved.

These and other conversations can start to change the company’s culture of innovation, leading to different results. But time is never on your side. One speaker at the summit summarized the call to action as, “you have to self-disrupt before you self-destruct.”

A new road map for oversight

One director explained that, “short-term results do matter—otherwise you won’t have the right to exist,” he said. “But they shouldn’t dominate long-term concerns.” He went on to explain that achieving the right balance involves governance to protect the long-term investor.

Boards should consider the Business Roundtable’s recent Statement on the Purpose of a Corporation, which suggests companies balance a short-term “stockholder perspective” with a long-term “stakeholder perspective,” encompassing employees, consumers and society.

The Chief Executives for Corporate Purpose (CECP) maintains that a company’s social strategy—“how it engages with key stakeholders, including employees, communities, investors and customers”—determines its success. The CECP calls for boards to consider several steps, including clearly defining the company’s purpose and discussing strategy at every meeting.

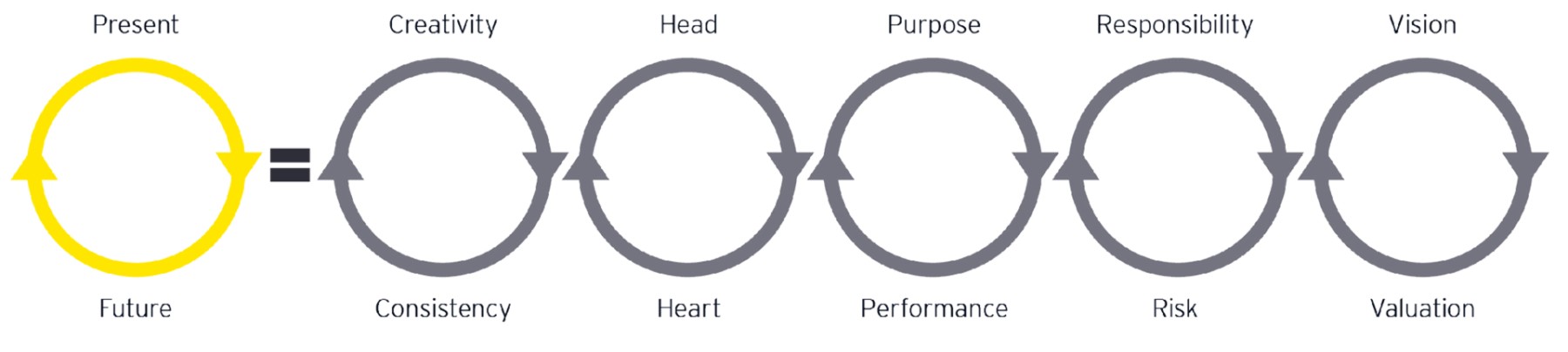

To act on these recommendations, boards and management may want to consider the four key drivers of long-term growth identified in the Embankment Project for Inclusive Capital (EPIC), which are talent, innovation and consumer trends, society and the environment, and corporate governance. EPIC’s Long-Term Value Framework provides an approach companies can take to identify and evaluate company-relevant key value drivers and develop nonfinancial metrics that can help clarify value and value creation.

The best boards are defined by diversity in their background and experience. For instance, some boards are adding academics and others who have never been general managers. This outside perspective can help identify challenges or risks that might otherwise be overlooked.

Bringing the outside in

How do board members keep up with all of the new technologies, business models and process innovations? Is the board digitally savvy? Does the board’s skills matrix need to be updated to reflect the skills and experiences that will be needed in the future? How do they get at the unknown unknowns? Or learn enough to oversee a duality of strategy and push for effective innovation?

Directors can address the challenge of understanding change by opening the doors of their boardrooms and bringing the outside in—in the form of new perspectives, new directors and new data. Outside points of view can be brought by customers and suppliers, investment analysts, regulators, academics and others, even if what they say challenges a cherished legacy. As one director suggested, “The new mantra is ‘What got you here, won’t get you there.’”

A particularly powerful approach, said Woody Driggs, Americas EY wavespace™ Leader, is giving board members and senior leaders an opportunity to experience emerging technologies together. “When we conduct immersive learning sessions with clients, it helps them reimagine business problems in a completely new way: it’s like doing three months’ worth of work in three days,” Driggs said. During the summit, directors spent time at Ernst & Young LLP’s Chelsea, New York, wavespace™, engaging with live demonstrations of blockchain technology, artificial intelligence, virtual reality and advanced data analytics.

At the end of the demonstrations, one attendee commented, “This experience showed me how easy it is for companies to fall behind. As directors, we must look for ways to encourage our own and our management teams’ exposure to digital disrupters on an ongoing basis.”

Indeed, consideration of value drivers has changed, and in this era of digital disruption, a transformative view of value drivers is critical.

Directors must consider building strategies and innovation approaches that consider the following:

- Technology at speed. Consider forming a technology subcommittee of the board, with directors with relevant experience who can work closely with management and keep the full board informed. Insist that strategy and innovation issues are on the agenda for every board meeting.

- Humans at center. Get out of the boardroom. Walk around the company’s facilities and locations to see firsthand the culture and what’s working and what isn’t. Design with human experience as the focus and human needs as the driving force.

- Innovation at scale: Track venture capital investment patterns in the company’s industry, as well as in adjacent sectors. Attend trade shows and technology conferences to stay current on innovation. Ask management to conduct a strategy and innovation audit. Above all, keep talking, stay curious and remain open to the outside. As one director explained, “Be your own activist. If you’re not learning at the right speed, you’re in trouble.”

The practicalities of the innovation process

There are cultural, risk and organizational issues to sort out to scale and industrialize innovation. And there’s at least one guiding principle to keep in mind: it’s not the technology advancements per se that are the key, but how they are applied to the company’s business model that is critical. For example, ride-sharing providers employed plenty of tech wizardry that already existed—what proved disruptive was the way they put the technology together to create a new business model. To support innovation, directors at the summit reviewed a few actions that boards can encourage management teams to take, including:

- Make a decisive commitment to innovation. If the goal is to be 5% more innovative, don’t have each employee set aside two hours on Fridays for brainstorming, but assign 5% of the top performers to innovation using 100% of their time.

- Unlock the energy in your company. There is a sense of urgency at the top for change, and while some within the organization may get it, it is important to bring along everyone. Coaching along with informal and formal learning can help explain the need for change and the opportunities it can bring.

- Embrace a culture of studied risk. What risks is the company willing to take? The more risks taken, the faster the potential innovation. But speed may also bring more mistakes. It is important to recognize them quickly and bounce back fast. It’s all about failing forward. As one director observed, “Effective risk management allows a company to innovate faster.”

- Organize an innovation portfolio. An ideal project mix is 70% to produce incremental improvements in existing operations, 20% to tap opportunities in adjacent markets and 10% to shoot for a disruptive new business model. You may get no return on your investment in that last category. Or, you just might get a unicorn.

- Create a platform for coordination. While some innovation efforts may be dedicated or assigned to specific people, a process should be created that provides for innovative ideas and processes to be shared by anyone in a centralized way.

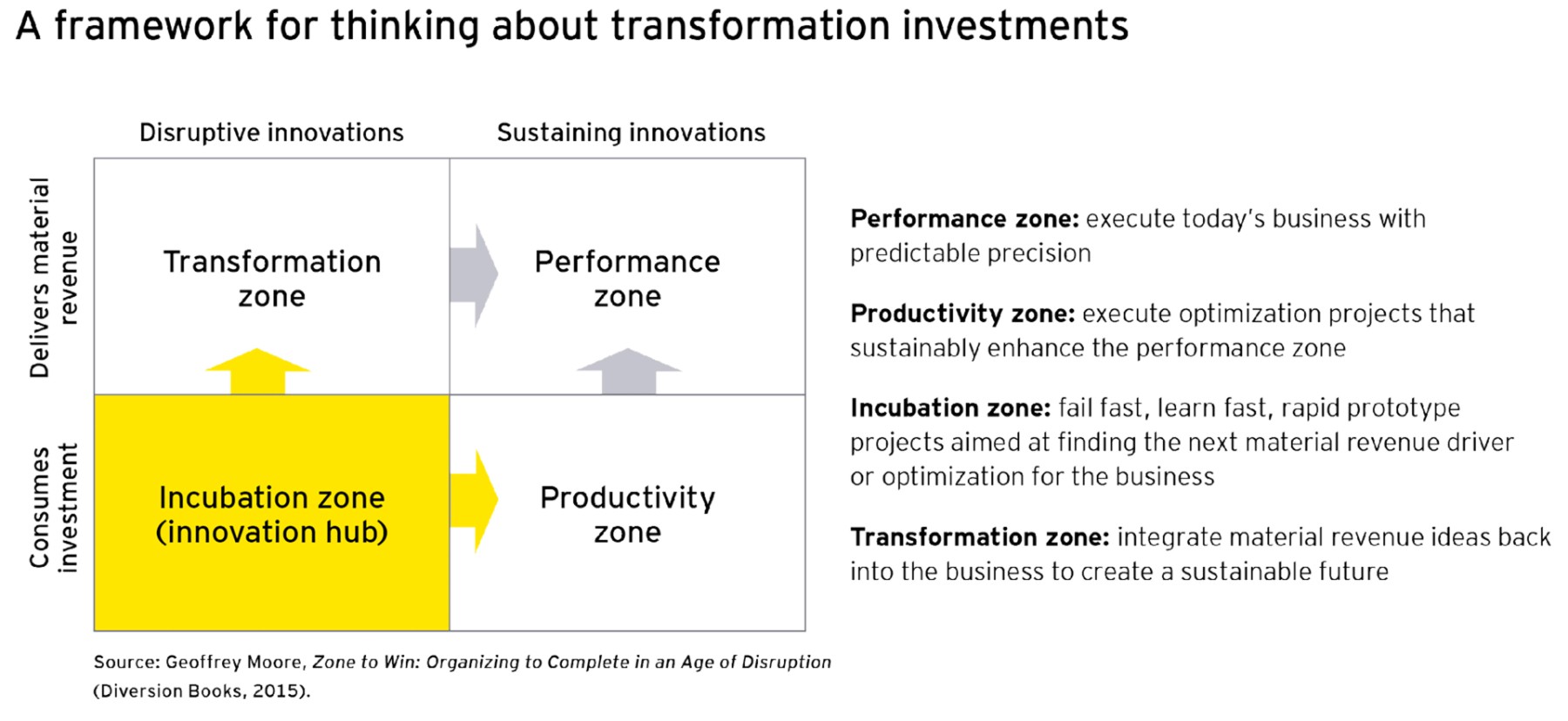

A framework for thinking about transformation investments

In terms of prioritizing innovation investments, a goal should be to prioritize investments into the “transformation zone,” wherein real drivers of the future business needs can flourish. When boards are helping companies prioritize and fund new innovative ideas, they should consider a full range of transformation investments. Taking a four-box model approach to investment consideration can insure that innovation dollars are spread across various buckets of transformation drivers and realize a portfolio of options. The Incubation Zone provides a great place for boards to engage and share knowledge.

Going forward

In the summit’s final session, the attendees identified hot spots to work on to make their oversight role in strategy and innovation more effective. Everyone agreed on leaning in more to shape the long-term strategy. And one way to do that is to become less confrontational with management and more collaborative, turning the board into a catalyst for conversation, a center of culture and a closer partner.

One director said, “We need management to use us for more than our ability to check boxes.” “There’s danger in a consensus mindset,” said another. “We have to be OK with some level of constructive tension in the boardroom.”

“We’re already engaged,” another director said, “and don’t want management to present us with the slick marble surface of a strategic plan. Give us the rough edges—get us in early so that we can add value.”

On the issue of time, directors acknowledged that being a director is a 24/7 part-time job. “We have to think about it all the time, but only engage physically four or five times a year,” said one director. “How do we follow through? How do we keep up a cadence of conversations?”

At the physical meetings, strategy and accountability must be ongoing topics. “We need debriefs on where we thought we were going and where we wound up.” But to maintain the cadence between meetings, some directors gather outside the boardroom, at conferences and other venues.

The directors agreed on the importance of having a diverse mix of people, experience and expertise. But the idea of establishing a separate strategy committee didn’t draw support. “There can’t be pockets of the board that don’t understand strategy,” one attendee said. “Everyone has to be engaged.” Another cut to the chase: “The board is the strategy committee.”

Questions for the board to consider

- How often and when does the board discuss strategic issues, especially the interplay between short- and long-term concerns?

- How early—and how often—is the board involved in management’s strategic planning process?

- What is the board’s role in determining the mix, scope and risk level of your company’s innovation efforts?

- What informs the board’s discussions and decisions in this area? Is it getting enough information from outside the company about existing and potential competitors?

- How is the board keeping up with the explosion of tech advances and products? Who is helping it to understand how these things work and their potential impact on the business?

- How diverse is the board’s composition, by gender, age, racial and ethnic background, expertise and experience?

- Is the board tracking developing trends in the industry and others and performing what-if exercises to scope out the near- and long-term implications?

- Has the board ever gone through an immersive learning exercise in an off-site setting to explore a specific issue facing the company?

- Does the company have the right senior managers and is there a continuous supply of talent to mirror the ongoing change?

- Does your board have the time to stay on top of your oversight responsibilities? Are there structural changes that might make the board more effective?

Print

Print