Richard Blake, Shannon Delahaye, and Lauren Lichtblau are partners at Wilson Sonsini Goodrich & Rosati. This post is based on a WSGR memorandum by Mr. Blake, Ms. Delahaye, Ms. Lichtblau, Angela Chen, Andrew Gillman, and Brianna Murray.

Introduction

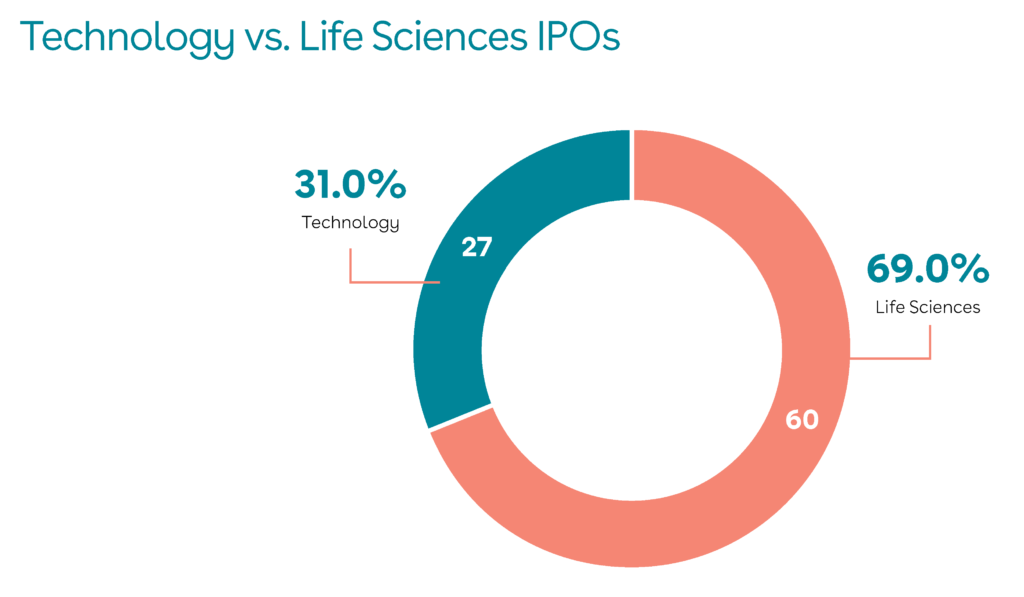

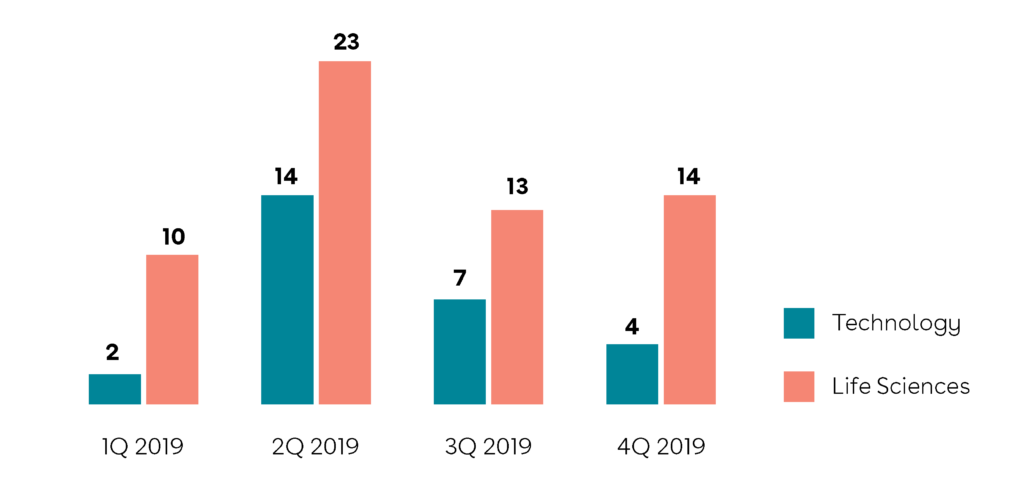

Wilson Sonsini Goodrich & Rosati’s 2019 Technology and Life Sciences IPO Report presents analysis related to the closing of 87 initial public offerings completed by U.S.-based technology and life sciences issuers between January 1 and December 31, 2019. (Source: CapitalIQ) The report includes IPO filing, pricing, and value statistics for both sectors; governance and board of director details; ownership and deal structure factors; and defensive measure data points.

2019 was another vibrant year for tech and life sciences IPOs, with just a slight decline from 2018 despite the U.S. government shutdown and market volatility that slowed IPO activity in early 2019. Comparing this year’s report with the firm’s 2018 year-end edition, the number of IPOs in 2019 fell only six short of the 93 tech and life sciences IPOs in 2018.

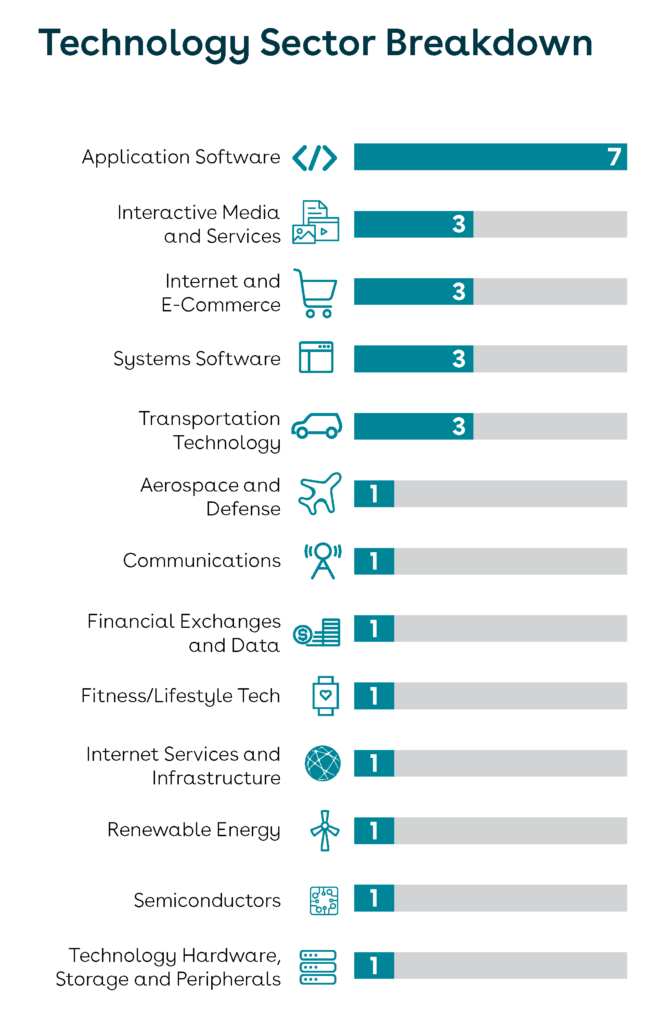

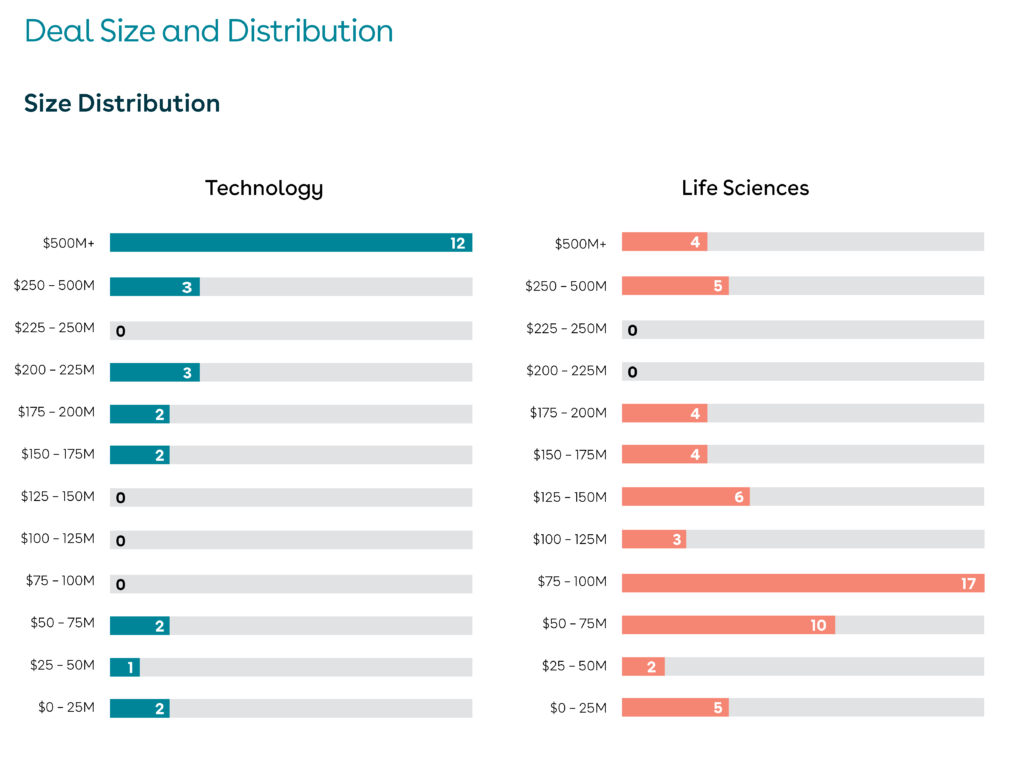

Technology

Twenty-seven technology companies priced IPOs during 2019. Application software led all technology sub-sectors, with seven IPOs. Other active sub-areas included internet and e-commerce, systems software, interactive media, and transportation technology. Combined, the above categories made up more than 70% of the technology IPOs in 2019. Although there were more than twice as many life sciences IPOs as tech deals, tech IPOs generated much larger deal values. Of the 27 tech IPOs, 12 had a total deal value exceeding $500 million.

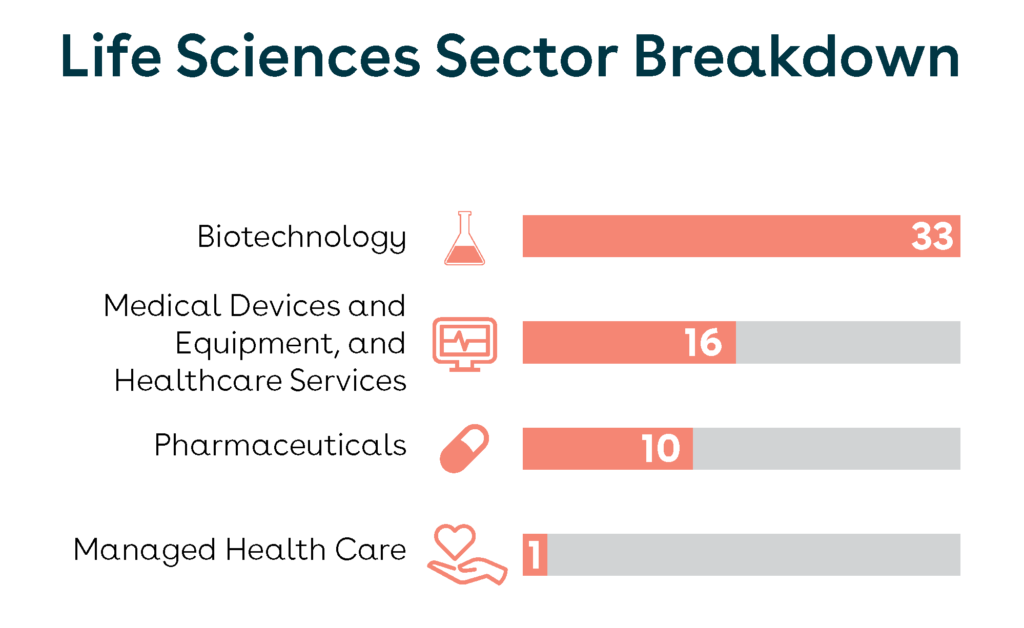

Life Sciences

Sixty life sciences companies priced IPOs during 2019—more than double the total number of tech IPOs. Of the 60 life sciences IPOs, more than half were by biotech companies, followed by 16 IPOs involving medical device companies, and 10 IPOs by pharmaceutical companies. Despite having a larger number of IPOs, deal value sizes for life sciences companies were generally much lower than for tech issuers. Only four of the life sciences IPOs had a total deal value over $500 million.

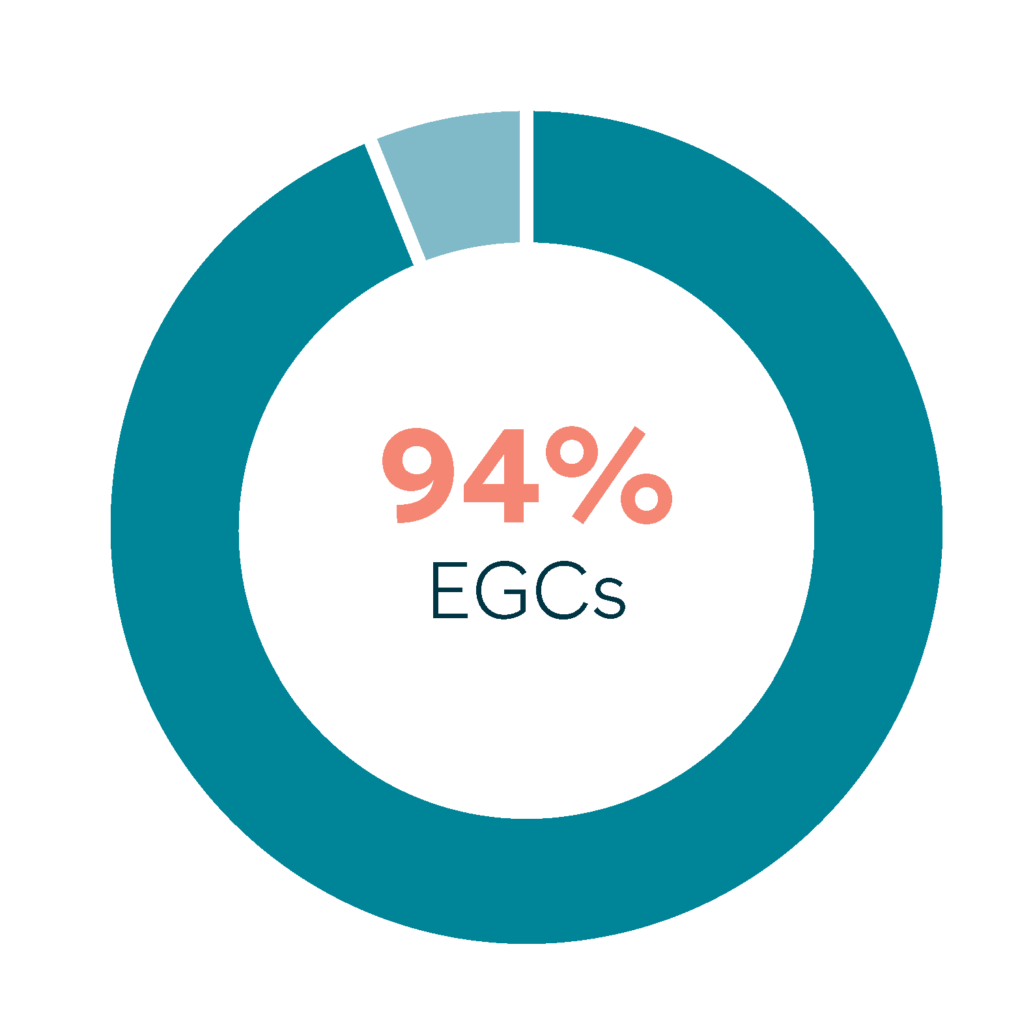

Company Type

Out of the 87 companies surveyed, 82 were emerging growth companies (EGCs).

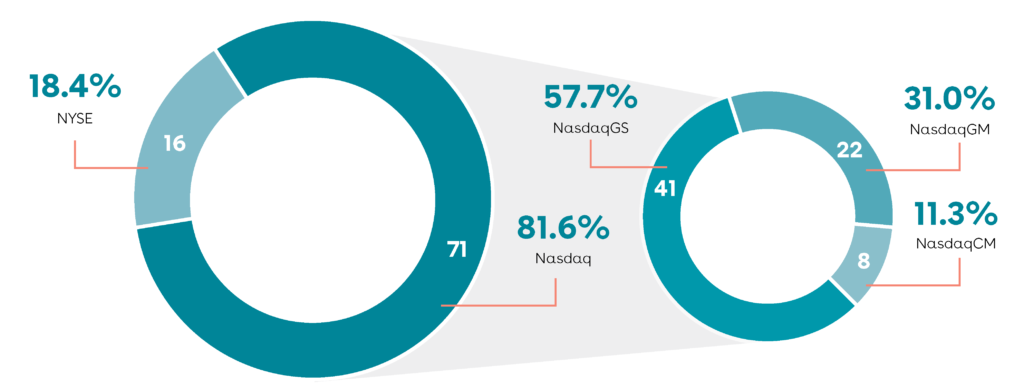

Exchange

Out of the 87 companies surveyed, 71 listed on Nasdaq, representing 81.6% of companies, while 16 listed on the NYSE, representing

18.4% of companies.

Direct Listing

A direct listing is an alternative to a traditional IPO in which outstanding shares are listed on a stock exchange without an underwritten offering. Existing stockholders may sell their shares immediately, but are not obligated to do so. Direct listing is still a relatively new concept; there have only been two. Slack Technologies, Inc. completed a direct listing in June 2019 and Spotify Technology SA completed one in April 2018. From an execution standpoint, there are not many differences between a direct listing and an IPO; however, so far, the results for direct listings compared to IPOs are mixed.

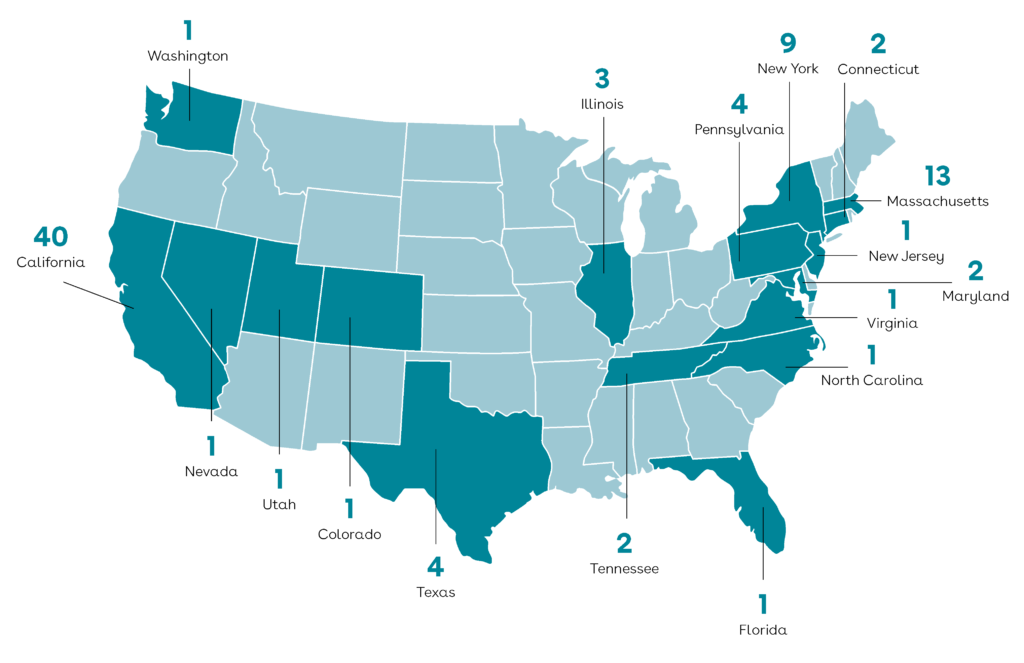

Headquarters (U.S.)

The map below shows the headquarters location for the 87 companies reviewed in this report.

Headquarters (California)

Of the 40 companies with headquarters in California, 30 are based in Northern California and 10 are based in Southern California.

Board of Directors

Directors and Independence

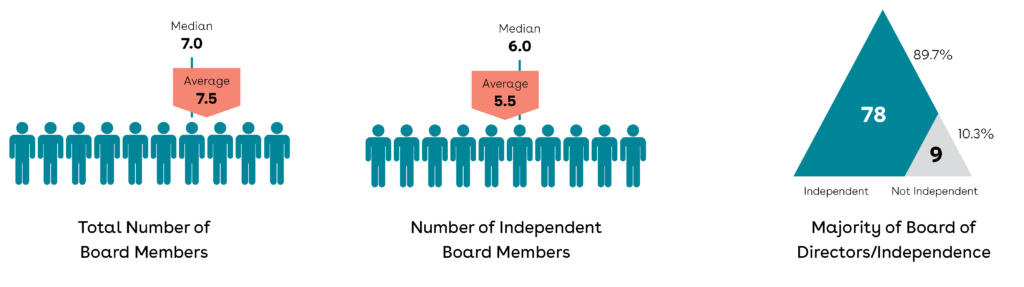

Using data obtained from final IPO prospectuses, we examined information regarding the size of the board of directors, director independence, whether the CEO and board chairperson roles were combined, the existence of lead independent directors in companies where the CEO and board chairperson roles were combined, and the number of companies relying on exemptions from compliance with corporate governance requirements.

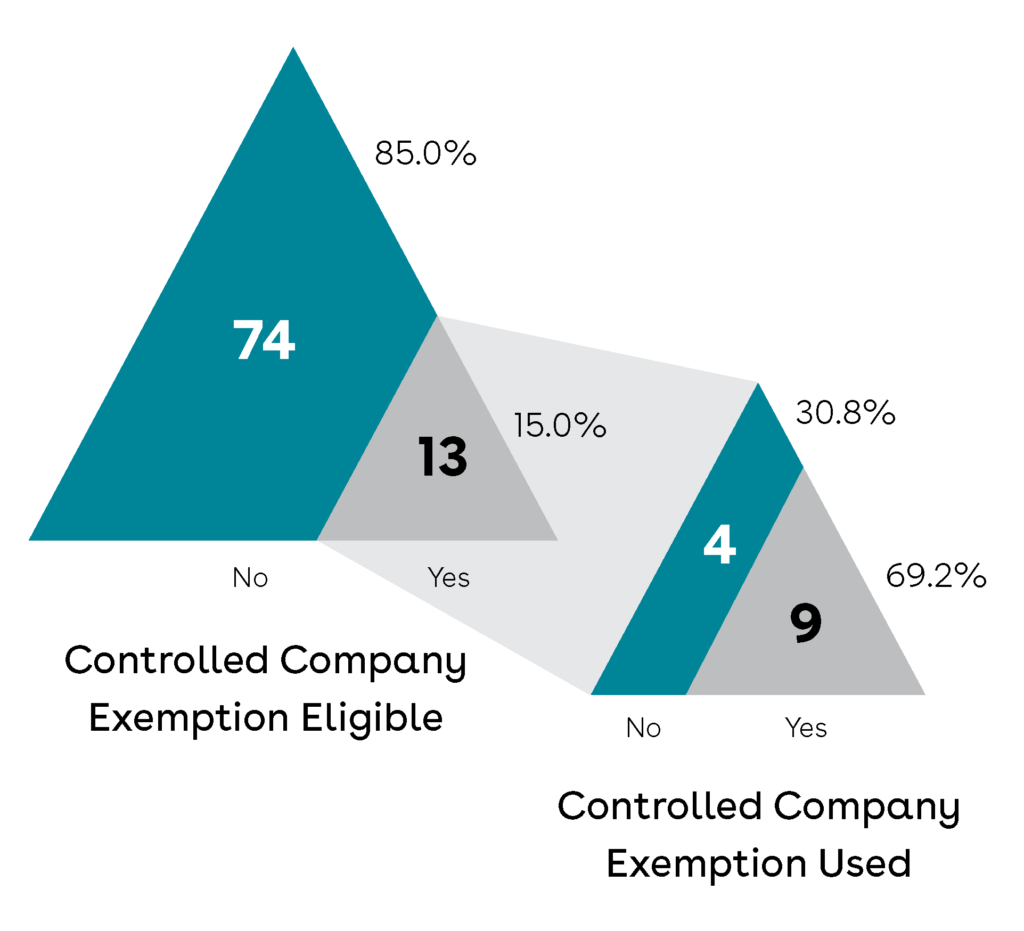

Controlled Company Exemption

Thirteen (approximately 15%) of the companies were controlled company exemption eligible. Of those companies, nine (69.2%) used the controlled company exemption, while four (30.8%) did not.

Board Size and Director Independence

- Of the 87 companies considered, the average number of directors on the board at pricing was 7.5, while the median was 7.0.

- Of the 87 companies considered, the average number of independent directors was 5.5, and the median was 6.0.

- Of the 87 companies considered, 78 (89.7%) issuers had a majority of independent directors on the board at pricing.

Board Chairpersons and Lead Directors

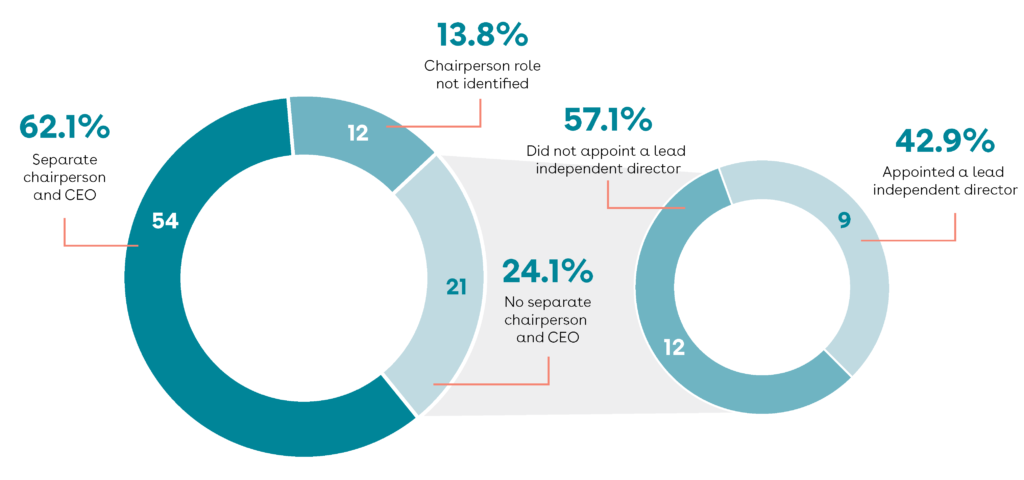

Securities and Exchange Commission rules do not require companies to have separate board chairperson and CEO positions. As such, companies are not required to disclose in their IPO prospectus whether or not the board chairperson and CEO positions are separated, although many choose to do so. As an alternative to separating the board chairperson and CEO positions, some companies with a board chairperson who is also CEO appoint a lead independent director to, among other things, act as the principal liaison between independent directors and the CEO.

Separation of Chairperson and CEO; Lead Independent Director

Of the 87 companies considered, 54 companies (62.1%) had a separate chair and CEO, while 21 (24.1%) combined the chair and CEO roles. Twelve companies (13.8%) did not identify a chairperson role or otherwise did not specify whether the chair and CEO roles were separate. Of the 21 companies that combined the chair and CEO roles, nine companies (42.9%) appointed a lead independent director, while 12 (57.1%) did not.

Ownership and Structure Factors

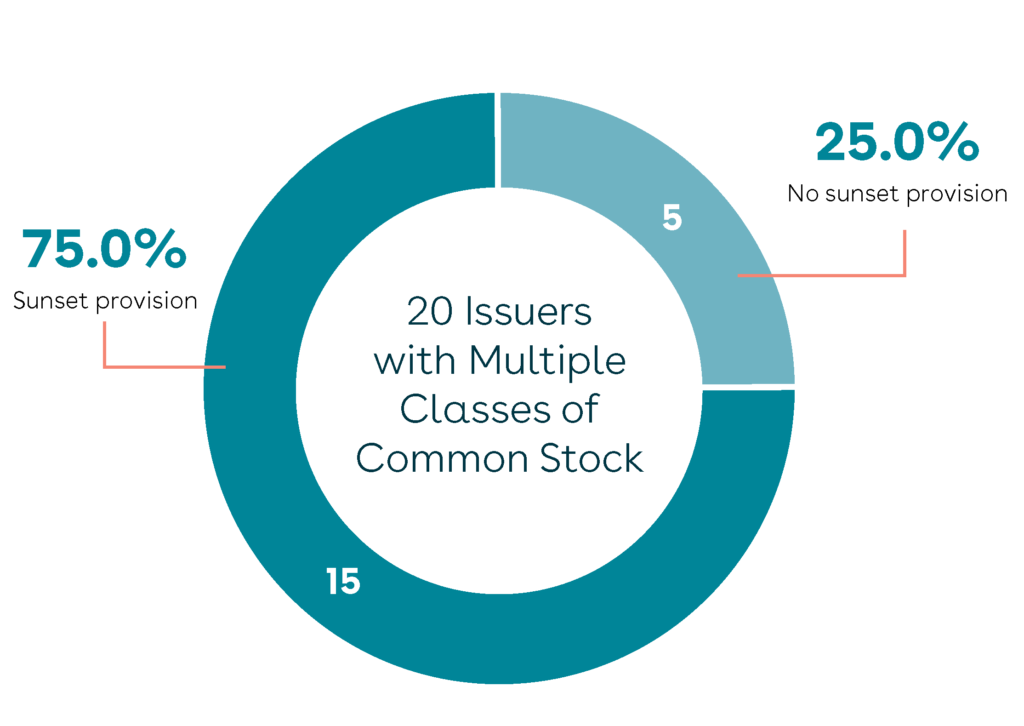

Classes of Common Stock

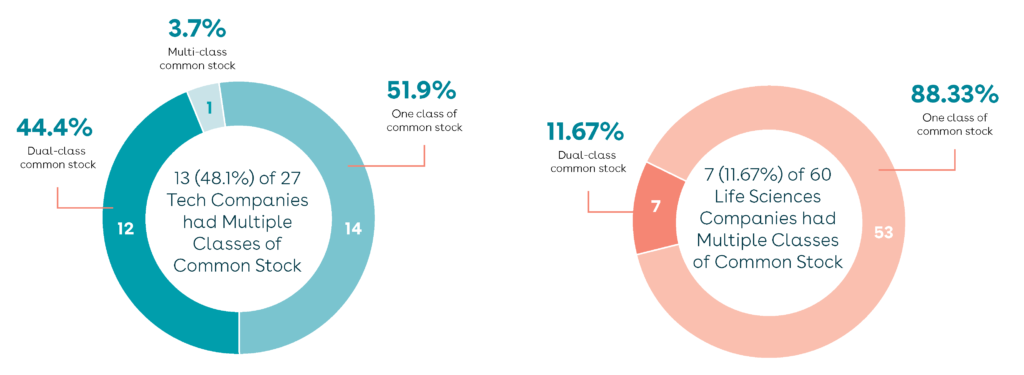

Of the 87 companies considered, 20 companies (23%) had multiple classes of common stock. Of those 20, 13 were technology companies and seven were life sciences companies. Nineteen of the 20 companies—12 technology companies and seven life sciences companies—implemented dual-class common stock and one technology company implemented multi-class common stock.

Sunset Provisions

Many companies that implement a dual or multi-class structure include a sunset provision in the charter where the high-vote shares fall away upon the occurrence of a specified condition, such as the date on which all high-vote shares represent less than a certain percentage of all shares outstanding, after a specified time period, or upon the occurrence of a specific event, such as the death of a founder. The most common approach is that all high-vote shares automatically convert to low-vote shares at such time that they represent less than a certain percentage of all shares outstanding. A time-based fall away is also a possibility, though less common. Of the 20 companies that had multiple classes of common stock, 15 companies (75%) had a sunset provision.

Of the 15 companies that had a sunset provision:

- 4 were determined by event or percentage

- 3 were determined by time, event, or percentage

- 3 were determined by percentage only

- 2 were determined by time or percentage

- 2 were determined by event or time

- 1 was determined by event only

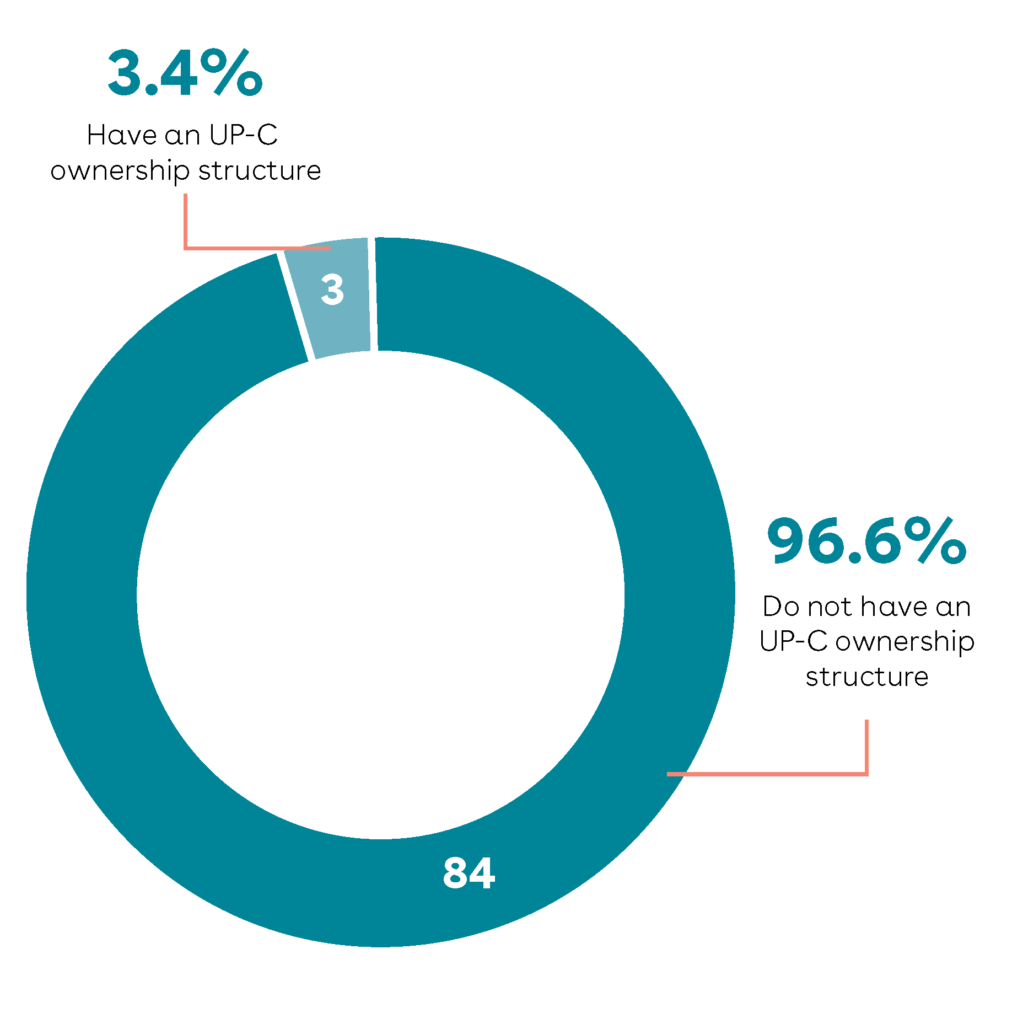

UP-C Structure

An “UP-C” structure is an ownership structure in which public shareholders hold stock in a publicly-traded corporation that in turn owns interests in a partnership or LLC taxed as a partnership in which certain pre-IPO owners have a direct interest. This structure permits owners of private businesses taxed on a pass-through basis to continue to retain this treatment after an IPO, and allows these owners and the publicly-traded corporation to share in the tax benefits from certain tax attributes that arise when such owners sell their interests in the partnership/LLC. It is not an uncommon IPO structure for pass-through private businesses including certain private equity-backed companies.

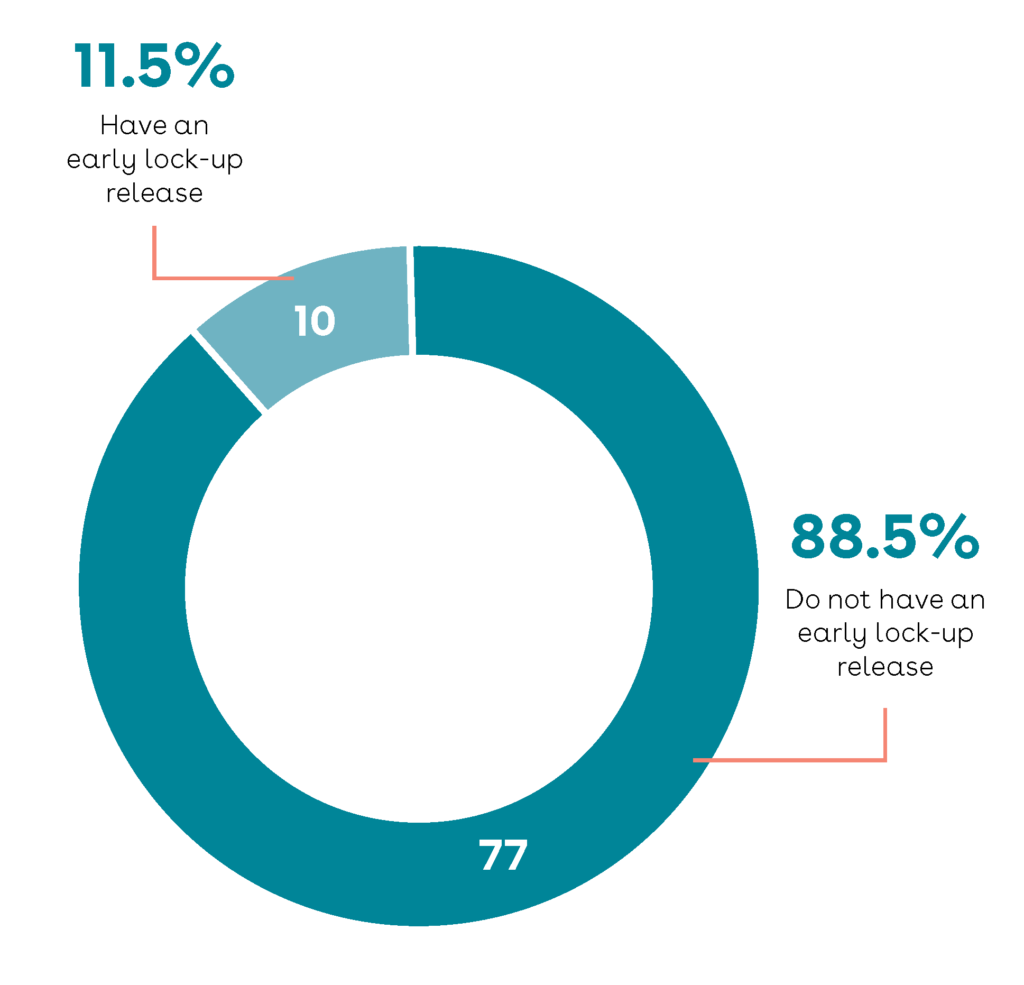

Early Lock-Up Release

The vast majority of lock-up agreements limit sales by pre-IPO stockholders for 180 days after an IPO. However, the banks and companies involved frequently discuss permitting early sales, which are often allowed. Some companies have successfully negotiated for more transparent early release provisions in the lock-up agreement itself, though that is a rare occurrence.

One type of early release provision is tied to stock price performance. That is, after a certain period of time, stockholders may sell a certain percentage of shares if the stock price meets a specified performance target. Some companies assert that this type of staggered release provision relieves the pressure of a “straight cliff” after the 180-day lock-up period. Another type of early release provision is an “anti-front running provision.” Under this type, if the lock-up is set to expire during a quarterly blackout period, the expiration date is accelerated so that all parties can sell during an open window. Otherwise, non-insider stockholders are able to sell at a time when affiliates and employees are still prohibited from doing so under the company’s insider-trading policy.

Deal Structure

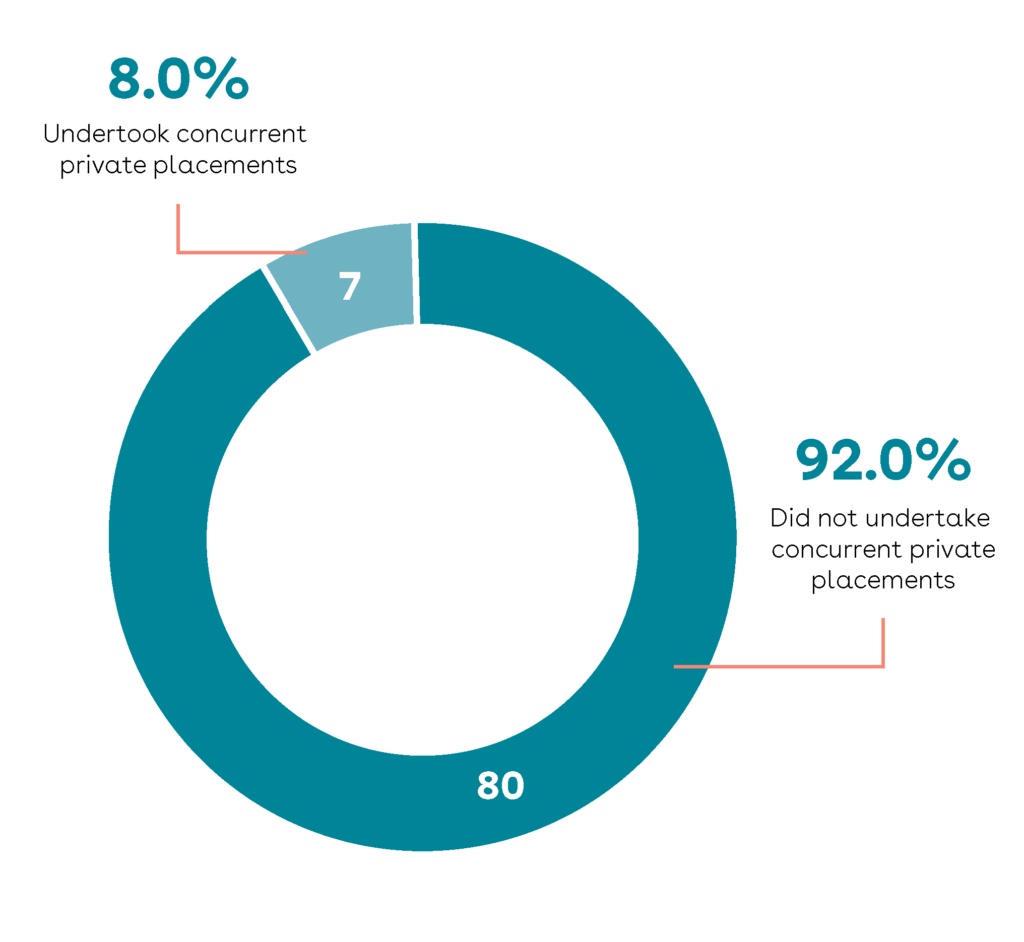

Concurrent Private Placements

Because the IPO process can take many months, a company may opt to pursue a private offering (which does not require registration with the SEC) on the same schedule as the IPO. In addition to raising capital, a company can use a concurrent private placement structure to enhance its relationships with strategic partners. However, concurrent private placements must be structured carefully to comply with the SEC’s integration and general solicitation guidance.

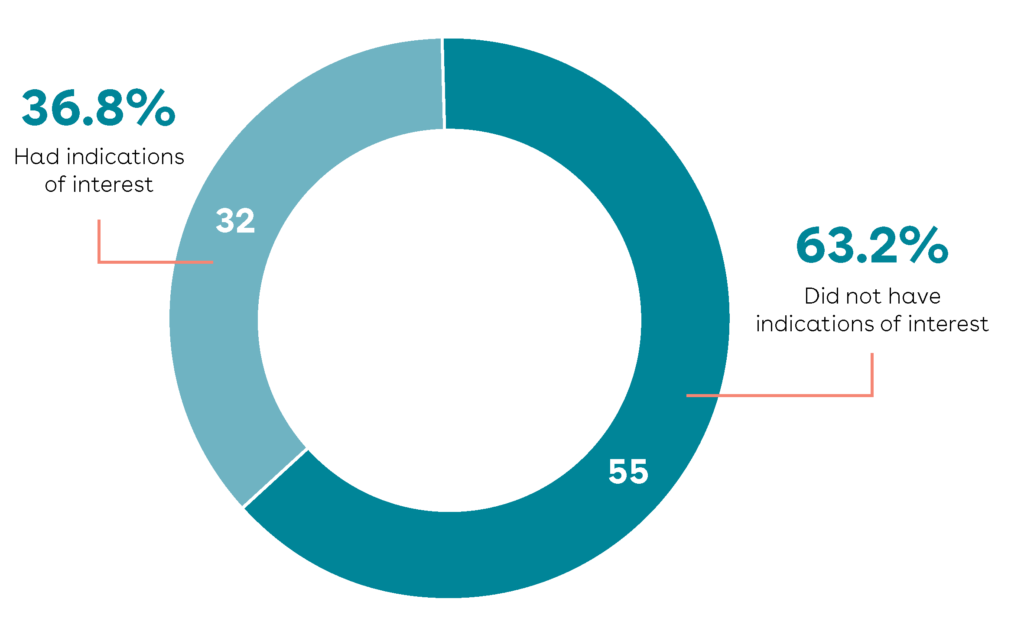

Indications of Interest

Before an IPO, a current investor may express an indication of interest in participating in the offering. It demonstrates a conditional, non-binding interest in buying shares in the offering directly from the underwriters and is typically reflected on the cover page of the red herring. This is often seen as a marketing tool to demonstrate to the investing public that existing stockholders already have indicated an interest in purchasing shares in advance of the roadshow.

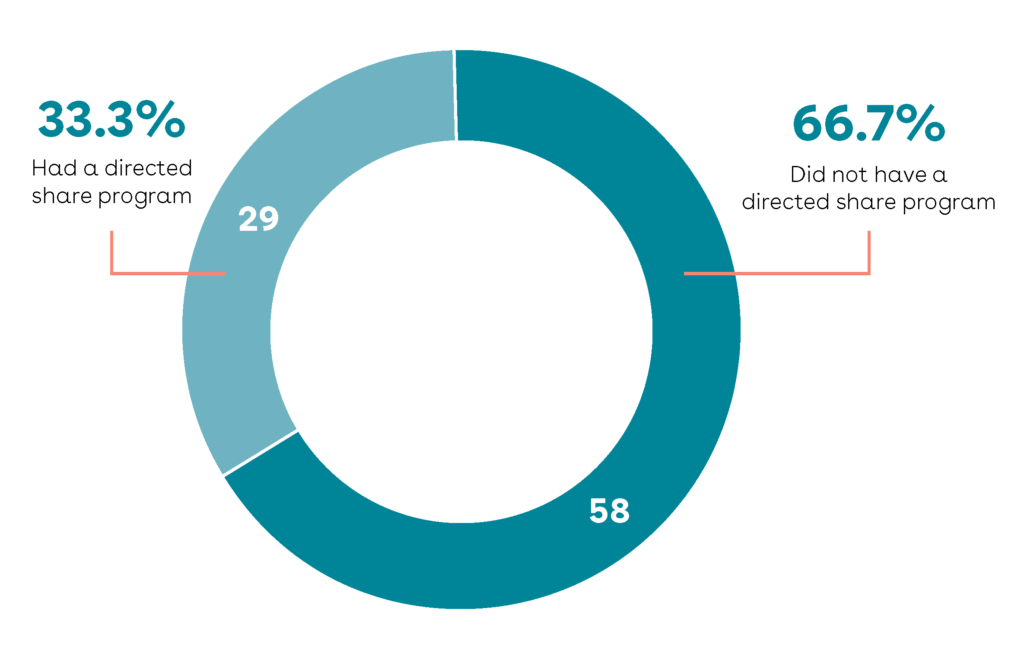

Directed Share Program

Directed share programs allow companies to reserve a certain number of shares in the IPO for purchase by individuals who may otherwise not receive an allocation in the deal, such as directors, officers, employees, family members, consultants, customers, suppliers, and other business partners. If a company decides to offer a directed share program, it is typical for the underwriters to reserve up to 5 percent of the deal and to permit the company to designate the list of participants.

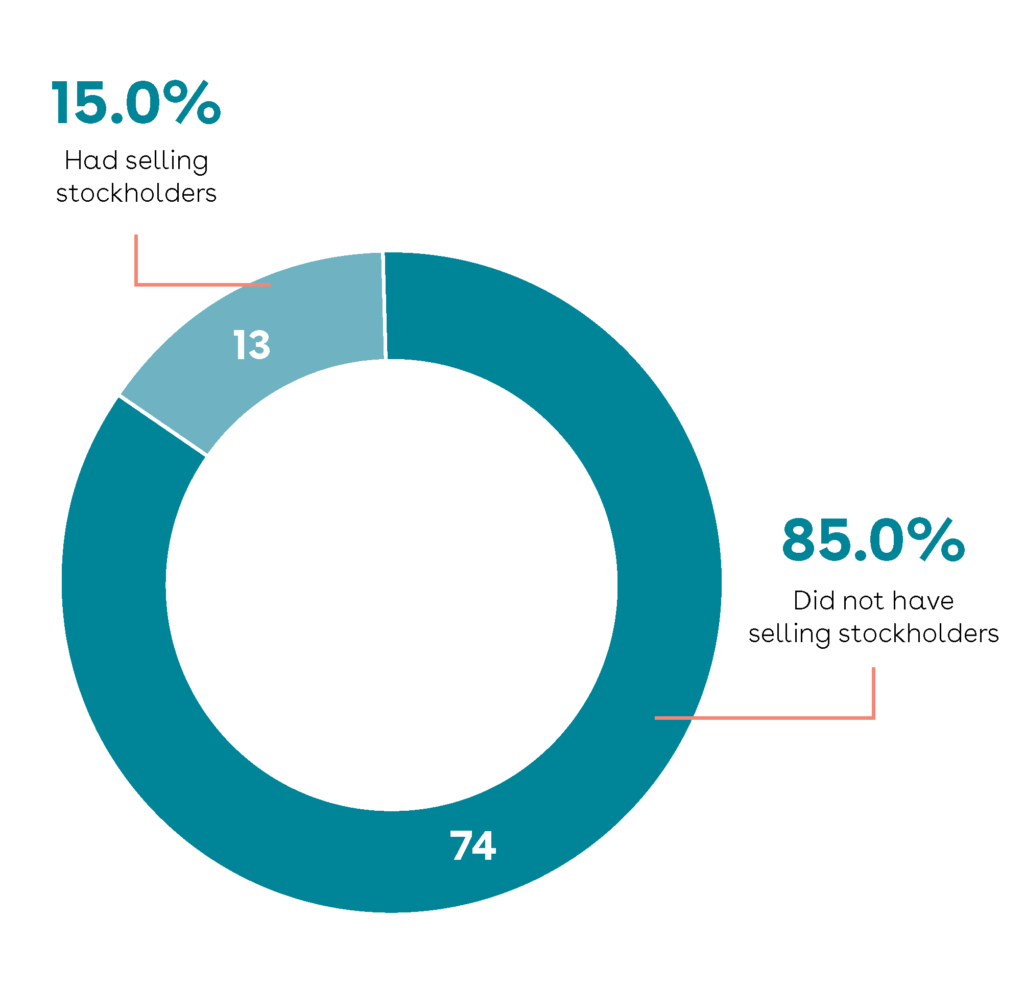

Selling Stockholders

Certain companies will allow current stockholders to sell a portion of their shares in the IPO. These shares are included in and registered on the S-1 as part of the offering. Some companies may be bound by contractual rights to register shares for certain stockholders and other companies may want to provide liquidity for certain stockholders, including employees or investors. The portion of the total deal size accounted for by selling stockholders can vary greatly for many reasons, including market conditions, existing contractual rights, and the needs of the company.

Total IPO Deal Size (Gross)

| Low | High | Median | Average | |

|---|---|---|---|---|

| Technology | $10,500,000.00 | $8,100,000,000.00 | $325,500,000.00 | $786,774,285.33 |

| Life Sciences | $5,000,000.00 | $2,898,000,000.00 | $89,624,992.00 | $195,478,019.57 |

| All Values | $5,000,000.00 | $8,100,000,000.00 | $126,400,000.00 | $378,983,757.22 |

Total Deal Size (Including Private Placement)

| Low | High | Median | Average | |

|---|---|---|---|---|

| Technology | $10,500,000.00 | $8,600,000,040.00 | $338,520,000.00 | $813,182,433.93 |

| Life Sciences | $5,000,000.00 | $2,898,000,000.00 | $89,624,992.00 | $196,993,801.70 |

| All Values | $5,000,000.00 | $8,600,000,040.00 | $130,000,000.00 | $388,224,756.53 |

Amount of Private Placement

| Low | High | Median | Average | |

|---|---|---|---|---|

| Technology | $13,020,000.00 | $500,000,040.00 | $99,999,986.00 | $178,255,003.00 |

| Life Sciences | $10,000,000.00 | $65,946,928.00 | $15,000,000.00 | $30,315,642.67 |

| All Values | $10,000,000.00 | $500,000,040.00 | $65,946,928.00 | $114,852,420.00 |

% of Private Placement of Total Deal Size

| Low | High | Median | Average | |

|---|---|---|---|---|

| Technology | 3.8% | 11.7% | 6.9% | 7.3.% |

| Life Sciences | 9.4% | 38.2% | 21.4% | 23.0% |

| All Values | 3.8% | 38.2% | 9.4% | 14.0% |

Amount of Indication of Interest

| Low | High | Median | Average | |

|---|---|---|---|---|

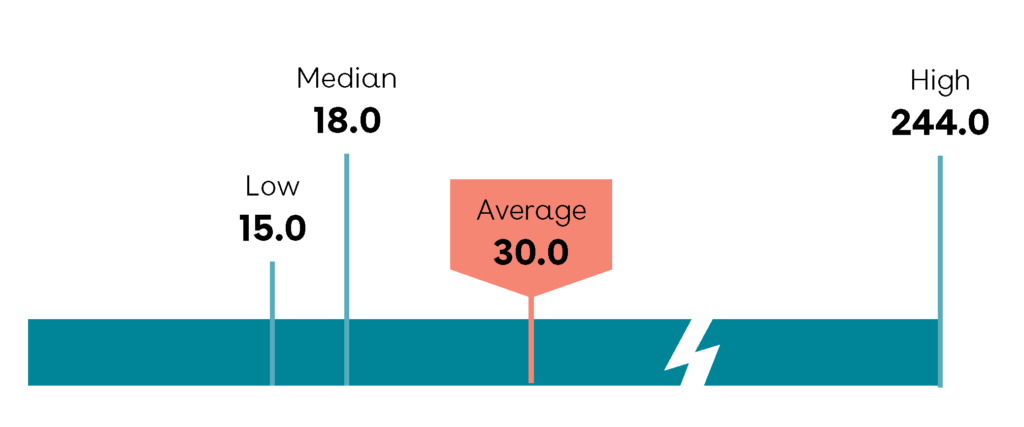

| Technology | $1,129,999.00 | $75,000,000.00 | $18,000,000.00 | $25,925,999.80 |

| Life Sciences | $6,000,000.00 | $122,708,000.00 | $31,000,000.00 | $41,675,820.46 |

| All Values | $1,129,999.00 | $122,708,000.00 | $30,000,000.00 | $39,289,484.00 |

% of Indication of Interest of Total Deal Size

| Low | High | Median | Average | |

|---|---|---|---|---|

| Technology | 0.2% | 25.9% | 13.2% | 11.3% |

| Life Sciences | 1.7% | 70.1% | 41.6% | 40.4% |

| All Values | 0.2% | 70.1% | 36.2% | 36.0% |

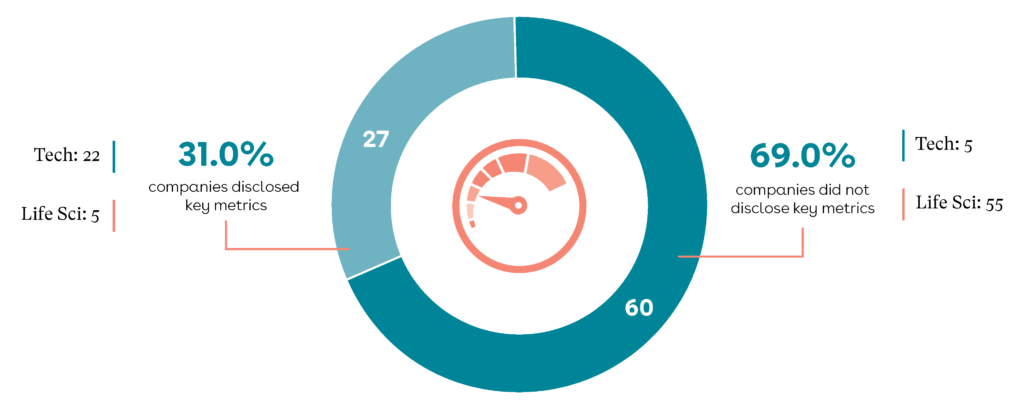

Key Metrics and Non-GAAP Financial Measures

In addition to presenting financial results in accordance with generally accepted accounting principles (GAAP), many companies track and disclose certain key metrics and non-GAAP financial measures, such as EBITDA, adjusted EBITDA, and free cash flow.

Key Metrics

Non-GAAP Financial Measures

Of the 87 companies considered:

- 25 issuers (28.7%) disclosed EBITDA and/or adjusted EBITDA

- Tech: 16 Life Sci: 9

- 10 issuers (11.5%) disclosed free cash flow

- Tech: 8 Life Sci: 2

- 6 issuers (6.9%) disclosed non-GAAP gross margin

- Tech: 4 Life Sci: 2

- 4 issuers (4.6%) disclosed adjusted net income

- Tech: 1 Life Sci: 3

- 1 issuer (1.1%) disclosed net revenue

- Tech: 1 Life Sci: 0

Defensive Measures

Based on data obtained from final IPO prospectuses, bylaws, certificates of incorporation, and other documents filed with the SEC at the time of the IPO, we reviewed defensive measures adopted by newly listed companies to prevent hostile takeovers. Controlled companies are not excluded from this section and the below results reflect the provisions that will be in place once any provisions with additional protections for the controlling stockholders fall away. Of the 87 companies considered:

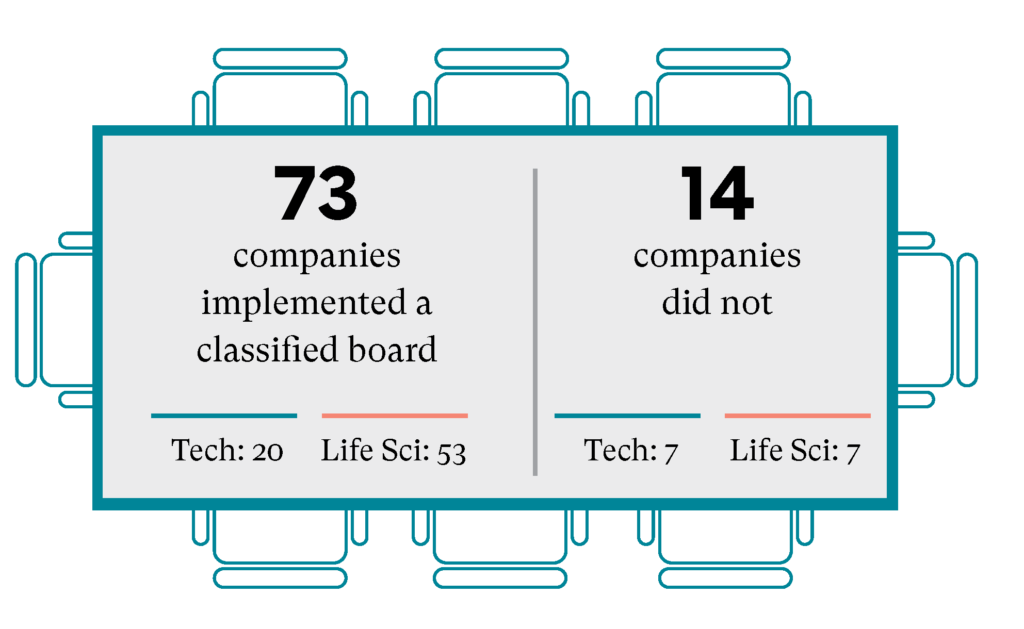

Classified Boards

For companies implementing a classified board in connection with the IPO, director elections will be staggered over a threeyear period after the IPO, with approximately one-third of the directors subject to re-election each year.

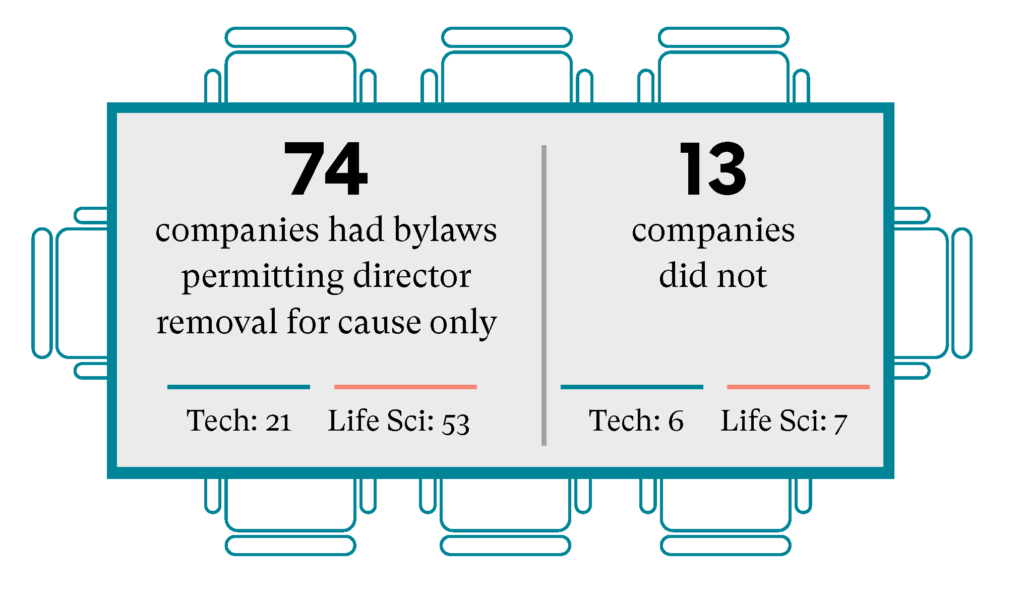

Director Removal for Cause Only

According to Delaware law, examples that constitute cause for removal of directors include: malfeasance in office, gross misconduct or neglect, false or fraudulent misrepresentation inducing the director’s appointment, willful conversion of corporate funds, breach of the obligation of full disclosure, incompetency, gross inefficiency, or moral turpitude.

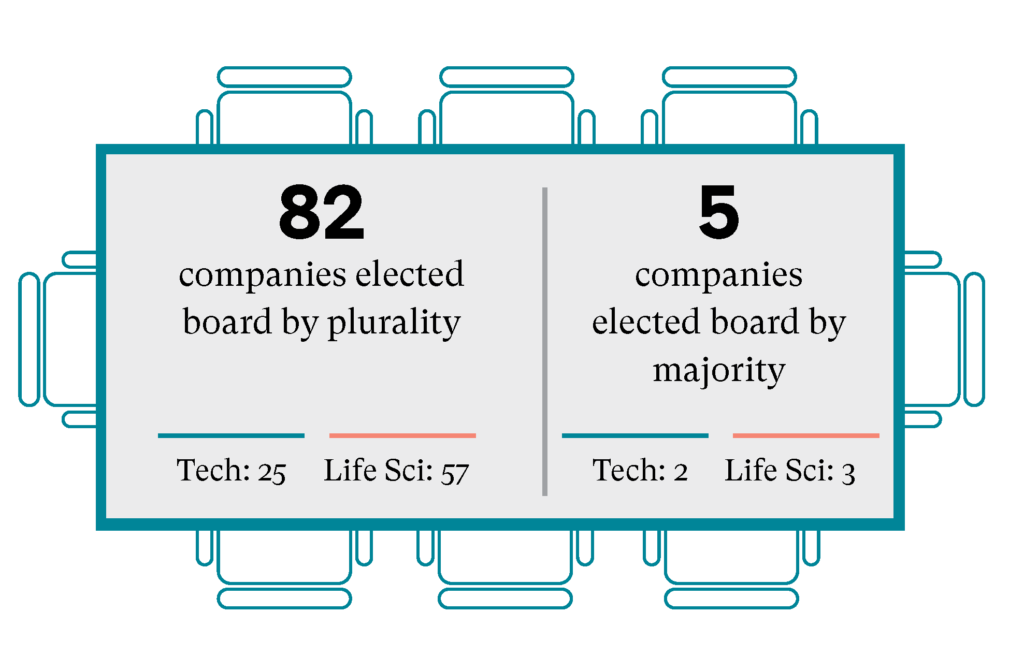

Board Elected by Majority or Plurality?

If the board is selected by a plurality of votes cast, the winners are the nominees who receive the most votes regardless of whether that is more than 50% of the votes cast. If the board is elected by a majority of the votes cast, a nominee must receive more than 50% of the votes cast in order to be elected.

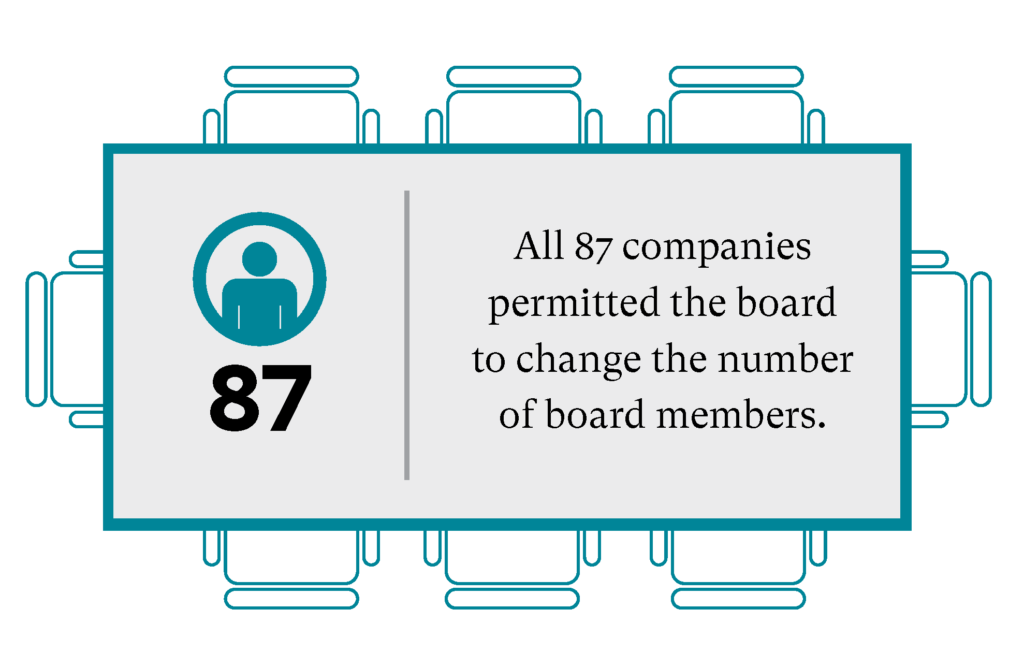

Board Authority to Change Number of Directors

The typical provision in a company’s certificate of incorporation will provide the board of directors with the ability to increase or decrease the size of the board.

Board Authority to Fill Vacancies on the Board

The typical provision in a company’s certificate of incorporation will provide the board of directors, even if less than a quorum, with the exclusive ability to fill vacancies on the board, including new director positions created through an increase in the authorized number of directors.

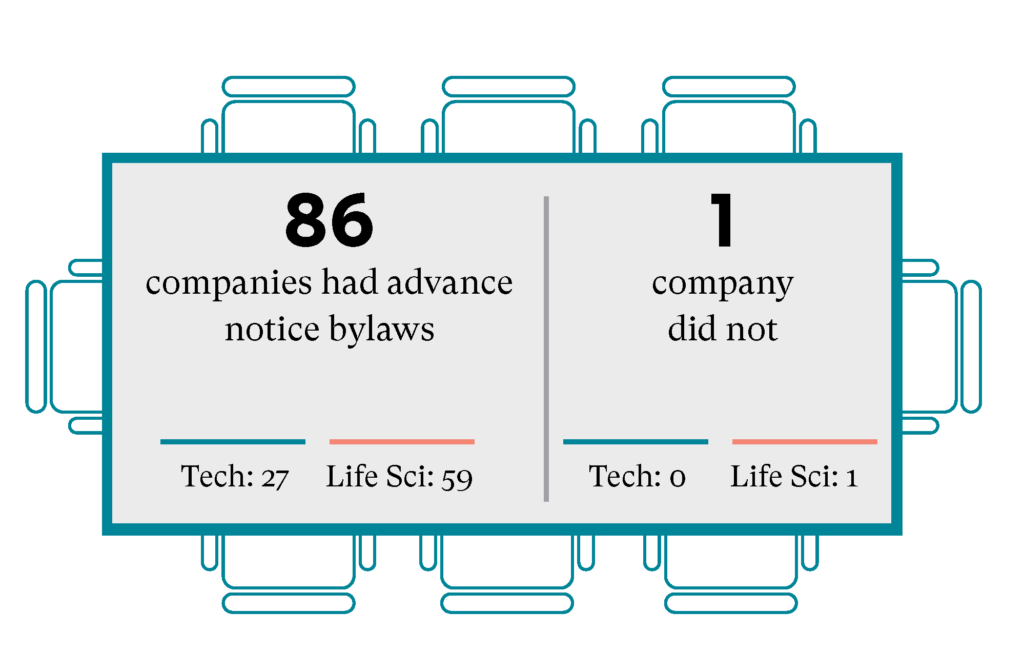

Advance Notice Bylaws

Advance notice bylaws set forth certain requirements that a stockholder must meet in order to bring a matter of business before a stockholder meeting or nominate a director for election.

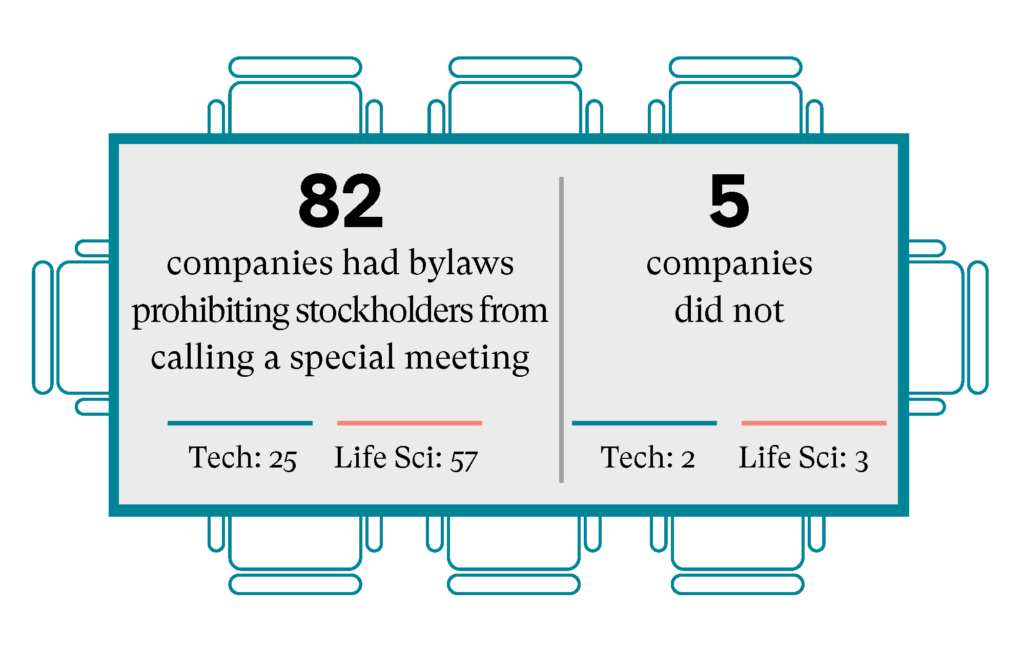

Stockholder Ability to Call Special Meeting

The typical provision in a company’s bylaws provides that a special meeting may only be called by the chairperson of the board, the chief executive officer, or the president (in the absence of a chief executive officer).

Shareholder Rights (Poison Pills)

A shareholder rights plan, also known as a “poison pill,” acts as a defensive measure against hostile takeovers by making a company’s stock less attractive to an acquirer.

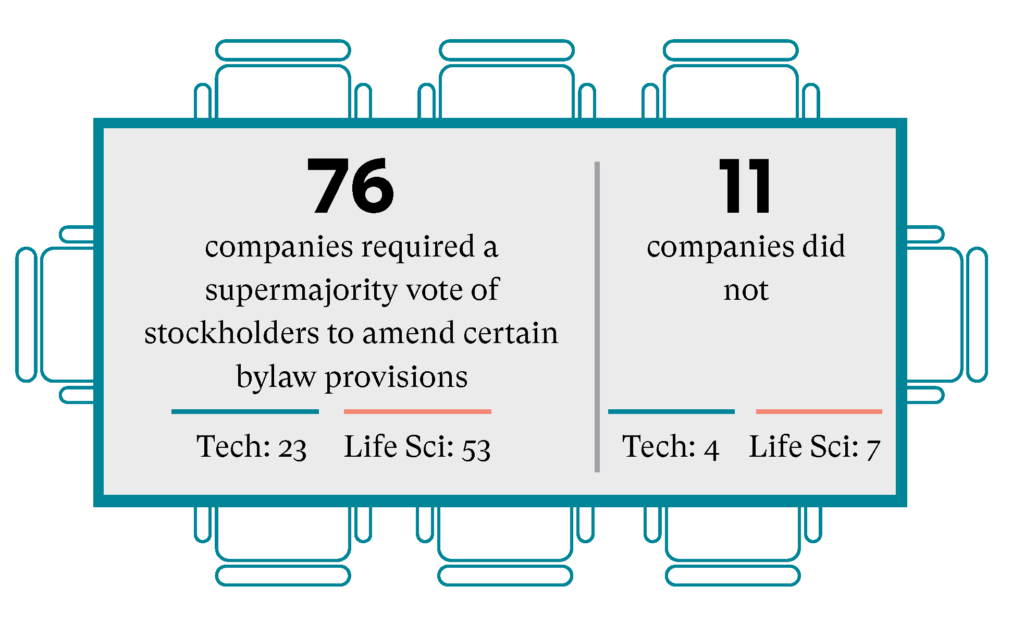

Supermajority Stockholder Vote Required to Amend Bylaws

More than a simple majority of the issuer’s outstanding stock is required to amend this governing document.

- 62 companies required a 66.67% vote to amend bylaws

- Tech: 19 Life Sci: 43

- 11 companies required a 75% vote to amend bylaws

- Tech: 3 Life Sci: 8

- 2 companies required a 66% vote to amend bylaws

- Tech: 1 Life Sci: 1

- 1 company required an 80% vote to amend bylaws

- Tech: 0 Life Sci: 1

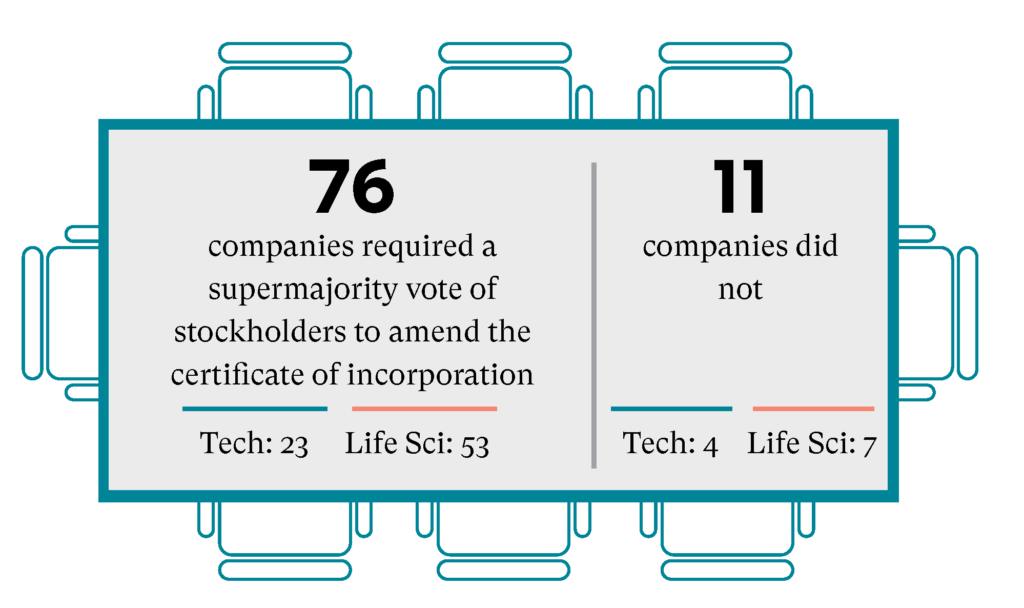

Supermajority Stockholder Vote Required to Amend Certificate of Incorporation

More than a simple majority of the issuer’s outstanding stock is required to amend this governing document.

- 62 companies required a 66.67% vote to amend the certificate of incorporation

- Tech: 19 Life Sci: 43

- 10 companies required a 75% vote to amend the certificate of incorporation

- Tech: 2 Life Sci: 8

- 2 companies required a 66% vote to amend the certificate of incorporation

- Tech: 1 Life Sci: 1

- 2 companies required an 80% vote to amend the certificate of incorporation

- Tech: 1 Life Sci: 1

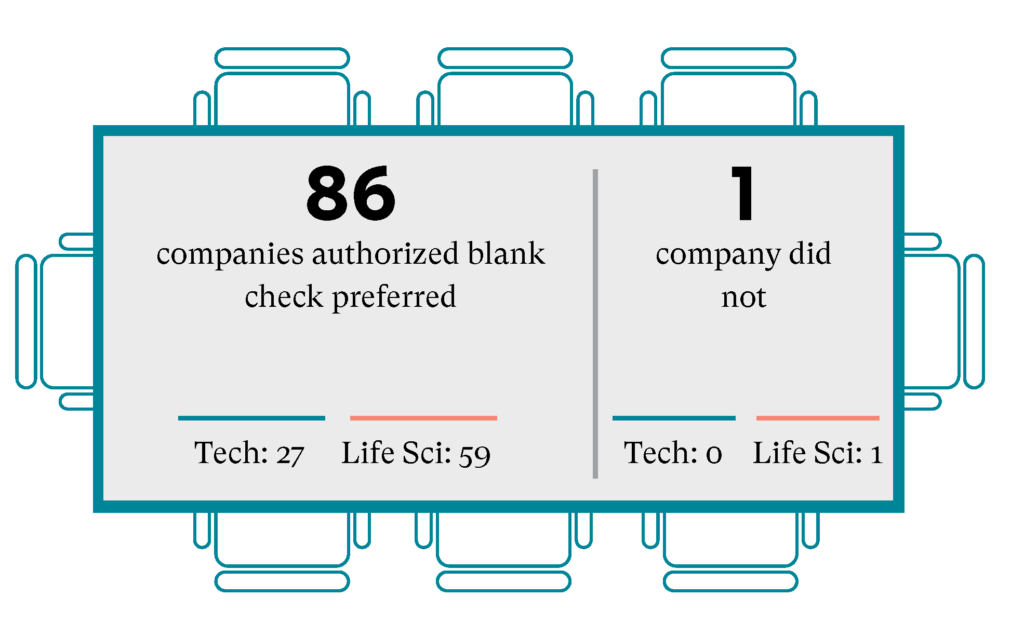

Blank Check Preferred

A certificate of incorporation authorizing blank check preferred allows the board of directors, without further stockholder approval, to issue preferred stock in one or more series and determine the rights, preferences, and privileges of the preferred stock issued (e.g., rights to voting, dividends, redemption, etc.).

Cumulative Voting

Cumulative voting is a method of voting for a company’s directors. Each stockholder holds a number of votes equal to the number of shares owned by the stockholder, multiplied by the number of directors to be elected.

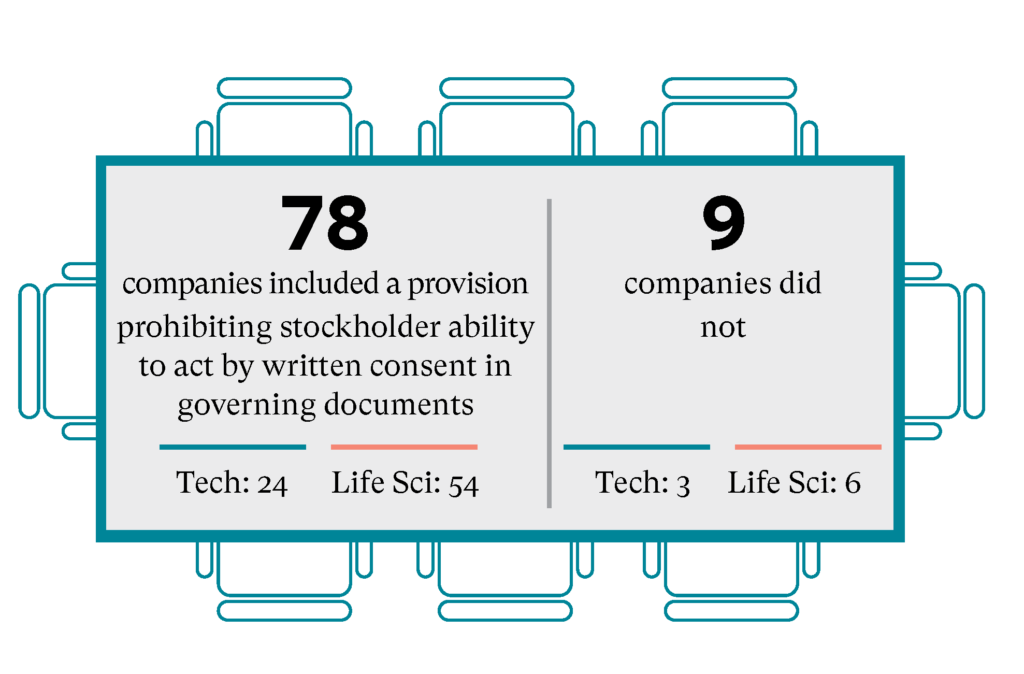

Stockholder Ability to Act by Written Consent

If companies do not permit stockholders to act by written consent, any action requiring stockholder approval must occur at a stockholder meeting.

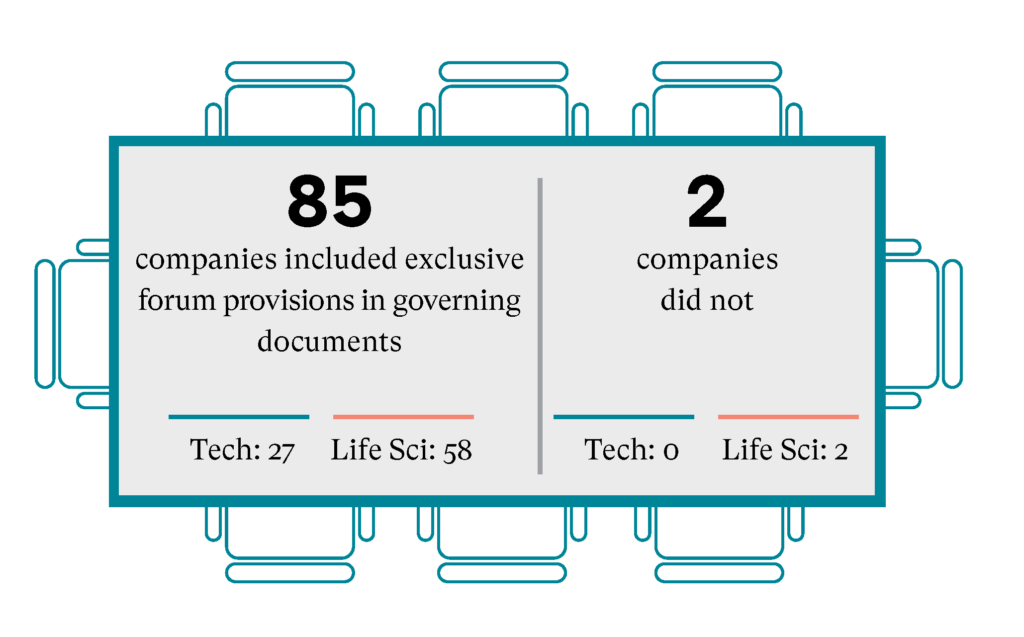

Exclusive Forum Provisions

Companies may include exclusive forum provisions in their governing documents requiring that certain types of litigation (such as derivative suits brought on behalf of the company, claims of breach of fiduciary duty, claims arising pursuant to any provision of the Delaware General Corporation Law, or claims governed by the internal affairs doctrine) be brought solely and exclusively in the Court of Chancery of the State of Delaware (or another specified forum).

Filing Information

Technology Issuers

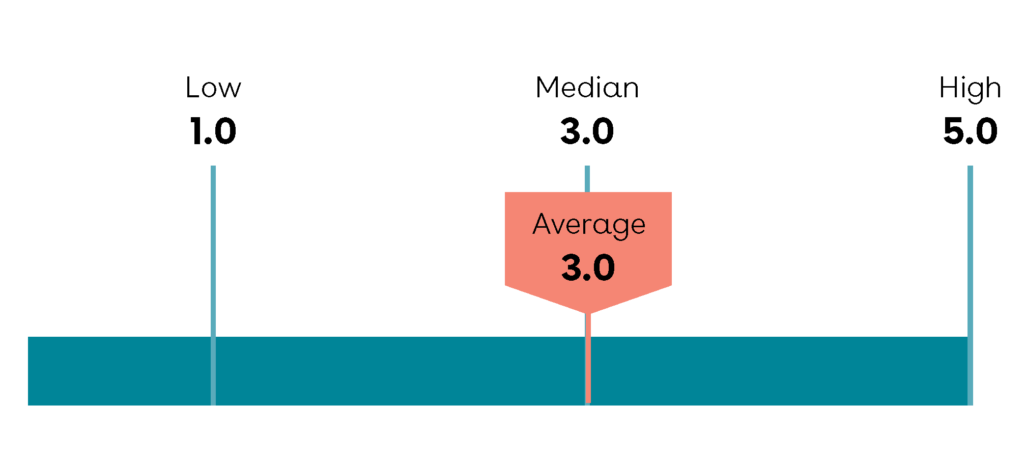

Number of Years from Inception to IPO

Months in Registration

Represents the number of months between the initial

submission or filing of the registration statement and the

effective date of the registration statement.

Number of Confidential Submissions

Represents the number of confidential draft registration statements submitted to the SEC before the public filing of the registration statement.

Days Between Public Filing and Roadshow

Represents the number of days between the public filing of the registration statement and the filing of the preliminary prospectus with the SEC containing a price range, which typically coincides with the start of the roadshow, where the company’s executive management will meet with potential investors to gauge interest in the offering. SEC rules require a minimum of 15 days between these two events.

Life Science Issuers

Number of Years from Inception to IPO

Months in Registration

Represents the number of months between the initial submission or filing of the registration statement and the effective date of the registration statement.

Number of Confidential Submissions

Represents the number of confidential draft registration statements submitted to the SEC before the public filing of the registration statement.

Days Between Public Filing and Roadshow

Represents the number of days between the public filing of the registration statement and the filing of the preliminary prospectus with the SEC containing a price range, which typically coincides with the start of the roadshow, where the company’s executive management will meet with potential investors to gauge interest in the offering. SEC rules require a minimum of 15 days between these two events.

IPO Fees and Expenses

Total Legal Fees

| Low | High | Median | Average | |

|---|---|---|---|---|

| All Values | $50,000 | $9,300,000 | $1,600,000 | $1,894,171.55 |

| Technology | $50,000 | $9,300,000 | $1,876,000 | $2,416,126.30 |

| Life Sciences | $200,000 | $5,000,000 | $1,500,000 | $1,646,929.82 |

Total Underwriter Compensation

| Low | High | Median | Average | |

|---|---|---|---|---|

| All Values | $450,000 | $106,200,000 | $8,748,285.00 | $16,319,581.05 |

| Technology | $840,000 | $106,200,000 | $21,952,500.00 | $29,072,120.08 |

| Life Sciences | $450,000 | $79,695,000 | $6,273,749.50 | $10,793,480.80 |

Total Accounting Fees

| Low | High | Median | Average | |

|---|---|---|---|---|

| All Values | $21,500 | $5,000,000 | $961,000 | $1,217,206.86 |

| Technology | $21,500 | $5,000,000 | $1,800,000 | $1,691,750.63 |

| Life Sciences | $35,000 | $4,200,000 | $875,000 | $996,298.55 |

Printing Fees

| Low | High | Median | Average | |

|---|---|---|---|---|

| All Values | $3,000 | $1,500,000 | $325,000 | $353,933.49 |

| Technology | $5,000 | $1,500,000 | $395,000 | $447,669.56 |

| Life Sciences | $3,000 | $700,000 | $300,000 | $310,297.74 |

The complete publication, including Appendix, is available here.

Print

Print