Steve W. Klemash is Americas Leader; Jamie C. Smith is Associate Director; and Rani Doyle is Executive Director, all at the EY Center for Board Matters. This post is based on their EY memorandum.

For the past nine years, we have engaged governance specialists from a broad range of institutional investors to find out what they are focused on for the upcoming proxy season. This year they told us they want companies to more clearly explain how they are creating long-term value and competitive advantage.

They are particularly interested in how companies are addressing environmental, social and governance (ESG) matters to build resiliency amid continued disruption, accelerating climate risk and other trends shaping the global business landscape. They also want to better understand how boards are evolving their practices to strengthen board composition, enhance perspective and better navigate rapidly evolving risks. And they want to know how executive pay is enabling effective development and execution of strategy and driving long‑term value.

These are some of the key themes of our conversations with governance specialists from more than 60 institutional investors representing over US$35 trillion in assets under management, including asset managers (62% of all participants), public funds (18%), labor funds (15%), and faith‑based investors (3%), as well as investor consultants and associations (2%).

This report brings together investor insights and focuses on:

- Top factors investors view as enabling strategy

- Top factors investors view as threatening strategic success

- How investors are assessing board risk oversight

- Challenges investors face in assessing ESG

- Top investor concerns around executive pay

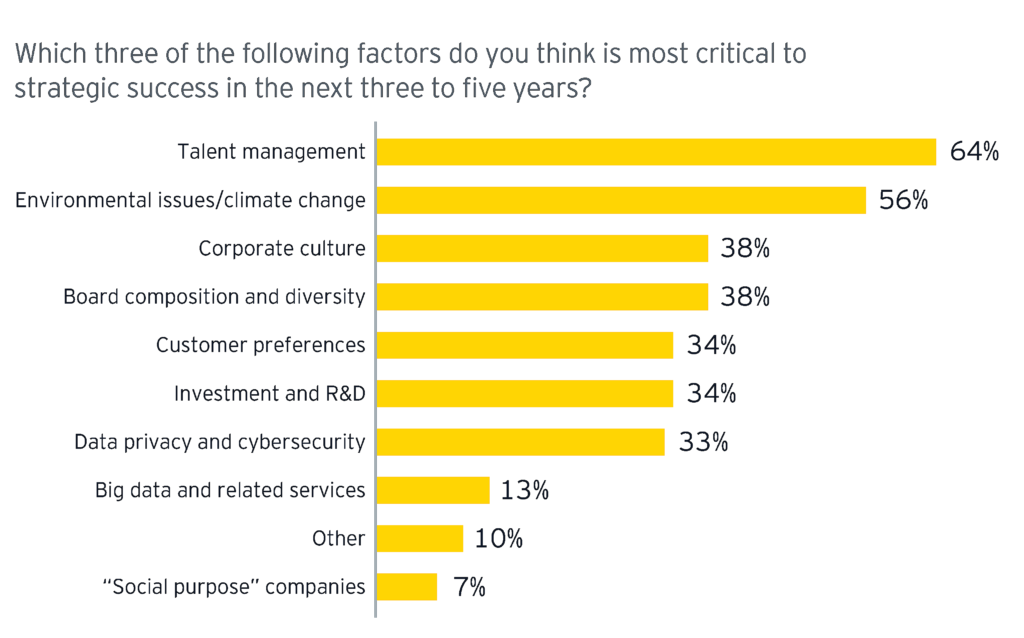

1. Investors see talent management, climate resilience, corporate culture and board composition as key enablers of strategic success

Talent management, environmental issues/climate change, corporate culture and board composition top the list of factors investors view as most critical to their portfolio companies’ strategic success in the next three to five years. They also closely align with investors’ top 2020 engagement priorities (see table), as well as the 2019 engagement priorities investors shared with us last year. [1] This reinforces the opportunity for companies to strengthen their governance, operations and communications around these topics.

Talent management

Nearly two‑thirds (64%) of investors cited talent management, meaning the broader workforce, as critical to strategic success over the next three to five years for the companies in which they invest. These investors said that having an appropriately skilled, fully engaged and diverse workforce is critical. Some stressed that in this era of rapid technological disruption and cultural shifts, human capital is essential to helping companies adapt, problem‑solve, innovate and increase productivity. A few noted that developments related to the future of work have broader societal implications (citing, for example, reports that automation and artificial intelligence have already displaced and will increasingly displace millions of jobs) and will require companies to consider stakeholder impacts in shaping talent strategy and investments in human capital. Several commented on their dissatisfaction with issuers’ current human capital disclosures, particularly given its importance to driving corporate competitiveness and value.

When we asked which human capital issues investors are most focused on, two‑thirds said workforce diversity. Many cited the importance of diversity and inclusion to attracting and retaining top talent, and to bringing together different perspectives that spur innovation and lead to more effective problem solving and decision‑making.

Just over half said they are focused on board oversight of human capital. Key themes of those discussions were investors’ interest in understanding how boards are assessing human capital management, development and performance and what metrics they are using to enable these assessments. Investors also want to understand the board’s role in overseeing how talent management is integrated into strategy and stress the importance of boards having a strong pulse on workforce challenges and strengths, culture, and external trends shaping the future of work.

The same percentage of investors (52%) said they are focused broadly on workforce compensation. Many investors tied this topic to workforce diversity, citing an interest in pay equity as well as promotion rates across different diversity categories. Some shared views that US companies demonstrate leadership and commitment to talent management when they voluntarily provide disclosures relating to pay equity. In particular, investors cited disclosure of median pay gaps as important to identifying and addressing a lack of representation of women and minorities in higher‑paying roles. [2]

Environmental issues/ climate change

More than half (56%) of investors cited effective management of environmental issues and climate change as critical to the strategic success of their portfolio companies over the next three to five years. Most focused their comments on climate change and its related risks. While some noted the upside opportunities of successfully navigating climate change (e.g., differentiation in the marketplace, getting ahead of regulation, reputational benefits with consumers and employees, new revenue streams), others asserted that a carbon constrained economy would create net negative impacts for most companies. With this paradox, investors are identifying corporate resilience and sustainability as the mark of strategic success in this area. See the next section for more climate risk related insights.

Corporate culture

Thirty‑eight percent of investors cited corporate culture as critical to companies’ strategic success over the next three to five years. Many of these investors spoke about culture and talent management in tandem, stressing that the right culture is needed to attract, engage, motivate and retain the right talent. Particularly as workforces diversify, investors stressed that a culture of inclusivity enables capitalizing on the benefits of a diverse workforce. They also noted that a strong culture supports strategic adaptability and innovation.

Some investors also commented on perceived challenges to measuring and assessing culture. They said that quantitative data provides valuable signals, but further nuance and context is often needed to discern cultural problems or progress (e.g., an employee survey that consistently gets high marks should raise questions from the board regarding the survey’s effectiveness). Similarly, a few commented that employee reviews on external career websites help to a degree but can ultimately distort the picture without deeper context.

Investors are looking for companies to deepen communications on their culture — what it is, how it aligns with leadership, strategy and operations, how it impacts talent management and company behaviors, and how management and the board monitor, assess and enhance the culture needed to achieve long‑term value and sustainability.

Board composition and diversity

Tying with corporate culture for third place, 38% cited board composition as critical to issuers’ strategic success over the next three to five years. Many investors spoke of board composition as foundational, setting the tone for the company and positioning it to address all the factors listed. Many also emphasized the need for director expertise to align with company strategy and risk environment to enable the board to help guide the company, especially during these volatile times.

Investors also stressed the value of board diversity across many dimensions, but particularly around gender and racial diversity. On a related note, when we separately asked investors what elements of board composition currently need the most attention from nominating committees, they ranked board diversity across gender, race and other personal characteristics (e.g., age, nationality) highest, with 72% of investors saying personal diversity characteristics should be a priority. Beyond diversity’s role in improving board perspectives, deliberations and decision‑making, some investors expressed the view that board diversity itself is evidence that the board is doing the necessary work to find the talent it needs to be effective. Some investors also noted that board diversity itself sets an important tone at the top for broader workforce diversity.

Key board takeaways

Consider how talent management, culture, climate resilience and other business‑relevant ESG practices are integrated into long‑term strategy and can drive long‑term value. Challenge whether the board is appropriately engaged, seeking and getting the right information from management, understanding broader perspectives and trends, and setting the right tone at the top. Review what the company communicates about its ESG priorities and activities.

Build a diverse pool of board candidates; require director recruitment firms to include in candidate searches women, minorities, younger high‑performers, people of different nationalities, and other diverse candidates with the expertise and experience best suited to the company’s culture and strategy. Consider overboarding issues and look beyond search firms to nontraditional sources for obtaining diverse candidates. Challenge whether the proxy statement effectively communicates why the board has the right directors at the right time for the right company.

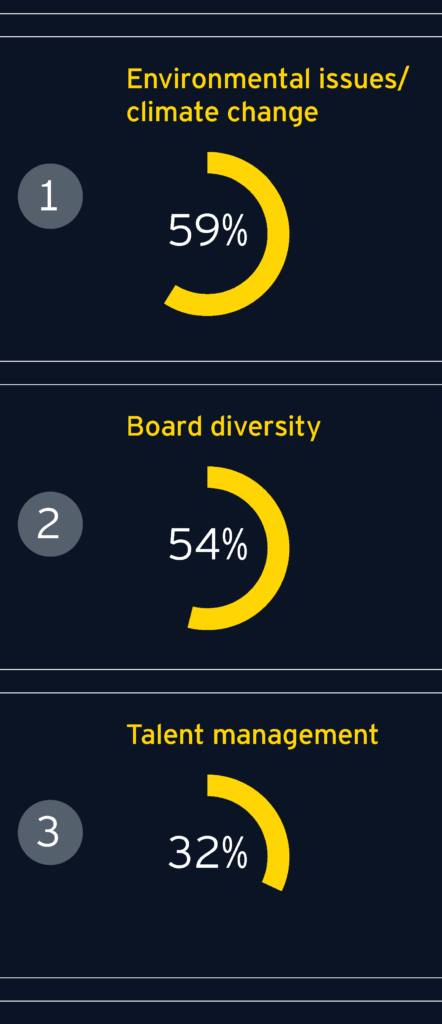

Top three investor engagement priorities for 2020

% represents percentage of investors that cited the topic as a stewardship priority for 2020.

Environmental issues/ climate change

Most investors that cited climate risk said they are engaging companies via broader initiatives, including Climate Action 100+ [3] and other initiatives (including related to corporate lobbying [4] and utility company emissions [5]), and are generally urging companies to:

- Reduce greenhouse gas emissions in line with the Paris Agreement

- Articulate the board’s oversight of climate risk and opportunities

- Provide enhanced disclosure in line with the Task Force on Climate‑related Financial Disclosures (TCFD)

Board diversity

These investors generally want to see boards appoint more women, racial minorities and other diverse candidates, but many remain focused on gender diversity citing the relative simplicity in obtaining gender data and a lack of reliable data on racial diversity. [6] Some of these investors are also strengthening their voting policies related to gender diversity, though were generally reluctant to predict whether this would result in more votes against directors. Many of these investors also said they are looking at diversity across senior executives. Notably, at least one high-profile investor initiative this year will include a focus on racial diversity and the CEO seat. [7]

Talent management

Investors said they seek enhanced company-specific disclosures around human capital, including how boards are overseeing human capital and related issues. Some seek a better understanding of talent strategy, including how the company is positioning itself as the most attractive employer in its sector, and how the board is getting information on the company’s workforce and external business, competitive and societal trends. Some cited their work with the Human Capital Management Coalition, which encourages enhanced disclosure of human capital practices and key performance indicators. [8]

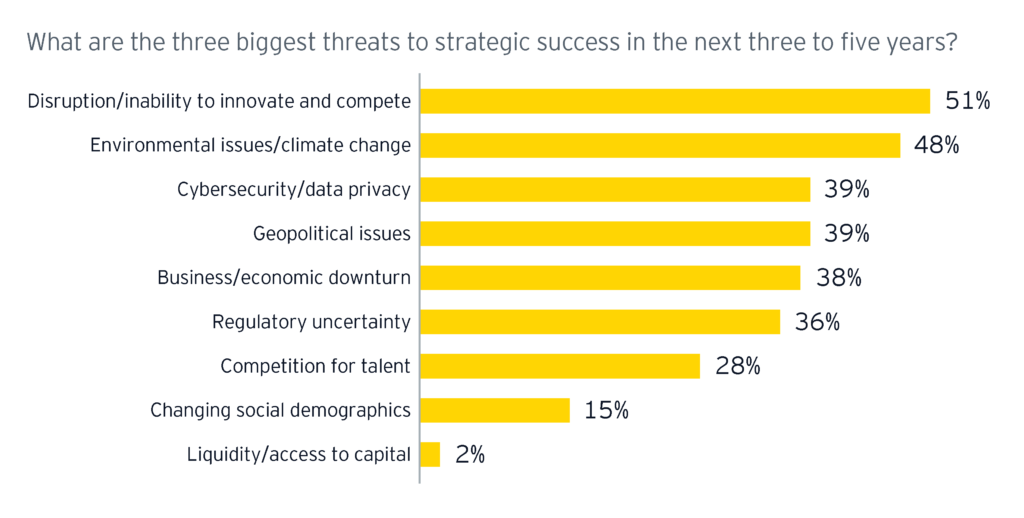

2. Investors see disruption, climate change, cybersecurity/data privacy and geopolitical issues as key threats to strategic success

We asked investors what they view as the biggest threats to portfolio companies’ strategic success in the next three to five years: disruption/inability to innovate and compete, environmental issues/climate change, cybersecurity/data privacy and geopolitical issues topped the list.

Disruption/inability to innovate and compete

Just over half (51%) identified disruption/ inability to innovate and compete as one of the biggest threats to strategic success. In many ways, these conversations mirrored the conversations around talent management and culture as strategy enablers. Investors emphasized the strategic importance of a workforce and culture that enables innovation and the adaptability needed to compete — including establishing that leaders at the executive and board levels are attuned to external trends and recognize the risk of doing the right thing for too long.

Environmental issues/climate change

Nearly half (48%) of investors chose environmental issues/climate change as a key threat. Most focused their comments on climate change, characterizing it as an increasingly urgent, systemic risk and noting the recent manifestation of physical climate risks that are accelerating at a rapid rate and complicating risk management.

Some cited recent reports highlighting accelerating climate risk, including the World Economic Forum’s Global Risks Report 2019, which identified extreme weather events and failure of climate‑change mitigation and adaptation as the biggest threats to the global economy, and the Intergovernmental Panel on Climate Change’s Global Warming of 1.5˚, which underscores the unprecedented scale of rapid transformation required to limit global warming to 1.5˚C. [9]

Some commented on the impacts of the wildfires in Australia and California, noting growing risks to business infrastructure, operations and supply chains amid more extreme weather events and the related need for careful repricing of climate risk in the insurance and real estate markets. Investors want to see companies communicate their consideration, assessment and management of these climate issues and risks, and how their actions or inactions around climate change are viewed by management and the board in the context of corporate strategy, reputation and long‑term value.

Some investors also raised regulatory risks related to climate, with several citing the potential for dramatic policy shifts and referencing the UN Principles for Responsible Investment’s case for an inevitable policy response as the realities of climate change become increasingly apparent. [10] Some also noted that companies are facing heightened reputational risks related to environmental and other social issues, citing trends around consumers and employees making values‑based decisions regarding which products to buy and where to work.

Investors concerned about the business threat of climate change stressed their view that climate risk reaches far beyond the traditionally exposed industries (citing, for example, scrutiny around how banks are financing emissions-intensive industries, or the potential ripple effects of a carbon tax across airlines, hotels, and companies transporting fuel), and that to avoid the most catastrophic effects of climate change and capitalize on related long‑term opportunity, companies need to take strategic action now.

Cybersecurity/data privacy

Thirty‑nine percent of investors cited cybersecurity/data privacy as a top threat to portfolio companies. Investors generally commented that every company in every industry has exposure to these risks, and that as consumer preferences and business efficiency demands are leading to an ever more digitized and electronically connected world, the risks continue to multiply. They also noted the increasing number and types of threats to business assets, operations, and customer and public trust.

Some investors stressed that since the threat of a breach cannot be eliminated, they are particularly interested in resiliency, including how (and how quickly) companies are preparing for, detecting, and mitigating cybersecurity incidents and how they are working to prevent attacks that can impair the business. Some said they are asking about specific practices, such as whether the company has had an independent assessment of its cybersecurity program.

Reflecting broader trends, some investors said they are increasing their attention to data privacy and whether companies are adequately looking to identify and address growing user/consumer concerns and expanding regulatory requirements regarding data collection, use and privacy.

Geopolitical issues

Tying with cybersecurity/data privacy for third place, 39% cited geopolitical issues as a top threat. Most related comments were generally high‑level, with investors noting uncertainty regarding what will come out of Washington, Brexit, China, other political hotspots and the resulting impacts. A few investors tied geopolitical uncertainty to regulatory uncertainty, which they characterized as prohibitive to innovation and long‑term strategy because companies may lack the confidence to make significant capital expenditures or investments in research and development. Investors want to understand how companies are managing these issues and whether boards have confidence in their understanding and oversight of these issues.

Key board takeaways

Understand that historical value drivers like scale, scope and efficiency have given way to digital technology’s power to upend entire industries, and the power of human capital and other intangible assets to drive competitive advantage. Keep a stronger pulse on disrupters, have ongoing strategic discussions with management, and bring in outside perspectives to challenge internal bias and stay on top of external trends. Do scenario analyses and stress testing of key assumptions to inform strategy and strengthen resiliency. Strengthen critical cybersecurity risk preparedness through cyber breach simulations and independent assessments.

3. How investors are assessing board risk oversight

How are investors assessing board oversight of these and other key risks? Some of the top factors they are considering include directors’ risk oversight acumen, the structure and process for risk oversight at the board level, the strength of company reporting on how risks are managed and measured, and directors’ understanding of the business’ social impacts. A majority of investors also said that when it comes to risk oversight, they think audit committees are overburdened.

Investors want to see board members with expertise tied to the risks most relevant to the company’s strategy. Some stressed that this does not necessarily mean having an appointed expert on the board (particularly given the speed at which certain risks are evolving), and instead emphasized the importance of ongoing director education, including from independent experts to better inform the board’s decision‑making. Some investors are also using direct conversations with board members to evaluate directors’ depth of understanding and fluency related to specific risks. In some cases, investors specifically assess director competency by looking at their record of performance across all the corporate boards on which they serve.

Investors also want robust disclosure around the board’s risk oversight structure, including explicit responsibilities assigned to the full board and its committees and codified in governance documents. Many also want to understand the process around how information is sourced and communicated to the board, including whether directors regularly communicate with each other outside board meetings, how engaged they are with management, whether they are engaging with independent advisors, and how the board assesses whether its information practices are effective. Some also want to understand processes around how key risks and compliance matters (e.g., whistleblower complaints, cyber incidents) are escalated to the board.

When it comes to reporting, investors want informative risk reporting that goes well beyond boilerplate, including the structure of an enterprise risk management program, and the methods and metrics the company uses to identify, assess, monitor and mitigate risk.

While less frequently cited, some investors also said they want to understand whether and how the board is considering the effects of the business on society more broadly. For example, how are technology company boards thinking about the effects of their products and services on youth? Or how are pharmaceutical companies considering public health? They seek confidence about the societal consciousness of the company, its management, and its board and how that conscientiousness factors into culture, strategy and operations.

We asked investors if they have concerns that audit committees are overburdened with expanding risk oversight responsibilities. Fifty‑six percent responded yes, [11] largely citing concerns about whether most audit committee members, whose expertise traditionally focuses on financial management, reporting and auditing, have the modern skills and expertise to oversee a growing list of diverse and emerging risks. Respondents also questioned whether audit committees alone can give sufficient time to oversee risk given the increasing range and complexity of audit and financial reporting issues under their purview. On a related note, some investors said they apply, or are considering adopting, overboarding policies specifically relating to audit committee service.

While most said they defer to the board in determining the risk oversight structure that works best, some did suggest alternative structures or other potential solutions, such as creating a risk committee, assigning cybersecurity and other fundamental business risks to the full board, or bringing in specialized external expertise.

Notably, a few investors said they would paint the issue more broadly across boards as a whole, and even across their own stewardship teams. They explained that just as boards are challenged to oversee increasingly complex and rapidly‑evolving risks, they, too, are experiencing a widening mandate for the issues on which they are expected to engage and vote.

Key board takeaways

Challenge whether board and committee expertise align with key risks, and how the proxy statement communicates such alignment. Review the allocation of risk oversight responsibilities among committees and the full board, to achieve adequate coverage, eliminate duplication, and avoid overburdening any single committee. Consider whether management’s reporting on risk is effective and whether it can be improved. Confirm that risk is given sufficient time for discussion at board meetings.

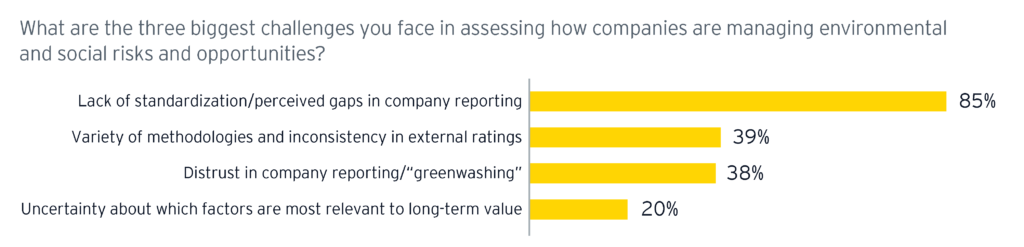

4. Lack of standardized reporting is the biggest obstacle to assessing ESG risk

We asked investors to identify the biggest challenges they face in assessing how companies are managing ESG risks and opportunities. The current lack of standardized reporting ranked the highest by far, with 85% of investors citing this as a key challenge.

These investors stressed their desire for consistent, comparable business‑relevant metrics to support more thorough analysis. They expressed frustration that current ESG disclosures generally lack substance and do not address relevant, multi‑year data points needed for effective analysis, performance benchmarking, and assessing the impact of company initiatives. Among the investors that commented on external reporting frameworks, most (76%) said the Sustainability Accounting Standards Board (SASB) is a disclosure framework they encourage companies to consider. [12]

A minority of investors sees the lack of standardized disclosures in this area as a benefit, at least at this stage. Some cautioned that rushing to specific disclosure approaches now may result in a check‑the‑box approach, and that the more constructive step forward at this stage would be for companies to better sensitize the market to what aspects of ESG are relevant to business strategy, operations and long‑term value. A few noted that, particularly considering the model of stakeholder primacy more companies are now embracing, standardization would be an oversimplified approach for communicating multilayered, complex decisions companies are making regarding ESG topics.

Taking a closer look at human capital, we also asked investors whether they want to see more company disclosure around human capital management, and, if so, whether standardization or flexibility is more important to them. Nearly all (98%) support additional disclosure. While “both” was not provided as a response option, 38% expressed preference for a hybrid framework. Thirty‑seven percent prioritized standardization, noting the value of flexible disclosures to provide context but stressing their concern that a purely principles‑based disclosure framework could result in boilerplate. Twenty-two percent prioritized flexibility, citing concerns that regulators face challenges in developing specific disclosure requirements that would be relevant across different industries, and raising concerns that standardized disclosure requirements could become a “tick the box” exercise.

Key board takeaways

Ask how management is using external market‑driven frameworks like SASB or the Embankment Project for Inclusive Capital [13] as a model to help focus company strategy, operations and disclosures on factors that are material to the business. Challenge management to upgrade ESG communications, including by putting controls around ESG disclosures, disclosing metrics and company-specific narratives that enable assessment of ESG activities and results, and both streamlining and aligning ESG disclosures across the company’s various communication platforms—from marketing materials to sustainability reports to Forms 10‑K.

5. Most investors remain concerned about disconnect between executive pay and long‑term value drivers

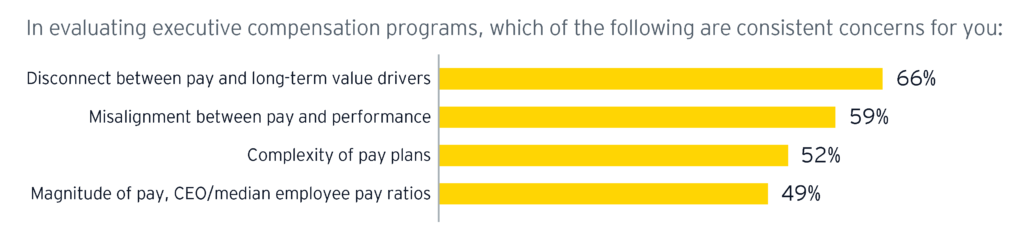

When asked about executive pay practices, two‑thirds of investors cited a continuing apparent disconnect between executive pay and long‑term value drivers. Some expressed frustration that companies will speak with them at length about long‑term strategic objectives (including related to ESG factors), that appear disconnected from the pay program, raising questions regarding how executives are incentivized to meet them.

Concerns about the complexity of executive pay plans and the magnitude of pay were often characterized as growing concerns. Regarding pay complexity, investors suggested that the level of complexity in many plans may negate the purpose of incentive pay. Regarding magnitude, some investors cited the reputational risks of ballooning pay, particularly where there is misalignment with performance or questionable pay‑ratio/pay‑equity gaps, in light of growing concerns about rising income inequality and related societal impacts among broad groups of people and policymakers. Others criticized sustained high pay at underperforming companies, and the impact of a strong market alone on company performance resulting, in turn, in achievement of executive performance goals. Investors questioned whether compensation committees are willing and prepared to address pay magnitude.

Other key themes of these conversations included concerns around a perceived overreliance by some committees on compensation consultants, short performance cycles, lack of robust equity retention requirements, the regular use of one‑time discretionary awards, and a lack of reconciliation to GAAP in the proxy statement for non‑GAAP “adjusted” executive compensation performance measures.

Key board takeaways

Challenge how the company’s executive pay philosophy and resulting compensation plan design aligns with strategy and drives long‑term value. Consider whether plans should be simplified to clarify incentives, upgraded to address critical ESG performance measures, and whether pay disclosures could be both simpler and more effective. Question whether the magnitude of pay, particularly in the context of underperformance or high CEO pay ratios and other pay gaps, may raise reputational risks or concerns about the strength of the compensation committee’s independence.

Looking ahead

As ESG continues to grow in prominence, and as investors increase their integration of related factors in investment and stewardship processes, companies have an opportunity to better develop and communicate their ESG value proposition. Expectations around ESG disclosures are evolving. Consistent disclosures that focus on what is material to the company’s business, provide concise context, and align with market-based frameworks like SASB are generally preferred. Highlighting how the board is evolving relative to changing oversight needs and enhancing its competency around complex and changing risks is important, as is clear alignment between the pay program and the company’s strategic goals and long-term value creation. Engaging shareholders and reviewing their policies, views and voting records remain paramount to understanding and meeting investor expectations.

Questions for the board to consider

- Does the board’s composition appropriately align with the company’s culture, long-term strategy and risk profile?

- How does the board stay current on the company’s culture and trends related to the future of work? Is it receiving relevant trend information, company‑specific data and having robust discussions with the CHRO to effectively oversee culture and talent strategy?

- Does the board understand how projected climate changes might impact the company’s strategy, infrastructure, supply chain and operations? Does the board understand how the company’s stakeholders want the company to address climate change issues?

- Do the board’s information practices give the board confidence in its oversight of the company’s culture, strategy, risk management, reputation and performance?

- Can the board identify the ESG risks most relevant to long-term value and clearly articulate management’s strategy to manage those risks? Are there transparent governance structures to oversee those risks, and reporting that communicates how success is measured?

- Is the board appropriately diverse? Does it have women, minorities, international perspective, and the collective experiences and expertise to provide effective insight, foresight and oversight to the company and its management?

- How well does the executive pay program align to long-term value creation and the achievement of specific ESG goals? Are the company’s disclosures sufficient to address stakeholder questions about executive pay practices?

- How does the board stay informed about shareholders’ views of company strategy, risks and governance?

Endnotes

1See What investors are expecting from the 2019 proxy season, EY Center for Board Matters, February 2019.(go back)

2While pay gap data is often adjusted to account for job function (i.e., demonstrating whether women and minorities are paid the same as their direct peers), median pay gaps show how women and/or minorities across the organization are paid on average regardless of role. (See “Pension funds step up campaign to reduce gender pay gap,” Financial Times, 19 August 2019.)(go back)

3Climate Action 100+. This initiative involves more than 370 investors with more than $35 trillion in assets under management.(go back)

4An investor lobbying initiative seeks to align climate lobbying with the goals of the Paris Agreement. This initiative involves some 200 investors with a combined $6.5 trillion in assets under

management. Some of these investors stressed their view that the voluntary steps companies are taking in their own operations are not sufficient given the accelerating risk. (200 Investors Call on

U.S. Companies to Align Climate Lobbying with Paris Agreement, Ceres, September 2019.)(go back)

5A Climate Majority Project initiative is urging U.S. utility companies to commit to net-zero emissions by 2050. Investors representing $1.8 trillion in assets under management are part of this

effort. (Net-Zero by 2050: Investor risks and opportunities in the context of deep decarbonization of electricity generation, Climate Majority Project, February 2019. See also: Institutional Investor

Statement Regarding Decarbonization of Electric Utilities, February 2019.)(go back)

6While the U.S. House of Representatives recently passed a bill requiring public companies to annually disclose the voluntarily self-identified gender, race, ethnicity and veteran status of their board

of directors and senior executives, the likelihood of passage in the Senate is unclear. H.R. 5084 — Improving Corporate Governance Through Diversity Act of 2019.(go back)

7Through its publicly disclosed Boardroom Accountability Project 3.0, the New York City Comptroller’s Office is calling on companies to adopt a policy requiring the consideration of both women

and people of color for every open board seat and for CEO appointments. Boardroom Accountability Project 3.0, New York City Comptroller Scott Stringer.(go back)

8Human Capital Management Coalition is a cooperative effort led by the UAW Retiree Medical Benefits Trust and includes 28 institutional investors representing $4 trillion in assets.(go back)

9The Global Risks Report 2019, World Economic Forum; Global Warming of 5˚, Intergovernmental Panel on Climate Change.(go back)

10Preparing investors for the Inevitable Policy Response to climate change, UN Principles for Responsible Investment.(go back)

11Fifty‑six percent responded yes, 29% responded no, and 15% declined to answer this question.(go back)

Print

Print