The Investment Company Institute supports the Commission’s examinations of proxy advice and the shareholder proposal rule. The Commission’s proposals would affect registered investment companies (“funds”) as both investors and issuers. As investors, funds may retain proxy advisory firms for administrative or research services. As issuers, funds receive proposals from their own shareholders; as investors, funds evaluate and vote on proposals that their fellow shareholders submit to their portfolio companies. Our comments seek to assist the Commission in striking the right balance between the interests of companies and shareholders. Funds’ multi-faceted participation in the proxy system provides us with a unique vantage point to do so.

Proxy advice should be accurate, transparent, and complete, but we do not support the proxy advice proposal’s set of provisions that would grant companies the right to review and comment on proxy advisory firms’ draft advice before fund complexes and other clients receive it. This proposed framework would affect substantially and adversely the timeliness and cost of proxy advisory firms’ advice, and thus its overall value to funds and their shareholders. We recommend an alternative whereby funds and other clients would receive proxy reports concurrent with their release to companies for review and comment.

We support the proposed changes to the eligibility and resubmission standards in the shareholder proposal rule. We regard these changes as reasonable regulatory line drawing, which will preserve access to the company proxy for smaller shareholders while also seeking to align the interests of shareholder proponents with those of long-term shareholders generally. We recommend revising the proposed “momentum” exclusion—which would permit companies to exclude resubmitted proposals that experience a specified loss of shareholder support—to strike a more appropriate balance between the interests of shareholders and companies. We also recommend applying a different vote-counting methodology for shareholder proposals resubmitted to closed-end funds, which should account better for the unique attributes and characteristics of those funds and their shareholders.

We comment on the proxy advice proposal in Section I and the shareholder proposal rule in Section II.

I. Proxy Advice Proposal

As institutional investors, funds vote proxies for their portfolio securities, and many fund complexes retain proxy advisory firms (or “PVABs”) for administrative and/or research-oriented proxy voting assistance. As issuers, funds prepare proxy solicitation materials for their shareholder meetings, and PVABs often issue proxy advice (e.g., reports consisting of research, analysis, and voting recommendations) regarding funds’ proxy proposals.

We strongly support the proxy advice proposal’s overarching goal, that is:

to help ensure that investors who use proxy voting advice receive more accurate, transparent, and complete information on which to make their voting decisions, in a manner that does not impose undue costs or delays that could adversely affect the timely provision of proxy voting advice.

As this formulation recognizes, however, regulatory attempts to improve the accuracy, transparency, and completeness of proxy advice could impair the timeliness and cost-effectiveness of that advice. As explained below, we believe that the SEC’s proposed review framework would do just that and move funds farther from this stated goal. Our recommended alternatives described below would address our concerns.

A. Background on Fund Complexes’ Use of PVABs

As explained in our March 2019 comment letter and in ICI’s report on funds’ use of proxy advisory firms, PVABs provide a wide range of administrative and research services related to proxy voting, and many fund complexes retain PVABs to assist them in carrying out their proxy voting responsibilities. Those fund advisers that consult PVABs’ research and recommendations may consider this information to varying degrees, along with views of companies, other investors, and shareholder proponents. Given the complexity and range of fund proxy voting responsibilities, many fund complexes value PVABs’ services.

Fund complexes fully embrace the ongoing oversight and due diligence obligations that accompany their use of PVABs. Funds’ use of third-party service providers such as PVABs is not novel, and continued oversight of key service providers—by both fund boards and advisers—is critically important and deeply ingrained in practice and regulation.

Fund complexes operate under tight time constraints during the US proxy season. For some, the volume of matters analyzed and votes cast can be immense. For instance, for the 12 months ended June 30, 2017 (the 2017 proxy year), shareholders at the 3,000 largest public companies (i.e., companies in the Russell 3000 Index) considered more than 25,000 proposals. For US-listed companies, proxy campaigns are heavily concentrated in the second quarter.

Funds’ proxy voting guidelines and research, together with PVABs’ general and custom advice (e.g., customized research and recommendations that PVABs provide to a specific client, often based on the client’s custom proxy voting guidelines), are important tools in helping identify those proposals requiring greater attention. Often, a proposal’s need for greater analysis will be readily apparent (e.g. proposed mergers, contested director elections, and certain shareholder proposals). For these proposals, a fund adviser may begin its analysis concurrent with the release of the company’s definitive proxy materials. The PVAB’s report may organize the underlying proxy information in a uniform way that facilitates and supplements the adviser’s analysis, and in some cases, the report may identify additional issues. Timeliness is especially critical here, because these matters are complex and may have a significant impact on a fund’s investment in a company. Following receipt of the report, fund advisers may engage directly with companies, requesting additional information or perspective.

Timing varies as to when fund advisers typically receive proxy reports from PVABs. During relatively slow periods, fund advisers may receive these reports within twenty days of the shareholder meeting; during the peak of proxy season or for special meetings, receipt may occur seven days or less prior to the meeting. Furthermore, fund advisers’ receipt of custom advice may lag their receipt of “benchmark” proxy reports (i.e., those standardized PVAB reports issued broadly to clients that include research, analysis, and a general voting recommendation).

Funds also experience pressure on the back end of the proxy timeline. Because of the intermediated nature of proxy voting and the number of entities involved, funds typically must vote two days or more prior to the meeting date. For foreign companies that list on US exchanges, the voting cut-off date may be even sooner, with funds at times required to vote a week or more in advance of the meeting. This existing timeline is tight, and funds are greatly concerned about regulatory changes that would exacerbate these already intense timing pressures.

Considering the strong regulatory framework in place for, and the developed voting practices of, funds and their advisers, we question the need for additional regulation—direct or indirect—that could adversely affect funds’ ability to vote proxies.

In fact, the Commission more heavily regulates proxy voting by funds than that of any other entity that casts votes. Since 2004, funds have publicly reported their proxy votes to the SEC, providing a full and transparent voting record. Funds also must describe in their registration statements the policies and procedures that they use to determine how to vote proxies for their portfolio securities.

The Commission further requires a fund adviser with voting authority to adopt and implement proxy voting policies and procedures reasonably designed to ensure that it votes client proxies in the best interest of its clients. The adviser must describe its policies and procedures in its Form ADV. Further, the policies and procedures must address how the adviser will handle material conflicts of interest between it and its clients.

The SEC has considered regulating the activities of PVABs at least since 2010, when it issued its concept release on the proxy system. While we have questioned the need for additional regulation of PVABs, ICI has remained open to regulatory changes that do not:

- Impede fund complexes’ ability to receive administrative or research-oriented proxy voting assistance from PVABs;

- Adversely affect the timeliness of the PVAB advice for which fund complexes pay, and which may be an important input for fund advisers to analyze and consider within an already- compressed proxy voting schedule; or

- Overly complicate communications flows or systems in ways that add costs that fund shareholders likely would bear.

With these principles in mind, we evaluate the review framework and offer more suitable alternatives below.

Proposal’s Framework for Company Review

We do not believe that the proposed review framework sufficiently accounts for the interests of funds and their shareholders, particularly their need for timely and cost-effective advice.

Rule 14a-2(b) under the Exchange Act conditionally exempts certain solicitations, including those of PVABs, from the proxy rules’ information and filing requirements. The proposal would modify the rule’s conditions for claiming these exclusions. Most significantly for funds, the proposed amendments would require that PVABs:

- Provide companies with an opportunity to review and provide feedback on proxy advice before PVABs issue it to their clients (e.g., fund complexes), with the length of review generally as follows:

- no less than five business days before issuance, if the company has filed its definitive proxy statement at least 45 calendar days before the meeting date; and

- no less than three business days before issuance, if the company has filed its definitive proxy statement less than 45 calendar days, but at least 25 calendar days, before the meeting date.

- Provide companies a second and final notice of voting advice (no earlier than the applicable review period and no later than two business days prior to delivery to clients). This final notice must include a copy of the proxy voting advice that will be delivered to clients, including any revisions made after the review and feedback period.

- Include in the final proxy voting advice a hyperlink that leads to a statement with the company’s views on the advice, upon the company’s request.

In sum, the framework’s costs to funds and their shareholders would outweigh its benefits.

Specific to investors (including funds), the SEC states that the review framework’s benefits include “enhancing the overall mix of information available,” “more accurate and complete voting advice,” and “ready and timely access to the company’s and other soliciting person’s perspective when considering the advice, such as where there are differing views about the proxy advisor’s methodological approach or other differences of opinion… .”

More specifically, the SEC’s analysis indicates that the number of factual errors reported by companies in their additional proxy materials in 2018 were less than three-tenths of a percent (17/5,862). This analysis evidences that companies already publicly voice their disagreements—factual and otherwise— with proxy advice, suggesting that “completeness” is an area where improvement may be only modest. And since the number of company-reported factual errors is such a small percentage of total annual proxy filings, there would appear to be little room for improved factual accuracy. If anything, this analysis calls into question the magnitude of benefits that regulation may produce.

The SEC does not attempt to quantify investors’ costs in its economic analysis and instead states only that certain costs imposed on PVABs could be passed along to investors, and that failure to deliver timely advice could cause investors to “incur an indirect cost in that they would have less time to consider the business’s voting advice prior to the proxy vote.” It also states that the review framework “could impact perceptions about the independence and objectivity of the advice … [and] affect the willingness of investment advisers and other clients to engage the services of proxy voting advice businesses.”

The SEC’s treatment of investor costs is far too cursory, and fails to appreciate fully the review framework’s impact on the timeliness and cost of proxy advice, which we highlight below.

1. The Scope of Review is Overly Broad and Would Compromise the Confidentiality of Fund Complexes’ Proxy-Related Information

Under the proposed review framework, the scope of materials that the SEC would permit companies to review is far too broad. The proposed amendments do not define “proxy voting advice,” but the proposing release contemplates a very broad definition, including not only the benchmark reports that PVABs distribute broadly to clients but also custom reports that PVABs issue to individual clients. The distribution and review of custom reports would create a tremendous amount of work for companies and PVABs alike, which in turn would affect PVABs’ ability to provide their clients with timely advice.

Most significantly for fund complexes, it could expose confidential and proprietary information (e.g., underlying methodological information) that they provide to PVABs for purposes of effectuating their proxy voting guidelines, which in some cases exceeds what they publicly disclose. It is imperative that any final review framework not include PVAB communications containing client-specific information.

2. The Framework Is Highly Likely to Reduce the Timeliness of PVABs’ Advice and Increase Its Costs

Fully informed and thoughtful proxy voting requires fund advisers to receive relevant information as early as possible. Funds are deeply concerned about the proposal’s impact on the timeliness and cost of the proxy advice that they receive, for the following reasons.

First, the company review periods are overly generous and timed too closely to the intended distribution of the advice. Assuming they timely file their definitive proxy statements, companies would have two separate, non-concurrent review periods—an initial five-business or three-business day review period, followed by an additional two-business day review period. Thus, these review and comment periods would total either (i) seven business days for those filing their materials at least 45 calendar days before the meeting date, or (ii) five business days for those filing their materials less than 45 calendar days, but at least 25 calendar days, before the meeting date. All timely filers receive these review rights, irrespective of whether they have any intention of exercising them. And PVABs are precluded from distributing advice to their clients during this fixed review period, even though many companies may not review nor comment on the advice.

The SEC does not explain why it sets company review periods in business days, while it conditions companies’ review rights on filing proxy statements within set numbers of calendar days. But this critical distinction, together with the lengthy review periods described above, would negatively affect funds, as we demonstrate in the example below.

Example of How Company Review Would Affect Funds

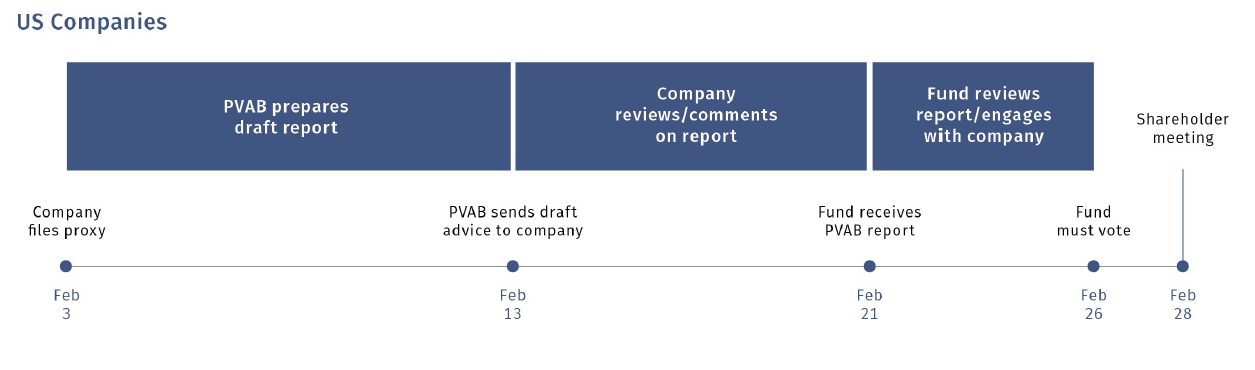

Suppose that a company files its proxy statement today (February 3, 2020), and schedules its shareholder meeting for February 28, 2020. The proposal would entitle the company to a five business day review period (three business days plus two additional business days for final review). If the PVAB wished to provide its clients even a week to review its advice prior to the meeting date—far from ideal, especially for matters such as proposed mergers and contested director elections—it would distribute it to them on February 21. This means that the PVAB would need to provide the company with the draft advice by February 13. In such a scenario, PVABs would have 10 calendar days to prepare draft advice; companies would have eight calendar days to review it (five business days, two weekend days, and Presidents’ Day); and fund advisers would have no more than five calendar days (three business days) to consider it prior to voting.

We show this graphically below. Company review consumes nearly a third of the period, leaving the fund adviser with relatively little time to review the advice and engage with the company. Moreover, this example optimistically assumes (i) that the company’s review does not delay the PVAB’s distribution of its advice to clients, and (ii) a relatively late voting cut-off date (two days prior to the meeting; as noted above, however, the voting cut-off date for certain US-listed foreign companies may be a week or more prior to the shareholder meeting). If these assumptions do not hold, then fund complexes would be further squeezed, and the value of advice once received would be diminished further. A company would have more time with, and earlier access to, the advice than the PVABs’ paying customers, a result that surely does not support informed proxy voting.

Second, the proposal would not require companies to promptly provide comments. Rather, a company need only provide comments prior to the expiration of the two-day review period, i.e., at the very end of its overall review. This means that a company with a seven business day review period could provide substantive comments immediately before the PVAB’s intended distribution date, all but ensuring that the PVAB will delay releasing its advice to clients while it reviews the comments and determines which changes, if any, to make.

Third, the SEC has not sufficiently incentivized companies to accelerate their proxy statement filings. Although the Commission generally acknowledges the importance of timely advice, the review framework itself undermines this key objective.

Companies that do not file their proxy statements at least 25 days before the shareholder meeting date would have no review rights, but this is not much of an incentive. The proposal states that companies customarily file and/or mail their definitive proxy materials anywhere from 35 to 40 or 30 to 50 days before a shareholder meeting. Most companies already would qualify for the five business day review period, and the marginal benefit of extending this to seven likely is not very great. If substantial numbers of companies do not file earlier than they do now, then the spring proxy timeline will not meaningfully “expand.” Without this expansion, fitting this review framework into a still-cramped timeline will lead to some combination of (i) delays in PVABs’ issuance of their advice, or (ii) increased costs to efficiently handle these responsibilities, which PVABs are likely to pass along to funds. Neither is desirable for fund shareholders.

Fourth, the review framework is needlessly complicated and has at least one significant ambiguity. The Commission has not presented a compelling reason for a two-step pre-distribution review process, especially when companies need not act during the first period. We also are troubled by the requirement to provide “a copy of such proxy voting advice that the proxy voting advice business will deliver to its clients… .” (emphasis added) It is unclear whether subsequent changes to the advice would re-set the review clock for companies. One easily can imagine scenarios where the linked comments are helpful (and could convince the PVAB to make certain necessary changes to its report), or where the PVAB believes that the linked comments are misguided, and wishes to explain why in its report. But if doing so triggers a new review period, “timeliness” is compromised. If a provision along these lines is retained, the SEC should clarify that any subsequent amendments do not trigger a new review period for companies.

Finally, delays caused by the proposed framework would limit the time that fund advisers have to engage with companies, particularly following a PVAB’s “against” recommendation on a management proposal or a “for” recommendation on a shareholder proposal. If a fund adviser has only a few days between receipt of proxy advice (which may include the company’s objection(s)) and the deadline to vote, there would be little time to communicate directly with the company, evaluate the competing claims of the company and the PVAB, and decide how to vote. In these cases, the company’s ability to rebut may be limited to its linked statement in the final advice. By contrast, having a system where recommendations are released sooner would allow for more comprehensive dialogue on important and complex topics.

3. The Framework’s Increased Costs to Funds and Shareholders Would Continue a Disturbing Regulatory Trend

More generally, we are deeply concerned by the cumulative and increasing regulatory costs that funds and their shareholders are bearing. In response to ICI’s 2017 survey, members reported a median increase in compliance costs of an estimated twenty percent over the previous five years. Members cited one-time compliance costs (e.g., legal costs, preparation of new policies and procedures, creation of internal controls, and staff training), increased technology expenditures, increased use of third- party fund service providers (i.e., vendors), increased vendor costs, increased oversight of vendors and intermediaries, and increased staffing needs as primary drivers of these overall cost increases. If adopted, these proxy advice amendments would be the latest rulemaking that increases vendor costs for funds and their shareholders.

ICI’s Proposed Alternative Review Frameworks

If the SEC is intent on providing a mandated review for companies, the process should be as efficient and unobtrusive as possible. Below we present two alternatives that achieve the SEC’s stated objectives without the previously-discussed deleterious effects on funds. The first would grant a company the right to review and comment on the PVAB’s benchmark report concurrent with its release to clients.

The second also would grant this concurrent review right, along with a limited right to review and comment on draft factual information prior the report’s distribution to clients. We recommend the first alternative, because it is simpler, less costly to implement, and less likely to compromise funds’ receipt of timely advice.

1. Preferred Alternative: Concurrent Review of PVAB Reports

The SEC could require that a PVAB do the following for any company that files its definitive proxy statement at least 60 days prior to the shareholder meeting:

- Concurrently share with the company its final benchmark report.

- Notify its clients if the company raises any objections to the PVAB’s report within 2 business days of receipt.

As with the proposal, the PVAB could, but would not be obligated to, amend its final report. We strongly support this aspect of the SEC’s proposal, and it is imperative that the SEC retain it in any final framework. We also believe that companies should pay for access to these reports so that PVABs’ clients do not bear any expenses incurred to implement and administer this review framework.

As discussed in our March Letter, this framework would provide investors with a more complete, and easily accessible, “record” prior to casting votes. It would provide companies with another channel to communicate with investors and allow for better visibility of their comments on PVAB advice. Unlike the SEC’s proposal, this would not delay fund advisers’ review of PVAB advice, and it would help insulate fund shareholders from any cost increases resulting from these regulations.

2. Second Alternative: Limited Review of Draft Materials and Concurrent Review of Final Reports

While we do not favor this second alternative, if the SEC insists on providing companies the right to review draft PVAB materials prior to distribution to clients, we recommend that any such review framework have the following provisions:

- Single Pre-Distribution Review Only for Timely Filers. A company could review a PVAB’s “proxy voting research” (as defined below) only if it files its definitive proxy statement at least 60 days prior to its shareholder meeting. A qualifying company could review this research only once prior to distribution to clients.

- Definition of “Proxy Voting Research” (a new proposed term). We recommend replacing “proxy voting advice” with “proxy voting research,” defined to include only factual information in any PVAB benchmark report. Again, any review rights must not include custom reports or any other client-specific information.

- Additional Provisions. A review framework designed to help investors should have the following additional provisions:

As with our preferred alternative, we believe that companies should pay for access to these reports so that PVABs’ clients do not bear expenses incurred to implement and administer this review framework. We would expect the expenses of this second alternative to be higher than those for the first.

II. Proposed Amendments to the Shareholder Proposal Rule (Rule 14a-8)

The parameters of the shareholder proposal rule are important to funds both as investors (funds vote on shareholder proposals for their portfolio companies) and issuers (funds receive and respond to proposals from their shareholders). In this section, we comment on the proposed rule amendments that would alter the current requirements for submitting and resubmitting shareholder proposals, and also recommend: (i) a requirement that mutual funds’ and ETFs’ shareholder proponents reaffirm periodically any outstanding proposals; and (ii) improvements to the SEC staff’s process for reviewing requests to exclude shareholder proposals.

A. Shareholder Eligibility Requirements

Currently, to submit a proxy proposal, a shareholder must continuously hold at least $2,000 in market value (or one percent) of a company’s stock entitled to vote for at least one year. The proposed changes would permit a shareholder to submit a proposal if the shareholder has continuously held at least: (i) $2,000 of the company’s securities for at least three years; (ii) $15,000 of the company’s securities for at least two years; or (iii) $25,000 of the company’s securities for at least one year.

ICI supports these changes. Considering minimum dollar investments in tandem with holding periods is a reasonable way to ensure that smaller shareholders maintain their access to this engagement channel, while also properly insisting that their interests be aligned with those of long-term shareholders generally. These changes recognize the costs that a single shareholder’s proposal generates for all shareholders and the importance of permitting long-term shareholders to submit shareholder proposals.

B. Resubmissions Thresholds for Shareholder Proposals

Rule 14a-8(i) provides 13 bases upon which a company may exclude a shareholder proposal, including a “resubmissions” exclusion. Currently, a fund may exclude a shareholder proposal to resubmit the same (or a similar) proposal that has been submitted during the preceding 5 calendar years if the prior proposal did not receive at least 3, 6, and 10 percent shareholder approval for the first, second, and third submissions, respectively. The proposal would raise those resubmission thresholds to 5, 15, and 25 percent, respectively, of “votes cast.”

ICI supports the proposed increases to the existing thresholds. But we recommend applying a different vote-counting methodology to closed-end funds, as described below.

We commend the Commission for relying on data and its experience with the shareholder proposal process. As we stated in our March Letter, the rule’s resubmission thresholds should permit exclusion of proposals that stand “no significant chance” of obtaining shareholder approval in a subsequent resubmission, and we believe the SEC’s proposal reasonably can be expected to accomplish this.

The proposed higher thresholds would preserve a shareholder’s ability to build support for its proposal through successive submissions while also reducing the number of repeat proposals that have little, or no, chance of gaining majority shareholder support. Such proposals impose costs on companies and also on those shareholders (including funds) that attempt to vote thoughtfully on those matters put before them. These costs simply are not justified where lack of support for a previously-unsuccessful proposal indicates little or no likelihood that a resubmitted proposal ever would gain acceptance.

We strongly recommend, however, that the Commission adopt a different vote-counting methodology for shareholder proposals resubmitted to closed-end funds. In particular, the Commission should calculate resubmission eligibility for closed-end funds using a “shares entitled to vote” rather than a “votes cast” standard. The recommended approach has precedent: Both current rule 14a-8 and the rule as proposed to be amended use an “entitled to vote” counting methodology for purposes of initial eligibility to submit a shareholder proposal. Additionally, the recommended approach would account better for the unique attributes and characteristics of closed-end funds and their shareholders and is consistent with the Commission’s overarching policy objectives.

Closed-end funds register under the Investment Company Act and register their shares under the Securities Act. The assets of a closed-end fund are professionally managed in accordance with the fund’s investment objectives and policies, and may be invested in stocks, bonds, and other assets. Closed-end funds generally issue a fixed number of shares that are listed on a stock exchange or traded in the over-the-counter market. The market price of closed-end fund shares fluctuates like those of other publicly-traded securities and is determined by supply and demand in the marketplace.

Therefore, a fund’s shares may trade at a price higher or lower than net asset value (NAV). A closed- end fund trading at a share price higher than its NAV is said to be selling at a “premium” to the NAV, while a closed-end fund trading at a share price lower than its NAV is said to be selling at a “discount.”

Closed-end funds generally have individual, retail “Main Street” investors who invest for the long-term and also have arbitrageurs who seek to profit at the expense of these long-term shareholders by taking advantage of situations where a fund’s shares are trading at a discount to NAV. Recently, such arbitrageurs have intensified their efforts to seize control of closed-end funds to extract short-term profits. Arbitrageurs typically accumulate large positions in the fund, and then seek to cause the fund to take immediate actions to provide liquidity at or near NAV (e.g., tender offer, conversion to open-end, or liquidation). These arbitrage tactics can cause serious harm to a fund and the interests of its long- term investors, including forcing fundamental changes to the nature of the product that are contrary to what Main Street investors sought when choosing to invest in the fund.

The Institute has been working closely with our closed-end fund members to assist with identifying ways, including through possible regulatory changes, that would provide closed-end fund boards with additional tools to protect long-term shareholders.

If the Commission were to amend Rule 14a-8 to permit closed-end funds to measure support for shareholder proposals using a “shares entitled to vote” standard, it would depict more accurately whether there truly is “widespread” support for a proposal that would merit allowing a shareholder to resubmit the proposal. In other words, for closed-end funds, the level of support should be assessed, in part, based on whether a sufficient portion of retail long-term shareholders have made the effort to both cast a vote and vote in favor of the proposal. A “votes cast” standard effectively discounts those who simply have chosen not to vote.

Applying a “shares entitled to vote” standard for closed-end funds would be consistent with the Commission’s policy of placing limits on the unfettered ability of one, or a few, shareholders to use the shareholder proposal process to repeatedly and unreasonably create significant costs for all shareholders. Importantly, it would relieve closed-end funds of the obligation to consider and spend resources on matters that do not reflect the views of the broader shareholder base.

C. “Momentum” Exclusion

Under the resubmissions exclusion, the proposal also creates an additional means of excluding shareholder proposals: A company could exclude a proposal that previously had been voted on three or more times in the last five years, notwithstanding having received at least 25 percent of the votes cast on its most recent submission, if at the time of the most recent vote the proposal: (i) received less than 50 percent of the votes cast; and (ii) experienced a decline in shareholder support of 10 percent or more compared to the immediately preceding vote (the “momentum exclusion”). The exclusion’s purpose is to relieve management and shareholders from repeatedly considering, and bearing the costs related to, matters for which shareholder interest has declined.

While we do not object to the momentum concept, we recommend modifying its parameters to require a greater decline in support. As proposed, the same shareholder proposal could garner shareholder support of:

- 10 percent in year one;

- 20 percent in year two;

- 49 percent in year three; and

- 44 percent in year four.

If the shareholder proponent submitted it a fifth time, the company could exclude it from its proxy statement, notwithstanding the still-substantial level—44 percent—of shareholder support.

In our view, the Commission should permit a company to exclude a shareholder proposal that experiences a decline in support of 30 percent or more after at least three attempts. A decline of this larger magnitude would better assure that potentially viable proposals would not be excluded based on a relatively small decline in support that could be temporary.

D. Recommended Shareholder Affirmation of Outdated Proposals

The proposing release observes that mutual funds and ETFs generally do not hold annual shareholder meetings, and that several years may pass between submission of a shareholder proposal and the next shareholder meeting. The release then asks whether the Commission should consider requiring shareholder proponents to reaffirm prior proposals after some passage of time.

We recommend that the Commission adopt amendments to effectuate this. The Commission correctly notes that as time passes, the initial submission may no longer reflect the interest of the proponent, or the proponent may have sold its shares.

For funds with these outdated proposals, tracking and reconfirming them can be a significant administrative burden, given the fluidity of share ownership over long periods. Therefore, we recommend implementing an expiration date for shareholder proposals to open-end funds (e.g., three years from the date of submission, if no shareholder meeting has been held during that period). Absent resubmission or some other form of written reaffirmation of the initial proposal prior to expiration by the shareholder proponent (which would include reaffirmation that the shareholder continues to satisfy the rule’s eligibility requirements), the proposal would expire, and the fund would not be obligated to include it on the proxy statement for its next shareholder meeting.

E. Recommended Improvements to the Staff Review Process

While not addressed in the proposing release, the Division of Corporation Finance staff recently announced changes to its shareholder proposal exclusion review process. The staff stated that:

[s]tarting with the 2019-2020 shareholder proposal season, … the staff may respond orally instead of in writing to some no-action requests … . If the staff declines to state a view on any particular request, the interested parties should not interpret that position as indicating that the proposal must be included. In such circumstances, the staff is not taking a position on the merits of the arguments made, and the company may have a valid legal basis to exclude the proposal under Rule 14a-8.

The staff weighs in only when the company wishes to exclude a shareholder proposal on one or more of the bases provided in Rule 14a-8(i). Staff involvement brings more certainty and consistency to the process and imposes discipline on companies and shareholder proponents alike.

We appreciate the difficulty of this staff work, but this announcement concerns us on both substantive and procedural grounds. Our members are apprehensive that these changes will promote uncertainty for all parties.

Given the importance of these matters and the tight time constraints of the proxy season, a company or fund that submits an exclusion request to the staff and receives no substantive reply will have three unappealing options: (i) include the proposal on its proxy statement and incur any related costs, despite misgivings about its appropriateness and legality; (ii) exclude the proposal from its proxy statement based on its interpretation and application of existing precedent, without any indication from the staff or a court that doing so is legally appropriate; or (iii) “seek formal, binding [court] adjudication,” as the staff’s statement suggests, with its attendant costs and uncertainty.

We recommend that the SEC and staff return to the status quo ante on a permanent basis. If the Commission is not willing to do so, we request that, at a minimum, it temporarily return to the status quo ante while it provides interested parties an opportunity to comment and share any observed consequences of the staff’s decision.

The complete publication, including footnotes, is available here.

Investment Company Institute Comment Letter to SEC on Proposed Rules for Proxy Voting Advice and Shareholder Proposals

More from: Paul Schott Stevens, Investment Company Institute

Paul Schott Stevens is president and CEO of the Investment Company Institute (ICI). This post is based on ICI’s comment letter to the SEC on its proposed amendments to exemptions from the proxy rules for proxy voting advice and on the proposed rule regarding the submission and resubmission of shareholder proposals (discussed in posts here and here).

The letter was co-authored by Susan M. Olson, general counsel; Dorothy M. Donohue, deputy general counsel, securities regulation; and J. Matthew Thornton, assistant general counsel, securities regulation.

The Investment Company Institute supports the Commission’s examinations of proxy advice and the shareholder proposal rule. The Commission’s proposals would affect registered investment companies (“funds”) as both investors and issuers. As investors, funds may retain proxy advisory firms for administrative or research services. As issuers, funds receive proposals from their own shareholders; as investors, funds evaluate and vote on proposals that their fellow shareholders submit to their portfolio companies. Our comments seek to assist the Commission in striking the right balance between the interests of companies and shareholders. Funds’ multi-faceted participation in the proxy system provides us with a unique vantage point to do so.

Proxy advice should be accurate, transparent, and complete, but we do not support the proxy advice proposal’s set of provisions that would grant companies the right to review and comment on proxy advisory firms’ draft advice before fund complexes and other clients receive it. This proposed framework would affect substantially and adversely the timeliness and cost of proxy advisory firms’ advice, and thus its overall value to funds and their shareholders. We recommend an alternative whereby funds and other clients would receive proxy reports concurrent with their release to companies for review and comment.

We support the proposed changes to the eligibility and resubmission standards in the shareholder proposal rule. We regard these changes as reasonable regulatory line drawing, which will preserve access to the company proxy for smaller shareholders while also seeking to align the interests of shareholder proponents with those of long-term shareholders generally. We recommend revising the proposed “momentum” exclusion—which would permit companies to exclude resubmitted proposals that experience a specified loss of shareholder support—to strike a more appropriate balance between the interests of shareholders and companies. We also recommend applying a different vote-counting methodology for shareholder proposals resubmitted to closed-end funds, which should account better for the unique attributes and characteristics of those funds and their shareholders.

We comment on the proxy advice proposal in Section I and the shareholder proposal rule in Section II.

I. Proxy Advice Proposal

As institutional investors, funds vote proxies for their portfolio securities, and many fund complexes retain proxy advisory firms (or “PVABs”) for administrative and/or research-oriented proxy voting assistance. As issuers, funds prepare proxy solicitation materials for their shareholder meetings, and PVABs often issue proxy advice (e.g., reports consisting of research, analysis, and voting recommendations) regarding funds’ proxy proposals.

We strongly support the proxy advice proposal’s overarching goal, that is:

As this formulation recognizes, however, regulatory attempts to improve the accuracy, transparency, and completeness of proxy advice could impair the timeliness and cost-effectiveness of that advice. As explained below, we believe that the SEC’s proposed review framework would do just that and move funds farther from this stated goal. Our recommended alternatives described below would address our concerns.

A. Background on Fund Complexes’ Use of PVABs

As explained in our March 2019 comment letter and in ICI’s report on funds’ use of proxy advisory firms, PVABs provide a wide range of administrative and research services related to proxy voting, and many fund complexes retain PVABs to assist them in carrying out their proxy voting responsibilities. Those fund advisers that consult PVABs’ research and recommendations may consider this information to varying degrees, along with views of companies, other investors, and shareholder proponents. Given the complexity and range of fund proxy voting responsibilities, many fund complexes value PVABs’ services.

Fund complexes fully embrace the ongoing oversight and due diligence obligations that accompany their use of PVABs. Funds’ use of third-party service providers such as PVABs is not novel, and continued oversight of key service providers—by both fund boards and advisers—is critically important and deeply ingrained in practice and regulation.

Fund complexes operate under tight time constraints during the US proxy season. For some, the volume of matters analyzed and votes cast can be immense. For instance, for the 12 months ended June 30, 2017 (the 2017 proxy year), shareholders at the 3,000 largest public companies (i.e., companies in the Russell 3000 Index) considered more than 25,000 proposals. For US-listed companies, proxy campaigns are heavily concentrated in the second quarter.

Funds’ proxy voting guidelines and research, together with PVABs’ general and custom advice (e.g., customized research and recommendations that PVABs provide to a specific client, often based on the client’s custom proxy voting guidelines), are important tools in helping identify those proposals requiring greater attention. Often, a proposal’s need for greater analysis will be readily apparent (e.g. proposed mergers, contested director elections, and certain shareholder proposals). For these proposals, a fund adviser may begin its analysis concurrent with the release of the company’s definitive proxy materials. The PVAB’s report may organize the underlying proxy information in a uniform way that facilitates and supplements the adviser’s analysis, and in some cases, the report may identify additional issues. Timeliness is especially critical here, because these matters are complex and may have a significant impact on a fund’s investment in a company. Following receipt of the report, fund advisers may engage directly with companies, requesting additional information or perspective.

Timing varies as to when fund advisers typically receive proxy reports from PVABs. During relatively slow periods, fund advisers may receive these reports within twenty days of the shareholder meeting; during the peak of proxy season or for special meetings, receipt may occur seven days or less prior to the meeting. Furthermore, fund advisers’ receipt of custom advice may lag their receipt of “benchmark” proxy reports (i.e., those standardized PVAB reports issued broadly to clients that include research, analysis, and a general voting recommendation).

Funds also experience pressure on the back end of the proxy timeline. Because of the intermediated nature of proxy voting and the number of entities involved, funds typically must vote two days or more prior to the meeting date. For foreign companies that list on US exchanges, the voting cut-off date may be even sooner, with funds at times required to vote a week or more in advance of the meeting. This existing timeline is tight, and funds are greatly concerned about regulatory changes that would exacerbate these already intense timing pressures.

Considering the strong regulatory framework in place for, and the developed voting practices of, funds and their advisers, we question the need for additional regulation—direct or indirect—that could adversely affect funds’ ability to vote proxies.

In fact, the Commission more heavily regulates proxy voting by funds than that of any other entity that casts votes. Since 2004, funds have publicly reported their proxy votes to the SEC, providing a full and transparent voting record. Funds also must describe in their registration statements the policies and procedures that they use to determine how to vote proxies for their portfolio securities.

The Commission further requires a fund adviser with voting authority to adopt and implement proxy voting policies and procedures reasonably designed to ensure that it votes client proxies in the best interest of its clients. The adviser must describe its policies and procedures in its Form ADV. Further, the policies and procedures must address how the adviser will handle material conflicts of interest between it and its clients.

The SEC has considered regulating the activities of PVABs at least since 2010, when it issued its concept release on the proxy system. While we have questioned the need for additional regulation of PVABs, ICI has remained open to regulatory changes that do not:

With these principles in mind, we evaluate the review framework and offer more suitable alternatives below.

Proposal’s Framework for Company Review

We do not believe that the proposed review framework sufficiently accounts for the interests of funds and their shareholders, particularly their need for timely and cost-effective advice.

Rule 14a-2(b) under the Exchange Act conditionally exempts certain solicitations, including those of PVABs, from the proxy rules’ information and filing requirements. The proposal would modify the rule’s conditions for claiming these exclusions. Most significantly for funds, the proposed amendments would require that PVABs:

In sum, the framework’s costs to funds and their shareholders would outweigh its benefits.

Specific to investors (including funds), the SEC states that the review framework’s benefits include “enhancing the overall mix of information available,” “more accurate and complete voting advice,” and “ready and timely access to the company’s and other soliciting person’s perspective when considering the advice, such as where there are differing views about the proxy advisor’s methodological approach or other differences of opinion… .”

More specifically, the SEC’s analysis indicates that the number of factual errors reported by companies in their additional proxy materials in 2018 were less than three-tenths of a percent (17/5,862). This analysis evidences that companies already publicly voice their disagreements—factual and otherwise— with proxy advice, suggesting that “completeness” is an area where improvement may be only modest. And since the number of company-reported factual errors is such a small percentage of total annual proxy filings, there would appear to be little room for improved factual accuracy. If anything, this analysis calls into question the magnitude of benefits that regulation may produce.

The SEC does not attempt to quantify investors’ costs in its economic analysis and instead states only that certain costs imposed on PVABs could be passed along to investors, and that failure to deliver timely advice could cause investors to “incur an indirect cost in that they would have less time to consider the business’s voting advice prior to the proxy vote.” It also states that the review framework “could impact perceptions about the independence and objectivity of the advice … [and] affect the willingness of investment advisers and other clients to engage the services of proxy voting advice businesses.”

The SEC’s treatment of investor costs is far too cursory, and fails to appreciate fully the review framework’s impact on the timeliness and cost of proxy advice, which we highlight below.

1. The Scope of Review is Overly Broad and Would Compromise the Confidentiality of Fund Complexes’ Proxy-Related Information

Under the proposed review framework, the scope of materials that the SEC would permit companies to review is far too broad. The proposed amendments do not define “proxy voting advice,” but the proposing release contemplates a very broad definition, including not only the benchmark reports that PVABs distribute broadly to clients but also custom reports that PVABs issue to individual clients. The distribution and review of custom reports would create a tremendous amount of work for companies and PVABs alike, which in turn would affect PVABs’ ability to provide their clients with timely advice.

Most significantly for fund complexes, it could expose confidential and proprietary information (e.g., underlying methodological information) that they provide to PVABs for purposes of effectuating their proxy voting guidelines, which in some cases exceeds what they publicly disclose. It is imperative that any final review framework not include PVAB communications containing client-specific information.

2. The Framework Is Highly Likely to Reduce the Timeliness of PVABs’ Advice and Increase Its Costs

Fully informed and thoughtful proxy voting requires fund advisers to receive relevant information as early as possible. Funds are deeply concerned about the proposal’s impact on the timeliness and cost of the proxy advice that they receive, for the following reasons.

First, the company review periods are overly generous and timed too closely to the intended distribution of the advice. Assuming they timely file their definitive proxy statements, companies would have two separate, non-concurrent review periods—an initial five-business or three-business day review period, followed by an additional two-business day review period. Thus, these review and comment periods would total either (i) seven business days for those filing their materials at least 45 calendar days before the meeting date, or (ii) five business days for those filing their materials less than 45 calendar days, but at least 25 calendar days, before the meeting date. All timely filers receive these review rights, irrespective of whether they have any intention of exercising them. And PVABs are precluded from distributing advice to their clients during this fixed review period, even though many companies may not review nor comment on the advice.

The SEC does not explain why it sets company review periods in business days, while it conditions companies’ review rights on filing proxy statements within set numbers of calendar days. But this critical distinction, together with the lengthy review periods described above, would negatively affect funds, as we demonstrate in the example below.

Example of How Company Review Would Affect Funds

Suppose that a company files its proxy statement today (February 3, 2020), and schedules its shareholder meeting for February 28, 2020. The proposal would entitle the company to a five business day review period (three business days plus two additional business days for final review). If the PVAB wished to provide its clients even a week to review its advice prior to the meeting date—far from ideal, especially for matters such as proposed mergers and contested director elections—it would distribute it to them on February 21. This means that the PVAB would need to provide the company with the draft advice by February 13. In such a scenario, PVABs would have 10 calendar days to prepare draft advice; companies would have eight calendar days to review it (five business days, two weekend days, and Presidents’ Day); and fund advisers would have no more than five calendar days (three business days) to consider it prior to voting.

We show this graphically below. Company review consumes nearly a third of the period, leaving the fund adviser with relatively little time to review the advice and engage with the company. Moreover, this example optimistically assumes (i) that the company’s review does not delay the PVAB’s distribution of its advice to clients, and (ii) a relatively late voting cut-off date (two days prior to the meeting; as noted above, however, the voting cut-off date for certain US-listed foreign companies may be a week or more prior to the shareholder meeting). If these assumptions do not hold, then fund complexes would be further squeezed, and the value of advice once received would be diminished further. A company would have more time with, and earlier access to, the advice than the PVABs’ paying customers, a result that surely does not support informed proxy voting.

Second, the proposal would not require companies to promptly provide comments. Rather, a company need only provide comments prior to the expiration of the two-day review period, i.e., at the very end of its overall review. This means that a company with a seven business day review period could provide substantive comments immediately before the PVAB’s intended distribution date, all but ensuring that the PVAB will delay releasing its advice to clients while it reviews the comments and determines which changes, if any, to make.

Third, the SEC has not sufficiently incentivized companies to accelerate their proxy statement filings. Although the Commission generally acknowledges the importance of timely advice, the review framework itself undermines this key objective.

Companies that do not file their proxy statements at least 25 days before the shareholder meeting date would have no review rights, but this is not much of an incentive. The proposal states that companies customarily file and/or mail their definitive proxy materials anywhere from 35 to 40 or 30 to 50 days before a shareholder meeting. Most companies already would qualify for the five business day review period, and the marginal benefit of extending this to seven likely is not very great. If substantial numbers of companies do not file earlier than they do now, then the spring proxy timeline will not meaningfully “expand.” Without this expansion, fitting this review framework into a still-cramped timeline will lead to some combination of (i) delays in PVABs’ issuance of their advice, or (ii) increased costs to efficiently handle these responsibilities, which PVABs are likely to pass along to funds. Neither is desirable for fund shareholders.

Fourth, the review framework is needlessly complicated and has at least one significant ambiguity. The Commission has not presented a compelling reason for a two-step pre-distribution review process, especially when companies need not act during the first period. We also are troubled by the requirement to provide “a copy of such proxy voting advice that the proxy voting advice business will deliver to its clients… .” (emphasis added) It is unclear whether subsequent changes to the advice would re-set the review clock for companies. One easily can imagine scenarios where the linked comments are helpful (and could convince the PVAB to make certain necessary changes to its report), or where the PVAB believes that the linked comments are misguided, and wishes to explain why in its report. But if doing so triggers a new review period, “timeliness” is compromised. If a provision along these lines is retained, the SEC should clarify that any subsequent amendments do not trigger a new review period for companies.

Finally, delays caused by the proposed framework would limit the time that fund advisers have to engage with companies, particularly following a PVAB’s “against” recommendation on a management proposal or a “for” recommendation on a shareholder proposal. If a fund adviser has only a few days between receipt of proxy advice (which may include the company’s objection(s)) and the deadline to vote, there would be little time to communicate directly with the company, evaluate the competing claims of the company and the PVAB, and decide how to vote. In these cases, the company’s ability to rebut may be limited to its linked statement in the final advice. By contrast, having a system where recommendations are released sooner would allow for more comprehensive dialogue on important and complex topics.

3. The Framework’s Increased Costs to Funds and Shareholders Would Continue a Disturbing Regulatory Trend

More generally, we are deeply concerned by the cumulative and increasing regulatory costs that funds and their shareholders are bearing. In response to ICI’s 2017 survey, members reported a median increase in compliance costs of an estimated twenty percent over the previous five years. Members cited one-time compliance costs (e.g., legal costs, preparation of new policies and procedures, creation of internal controls, and staff training), increased technology expenditures, increased use of third- party fund service providers (i.e., vendors), increased vendor costs, increased oversight of vendors and intermediaries, and increased staffing needs as primary drivers of these overall cost increases. If adopted, these proxy advice amendments would be the latest rulemaking that increases vendor costs for funds and their shareholders.

ICI’s Proposed Alternative Review Frameworks

If the SEC is intent on providing a mandated review for companies, the process should be as efficient and unobtrusive as possible. Below we present two alternatives that achieve the SEC’s stated objectives without the previously-discussed deleterious effects on funds. The first would grant a company the right to review and comment on the PVAB’s benchmark report concurrent with its release to clients.

The second also would grant this concurrent review right, along with a limited right to review and comment on draft factual information prior the report’s distribution to clients. We recommend the first alternative, because it is simpler, less costly to implement, and less likely to compromise funds’ receipt of timely advice.

1. Preferred Alternative: Concurrent Review of PVAB Reports

The SEC could require that a PVAB do the following for any company that files its definitive proxy statement at least 60 days prior to the shareholder meeting:

As with the proposal, the PVAB could, but would not be obligated to, amend its final report. We strongly support this aspect of the SEC’s proposal, and it is imperative that the SEC retain it in any final framework. We also believe that companies should pay for access to these reports so that PVABs’ clients do not bear any expenses incurred to implement and administer this review framework.

As discussed in our March Letter, this framework would provide investors with a more complete, and easily accessible, “record” prior to casting votes. It would provide companies with another channel to communicate with investors and allow for better visibility of their comments on PVAB advice. Unlike the SEC’s proposal, this would not delay fund advisers’ review of PVAB advice, and it would help insulate fund shareholders from any cost increases resulting from these regulations.

2. Second Alternative: Limited Review of Draft Materials and Concurrent Review of Final Reports

While we do not favor this second alternative, if the SEC insists on providing companies the right to review draft PVAB materials prior to distribution to clients, we recommend that any such review framework have the following provisions:

This would provide the company with a second and more comprehensive review. Crucially, however, this review would not delay or shorten fund advisers’ reviews.

As with our preferred alternative, we believe that companies should pay for access to these reports so that PVABs’ clients do not bear expenses incurred to implement and administer this review framework. We would expect the expenses of this second alternative to be higher than those for the first.

II. Proposed Amendments to the Shareholder Proposal Rule (Rule 14a-8)

The parameters of the shareholder proposal rule are important to funds both as investors (funds vote on shareholder proposals for their portfolio companies) and issuers (funds receive and respond to proposals from their shareholders). In this section, we comment on the proposed rule amendments that would alter the current requirements for submitting and resubmitting shareholder proposals, and also recommend: (i) a requirement that mutual funds’ and ETFs’ shareholder proponents reaffirm periodically any outstanding proposals; and (ii) improvements to the SEC staff’s process for reviewing requests to exclude shareholder proposals.

A. Shareholder Eligibility Requirements

Currently, to submit a proxy proposal, a shareholder must continuously hold at least $2,000 in market value (or one percent) of a company’s stock entitled to vote for at least one year. The proposed changes would permit a shareholder to submit a proposal if the shareholder has continuously held at least: (i) $2,000 of the company’s securities for at least three years; (ii) $15,000 of the company’s securities for at least two years; or (iii) $25,000 of the company’s securities for at least one year.

ICI supports these changes. Considering minimum dollar investments in tandem with holding periods is a reasonable way to ensure that smaller shareholders maintain their access to this engagement channel, while also properly insisting that their interests be aligned with those of long-term shareholders generally. These changes recognize the costs that a single shareholder’s proposal generates for all shareholders and the importance of permitting long-term shareholders to submit shareholder proposals.

B. Resubmissions Thresholds for Shareholder Proposals

Rule 14a-8(i) provides 13 bases upon which a company may exclude a shareholder proposal, including a “resubmissions” exclusion. Currently, a fund may exclude a shareholder proposal to resubmit the same (or a similar) proposal that has been submitted during the preceding 5 calendar years if the prior proposal did not receive at least 3, 6, and 10 percent shareholder approval for the first, second, and third submissions, respectively. The proposal would raise those resubmission thresholds to 5, 15, and 25 percent, respectively, of “votes cast.”

ICI supports the proposed increases to the existing thresholds. But we recommend applying a different vote-counting methodology to closed-end funds, as described below.

We commend the Commission for relying on data and its experience with the shareholder proposal process. As we stated in our March Letter, the rule’s resubmission thresholds should permit exclusion of proposals that stand “no significant chance” of obtaining shareholder approval in a subsequent resubmission, and we believe the SEC’s proposal reasonably can be expected to accomplish this.

The proposed higher thresholds would preserve a shareholder’s ability to build support for its proposal through successive submissions while also reducing the number of repeat proposals that have little, or no, chance of gaining majority shareholder support. Such proposals impose costs on companies and also on those shareholders (including funds) that attempt to vote thoughtfully on those matters put before them. These costs simply are not justified where lack of support for a previously-unsuccessful proposal indicates little or no likelihood that a resubmitted proposal ever would gain acceptance.

We strongly recommend, however, that the Commission adopt a different vote-counting methodology for shareholder proposals resubmitted to closed-end funds. In particular, the Commission should calculate resubmission eligibility for closed-end funds using a “shares entitled to vote” rather than a “votes cast” standard. The recommended approach has precedent: Both current rule 14a-8 and the rule as proposed to be amended use an “entitled to vote” counting methodology for purposes of initial eligibility to submit a shareholder proposal. Additionally, the recommended approach would account better for the unique attributes and characteristics of closed-end funds and their shareholders and is consistent with the Commission’s overarching policy objectives.

Closed-end funds register under the Investment Company Act and register their shares under the Securities Act. The assets of a closed-end fund are professionally managed in accordance with the fund’s investment objectives and policies, and may be invested in stocks, bonds, and other assets. Closed-end funds generally issue a fixed number of shares that are listed on a stock exchange or traded in the over-the-counter market. The market price of closed-end fund shares fluctuates like those of other publicly-traded securities and is determined by supply and demand in the marketplace.

Therefore, a fund’s shares may trade at a price higher or lower than net asset value (NAV). A closed- end fund trading at a share price higher than its NAV is said to be selling at a “premium” to the NAV, while a closed-end fund trading at a share price lower than its NAV is said to be selling at a “discount.”

Closed-end funds generally have individual, retail “Main Street” investors who invest for the long-term and also have arbitrageurs who seek to profit at the expense of these long-term shareholders by taking advantage of situations where a fund’s shares are trading at a discount to NAV. Recently, such arbitrageurs have intensified their efforts to seize control of closed-end funds to extract short-term profits. Arbitrageurs typically accumulate large positions in the fund, and then seek to cause the fund to take immediate actions to provide liquidity at or near NAV (e.g., tender offer, conversion to open-end, or liquidation). These arbitrage tactics can cause serious harm to a fund and the interests of its long- term investors, including forcing fundamental changes to the nature of the product that are contrary to what Main Street investors sought when choosing to invest in the fund.

The Institute has been working closely with our closed-end fund members to assist with identifying ways, including through possible regulatory changes, that would provide closed-end fund boards with additional tools to protect long-term shareholders.

If the Commission were to amend Rule 14a-8 to permit closed-end funds to measure support for shareholder proposals using a “shares entitled to vote” standard, it would depict more accurately whether there truly is “widespread” support for a proposal that would merit allowing a shareholder to resubmit the proposal. In other words, for closed-end funds, the level of support should be assessed, in part, based on whether a sufficient portion of retail long-term shareholders have made the effort to both cast a vote and vote in favor of the proposal. A “votes cast” standard effectively discounts those who simply have chosen not to vote.

Applying a “shares entitled to vote” standard for closed-end funds would be consistent with the Commission’s policy of placing limits on the unfettered ability of one, or a few, shareholders to use the shareholder proposal process to repeatedly and unreasonably create significant costs for all shareholders. Importantly, it would relieve closed-end funds of the obligation to consider and spend resources on matters that do not reflect the views of the broader shareholder base.

C. “Momentum” Exclusion

Under the resubmissions exclusion, the proposal also creates an additional means of excluding shareholder proposals: A company could exclude a proposal that previously had been voted on three or more times in the last five years, notwithstanding having received at least 25 percent of the votes cast on its most recent submission, if at the time of the most recent vote the proposal: (i) received less than 50 percent of the votes cast; and (ii) experienced a decline in shareholder support of 10 percent or more compared to the immediately preceding vote (the “momentum exclusion”). The exclusion’s purpose is to relieve management and shareholders from repeatedly considering, and bearing the costs related to, matters for which shareholder interest has declined.

While we do not object to the momentum concept, we recommend modifying its parameters to require a greater decline in support. As proposed, the same shareholder proposal could garner shareholder support of:

If the shareholder proponent submitted it a fifth time, the company could exclude it from its proxy statement, notwithstanding the still-substantial level—44 percent—of shareholder support.

In our view, the Commission should permit a company to exclude a shareholder proposal that experiences a decline in support of 30 percent or more after at least three attempts. A decline of this larger magnitude would better assure that potentially viable proposals would not be excluded based on a relatively small decline in support that could be temporary.

D. Recommended Shareholder Affirmation of Outdated Proposals

The proposing release observes that mutual funds and ETFs generally do not hold annual shareholder meetings, and that several years may pass between submission of a shareholder proposal and the next shareholder meeting. The release then asks whether the Commission should consider requiring shareholder proponents to reaffirm prior proposals after some passage of time.

We recommend that the Commission adopt amendments to effectuate this. The Commission correctly notes that as time passes, the initial submission may no longer reflect the interest of the proponent, or the proponent may have sold its shares.

For funds with these outdated proposals, tracking and reconfirming them can be a significant administrative burden, given the fluidity of share ownership over long periods. Therefore, we recommend implementing an expiration date for shareholder proposals to open-end funds (e.g., three years from the date of submission, if no shareholder meeting has been held during that period). Absent resubmission or some other form of written reaffirmation of the initial proposal prior to expiration by the shareholder proponent (which would include reaffirmation that the shareholder continues to satisfy the rule’s eligibility requirements), the proposal would expire, and the fund would not be obligated to include it on the proxy statement for its next shareholder meeting.

E. Recommended Improvements to the Staff Review Process

While not addressed in the proposing release, the Division of Corporation Finance staff recently announced changes to its shareholder proposal exclusion review process. The staff stated that:

The staff weighs in only when the company wishes to exclude a shareholder proposal on one or more of the bases provided in Rule 14a-8(i). Staff involvement brings more certainty and consistency to the process and imposes discipline on companies and shareholder proponents alike.

We appreciate the difficulty of this staff work, but this announcement concerns us on both substantive and procedural grounds. Our members are apprehensive that these changes will promote uncertainty for all parties.

Given the importance of these matters and the tight time constraints of the proxy season, a company or fund that submits an exclusion request to the staff and receives no substantive reply will have three unappealing options: (i) include the proposal on its proxy statement and incur any related costs, despite misgivings about its appropriateness and legality; (ii) exclude the proposal from its proxy statement based on its interpretation and application of existing precedent, without any indication from the staff or a court that doing so is legally appropriate; or (iii) “seek formal, binding [court] adjudication,” as the staff’s statement suggests, with its attendant costs and uncertainty.

We recommend that the SEC and staff return to the status quo ante on a permanent basis. If the Commission is not willing to do so, we request that, at a minimum, it temporarily return to the status quo ante while it provides interested parties an opportunity to comment and share any observed consequences of the staff’s decision.

The complete publication, including footnotes, is available here.