Edouard Dubois is a partner at SquareWell Partners Ltd. This post is based on his SquareWell memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors by Lucian Bebchuk, Alma Cohen, and Scott Hirst (discussed on the Forum here); Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy by Lucian Bebchuk and Scott Hirst (discussed on the forum here); The Specter of the Giant Three by Lucian Bebchuk and Scott Hirst (discussed on the Forum here); Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Robert H. Sitkoff and Max M. Schanzenbach (discussed on the Forum here); Social Responsibility Resolutions by Scott Hirst (discussed on the Forum here).

After all the Best Wishes cards, executives and board members have become accustomed to receiving another type of letter every January. These coming from the CEOs of two of their largest investors, BlackRock and State Street Global Advisors (SSgA), managing respectively USD 6.96 trillion and 2.95 trillion of assets. Larry Fink (BlackRock) and Cyrus Taraporevala (SSgA) have written this year again to their portfolio companies, restating some familiar as well as some newer messages. Companies should pay attention to these missives as in the past they have not only set the tone for the engagements with these two global investment firms but also had an impact on the public policy debates around the world.

What were they saying last year?

These past years, as the level of public trust in institutions and corporations is taking a hit, Larry Fink had called for companies to focus on defining their sense of purpose; defending only purpose-led companies that respect their stakeholders will be able to create sustainable value while the others will disappear. Larry Fink argued that taking care of stakeholders is not only compatible with the profit maximization theory of Milton Friedman, but it is also the only sustainable approach: “a company cannot achieve long-term profits without embracing purpose and considering the needs of a broad range of stakeholders.” SSgA was also asking companies to pay more attention to their intangible value drivers, starting with their corporate culture and how it aligns with their long-term strategy. Since then, there have been more calls for an evolution or reform of capitalism. The CEO of Fidelity International, Anne Richards, declared last November that investors had to “rethink the very purpose of our economic systems“. “The pressure is coming from all around. It’s hard to find voices that defend ‘business as usual’ and actually even capitalism as a concept”, she added.

BlackRock focuses on climate change

This year Larry Fink is taking the next logical step, highlighting the need to rethink the financial system. As climate change is poised to reshuffle investment risks and drive a significant reallocation of capital, BlackRock wants to make sustainability at the centre of how they invest. It is hard not to remember the fake BlackRock letter published last year by a group of hoaxers, the Yes Men, just one day before the original one, that duped many journalists. While the spoof letter was making multiple public commitments about climate change, the real letter had shied away from making any of these promises.

In the twelve months since, the voices criticizing BlackRock have only gone louder, from the climate activists “BlackRock’s Big Problem” or Extinction Rebellion protesting in front of BlackRock’s offices to the dozen of US Congressmen sending a letter to Larry Fink regarding BlackRock’s responsibility in the destruction of the Amazonian forest. Even the nuns have joined the chorus, the “Sisters of Mercy”, an investment fund representing 9,000 nuns, have co-filed a shareholder proposal with a group of investors asking BlackRock to review how climate change is impacting its portfolios and to make sure its proxy voting on climate-related proposals is aligned with its fiduciary duty. To top it off, Al Gore himself criticized the two large index funds houses, BlackRock and Vanguard, for “financ[ing] the destruction of human civilization”.

Given the media coverage, one can safely assume that Larry Fink has received a significant amount of phone calls from puzzled clients. Asset owners themselves are under pressure to make sure they future-proof their investments as they look closer at how their managers are integrating sustainability into their processes. Larry Fink makes that point clearly: “climate change is almost invariably the top issue that clients around the world raise with BlackRock“. This is evidenced as well by the fact that for the first time BlackRock is writing not only to CEOs but also to its clients, to explain the company’s efforts regarding ESG integration.

Calling for greater standardization of sustainability disclosure

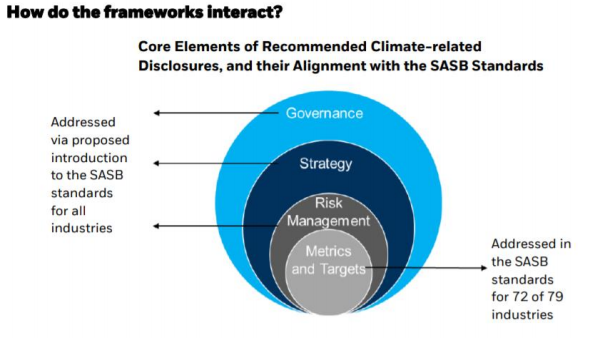

This year BlackRock and SSgA are publicly calling companies to comply with the frameworks created by the Sustainability Accounting Standard Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). The SASB standards might be unfamiliar to corporates outside of North America. Compared to the Global Reporting Initiative (GRI) framework, SASB is based on a limited number of industry-specific metrics that are deemed to be financially material and, therefore, being more relevant to investors. As such, we would recommend that companies around the world familiarize themselves with what is considered as material by SASB for their industry.

The TCFD recommendations, on the other hand, have been gaining international recognition since their publication and the European Union, as well as the United Kingdom, have been pushing for their implementation. While BlackRock does not go as far as requesting emission reduction targets approved by the Science Based Targets initiative (SBTi), they do expect companies to have a “plan for operating under a scenario where the Paris Agreement’s goal of limiting global warming to less than two degrees is fully realized”.

It is the first time, to the extent of our knowledge, that an investor is calling for the use of the TCFD framework not only for climate-related risks but for “all material environmental and social (E&S) factors”. We note that the letter does not mention any specific sector regarding these requirements. Given the global impact of climate change and potential regulations, including a carbon price, all companies should get accustomed with these frameworks and examine if their disclosure is appropriate. BlackRock has published a note with further details on their engagement approach on climate change.

Source: BlackRock Investment Stewardship’s Approach to Engagement on the TCFD and the SASB Aligned

Reporting, 2020.

Sustainability is also at the core of SSgA’s letter which is directed to all the board members of their portfolio companies. SSgA is putting boards around the globe on notice, announcing that “fewer than 25% of the companies we’ve evaluated have meaningfully identified, incorporated and disclosed material ESG issues into their strategies”. SSgA expects companies to have “meaningfully identified, incorporated and disclosed material ESG issues into their strategies”.

To the companies that are concerned by the number of competing ESG frameworks, SSgA had already answered previously “We consider SASB reporting a floor, not a ceiling, and encourage you to consider SASB disclosure as a primary ESG disclosure for investors, while continuing to draw on other frameworks as appropriate”. In a policy paper published concomitantly of the CEO letter, BlackRock is calling for a consolidation of the different ESG reporting frameworks to ensure a better standardization. The giant investment house is also supporting the concept of a common definition of “sustainable investing” in order to enable “asset owners to differentiate products and provides clear, transparent data regarding product attributes”. To avoid “greenwashing” by asset managers, BlackRock argues that there needs to be “a common understanding of what constitutes a sustainable investment”.

ESG integration is a fiduciary duty

The focus on ESG materiality from these two asset managers is strategic. They make clear that ESG integration is part of their fiduciary duty to their clients. In the United States more particularly, critics have implied in the past that integrating ESG criteria could have a negative impact on the financial performance of funds and therefore violates the investors’ fiduciary duty. In the Trump era, even more investors have had to make the case that ESG investing is just good business: “this is a matter of value, not values”, in the words of Cyrus Taraporevala. In the past, Larry Fink had been criticized for trying to advance his own political and personal agenda. However, this is not about investors “imposing their views of ‘doing good’ on society”, contrary to the views of Warren Buffet, but about investors enriching their investment decisions by considering all material financial risks.

BlackRock makes sustainability its new standard for investing

In the letter to their clients, BlackRock is explaining how they are working on building more resilient portfolios which are taking account of sustainability risks, including in particular the impacts of climate change and the energy transition:

- Active funds will push further the integration of sustainability factors in their investment decisions and will reduce their exposure to high ESG risk sectors, starting by divesting from companies that generate more than 25% of their revenues from thermal coal production;

- BlackRock will offer a more sustainable version of their funds and their iShares Exchange Traded Funds (ETF), with the intention of doubling their offering of ESG ETFs; and

- BlackRock will engage with index providers to create sustainable versions of their flagship

Investors develop proprietary sustainability ratings

Asset managers are looking to develop their own proprietary ESG data and tools to lessen their dependence on rating firms such as MSCI or Sustainalytics. SSgA is integrating ESG factors through the use of its R-Factor (the ‘R’ stands for Responsibility), “a transparent scoring system that measures the performance of a company’s business operations and governance as it relates to financially material and sector-specific ESG issues”. The R-Factor is based on the SASB framework and local corporate governance codes. The technological platform of BlackRock, Aladdin, will also integrate ESG proprietary measurements tools, including physical climate risks and carbon pricing stress-testing.

SquareWell notes that other investors including Allianz Global Investors, Schroders, Aviva Investors, and Norges Bank Investment Management have also developed their own internal ESG rating tools. These internal ratings may take into account the quality of their engagements with portfolio companies, which creates an additional incentive for listed companies to meet regularly their shareholders and respond to their concerns.

BlackRock walking the talk?

As BlackRock is asking companies to improve their reporting, it also commits to improving its own disclosure as publicly-listed company. To show its intention to “walk the talk”, BlackRock published a few days earlier than the letter its own SASB report, albeit with 2018 metrics. BlackRock has committed to disclose by year end an ESG score, the carbon footprint and other sustainability elements for its ETF iShares range and mutual funds. Additional disclosure will also concern their engagement and voting efforts with quarterly reporting, including a voting rationale, and more extensive explanations for their most strategic votes. They did not wait long since the publication of this year’s letter as two voting bulletins have already been published this year, including one regarding the general meeting of Siemens AG. Their Stewardship reports will also start listing the topics addressed during their engagements with portfolio companies while current reports were only disclosing the names of companies.

BlackRock and SSgA put the onus on board members

In their letters, the two fund houses identify clearly who will be held responsible in the case of a company failing to disclose the necessary information on their sustainability practices: board members. Given that most of their assets are invested through index funds, BlackRock and SSgA are limited in their actions as they cannot divest from companies. While they cannot exit, they will use their voice and they will vote against board members whenever their concerns are not addressed. This is a meaningful development in the corporate governance universe where for too long investors and proxy advisors have limited their analysis of director elections to an assessment of their independence and diversity. Holding board members accountable for their actions, or lack thereof, is a positive evolution of stewardship which could be material given the voting weight of the two investment houses.

SquareWell would advise companies to read with close attention not only the letters but also the different viewpoints that these two giant investors have published in the last months as they detail clear expectations regarding ESG disclosure from their portfolio companies. The two large asset managers have given teeth to their statements with the threat to vote against board members of laggard companies. Time will tell if BlackRock and SSgA are respecting their New Year resolutions, the world is watching.

Print

Print