Doreen E. Lilienfeld is a partner and Matthew Behrens is an associate at Shearman & Sterling LLP. This post is based on their Shearman memorandum.

From Wall Street to the soccer pitch, public interest in addressing the gender pay gap is greater than ever. While the press covers the U.S. Women’s World Cup team’s struggles to earn equal pay for equal (or, rather, superior) work, ESG-focused investors are demanding more granular disclosure of companies’ efforts to close the gender pay gap. Companies that fail to address gender pay inequality may not only see reputational damage, but may find themselves at a competitive disadvantage as talent migrates to those companies that prioritize fair pay and opportunities for career advancement. Companies that do not keep up face the risk of potential legal action, as well as shareholder and consumer backlash.

This post analyzes recent developments in the gender pay gap debate and offers practical advice to companies confronting deficiencies in this area.

The Gender Pay Gap as an Opportunity Gap

Here are the facts: In 2019, the median pay for women is 21% less than the median pay for men or, put another way, women earn only 79 cents for every dollar earned by a man. [1] When factoring in race, the gap grows even larger. For each dollar earned by a white man, a white woman earns 80 cents while American Indian, Alaska Native, black and Hispanic women earn just 74 cents. By its nature, a “median pay” comparison is derived without regard to job type, seniority, location, experience or other similar factors. When applying an “equal pay” measure that controls for the same position and qualifications, the gap shrinks substantially — such that white women earn 98 cents for every dollar earned by a white man while non-majority women with similar educational and other qualifications earn 97 cents for every dollar earned by a white man. [2]

The large median pay gap compared to the smaller “equal pay gap” serves to illustrate that the gender pay gap may be more properly characterized as an “opportunity gap.” For example, while 75% and 74% of men and women, respectively, start their careers as individual contributors (i.e., they do not manage others), by late career, 57% of men are managers or higher while only 41% of women reach managerial ranks. As discussed below, shareholder proposals on gender pay are evolving in light of investor recognition that the gender pay gap reflects a failure to promote women to, or hire them for, jobs with more responsibility that are higher paying. [3]

The “Equal Pay” Gap

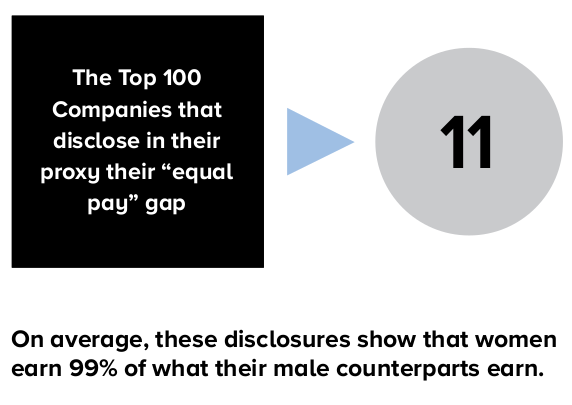

Since 2015, more than 60 companies have received shareholder proposals on their gender pay gap. Although initially focused on the tech sector, more recent proxy seasons have seen a proliferation of these proposals in the financial services and retail sectors and, in 2019, in the healthcare sector. The companies targeted by these proposals were some of the largest public companies in the world, which has significantly elevated the prominence of the issue. Prior to the 2019 proxy season, these proposals demanded disclosure of the “equal pay” gap, i.e., the disparity in pay between men and women with comparable jobs and qualifications, as adjusted for factors such as geography and seniority. In 2018, of the 33 proposals that were filed, 24 were withdrawn as companies agreed to make disclosures and work to close their pay gaps. [4]

2019: The “Median Pay” Gap

While the recent disclosures on the equal pay gap is a welcomed development, these disclosures do not provide information as to the opportunity gap or the representation of women in the most high-paying positions. As a result, in 2019, Arjuna Capital, which has led the fight for gender pay gap disclosures, targeted 12 companies across the banking, tech and retail sectors with a “median pay gap” proposal. The proposal would require the issuer to disclose the median pay of women working full time to that of men working full time. The disclosure of a “median pay” gap is not new to companies that operate in the United Kingdom. Under regulations that became effective in 2017, organizations with over 250 employees doing business in the United Kingdom are required to publish annually their median gender pay gap on a government website.

Of the 12 companies targeted by Arjuna Capital, only Citigroup disclosed its median pay number, which resulted in Arjuna withdrawing its shareholder proposal and Citigroup being the only company to earn an “A” on a Gender Pay Scorecard issued by Arjuna Capital and Proxy Impact. Along with its voluntary disclosure, Citigroup discussed its efforts to reduce the disparity in pay, including increasing representation at the Assistant Vice President through Managing Director levels to at least 40% for women by the end of 2021. (Citigroup also disclosed the median pay for U.S.-based non-majority employees and discussed its efforts to increase representation at the Assistant Vice President through Managing Director levels to at least 8% for black employees in the U.S. by the end of 2021.) Arjuna Capital’s shareholder proposal failed at the other 11 companies it targeted, but the pressure on issuers to close the gender pay gap is not going to fade.

Government Actions

Issues of pay equity are not being left to private ordering alone. Governments, at all levels, and courts are addressing the issue, too.

EEOC

On April 25, 2019, the U.S. District Court for the District of Columbia ordered the Equal Employment Opportunity Commission to comply with an Obama administration rule requiring the collection of pay data, broken down by race, gender and ethnicity. By September 30, 2019, employers with at least 100 employees must report to the EEOC wage information and total hours worked for all employees by race, ethnicity and gender.

Proposed Federal Legislation

In Congress, the Paycheck Fairness Act, first introduced in 1997, was passed by the House of Representatives in March 2019. The bill would, among other things, prohibit employers from using salary history as a way to set salaries for job candidates and from retaliating against workers who discuss their wages. In addition, it would allow workers to sue for punitive damages for wage discrimination.

State Laws

On July 10, 2019, New York became the latest state to strengthen its equal pay legislation, expanding its protections from gender-based discrimination in pay practices to discrimination against additional protected classes, including, among other classes, age, race, creed, sexual orientation and gender identity or expression. In addition, on the same date, New York became the most recent state to forbid employers from asking prospective employees about their salary history, or from relying on salary history to determine wages for any individual.

Litigation

Prior to the start of the 2019 FIFA Women’s World Cup, the U.S. Women’s World Cup team filed a class action suit against the United States Soccer Federation (USSF) for violations of the Equal Pay Act and Title VII of the Civil Rights Act of 1964, because the USSF pays the women’s team substantially less than their male counterparts. The case is far from the only gender pay lawsuit working its way through the courts. In 2018 and 2019, high-profile gender pay class action lawsuits were filed against a number of companies, including Nike, Disney, Oracle and Google.

What Can Companies Do Now?

The following is a list of action items for companies concerned about pay inequality within their organization.

Take stock

Companies should consider conducting a comprehensive pay audit that examines pay practices at every level in the organization, and make adjustments to practices that perpetuate pay differences.

Set goals

Establish goals for gender representation at senior levels throughout your organization and track your progress against your goals.

Hold managers and directors accountable

Ensure those making hiring and promotion decisions are held accountable for making progress towards gender equality in the organization. Recently, Uber announced it would be linking incentive compensation to the achievement of workplace diversity goals as it seeks to increase the percentage of women and other underrepresented groups in managerial roles.

Examine hiring and promotion practices

Companies must train managers to identify unconscious bias in hiring, promotion and compensation decisions. Many factors have been cited as contributing to the lack of promotion of women—including job “segregation,” where women are tapped for roles that typically do not lead to career progression, and unintentional penalties imposed following leaves of absence for caregiving. Further, provide female employees with mentoring opportunities that can serve to guide them in their career paths.

Engage with shareholders

As part of a company’s regular shareholder engagement, discuss with key shareholders their posture on gender pay parity. Companies should be prepared to have a frank dialogue on the issue and discuss goals and steps taken by the company.

Endnotes

1See Payscale, The State of the Gender Pay Gap 2019.(go back)

2Id.(go back)

3Id.(go back)

4See Arjuna Capital and Proxy Impact, Gender Pay Scorecard, Second Edition.(go back)

Print

Print