David H. Kistenbroker, Joni S. Jacobsen, and Angela M. Liu are partners at Dechert LLP. This post is based on their Dechert memorandum.

Introduction

Companies headquartered or with principal places of business outside the United States (“non-U.S. issuers”) continue to be targets of securities class actions filed in the United States. Indeed, 2019 continued to see an uptick in the number of securities class action lawsuits brought against non-U.S. issuers from the previous year, consistent with the general trend of filings trending upwards over the last decade. It is therefore imperative that multinational companies not only pay attention to recent filing trends in the United States, but that they also take proactive measures to mitigate any potential risks.

In 2019, plaintiffs filed a total of 64 securities class action lawsuits (as compared to 54 in 2018) against non-U.S. issuers through a total of 83 securities class action complaints filed before consolidation:

- The Second Circuit continued to be the jurisdiction of choice for plaintiffs, with the next most popular circuit as the Third Circuit.

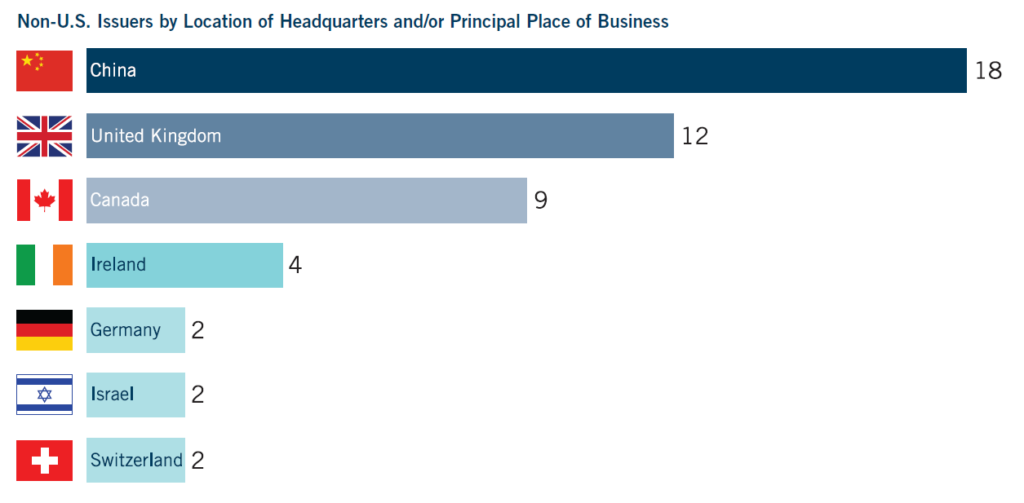

- Of the 64 non-U.S. issuers against whom securities class action complaints were filed in 2019, 18 have a headquarters and/or principal place of business in the People’s Republic of China (“China”), 12 in the United Kingdom, and nine have corporate headquarters and/or principal places of business in Canada.

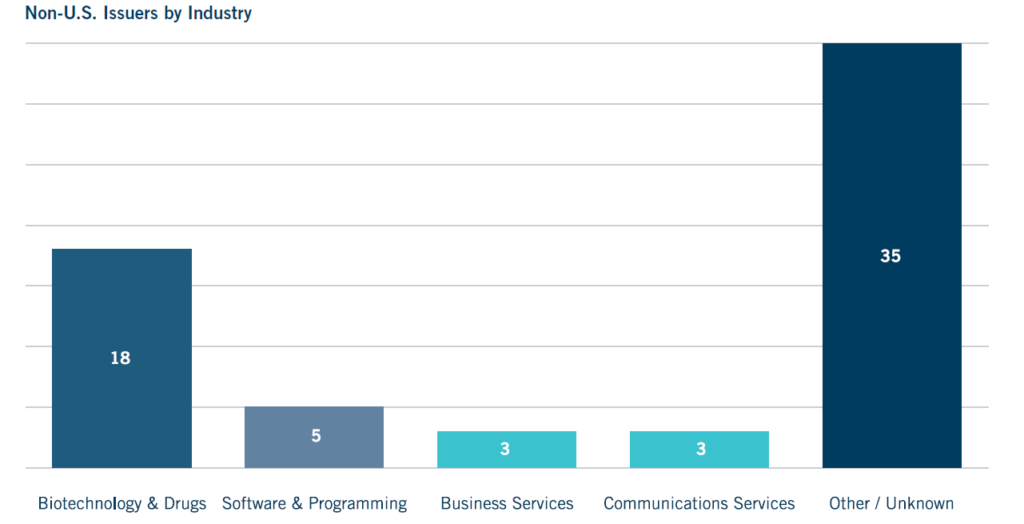

- The biotechnology and drugs industry was the industry with the largest number of class action lawsuits brought against non-U.S. issuers with 18 filed in 2019.

- The Rosen Law Firm P.A. continued to be the most active law firm in this space, leading the way with respect to first-in-court filings against non-U.S. issuers in 2019 and with respect to the number of cases in which it was appointed as lead counsel.

An examination of the types of cases filed against non-U.S. issuers in 2019 reveals the following substantive trends that were notable and specific to this year:

- Six of the non-U.S. issuers against whom securities class actions were filed in 2019 are alleged to have misrepresented the prospects of approval by the U.S. Food and Drug Administration (“FDA”) and/or compliance with FDA rules and regulations.

- Three of the non-U.S. issuers against whom securities class actions were filed in 2019 are alleged to have failed to disclose alleged violations of Chinese government regulations.

- Three of the securities class actions filed against non-U.S. issuers in 2019 related to alleged bribery schemes.

- Seven of the non-U.S. issuers against whom securities class actions were filed in 2019 are alleged to have failed to disclose conflicts of interest that were purportedly relevant to investors.

In addition to these filings, in 2019, the U.S. Supreme Court also denied certiorari in the closely watched Toshiba matter, resulting in the Central District of California denying the newly filed motion to dismiss. As discussed herein, this was an important decision for non-U.S. issuers with unsponsored American Depositary Receipts (“ADRs”).

Further, courts in 2019 and early 2020 issued fewer dispositive decisions on motions to dismiss in securities class action lawsuits brought against non-U.S. issuers than were issued in 2018 and early 2019. Specifically, only seven dispositive motions to dismiss decisions were rendered with respect to securities class actions that were initiated in 2018.

In addition, four 2018 filings were voluntarily dismissed in their entirety while one 2018 filing was dismissed in its entirety pursuant to a stipulation between the parties. There were no dispositive motions to dismiss decisions rendered with respect to 2019 filings, but eight 2019 filings were voluntarily dismissed in their entirety, and one 2019 filing was dismissed in its entirety pursuant to a stipulation between the parties.

Although it is hard to discern trends from just seven dispositive decisions, the courts’ reasoning for dismissing cases—discussed below—is still instructive for non-U.S. issuers who may find themselves subject to securities class actions.

Non-U.S. Companies Remain Popular Targets for Securities Fraud Litigation

2019 saw an uptick in the number of securities class actions filed against non-U.S. issuers. This survey is intended to provide an overview of securities lawsuits against such companies. First, we analyze the number of cases filed, including trends relating to location of the courts, types of companies that are targeted and counsel retained. Next, we analyze the dispositive securities decisions rendered against non-U.S. issuers in 2019 and early 2020 in an effort to provide insight to non-U.S. issuers who may find themselves subject to securities class actions.

Filing Trends

In 2019, 404 securities class action lawsuits were brought with an increase over the previous year. Just over 15% (64 of 404) of the class action lawsuits that were brought in 2019 were brought against non-U.S. issuers, a slight uptick from 2018 when 54 class actions lawsuits were brought against non-U.S. issuers. These class action lawsuits were initiated through 83 securities class action complaints. As in years past, certain filing trends emerged:

- The Second Circuit continued to be the jurisdiction of choice for plaintiffs in 2019. More than 70% of the original 83 class action complaints (59) were initially filed in the Second Circuit with 41 of those filed in the Southern District of New York. The next most popular circuit was the Third Circuit, with 15 lawsuits initiated there. The Ninth Circuit saw five initial complaints and the Eleventh and Fifth Circuits followed, with two initial complaints each.

- Of the 64 non-U.S. issuers against whom securities class action complaints were filed in 2019, 18 have corporate headquarters and/or principal places of business in China. Of these 18 companies, 15 are incorporated in the Cayman Islands. None appear to be incorporated in China.

- Twelve of the non-U.S. issuers against whom securities class actions were filed in 2019 have corporate headquarters and/or principal places of business in the United Kingdom. Nine have corporate headquarters and/or principal places of business in Canada.

- With the legalization of recreational marijuana in Canada, six of the Canadian companies against whom securities class actions were brought in 2019 were cannabis- related companies.

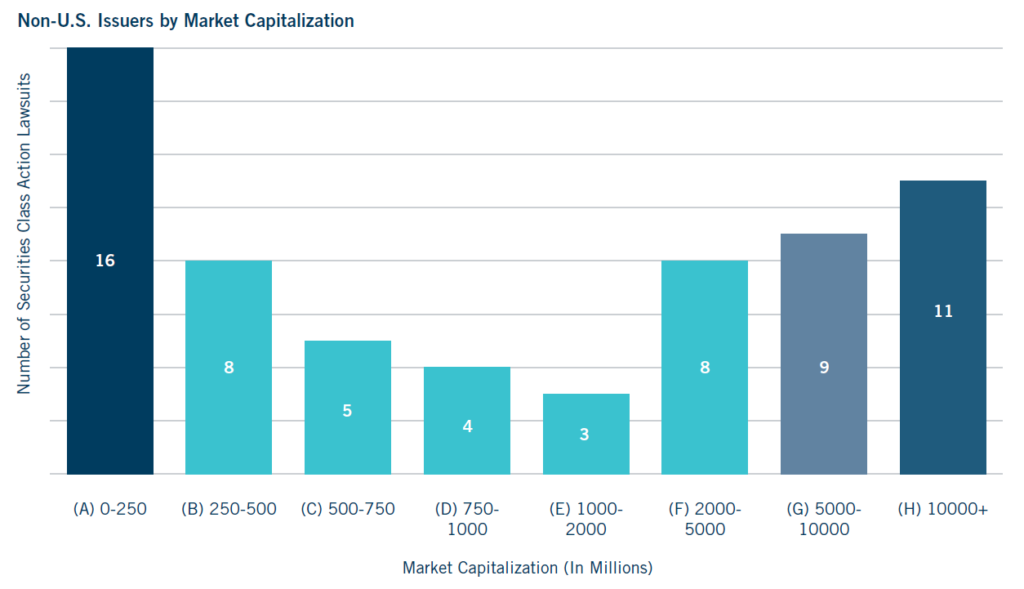

- The market capitalization of the non-U.S. issuers at the time at which the securities class actions were filed largely consisted of both smaller market cap companies (16 of 64) under US$250 million and larger market cap companies (20 of 64) over US$5 billion.

- The biotechnology and drugs industry was the industry with the largest number of class action lawsuits, with 18 filed in 2019 against non-U.S. issuers.

- As in 2018, the Rosen Law Firm P.A. continued to be the most active law firm in this space. It led the way with respect to the number of first-in-court filings against non-U.S. issuers in 2019 (20) and with respect to the number of cases in which it was appointed as lead counsel (13).

- Also as in 2018, Pomerantz LLP and Glancy Prongay & Murray LLP followed with respect to first-in-court filings. Specifically, Pomerantz LLP was associated with 12 first-in-court filings, whereas Glancy Prongay & Murray LLP was associated with seven first-in-court filings. With respect to lead counsel, Levi & Korsinsky, LLP followed the Rosen Law Firm P.A. and was appointed as lead counsel in seven cases while Pomerantz LLP and Robbins Geller Rudman & Dowd LLP were appointed as lead counsel in six cases each.

Substantive Trends

An examination of the types of cases filed in 2019 reveals four notable trends this year in securities class actions brought against non-U.S. issuers. Specifically, companies are alleged to have:

- misrepresented the prospects of FDA approval and/or compliance with FDA rules and regulations;

- failed to disclose alleged violations of Chinese government regulations;

- engaged in bribery; and

- failed to disclose conflicts of interest that were relevant to investors.

Cases Involving FDA Compliance

In 2019, the industry in which the largest number of securities class actions were filed against non-U.S. issuers was the biotechnology and drugs industry, with 18 of 64 securities class action suits filed. Several of the complaints against these companies involved allegations that defendants misrepresented the prospects of approval in the United States by the FDA and/or compliance with FDA rules and regulations. Two such cases were filed in the District of New Jersey, where the multinational companies had U.S. operations. In In re Travis Ito-Stone, et al. v. DBV Technologies S.A., et al.,17 investors brought suit against defendant DBV, a pharmaceutical company incorporated and headquartered in France with North American operations based in New Jersey, which supported the company’s manufacturing needs in North America. DBV trades on the National Association of Securities Dealers Automated Quotations System (“NASDAQ”). The company allegedly failed to disclose serious manufacturing and quality control issues with its proposed peanut allergy treatment. These issues allegedly threatened the product’s prospects of obtaining FDA approval in the United States of DBV’s Biologics License Application and ultimately caused DBV to withdraw its application. In re Amarin Corporation plc Securities Litigation involves allegations that defendant Amarin, headquartered in Ireland with a U.S. office in New Jersey, disclosed positive results from its clinical trials aimed at showing that the drug Vascepa could be used to reduce the risk of cardiovascular events, while failing to disclose two key issues with the results related to (1) the appropriateness of the placebo used, and (2) the drug’s causal mechanism. The plaintiffs allege that Amarin and its officers and directors, understood that those issues were significant to the scientific community, investors and the public and that they could impact Vascepa’s prospects for FDA approval.

Other cases involving alleged misrepresentations of FDA approval prospects were filed in the Southern District of New York, presumably because the companies trade on exchanges located within the district. For example, in Larry Enriquez, et al. v. Nabriva Therapeutics plc, et al., the plaintiffs allege that Irish defendant Nabriva, which trades common stock on the NASDAQ, led the market to believe that FDA approval for a drug called Contepo was imminent and failed to disclose serious manufacturing problems that eventually led the FDA to refuse to approve the Contepo New Drug Application (“NDA”) as well as a significant delay in the drug’s potential approval timeline. The disclosure of the FDA’s refusal on April 20, 2019 led to a 27% decline in Nabriva’s share price by market close on May 1, 2019. Likewise, in Josh Feierstein, et al. v. Correvio Pharma Corporation, et al., the plaintiffs allege that the Canadian pharmaceutical company, Correvio (which trades on the NASDAQ), failed to disclose that the data supporting the resubmitted NDA for a treatment for the rapid conversion of recent onset atrial fibrillation (“AFib”) to sinus rhythm did not minimize the significant health and safety issues observed in connection with the drug’s original NDA (namely, the death of a patient with AFib), which substantially diminished the likelihood of FDA approval.

Finally, in Daniel Brody, et al. v. Mylan N.V., et al.,22 investors filed in the Western District of Pennsylvania and allege that Dutch pharmaceutical company Mylan, with facilities in Pennsylvania, failed to disclose violations of FDA regulations at its’ Morgantown, West Virginia manufacturing facility and that the company lacked effective internal control over financial reporting. As a result, the complaint alleges that upon the announcement of a restructuring and remediation program at Mylan’s Morgantown facility, the stock price dropped about 6.68%. The stock price dropped an additional 15.06% and later 23.81% purportedly upon further announcements of financial results.

Cases Involving a Failure to Disclose Alleged Violations of Chinese Government Regulations

Of the 64 non-U.S. issuers against whom securities class actions were filed in 2019, 18 have corporate headquarters and/or principal places of business in China. Some of the non-U.S. issuers against whom securities class actions were filed in 2019 allegedly failed to disclose violations or potential violations of Chinese government regulations, the U.S. nexus for these cases being that the companies traded American Depository Shares (“ADSs”) on the New York Stock Exchange (“NYSE”) or NASDAQ. For example, in Theresa Gordon, et al. v. Tencent Music Entertainment Group, et al., the plaintiffs sued Tencent Music Entertainment Group—an operator of online music entertainment platforms that is headquartered in China, incorporated in the Cayman Islands, and trades ADSs on the NYSE. Investors allege that the registration statement and prospectus that Tencent had filed in connection with its IPO in late 2018 failed to disclose and/or made materially false and/or misleading statements regarding the anti-competitive efforts in which it was engaged and that such efforts “were reasonably likely” to result in Chinese regulatory scrutiny. Specifically, in these filings, Tencent allegedly failed to disclose that its exclusive licensing agreements with record labels were anti-competitive and that that due to the anti-competitive nature of those licensing agreements, sublicensing content from Tencent was “unreasonably expensive”—a violation of Chinese antimonopoly laws. The plaintiffs further allege that when the anti-competitive nature of these agreements came to light on August 27, 2019, the price of Tencent’s ADSs fell by 6.8%.

Investors likewise filed suit against Momo Inc., an operator of “several mobile-based social and entertainment platforms” in China. The plaintiffs allege that in 2014, the Chinese government found that Momo was a “purveyor” of pornographic content and that, in 2015, it fined the company. In addition, the Chinese government allegedly ordered the company to “shut down all pages that featured pornographic media, screen all media for pornography[,] temporarily make it impossible for users to upload media[,] submit a rectification report and make a public apology.” The plaintiffs allege that in an effort to demonstrate to investors that it was no longer engaged in illicit activities, Momo—in its Securities and Exchange Commission (“SEC”) filings—claimed that it was engaged in extensive content moderation to filter out indecent content. But the plaintiffs allege that the reality was different. For example, the plaintiffs claim that a mobile dating application that Momo had acquired in 2018 was used to facilitate prostitution. When a journalist brought the alleged prostitution to light, the Chinese government allegedly took action, which included removing the application from Android phones and from Apple’s App Store. The plaintiffs allege that the disclosure and subsequent action caused Momo’s stock price to fall, damaging investors. The plaintiffs further allege that Momo failed to disclose in its SEC filings its relationship—and the resulting risk of exposure to Chinese government regulation—with a talent agency that Momo allegedly used to find live performers (the majority of whom were allegedly “young attractive women”). When a third-party analyst disclosed this relationship, Momo’s stock price fell, allegedly further damaging investors.

Cases Involving Bribery

Non-U.S. issuers can also be the subject of securities class actions arising out of alleged or admitted bribery schemes occurring inside and/or outside of the United States. Such cases were filed against three companies in 2019. In Shayan Salim, et al. v. Mobile TeleSystems PJSC, et al., the plaintiffs allege that Russian telecommunications company Telesystems defrauded investors by issuing false and misleading statements about the company’s liability for an illegal bribery scheme involving payments by a subsidiary for the benefit of an Uzbek government official in order to enter and operate in the Uzbek telecommunications market between 2004 and 2012; the effectiveness of the company’s internal controls and compliance; and the company’s cooperation with a United States Foreign Corrupt Practices Act investigation, which led to a deferred prosecution agreement that was unsealed in March 2019. The stock price allegedly fell approximately 8% on November 20, 2018 after the magnitude of the company’s potential liability to the SEC and the U.S. Department of Justice (“DOJ”) for the bribery scheme was disclosed. The stock price allegedly dropped an additional 3% on March 7, 2019, when the Deferred Prosecution Agreement with the DOJ was unsealed.

In Jung Kyoon Kong, et al. v. Fiat Chrysler Automobiles N.V., et al., also filed in the Eastern District of New York, the plaintiffs allege that Fiat made false and misleading statements in its SEC Form 20-F filings by failing to disclose a bribery scheme that the company engaged in in order to obtain favorable terms in its collective bargaining agreement with International Union, United Automobile, Aerospace and Agricultural Implement Workers of America. According to the complaint, the details of the bribery scheme began to emerge on November 20, 2019, when General Motors filed a racketeering lawsuit against Fiat, which purportedly caused the stock price to drop.

In William Likas, et al. v. ChinaCache International Holdings Limited, et al., which is pending in the Central District of California, plaintiffs claim that ChinaCache, a Chinese Company incorporated in the Cayman Islands and which trades ADRs on the NASDAQ, made materially false and misleading statements by failing to disclose that ChinaCache and the company’s Chief Executive Officer and Chairman of the Board of Directors were engaged in enterprise bribery. Details of the bribery scheme are not alleged. Upon the announcement, on May 17, 2019, of a criminal investigation into the bribery scheme in China, as well as the CEO’s arrest and resignation, the company’s stock price allegedly fell 20%. A few days later, the company disclosed the receipt of a letter concerning the company’s failure to comply with NASDAQ listing requirements. Trading of the company’s shares was halted as of the date the complaint was filed, and the company has since been delisted.

Cases Involving Conflicts of Interest

Several cases filed in 2019 allege violations of the securities laws based on a failure to disclose conflicts of interest and significant related party transactions. Many of these purported violations came to light in connection with the companies’ involvement in a transaction that is unrelated to the United States.

For example, in Nancy Lin, et al. v. Liberty Health Sciences Inc., et al., filed in the Southern District of New York, investors brought a securities class action suit against the Toronto-based company Liberty, whose principal business activity is the production and distribution of medical cannabis in Florida. The plaintiffs allege that Liberty violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) by failing to disclose the details of insider transactions, including the acquisition of assets in Latin America via shell entities designed to profit the owners of those entities and an unannounced stock sale which purportedly benefitted insiders at the expense of shareholders.

In Bradley Thomas, et al. v. China Techfaith Wireless Communication Technology Limited, et al., filed in the Eastern District of New York, the plaintiffs allege that “[t]he two brothers who run the Company, Defendant Deyou Dong, current Chairman (“Defendant Dyou”), and Defendant Defu Dong, former Chairman (“Defendant Defu”), have together caused China TechFaith to engage in undisclosed related party transactions with Defendant Defu’s privately-owned companies that, over the years, have effectively stolen nearly all of the Company’s business and assets and caused the Company’s performance to continuously deteriorate and become an unprofitable shell of its former self.” “China TechFaith’s failure to disclose the material related party transactions . . . violated GAAP, and SEC regulations and rendered China TechFaith’s financial statements false and misleading.” Investors allege that when the damage to the company’s financial condition caused by the defendants’ fraudulent undisclosed related party transactions was disclosed over time, the value of China TechFaith shares declined, damaging investors.

In Mark Mikhlin, et al. v. Oasmia Pharmaceutical AB, et al., also filed in the Eastern District of New York, the plaintiffs allege that Swedish biotech company Oasmia violated Sections 10(b) and 20(a) of the Exchange Act by failing to disclose the off-the-books related party transactions and outright theft carried out by Oasmia’s former CEO, Defendant Julian Aleksov, and Defendant Bo Cederstrand, former Chairman of the board of Oasmia and a member of Aleksov’s family.

Some conflicts of interest cases involving transactions were filed in the District of Delaware. For example, in Michael Kent, et al. v. Avon Products, Inc., et al., filed in the District of Delaware, the plaintiffs allege violations of Sections 14(a) and 20(a) of the Exchange Act against Defendant Avon Products. The complaint alleges that Avon omitted material information from the proxy statement filed in connection with Avon’s proposed acquisition by Natura Cosmeticos including about the companies’ financial projections; the analysis performed by Avon’s financial advisors Goldman Sachs and PJT Partners; confidentiality agreements that may have prevented superior acquisition offers; and PJT’s potential conflicts of interest as a result of having provided past services to Avon, its affiliates and/or Cerberus Capital Management L.P., controlling shareholder of Avon. The case was voluntarily dismissed on January 22, 2020.

Eric Sabatini, et al. v. Foamix Pharmaceuticals Limited, et al., also was filed in the District of Delaware and alleges violations of Sections 14(a) and 20(a) of the Exchange Act. The complaint alleges that Israeli pharmaceutical company Foamix omitted material information in its registration statement filed in connection with a proposed merger between Foamix and Menlo Therapeutics Inc. The complaint alleges that the registration statement omits information regarding financial projections, cash-flow analysis and potential conflicts of interest of Foamix’s financial adviser, Barclays Bank PLC, as a result of failing to disclose the amount of compensation Barclays received for past services to Foamix.

Motion to Dismiss Decisions

Stoyas v. Toshiba Corp. et al.

It is worth noting the much-anticipated recent decision by Judge Pregerson in Mark Stoyas v. Toshiba Corporation et al. in the Central District of California as it demonstrates that even companies with unsponsored ADRs trading in the United States can be subject to U.S. securities laws.

The defendant in Stoyas is Toshiba Corporation—a “worldwide enterprise that engage[s] in the research development, manufacture, construction, and sale of a wide variety of electronic and energy products and services”— which is headquartered in Japan. The plaintiffs allege that Toshiba violated the Exchange Act as well as Japan’s Financial Instruments & Exchange Act (“JFIEA”). Toshiba’s common shares trade on the Tokyo stock exchange, but Toshiba has unsponsored Level I ADRs that trade in the United States (i.e., the ADRs were set up by a depositary bank without Toshiba’s involvement). All claims relate to allegations of fraudulent accounting and misrepresentations. The court originally dismissed the first amended complaint with prejudice in 2016. The plaintiffs then appealed, and on July 17, 2018, the Ninth Circuit reversed and remanded. Though the Ninth Circuit held that plaintiffs had not sufficiently alleged a domestic transaction nor sufficiently alleged that the fraudulent conduct was “in connection with” the sale of securities, the court concluded that leave to amend should have been granted. The U.S. Supreme Court denied certiorari. On August 8, 2019, the plaintiffs filed a second amended complaint, and the defendants moved to dismiss.

This time, Judge Pregerson denied the motion to dismiss. The court found that the plaintiffs plausibly alleged that the parties incurred irrevocable liability within the United States, reasoning that allegations regarding the location of the broker, the tasks carried out by the broker, the placement of the purchase order, the passing of title and the payment made were relevant to the domestic transaction inquiry. The court explained, “[t]hat [if] discovery ultimately reveals that the ADR transaction involved an initial purchase of common stock in a foreign transaction . . . [that] can be a matter properly raised at the summary judgment stage.”

The court also found that the plaintiffs sufficiently alleged Toshiba’s “plausible participation in the establishment of the ADR program.” The court stated that the plaintiffs sufficiently alleged the “in connection with” element of the securities claim. In other words, the plaintiffs alleged “the nature of the . . . ADRs, the OTC market, the Toshiba ADR program, including the depositary institutions that offer Toshiba ADRs, the Form F-6s, the trading volume, the contractual terms and Toshiba’s plausible consent to the sale of its stock in the United States as ADRs.” The court also found that the plaintiffs sufficiently alleged that the purported fraudulent conduct concealed the true condition of the company and risks associated with its stock. The allegations plausibly demonstrated “some causal connection” between the defendants’ conduct and the purchase or sale of the ADRs at issue. Last, the court concluded that the plaintiffs had sufficiently alleged Exchange Act claims, and concluded that comity and forum non conveniens did not compel dismissal.

The ruling shows that even companies with unsponsored ADRs trading in the United States can be subject to U.S. securities laws, and it is not enough to simply defend the matter by arguing that the company did not sponsor the ADRs.

Dispositive Decisions of 2018 and 2019 Filings

In 2019 and early 2020, courts issued fewer dispositive decisions on motions to dismiss in securities class actions brought against non-U.S. issuers than were issued in 2018 and early 2019. Specifically, only seven dispositive decisions were rendered. In addition, four 2018 filings were voluntarily dismissed in their entirety while one 2018 filing was dismissed in its entirety pursuant to a stipulation between the parties. There were no dispositive motions to dismiss decisions rendered with respect to 2019 filings, but eight 2019 filings were voluntarily dismissed in their entirety, and one 2019 filing was dismissed in its entirety pursuant to a stipulation between the parties. Finally, the Southern District of New York dismissed, in part, one securities class action that was filed in 2019 and another that was filed in 2018.

While it is difficult to discern trends from just seven dispositive decisions, the courts’ reasoning for dismissing cases is still instructive for non-U.S. issuers who may find themselves subject to securities class action lawsuits.

First, two securities class actions that were brought against non-U.S. issuers were dismissed on international comity grounds. In Kim C. Block, et al. v. Interoil Corporation, et al.,51 Judge Karen Scholer of the Northern District of Texas dismissed a complaint that had been filed against InterOil Corporation, a company headquartered in Singapore and incorporated in Yukon Territory, Canada. In the complaint, lead plaintiff alleges that InterOil circulated false information ahead of a shareholder vote regarding whether InterOil should be acquired. The shareholders voted in favor of the acquisition, and the acquisition was subsequently approved by the Supreme Court of Yukon. In addition to challenging the substance of the complaint’s allegations, defendants argued that the district court should not disturb the decision of the Canadian court. Judge Scholer agreed, explaining:

In the case at hand, the Court finds that the Canadian court proceedings satisfy every element that warrants dismissal on international comity grounds: (1) the Supreme Court of Yukon was a court of competent jurisdiction that had jurisdiction over InterOil and InterOil’s shareholders; (2) the court’s final judgment was supported by submissions by InterOil; (3) InterOil shareholders had an opportunity to appear and be heard; (4) the court followed established procedural rules; and (5) the court issued a written order resolving the hearing.

Likewise, in EMA GARP Fund, L.P., et al. v. Banro Corporation, et al., Judge Katherine Failla of the Southern District of New York dismissed a securities class action against Banro Corporation—a company that is both incorporated and headquartered in Canada—in deference to a reorganization proceeding in the Ontario Superior Court of Justice that had been ongoing when plaintiffs filed their complaint and in which plaintiffs had elected not to participate. Much like Judge Scholer, Judge Failla explained:

[A]s the [Canadian] [p]roceeding was a parallel proceeding that satisfied fundamental standards of procedural fairness, and as dismissal would not violate U.S. law or public policy, the Court exercises its discretion to dismiss Plaintiffs’ claims against Banro on international comity grounds.

Judge Failla then went on to dismiss the claims that had been brought against Banro’s former CEO, explaining that allowing those claims to proceed would “defeat the purpose of granting comity to the Canadian court.”

Second, four securities class actions filed in the Southern District of New York against non-U.S. issuers listed on the NYSE or NASDAQ were dismissed in September 2019, each on different grounds.

In Runcie Dookeran, et al. v. Xunlei Limited, et al., the plaintiffs allege that Xunlei, a software and technology company headquartered in China, and its Chief Executive Officer made six materially false and misleading statements following the launch of its OneCoin Rewards Program by failing to disclose to U.S. investors that the program was illegal and banned in China. Judge Paul Crotty granted defendants’ motion to dismiss because plaintiffs did not allege that the Chinese regulatory authorities have taken formal action against Xunlei with respect to the Program and did not plausibly allege that, notwithstanding such inaction. Xunlei’s conduct violates Chinese law. Moreover, Judge Crotty found that the plaintiffs failed to allege scienter because the regulatory notice regarding the possible illegality was publicly available.

In Rajan Chahal, et al. v. Credit Suisse Group AG, et al., the plaintiffs allege that defendants, listed on the NYSE, made material misstatements or omissions (1) with respect to the issuance of a complex investment vehicle known as VelocityShares Daily Inverse VIX Short Term Exchange Traded Notes and (2) by failing to take action to correct or warn the market during a sudden spike in volatility, as well as engaged in a scheme to manipulate the market by issuing a large volume of additional notes. Judge Analisa Torres, after considering and rejecting each of the plaintiffs’ objections, adopted the magistrate judge’s report and recommendation granting defendants’ motion to dismiss in their entirety. The court found that a supplemental prospectus issued by defendants had expressly warned of all of the material risks involved in purchasing the notes and that the complaint did not support an inference of scienter for either the market manipulation or failure to correct claim.

In Edward Lea, et al. v. TAL Education Group, et al., the plaintiffs allege that defendants engaged in two sham transactions, the sale of the company’s tutoring business and a re-purchase of that entity a year later, and that they made a variety of materially false or misleading statements in connection with those transactions. Judge Loretta Preska granted defendants’ motion to dismiss finding that plaintiffs failed to sufficiently plead that the two transactions were fraudulent because they did not properly allege that defendants had control over the target entity. The court reasoned that each allegation of control has “alternative explanations so obvious that they render plaintiff’s inferences unreasonable.”

In Yongqiu Zhao, et al. v. Deutsche Bank Aktiengesellschaft, et al.,58 the plaintiffs allege that Deutsche Bank’s statements that its internal control over financial reporting was effective based on the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) framework were fraudulently and materially misleading based on concerns with the Bank’s business raised by the Wall Street Journal. Judge Alison Nathan granted defendants’ motion to dismiss with prejudice finding the allegations to be conclusory because the plaintiffs did not plead how any of the supposed deficiencies in the bank’s controls may have led to problems with its financial reporting.

Finally, in January 2020, the Southern District of New York dismissed a securities class action that was brought against Telefonaktiebolaget LM Ericsson—a company headquartered and incorporated in Sweden that trades on the NASDAQ. In Bristol County Retirement System, et al. v. Telefonaktiebolaget LM Ericsson, et al., the plaintiffs allege that Ericsson “misrepresent[ed] Ericsson’s true financial condition by inaccurately accounting for its long-term contracts and by making false statements regarding those contracts.” Specifically, plaintiffs allege that the company engaged in four types of business/accounting practices that it did not disclose:

- entering into negative-value contracts;

- entering into contracts in which project scope exceeded the “fixed price” found on the contracts;

- pushing costs to future quarters; and

- prematurely recognizing revenue.

Of note, the plaintiffs allege that the decision to enter into the negative-value contracts “was made by Swedish headquarters.” Judge Jesse Furman granted the defendants’ motion to dismiss explaining, inter alia, that plaintiffs had failed to allege that the defendants’ statements regarding public statements were false in light of the four practices alleged, and that even if the plaintiffs had alleged the falsity of those statements, the plaintiffs had failed to allege that those statements were made with the requisite scienter.

Conclusion

A company does not need to be a U.S. issuer to face potential securities class action liability in the United States. Instead, as the foregoing analysis demonstrates, non-U.S. issuers remain targets of securities class action suits even when the alleged actions occurred abroad and even with unsponsored ADRs trading in the United States. As such, it is imperative that non-U.S. issuers take steps to mitigate risks in not only their home jurisdictions but also in the United States.

Non-U.S. issuers should be particularly cognizant when making disclosures or statements to:

- speak truthfully and to disclose both positive and negative results;

- ensure that a disclosure regimen and processes are well-documented and consistently followed;

- work with counsel to ensure that a disclosure plan is adopted that covers disclosures made in press releases, SEC filings and by executives; and

- understand that companies are not immune to issues that may cut across all industries.

Non-U.S. issuers should work with the company’s insurers and hire experienced counsel who specialize in and defend securities class action litigation on a full-time basis. Finally, to the extent that a non-U.S. issuer—despite its diligent mitigation efforts—finds itself the subject of a securities class action lawsuit, the bases upon which courts have dismissed similar complaints in the past can be instructive.

The complete publication, including footnotes, is available here.

Print

Print