Jason Frankl and Brian Kushner are Senior Managing Directors and Carl Jenkins is a Managing Director at FTI Consulting Inc. This post is based on a FTI memorandum by Mr. Frankl, Mr. Kushner, Mr. Jenkins, Kurt Moeller, Wyatt Friedman, and Walker Spier.

Introduction and Market Update

In this Activism Vulnerability Report, FTI has identified the industries that are most susceptible to shareholder activism in the U.S. and Canada according to the Activism Screener’s results. The Activism Vulnerability Report, and the Activism Screener itself, are intended to assist our public company clients and their outside advisors in determining the extent to which their business and underlying industry are vulnerable to pressure from activist investors. It provides a starting point for identifying and addressing the factors and dynamics that could invite activist investors to seek material changes in the business, management team and/or board of directors.

The Report summarizes the Activism Screener’s results and evaluates 25 well-known industries, enabling us to understand which of those industries are most vulnerable to shareholder activism each quarter, based upon an average of the aggregate vulnerability scores of the components of each industry. FTI publishes the Report quarterly as financial data and other common publicly disclosed information become available. While FTI will not release a complete list of companies and their scores, FTI welcomes company representatives to contact our Activist and M&A Solutions team members to discuss their individual vulnerability score and the key contributing factors.

In this second edition, the world has decidedly changed in many ways since our inaugural report in December 2019. The global spread of COVID-19 has affected every company and investor on the planet, with few bright spots. Putting briefly to the side all human health and wellbeing concerns that are unquestionably first and foremost, the impact of COVID-19 on businesses, workers and investors is difficult to fully comprehend. Projecting what it all means into the future is virtually impossible at this early point.

While the COVID-19 crisis has varied impact on different sectors of the economy, the unprecedented downturn in the worldwide financial markets and the differing governmental responses have all generated a significant level of uncertainty in corporate boardrooms and financial markets. The second quarterly edition of the Activism Vulnerability Report incorporates some of this impact. As with any retrospective market analysis, the devil is always in the details, meaning the underlying criteria and their relative weightings used by the Activism Screener. To that end, there are two important details for our readers to understand as they interpret the Q4 scores.

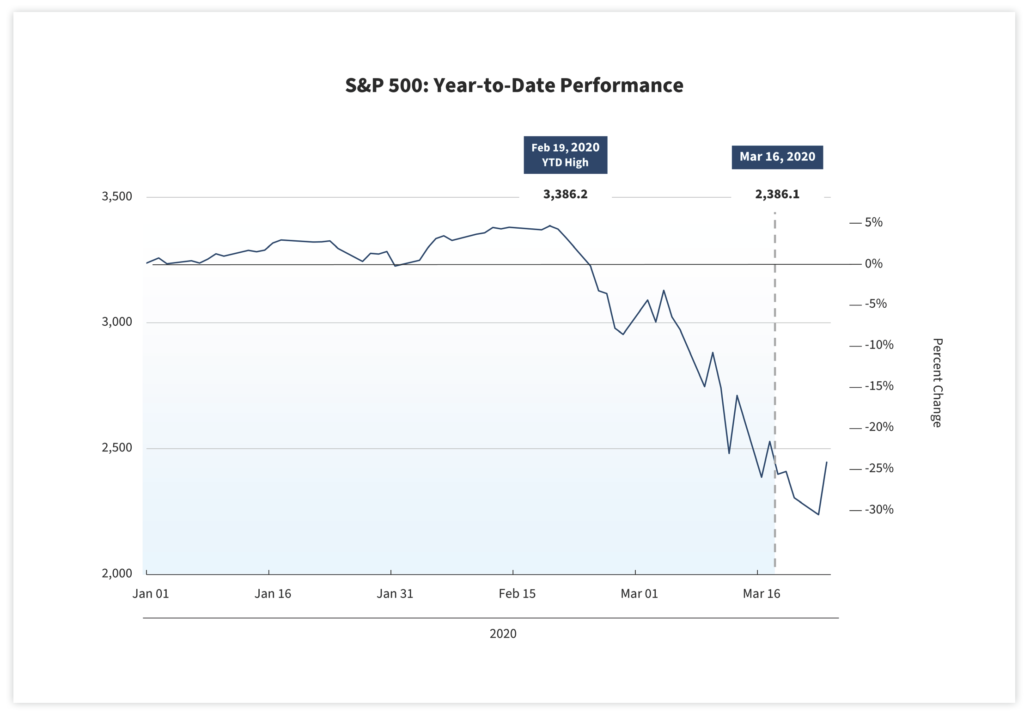

The first is that two of the four categories of criteria (Operating Performance and Balance Sheet) are based upon component companies’ financial statements from their most recently filed fiscal period, which is December 31, 2019 for 82% of the population. However, both the Governance and Total Shareholder Return (“TSR”) categories utilize data as of March 16, 2020, which of course reflects some of the recent impact from COVID-19 on the U.S. and Canadian equities markets depicted in the chart above showing the dramatic drop in the S&P 500, as well as governance provisions enacted in its wake.

Since the inception of the Activism Screener, we have consciously chosen to use the most recent Governance and TSR data, as it serves to reflect subsequent events that have been introduced and digested into the market since the last financial reporting period. The scores in this report reflect Balance Sheet and Operating Performance results as of the most recent quarter end, and Governance and TSR data as of March 16, 2020. As a result, given the recent market turmoil and the precipitous nature of the decline, there may be some sector ranking anomalies that do not reflect the current risk profile or vulnerability of those industries, such as Aerospace and Defense, and Hospitality, Gaming and Leisure.

Additionally, each criterion is evaluated relative to each industry component, meaning that all scores are calculated on a relative basis. The FTI Activism Screener was constructed this way in order to compare companies to their more direct peers, with the understanding that different industries have different expectations around profitability and returns, and different best practices in capital allocation and governance. This is made apparent following the March 2020 market sell-off as depicted in the chart above. Despite some large absolute negative returns, companies that outperformed their sector on a relative basis over several periods received lower TSR scores, and thus lower composite vulnerability scores.

FTI Activism Screener Methodology

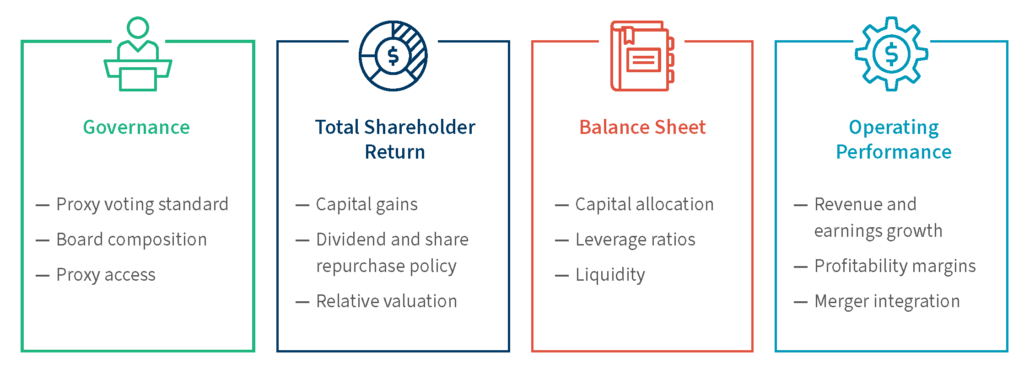

- The Activism Screener is a model that aggregates and analyzes over 25 criteria that are relevant to activist investors. They are sorted into four broader categories, scored 0.0-25.0, (1) Governance; (2) Total Shareholder Return; (3) Balance Sheet; and (4) Operating Performance, which are aggregated to a final Total Vulnerability Score. The Screener determines a score for each category by applying weightings to each criterion based on its significance.

- By classifying the relevant attributes and metrics into broader categories, FTI is able to uncover precisely where potential vulnerabilities are found, which allows for a more targeted response.

- FTI’s Activism and M&A Solutions team determined these attributes and metrics, along with their respective weightings, through careful research of historical activist campaigns in order to locate themes and characteristics frequently targeted by activist investors. The following is a selection of themes that are included for each category:

- As specialists in the field, the Activism and M&A Solutions team is constantly following the latest trends and developments in shareholder activism. Because of the constantly evolving activism landscape, and with a desire to keep the Activism Screener in-line with these changing market dynamics, the attributes and metrics and/or their respective weightings may be updated in future quarters.

Most Vulnerable Industries for Q4 2019

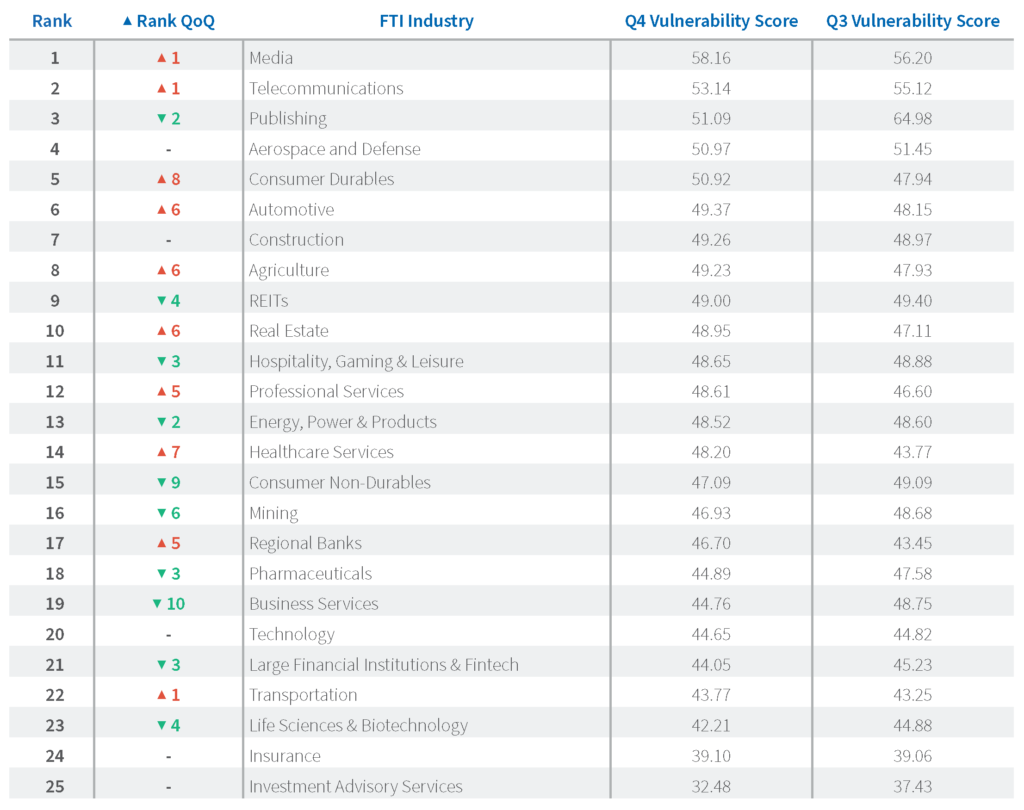

The chart below displays the Total Vulnerability Scores for 25 well-known industries as of December 31, 2019:

Our Q4 2019 data show that the top four most vulnerable industries remain the same when compared to Q3 2019, with a slight shuffling in the order, although the gap between them has slimmed considerably, as the Publishing industry reduced its Total Vulnerability Score from about 65.0 to 51.1.

Some of the largest vulnerability increases into the Top 10 come from Consumer Durables, Automotive, Agriculture and Real Estate, each of which moved at least six places. These upward movers replace Hospitality, Gaming & Leisure, Consumer Non-Durables, Mining and Business Services, as industries that reduced their vulnerability scores and shifted out of the Top 10.

As mentioned earlier, at this point, only TSR and Governance categories incorporate data inclusive of the recent effects of COVID-19. It is inevitable that as these effects move from financial markets to business operations, we will begin to see this impact the backward-looking financial statement metrics, thus impacting Balance Sheet and Operating Performance categories as soon as next quarter.

Major Funds’ Holdings by Industry

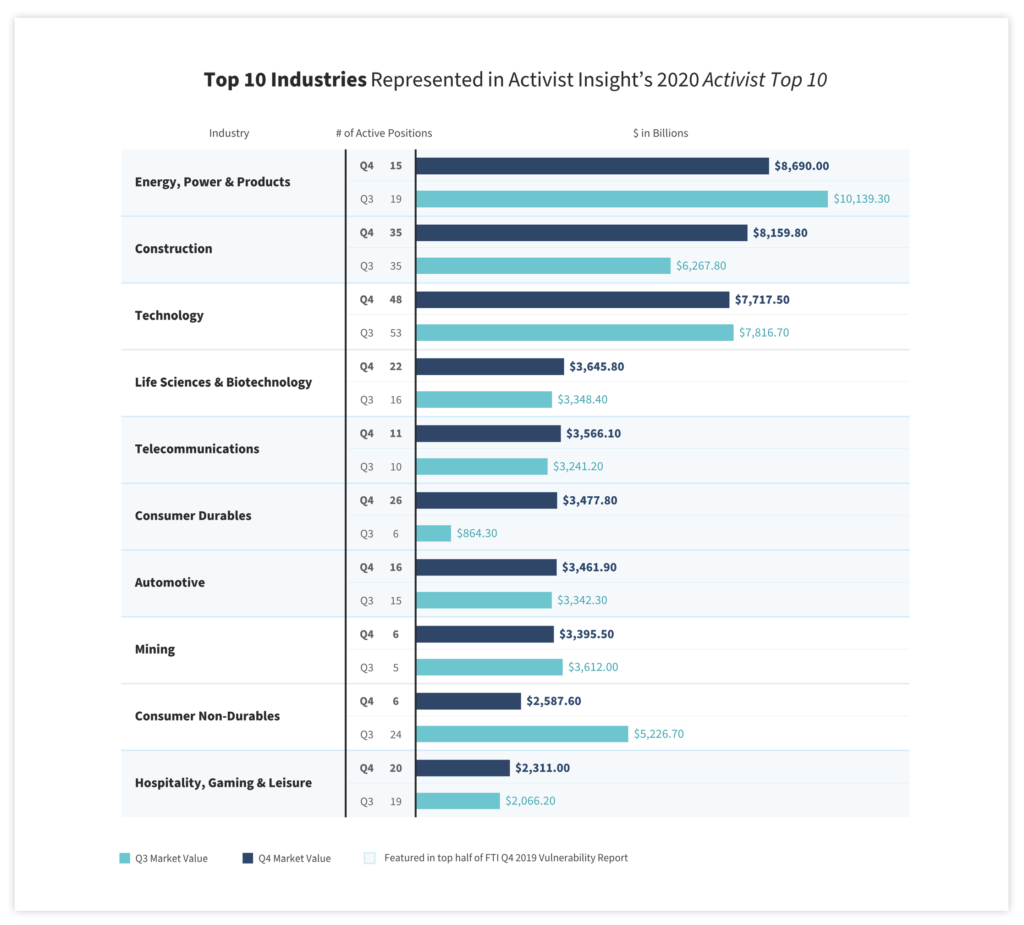

As in last quarter’s report, FTI analyzed the holdings of major hedge funds whose primary strategy is shareholder activism by industry to compare with the Screener’s findings. For purposes of consistency this quarter and going forward, FTI will use Activist Insight’s Annual Activist Top 10 list to determine the funds to include in this analysis.

Of the top ten industries making up Activist Insight’s Activist Top 10, six are within the top half of FTI’s most vulnerable industries list.

“It’s a Whole Different Ballgame”

The potential economic impact of COVID-19, and to a lesser extent the collapse in oil prices, led to the fastest 30% drop of the S&P 500 in history. At present, forward-looking earnings and cash flow valuation metrics are largely irrelevant for many industries, as it is impossible for both managers and investment analysts to predict the near-term impact on most companies’ earnings and cash flow.

While valuations will become clearer over the coming weeks and months as firms are better able to quantify these impacts, the absolute drop in equity prices have led some activists with dry powder on the sideline to begin cautiously deploying uninvested assets in current and future targets that are trading at depressed values. While most of us are cautiously optimistic that the spread of the virus can be contained and a vaccine and cure will be found, the reality as of this publication is that uncertainty reigns supreme. Many managers and investors alike remain hopeful that governmental monetary and fiscal policy actions will be able to effectively combat these sudden shocks, clearing the way for an economic recovery in the second half of 2020.

Impact on Shareholder Activism

As shareholder activism has increasingly become accepted as its own asset class, it became helpful to define different types of shareholder activism, as one size does not fit all. The categories roughly fall into the following groupings: (i) M&A activism; (ii) operational activism; (iii) corporate governance activism; (iv) balance sheet activism; and (v) ESG activism.

In 2019, M&A activism was most prevalent, as 47% of campaigns had some M&A thesis to it, typically either arguing for a sale of part or all of the target or intervening in an existing negotiation to force the bidder to improve its terms. Although the current levels of uncertainty will hinder the deal-making process in the near-term, it would not be surprising to see this activity rejuvenated when the market has stabilized. Activists may push for consolidation in industries with the greatest impact from COVID-19, as low share prices could offer attractive M&A opportunities based on value. This may also give way to campaigns involving interlopers acting as shareholders of target companies to ensure an appropriate price is paid, given the presently discounted valuations. We may also see reductions in some categories of activism, as the cost of campaigns impacts both the fund manager and the company alike, and certain initiatives, like ESG, may decrease in importance relative to overall sector and corporate survival.

In the past, activists often pushed for more shareholder friendly capital allocation policies, where more of a company’s cash was returned to shareholders through share repurchases and dividends. With the expected increase in corporate debt relative to free cash flow ratios, we would expect boards and executives alike to quickly shift allocation priorities to liquidity management and then to the eventual debt reduction. In this current crisis environment, we are hopeful that activists will work constructively with boards and management teams in determining optimal capital structure and allocation strategies that will position targets attractively when greater economic activity resumes.

FTI Observations and Insights

Shareholder Activism Trends

“Prior to the outbreak of COVID-19, as the U.S. economy remained strong and the bull market roared forward, there were fewer cheap-looking stocks and fewer companies whose fundamentals appeared weak. These factors may have led activists to invest in companies with not as much room for improvement and where a compromise with management could more easily be reached. As such, fewer recent activist campaigns have gone to a shareholder vote and many have resulted in settlements, including this month between Carl Icahn and Occidental Petroleum, for example.

The economic dislocation caused by COVID-19 should result in more variations in fundamental and stock price performance among industries and between companies within the same industry. These seem likely to provide more companies whose performance noticeably lags peers’ and more targets for activists. The result will likely be activist campaigns where the activist and the company have widely differing viewpoints, which should result in fewer settlements and more campaigns going to a shareholder vote.”

—Kurt Moeller, Managing Director – FTI Consulting’s Activism and M&A Solutions practice

Aerospace and Defense

“The Aerospace and Defense Sector is facing unprecedented turmoil as the world reacts to the COVID-19 crisis, varying governmental responses from shelter-in-place to complete lockdowns, and uncertainty as to how long the pandemic will last, how severe the economic impact will be and what the recovery will eventually look like. Against that backdrop of uncertainty, the aerospace and airline industries, their supply chains and vendor bases are taking the greatest hit, with global manufacturing churning to a halt, airlines reducing global and domestic service and US travel levels down over 80% YoY. This impacts the entire ecosystem of the aerospace and airline industries, ranging from component parts and semiconductor avionics suppliers, to gate support and refresh functions, to airfield and airspace management, to materials management and replacement support in the Maintenance, Repair and Overhaul sector. After spending the better part of the last year adjusting to the impact of the 737Max situation, the COVID-19 crisis places an added burden on an already stressed sector.

As in most economic shocks, liquidity availability and management takes on added importance, and the worldwide aerospace and airline industries are seeking government support to weather the storm. Investors and analysts want to know what form will such support take, how deep into the supply chain and vendor base will such support flow, what governance actions can maximize survival and which companies are optimally positioned for the eventual recovery?”

—Brian Kushner, Senior Managing Director – Co-Leader of FTI Consulting’s Aerospace, Defense and Government Contracting and Activism and M&A Solutions practice

Media & Entertainment

“Change is everywhere in today’s media landscape. The only real driver of growth today is in the digital segment. Revenues from Subscription Video on Demand are rising at a 15% CAGR, the number of scripted TV shows is now over 500 (again driven by digital players like Netflix) and the number and diversity of channels and available video platforms has grown more in the last 5-10 years than in the previous 60. While the digital landscape is growing, across the legacy ecosystem, companies are trying to pivot to become major digital enterprises, if they can, and to shore up their existing legacy operations.

All this change has led to enormous stock valuations for some companies and crashing stock valuations for others. All the change has also led to waves of major consolidations. Many newly consolidated operations are attempting untested new strategies with material entrepreneurial risk associated with them.

There already are winners and losers in the landscape and the shake out from the change in the industry will only continue.”

—Phil Schuman, Leader of FTI Consulting’s Media & Entertainment practice

What This Means

With COVID-19 and its resulting impact taking center stage in world health and economic news, equities markets reacted as they often do at a time of great uncertainty—they went down. Fast. The fact that this crisis occurred as proxy season began has, and likely will continue to, disrupt a number of proxy contests. But no matter how many contests get disrupted or how many annual meetings of shareholders must be held virtually, COVID-19 brought an element that all of us are suddenly cognizant of—fragility.

In the U.S. and Canadian equities markets, we moved from a very healthy, broadly-based 11-year old bull market to an incredibly volatile and vicious 30+% dive in a one-month period. Companies that were once industry leaders across many sectors went from lofty relative valuations to virtually shutting down operations, requiring some companies to revise downward or vacate forward looking guidance altogether. All attributable to a highly contagious, microscopic enemy that has disrupted lives and economies and whose impact we cannot measure or hedge against.

In the equities markets we now see valuations that would have been impossible to imagine as recently as mid-February. Yet, they still may be too high, as future global economic growth and earnings are mysteries. Many individual investors are acutely aware of this as they look at the value of their retirement or trading accounts. Professional investors, particularly those who have cash to invest, are triaging their portfolios, assessing risk and liquidity strategies, and watching carefully to determine which companies weather this storm better than their peers and may have been collateral damage in the market selloff.

For boards and management teams who can fortify and prove the resilience of their businesses before their peers, they will rightfully earn the admiration of their employees, their customers, their vendors, their communities and their investors.

Print

Print