Brian Lane is a Partner, Linda Pappas is a Principal, and Peter Ringlee.is a consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum. Related research from the Program on Corporate Governance includes Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

Introduction

On March 23, Pay Governance released a Viewpoint article discussing COVID-19’s impact on executive compensation programs. The article—“Everything Should Be On The Table”—outlined several high-level initial considerations that should be “on the table” as possible responses to the disruption caused by COVID-19.

It is still too early to understand the full impact, financial and otherwise, that the pandemic will have. Its effect on business and the appropriateness of potential responses will vary by industry and company. Our objective in presenting these considerations broadly is to arm compensation committees with a toolkit of possible adjustments and a general understanding of the benefits, drawbacks, and implications of any such actions.

This post explores one consideration in detail: re-thinking long-term performance periods within performance stock unit (PSU) designs. We present potential alternative approaches to the traditional three-year cumulative measurement.

Prevailing practice—particularly for large companies—provides for PSUs to vest and be earned contingent upon actual company performance compared to an established goal measured cumulatively over a three-year period. Currently, variations to this design where performance is measured over shorter periods (e.g., three annual measurement periods) are less common. These variations can be useful in situations where setting long-term goals is difficult. However, they are often employed at the risk of negative scrutiny from proxy advisors and/or come with overarching three-year performance measures, such as a relative total shareholder return (TSR) modifier, to strengthen the focus on the long term.

Does the increase in uncertainty associated with COVID-19, which presents a fundamental challenge to setting reliable long-term goals, warrant consideration of shorter performance measurement periods on a temporary basis? Long-term plans can lose motivational and incentive value on both sides of the spectrum (i.e., if the goal is achieved too early or if the goal is perceived as unachievable). Both scenarios diminish one of the key objectives of long-term performance awards: encouraging and rewarding sustained long-term performance.

Our discussions with client compensation committees thus far have focused on an overarching theme: continue to motivate and incentivize management through performance-based pay that maintains alignment to the shareholder experience while acknowledging the disruption felt by many company stakeholders, including its community. The alternative approaches presented below seek to adhere to this theme while recognizing the challenges and uncertainty associated with the COVID-19 pandemic.

Alternative Approaches

Below, we present four alternatives to the traditional three-year cumulative performance cycle. Each comes with its own set of pros, cons, and broader implications, including external considerations which we discuss further below. The themes presented here are not meant to be exhaustive, and there are other design variations that may work just as well for a particular company’s circumstances.

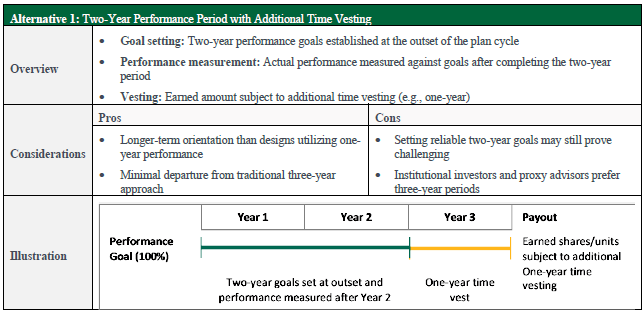

- Alternative 1—a two-year performance measurement period with one year of additional time vesting

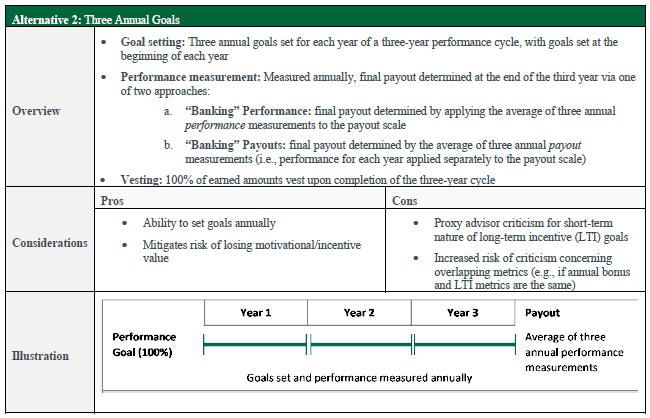

- Alternative 2—three distinct annual performance measurement periods, with goals set annually (i.e., at the beginning of each year) within a three-year plan period

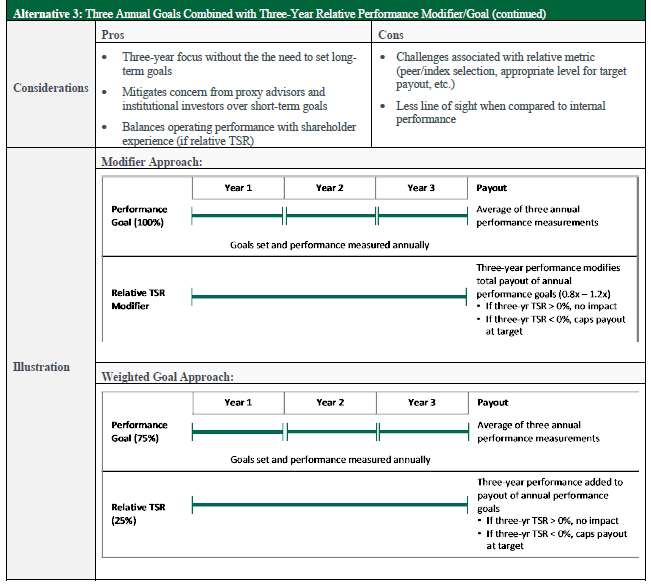

- Alternative 3—an extension of Alternative 2, where three annual performance measurements are combined with an overarching three-year relative performance goal (often relative TSR)

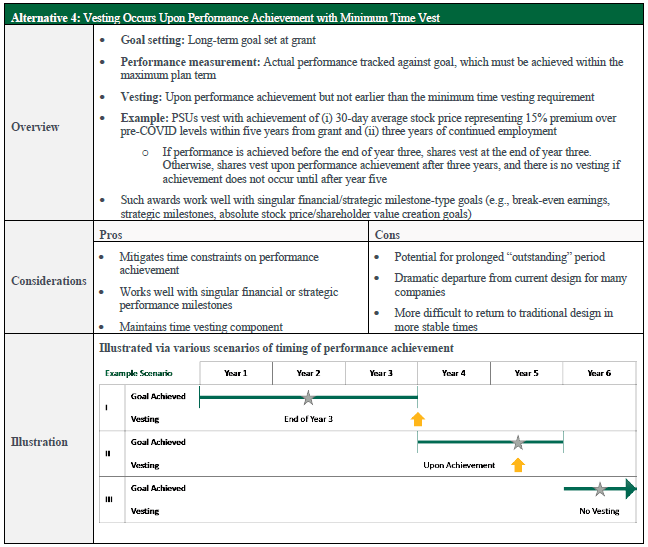

- Alternative 4—awards vest upon performance achievement (as opposed to a pre-determined date) with a minimum time vesting requirement

External Considerations

Current voting policies among proxy advisors and several institutional investors favor either multi-year or three-year performance periods for LTI or PSU plans. While decisions should be made on the basis of what is appropriate for each individual company’s circumstances, it is wise to fully understand the potential reactions from external parties.

Historically, proxy advisor criticisms of shorter PSU measurement periods have taken the form of a “red flag” or have potentially served as a contributing factor to an “against” Say on Pay vote recommendation (particularly where an overarching pay-for-performance disconnect has been identified). Heightened scrutiny may also result from the combination of PSUs which utilize a one-year metric that overlaps with the annual incentive program (i.e., “double dipping”).

Additionally, our review of proxy voting policies for the top 15 largest institutional investors (as defined by assets under management) suggests that about 20% of these firms, representing over $8 trillion in assets under management, prefer a three-year performance period.

If a company is contemplating a temporary shift from a traditional three-year performance period to an alternative design with a shorter measurement period, as with any significant change to an executive pay element, it may be prudent to provide strong disclosure of the rationale and outreach to the company’s largest shareholders to discuss the basis for these decisions.

It is yet to be seen whether the stance of proxy advisors and institutional investors on the length of long-term performance periods will shift in light of this unprecedented level of uncertainty. However, now more than ever, we anticipate these parties will expect companies to retain focus on the shareholder experience and the longer-term investor perspective.

Looking further ahead, as global markets stabilize and a sense of normalcy returns to day-to-day operations, companies may consider developing a road map to returning to multi-year goals in order to encourage longer-term alignment between executive pay programs and company performance.

Print

Print