Krystal Berrini is Partner, Allie Rutherford is a Managing Director, and Eric Sumberg is a Director at PJT Camberview. This post is based on their PJT Camberview memorandum.

Over the past several years, large institutional investors have addressed their growing concerns about the demands of board service by adopting or strengthening policies on a director’s total number of board commitments. This trend has resulted in significant declines in vote support for some directors considered “overboarded” according to these new or tightened guidelines. In many instances, these investor policies are stricter than those of the major proxy advisors.

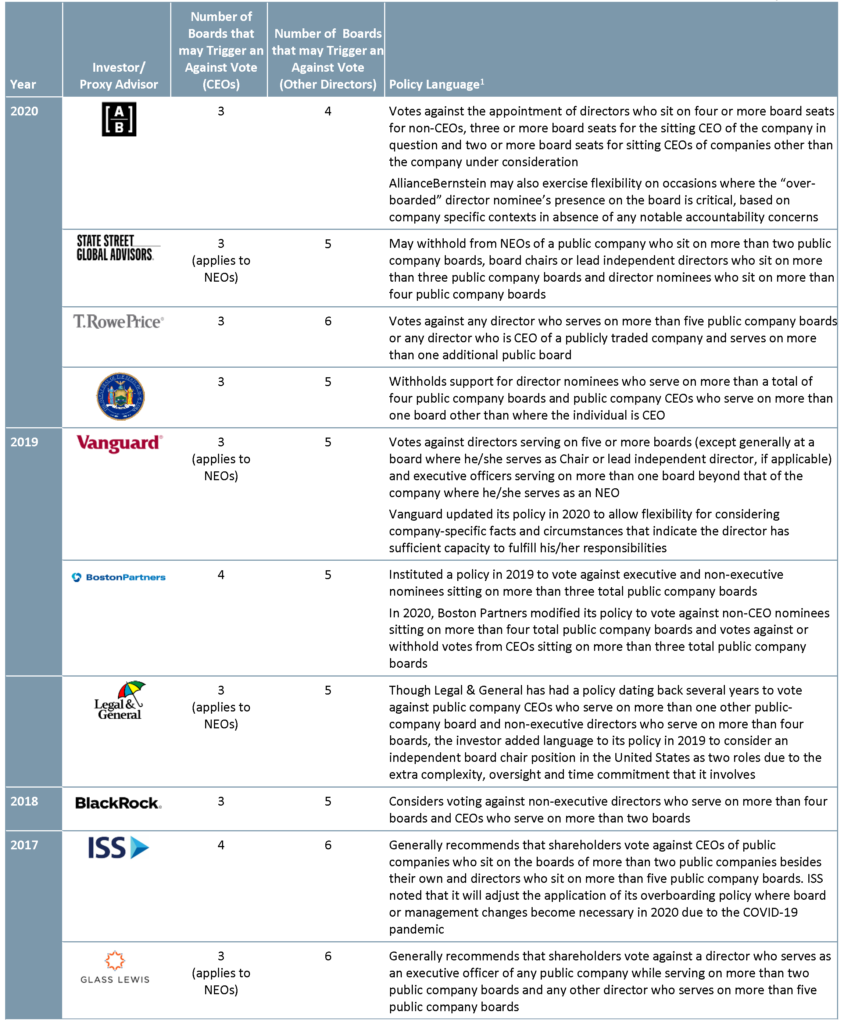

Heading into the 2020 proxy season, three institutional investors, State Street Global Advisors (SSGA), T. Rowe Price and AllianceBernstein, have tightened their director commitment policies. This follows similar actions by BlackRock in 2018 and Vanguard which adopted its first overboarding policy in April 2019. Vanguard subsequently modified its policy in early 2020 to allow some flexibility to consider company-specific facts and circumstances. As a result of these strengthened investor policies, non-executive directors who serve on more than four boards and CEOs (as well as NEOs for certain investors) who sit on more than one outside board can expect to see a decrease in support as compared to prior years.

The COVID-19 pandemic has focused investor attention on a range of governance and board oversight topics, including risk management, business continuity and human capital management. In the past few weeks, a number of investors, including BlackRock and SSGA, have reiterated their commitment to holding companies accountable for their long-term ESG practices during this challenging time, making it unlikely that investors will significantly deviate from guidelines on existing practices, inclusive of board commitments. The current COVID-19 crisis, which is placing additional demands on directors’ time, will likely further solidify investor views on the importance of directors having the capacity to fully engage across all of their board commitments in times of crisis.

Below is a summary of recent updates to investor and proxy advisor policies on director overboarding. The table lists the number of boards at which a director will generally receive a vote or recommendation against. Generally, investors and proxy advisors oppose executive directors only at their outside boards, i.e. not where they serve as CEO or a NEO.

1Information regarding investor and proxy advisory policies is obtained from published U.S. or North American policies which can be found on their respective websites

Print

Print