Steve W. Klemash is Americas Leader, Jennifer Lee is Audit and Risk Specialist, and Jamie Smith is Investor Outreach and Corporate Governance Specialist, all at the EY Americas Center for Board Matters. This post is based on their EY memorandum.

The focus on human capital and talent in corporate governance is intensifying, as more stakeholders—led by large institutional investors—seek to understand how companies are integrating human capital considerations into the overarching strategy to create long-term value. After all, a company’s intangible assets, which include human capital and culture, are now estimated to comprise a significant portion of a company’s market value.

Many influential groups, including the Global Reporting Initiative, the Embankment Project for Inclusive Capitalism, the Business Roundtable and the Sustainability Accounting Standards Board (SASB), have identified human capital as a key driver of long-term value. Recent developments reflect a clear and growing market appetite to understand how companies are managing and measuring human capital. This includes influential investors making human capital an engagement priority with directors, as well as comment letters from various stakeholders to the U.S. Securities and

Exchange Commission supporting greater human capital disclosure and asserting the importance of human capital management in assessing the potential value and performance of a company over the long term.

At the same time, there is an ongoing cultural shift brought about by new generations of workers, digitization, automation and other megatrends related to the future of work. In this new era, it is critical for management teams and boards to keep pace with this transformation and consider redefining long-term value and corporate purpose. Creating value for multiple stakeholders, including employees, will ultimately help build and sustain shareholder value over the long term. To better understand where companies are on this journey, Corporate Board Member, in partnership with the EY Center for Board Matters, surveyed 378 U.S. public company board members in the fall of 2019.

This post presents our findings.

Key Findings

- There is a discrepancy between directors who view human capital and talent issues as important topics for the board and those who believe these issues are beyond the board’s purview.

- Nearly 80% of directors say their board spends more time discussing talent strategy than it did just five years ago, but many boards are not monitoring key talent metrics.

- Directors stay current on human capital and talent trends primarily through management briefings; yet, nearly half say the Chief Human Resources Officer (or equivalent) does not regularly report on human capital to the board.

- Nearly 85% of directors support investments in employee training and reskilling to secure long-term value benefits even if they may not deliver short-term returns.

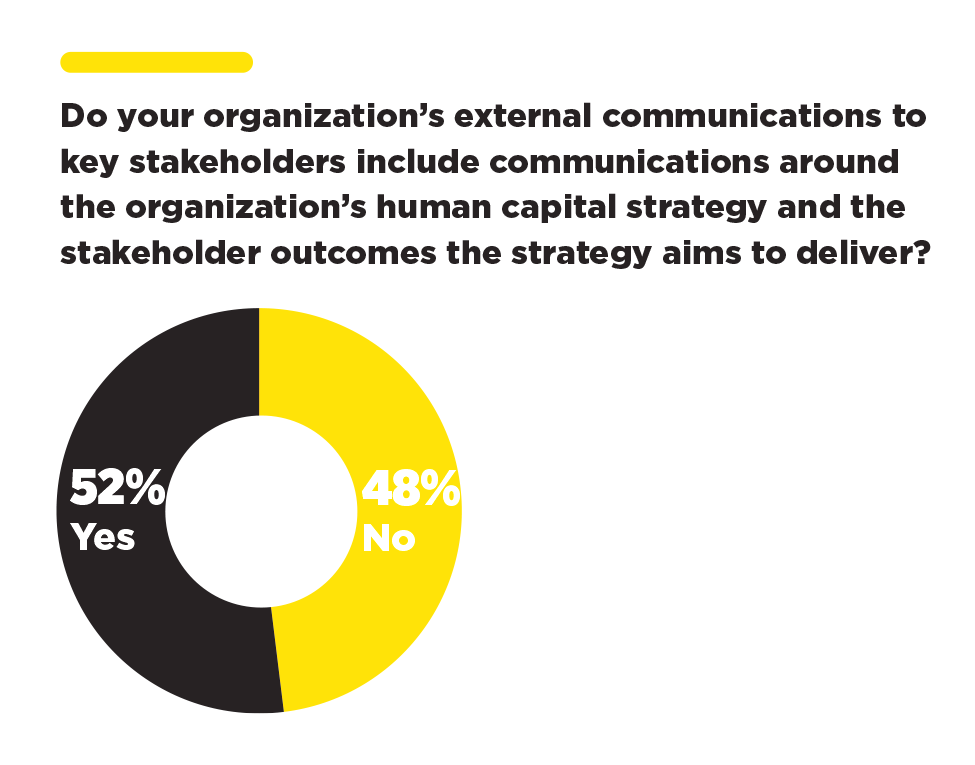

- Almost half of directors do not think their company’s external reporting communicates the organization’s human capital strategy and the stakeholder outcomes it aims to deliver.

There is a discrepancy between directors who view human capital and talent issues as important topics for the board and those who believe these issues are beyond the board’s purview.

Stakeholder interest in the governance of human capital and talent strategy has been gaining momentum in recent years as the result of several transformations occurring in the workforce. The largest working generation is starting to leave the workforce, advanced technologies are being implemented, a younger generation of workers is seeking new ways of working, and stakeholders are increasingly focused on social issues. These developments are upending the very nature of work—and several industries.

Some directors believe the issue of talent is one that belongs at the HR or management level and not within the board’s oversight responsibility, with some citing the “eyes in, nose out” governance mantra as a justification for their viewpoint. This may result, at least in part, from generational views held by directors whose experience draws from a vastly different working environment and culture, and whose board service has long adhered to expectations that talent oversight is limited to C-Suite succession planning and development.

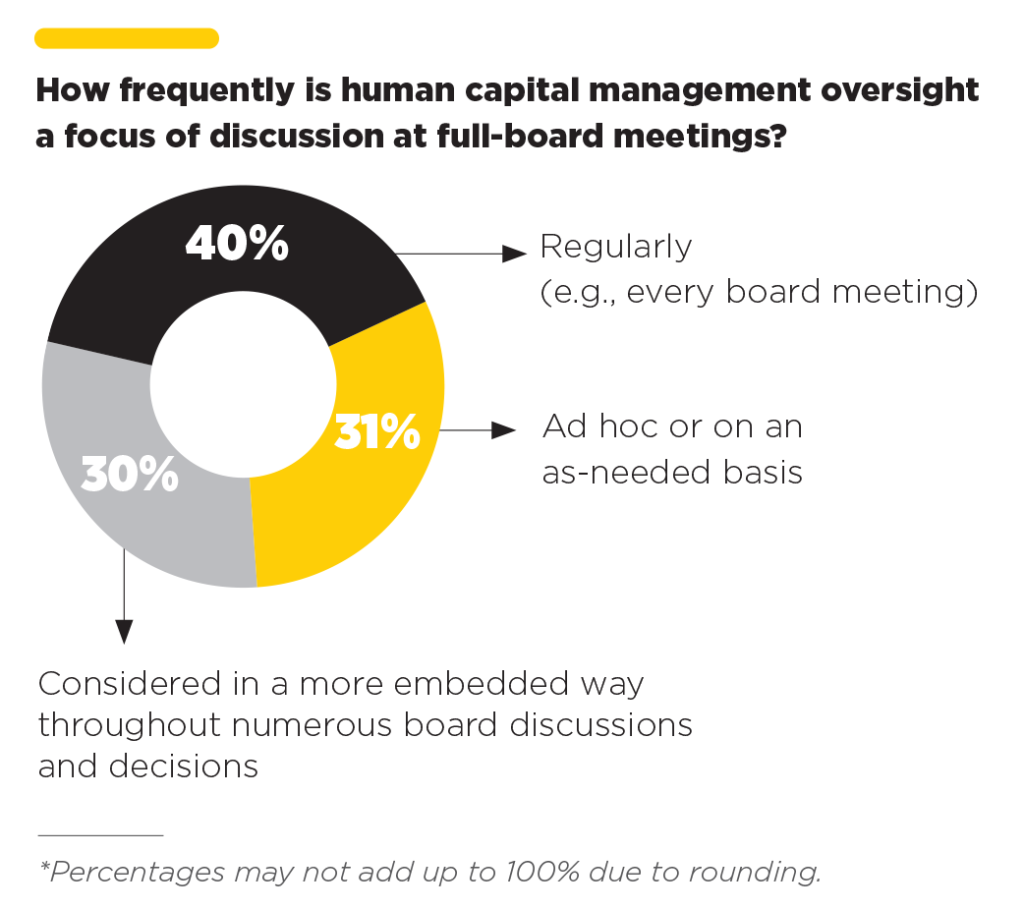

Conversely, other directors argue not only that the generational shift taking place, the transformation of the traditional employer-employee relationship and the elevation of corporate culture as a key strategic enabler carry significant new risks, but also that a well-thought-out and executed talent strategy serves as a competitive differentiator, thus giving human capital matters relevance in the boardroom. Some say that it’s the changing nature of work—through digitization, automation and the gig economy—that is challenging the long-term view and, thus, boards must embed this evolving reality into their core strategy discussion. As a result, nearly 40% of boards are consistently discussing human capital matters at every board meeting, according to the study.

Overall, most directors surveyed say they have the issue under control—wherever it resides and from whichever angle it is perceived. Nearly 70% of directors say their board spends enough time discussing talent strategy and issues, 78% say their board has a strong understanding of current talent and workforce issues, and 66% say their board has the appropriate skill sets and experience to oversee talent strategy in today’s transformative age.

The Opportunity

Amid these findings, there is opportunity for boards to make, or reaffirm, oversight of human capital and culture as a strategic priority. Approximately 30% of directors indicated that they are either unsure or unable to articulate their company’s cultural strengths and weaknesses, indicating there is room for improvement, especially given the investor focus in this area.

Talent and workforce strategies are essential to any company strategy and, therefore, must be overseen by the board. Additionally, high-performing boards believe their responsibility should include overseeing a robust enterprise risk management program that extends to a full spectrum of human capital opportunities and risks.

Boards should see that the company’s purpose, vision, mission, strategy and culture are aligned and broadly understood by all stakeholders. The board should also have a strong pulse on the company’s culture and ensure that employee behaviors to drive and execute the strategy are defined, rigorously communicated and monitored.

“How can you say that your human capital isn’t the most important thing you’ve got?

You can get good technology and you can get a good product, but at the end of the day,

it’s people that make the difference.”

— Gary Cowger, CEO, GLC Ventures; Board Member, Delphi Technologies and Titan International; Former President, GM North America

Directors stay current on human capital and talent trends primarily through management briefings; yet, nearly half say the Chief Human Resources Officer (or equivalent) does not regularly report on human capital to the board.

The board’s oversight role includes challenging management’s decisions to make sure risks and opportunities have been thoroughly considered and weighed against the strategy. Knowing which questions to ask and which areas to probe requires skills and knowledge that directors must acquire,

particularly when an issue is nascent or transformative. Onboarding directors with specific skill sets is one way to acquire this knowledge, but successful boards also place great emphasis on individual learning and development, because a historical view is unlikely to serve any board well on this matter moving forward.

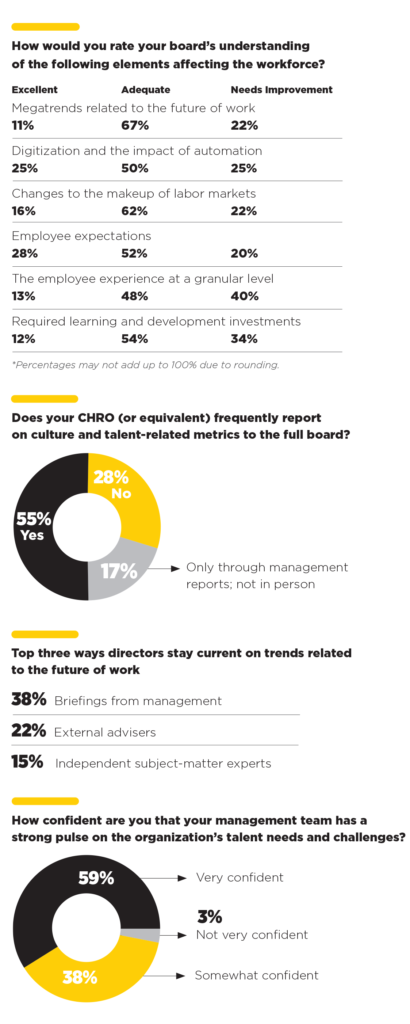

When asked about their level of knowledge pertaining to the various trends and elements affecting the workforce (e.g., digitization and the impact of automation, changes to the makeup of labor markets, megatrends related to the future of work), on average 27% of directors say their understanding of those elements needs improvement.

At the same time, the survey shows that most directors remain current on those trends primarily through management briefings, despite the fact that nearly half of them say their Chief Human Resources Officer (CHRO)—or equivalent, depending on company size and structure—does not regularly report on culture and talent metrics to the board.

The Opportunity

This reveals significant opportunity to enhance board knowledge and understanding through more regular interactions with and reporting from the CHRO. The CHRO should be a strategic resource for the board on matters of talent and culture, keeping the board apprised of the talent agenda in the same way that the chief financial officer keeps the board apprised of the financial agenda. The CHRO plays a key role in breaking down the silos between the HR and risk and/or finance functions by developing a common language and robust analytics capabilities to give boards access to relevant information to improve their oversight. The elevation of the CHRO role should be part and parcel of prioritizing the talent agenda at the board level.

Still, the CHRO should not be the only voice the board is hearing on talent trends. While 59% of directors say they are “very confident” their management team has a strong pulse on the company’s human capital and talent needs and challenges, an external independent voice is crucial to the conversation. Less than a quarter of directors say they are engaging with external advisers or independent subject-matter experts to stay current on trends related to the future of work. On the topic of talent and beyond, bringing an outside perspective into the boardroom is crucial to keeping a pulse on external trends, challenging internal bias, identifying blind spots and bringing an objective viewpoint and new ideas to the strategic planning process.

Nearly 80% of directors say their board spends more time discussing talent strategy than it did just five years ago, but many boards are not monitoring key talent metrics.

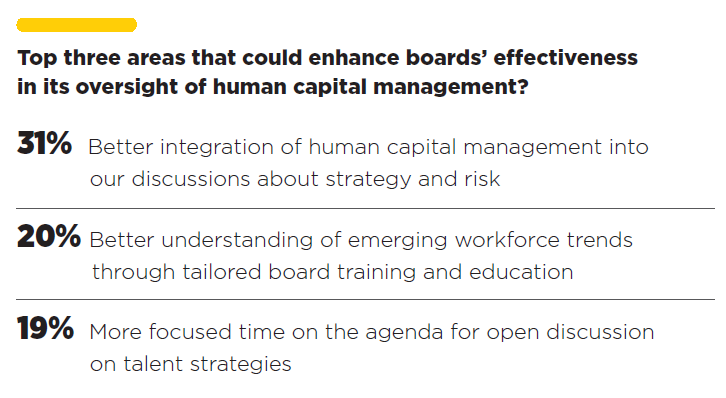

Regardless of the stance on the board’s role in the matter, human capital issues are continuing to make headway into the boardroom, with 79% of directors saying their board now spends more time discussing talent strategy than just five years ago. Further, around half of directors think spending even more time on talent would be beneficial. The top areas directors identified that could enhance the full board’s effectiveness in its oversight of human capital are 1) better integration of human capital matters into the board’s discussions about strategy and risk (31% of directors), 2) better understanding of workforce trends through tailored board training and education (20%) and 3) more focused time on the agenda for open discussion on talent strategies (19%).

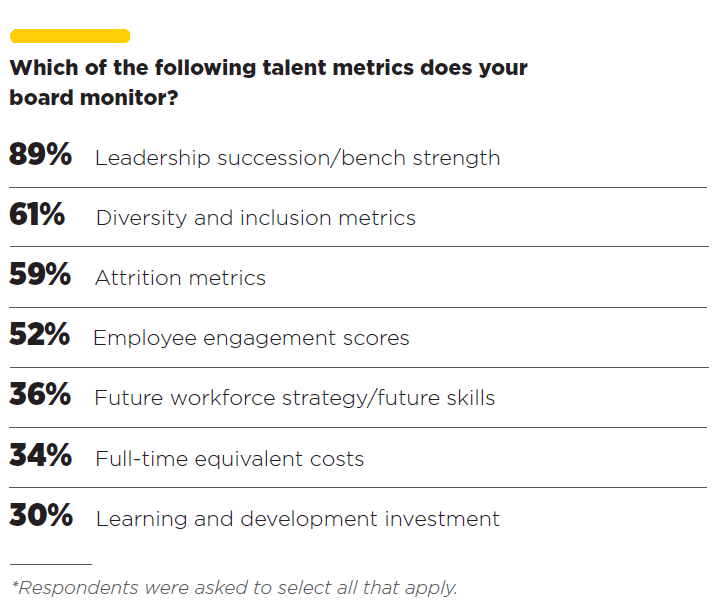

One of the most interesting findings of this study is that despite the increased focus on talent strategy in the boardroom, many boards are, nevertheless, not monitoring key talent metrics. Only a minority of directors reports that their boards are monitoring talent metrics related to learning and development investment and future workforce strategy and skills, and around half say their board is monitoring employee engagement scores.

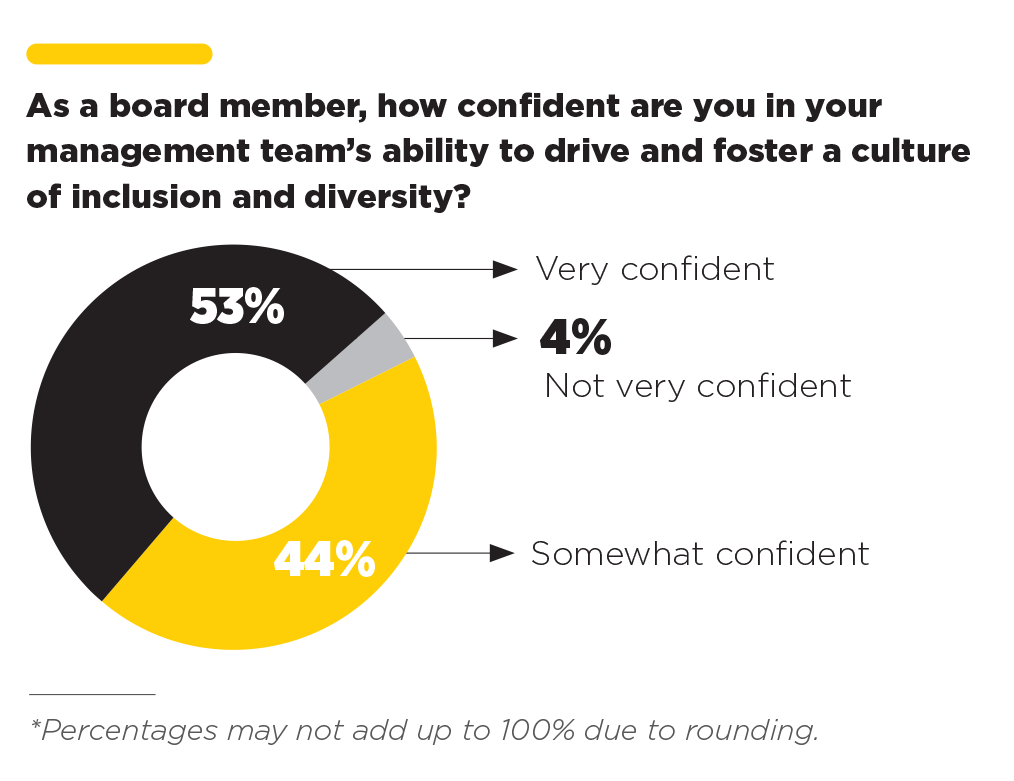

Even with diversity and inclusion (D&I), which is widely recognized as imperative to talent strategy in today’s business environment, nearly 40% of directors report that their board is not monitoring D&I metrics. These results are unexpected, particularly considering that an overwhelming majority (96%) of directors feel confident that their management team is fostering a culture of inclusion and diversity. It seems such confidence could be more strongly rooted in data related to D&I performance.

In fact, of the talent metrics presented, only leadership succession/bench strength is being monitored by an overwhelming majority (89%) of the boards represented, which is expected given that succession planning has long been understood as a primary board responsibility, although the study finds, at least anecdotally, that discussions surrounding succession planning remain focused on the CEO and not as much on job functions below the top senior executive posts..

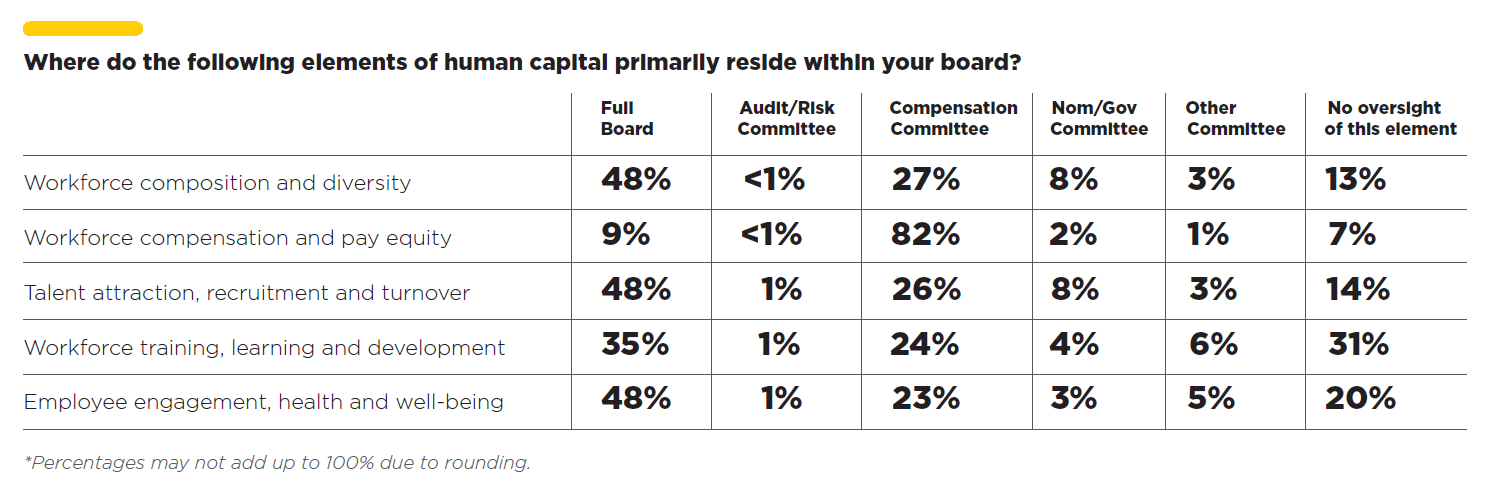

Similarly, while most directors report that fundamental elements of human capital are overseen by the full board or a key committee (usually the compensation committee), some report no oversight of other elements. For instance, close to a third (31%) of directors report that there is no oversight of workforce training, learning and development on their board, 20% report that there is no oversight of employee engagement, health and well-being, and around 13% report there is no oversight of workforce composition and diversity or talent attraction, recruitment and turnover.

The Opportunity

Regularly monitoring a variety of human capital metrics and ensuring board or committee responsibility for key elements offers boards deeper insight into fundamental areas of value. Having a diverse workforce with a strong culture of inclusion is foundational to attracting, engaging and retaining top talent. Employee turnover can represent a significant cost to organizations given lower productivity and the resources expended to recruit and onboard new employees. Employee engagement is critical to productivity and innovation. Reskilling workers to meet future strategy needs and fill skills gaps has the potential to meet the needs of the company while also providing career mobility and adaptability, increased job security and higher wages to a large swath of the workforce. Similarly, investing in the compensation, learning and development of the company’s most significant asset—its people—is fundamental to securing and capitalizing on that asset as well as benefiting the broader labor market and economy.

Boards should embrace a “trust but verify” oversight approach using analysis of direct and indirect metrics for culture and human capital intelligence. Overseeing a broader scope of human capital elements and regularly monitoring related metrics (such as those listed on the following page) can help all boards obtain a comprehensive picture of the company’s human capital and its enablement of (or risks to) business objectives. Further, with an overwhelming majority of boards spending more time discussing talent strategy, regularly incorporating a more comprehensive set of culture- and talent-related metrics will make those discussions more robust and productive, and assigning explicit responsibilities at the full board or committee level will provide greater visibility and foster accountability.

“Many of the most well-thought-out strategies either fail or are less effective because the human capital that’s required to implement it and sustain it and build resiliency isn’t at the company. And I think that’s a failing of the board as well as management.”

— Henry Nasella, Lead Director and Nom/Gov Chair, PVH Corporation; Former President, Staples; Former Board Member, Panera Bread, Denny’s and Ulta Beauty

Nearly 85% of directors support investments in employee training and reskilling to secure long-term value benefits even if they may not deliver short-term returns.

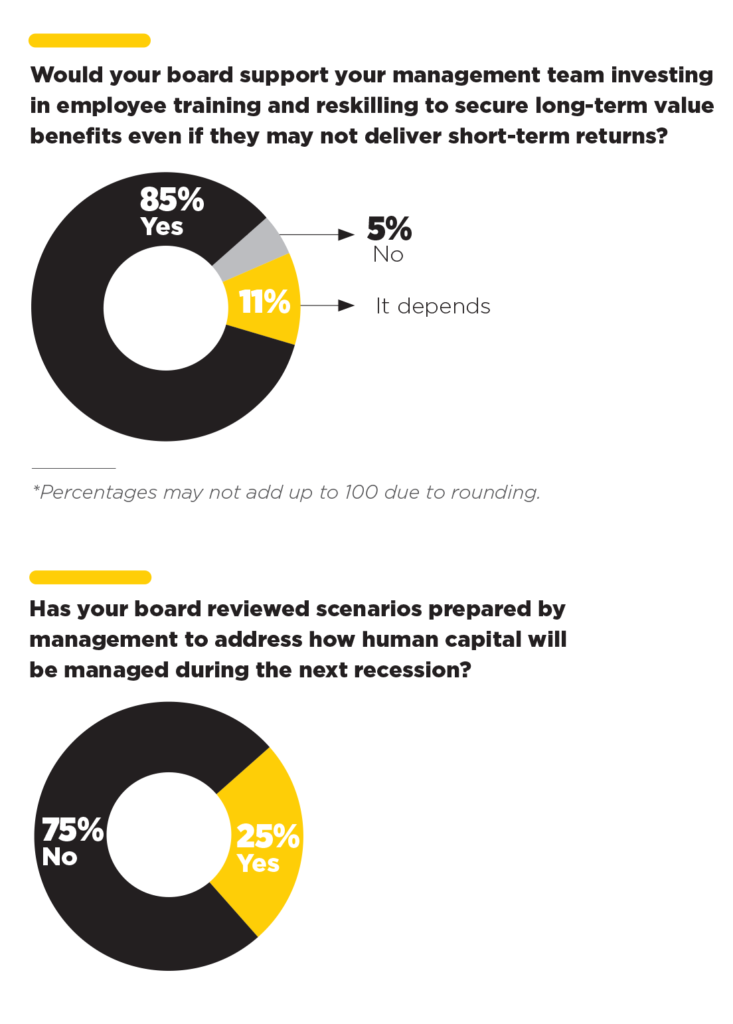

Another challenge facing companies and their boards is the impact of new technologies on their workers, as an increasing number of functions get automated. According to the survey, 51% of directors say their board has not discussed the impact of technological disruption on the company’s workforce. Still, 85% say they would support management’s decision to invest in employee training and reskilling to secure long-term value benefits even if they may not deliver short-term returns.

Board support for long-term talent investments—and deeper board understanding of how technological disruption is impacting the workforce—is critical. Given the fast pace of change, organizations that lack a strategy for continually developing the skills of their people are not likely to have much of a future. In this period of disruption, companies need to nurture not only technical skills but also new ways of thinking and responding to change—this may include enhancing human capabilities, such as critical thinking, the ability to collaborate, embracing D&I and continuous learning, and feeling comfortable with ambiguity and change. Companies should challenge themselves as to how successfully they are developing change management as a core competency at the entity and individual levels and augmenting that focus with continual learning opportunities. Organizational agility and adaptability are critical to sustainability. Given rising stakeholder expectations around the role corporations should play in society, board understanding of the broader implications of the company’s human capital approach is needed to better inform strategy.

Board support for long-term talent investments that may dampen short-term returns is likely to be tested in the next economic downturn. Boards should help their companies strategize for challenges beyond the horizon while driving current business results, even—and perhaps particularly— during times of economic uncertainty and challenge. Companies that fare best in uncertain business environments don’t just play it safe; they also look for opportunities in that uncertainty and allocate resources to double down on growth. For the talent agenda, this could mean investing in new technologies and related employee reskilling, maintaining a focus on innovation and culture and continuing to prioritize investments in the workforce that benefit the company as well as the broader labor market (e.g., learning and development programs and D&I initiatives that position workers for upward mobility).

The Opportunity

Scenario analyses and stress testing are helpful tools to foster meaningful discussions around potential risks the company faces, how those challenges may impact future performance and what should be done to manage them. However, only a quarter of directors say their board has reviewed scenarios prepared by management to address how human capital will be managed during the next recession. We think this reveals opportunity for more robust strategy-setting discussions and “what if” scenario analyses around talent implications, especially given current economic, geopolitical and social signals.

Through stress testing and scenario analyses, companies can analyze the implications of various top-line decreases and related impacts to the workforce. Such analyses may include consideration of the critical skill sets that are needed now, future skill sets required to execute long-term strategic objectives, and which employees may need to be retrained or upskilled. Other considerations may include whether the company will reduce headcount in the next economic downturn. And if so, by how much and over what period of time? Or, will the company shift its labor pool to operate in lower-cost geographies? Has the organization optimized its human/technology mix? Evaluating these and other implications through scenario planning around the workforce allows the board and management to determine in advance of economic downturns how best to reallocate resources to optimize operations during those periods. These scenario exercises may also help organizations evaluate and shift fixed costs to variable costs, allowing them to embed greater flexibility into their operating model to adapt to recessionary conditions or flex as growth opportunities arise.

“Most boards take CEO succession planning very seriously but don’t have as robust a discussion around key human capital tenets that address the leadership team’s strengths, weaknesses and gaps. There’s a strategy behind it: How do you attract talent? How do you work with the new generation of workers? How do you enable your people to take the company to the next level? And how do individual leaders build upon

or erode the corporate culture?”

— Dawn Zier, Former CEO, Nutrisystem; Board Member, The Hain Celestial Group and Spirit Airlines

Almost half of directors do not think their company’s external reporting communicates the

organization’s human capital strategy and the stakeholder outcomes it aims to deliver.

Human capital has emerged as a critical focus for stakeholders. And yet, almost half (48%) of directors say that their organization’s external communications to key stakeholders do not include communications around the organization’s human capital strategy and the stakeholder outcomes the strategy aims to deliver.

In today’s business environment, integrating information about long-term value drivers like human capital and culture across company communications is increasingly important. Further, as investors increase their integration of ESG (environmental, social and governance) matters into investment processes, not effectively communicating the company’s human capital strategy and progress may ultimately impact the company’s inclusion in certain portfolios.

Companies seeking to enhance how they measure and report on human capital and culture may look to a variety of market-driven frameworks (e.g., SASB, the Embankment Project for Inclusive Capitalism, the Global Reporting Initiative) that support the redefinition and communication of corporate value through an expanded stakeholder lens.

Conclusion

When companies prioritize employees—through purpose, culture, development and leadership—and deploy technology and automation as tools to support their capabilities, the true human potential for agility, creativity and innovation can soar. Each organization has to define how it can best manage its human capital risks and priorities, and there is no one-size-fits-all solution. What is clear, though, is that many directors are looking for ways to provide insight, foresight and oversight in matters of talent and culture, and many boards are actively enhancing their governance in this area.

Strengthening board oversight of human capital and talent will be a journey, and a starting point for many boards may be to rethink their views on the board’s fundamental role in this area. In today’s disruptive information age, human capital and culture are essential to helping companies adapt, problem-solve, innovate and increase productivity. Human capital has moved beyond being a strategic asset to become a strategic imperative. Boards should embrace this change and seize the opportunity to help make the company’s people a greater strategic priority.

Questions for the Board to Consider

- Does the board set the right tone at the top regarding the strategic importance of human capital by dedicating the appropriate level of time and attention to these topics, including at the full board and committee levels?

- Does the board have the right mix of relevant skills, expertise, perspectives and experiences that allows for effective oversight and direction of human capital and talent?

- Do the board and the company’s senior leaders understand the trends affecting the workforce of the future? Are the senior leaders driving the necessary shifts in culture, training and development?

- Does the board integrate the topic of human capital and talent strategy into discussions about strategy and risk?

- What actions should the board take to enhance its effectiveness in its oversight of the human capital strategy?

- What are the future skill sets that will be needed to successfully achieve the company’s long-term strategic objectives? How will the organization acquire or develop such skill sets?

- Have appropriate and meaningful human capital and talent-related metrics been identified? If so, how often is the board reviewing such metrics with the CHRO?

- How is the company integrating human capital metrics and performance into earnings calls, analyst meetings and its external financial reporting to better communicate long-term value?

Survey Methodology

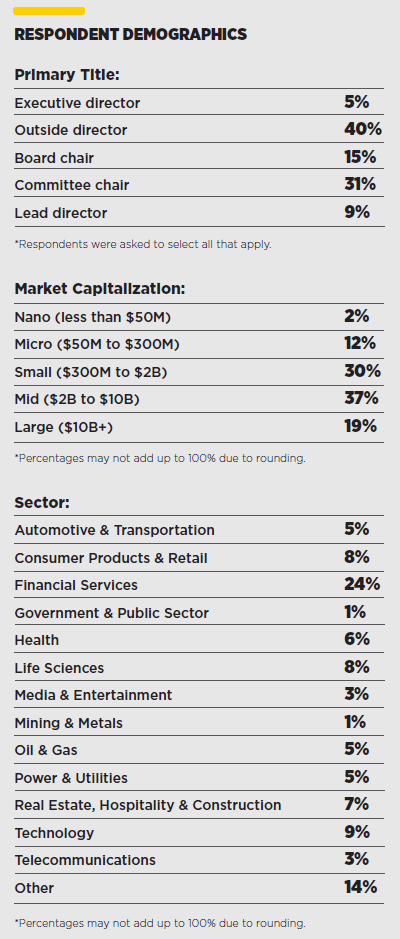

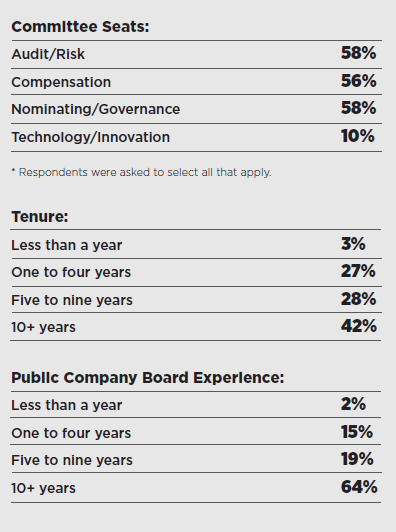

In September and October of 2019, Corporate Board Member partnered with EY to survey public company directors in the United States on their views and experience with how boards and their management teams are handling talent strategies in a new workforce era. Data was collected from 378 participating board members. Their demographics are presented below.

Print

Print