Hannah Orowitz is Managing Director of Corporate Governance and Brigid Rosati is Director of Business Development at Georgeson.

With only one month remaining in the 2020 proxy season, an examination of early voting statistics [1] among Russell 3000 companies reveals that climate-related investor concerns are having a meaningful impact on the 2020 season. This is not surprising given the focus paid to this topic by both BlackRock and State Street in their respective CEO letters published in January of this year. We saw this impact not only through increased support for climate-focused shareholder proposals, but also as a notable factor influencing the degree of support for director elections. The impact of climate concern is affecting other “traditional” governance-focused shareholder proposals as well, such as those seeking to separate the roles of board chair and CEO.

Beyond climate-focused proposals, an examination of environmental and social (E&S) shareholder proposals generally shows that diversity-focused proposals are also garnering significant shareholder support this season. A look at governance shareholder proposals illustrates that measures seeking to remove supermajority vote requirements, implement shareholder rights to act by written consent or to call a special meeting are still receiving strong shareholder support. Support for proposals seeking to separate the roles of chair and CEO appears to be increasing significantly this season.

While Covid-19’s shadow loomed large over the peak annual meeting season, the proposals being voted upon were submitted in advance of the pandemic’s arrival in the U.S. Accordingly, while in some cases a company’s to-date response to the pandemic may have factored into investors’ voting decisions, we will not see the pandemic’s impact on the shareholder proposal landscape in earnest until the 2021 proxy season. Next year, we expect to see more proposals addressing topics such as employee health and safety, human rights, supply chain management and human capital management.

Of course, the pandemic did affect meeting logistics. While meeting postponement has been more common abroad, only 14 companies have done so within the US, [2] according to Glass Lewis. Instead, most U.S. companies with mid-March and later meeting dates opted to transition to a virtual meeting format—a total of 2,208 companies as of May 13th, according to ISS. [3]

Director Elections

To date this season, 35 directors failed to receive at least 50% shareholder support for their election or re-election. [4]

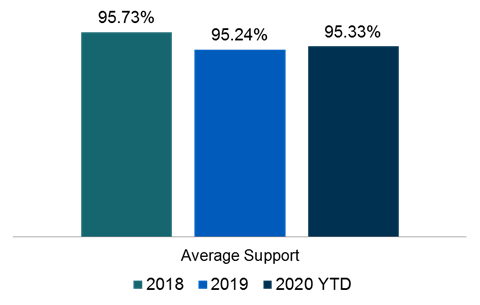

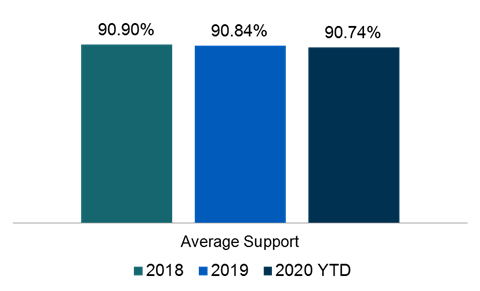

Director Elections: Average Support 2018—2020

Average support for directors to date in 2020 is within the range of average support directors experienced in the 2018 and 2019 seasons.

While overall support remains high, investors continue to scrutinize board composition and accountability. Specific voting decisions will not be known until late August, however our voting intelligence to-date suggests that issues such as board diversity, director overboarding and companies’ management of disclosure regarding E&S issues are driving investors to vote against incumbent directors. For example, at National Fuel Gas Company’s annual meeting, BlackRock reported voting against the re-election of the company’s audit committee chair due to “the company’s lagging disclosure related to the oversight and management of climate-related risks and the materiality of the risk to the company.” And at Bristol-Myers Squibb Co.’s May meeting, Neuberger Berman disclosed voting against an incumbent director due to overboarding concerns.

Say on pay

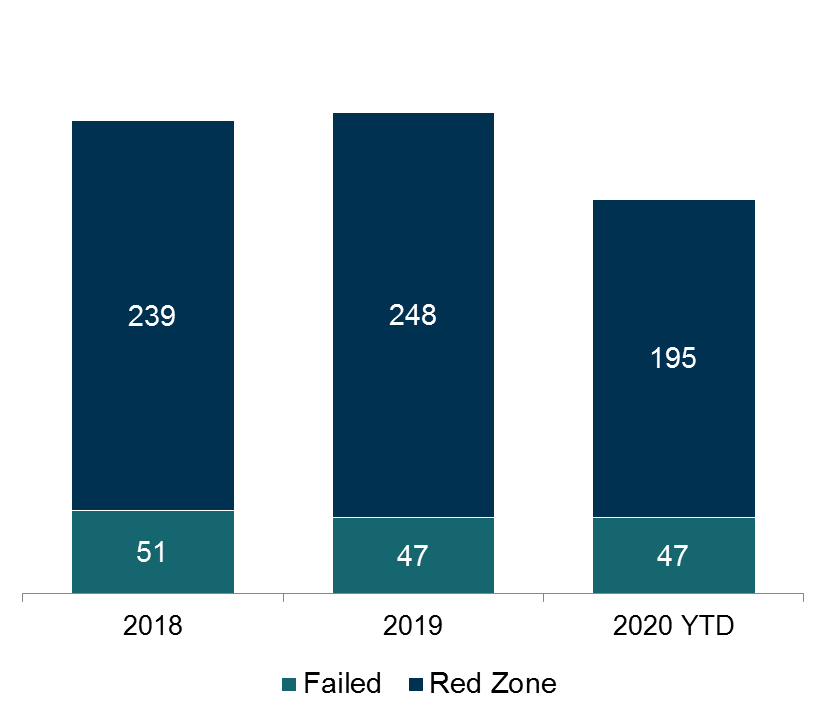

While average support for say on pay proposals remained strong this season at 90.74%, 47 companies have failed to receive majority support so far this year. In total, 195 companies failed to reach at least 80% support—the “red zone” threshold at which Glass Lewis begins to scrutinize companies’ responsiveness to shareholder concerns. ISS reviews companies’ responsiveness with additional scrutiny where shareholder support fails to reach 70%.

Average Say on Pay Support 2018—2020 [5]

Challenged Say on Pay Votes 2018—2020

Shareholder Proposals

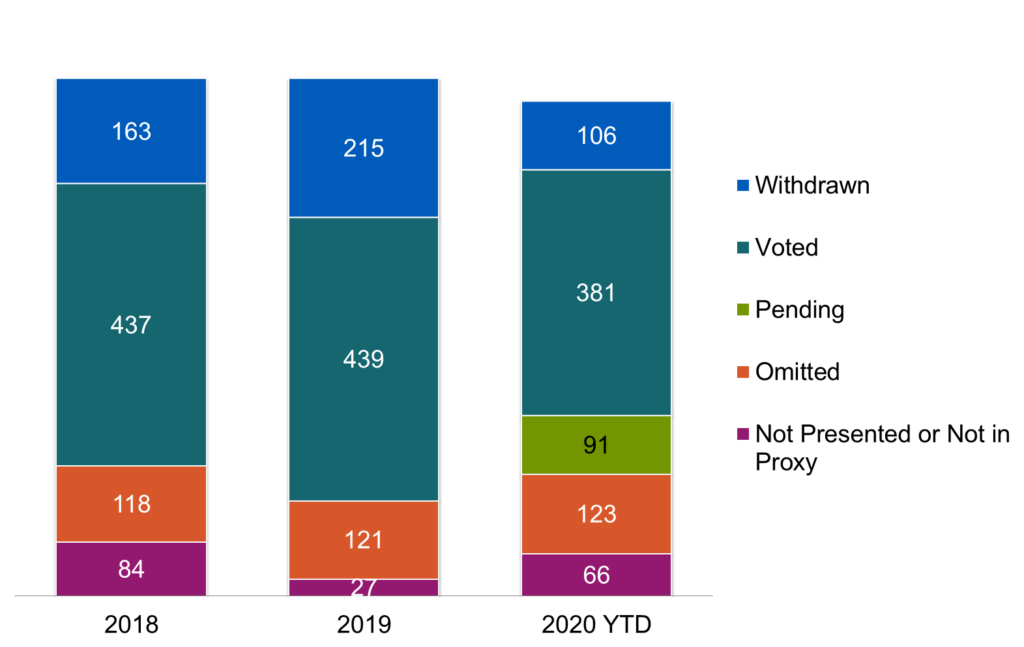

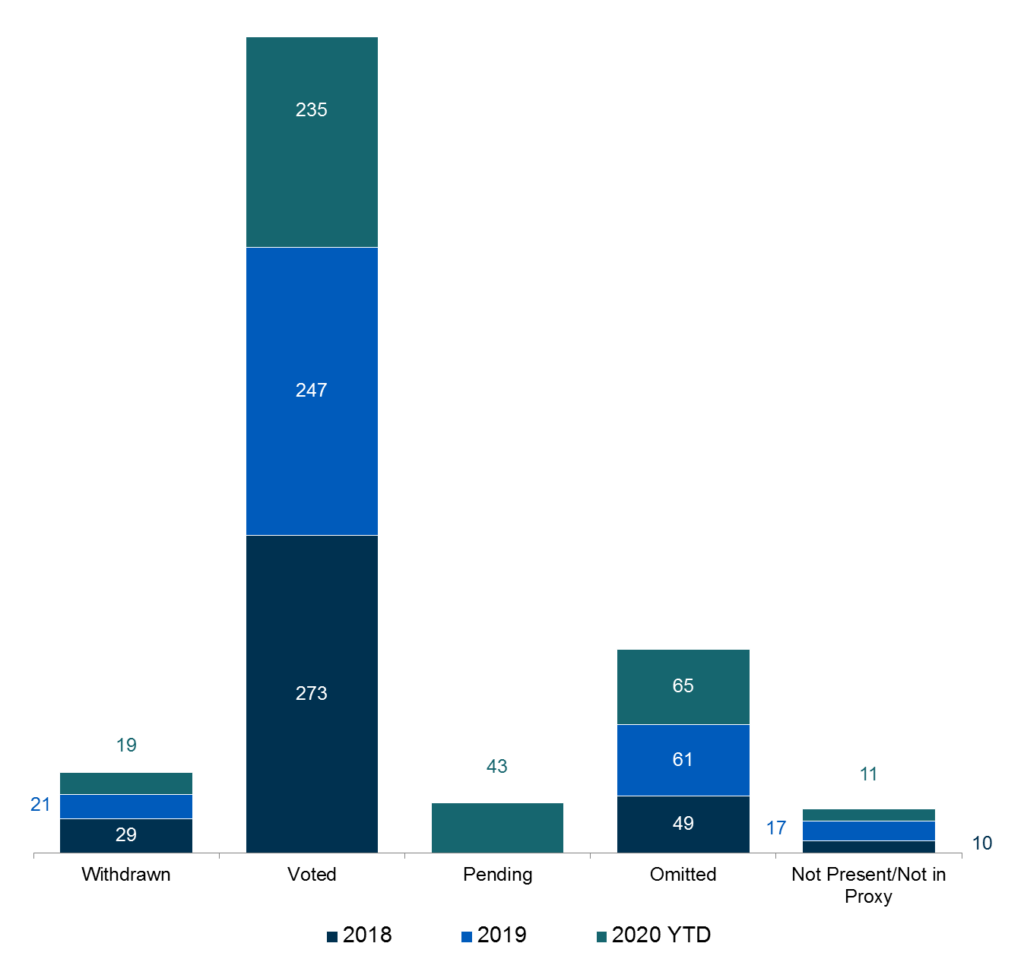

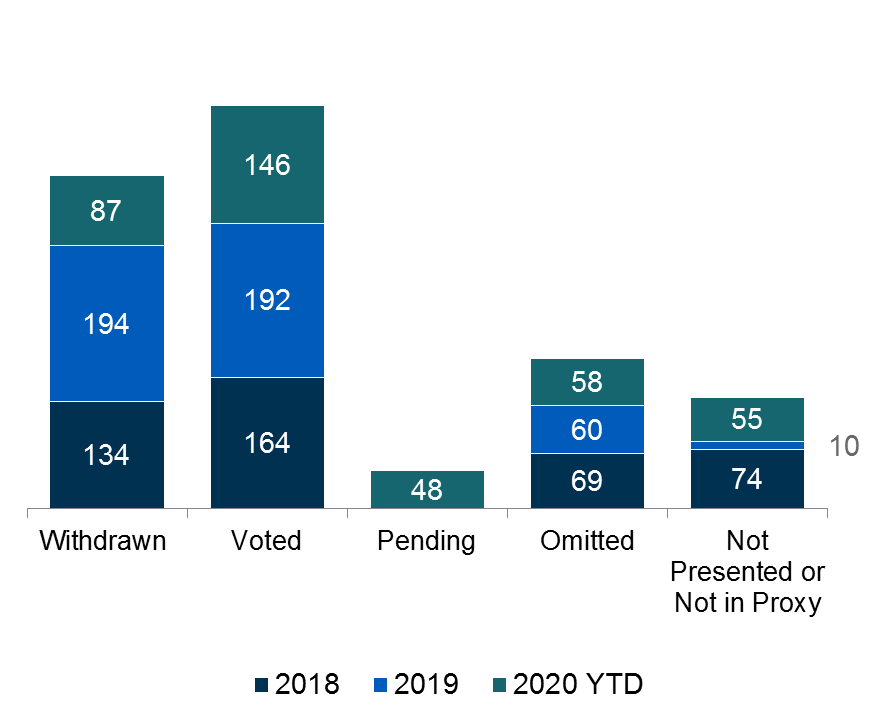

If the trend line continues, [6] it appears that approximately 62% of proposals submitted will be voted upon this season, compared to 55% and 54% in the 2019 and 2018 seasons, respectively. At the same time, the number of proposals withdrawn during the 2020 season represents just under 14% of proposals, as compared to 27% and 20% in 2019 and 2018, respectively. Given the season is not yet complete, it is possible that gaps in available data are impacting these results. [7] Based on the information presently available, however, it appears that proponents may have been less willing to compromise than in prior seasons. This may have been driven in part by an increased willingness by proponents to reach settlement on environmentally focused proposals during the 2019 season. In particular, during 2019 proponents may have been learning to navigate the SEC’s October 2018 guidance regarding micromanagement as a basis of exclusion under Rule 14a-8. As the following charts illustrate, companies and proponents are much more likely to reach negotiated settlements on E&S-focused proposals as compared to governance proposals.

As for proposals receiving no-action relief, those numbers have held relatively steady, representing 16%, 15% and 15% of all proposals for 2020, 2019 and 2018, respectively. Accordingly, it appears that the revisions to the SEC’s no-action process in the Fall of 2019 have had minimal impact on the number of proposals receiving no-action relief.

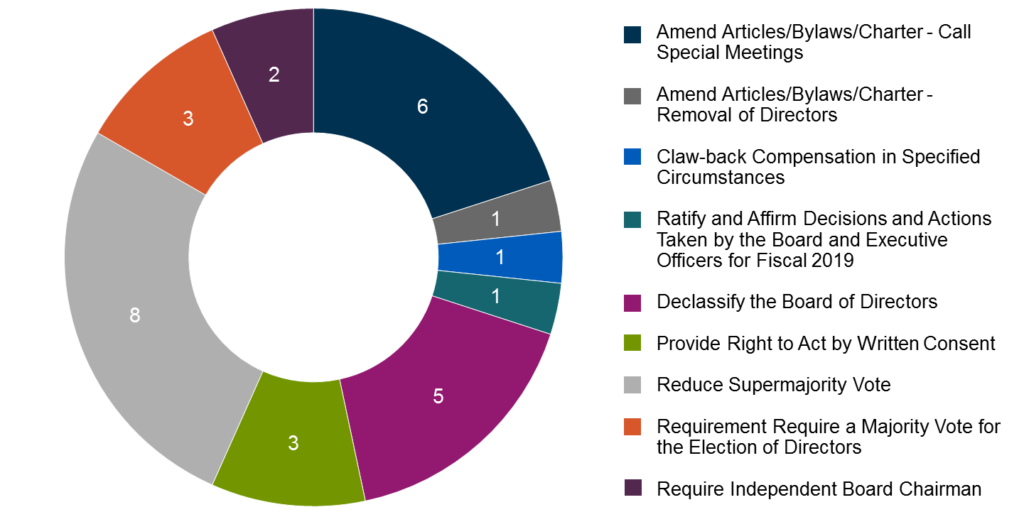

Governance Proposals 2018—2020 [8]

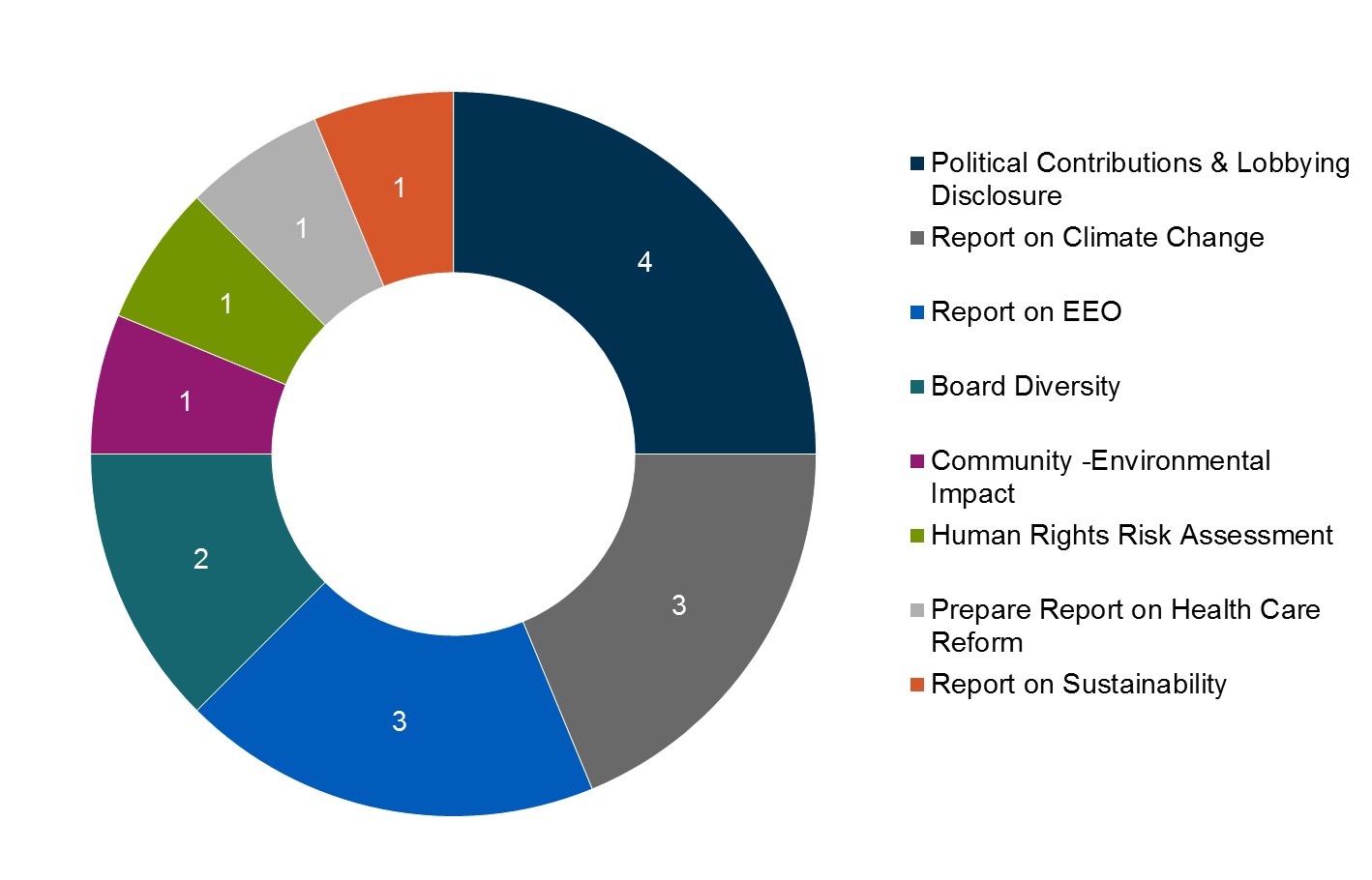

Environmental & Social Proposals 2018—2020

As of June 4th, 46 shareholder proposals have received majority support this season, as compared to 62 for the entire 2019 season. [9] Considering that 91 shareholder proposals are still pending, we anticipate the number of proposals receiving majority support for the full 2020 season will be somewhat lower than in 2019. Of those proposals that received majority support, 30 addressed traditional governance matters—such as majority voting, board leadership structure, and shareholder rights to act by written consent or call a special meeting—and 16 addressed a variety of environmental and social topics.

2020 Majority Supported Governance Proposals

2020 Majority Supported E&S Proposals

Discussed below are a few notable shareholder proposal trends we observed within these results.

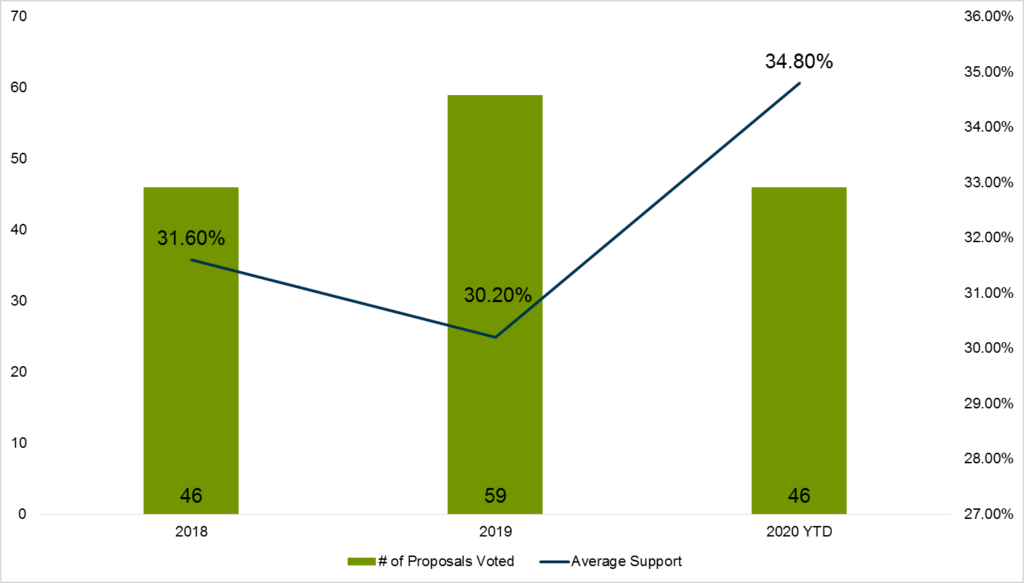

Support for Separating the Roles of Chair and CEO Has Increased

Heading into this season, we observed momentum in investors’ revisions to voting policies relating to leadership structure—such as at Legal & General and Wellington—and attention paid to the robustness of lead independent directors’ duties—such as at State Street. As expected, this momentum translated into increased scrutiny of companies’ board leadership structures in 2020. Year over year, investors’ support of proposals seeking to separate the roles of board chair and CEO increased notably from an average of 30.2% in 2019 to 34.8% as of June 4, 2020—an increase of over 15%. Further, although no such proposal received majority support during the 2019 calendar year, two such measures have received majority support as of June 4, 2020, at The Boeing Company and at Baxter International. An additional 16 proposals received support of more than 40%.

Independent Chair Shareholder Proposals Voted on 2018—2020

Historically, U.S.-based investors have been relatively agnostic about leadership structure so long as the lead independent director role was well-defined. However, it appears viewpoints may be meaningfully shifting, with investors challenging companies who maintain a combined role with greater frequency this season, particularly in instances where investors have broader governance concerns. For example, BlackRock reported supporting a proposal to separate the roles of chair and CEO at Exxon Mobil’s May 27, 2020 annual meeting due to a perceived shortcoming in the company’s disclosure and actions relating to several components of its climate risk management. 2020 may represent a tipping point with respect to investors’ support of the separation of these roles. Further, given the increased demands on boards and senior management due to the ongoing coronavirus pandemic, support for these proposals may continue to accelerate into the 2021 proxy season.

Investors’ Focus on Diversity Continues

In October 2019, The New York City Comptroller’s Office launched its Board Accountability Project 3.0 campaign, sending letters to 56 companies seeking the implementation of policies requiring the consideration of qualified women and racially/ethnically diverse candidates for director and external CEO searches. The Comptroller’s proposed policy is referred to as the Rooney Rule, borrowed from the NFL, which requires teams to interview minority candidates for front office positions.

As promised in the Board Accountability Project 3.0 letter, the Comptroller’s Office submitted shareholder proposals at 17 of the targeted companies that did not in the Office’s view adequately address its request. After receipt of the shareholder proposals, 13 of the 17 companies implemented Rooney Rule policies. Accordingly, the Comptroller’s Office reported withdrawing the proposals at the following companies:

- Activision Blizzard

- Dover Corporation

- Expedia Inc.

- Fastenal Company

- Genuine Parts Company

- Hilton Worldwide Holdings

- L Brands

- MarketAxess Holdings, Inc.

- Nektar Therapeutics

- Robert Half International

- Ross Stores

- UDR, Inc.

- Verisign

While many companies have adopted policies requiring consideration of diversity for director searches, these are the first 13 companies known to have extended such a policy to external CEO searches. Additionally, Regions Financial, which was not one of the 56 companies targeted by the Comptroller’s Office, proactively extended its existing director diversity search policy to also apply to CEO searches after the campaign’s launch.

Among the four remaining companies where the proposal was not withdrawn:

- One received majority support—Expeditors International of Washington, Inc.

- Two of the focus companies—Arthur J. Gallagher and PACCAR—implemented policies addressing only the director search prong of the Comptroller’s proposal. PACCAR subsequently successfully received no-action relief from the SEC to exclude the proposal. However, the proposal went to a vote at A.J. Gallagher, receiving just over 24% support.

- The fourth proposal, at Berkshire Hathaway, did not receive meaningful support given company’s significant insider ownership.

These results demonstrate that, for the time being at least, the absence of any policy at a target company likely will be heavily scrutinized by investors. However, extrapolating from the results at A.J. Gallagher as compared to those at Expeditors International, diverse candidate pools at the C-suite level appear to have been lower priority to investors than in the boardroom. We expect many companies may face increasing pressure to extend director search policies to CEOs considering the results of the Comptroller’s campaign and the current social climate.

Beyond the Boardroom Accountability 3.0 campaign, several other diversity-related proposals have also received majority support so far this season. Also on the subject of board diversity, a proposal requesting a report on the company’s plans to increase board diversity submitted at National HealthCare Corporation by the New York State Comptroller received majority support. In the vein of workforce diversity and inclusion, proposals at Fastenal Company, Genuine Parts Company and O’Reilly Automotive, Inc. received majority support. All three proposals sought reporting on the diversity of the respective company’s workforce based on gender and the Employer Information Report EEO-1 racial and ethnic categories. In the case of Genuine Parts and O’Reilly Automotive, the proposal also requested broader reporting on policies, performance and improvement targets (taking into account SASB-aligned metrics) related to material human capital risks and opportunities.

Five Environmentally-Focused Proposals Receive Majority Support

To date, five proposals focused on climate-related reporting have received majority support. This represents a notable increase compared to the 2019 proxy season, where no such proposals garnered majority support. The affected companies were:

- B. Hunt Transport Services, Inc., where a proposal seeking a report describing if and how the company plans to reduce its contribution to climate change, and align its operations with Paris Agreement goals received 54.5% support

- Ovintiv, Inc., where a proposal seeking disclosure of the company’s climate-related targets, risks and opportunities aligned with Paris Agreement goals received 56.4% support

- Phillips 66, where a proposal seeking a report assessing the public health risks of expanding petrochemical operations and investments in areas increasingly prone to climate change-induced storms, flooding and sea level rise received 53.9% support

- Chevron, where a proposal seeking reporting on climate lobbying aligned with Paris Agreement goals received 53.9% support

- Enphase Energy, where a proposal seeking a report on the company’s ESG performance—specifically citing waste, water reduction targets and product related environmental impacts as topics that potentially pose significant risks to the company—received 51.8% support

Phillips 66 and Chevron are two of the 161 companies targeted by the Climate Action 100+ investor initiative focused on climate change, which continued to gain momentum this proxy season. Notably, in line with BlackRock’s vocal focus on climate change this season, it became a Climate Action 100+ signatory in January 2020. BlackRock’s disclosed stewardship activities to date suggest it is taking a firmer stance on climate change than in the past. While BlackRock has not yet disclosed its voting decision at Phillips 66’s meeting, at Chevron’s May 28th annual meeting, it disclosed voting in favor of the above-mentioned lobbying proposal. In doing so, it noted that investors would benefit from understanding the “alignment between Chevron’s political activities and the goal of the Paris Agreement to limit global warming to no more than two degrees Celsius…” BlackRock also reported supporting the proposal at Ovintiv, due to the fact, over a multi-year engagement with the company on climate-related matters, it has not yet set targets recommended by the TCFD framework, or disclosed a timeline for doing so. Notably, BlackRock reported voting against the proposal at J.B. Hunt. That the proposal attracted majority support indicates that other institutions also may have shifted behavior to vote in support of climate-related proposals. Once N-PX filings are available, it will become apparent which institutions have done so.

In addition to majority supported proposals, significant activity surrounding climate change during the 2020 proxy season took place outside of the four corners of a proxy ballot. A review of withdrawn proposals shows 44 environmentally-focused proposals where presumably the subject company and the proponent reached an agreement on the subject matter of the proposal.

One company falling into this category—Southern Company—had a withdrawn proposal seeking climate change risk reporting from Climate Action 100+ participant As You Sow. At its recent annual meeting, Southern Company announced committing to a 2050 net-zero carbon emissions target consistent with the position advocated by Climate Action 100+.

Where companies did not settle with proposal proponents, engagements with their institutional investors prior to their meetings also often influences vote outcomes. A BlackRock vote bulletin relating to Sanderson Farms’ annual meeting is illustrative in this regard: BlackRock declined to support two shareholder proposals on the ballot, one of which related to water resource risks, on the basis that during discussions with BlackRock prior to the meeting, Sanderson Farms committed to producing SASB-aligned disclosure.

One More Month

Despite the pandemic, most U.S. companies moved forward with their annual general meetings, either turning to a virtual-only or hybrid format. Based on the shareholder support we are seeing so far, it doesn’t appear that investors are giving companies respite from climate-related concerns in light of the pandemic. It is not yet clear whether shifting investor priorities in light of the pandemic factored into voting decisions overall this season.

Covid-19 is being raised in companies’ engagements with issuers, and recent statements from investors ranging from State Street to Boston Walden Trust indicate companies should be prepared to discuss Covid-19 considerations during off-season engagements, including how the pandemic is impacting strategic planning, supply chain management and employee-related considerations.

The impact from Covid-19 on the shareholder proposal landscape will mostly come into play next season. In particular, executive compensation decisions will be closely examined. We expect shareholders will not respond favorably to boards that have reset executives’ performance metrics, repriced options, or otherwise used discretion to revisit pay decisions that are not aligned with shareholders’ experiences. It is likely that we’ll see some shareholder proposal focuses arise from Covid-19 as well, perhaps more looking at supply chain risk or employee health and safety.

Appendix

The table below shows the shareholder proposals that have passed in accordance with each company’s applicable voting standard, as indicated in green text in the applicable column, as of June 4, 2020.

| Company Name | Category | Proposal Type | For/

F+A% |

For/F+A+AB% | Meeting Date |

| Abbott Laboratories | Governance | Reduce Supermajority Vote Requirement | 84.9 | 84.5 | 2020-04-24 |

| Abeona Therapeutics, Inc. | Governance | Require a Majority Vote for the Election of Directors | 99.6 | 99.5 | 2020-05-20 |

| Alaska Air Group, Inc. | E&S | Political Lobbying Disclosure | 52.3 | 50.9 | 2020-05-07 |

| Alico, Inc. | Governance | Require a Majority Vote for the Election of Directors | 95.5 | 76.6 | 2020-02-27 |

| AMERCO | Governance | Company-Specific–Governance-Related | 81.3 | 81.2 | 2019-08-22 |

| Axon Enterprise, Inc. | Governance | Declassify the Board of Directors | 84.8 | 84.5 | 2020-05-29 |

| Baxter International Inc. | Governance | Require Independent Board Chairman | 55 | 54.9 | 2020-05-05 |

| Berry Global Group, Inc. | Governance | Provide Right to Act by Written Consent | 54.6 | 54.2 | 2020-03-04 |

| Bloomin’ Brands, Inc. | Governance | Declassify the Board of Directors | 84.5 | 84.5 | 2020-05-29 |

| Cadence Design Systems, Inc. | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 54.5 | 53.7 | 2020-04-30 |

| Centene Corporation | E&S | Political Contributions Disclosure | 51.4 | 51.2 | 2020-04-28 |

| Centene Corporation | Governance | Reduce Supermajority Vote Requirement | 93.9 | 93.8 | 2020-04-28 |

| Chevron Corporation | E&S | Report on Climate Change | 53.5 | 49.3 | 2020-05-27 |

| Daseke, Inc. | Governance | Declassify the Board of Directors | 97.6 | 95.8 | 2020-05-21 |

| Duke Energy Corporation | Governance | Reduce Supermajority Vote Requirement | 94.2 | 85.6 | 2020-05-07 |

| E*TRADE Financial Corporation | Governance | Reduce Supermajority Vote Requirement | 99.4 | 97.4 | 2020-05-07 |

| Electronic Arts Inc. | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 57.5 | 57.4 | 2019-08-08 |

| Enphase Energy, Inc. | E&S | Report on Sustainability | 52.3 | 51.8 | 2020-05-20 |

| Expeditors International of Washington, Inc. | E&S | Board Diversity | 52.9 | 52.7 | 2020-05-05 |

| Farmer Bros. Co. | Governance | Declassify the Board of Directors | 97.1 | 76 | 2019-12-10 |

| Fastenal Company | E&S | Report on EEO | 61.1 | 57.7 | 2020-04-25 |

| Genuine Parts Company | E&S | Report on EEO | 79.1 | 74.5 | 2020-04-27 |

| Guidewire Software, Inc. | Governance | Require a Majority Vote for the Election of Directors | 88.1 | 87.7 | 2019-12-17 |

| International Business Machines Corporation | Governance | Amend Articles/Bylaws/Charter – Removal of Directors | 54.5 | 53.7 | 2020-04-28 |

| J.B. Hunt Transport Services, Inc. | E&S | Report on Climate Change | 54.5 | 54.3 | 2020-04-23 |

| J.B. Hunt Transport Services, Inc. | E&S | Political Contributions Disclosure | 53.2 | 53 | 2020-04-23 |

| Johnson & Johnson | E&S | Prepare Report on Health Care Reform | 60.9 | 56.7 | 2020-04-23 |

| Kellogg Company | Governance | Reduce Supermajority Vote Requirement | 52.8 | 52.6 | 2020-04-24 |

| Laboratory Corporation of America Holdings | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 53.4 | 53.2 | 2020-05-13 |

| Legg Mason, Inc. | Governance | Reduce Supermajority Vote Requirement | 97.4 | 93.4 | 2019-07-30 |

| Marathon Petroleum Corporation | Governance | Reduce Supermajority Vote Requirement | 98.5 | 97.9 | 2020-04-29 |

| Marriott International, Inc. | Governance | Reduce Supermajority Vote Requirement | 66.9 | 65.5 | 2020-05-08 |

| Microchip Technology Incorporated | E&S | Human Rights Risk Assessment | 51.3 | 50.6 | 2019-08-20 |

| National Fuel Gas Company | Governance | Declassify the Board of Directors | 73.2 | 72.2 | 2020-03-11 |

| National HealthCare Corporation | E&S | Board Diversity | 59.2 | 57.9 | 2020-05-07 |

| OGE Energy Corp. | Governance | Provide Right to Act by Written Consent | 79.8 | 78.7 | 2020-05-21 |

| O’Reilly Automotive, Inc. | E&S | Report on EEO | 66 | 64.9 | 2020-05-14 |

| Ovintiv, Inc. | E&S | Report on Climate Change | 56.4 | 56.4 | 2020-04-29 |

| Phillips 66 | E&S | Community -Environmental Impact | 54.7 | 53.9 | 2020-05-06 |

| Rite Aid Corporation | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 60.3 | 59.7 | 2019-07-17 |

| Sonoco Products Company | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 70.2 | 70.1 | 2020-04-15 |

| Stanley Black & Decker, Inc. | Governance | Provide Right to Act by Written Consent | 51 | 50.9 | 2020-04-17 |

| Stericycle, Inc. | Governance | Claw-back Compensation in Specified Circumstances | 54.5 | 53.1 | 2020-05-22 |

| The Boeing Company | Governance | Require Independent Board Chairman | 52.9 | 52.1 | 2020-04-27 |

| The Western Union Company | E&S | Political Contributions Disclosure | 53.3 | 53 | 2020-05-14 |

| Verizon Communications Inc. | Governance | Amend Articles/Bylaws/Charter – Call Special Meetings | 52.3 | 51.8 | 2020-05-07 |

| Company Name | Category | Proposal Type | For/F+A% | For/F+A+AB% | Meeting Date |

|---|---|---|---|---|---|

| Abbott Laboratories | Governance | Reduce Supermajority Vote Requirement | 84.9 | 84.5 | 2020-04-24 |

| Abeona Therapeutics, Inc. | Governance | Require a Majority Vote for the Election of Directors | 99.6 | 99.5 | 2020-05-20 |

| Alaska Air Group, Inc. | E&S | Political Lobbying Disclosure | 52.3 | 50.9 | 2020-05-07 |

| Alico, Inc. | Governance | Require a Majority Vote for the Election of Directors | 95.5 | 76.6 | 2020-02-27 |

| AMERCO | Governance | Company-Specific–Governance-Related | 81.3 | 81.2 | 2019-08-22 |

| Axon Enterprise, Inc. | Governance | Declassify the Board of Directors | 84.8 | 84.5 | 2020-05-29 |

| Baxter International Inc. | Governance | Require Independent Board Chairman | 55 | 54.9 | 2020-05-05 |

| Berry Global Group, Inc. | Governance | Provide Right to Act by Written Consent | 54.6 | 54.2 | 2020-03-04 |

| Bloomin’ Brands, Inc. | Governance | Declassify the Board of Directors | 84.5 | 84.5 | 2020-05-29 |

| Cadence Design Systems, Inc. | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 54.5 | 53.7 | 2020-04-30 |

| Centene Corporation | E&S | Political Contributions Disclosure | 51.4 | 51.2 | 2020-04-28 |

| Centene Corporation | Governance | Reduce Supermajority Vote Requirement | 93.9 | 93.8 | 2020-04-28 |

| Chevron Corporation | E&S | Report on Climate Change | 53.5 | 49.3 | 2020-05-27 |

| Daseke, Inc. | Governance | Declassify the Board of Directors | 97.6 | 95.8 | 2020-05-21 |

| Duke Energy Corporation | Governance | Reduce Supermajority Vote Requirement | 94.2 | 85.6 | 2020-05-07 |

| E*TRADE Financial Corporation | Governance | Reduce Supermajority Vote Requirement | 99.4 | 97.4 | 2020-05-07 |

| Electronic Arts Inc. | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 57.5 | 57.4 | 2019-08-08 |

| Enphase Energy, Inc. | E&S | Report on Sustainability | 52.3 | 51.8 | 2020-05-20 |

| Expeditors International of Washington, Inc. | E&S | Board Diversity | 52.9 | 52.7 | 2020-05-05 |

| Farmer Bros. Co. | Governance | Declassify the Board of Directors | 97.1 | 76 | 2019-12-10 |

| Fastenal Company | E&S | Report on EEO | 61.1 | 57.7 | 2020-04-25 |

| Genuine Parts Company | E&S | Report on EEO | 79.1 | 74.5 | 2020-04-27 |

| Guidewire Software, Inc. | Governance | Require a Majority Vote for the Election of Directors | 88.1 | 87.7 | 2019-12-17 |

| International Business Machines Corporation | Governance | Amend Articles/Bylaws/Charter—Removal of Directors | 54.5 | 53.7 | 2020-04-28 |

| J.B. Hunt Transport Services, Inc. | E&S | Report on Climate Change | 54.5 | 54.3 | 2020-04-23 |

| J.B. Hunt Transport Services, Inc. | E&S | Political Contributions Disclosure | 53.2 | 53 | 2020-04-23 |

| Johnson & Johnson | E&S | Prepare Report on Health Care Reform | 60.9 | 56.7 | 2020-04-23 |

| Kellogg Company | Governance | Reduce Supermajority Vote Requirement | 52.8 | 52.6 | 2020-04-24 |

| Laboratory Corporation of America Holdings | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 53.4 | 53.2 | 2020-05-13 |

| Legg Mason, Inc. | Governance | Reduce Supermajority Vote Requirement | 97.4 | 93.4 | 2019-07-30 |

| Marathon Petroleum Corporation | Governance | Reduce Supermajority Vote Requirement | 98.5 | 97.9 | 2020-04-29 |

| Marriott International, Inc. | Governance | Reduce Supermajority Vote Requirement | 66.9 | 65.5 | 2020-05-08 |

| Microchip Technology Incorporated | E&S | Human Rights Risk Assessment | 51.3 | 50.6 | 2019-08-20 |

| National Fuel Gas Company | Governance | Declassify the Board of Directors | 73.2 | 72.2 | 2020-03-11 |

| National HealthCare Corporation | E&S | Board Diversity | 59.2 | 57.9 | 2020-05-07 |

| OGE Energy Corp. | Governance | Provide Right to Act by Written Consent | 79.8 | 78.7 | 2020-05-21 |

| O’Reilly Automotive, Inc. | E&S | Report on EEO | 66 | 64.9 | 2020-05-14 |

| Ovintiv, Inc. | E&S | Report on Climate Change | 56.4 | 56.4 | 2020-04-29 |

| Phillips 66 | E&S | Community -Environmental Impact | 54.7 | 53.9 | 2020-05-06 |

| Rite Aid Corporation | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 60.3 | 59.7 | 2019-07-17 |

| Sonoco Products Company | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 70.2 | 70.1 | 2020-04-15 |

| Stanley Black & Decker, Inc. | Governance | Provide Right to Act by Written Consent | 51 | 50.9 | 2020-04-17 |

| Stericycle, Inc. | Governance | Claw-back Compensation in Specified Circumstances | 54.5 | 53.1 | 2020-05-22 |

| The Boeing Company | Governance | Require Independent Board Chairman | 52.9 | 52.1 | 2020-04-27 |

| The Western Union Company | E&S | Political Contributions Disclosure | 53.3 | 53 | 2020-05-14 |

| Verizon Communications Inc. | Governance | Amend Articles/Bylaws/Charter—Call Special Meetings | 52.3 | 51.8 | 2020-05-07 |

Endnotes

1All data used in this report has been sourced via ISS Corporate Solutions Voting Analytics, unless otherwise indicated. For purposes of this article, the proxy season refers to July 1 to June 30 for prior year 2018 and 2019 results discussed. For example, the 2019 proxy season includes meeting results from July 1, 2018 to June 30, 2019. With respect to the 2020 season, annual meeting results examined are for meeting dates held July 1, 2019 through June 4, 2020, unless otherwise indicated.(go back)

2See https://www.glasslewis.com/agm-and-shareholder-meeting-tracker-date-changes-due-to-coronavirus-pandemic/ (as of May 26, 2020). Note that this number does not include cancellations or instances where a company convened and immediately adjourned a meeting to a later date, such as in the case of Agilent on March 18, which was subsequently held on April 17. According to ISS’s Covid-19 resource center (accessible at: https://www.issgovernance.com/covid19-resource-center/) as of May 13, 2020 there had been 159 cancellations or postponements within the U.S.(go back)

3See https://www.issgovernance.com/covid19-resource-center/.(go back)

4In some cases, the applicable voting standard in place for the director’s election was a plurality of votes cast. Accordingly, failure to receive majority support does not necessarily indicate a failure to receive the support necessary for reelection under the applicable voting standard.(go back)

5All percentages discussed herein for purposes of average shareholder proposal support have been calculated on the basis of F/F+AG.(go back)

6Assuming the 91 proposals that are pending as of June 4th are voted upon at upcoming annual meetings(go back)

7For example, ISS Corporate Solutions Voting Analytics’ database does not yet capture the Rooney Rule proposals withdrawn by the New York City Comptroller’s office, discussed below.(go back)

8“Omitted” refers to proposals that were excluded on the basis of SEC no-action relief. “Withdrawn” refers to proposals where a proponent confirmed either publicly or directly to ISS that it had withdrawn the proposal. ”Not presented” indicates proposals that were included in proxy statements but not presented by the proponent at the annual meeting. ”Not in proxy” indicates proposals where it is not definitively known whether the proponent withdrew the proposal, and no record of no-action relief exists.(go back)

9Pass/fail determinations for all shareholder proposals discussed reflects proposal passage determinations reported by ISS Corporate Solutions Voting Analytics based on each company voting procedures (F/F+AG+AB or F/F+AG). All percentages discussed for purposes of average shareholder proposal support have been calculated on the basis of F/F+AG.(go back)

Print

Print