Kevin Eckerle is Director of Corporate Research and Engagement at the Center for Sustainable Business at the NYU Stern School of Business; Brian Tomlinson is Director of Research, CEO Investor Forum at Chief Executives for Corporate Purpose; and Tensie Whelan is Clinical Professor for Business at the NYU Stern School of Business. This post is based on their recent report.

The information shared through quarterly reporting moves markets. Institutional investors highly value the transparency and outputs of frequent periodic reporting. Investor Relations Officers (IROs) consistently identify the earnings call as the most important venue through which to communicate their story to the capital markets. Within the C-suite, preparing for the earnings call—and its associated package of disclosures—requires a significant commitment of time and resources.

The Earnings Call and the Short-Term

Quarterly reporting has been identified as a potential source or amplifier of short-term market pressures. Management’s focus on hitting quarterly financial targets can cause overweighting by both the C-suite and equity markets of in-year or in-quarter performance benchmarked to a narrow set of financial indicators. This underweights strategic issues with a longer-term time horizon, or those that are harder to quantify in the near-term, and consequently results in insufficient analysis and reporting of these issues in the earnings call.

For example, management teams may cut research and development (R&D) or other discretionary spending in order to meet an earnings target. Chief financial officers (CFOs) report that this occurs; it is an anticipated peer-group behavior among CFOs. This expected behavior is confirmed in the literature as firms that issue and just meet near-term earnings per share (EPS) targets display discontinuous R&D spending, which illustrates the underlying pattern that planned R&D spending (and economic value) is often sacrificed to avoid a short-term earnings miss. Overall, when compared with equivalent privately held peer firms, public companies have a shorter-term focus. Concern regarding the perceived impatience of the equity markets also appears to depress listing activity.

The concern about the negative impacts of quarterly reporting has led some commentators and policymakers to seek to reduce reporting frequency. In the United States, where quarterly reporting is mandatory, a move to end mandatory quarterly reporting entirely would be resisted by both the buy side and the sell side, particularly those analysts who rely on periodic disclosure to conduct fundamental analysis. The CFA Institute conducted a survey of institutional investors in 2019 that indicated overwhelming investor support for the continuation of quarterly reporting. At the roundtable on short-term and long-term capital markets organized by the Securities and Exchange Commission (SEC), there was minimal expectation of a reduction in reporting frequency. Evidence suggests that the move to semi-annual reporting by European jurisdictions has produced little practical impact. Additionally, studies suggest that volatility may marginally increase with less frequent company-reported information. Many companies, when given the option to report semi-annually, have chosen to continue to report quarterly to meet the information expectations of institutional investors.

Given the U.S. regulatory context and the investor attitudes described above, we focus this paper on adjusting the mix and time frame of the information reported quarterly, rather than on the frequency with which it is reported. In practical terms, it is not necessarily true that conversations conducted quarterly must focus exclusively on near-term goals; managers can have quarterly calls about longer-term targets. Issuers have substantial agency over what and how they report within the existing regulatory framework. This flexibility can be used to signal a long-term outlook and an alignment with the strategic priorities of structurally long-term investors.

The significance of conventional earnings call disclosures is also in question. The work of Baruch Lev suggests that the relevance of meets, beats, and misses of consensus EPS estimates seems to have diminished. There is growing informed skepticism about the usefulness of investment strategies focused on quarterly earnings analysis, and an emerging interest in a more appropriate focus on key value drivers relevant to the sector in which the business operates. As we know, key drivers of business value, particularly over the medium and long terms, may not be well captured by existing financial metrics.

Evidence of Disclosure Shifting Toward the Long-Term:

Investor days: Issuers are sharing long-term focused content at investor days. A notable example was United Health Group’s 2018 investor day presentation, which provided a view of the company to 2028. Other issuers identified as setting out long-term value stories include Best Buy, Cognizant, Ingersoll Rand, and P&G.

Environmental, social, and governance–focused calls: Issuers are starting to convene environmental, social, and governance (ESG) calls, which are opportunities to focus an investor-facing call on ESG themes (e.g., climate change, employee diversity and inclusion, and board diversity). These calls often follow the publication of the issuer’s annual sustainability report. Examples of companies hosting such calls include Jones Lang LaSalle, Johnson & Johnson, and Phillips. These efforts follow earlier pilot programs, such as the UN Global Compact’s ESG Investor Briefing Project, in which several companies (SAP, Enel, etc.) experimented with approaches to improve corporate communication with investors on material ESG issues. The concept did not catch on at the time, but has been rejuvenated by the volume and specificity of requests for ESG information from investors.

Earnings calls: Issuers have begun experimenting with methods of building elements of ESG-type disclosures into earnings call content. Becton, Dickinson and Company has been sharing sustainability highlights in their earnings call presentation as a first step to including greater ESG themes in call content.

Guidance practice: Issuing quarterly EPS guidance is now a minority practice. This has generally been replaced with end-of-year guidance within a range. The number of issuers providing longer-term financial guidance is increasing from a low base.

The Earnings Call and ESG: Gaps, Labels, and Coverage

A defining feature of the earnings call has been the absence of ESG information, both in terms of the content shared by issuers and the questions asked by sell-side analysts; the ESG characteristics of a company’s value proposition have often not been meaningfully discussed. There are several reasons for this absence of ESG discussions.

First, there is a clear nomenclature and knowledge gap among sell-side analysts (the typical target audience for earnings calls). As part of the ESG and Quarterly Call research pilot, we conducted one-on-one interviews with several sell-side analysts. Each analyst noted they had limited knowledge of ESG issues and their exposure to ESG issues and content, outside of their engagement with companies, was limited to the occasional headline in the business press.

Second, when engaging with the ESG issues of the companies they follow, sell-side analysts noted both a limited supply of, and demand for, ESG information. The analysts we interviewed noted that the ESG content they most often see from companies is related to a company’s safety record or environmental violations. Further, sell-side analysts noted that questions from buy-side analysts about a company’s ESG strategy and/or performance are infrequent.

Third, there is a tension between the time horizon and periodicity of the earnings call and long-term value themes like ESG. Some ESG data may only be available annually, though updates from specific ESG initiatives may be available on a quarterly time horizon (e.g., green infrastructure installations connected to greenhouse gas emission reduction targets). The short-term value of some ESG themes may not be easily quantified, requiring management to provide narrative reporting and appropriate time horizons to enable the value to be assessed (e.g., investments to make supply chains more resilient to adverse weather events and reduce the likelihood of a supply chain disruption). As ESG remains at pre-GAAP maturity, there are frequently expressed concerns around comparability and assurance. This causes a reluctance to share “ESG data” in the earnings call context where analysis is driven by inter-period and peer comparability.

The net effect of these challenges on analysts is that the stimulus for further education on ESG issues and the integration of corporate ESG performance into valuation methods is minimized. When asked, only one sell-side analyst indicated that they incorporated quantitative data on ESG issues into their valuations, subtracting environmental liabilities of the company. Others noted that they may include a qualitative evaluation of a company’s ESG performance into their valuation steps, but most analysts we spoke with do not currently factor ESG issues into their valuations. Given these factors, it is not surprising that evidence indicates that analysts have systematically undervalued firms with good ESG performance, predicting that companies will perform less well than they do in terms of financial and stock market performance.

For companies, these challenges can cause ESG issues to be included in capital markets presentations but glossed over. Often presented as a sidebar to the main presentation, ESG issues have been discussed in a generic manner not clearly linked to strategy and underlying performance. Given the time constraints and content-rich nature of earnings call disclosures, generic treatment of ESG issues may give the impression that these issues are of marginal importance, represent “greenwashing” or, more cynically, an attempt to distract from more difficult subjects.

Yet, these challenges reduce neither the need for analysts to incorporate ESG issues into their valuations nor the need for issuers to deliver ESG content in earnings calls. Analysts must have information that enables them to accurately update their valuation models and their related price and earnings forecasts. Further, analysts will ask questions about the issues raised by management, when management clearly identifies the issues as being important to the business’s long-term success. As such, it is the C-suite’s role to educate the company’s analysts on what it sees as relevant to value; if management regards ESG performance as critical to value, risk, prospects, and performance, they have to explain why that is the case. This involves bridging the gap between broad, public, corporate citizenship–style statements of the importance of ESG themes and an earnings call in which such themes have been omitted or only superficially addressed. Without such leadership, the sell-side analyst community’s primary exposure to ESG issues is likely to continue to be through daily press headlines. Those headlines are increasingly highlighting ESG issues that are critical to brand reputation and value and have significant stock price implications.

Driven by a variety of trends, asset managers are giving increased focus to ESG issues in the investment process and are building out their teams accordingly across asset classes. That resource-intensive response to the ESG imperative on the buy-side seems likely to drive deeper sell-side engagement with ESG, as an extension to the existing sell-side skill set. This seems increasingly likely as hedge funds increase their engagement with ESG themes and investment strategies. This trend plays out in a market for analyst coverage affected by MiFID II, which has seen declines in analysts following across cap sizes as investment research budgets, having been unbundled, are exposed to more scrutiny.

This context provides the setting for a disconnect between practice and reporting as companies are applying capital toward “ESG initiatives,” yet are often failing to effectively measure the return on those investments. With increasing insistence, issuers are saying ESG themes are important to business performance. As such, there is an imperative for issuers to highlight the extent of their long-term sustainability activities and investments and to explain how these are connected to operational and financial performance. To do this, issuers need the tools to estimate the financial value of their long-term sustainability investments, as well as the reporting architecture through which to communicate the financial and operational implications of sustainability. Frameworks and tools for monetizing sustainability investments are becoming more readily available, through efforts like the Return on Sustainability Investment (ROSI) monetization framework from New York University’s Stern Center for Sustainable Business (Stern CSB). There are also indications that issuers are beginning to experiment with folding more ESG content into the earnings call—as indicated in the research report A Revolution Rising: From Low Chatter to Loud Roar by Goldman Sachs Sustain.

Drivers of Change in Disclosure

There are several drivers for more disclosure of long-term plans and ESG strategy and performance data in quarterly reporting—the most prevalent being investor demand. Across financial institutions, ESG integration is rising, and ESG is increasingly considered part of prudent investment analyses. More ESG themes have become topics of investor engagement and investors have organized into coalitions, such as the Task Force on Climate-Related Financial Disclosures, Climate Action 100+, and the Sustainability Accounting Standards Board (SASB), to encourage standardization of ESG reporting.

Cross-industry bodies are also taking steps to stimulate more long-term and ESG approaches. The National Investor Relations Institute (NIRI) released its ESG policy statement that described the imperative for IR professionals to educate themselves on the types of ESG data demanded by investors, and to work across functions (legal, communication, etc.) to develop and execute a consistent approach for disclosing long-term and ESG strategy and performance information—an outlook supported by NIRI’s policy statement on guidance practices. Corporate leaders are also increasingly pushing back against the short-term shareholder primacy model, with the most prominent example being the Business Roundtable’s Statement on the Purpose of the Corporation, which asserts that the longer-term, stakeholder approach should define corporate practice.

Long-Term Plans—How the Long Term and Short Term Work Together

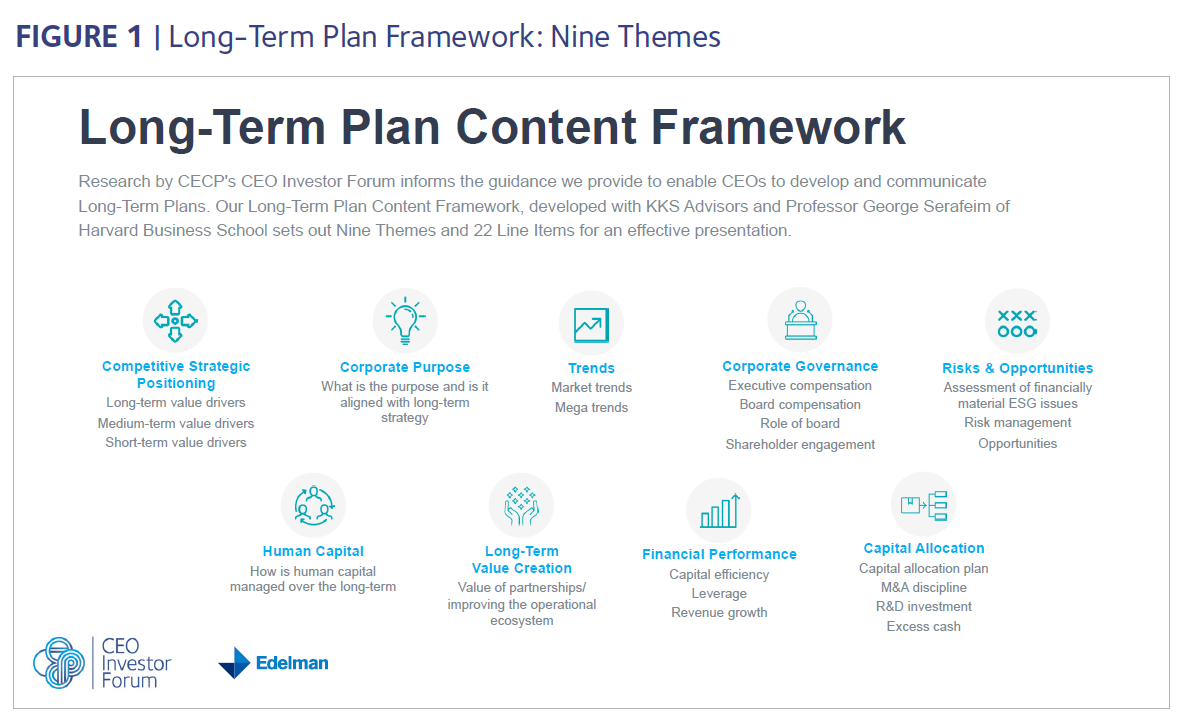

The concerns expressed regarding short-termism have led the authors to work on several initiatives to address the issue. Since 2017, CECP’s CEO Investor Forum has been providing a disclosure setting in which CEOs can present a long-term plan to an audience of investors who seek disclosures on themes with a longer-term time horizon. To help issuers prepare a long-term plan, the CEO Investor Forum developed a Long-Term Plan Framework that provides issuers with content guidance on the key elements of an effective investor-facing long-term plan. More than 30 issuers representing in excess of $2tn in market capitalization have shared long-term plans at investor conferences convened by the CEO Investor Forum at CECP.

By annually setting out at an updated long-term plan, which describes a time horizon of three to five years (as appropriate for the sector), an issuer can create an accountability environment in which the earnings call becomes a setting for monitoring the delivery of a multiyear plan that incorporates the ESG themes and stakeholder relationships that underlie long-term value. In our research, CEOs and their teams expressed a number of motivations for delivering a long-term plan, including frustration at short-term focused market infrastructure, demonstrating readiness on key “activism” issues, meeting investor expectations, and using disclosure to attract more long-term investors.

The ESG and Quarterly Call Pilot

In collaboration with the CEO Investor Forum at CECP and with the financial support of the Investor Responsibility Research Center Institute (IRRCi), the Stern CSB conducted research into how companies could better integrate the financial impacts of ESG strategy into the quarterly earnings call.

The ESG and Quarterly Reporting Framework

Working with a group of issuers, the Stern CSB developed an initial framework for how companies could integrate financially material ESG and long-term strategy content into the quarterly earnings presentation. The key insights were that ESG should be reported through the lens of its relationship to core business strategy and that the financial impacts of ESG, rather than ESG performance alone, should be reported. In other words, a climate change strategy may drive energy cost-savings and growth through new product offerings and lower risk—all of which can be monetized and reported in the context of a quarterly call.

The development of the framework included research and recommendations from the CEO Investor Forum at CECP, in addition to other leading organizations, including FCLTGlobal and McKinsey & Company. The template was also based on a review and synthesis of the style, format, structure, and information contained in the earnings presentations of a number of global companies (e.g., Becton, Dickinson; Dow Chemical; General Electric; and Unilever), each of which has taken steps to better integrate ESG and long-term strategy content into its earnings call content. Following the development of the template, the Stern CSB team worked with representatives from The Dow Chemical Company, Voya Financial, and Jones Lang LaSalle to review and refine the template, and pilot tested the integration of the template into their quarterly earnings call and other investor-facing presentations.

Based on our review of how leading companies integrate ESG content into earnings and other investor-facing presentations, and our work with the piloting companies, we structured the presentation template into two sections. The first section (see Appendix 1) includes content that can be presented and discussed during the formal presentation in the earnings call, and includes:

- a statement of the corporate vision or purpose

- a one-page summary of the key components of the corporate strategy

- a one-page summary of how the ESG strategy integrates with and supports the corporate strategy

- a summary of corporate performance goals, including financial and ESG targets

- corporate-wide performance highlights for the quarter, including financial and ESG highlights

- business unit performance summary(ies)

The second section of the template includes content that can be included in the appendix of each quarterly earnings presentation and is intended to support the ongoing review and reporting of quarterly performance, in relation to longer-term ESG and financial performance targets. Although some of the appendix material is duplicative of the content in the main presentation, additive components include a summary of the capital allocation strategy, a listing of the members of the Board of Directors and of the board committees responsible for overseeing ESG strategy and execution, and a description of the alignment between ESG performance goals and executive compensation.

Reviews of the Reporting Framework

As a key component of the pilot study, the Stern CSB, in collaboration with the CEO Investor Forum, hosted an all-day workshop that included a working session on the ESG and Quarterly Call Reporting Framework. In that session, workshop participants provided feedback on the existing template, with suggestions for how it could be modified and improved. Workshop participants noted that the key benefits of the template included: (1) the relative simplicity of the reporting framework; (2) the flow of content from the big picture to more granular details; (3) the inclusion of an appendix, which allows for flexibility in what information is shared (and how it is shared), and relieves pressure to cover everything in the main presentation; (4) reporting on the performance of individual business units; (5) the applicability of the framework for companies from various industrial sectors; and (6) the emphasis on linking ESG strategy and performance to long-term strategy.

Workshop participants also suggested a number of potential improvements including: (1) a discussion on how companies came to key ESG decisions; (2) presenting data on key performance metrics only on an annual basis, but updating the general ESG narrative quarterly; (3) providing suggestions on how to create leadership and investor buy-in without disrupting the flow of relationships; and (4) recommending key metrics that could be tracked and reported, and could gradually be integrated into the earnings discussion.

Challenges of Integrating ESG into the Earnings Call

Our workshop participants, across Investor Relations, Strategy, and Sustainability functions, also shared perspectives on the capital market pressures and operational process challenges connected to integrating more and better ESG content into investor-facing presentations, particularly the earnings call. Table 1 presents a selection of those challenges, each having been raised by multiple workshop participants.

Table 1. A synthesis of capital market pressures and operational process challenges that have slowed the pace of ESG and long-term strategy content being integrated into the earnings call

| Capital Market Pressures | Operational Process Challenges |

|---|---|

| Analyst expectations and existing practice: Despite the rising interest in ESG themes, there was a concern that the sell-side analyst community would push back on adjusting the content mix of the call. As such, it was important to “educate the analysts” but also “give them what they need.” | Management buy-in: The earnings call is led by the CEO and CFO. The C-suite must be comfortable with ESG themes in order to embed them into this key forum. The CFO team must have comfort both with ESG themes and the time horizon over which they will have an impact. |

| Lack of standardization of ESG reporting: Though SASB’s codified standards provide a basis for comparable reporting across issuers on a sector basis, there was concern that the voluntary, pre-GAAP basis of this reporting could create false comparisons with information disclosed on the same topic but using different standards, approaches, or scope. Participants indicated that the broad market adoption of SASB standards would significantly lessen these concerns. | ESG maturity and governance: Issuers must build clear reporting lines and governance of ESG issues for these to be blended into existing reporting and control structures for sharing financial information.

Internal collaborations were also critical, particularly that between Investor Relations and Corporate Sustainability. Issuers could use a framework like SASB’s to agree on a tight set of financially material ESG issues that would be appropriate to discuss in the context of an earnings call. |

| Call bandwidth: The earnings call is a tightly managed, information-rich environment. Following mergers and acquisitions activity or major product launches, significant time is spent on the earnings call addressing the key elements to understand such developments (e.g., integration processes or relevant sales and margin growth). This leaves little bandwidth to address other themes. | Demonstrating performance link: For many participants, the performance advantages derived from good performance on financially material ESG factors were intuitively clear and increasingly supported by robust academic evidence. ESG was part of a resilient business, with a strong reputation and high-quality management who vigilantly worked to understand and reduce its risks and enhance its opportunity set. Nonetheless, in the context of the earnings call, making the case for the performance link of these often long-term issues is a challenge. A clear narrative by management that makes the case for these themes and their importance to value is key. |

Integrating ESG and Long-Term Strategy and Performance Content into the Earnings Call

Based on the evolving nature of corporate quarterly reporting, and our experiences with the ESG and Quarterly Call research pilot, we have synthesized several conditions for success and content recommendations for companies that are considering how they might better integrate ESG and long-term strategy content into the quarterly earnings call.

Conditions for Success

Following are four key conditions that companies should put in place, before they start the process of integrating ESG and long-term strategy content into the earnings call:

- gain C-suite level buy-in

- establish a firm understanding of the most financially material ESG issues driving your business

- develop a strategy and execution plan for delivering short- and long-term value (environmental, social, and financial) for the business by addressing the risks and opportunities embedded in those financially material ESG issues

- embed a robust and repeatable process, and supporting technical systems, for reliably measuring, auditing, and reporting on corporate ESG performance and the impact that ESG strategy execution has on corporate financial performance

Recommendations

Integrate ESG and long-term content sequentially: Consistency and continuity are important elements in an issuer’s equity story. However, because of its typical time horizon, its vocal constituency, and the scripted nature of the earnings call presentation, the quarterly call tends to be regarded as the most challenging venue for integrating ESG content. Therefore, we recommend that companies begin integrating ESG and long-term strategy content into existing disclosures in a manner that builds comfort and confidence within both the investor base and management. Several of the companies we spoke with saw this as a cautious and careful journey, but each noted the importance of reflecting the company’s own understanding of its value proposition and meeting the increased demand from investors. The primary goal, however, is making ESG and long-term strategy content a recurring theme across all investor-facing presentations.

Companies saw value in the development of ESG within its equity story as a sequence, which can include the following steps:

- Build investor-facing ESG reporting into the existing sustainability report, using the SASB guidelines (or produce a free-standing SASB report). Include reporting on the financial impact of ESG strategy development and execution, especially on the most material ESG issues in your annual report. For example, if your factories are in water-stressed areas, include qualitative and quantitative data on the investments you are making to improve water efficiency and conservation, and the return on investment and risk reduction achieved, since it would be financially material.

- Increase ESG content in proxy statements, paying particular attention to the most material ESG issues. For example, a high retention rate of employees is financially material for a retailer, and a strong ESG strategy can improve retention.

- Conduct ESG-specific investor engagement. A growing number of investors are very interested in the management of material ESG issues. Companies can educate investors on ESG strategy and the impact of ESG strategy execution on corporate financial performance through direct investor engagement. For instance, companies can make Investor Day presentations that include comments from the CEO and CFO on the company’s ESG strategy and the financial impact achieved through ESG strategy execution. Similarly, companies can host ESG-focused webinars to educate investors on the company’s ESG strategy and how the strategy delivers short- and long-term value for the company and its investors. As a result of their involvement in the ESG and Quarterly Call pilot, Jones Lang LaSalle hosted its first ESG webinar in Fall 2018 and has subsequently hosted a second.

- Finally, begin to gradually build substantive ESG content into the earnings call presentation. Analysts are most interested in data that are material and could affect their valuation estimates. For example, a company can discuss projected growth in revenue for a product and describe how its sustainability attributes are key elements of that growth story. (This is particularly important for consumer packaged goods companies, such as Nestle).

Prime the analysts: The question and answer (Q&A) portion of the earnings call tends to be managed very carefully, typically with individual sell-side analysts given the opportunity to ask a single question. As companies integrate ESG and long-term strategy content into the earnings call, consider sharing ESG-specific questions with your sell-side analysts to shape the Q&A discussion and more regularly bring ESG and long-term strategy into the discussion.

Adapt the earnings call schedule: Disclosing your company’s ESG strategy, and the impact your ESG execution has on corporate financial performance should become a regular and consistent component of your reporting. When integrating this content in the earnings call, develop a plan for how you will use each of the four calls in a year. For instance, provide quarterly updates on key ESG performance and financial measures in three of the four quarters, but use one of the four quarterly calls (either Q1 or Q4) and provide a deeper discussion of ESG and long-term strategy and how recent performance compares with expectation.

Cross-function collaboration—metrics and materiality: Disclosure can operate as a forcing function, enabling the development of new relationships, systems, and practices. Issuers must develop internal collaboration constructs and reporting lines to enable ESG themes to be blended into existing reporting structures. These four suggestions arose from our work:

- Investor Relations and Corporate Sustainability should work together to co-develop relevant content and agree on issue significance.

- Convene regular meetings of an ESG working group composed of individuals representing the relevant functions (i.e., human resources, supply chain, procurement, risk management, marketing, finance, etc.), and make the meetings open access to ensure that all issues are addressed and learning is shared across the company.

- Develop Board oversight and engagement on ESG issues. There should be clear reporting lines for ESG strategy and performance to the Board of Directors. This may require that an ESG-specific committee or an existing committee, such as the nominating and governance committee, has ESG structured into its remit. Companies should also consider whether current Board members have the skills and awareness to manage these issues and adjust the Board composition accordingly, if necessary.

- Expand the CFO role to include engagement in sustainability. Presenting long-term–focused disclosures and other investor-facing information in the earnings call requires CFO buy-in. In order to buy in, CFOs need to see and understand how the company’s long-term and ESG strategy and execution will deliver financial benefit for the business. Through the use of tools like the Stern CSB’s ROSI framework for monetization—which enables companies to estimate the value of risks and intangibles—and long-term forecasts (not just annual budgets), CFOs can engage in the conversation and transition the earnings call from a short-term–focused discussion on financial performance to a discussion of long-term value creation.

Disclose output and process: When developing the ESG performance metrics and financial measures associated with ESG strategy execution, reference and make use of existing reporting frameworks for investor-facing ESG disclosures. For investors, outputs are important. But it is also important to understand the process through which issues are understood and prioritized, how regularly such processes are updated, and whether these are addressed within the C-suite and by the Board on an ongoing basis. For example, describe the process for conducting and updating the materiality assessment, including the frequency of review, by the Board and by management.

Sustainability and financial value: Many academic studies are finding a correlation between ESG performance and stock performance, operational performance, and lower cost of capital. The Stern CSB, through its work to develop and refine its ROSI monetization framework has found that sustainability can create value through nine mediating factors, including operational efficiency, innovation, employee retention, and risk reduction, among others. Companies can assess the benefits of material sustainability strategies through the lens of these mediating factors and monetize them. It is often easiest to begin with operational efficiency and innovation. For example, a waste reduction strategy is likely to result in avoided costs for new materials and waste disposal. A launch of innovative sustainable products may lead to greater market share. The inclusion of these metrics can be a good way to start the integration of this content into the earnings call. Over time, companies can integrate the financial metrics linked to the more intangible benefits of ESG strategy execution, such as risk avoidance (e.g., investing in climate resiliency and adaptation). This sequence reflects an emerging understanding that sound ESG performance on material ESG issues are “table stakes” for leading companies and strategy will converge by sector around a baseline of sound practice. Over time, management teams increasingly will look to generate distinct sustainability strategies as a source of competitive advantage.

Monetizing risk: Consider including an assessment of the value at risk associated with not taking action on a particular theme. For instance, the potential costs of litigation, the loss of reputation and brand value, and the loss of operational efficiency from avoiding human capital investments.

Conclusion

Market pressures have led to executive decisions that sacrifice long-term value creation in favor of meeting short-term financial targets. In response to these market pressures and suboptimal capital allocations decisions, there has been increasing interest by corporate leaders to focus more on long-term strategy and performance, and on delivering on a company’s purpose. CECP and the Stern CSB have worked to develop and disseminate reporting frameworks to enable the integration of a company’s long-term and ESG strategy and its impact into the earnings call and other investor-facing presentations. The use of this framework, the development of ESG disclosures on material issues, and the integration of these disclosures in investor-facing communication, including the earnings call, are essential steps to improve corporate ESG and financial performance and investor decision-making.

The complete publication, including footnotes, is available here.

Print

Print