Snorre Gjerde is Analyst, Sustainability; Wilhelm Mohn is Head of Sustainability; and Carine Smith Ihenacho is Chief Corporate Governance Officer at Norges Bank Investment Management. This post is based on their Norges Bank memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Robert H. Sitkoff and Max M. Schanzenbach (discussed on the Forum here).

Voting on shareholder proposals allows investors to exercise their ownership rights by holding the board accountable and steering companies in the right direction. In many markets, an increasing number of proposals focus on the environmental and social aspects of companies’ activities. Emerging academic research indicates that some of these proposals may have positive financial implications for the target company, if adopted. However, the increasing number of proposals can also present challenges for investors. These proposals address many complex and distinctive issues, and filers may pursue objectives beyond the best interests of the company.

Faced with this situation, asset managers need efficient solutions that enable them to vote in favour of relevant, value-adding initiatives, and vote against proposals that are misaligned with shareholder value. Shareholder proposals can be instrumental in driving adoption of more responsible business practices at companies. We emphasise the importance of making considered voting decisions and recommend an analytical approach focused on materiality, limited prescriptiveness and consideration of company context. We call on filers to utilise the proposal mechanism to raise material sustainability risks that a company is managing inadequately, and not as a tool for micro-managing company operations or drawing attention to tangential issues.

Introduction

A shareholder proposal, also referred to as a resolution, is a recommendation that a shareholder submits to a public company, requesting a specific course of action. If the proposal is included as an item at the company’s annual general meeting (AGM), shareholders will be able to vote for or against its adoption. The level of support needed for the proposal to be submitted and to pass, and the extent to which implementation is binding, vary across jurisdictions.

The past decade has seen a substantial increase in shareholder proposals submitted at company meetings across many markets. Many of these focus on environmental and social (E&S) implications of companies’ activities and call for improved disclosure and accountability on these sustainability-related issues.

In this post, we explore the evolving landscape of E&S-related shareholder proposals and review current evidence on the effectiveness of these proposals in creating value and promoting responsible business practices at companies. We discuss how asset managers can best establish voting processes that allow them to vote on E&S proposals in a way that is consistent with their risk and return objectives. We emphasise the importance of an informed vote and recommend an analytical approach grounded in the principles of materiality and limited prescriptiveness, but with flexibility to accommodate market- or company-specific circumstances.

We call on filers to utilise the proposal mechanism to raise material E&S risks that a company is managing inadequately, and not as a tool for micro-managing company operations or diverting the board’s attention away from more relevant issues.

Global trends in shareholder proposals

The global volume of shareholder proposals increased significantly in the wake of the 2008 financial crisis. Academics and market participants attribute this to escalating shareholder concerns and regulators’ promotion of increased investor engagement through the introduction of corporate governance codes in many jurisdictions. Other drivers cited include decreasing costs of communication and voting due to technological developments and increasing concentration of share ownership among institutional investors and hedge funds seeking to capitalise on their voting power.

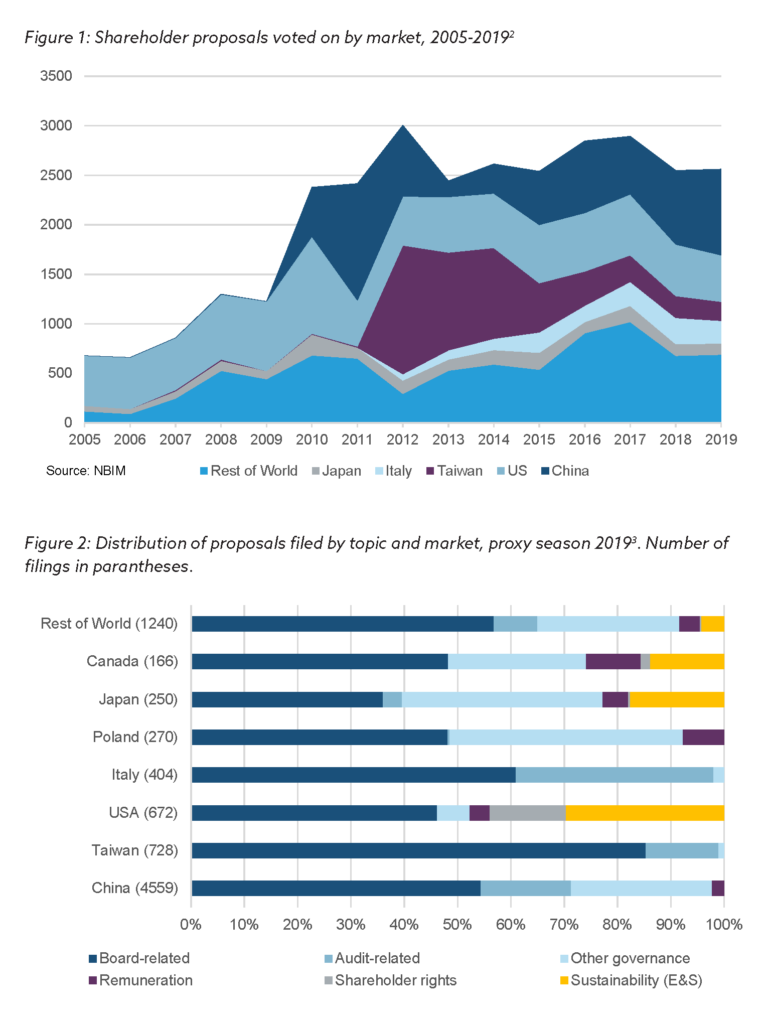

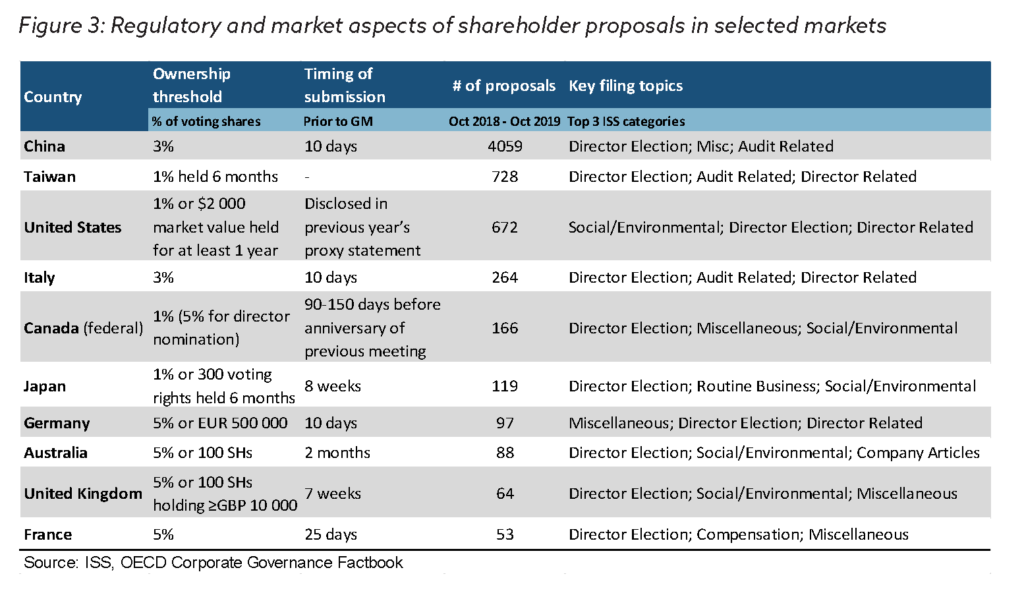

Norges Bank Investment Management’s database of historical voting records highlights China, Taiwan and the US as the countries with the highest number of shareholder proposals voted on at company meetings (see Figure 1). While filing activity has grown substantially across several markets, there are considerable geographical variations in how the proposal mechanism is utilised. Based on our categorisation of topics (Figure 2), most shareholder proposals globally relate to the nomination of specific candidates for the board and auditor. Such proposals account for around 70 percent of all shareholder-sponsored items voted on at company meetings globally.

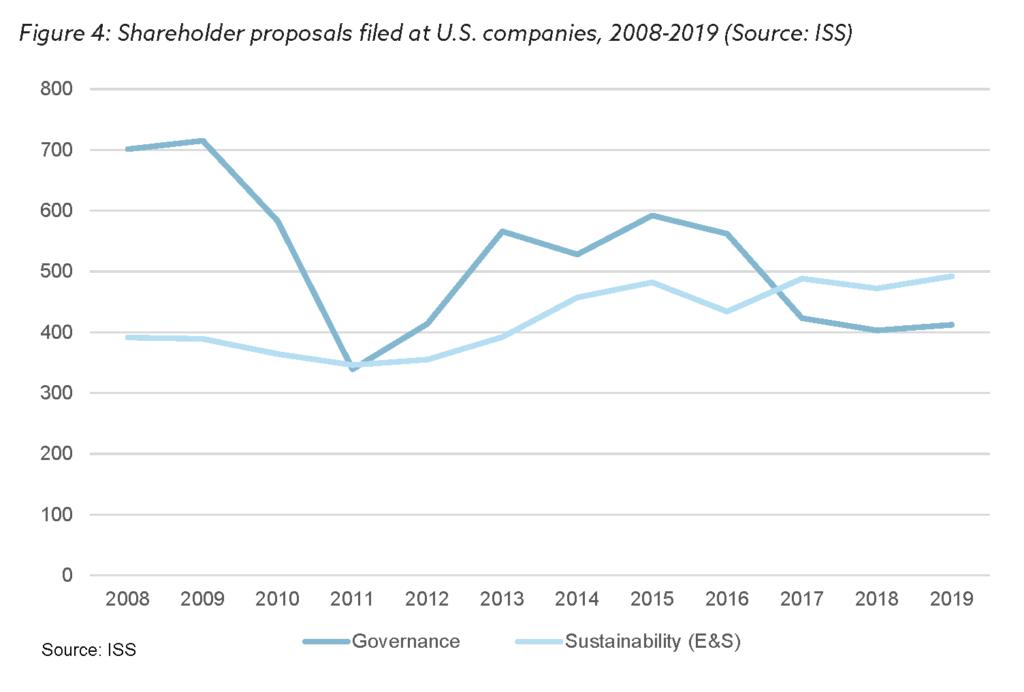

The remaining 30 percent of proposals tend to address specific concerns or issues around a company’s governance, strategy or external impacts, rather than the election of board candidates. Such “issue-based” proposals are concentrated in certain markets, notably the US, Canada and Japan. The ownership thresholds for submitting proposals in these jurisdictions are lower than in many other countries (see Figure 3). This is likely to be a key enabler of filing activity.

In addition to filing thresholds, interrelated circumstances such as ownership structure and engagement culture can also influence the number of shareholder proposals in a given market. For example, the US has a more dispersed ownership structure with fewer controlling shareholders than many European and Asian markets. Research also highlights a tendency for non-US investors to prefer engagement via private dialogue, as opposed to publicly filed proposals. Many European countries operate a 5 percent ownership threshold for filing proposals, but this approach also reflects the fact that resolutions in these markets are often binding and not merely advisory.

Shareholder proposals on sustainability

“Issue-based” shareholder proposals can be broadly divided into two groups: those that address traditional corporate governance concerns and those pertaining to sustainability-related matters. The former tend to focus on the division of responsibilities and decisions between shareholders and management, covering issues such as executive pay, shareholder rights and approval of equity transactions or company bylaws. The latter address a range of E&S aspects of company operations and their broader impacts, spanning from climate change strategy to human rights policies and political lobbying disclosure. E&S proposals often raise unfamiliar or emerging issues with complex root causes and multiple stakeholder relationships involved, making it challenging for investors to apply binary, mechanistic principles to voting decisions.

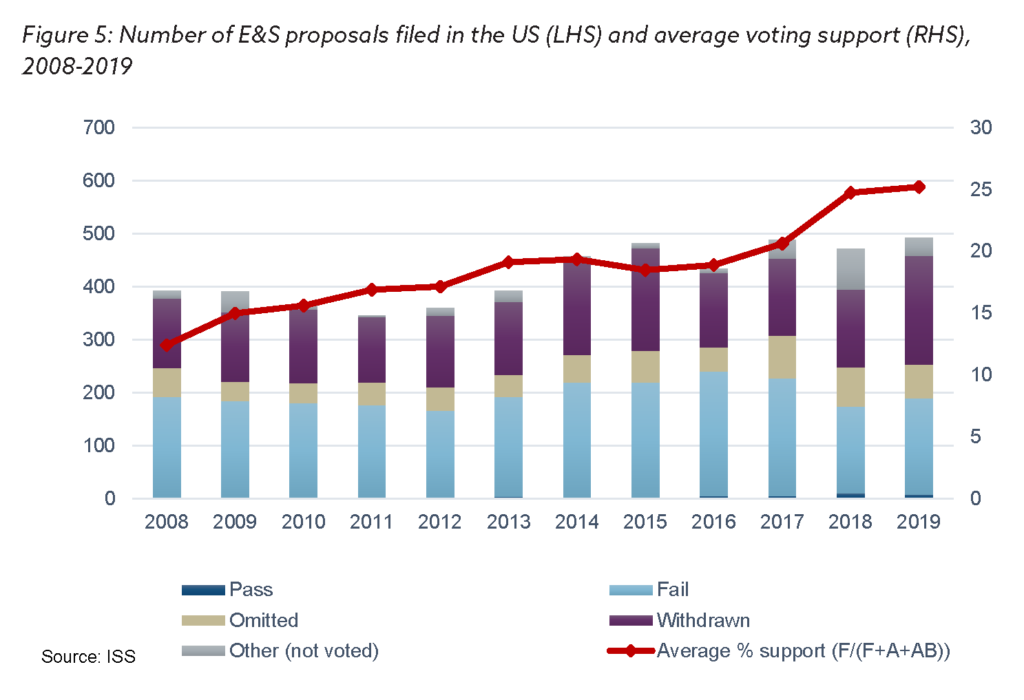

The US stands out as the market with the highest volume of E&S proposals. The number of E&S filings has increased steadily over the past decade, surpassing the number of governance proposals in the last two years (see Figure 4). In 2019, E&S proposals represented more than 35 percent of all shareholder-sponsored items voted on at US companies, and over 55 percent of all shareholder filings. Recent years have also seen a growing number of E&S proposals at non-US companies, implying increased global recognition of the importance of such matters. Notable examples include requests for improved climate risk disclosure at European oil and gas companies, demands for stricter fossil fuel financing policies at large international banks, and calls to phase out nuclear energy at Japanese utility providers following the 2011 Fukushima nuclear disaster.

Public pension funds have traditionally been the most frequent filers of E&S proposals at US companies. Many of their proposals have called for increased transparency around lobbying and political contributions, better reporting on climate risk, and strengthened policies on diversity and inclusion both on the board and in the overall workplace. Faith-based investors, socially responsible investment (SRI) funds and special interest organisations also submit a considerable volume of proposals each proxy season. Proposals from these shareholder groups can be similar to those raised by pension funds but may also address a longer tail of E&S issues more specific to the remit of the sponsoring organisation; for example drug pricing, product testing on animals or tobacco marketing.

On average, 30-40 percent of E&S proposals at US companies are withdrawn before being voted on, usually indicating that the proponent and the company have reached a mutual understanding. Among those E&S proposals that go to a vote, only a small number receive the majority support required to pass (see Figure 5). Nevertheless, average support levels have been trending upwards over the past decade, reaching 25 percent for the 2019 proxy season, up from 15 percent in 2008. The growing support could imply a shift in investor attitudes and willingness to engage on how companies manage sustainability-related aspects of their business. It could also be driven by an improved quality of proposals; a general trend observed across E&S proposals is that their scope has shifted away from demanding action or operational changes, moving towards seeking improved disclosure, risk assessment or oversight. This may reflect an increased focus on the long-term financial impacts of E&S risks, as opposed to near-term actions related to specific business activities.

Effectiveness of shareholder proposals

Academic debate on shareholder proposals often addresses the trade-off between enabling shareholder monitoring to reduce agency costs and preserving managerial discretion to run the business. Some argue that proposals are a useful and relevant tool in cases where managerial interests are not aligned with those of shareholders. Others highlight that companies can have a variety of investors with different sets of incentives that are not necessarily financial in nature.

Long-term, diversified investors who regularly vote at company meetings need efficient and accurate methods to determine whether a proposal is likely to entail benefits over time and hence merits their support. This requires understanding of whether adoption of the proposal is likely to add to financial value, and whether implementation could improve business practices, both at the target company and for the wider market.

Financial effects of sustainability proposals

Identifying and isolating the effect of a shareholder proposal on company value is challenging given the multitude of other factors that can influence a company’s prospects. However, recent research on E&S proposals finds that companies can benefit financially from adopting those that receive high investor support.

Most practitioners highlight that the valuation effects of shareholder proposals are likely to vary according to the topic and the identity of the filer. Emerging research suggests that proposal filings addressing financially material sustainability issues correlate with subsequent increases in company value, while resolutions that address irrelevant or immaterial issues are associated with valuation declines. Many view this diversity as inevitable given the low cost of filing a shareholder proposal in some markets, which enables a wide variety of sponsors to engage with companies through this mechanism. Often, these sponsors may have tangential motives for filing or lack the organisational capabilities to analyse companies’ individual situations, resulting in proposals whose associated costs outweigh any benefits of implementation.

These emerging insights on E&S proposals suggest that they can be either well-researched, high-quality proposals with positive financial implications for the target company, or less relevant, low-quality motions that ultimately may destroy financial value. From the perspective of an asset manager, this underlines the need to distinguish between these categories of E&S proposal when voting. We note, however, that research on the value effects of the E&S subset of shareholder proposals is still at an early stage, and perspectives are evolving. Further exploration of the long-term financial implications of E&S proposals could provide additional guidance for asset managers’ voting decisions.

Wider effects on company practices

Shareholder proposals do not only have the potential to influence valuation—they can also change company and market practices. Studies show that adoption of E&S proposals that either pass or fail by a small margin can have long-term positive effects on the target company’s sustainability performance and operating efficiencies. Even proposals that fail to receive majority support through a shareholder vote can in themselves be effective in influencing company practices, as evidenced by both academic studies and practitioner insights.

Historically, shareholder proposal campaigns in the US have contributed to shaping corporate governance practices by introducing features such as proxy access and majority vote rules. There is less evidence for potential market-wide spill-over effects of filing E&S proposals. One reason may be that such proposals to date have not been numerous or homogenous enough to establish clear evidence. Nevertheless, some recent findings indicate that passage of a corporate social responsibility (CSR) proposal at a company can spur adoption of related CSR practices at its peers.

Outside the US, shareholder proposal campaigns are less widespread; there are a few examples of resolutions that have led to market-wide reform.

Within the sustainability sphere, certain proposals on climate change could be considered important drivers of industry-wide developments. Recent campaigns calling for improved climate risk disclosure at European oil and gas companies are an anecdotal example. These proposals are noteworthy because many of them receive the support of both management and 96-98 percent of shareholders.

A framework for optimising voting practices

The emerging studies on E&S proposals have several implications. Firstly, they indicate that E&S proposals can have financial effects—either as an early warning signal of downside risk or by adding value through successful implementation. Secondly, they highlight the heterogeneity in E&S proposals which include filings covering immaterial topics that could ultimately destroy value for the target company. There is therefore a need for investors to analyse specific proposals in order to differentiate their quality, and to make an informed voting decision based on such an assessment.

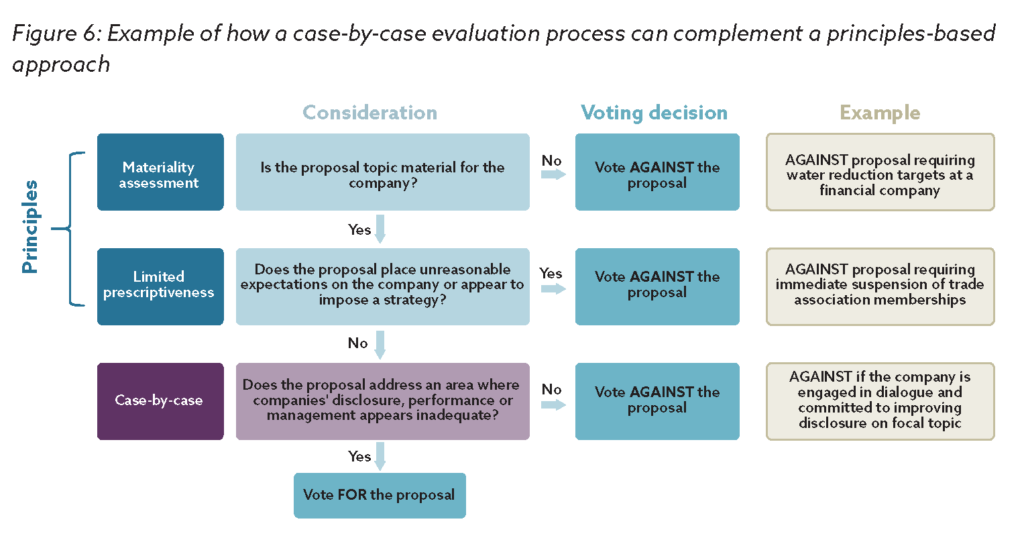

In order to make these considered decisions, asset managers ideally need a framework that can be applied consistently across their portfolios. Based on our own analyses and experience as a global investor, we see three key dimensions that asset managers can focus on when voting on E&S proposals: a materiality assessment of the sustainability topic addressed, a requirement for limited prescriptiveness, and a final case-by-case consideration of company- or market-specific circumstances that could be relevant to the voting decision. Figure 6 illustrates how such an analytical process can work in practice.

Materiality as a guiding principle

A key challenge pertaining to E&S proposals is the plethora of complex issues that asset managers need to opine on by voting for or against the proposal. While research on E&S proposals is still at a nascent stage, both the emerging academic evidence and practitioner insights highlight the importance of materiality when determining whether a proposal could add value for the target company.

The concept of materiality may vary according to different investors’ mandates and investment horizons. A natural starting point for such an assessment could be financial materiality. Frameworks such as the industry-specific materiality matrix developed by the Sustainability Accounting Standards Board can be a useful tool to determine whether a proposal addresses an issue that is likely to have a future impact on the company’s financial performance. Investors may also wish to consider the broader environmental and social consequences of company operations, in line with international standards for responsible business conduct.

Incorporating materiality as a guiding principle for voting on E&S proposals can allow investors to efficiently weed out shareholder proposals that have been filed without careful consideration of the company’s situation and prospects. It also provides a starting point for determining whether a proposal addresses an area where shareholders are likely to benefit from better disclosure, oversight or risk assessment from the company.

Requirement for limited prescriptiveness

Internationally accepted guidelines on corporate governance recognise that a corporation’s strategy and daily operations cannot be managed by shareholder referendum. One reason for this is the heterogeneity of the shareholder base. Shareholder interests, capabilities and investment horizons can vary significantly. In addition, complex and fast-moving markets often require businesses to make decisions more rapidly than the infrequent shareholder meetings can facilitate. For investors with a diversified portfolio of shares, it is also not operationally feasible to be drawn into every single decision at investee companies.

In light of these considerations, it makes sense for shareholders to delegate the responsibility for setting strategy to the board and a management team selected and motivated by the board. Such an agency model suggests that management’s recommendations should form the basis of a diversified investor’s voting process. The board and management have deep knowledge of a company’s circumstances and operating context and are usually best placed to address any issues the business may face.

To provide further guidance to the board, investors may wish to supplement internationally recognised guidelines and principles with their own published positions and perspectives. These can provide transparency around voting decisions and emphasise topics of relevance to an investor’s mandate. For example, Norges Bank Investment Management publishes expectations for how companies should manage and account for sustainability issues in their governance structure, strategy setting, risk assessments and public disclosures.

Recognising the role of the board and management entails voting against shareholder proposals that appear to impose a strategy or that prescribe detailed methods and unrealistic targets for implementation. In some jurisdictions, regulators also allow companies to exclude shareholder proposals that are deemed to be attempts at micro-management or undermining the role of the board.

Case-by-case analysis

In our view, a rules-based approach to voting analysis, grounded in the principles of materiality and limited prescriptiveness, provides a solid foundation for consistent and efficient decisions across a portfolio of companies. However, the complex attributes of some proposals and the context in which they are submitted, may require investors to accommodate market- and company-specific circumstances in order to determine their vote.

A case-by-case approach can include an assessment of a company’s disclosures on E&S impacts, its policies, frameworks and how well it appears to be managing related risks relative to peers. An additional consideration could be the motives of the proponents, and their alignment with the company’s best interests. Where a company’s reporting or management of a material risk does not meet the needs or expectations of asset managers, it is reasonable to support well-founded shareholder proposals that address these concerns in an appropriate manner. Nevertheless, there may be situations where the company has pre-committed to improving its practices or is exploring relevant solutions. In such instances, asset managers may choose to vote with management and follow up on the issue through bilateral dialogue with the company.

Conclusion

Shareholder proposals are an important feature of the corporate governance ecosystem. In certain markets, proposals have been instrumental in spurring adoption of best practices and in flagging material risks. While knowledge and perspectives on E&S proposals are still evolving, a growing body of research indicates that there are positive financial implications of making the right voting decisions when these issues are raised at company AGMs in the form of shareholder proposals.

We recognise that the shareholder proposal mechanism can be used to pursue objectives that run counter to the company’s best interests, or to infringe upon the roles and responsibilities of the board and management. We urge filers to be mindful of the topics they choose to raise via proposals, to carefully consider the context of the individual company, and to allow sufficient flexibility for management to implement the proposal into company strategy and operations.

The multi-faceted nature of E&S proposals, and the need to make decisions on issues that are often ambiguous, imply that there is no “one-size-fits-all” approach that asset managers can apply systematically across all such proposals. We believe a rigorous analytical process should precede voting decisions on these complex and often unfamiliar items. We recognise that detailed analysis of specific proposals requires asset managers to dedicate resources and capabilities to voting and stewardship activities, which can be costly. However, we also see a need to separate high-quality from low-quality proposals in order to protect and enhance shareholder value by supporting resolutions that are in the company’s best long-term interests and voting against those that are not. Failing to collect and analyse information before voting on a shareholder proposal can mean ignoring a material risk or issue and may have negative value implications.

We highlight materiality, prescriptiveness and company context as useful dimensions to assess when making voting decisions. Nevertheless, we underline the need for further research on the value effects of E&S shareholder proposals. An improved understanding of how these proposals and their ensuing implementation can affect valuations should contribute to improved proposals, and help investors refine their voting practices. This in turn will lead to voting decisions that provide clear guidance to companies and further align with the duties and objectives of asset managers.

The complete publication, including footnotes, is available here.

Print

Print