Taylor Bartholomew is an associate and Matthew Greenberg and Joanna Cline are partners at Troutman Pepper Hamilton Sanders LLP. This post is based on a recent Troutman Pepper memorandum by Mr. Bartholomew, Mr. Greenberg, Ms. Cline, and Christopher B. Chuff. This post is part of the Delaware law series; links to other posts in the series are available here. Related research from the Program on Corporate Governance includes Independent Directors and Controlling Shareholders by Lucian Bebchuk and Assaf Hamdani (discussed on the Forum here).

In 77 Charters, Inc. v. Gould, the Delaware Court of Chancery refused to dismiss breach of fiduciary duty claims against an indirect, “remote controller” of a limited liability company in connection with a series of transactions whereby the controller purchased preferred interests in the limited liability company from a member and subsequently amended the limited liability company’s operating agreement to increase the preferred’s distribution preference to the detriment of the holder of the limited liability company’s common interests. The decision serves as a cautionary reminder to investors that their actions may not be insulated from fiduciary liability—no matter how many intermediaries are involved—unless the applicable operating agreement clearly and expressly disclaims fiduciary duties.

Background

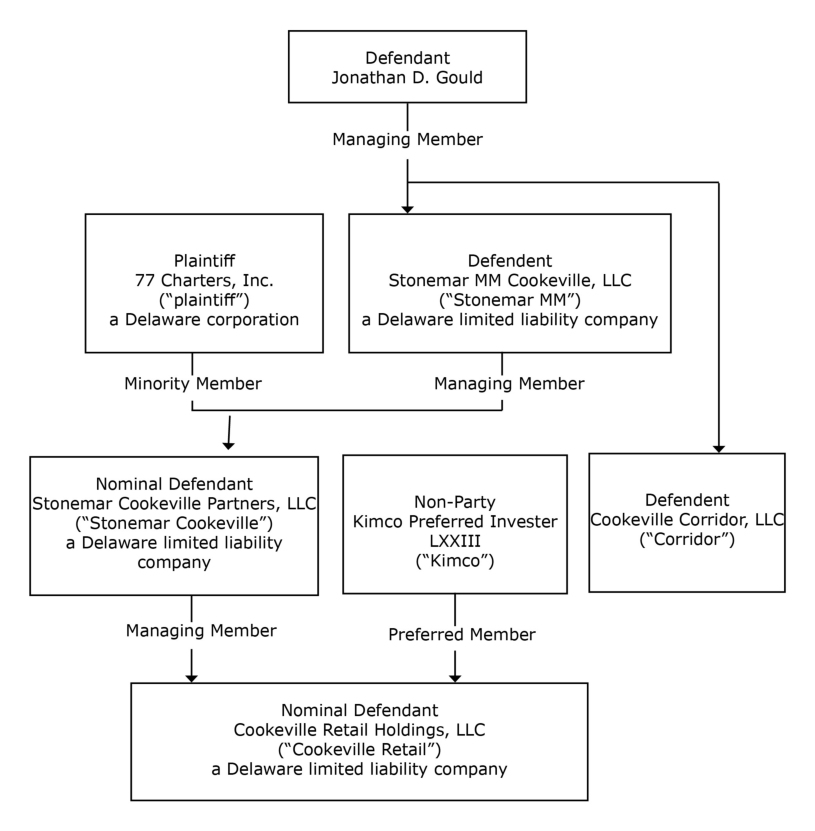

In 2007, as part of an investment in a retail shopping center, Cookeville Retail Holdings, LLC (Cookeville Retail) was formed by its managing member, Stonemar Cookeville Partners, LLC (Stonemar Cookeville), and its preferred member, Kimco Preferred Investor LXXIII, Inc. (Kimco). Around the same time, Stonemar Cookeville was formed by its managing member, Stonemar MM Cookeville, LLC (Stonemar MM), and its nonmanaging members, one of which is 77 Charters, Inc. (plaintiff). Jonathan D. Gould (Gould) is the managing member of Stonemar MM. Under the Limited Liability Company Agreement of Cookeville Retail (the CRA), Kimco was first allocated a 9 percent distribution on its capital contributions, while the excess was distributed to Stonemar Cookeville and its members (including the plaintiff). The following chart depicts the parties’ relationships.

On July 1, 2013, Kimco sold its preferred interests in Cookeville Retail to Gould’s affiliate, Cookeville Corridor, LLC (Corridor). After the sale closed, Corridor sold a portion of its preferred interests to Eightfold Cookeville Investor, LLC (Eightfold) at a premium, and Gould caused Cookeville Retail to amend the CRA (the Amended CRA) to (1) admit as members Corridor and Eightfold and (2) increase the preferred’s distribution preference from 9 percent to 12.5 percent.

In 2016, the plaintiff requested books and records of Stonemar Cookeville pursuant to the Delaware Limited Liability Company Act after it had become concerned about its investment, ultimately filing a books and records action in the Delaware Court of Chancery. After settling the action with Stonemar Cookeville, Cookeville Retail sold its operating asset to a third party without any advance notice given to the plaintiff. The sale proceeds were used to pay Cookeville Retail’s creditors, and the remaining amount was distributed to the holders of the preferred interests. Stonemar Cookeville (and, consequently, the plaintiff) received nothing. The plaintiff then brought breach of fiduciary duty claims against Stonemar MM and Gould in connection with the adoption of the Amended CRA.

Court’s Analysis

The court held that it was reasonably conceivable that Stonemar MM and Gould owed fiduciary duties, despite the fact that Gould was neither a member nor manager of Stonemar Cookeville or Cookeville Retail. Gould owed fiduciary duties as a “remote controller,” according to the court, under USACafes, L.P. Litigation, where then-Chancellor Allen held that “remote controllers” of alternative entities owe limited fiduciary duties if they exert control over the assets of the entity in question. As applied to the facts, the court found that the plaintiff’s complaint adequately pled a remote controller situation by alleging that Gould personally undertook the purchase and sale of the preferred interests and the adoption of the Amended CRA.

The court analyzed the Limited Liability Company Operating Agreement of Stonemar Cookeville (SCA) to determine whether the SCA eliminated common law fiduciary duties [1] or otherwise shielded the defendants from liability. The defendants argued that, by its terms, the SCA exempts any person “acting in its capacity as a Member (including the Managing Member and its Affiliates)” from personal liability. The plaintiff argued that the provision merely exculpated actions taken by persons in their capacity as members, but not as managing members. Agreeing with the plaintiff, the court found that the plain terms of the provision differentiated between actions by a member and actions by a managing member, which suggested that actions taken in the capacity of a managing member were not exculpable. After further analyzing the SCA, the court found that the SCA, and by implication, the plaintiff, unambiguously waived the corporate opportunity doctrine but still preserved “other default aspects” of the duty of loyalty.

Turning to the disputed transaction, the court held that, by using his newly acquired voting power via Corridor’s acquisition of the preferred interests in Cookeville Retail, Gould had “selfishly amended the CRA and shifted economic value toward Corridor and away from [the plaintiff]” in breach of his fiduciary duties. The court stated that, “[w]hile the scope of USACafes-type liability is limited, ‘it surely entails the duty not to use control over [an entity] to advantage the [controller] at the expense of’ the controller entity.” Such a case was pled here, according to the court, because Gould had increased the preferred’s distribution preference and then sold only a portion of the preferred units that Corridor had acquired to Eightfold at a premium, retaining a portion of the preferred units for Corridor, to the plaintiff’s exclusive detriment. [2]

Takeaways

The court’s decision in 77 Charters reinforces the fundamental premise that Delaware limited liability companies are creatures of contract. While inherently flexible, Delaware courts will only give effect to clear and unambiguous disclaimers or modifications of fiduciary duty and resulting monetary liability. In 77 Charters, for example, a simple disclaimer of fiduciary duty in the SCA or even an expanded exculpatory provision would likely have completely altered the outcome of the decision. In addition, investors should not rely on intermediary entities to absorb liability risk given the existence of USACafes-type liability. Following the court’s decision, investors and practitioners alike should be assured that the focus of a fiduciary analysis will be on the “practical” control over the limited liability company.

Endnotes

1While the court acknowledged that it was unclear whether the parties should look to the SCA or the CRA as the source of the governing standard of conduct, the court analyzed the SCA, rather than the CRA, because the plaintiff, Stonemar MM and Gould were not parties to the CRA.(go back)

2The defendants also contended that the plaintiff’s investment was “so far underwater” by the time of Cookeville Retail’s 2018 sale of its operating asset that the plaintiff could not have been harmed by the adoption of the Amended CRA. Relying on the plaintiff-friendly pleading standards inherent in a motion to dismiss, the court acknowledged that it was a “close call” but allowed the plaintiff’s claim to proceed.(go back)

Print

Print

One Comment

Interesting case but I am a bit leery about putting too much weight on decisions on motions to dismiss where only one side is heard from and where most well pleaded facts by plaintiff are accepted.